FW

XCEL is a professionally managed company headed by highly qualified and experienced people which has been involved in the industry since 1994 to offer excellent solutions for setting up hospitals, hotels, garment factories and commercial laundries.

The company has an in house processing facility and continuous R&D. It ensures an uniform quality and delivery commitments for a broad range of premium and economy machines produced at a progressive assembly line in technological association with major global companies.

For ironing there are all types of ironing and blowing tables for garments, up-steam tables for knits and woolens, inline pressing tables for sampling and inline pressing with built in boiler. For laundry is a complete range of front load washing machines, top or side load washing machines, drying tumblers and hydro extractors. Washing machines and drying tumblers are available in all versions of heating.

The company has had a tie-up with industry leader IIGM, with which it can sell these machines on a pan India basis. The company hopes this will add to its market share.

Post process printing machine suppliers are not organised as they lack the range. So XCEL has decided to launch the complete range of nine machines within the next six months though three machines will be launched in the coming GTE, March 2017, New Delhi. Also to be launched will be a range of digital printing post process equipments.

Unrest has hit Bangladesh’s readymade garment industry. At least 26 trade unionists and garment workers in Bangladesh have been jailed for participating in a strike since December last year following demands to increase the minimum wage.

In addition, more than 1,600 workers have been fired and police have filed cases against 600 workers and trade union leaders, including charges of terrorism. There is growing international concern around Bangladesh’s clampdown on trade unions in the country’s garment sector. Bangladesh’s garment workers remain the lowest paid in the world and have not received a pay rise in over three years, despite soaring inflation in the cost of basic goods.

The Bangladesh garment and textiles industry is progressing towards its goal of increased value of exports but this can only be based on profitable businesses that support decent employment for workers whose rights are respected.

Opening a dialogue on strategies to secure a more sustainable apparel supply chain from local and global perspectives may help. Employers say minimum wages in the apparel industry in the country have risen 219 per cent over the last six years and that they have created a Workers’ Welfare Fund, which will invest 10 million dollars this year on workers’ insurance, education, healthcare and other welfare activities.

VF Corporation’s jeanswear business decreased five per cent in the fourth quarter. Earnings per share on a reported basis were down 33 per cent compared to the same period last year. Adjusted earnings per share for the fourth quarter increased three per cent. VF Corporation is an international apparel and footwear company and has brands like Wrangler, Lee.

Wrangler brand revenues dipped one per cent in the fourth quarter. The brand’s revenue saw a high single-digit rate decrease in Europe and a 20 per cent decline in the Asia Pacific region. Full year revenue for Wrangler was down one per cent. Lee’s revenue saw a larger decline. The brand’s fourth quarter revenue decreased 13 per cent. Full year revenue for Lee declined three per cent.

For the full year, VF’s global jeanswear revenue was down two per cent. Looking ahead, VF remains cautionary, expecting revenue to increase at a low single-digit percentage rate. Meanwhile the corporation has reduced its global carbon emissions by 12 per cent from 2011 to 2015.

VF achieved these reductions while seeing vast expansions to its business, adding more than 500 sites to its global operations within the five-year period – a 40 per cent increase driven mainly by retail store expansion.

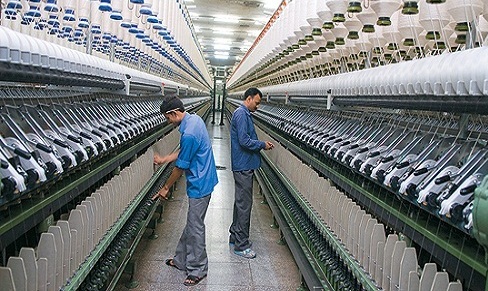

Pakistan’s textile industry is facing new threats of further losing its market share to China. China is heavily investing in textile manufacturing facilities in its province bordering the South Asian nation. The anticipated glut of textiles and garments from the Xinjiang textile park in the export as well as domestic markets of Pakistan poses a serious threat to Pakistan’s textile sector which is already struggling to remain afloat.

China is giving primary importance to Xinjiang province, bordering Pakistan. The province accounts for 60 per cent of China’s seven million tons of cotton production. The underdeveloped province is seeing a rapid industrialisation under China’s plan of developing it into a major textile exporting hub. Billions are being poured into garment factory constructions. By 2020, Xinjiang is expected to produce about 500 million garments a year.

