FW

At the International Labor Conference (ILC), Clean Clothes Campaign will call upon the representatives of governments, employers’ and workers’ organizations from 187 member states to establish institutional and enforcement frameworks that enable effective remedy after disasters and prevention of disasters in global supply chains.

For the first time in the long history of the ILC, global supply chain issues are a main focus of the conference and follows the work of the Committee on Decent Work in Global Supply Chains with heightened interest.

Clean Clothes Campaign is represented at the conference by a delegation of trade unionists and labor activists from Europe and Asia. The delegation will use its presence at the conference to emphasize the need for an institutional framework for remedy and prevention that can be scaled up to an enforceable solution. On the opening day, Clean Clothes Campaign will address these concerns in a short plenary speech.

At the ILC, the Clean Clothes Campaign will reiterate that it is demonstrably not sufficient to just bring supply chain actors together in a dialogue and rely on their collective ability to take action. The campaign knocks on the door of the International Labor Organization to become involved in overcoming the weaknesses of non-binding initiatives and to enhance collaboration and transparency among the industry partners.

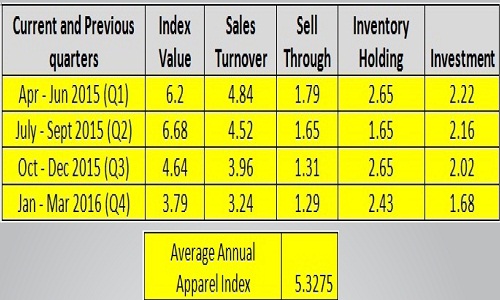

The apparel industry clocked in moderate growth in the four quarters of fiscal year 2015-16 (April ’15- March ’16). The index value of 5.32 points during this period was much lower than the Apparel Index for FY 14-15 at 7.28. In fact, FY15-16 ‘not so buoyant’ period with even the festive season, perceived as a season that helps in making up for turnover losses, as consumer sentiment is at its best at that time, not really recording very high growth.

The index value for last quarter of financial year 2015-16, registered the lowest growth at 3.79, among the four quarters and it grew the most during July-Sept 2015 quarter at 6.68 indicating business maximizing during this quarter which is dominated by EOSS and pre-festive quarter. This was closely followed by April-Jun '15 indicating a quarter known for summer season that generally sees rise in fresh sales.

Indicators dip in successive quarters

All indicators, viz. Sales Turnover, Sell Through and Investments reflected a consistent fall in growth value in successive quarter right from the first quarter. Except Inventory Holding that showed a significant improvement during July-Sept 2015, perhaps due to the offloading all inventories during EOSS quarter, that is why this quarter was the best performing quarter of FY 2015-16.

A comparison with last two financial years show the Apparel Index growth was much higher in FY14-15 compared to FY15-16, which was around 36 per cent higher at 7.28 against 5.33 in FY 2015-16. Interestingly, a common pattern was that the index fell in first three quarters from April-June, July-Sept, Sept-Dec in both years, except the fourth quarter, Jan-Mar of FY 2014-15, the index rebound strongly, whereas in the fourth quarter, Jan-Mar of FY 2015-16 , the growth further reduced. And this pattern was seen in all performance attributes: Sales Turnover, Sell Through, Investment, Inventory Holding in both financial years.

An analysis of Apparel Index, clearly indicates it is important to manage the two more important interdependent parameters Sales Turnover and Inventory Holding. The latter bogs down the index, hence clearing inventories even at discounts gives a boost to Sales Turnover. However, this does affect Sell Through to an extent. Independently increased Investment also adds to Sales Turnover, unless the investment is entrapped in inventory holding, that further pulls down the growth.

CMAl's Apparel Index aims to set a benchmark for the entire domestic apparel industry and helps brands in taking informed business decisions. For investors, industry players, stakeholders and policy makers the index is a useful tool offering concrete and credible information, and is an excellent source for assessing the performance of the industry. The Index is analysed on assessing the performance on four parameters: Sales Turnover, Sell Through (percentage of fresh stocks sold), number of days of Inventory Holding and Investments (signifying future confidence) in brand development and brand building. The Apparel Index research is conducted by DFU Publications.

"The 38th annual International Textile Machinery Shipment Statistics (ITMSS) results were released by the International Textile Manufacturers Federation (ITMF) recently and as per the figures in year 2015, shipments in some textile machinery segments saw a fall. Deliveries of new short-staple spindles fell by nearly 8 per cent from 2014 to 2015."

