FW

Global fabric production increased by more than three per cent in the third quarter of 2016.

Asian and South American output grew by over four per cent each, while European fabric production fell by nearly 15 per cent quarter-on-quarter.

Year on year, global fabric output improved moderately by 0.6 per cent in the third quarter with Asian production increasing by 0.6 per cent and South America’s output improving by 4.7 per cent. Europe’s fabric output fell by nearly seven per cent year on year.

Worldwide fabric stocks also fell quarter- on-quarter and fabric inventories were reduced in South America and increased moderately in Asia and North America. Year on year, fabric stocks declined while European and South American fabric orders also decreased quarter on quarter. On a yearly basis South America’s fabric orders increased and Europe’s fell.

Worldwide fabric stocks fell by 1.4 per cent compared to the previous quarter with an eight per cent drop in South America while inventories decreased by five per cent for the year. Asia was down by 0.4 per cent and Europe by two per cent. North American stocks increased by 0.8 per cent.

In the third quarter, yarn orders fell by five per cent in Europe compared to the second quarter. South American orders fell by 11 per cent for the quarter but rose 100 per cent year on year.

Pakistan wants Chinese companies to set up units at the Quaid-e-Azam apparel park. The zone is spread over 1,500 acres. Pakistan’s embassy in China hosted a roadshow, which was attended by representatives of 76 Chinese companies. Chinese entrepreneurs are being urged to explore the untapped commercial and business potential of Pakistan due to the availability of cheap raw materials and manpower.

The park is especially designed for exports of apparels from Pakistan. Around 1,000 acres of land are allotted to industrial plots of ten acres each. Each unit can employ up to 3,000 workers. The remaining land area will be for amenities and various services.

The industrial park would generate approximately annual exports of three to four billion dollars. It’s expected that the park’s ideal location and availability of all necessary amenities would lead to the success of this project and that the garments produced at the park would be exported the world over, adding billions to the country’s GDP.

Pakistan’s exports slid 3.82 per cent in the first half of the current fiscal year 2016-17. Currently textile exports account for more than half of the total exports from the country. Around 19,000 Chinese nationals are working in Pakistan on different projects.

Lenzing has developed fabrics featuring black fiber. This is a spun-dyed — or solution-dyed — fiber, in which pigment is added to the dope prior to extrusion, to produce a fiber with completely integrated color that does not wear off or wash off. The black fiber is meant to address consumer demand for permanently black jeans, and also for other wovens and knits for the wider apparel market.

Because of increased consumer interest in sustainability, Lenzing is emphasizing modal black’s environmental benefits. Using Lenzing modal black in fabrics lowers the environmental impacts of production by 50 to 65 per cent. In addition, spun-dyed modal black fiber uses only 20 per cent of the pigment required in conventional dyeing. Production of fabric containing the fiber requires half the energy and water needed for conventional fabric production and has a 50 per cent lower carbon footprint. Water effluent also is reduced.

Lenzing, based in Austria, developed modal fiber in the 1960s as a regenerated cellulosic fiber that offers improved tenacity. The raw material for Lenzing modal comes from sustainably managed beech wood forests in Europe. The fiber is produced using on-site-produced biomass process energy and chlorine-free cellulose. Ninety-five per cent of process chemical byproducts from modal production are recovered for reuse.

India’s silk industry is growing by 19 per cent a year. The country is expected to be self-sufficient in silk production by 2020.

China produces 80 per cent of global silk output while India’s share is 13 per cent. Production in other countries accounts for the remaining seven per cent.

But while China produces only mulberry, India produces other varieties, including tasar, eri and muga.

The silk industry in India is an integral part of the textile industry and is among the oldest industries. The silk industry in India engages about 60 lakh workers and involves small and marginal farmers. But the country’s production of raw silk falls short of requirement. The aim is to stop imports from China and produce that much in three or four years.

About 80 per cent of the silk produced in the country is of mulberry silk, most of which is produced in Karnataka, Andhra Pradesh and Tamil Nadu followed by West Bengal and Jammu and Kashmir.

India needs 120,000 tons of silk and with better infrastructure, the sericulture industry could improve its productivity by 15 per cent against the current seven per cent.

