FW

Antimicrobial chemicals help to control the growth of microorganisms in textiles as well as maintain their physical strength.

Recent research and developments have brought superior antimicrobial chemicals in the market which can be used easily with high effectiveness in all application sectors, including indoor, outdoor, apparels, technical, and industrial textiles.

Textiles with large surface area such as carpets, apparels etc. under certain temperature and moisture conditions become vulnerable for microorganism growth. These microorganisms are not only harmful to human beings, causing various infections and diseases, but also lead to undesirable effects on textiles such as discoloration, odor and reduced strength of material.

In order to decrease the health risks associated with infections from microorganisms, textile manufacturers are increasingly using antimicrobial chemicals in their products. Antimicrobial chemicals are used in textiles in two different stages i.e. during the spinning and during the textile finishing process.

A growing number of health awareness programs, development of hospitals and surgical labs create a substantial platform for the use of antimicrobial textiles. Recently developed smart textiles, used for health monitoring, also utilize hygienic and bacteria-free textile materials. Increasing consumption of smart textile materials is further expected to push the demand for antimicrobial textile chemicals over the coming decade.

"As the global textile industry’s most comprehensive sourcing summit for spring/summer season, Intertextile Shanghai Apparel Fabrics is the ideal place to find latest developments in product innovation and sustainability. This is especially true in the fair’s Beyond Denim zone, which this edition will feature over 110 exhibitors from China, Japan, Pakistan, Turkey and elsewhere."

As the global textile industry’s most comprehensive sourcing summit for spring/summer season, Intertextile Shanghai Apparel Fabrics is the ideal place to find latest developments in product innovation and sustainability. This is especially true in the fair’s Beyond Denim zone, which this edition will feature over 110 exhibitors from China, Japan, Pakistan, Turkey and elsewhere. Adding to a total of 3,300 exhibitors from around 22 countries and regions, they provide sourcing options for the entire industry, from fabrics for ladieswear, menswear, suiting, shirting, lingerie and swimwear to high-end wool fabrics, original pattern designs, functional & performance fabrics, sustainability products & services, digital printing technologies, garment & fashion accessories and more.

Volcanic ash is not uncommon in beauty products, it is known as Mother Nature’s skin purifier after all, and used as an exfoliator, but it is far less common in the textile industry. Orta Anadolu is set to change that with its Bioware denim, which is enriched with mineralised volcanic ash to create an odour absorbing effect. This technology captures and absorbs odour compounds that would normally pass through the fabric, neutralising bad bacteria while retaining the helpful bacteria that common deodorisers, which contain harsh substances, normally eliminate. This leads to an eco-friendly product that is better for the user’s skin.

Innovative presentations

Orta will also be presenting Biocharge at Intertextile, which, as the company claims, is the world’s first denim fabric for muscle wellness. Infused with minerals, Orta states that Biocharge is medically proven to refresh muscles, relieve muscle tension and optimise body balance. They will also present their Bounce stretch range, with high elasticity and a ‘street’ style, while Chronicle, another in its S/S 19 range, is a blend of heritage and future styles. Another innovative denim firm exhibiting at Intertextile Shanghai, and another blending old and new, is US Denim Mills. According to the company, their collection at the fair will harness tomorrow’s textile advances to revitalise the great style visions of the past by adding fashion, comfort, performance and sustainability advantages to authentic denim looks.

Kipas Denim’s multi-faceted programme includes recycling waste yarn from the production process, while it also takes waste cotton yarn and blends it with Repreve fibres to create an eco-friendly denim fabric. Kipas also uses BCI cotton and organic cotton, and targets each to be 15 per cent and 5 per cent of total consumption, respectively. Furthermore, their Conservablue technology aims to reduce the environmental impact of the dyeing process by eliminating the use of rinsing overflow boxes before and after the indigo dye boxes, as well as ensuring 100 per cent of applied dyestuff remains on the yarn in the rinsing bath. As well as the overseas offerings, a wide range of domestic denim exhibitors covering all price and quality points will also feature in Beyond Denim. Some of the more notable brands participating include Advance Denim, Black Peony, Guangzhou Foison and Prosperity Textile.

Invista panel discussion

The market is changing and so must apparel and textile manufacturers. Low prices and discounts are no longer driving sales the way they used to. Today’s consumer wants better quality, appreciates new technology and is evolving their casualwear style. This is the premise behind the Invista-sponsored panel discussion, which will take place on day 1 of the fair. Titled ‘Denim’s Next Move – New Opportunities to Keep Growing Sales of Jeans and Casualwear at Retail’, participants will learn what consumers really want in jeans and casualwear, the return of chinos and new fabric technologies that are energising casualwear. The panel will be moderated by Jane Singer, director & head – market development, Inside Fashion. Panellists will include representatives from Advance Denim, Guangzhou Conshing Clothing Group, Prosperity Textile and Texhong who will share their latest innovations that will help brands and retailers drive sales and profits.

