Earnings and Ebitda margins of Indian textile and apparel exporters will be hit in the near term following the rupee's appreciation against the dollar and weak apparel imports from traditional markets like the US and the UK. Ebitda margins are expected to erode around 150 basis points year-on-year in the fourth quarter ended March 2017.

Ebitda margin -- earnings before interest, tax, depreciation and amortisation divided by total revenue -- is a gauge of a company’s operating profitability. A stronger rupee is likely to have an adverse impact on export volumes and earnings since fresh orders will reduce competitiveness. Realisations are expected to shrink by three to five per cent in the near term and impact profitability of companies across the textile value chain.

The unabated strengthening of the rupee vis a vis the dollar in the current calendar year has increased the challenges of the textile and apparel industry. Export realisations may be dented due to the strong rupee. Over 70 per cent of India’s textile and apparel exports are dollar denominated. Export-oriented apparel manufacturers with unhedged receivable positions will be hurt the most due to their geographically concentrated (US and Europe) earnings profile, low market share and restricted bargaining power with their global clients.

Strong rupee may hit export margins of textile and apparel sector

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

CMAI FAB Show 2024 wraps up successfully, boosting textile industry

The Fabrics, Accessories & Beyond Show 2024 (FAB Show 2024), organized by the Clothing Manufacturers Association of India (CMAI), concluded... Read more

US retail sales on the rise, but fashion sector growth murky

American consumers are opening their wallets again, with retail sales experiencing a modest uptick in recent months. According to the... Read more

The Fast Fashion Conundrum: Profits soaring, sustainability stalling

The story of Shein's soaring profits in 2023 presents a fascinating paradox. While a growing number of consumers, particularly millennials... Read more

Wall Street and the Seduction of Sexy Calvin Klein Ads: Hype or performance boos…

The recent Calvin Klein campaign featuring Jeremy Allen White in his skivvies has set the fashion world abuzz. But can... Read more

Looming Iran-Israel conflict threatens to unravel global apparel trade

The already fragile global garment industry faces fresh challenges as tensions escalate between Iran and Israel. This adds another layer... Read more

Fabric Stock Services: A rising trend but not a replacement

The fashion industry is notorious for waste. Unsold garments and excess fabric often end up in landfills. Fabric stock services... Read more

CMAI’s FAB Show 2024 inaugurated with industry giants

The 4th edition of the Fabrics Accessories & Beyond Show 2024 (FAB Show), hosted by the Clothing Manufacturers Association of... Read more

Asian Apparel Exports: A tale of four tigers, one lagging behind

The apparel industry in Asia presents a fascinating picture of contrasting fortunes. While Bangladesh, Vietnam, and Sri Lanka have seen... Read more

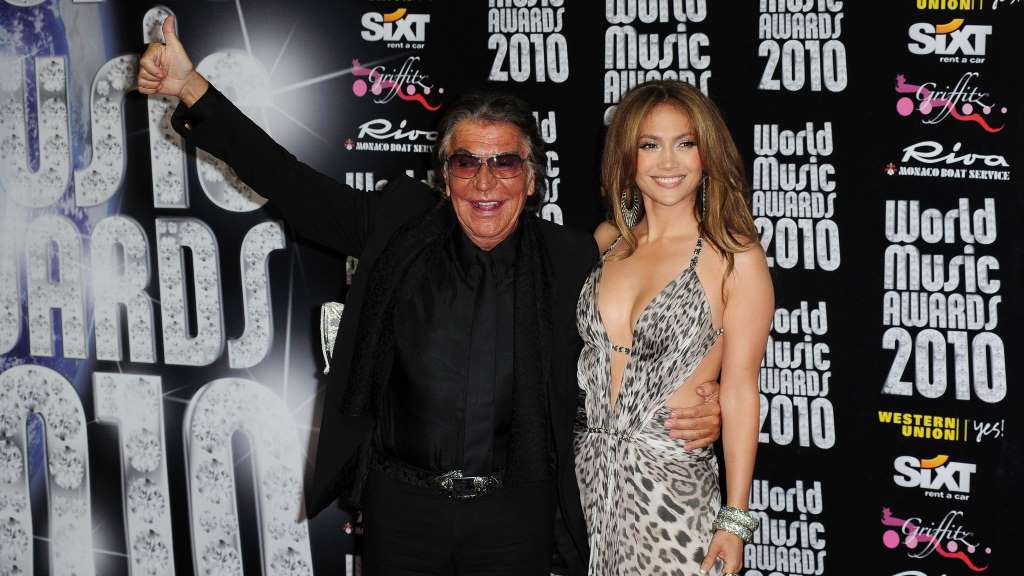

Roberto Cavalli: A legacy of bold prints and unbridled glamour

Roberto Cavalli, the iconic Italian designer who passed away on April 12, 2024, leaves behind a rich legacy. Cavalli was... Read more

Candiani & Madh unveil first regenerative cotton jeans

In a move towards sustainable fashion, Swedish denim brand Madh has partnered with Italian producer Candiani Denim to introduce the... Read more