An institute in India has developed a virus-resistant transgenic silkworm. This silkworm would help in stabilising silk yield levels by reducing uncertainties like viral outbreaks.

Whether China will continue with the cotton subsidy this year is unknown. However, farmers hope it continues. They feel if there is no subsidy, it won't be possible for them to grow cotton. Each year, authorities set a target price for cotton and pay farmers the difference if the market price falls short. Rising labor costs, bad weather and a lack of water to irrigate the crop have turned the 2016-2017 harvest into a particularly hard one.

Even with the subsidy, it is hard for farmers to make a living. After deducting labor cost for the cotton pickers, farmers hardly make a profit. The subsidy regime was established as a three-year pilot scheme in 2014-2015. In that year, the government needed to replace a disastrous price support program, which had been introduced with the aim of stabilizing the world market. As farmers sold their cotton to state reserves for more than the market price, China's textile mills imported cheaper cotton from abroad, leaving the government with a stockpile that peaked at 11 million tons. So the government opted for a direct subsidy to farmers instead.

It’s estimated that the subsidy costs Chinese government $4 billion in direct payments to cotton farmers in 2014-2015 alone. In addition, hundreds of millions of dollars are spent each year in subsidies for high quality seeds, and for transporting the crop from China's far northwest to the mills and factories in the east.

The United States has threatened to impose tariffs on products, among them denim, imported from Mexico. But it’s American consumers who would end up bearing the brunt. Half the jeans sold in the United States are made in Mexico. Imposing tariffs on a product so popular among US consumers would cause several problems. Mexican firms are the second biggest suppliers of denim to the US.

More than 2,000 manufacturers spread throughout Mexico are dedicated to denim and jeans production. More than 1,25,000 Mexicans depend on the industry for their livelihood. There is a widespread sense of uncertainty among jeans producers and manufacturers in the country.

But jobs in the US could also be affected. Over 64,000 US workers depend on the Mexico-US denim trade, particularly in the states of North and South Carolina and Georgia. US firms send the denim fabric to Mexican textile assembly plants, where the garments are sewn and given finishing touches. Once finished, the final product is shipped back north. Firms purchase the garments made in Mexico and sell them in the US. The back and forth movement of products across the border is tariff-free. The annual trade in men’s jeans is worth more than eight billion dollars.

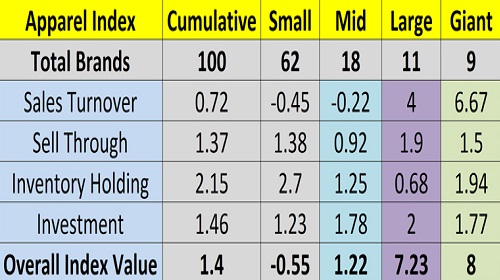

"CMAI’s Apparel Index for Q3 Oct-Dec FY 2016-17 shows this quarter had the lowest growth so far with overall Index Value at 1.4 points compared to previous quarter (July-Sept FY 2016-17) where overall Index Value was 4.64 points. The dismal growth last quarter is fallout of ‘Demonetisation’ that impacted all segments and sectors of Indian economy including the apparel industry. Within apparel industry, the impact has been felt across the board. However, big brands seem to have adapted and managed growth. While Large Brands (turnover of Rs 100 to Rs 300 crores), were at 7.23 and Giant Brands (turnover of R 300 crores and more) scored 8 points respectively."

CMAI’s Apparel Index for Q3 Oct-Dec FY 2016-17 shows this quarter had the lowest growth so far with overall Index Value at 1.4 points compared to previous quarter (July-Sept FY 2016-17) where overall Index Value was 4.64 points. The dismal growth last quarter is fallout of ‘Demonetisation’ that impacted all segments and sectors of Indian economy including the apparel industry. Within apparel industry, the impact has been felt across the board. However, big brands seem to have adapted and managed growth. While Large Brands (turnover of Rs 100 to Rs 300 crores), were at 7.23 and Giant Brands (turnover of R 300 crores and more) scored 8 points respectively. Small brands (turnover of Rs 10-25 crores) however, have been hit badly recording negative growth at -0.55 points, while mid brands (turnover of Rs 25 to 100 crores) managed to grow a meager 1.22 points.