China is also building a 3000-km road from Gwadar in Pakistan to Kashgar in China. Pakistani markets are already awash with low cost Chinese products. Pakistan fears a similar influx of goods under China’s transit trade. Textile exports contribute around 60 per cent to Pakistan’s total exports, which are already on the declining trend owing to a host of factors, including high production costs and lack of incentives.

"India has an opportunity to promote apparel, leather and footwear sectors because of rising wage levels in China that has resulted in China stabilising or losing market share. India is well positioned to take advantage of China’s falling competitiveness because wage costs in India are significantly lower than in China. Sadly, this is not happening yet. The space vacated by China is fast being taken over by Bangladesh and Vietnam in apparels; Vietnam and Indonesia in leather and footwear."

India has an opportunity to promote apparel, leather and footwear sectors because of rising wage levels in China that has resulted in China stabilising or losing market share. India is well positioned to take advantage of China’s falling competitiveness because wage costs in India are significantly lower than in China. Sadly, this is not happening yet. The space vacated by China is fast being taken over by Bangladesh and Vietnam in apparels; Vietnam and Indonesia in leather and footwear. Indian apparel and leather firms are relocating to Bangladesh, Vietnam, Myanmar, and even Ethiopia. The window of opportunity is narrowing and India needs to act fast if it is to regain competitiveness and market share in these sectors.

Why clothes and shoes?

Apparels and leather sectors offer tremendous opportunities for job creation, especially for women. Data show apparels are 80-fold more labour-intensive than autos and 240-fold more jobs than steel. The comparable numbers for leather goods are 33 and 100, respectively. Drawing on World Bank employment elasticities, it can be estimated that rapid export growth could generate about half a million additional direct jobs every year.

The opportunity created for women implies that these sectors could be vehicles for social transformation. Women in apparel factories emphasize the agency they had gained on financial decisions. The agency also extended to husbands starting to helping with household chores. In Bangladesh, female education, total fertility rates, and women’s labour force participation moved positively due to the expansion of the apparel sector.

Challenges abound

India still has comparative advantage in terms of cheaper and more abundant labour. But these are nullified by other factors that render them less competitive. The apparel and leather sectors face a set of common challenges: logistics, labour regulations, and tax & tariff policy, and disadvantages emanating from the international trading environment compared to competitor countries. On the logistics front, India is handicapped relative to competitors in a number of ways. The costs and time involved in getting goods from factory to destination are greater than those for other countries. Further, few very large capacity containers (VLCC) come to Indian ports to take cargo so that exports have to be trans-shipped through Colombo, which adds to travel costs and hence reduces the flexibility for manufacturers.

Labour regulations

Labour costs, India’s source of comparative advantage in this sector, is also not working in its favour. The problems are well-known: regulations on minimum overtime pay, onerous mandatory contributions that become de facto taxes for low-paid workers in small firms that results in a 45 per cent lower disposable salary, lack of flexibility in part-time work and high minimum wages in some cases. There are strict regulations for overtime wage payment as the Minimum Wages Act 1948 mandates payment of overtime wages at twice the rate of ordinary rates of wages of the worker.

One symptom of labour market problems is that Indian apparel and leather firms are smaller compared to firms in China, Bangladesh and Vietnam. An estimated 78 per cent of firms in India employ less than 50 workers with 10 per cent employing more than 500. In China, the comparable numbers are about 15 per cent and 28 per cent respectively.

Tax and tariff policies

On one hand, high tariffs on yarn and fibre increase the cost of production. India imposes a 10 percent tariff on man-made fibers vis-à-vis 6 per cent on cotton fibres. To an extent, this need not affect export competitiveness because drawback for tariffs paid on inputs is available. But drawbacks are not provided for purchases of domestically produced yarn that will reflect the high tariffs, adding to clothing costs. And in any case, domestic sales of clothing will not benefit from duty drawback which could also affect overall export competitiveness.

On the other hand, domestic taxes also favour cotton-based production rather than production based on man-made fibers with 7.5 per cent tax on the former and 8.4 per cent on the latter. To this end, there is a need to undertake rationalisation of domestic policies, which are inconsistent with global demand patterns.