The 38th annual International Textile Machinery Shipment Statistics (ITMSS) results were released by the International Textile Manufacturers Federation (ITMF) recently and as per the figures in year 2015, shipments in some textile machinery segments saw a fall. Deliveries of new short-staple spindles fell by nearly 8 per cent from 2014 to 2015. Shipped long-staple spindles and open-end rotors decreased by 61 per cent and 6 per cent, respectively. The number of shipped draw texturing spindles fell by 26 per cent and shipments for new circular knitting machines by 6 per cent year-on-year. In contrast, deliveries of shuttle-less looms increased by 14 per cent in 2015 and shipments of flat-knitting machines rose by 52 per cent.

The report covers six segments of textile machinery. The 2015 survey has been compiled in cooperation with over 140 textile machinery manufacturers, representing a comprehensive measure of world production. This number does not include the numerous Chinese companies that are represented by the so called ‘District.’ Therefore, the amount of participating companies is likely to be around 200.

Spinning Machines saw a decline

Shipments of new short-staple spindles fell by nearly 8 per cent year- on-

year in 2015, the second decrease in a row. The level of short staple spindles declined to about 9 million spindles, the lowest level since 2009. Most of the new short staple sindles (92 per cent) were shipped to Asia, whereby shipments fell by 7 per cent year-on-year. Thereby China, the world’s largest investor of short-staple spindles, experienced a decline of 26 per cent, whereas deliveries to Bangladesh, Indonesia and Vietnam rose by 97 per cent, 4 per5 cent and 31 per cent, respectively. All of the five largest investors for short-staple spindles in 2015 originate from Asia. Including China these are India, Viet Nam, Bangladesh and Indonesia.

Shipments of open-end rotors too fell by 6 per cent to a level over 383,000 rotors in 2015. About 81 per cent of worldwide shipments of open-end rotors were destined for Asia. Thereby, deliveries to Asia increased moderately by over 2 per cent to nearly 312’000 rotors. In contrast, regions such as North America and Western Europe recorded annual percentage declines of 47 per cent and 60 per cent, respectively. Shipments to China, the world’s largest investor of open-end rotors increased in a big way by around 66 per cent in 2015. The world’s second and third largest investors in 2015 were India and the USA.

Texturing machines shipments fall

Global shipments of single heater draw-texturing spindles (mainly used for polyamide filaments) fell by nearly 82 per cent from over 6’500 in 2014 to nearly 1’200 in 2015. With 65 per cent Asia is the region where most of the single heater draw-texturing spindles were shipped to, followed by Eastern Europe with 32 per cent and South America with nearly 3 per cent.

In the segment of double heater draw-texturing spindles (mainly used for polyester filaments) the downward trend continued and global shipments fell by 25 per cent on an annual basis to over 322,000 spindles. Asia’s share of worldwide shipments amounted to close to 81 per cent. Thereby, China remained the largest investor accounting for 57 per cent of global shipments.

Weaving sees a spurt

Worldwide shipments of shuttle-less looms increased by 14 per cent to nearly 82,000 units in 2015. Thereby, shipments of water-jet and rapier/projectile shuttle-less looms increased by 24 per cent to nearly 30,000 looms and by 17 per cent to close to 32,000. In contrast, the deliveries of air-jet looms fell by over 1 per cent to a level of nearly 20,000 looms.

Not surprisingly, the main destination of shipments of all shuttle-less looms (air-jet, water-jet and rapier/projectile) in 2015 was Asia with 93 per cent of worldwide deliveries, of which 39 per cent were water jet looms and 37 per cent rapier/projectile looms. In Europe and North America 75 per cent and 25 per cent of shipments were for rapier/projectile looms, while the share of water-jet looms was only 8 per cent and 2 per cent, respectively.

Circular & Flat Knitting sales dip

In 2015, global shipments of large circular knitting machines fell by 6 per cent to a level of 26,700 units. Also for this category Asia is the world’s leading investor. 88 per cent of all circular knitting machines were shipped to Asia in 2015. With 53 per cent of worldwide deliveries China is the single largest investor. India and Bangladesh rank second and third with 6,500 and 3,100 units, respectively. Year 2015 was a very good year for the segment of electronic flat knitting machines as global shipments grew by 52 per cent to 70,100 machines, the highest level since 2011. Not surprisingly, Asia received the highest share of shipments (93 per cent). China remained the world’s largest investor for flat knitting machines in 2015. Thereby, Chinese investments increased from 19,000 units to 35,500 units.