Big brands, maintained growth with fast clearance off goods and discounts that increased Sales Turnover to 4 and 6.67 points and reduced inventory holding increase to just 0.68 and 1.77 points respectively. Comparatively, Small and Mid brands lost Sales Turnover this quarter by 0.45 and 0.22 points and Inventory Holding increased for Small Brands at 2.70 and Mid Brands at 1.25 points. This had a cumulative impact on Sales Turnover and Inventory Holding of Overall Index Value as Small brands and Mid brands outnumber Large and Giant Brands greatly.

Large and Giant brands continue lead

Q3 Apparel Index clearly indicates that large and giant brands have outdone mid and small brands. Small and mid brands lost sales turnover, and one of the main reasons could be demonetization and its impact on overall retail sales. Smaller retailers and brands associated with them had much larger transactions based on cash instead of credit cards or other digital modes. Drop in sales impacted stocks clearance and hence, increased Inventory Holding affecting doubly the Index value of both (small and mid brands). Large brands and giant brands on the other hand, connected with organized retail through MBOs, EBOs and Large Format Stores took the deep discounting route thereby stimulating sales to clear off inventory at store and company level this is clearly reflected in increased Sales Turnover and restricted Inventory Holding in effect pushing up their Index at 7.23 and 8 points.

Since small and mid brands are more dependent on trade and have less control on retail, they couldn’t push sales, while large and giant brands could stimulate sales turnover thereby restricting Inventory Holding. As Vineet Gautam, Country Head, Bestseller India explains, “We have seen more than 50 per cent surge in sales for ONLY compared to last year. We had planned and added 40 new doors to the brand, which automatically implied an increase in inventory holding. Also, the key to managing increased inventory holding is increasing sell out. For ONLY, we successfully managed to increase sell out.” Arguing on similar lines Anant Daga, VP, ‘W’ and Aurelia, says, “Sales growth surge is backed by high double digit SSSG and aggressive expansion. Inventory reduction is a result of better than expected sales against planned buys.” Explaining the plight of winter wear makers and retailers which was impacted the most due to demonetization Vinod Kumar Gupta, MD, Dollar Industries, says, “Some of our products like thermals are seasonal in nature and production had been done in the month of July and August, to be sold up in winter months. But with demonetization, the entire industry witnessed a drastic fall in the last quarter. Naturally our inventory increased by a huge margin. But with summer approaching and the new financial year, we are hoping all summer products are sold and closing stock goes down.”

Classis Polo attributes increased Sales Turnover and better Sell Through, to a better designed product that catches consumers’ fancy. As Usha Periasamy, VP - Operations & Brand, Classis Polo opines, “Fine research in understanding the design needs of the target group and market thereby upgrading creativity to meet expectations precisely. Earlier, Classic Polo range had striper dominated tee's and basic collections but now non striper fashion category has taken over which is reaping results. We have identified the most liked categories in shirts and trousers viz., printed shirts and Lycra bottoms are order of the day.” In fact, brands getting closer to customer expectations and is the real reason behind turnover and sales push. This effect will be more evidently in the next fiscal. In fact around 41 per cent brands feel the outlook for next quarter is ‘Good’, another 10 per cent say the outlook is ‘Excellent’. Nearly 42 per cent foresee an average outlook and 7 per cent (previous quarter also 2) feel it will be ‘Below Average’. Next quarter being the last quarter of the year, brands assume demonetization impact though phasing out will still be there as consumers will take time to return to stories.

About CMAl's Apparel Index

CMAl's Apparel Index, conducted by DFU Publications aims to set a benchmark for the entire domestic apparel industry and helps brands in taking informed business decisions. For investors, industry players, stakeholders and policymakers the index is a useful tool offering concrete and credible information, and is an excellent source for assessing the performance of the industry. The Index is analysed on assessing the performance on four parameters: Sales Turnover, Sell Through (percentage of fresh stocks sold), number of days of Inventory Holding and Investments (signifying future confidence) in brand development and brand building. The Apparel Index research is conducted by DFU Publications.

Speaking at the onging Tex-Styles fair in Delhi, V. K. Kohli, Director & Officer Incharge, Govt of India, Ministry of Textiles, Regional Office of the Textile Commissioner said, “The government has a package for boosting apparel production and exports. To compensate for the export price difference between India and other countries, India has a 12 to 13 per cent leverage for exporters of made-ups. The package aims at creating one crore jobs in textiles and apparel over the next three years. This will lead to $30 billion in exports.”