An FTA with EU and UK will help. In the case of apparels, it will offset existing disadvantage for India compared to Bangladesh, Vietnam and Ethiopia, which already enjoy better market access. For leather, the FTA might give India an advantage relative to competitors. In both cases, the incremental impact would be positive.

Policy initiatives

Several measures form part of the package approved by the government for textiles and apparels in June 2016. Their rationale is to address the challenges described above. Even though these policies do not address all challenges but will go a long way in strengthening the apparel industry. Apparel exporters will be provided relief to offset the impact of state taxes embedded in exports, which could be as high as about 5 per cent of exports. Similar provisions for leather exporters would be useful. This is not a subsidy but really a drawback scheme that should be WTO-consistent because it offsets taxes on exports.

Archroma has launched a portable version of its popular color atlas system. The new compact color atlas includes the same 4,320 color swatches as the original, but is condensed from six to two slim volumes for increased mobility. Selling for a fraction of the price, the compact edition is also a first entry option for smaller brands and up-and-coming designers willing to access a best-in-class color management tool. It’s also a great additional option for companies who might like to expand Archroma’s tools within their organization.

The compact edition includes 2.5 x 2.5 cm single-layer color swatches, while lighter colors are represented with two-layer swatches in order to more faithfully present a hue’s true appearance. This edition’s swatches are securely attached to the page, as opposed to the full edition’s removable swatch interface.

Whether a designer is travelling around the world on an inspirational journey, or just across town to a corporate office, the compact color atlas offers portability and flexibility, complementing the full color atlas’ capabilities. This is also a great introduction to the program for young brands and design talent.

Archroma is a global leader in color and specialty chemicals which pioneered custom color engineering in textile and fashion.

Cotton yield in the Malwa region of west central India has surpassed last year’s figures. This inspite of the fact that the cotton growing area in the Malwa belt reduced to 2.48 lakh hectares in 2016-17 from 4.5 lakh hectares in 2015-16 as growers feared the possibility of a pest attack.

At least 6.6 lakh bales of cotton have been procured so far as against the total production of 6.5 lakh bales last year. Last year, whitefly destroyed more than 60 per cent of the cotton crop in the Malwa belt.

Higher prices of the white gold have come as an icing on the cake for growers as they are getting an average of Rs 5,900 per quintal for their crop. Last year, farmers got Rs 3,800 to Rs 4,200 per quintal after the whitefly attack.

The quality and yield of the cotton crop have improved this year and farmers are getting lucrative prices for their produce. More than 60 per cent of the total yield was sold for more than Rs 5,000 per quintal. Due to low production last year, the demand for cotton in India and abroad has shot up this year, which is another reason for farmers getting higher prices.

Kelheim Fibers is one of the world’s leading producers of viscose specialty fibers. The Germany-based company focuses on innovative high-quality fibers. These fibers are used in diverse applications as fashion, hygiene and medical products, specialty papers and in the nonwovens industry.

Kelheim offers a range of specialty viscose fibers allowing the specific properties of fabrics to be enhanced, generating added value in the textile chain. Viloft is for light and soft garments with outstanding next-to-skin-comfort. Viseta is 50 per cent finer than silk for a soft, flowing drape and a luxurious and natural feel. Bramante has extra high absorbency and retention capacity. Olea is the first viscose fiber with intrinsic water repellency. Danufil Tow includes spun dyed fibers and has continuous tow for stretch breaking and flock.

Viloft and Viseta fibers form the foundation of the company’s success in Asia, helping customers to obtain fabrics with outstanding comfort. The company has ideas for the use of viscose fibers in environmentally sound yet at the same time tailormade wound care, in semi-finished products with printed electrical circuits, eco-friendly felt pens, panels of pressed straw for construction applications and an idea for a regional marketing for regionally produced fiber products.

Bangladesh uses cotton imported from the US and Brazil to make readymade garments. It now wants these countries to consider duty-free market access for such garment products. Bangladesh is the second largest cotton importer in the world and the country has long been importing cotton from the US to make apparel for exports. Brazil is also a very potential market for Bangladesh’s apparel products.

Bangladesh’s apparel exports to the US, its single largest destination, have declined 1.96 per cent year-on-year. Garment items account for 95 per cent of the goods exported from Bangladesh to the US market. There is a change in the attitude of US consumers, who now prefer spending more on electronic gadgets compared to clothes. Bangladesh now faces an export duty of 15.62 per cent under America's most favored nations' category.