In addition to Intertextile Shanghai Apparel Fabrics, four other textile fairs also take place at the National Exhibition and Convention Center: Yarn Expo Spring, Intertextile Shanghai Home Textiles – Spring Edition, fashion garment fair Chic and knitting fair PH Value. Intertextile Shanghai Apparel Fabrics – Spring Edition 2018 is co-organised by Messe Frankfurt (HK) Ltd; the Sub-Council of Textile Industry, CCPIT; and the China Textile Information Centre.

The textile industry of Bangladesh is thinking of reusing waste water and other natural resources. There are economic and environmental benefits of reusing wastewater. Reusing wastewater can ensure sustainability and facilitate an overall shift to a circular apparel industry.

Factories adhering to such a program have achieved impressive resource savings including savings of water up to about 18.4 billion liters in a year and savings of electricity by 1.9 million MWh in a year.

Taking to eco-friendly production methods in textile and clothing can make the sector competitive and sustainable. Vegetation in the factories helps reduce emission of carbon monoxide and cool the environs.

A green lens can help business owners reduce costs, fight climate change, re-think long-held business practices and open doors to myriad of opportunities.

Extreme weather and other environmental disruptions don’t just affect the people, animal-plant and infrastructure in their path; they also have profound effects on businesses and economy.

Textile businesses can take a lead role in reducing greenhouse gas emission, water pollution, and air pollution by implementing actions that save money, improve productivity, protect the environment and secure the nation’s energy requirement.

Companies are using practices which are viewed as sustainable and environmentally friendly. These practices might include use of renewable energy in production processes, tighter protections against emissions, and environmentally responsible sourcing of supplies, or final products not hazardous to the environment.

Cambodia’s exports grew by 7.2 per cent in 2016.But the number of registered exporting factories fell by 10.4 per cent, while the number of workers declined by 2.9 per cent, compared to 2015.

Garments and footwear are still the country’s most important exports, accounting for 78 per cent of total merchandise exports in 2016.

The EU remains the most important market destination for Cambodia’s garment and footwear exports, with the US second.

The sector’s exports to the EU and US combined accounted for only 65 per cent in 2016, down from 72 per cent in 2015, with an increasing share going to markets outside the US and EU, notably Japan and Canada.

While the country’s economic growth remains strong, growth in garment exports eased, expanding at 8.4 per cent in value terms year-on-year in 2016, compared with 12.3 per cent in 2015.

Rising labor costs, driven in part by the increasing cost of living, the dollar appreciation, and competition from other regional low-wage countries, in particular Myanmar, continue to exert downward pressure on prices of exported garment products.

The system of subcontracting factories in Cambodia could be a way to undercut regulations, including labor laws and the minimum wage.

The World Bank is helping Bangladesh diversify exports beyond the garment sector.

The project will improve the competitiveness of existing and potential export-oriented industries such as leather, footwear, plastics and light engineering, where Bangladesh has demonstrated a competitive edge.

The project will help create more than 90,000 jobs in sectors other than readymade garments. It will help the economy to integrate further into the world trading system, and provide better jobs to Bangladeshi youth entering the labor market in the next decade, with a particular focus on improving female labor participation.

Firms will be able to access international markets and enhance their ability to comply with international standards through awareness building and matching grants.

There will be support to marketing and branding efforts to strengthen linkages to existing and new markets. The scheme will also address the shortage of skills development, especially in industrial training for women, as well as in infrastructure and technology.

Also, the project will encourage training to improve skills and labor productivity, and thus help generate better-paid jobs.

Bangladesh is the largest garment exporter in the world after China. Although the garment sector constitutes 82 per cent of exports, employment growth in the sector has stalled. However, the other manufacturing sectors have been generating about 3,00,000 new jobs annually since 2010.

Germany is looking to fill the void as India’s entry to European Union. Governments and leaders on the both the leaders have already discussed the significances of Brexit and its effect on India and Germany.

At present Germany is said to be among India’s 10 top trading partners, with accumulated FDI by Indian companies in Germany exceeding €6 billion. One of the most vital EU trade partner for India it ranks 6th among the country’s global trade partners as a provider of goods and services. On the other hand India is Germany’s 25th most important trade partner, ranking 28th in the area of imports and 27th for exports.

Indian investments in Germany include the needs to grow new markets, expand company reputation, increase access to technology and lastly use Germany as a gateway to Europe. 80 significant companies of Indian companies operating in Germany indicate that four sectors account for 97 per cent of India-related revenues within Germany.

So far UK has remained the most significant investment destination in Europe for Indian investors. Together, at present the UK and Germany account for almost two-thirds of all Indian FDI undertakings with a total of 265 projects. This encompasses around 45.5 per cent of all Indian projects in Europe.