He went on to say exporters are being given incentives. There is a scheme for rebates of levies on exports of garments. “This is the first time such compensation is offered. The budget has a provision of Rs 400 crores. It will provide for 3.4 to 4.4 per cent of the total expenses incurred on exports. This scheme is for exports of garments defined as goods under chapter 61 and 62 of the schedule of all India rate of drawback. Both garment exports and made-up exports are covered under the package. “

Kohli pointed out the scheme has been linked to production increase as well as employment generation as per the notification. There is an additional benefit of 10 per cent capital subsidy. An investment of Rs 1 crore has to yield a production value of Rs 3.4 crore. An investment of Rs 1 crore has to yield 70 jobs for garment manufacturers/manufacturing. The total cap has been increased to Rs 50 crores. At present Rs 30 crores is the maximum limit for the garment sector.

The eighteenth edition of Tex-Styles India Fair is being held on in New Delhi from February 21 to 24, 2017. The exhibitors are companies active in cotton, silk, wool, synthetics, power looms, jute, blended and other fibers space. At the inaugural of Tex Styles Rajneesh, Executive Director ITPO said “This is the flagship event of India Trade Promotion (ITPO). The event is being held in Pragati Maidan. This is a flagship event for ITPO. India is the third largest global exporter of textiles with six per cent of global textile trade. In clothing our share globally is three per cent. Traditionally India has been a frontrunner in textiles.” He said the textile sector has the inherent power of transforming lives across the world. Rajneesh also said Pragati Maidan as a venue has a tradition of supporting and promoting the export sector. Now there is a plan of upscaling facilities. “The project is to the tune of Rs 2,400 crores. It will have the state of the art convention center with a combined capacity of 7,000 people. The exhibiting space right now is 65,000 sq. mt. which will be more than doubled.”

The partner state for Tex-Styles this time is Jammu and Kashmir. Yasha Mudgil, Addl. Resident Commissioner, J & K said “This is the first time Jammu and Kashmir has partnered in the textile fair. Jammu and Kashmir is known for handicrafts whether in textiles or wood carvings and is known for shawls, carpets. But the arts and handicrafts of Kashmir haven’t been promoted to the extent they deserve. A lot needs to be done. Artisans deserve a better deal. I have seen people weaving pashmina with their hands. It takes a lot of effort and time. Weaving a pashmina shawl takes six to eight months. A jamawar can take up to five years. The eyes take a lot of beating and become dim at 45 or 50 years. Effort should be made to reach out to these artisans directly. The middleman should be eradicated. Retailers buy from the artisans at minimum price. Artists should get not only appreciation but rewards. This is essential to keep the art alive.”

On his part V. K. Kohli, Director & Officer Incharge, Govt of India, Ministry of Textiles, Regional Office of the Textile Commissioner said, “The legacy of the fair and exhibition will continue uninterrupted during the process of development of Pragati Maidan. The textile commissioner is organizing such exhibitions all over India. The government has a package for boosting apparel production and exports.”

After a long time of only focusing on exports, Vietnam’s enterprises are turning to the domestic market too. Domestic consumption of textile products in Vietnam has increased 10 to 15 per cent a year. Currently the market share of Vietnam’s textile industry is only 20 per cent in rural areas and about 60 per cent in urban areas.

And in urban areas domestic enterprises’ products must compete for a market share with imported goods. In addition smuggled goods have a significant share. Tax evasion and non-documented businesses make things very difficult for domestic legal enterprises. Products of unknown origin have flooded rural areas.

Currently, Vietnam’s retailers face challenges due to high rental costs. Leases get terminated without warning, so no enterprise dares to invest a lot because they are not sure how long they can rent the shop. Vietnam’s export market is larger than its domestic market. In contrast, India’s domestic market is three times larger than the export market. Indonesia’s domestic market is double that of the export market. Hence, when export markets face difficulties, these countries still have a basis to withdraw to and develop their domestic markets, a luxury that Vietnamese enterprises don’t have.

While the domestic market is estimated at $4.5 billion, the industry’s production capacity is $35 billion. This mismatch creates a problem for domestic manufacturers.