The 2015 edition of ITMF's International Textile Machinery Shipments Statistics included for the 10th time data on finishing machinery as well. However, the questionnaire was revised to present a more accurate picture of shipments in this sector. Therefore, it is not possible to compare this version with previous versions of the finishing machinery statistics.

The Paojiang New District of Shaoxing City has been making its commitment to building the largest textile resources reclamation base over the past few years. Up to now, two companies: Zhejiang Jiaren New Materials and Zhejiang Lvyu Environment Protection have joined this environment protection project.

Zhejiang Jiaren New Materials is a joint venture between Zhejiang Jinggong Holding Group and Japan Teijin Group. The company uses chemical method (ECO-CIRCLE technology) to manufacture recycled polyester fibers. In the first quarter of 2016, the company's total sales amounted to CNY 60 million and it is expected to reach CNY 200 million.

Zhejiang Lvyu Environmental Protection Co. is a new project invested by Zhejiang Guxiandao Industrial Fiber Co. It is designed to use the technology and process similar to ECO-CIRCLE to turn waste textiles into polyester chips. These chips are mainly sold to domestic textile mills for producing polyester filaments or staple. The project costs a total investment of CNY 5 billion. The first-phase project, with an investment of CNY 1 billion, broke ground in March. In the next five years, the total production capacity is expected to reach 1 million tons/year and total sales to reach CNY 10 billion. By then, it will be the largest base for regenerated resources in China.

Only 10 per cent (about 1.5 – 1.6 million tons) of waste textiles are reused in China at present. After two years, the above-mentioned two companies will be capable of recycling about 600,000 tons of textile wastes every year, accounting for 1/3 of China's total.

Under the Trans-Pacific Partnership agreement (TPP), US apparel imports and exports would only increase slightly which must be approved by Congress. The US International Trade Commission recently published an independent study of the free-trade accord and found that US apparel imports would inch up 1.4 per cent with a $1.9 billion increase by the year 2032 while exports would barely budge, seeing a 0.3 per cent rise, or a $10 million increase. The US textile industry would see modest gains too.

By 2032, TPP would help US textile imports see a 1.6 per cent increase by $869 million while US textile exports would edge up 1.3 per cent, or $257 million. The study showed that Vietnam, one of the TPP member countries, would benefit the most from the free-trade pact when it comes to manufacturing and exporting apparel to the United States because tariffs will be eliminated on many items produced there using regional yarns and fabric, a requirement for duty-free status. In 2015, US duties on apparel coming from Vietnam totaled $10.5 billion and the average tariff was set at 17 per cent.

Vietnam is the No. 2 provider of clothing to the United States, accounting for 10 per cent of all US apparel and textile imports. China is still No. 1 with shipments making up 38 per cent of all apparel and textiles imported into the United States.

In April 2016, spun yarn exports jumped 12 per cent in volume terms and were up 1.7 per cent in value terms. Spun yarn (all kinds) shipments were at 112.2 million kg worth $299 million or Rs 1,971 crores, implying per unit realisation of $2.66 per kg.

From India, 82 countries imported spun yarn in April 2016, with China accounting for 27.5 per cent of the total value with imports declining 7.1 per cent in terms of volume YoY and plunging 17 per cent in value YoY. Bangladesh, the second largest importer of spun yarns, accounted for around 19.2 per cent of all spun yarn exported from India. Export to Bangladesh rose 49.5 per cent in volumes and 33.2 per cent higher in value. Egypt was the third largest importer of spun yarns, which saw volume rising 10.7 per cent while value declined 4.6 per cent. These three top importers together accounted for around 52 per cent of all spun yarns exported from India in April.

Meanwhile, India's share in China’s yarn market has dropped from 32.6 per cent to 22.9 per cent whereas Pakistan's share plunged from 27.3 per cent to 19.6 per cent. This structural shift means that Indian and Pakistani spinners cannot rely any more on the Chinese yarn market, although they could keep a large share for specific products.

Spelling trouble for India at the on-going negotiations for the Regional Comprehensive Economic Partnership pact, China has demanded that New Delhi eliminate duties on almost all categories of items, including sensitive ones such as steel, electronics and chemicals, despite the initial decision taken by the two countries to keep ambitions low. In its first round of requests made to India, China’s demands have gone much beyond the understanding reached between the two countries on eliminating tariffs on 42.5 per cent of trade items.

India already held bilateral discussions with China on the sidelines of the last RCEP meeting in Australia asking it to be realistic and bring down its demand. But India has not yet received a positive response. New Delhi is worried about China’s aggressive stance as the Indian industry is neither equipped nor willing to face uninhibited competition from its neighbour.