As per the analysis, 83 per cent of German Mittelstand companies do not have a succession plan in place. Till present 40 per cent of company owners in this economic sections were older. There is a huge potential for Indian investors if 290,000 owners expected external succession by 2018.

Blossom Premiere Vision will be held in France, July 4 to 5, 2017.This is a biannual trade show dedicated to first collections and designed for creative, luxury and high-end fashion brands.

The third edition of the show will continue the positive momentum of the first two editions.

With new product developments, the latest fabric and material innovations and color directions, this edition presents the collections and creative directions for autumn winter 2018/19 from 89 exhibitors.

About 63 weavers (including ten new exhibitors) such as lace-makers, embroiderers, specialists in ultra-fantasy, jacket and coat weights, shirts and tailoring; knitwear specialists, experts in creative and fashionable technical fabrics, silk makers, sophisticated print technicians and embellishment specialists will participate in the event.

Close to five accessories manufacturers and component suppliers (including two new exhibitors) for clothing, jewelry, and leather goods; specialists in textile accessories (ribbons) or metallic elements (buttons, buckles, rivets), buttons, zips and labels will also be present. About 20 tanners (including ten newcomers) for the fashion and leather goods markets: calfskin, lambskin, kid leather, exotic leathers, etc. will also be present.

In keeping with the values of the Premiere Vision group - selectivity, creativity, quality and innovation - Blossom Premiere Vision accompanies the season’s earliest collections thanks to a selective and extremely high-quality positioning.

The retail industry in India is expected to grow at a rate of 12 to 14 per cent over the next four years.

The growth will be on the back of more demand with higher incomes, job creations and improved standard of living. Other factors include higher discretionary spends and higher participation of producers/retailers in the organised retail market, discounted and promotional pricing, increased number of products and more private labels.

Easy credit availability, increased use of plastic money, increased discretionary spending, growing female working population have also contributed to the growth. Factors like favorable demographics, rapid urbanisation, rising income levels and per capita expenditure also contribute.

The retail industry in India constitutes over ten per cent of the country's GDP with around eight per cent of employment and is valued at 672 billion dollars at present.

Currently, India's organised retail market is valued at about 60 billion dollars, which is only about nine per cent of the sector, whereas the unorganised retail market accounts for the rest.

India has occupied a remarkable position in global retail rankings; the country has high market potential, low economic risk, and moderate political risk.

India’s net retail sales are quite significant among emerging and developed nations; the country is ranked third after China and Brazil.

Pakistan’s total exports to the EU increased by 38 per cent from 4.25 billion Euros in 2013 to 6.28 billion in 2016.The country’s garment exports to the European Union increased by 75 per cent.

Trade incentives extended to Pakistan under GSP Plus played a positive role in boosting Pakistan’s exports to the EU.

Duty free access is helping Pakistani products to compete with products originating from Bangladesh, Vietnam and Turkey and many other countries.

Under GSP Plus Pakistani goods have duty free access to 28 EU member states. Out of these 28 EU countries, Pakistan’s exports have registered an increase in 26 countries. Out of these 26 countries, Pakistan’s exports have risen by 50 per cent or more to ten EU member countries while eight countries are such where Pakistani exports have risen by 25 per cent.

The textile sector has been a major beneficiary of GSP Plus. Pakistan’s exports of textiles have increased by 55 per cent in value terms in 2016 over 2013 and Pakistan’s exports also registered an increase of 33 per cent in terms of quantity during the same period.

Pakistan’s garment and hosiery exports to Europe have increased by 75.7 per cent. Likewise home textile exports to the EU have increased by 60 per cent.

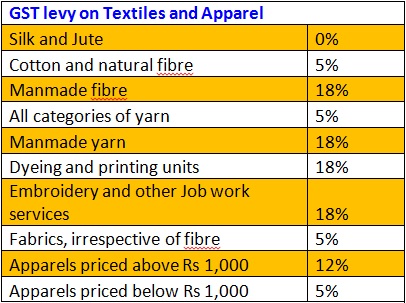

Overall GST seems to be in line with the expectations industry had envisaged, except for the fact, that man made fibres/synthetic fibre andyarns have not been treated at par with cotton and other natural fibres, giving scope of some kind of misrepresentation, play in invoicing and boost to cotton value chain instead of synthetic value chain, perhaps that was the need of the hour and government of India seems to have missed an opportunity .

Some of the feedbacks and early reactions to GST and its implementations are as:

Prashant Agarwal, Co. Founder & Jt. Managing Director, Wazir Advisors on Entire Value Chain Impact of GST:

1. Based on industry experience, following conversion ratios are used

a) From fiber to yarn , conversion factor of 2 is taken for cotton yarn

b) From manmade fiber to manmade yarn , conversion ratio of 1.4 is taken

c) From yarn to fabric conversion factor of 2 is taken

d) From fabric to garment at manufacturing stage, conversion of 2 is taken

e) From garment manufacturing stage to garment retail stage, conversion factor of 2 to 3 is considered for cotton garment and 1.5 to 2 is taken for manmade garment

Impact of GST in cotton value chain:

• As in value chain on cotton, GST is 5%, net impact will be positive, with more companies coming in organized value chain, paying GST, to take credit in whole vale chain.