Bangladesh has long been urging the US to allow it tariff-free market access. The US has already granted unilateral tariff-free market access to African and Caribbean less developed countries. Only Bangladesh, Cambodia, Nepal and a few other Asia-Pacific less developed countries are yet to get the access.

Bilateral trade in goods between Bangladesh and the United States declined slightly in the last calendar year. Both imports from Bangladesh to the US and exports from the US to Bangladesh declined in 2016.

"The 18th edition of Tex-Styles exhibition opened its doors today in the capital today. ITPO’s executive director Rajneesh inaugurated the fair. Also present at the inauguration were Yash Mudgil, Additional Resident Commissioner, J&K, Purshottam K Vanga, Chairman, Powerloom Development Council, Prem Singh, DGM, ITPO, top industry stakeholders among others."

The 18th edition of Tex-Styles exhibition opened its doors today in the capital today. ITPO’s executive director Rajneesh inaugurated the fair. Also present at the inauguration were Yash Mudgil, Additional Resident Commissioner, J&K, Purshottam K Vanga, Chairman, Powerloom Development Council, Prem Singh, DGM, ITPO, top industry stakeholders among others.

Showcasing the best in Indian textiles

In his welcome speech Jayant Das, GM, ITPO said the aim of Tex-Styles is to promote useful business convergence and awareness among manufacturers and buyers. “This is a premier B2B event showcasing the complete supply chain of the textile industry. Tex-Styles India also intends to empower small and medium enterprises which are the backbone of the Indian textile sector due to their inherent ability to promote exports and generate employment opportunities.”

He said, this year the fair also reflects the strong determination and commitment of the textile industry to showcase the best the sector despite several odds. “The fair is an occasion to showcase India’s world famed “textile brand” under one roof. Since its inception in 1995, Tex-Styles India Fair has emerged as an ideal forum for presenting the multi-faceted splendor of the Indian textile industry and established itself as the leading fair of its kind in South East Asia.”

Das said “We are confident that the textile sector will get further boost through the policy initiatives such as the GST. Empowering the industry, the government has also geared up to tie-up soon with the States and roll out a new scheme called ‘TIES’ (Trade Infrastructure for Export Scheme) to boost export infrastructure in alignment with the National Foreign Trade Policy as well as enhancing Central Agencies to set up common facilities for testing, certification trackback, packaging, labelling and storage.” He goes on to say exports of textiles and apparel have achieved a growth rate of 14 per cent in rupee terms and 7.5 per cent in dollar terms during the last three financial years. “Tex-Styles India also intends to empower the SME sector which is the backbone of Indian textile economy due to its inherent inherent ability to promote exports and generate employment opportunities.”

This is the only textile show in India which provides users a one-stop platform for purchase of every conceivable textile product produced by India i.e. furnishings, floor coverings, fabrics, garments, accessories etc. While a host of apex textile handloom and garment bodies like Department of Handloom Development, Govt. of Jammu & Kashmir, Khadi & Village Industries Board, Handloom Export Promotion, Chennai, Indian Silk Promotion council, New Delhi among others are participating Jammu and Kashmir is participating in as a ‘Partner State’ for the first time. Then there are theme pavilions, trend forums, fashion shows, fabric folios will be meaningful in terms of highlighting the new trends, season’s forecasts and innovative concept for textile industry.

The event also features an intensive strength of the tradition and updated textile industry which has a vast network of production centres, as well as millions of SMEs homes of its handlooms artisans all across the country. Markets and better integrating with major regions, thereby increasing the demand for India’s products and contributing to the ‘Make in India’ initiative; and to provide a mechanism for regular appraisal in order to rationalize imports and reduce the trade imbalance.

The fair is being held at Hall No. 11, Pragati Maidan from February 21 to 24, 2017. Covering an area of more than 5,000 sq. mt., Tex Style India features a wide range of products and services – fibers and yarns, cotton, wool, jute, synthetics and various blends, pure blended silk and wool, linen and its finer counts in cotton, blends in synthetics, hand wovens, denims, furnishings and made-ups, shawls, tassels, laces, threads, jackets, pants, skirts, blouses, shirts, cut and sewn garments etc.