The RCEP has prescribed a deadline of June 1 for all members to give their first round of requests to other members, based on the initial offers made by each, as efforts are on to wrap up the pact this year. In the first round of offers, India agreed to eliminate tariffs on 42.5 per cent of items for China, Australia and New Zealand, 65 per cent for Japan and South Korea and 80 per cent for the ASEAN. It is important for India to be a part of the proposed pact to counter bigger blocs like the TPP and also retain its competitiveness in the region.

Lectra, the world leader in integrated technology solutions dedicated to industries using fabrics, leather, technical textiles and composite materials has announced the winners of the Lectra/JCPenney (JCP) Fashion Design Contest, held recently at the Fashion Institute of Technology (FIT) in New York.

Lectra and JCPenney jointly organized the contest to support FIT in its mission to prepare its design students for careers in the fashion industry by giving them a chance to work on real-world projects and providing exposure for their designs. Fashion design students chose from one of JCPenney’s exclusive, private brands, including Worthington®, St. John’s Bay®, Stylus®, and Decree®, and created a collection using Lectra’s Kaledo® textile and fashion design solution, based on the brand’s positioning and its customer profile.

Cagla Ertan took first place in the competition, winning an eight-month internship at JCPenney’s SOHO design studio starting in September, along with a complimentary Kaledo license. Ertan created original designs, prints, and color palettes for Decree, JCPenney’s brand for juniors with a sophisticated point of view. The judges felt that Cagla’s collection best embodied the brand’s DNA. Second-place winner, Kevin Tung, and third-place winner, Cemile Simsek, were also awarded Kaledo licenses. Tung and Simsek’s collections both showcased strong original styles and prints.

FIT and Lectra have been partnering together for more than 25 years; both believe in the importance of educational initiatives that put students in direct contact with real-world businesses.

ICRA’s research update on Indian spinning industry indicates, slow growth in domestic consumption and exports will pose a challenge for profitability of spinners if the demand growth remains muted in FY17.

High dependence on exports to China and resulting sensitivity of India’s exports to China’s policy on reserve cotton stock has always warranted a cautious outlook on India’s yarn exports, says the report. Anil Gupta, AVP, Corporate Sector Ratings, ICRA points out, the slow pace of growth in spun yarn production has been driven by factors like tepid domestic consumption and limited growth in exports. With cautious outlook on cotton yarn exports, domestic demand growth will determine the production growth going forward.

As per ICRA estimates, the domestic consumption growth for FY16 is expected to be 1.4 per cent (7.6 per cent in FY15) for cotton yarn and 3.1 per cent (6.3 per cent in FY 15) for spun yarn. This is the lowest level of domestic consumption growth since FY2013. The growth in cotton yarn exports has also been slow with exports of 1,302 million kg in FY16, which reflects 3.7 per cent growth (47.5 per cent and 18.3 per cent growth witnessed in FY13 and FY14).

Industry has witnessed slowest pace of production growth in FY16 in terms of cotton yarn production growth, which is estimated to have grown by 2.0 per cent to 4,136 million kg and is lowest in last four years. Cotton yarn production had grown by 14.6 per cent, 9.6 per cent and 3.2 per cent in FY13, FY14 and FY15 respectively.

Bombay Dyeing’s net profit is expected to drop to Rs 32 crores at a rate 58.9 per cent quarter on quarter. Net revenue for the fourth quarter of financial year ’16 is expected to surge to Rs393 crores, at a rate of 17.1 per cent quarter on quarter but declining 48.1 per cent quarter on quarter. Operating profit margin is likely to be at 9.5 per cent, with a quarter on quarter jump of 1,253 basis points and a drop of 2,142 basis points year on year.

Bombay Dyeing is a flagship company of the Nusli Wadia group that was established in 1879. It is engaged in manufacturing textiles and chemicals. Textile manufacturing is the main activity of Bombay Dyeing. It manufactures cotton suitings, polyester cotton suitings, shoe linings and duck fabrics, satin furnishings, yarn dyed fabrics, towels, table tops and napkins, satin bed sets etc. Nearly 50 per cent of its textile production is exported.

The company is the largest manufacturer of Dimethyl Terephthalate (DMT) in India. DMT is the raw material for manufacturing polyester fiber, film, filament and yarn and engineering plastics. Presently it has a distribution chain of over 600 exclusive stores across the country.

www.bombaydyeing.com/