• The impact will be nullified to a larger extent, because of input credit from previous value chain and also credits taken from other inputs in the manufacturing process like, oil, dyes and chemicals, logistics etc.

• In garments sold above MRP of Rs 1000, an impact of 2-3 % price will come, which can be absorbed by branded players in present prices points

Impact of GST on synthetic value chain:

• The taxes remains same as cotton in whole value chain accept at fiber and yarn stage, where GST is 18%

• This higher GST at fiber and yarn stage will increase the price points by another 2-3 %

• But the major issue in not adopting fiber neutral policy, the investments needed by Synthetics industry will take slight hit in short term, but will be taken care in long term by increase in synthetics demand in market

“In totality GST and rates decided will be good for industry and will move industry towards more organized status and increased entry of bigger corporates in business in long term, which is needed to create jobs for the country.”

Ashok Chaudhry, Independent Consultant on Implementation

My opinion is based on a general view. Since the textile industry, starting from fibre to fashion, is very competitive and low margin products whether intermediate or finished, people associated with this industry are very innovative and hard working. These people have already started taking necessary steps to combat the impact of GST, after studying the details published. This industry would quickly adapt to changes coming without much impact.

K. D. Singh, CEO, Kanchan Textiles on Composite Mills vs Independent Units

Composite mills would stand to gain, where all tax credits are pooled at one point...even service tax paid on telephone bills, transport, hotels etc, will come handy while discharging final GST on finish fabric i.e.5% unlike independent processors where ST is 18%....there won't be any adverse revenue impact on composite mills

Now there will be arm twisting on standalone units..like independent weavers and processors, being basically in unorganised sector and catering to job work...processors will try to take advantage of 18% service tax levied on textile processing...

R S Singh, Business Head, Blue Blends on Cotton Value Chain

We probably couldn't have bargained any better. 5% uniform rate in yarn, fabrics and 1000 Rs garments will mean no change in prices for the consumers too. Majority of output in unorganised garmenting sector falls in this MRP range. Yarn and fabrics' prices will be unaffected too. I expect that compliance rate will improve significantly in unorganised sector.

Garments' manufacturing in organised sector too will look up. Of course net tax rates have gone up here but it will be partly compensated by reduction in input costs and the resultant impact will be marginal.

This will of course help composite sectors, There had been an army of merchant manufacturers and unorganized players in Ahmedabads and Mumbais of India, they will be impacted severely by this.But just thinking loudly, the tax paid on processing job can be taken a credit off by the merchant manufacturers and can be utilised in payments of GST on fabric sales. Thus it may not harm at all. The catch is "value addition". If it is not adequate, they may face a situation where the entire amount of credit is not utilised. Otherwise, this should not have any impact at all.

To conclude, I am very happy about the provisions for the cotton textiles value chain.

Govind Sharda, CEO, Vishal Fabrics on Cotton vs Manmade

Tax slab on man made fibre will tilt manufacturing in favour of cotton fabric. There is a possibility of shrinkage of man made fibre spinning where India remains uncompetitive as compared to Chinese scales. On the cotton yarn front, disparity between the yarn producing states and consumers could create further employment opportunities in otherwise deprived states. However, value added functions like job work based textile operations need be checked into. Overall, the fabric industry would be forced to go for higher value additions to neutralize the costs whereas middlemen for apparel could be squeezing some of their margins to insulate end prices. Yes, the composite apparel manufacturers could have NIL impact. We need to examine the total provisions and for sure, many of the existing business strategies would call for re-structuring.

Pankaj Sharma, Sr VP Mktg, Spentex Industries Ltd on Yarn

Yarn business was already under tax regime so major fireworks will be watched in fabric business, Job work business of weaving, yarn dyeing, processing, embroidery etc.

However govt has been smart enough in creating the GST narrative around business circles in such a way that everyone has conceived this concept and is ready to undergo the labor pains of implementation

Yogesh Gaikwad, Dir, Society of Dyes & Chemicals (SDC), UK on Manmade Value Chain

I personally expected that GST would help doing business in India simpler. I have reasons for being disappointed. 18% tax on man made fibers would lead to confusion about what exactly is man made especially in blended fabric. A common slab of 5% across the textile value chain would have helped to ease the burden on already troubled business due to the 'adventurous' demonitisation . Business will now have to focus on getting invoices correct every time and avoid the vat liabilities which could be more than the profit they earn.

Pankaj Tibrewal, VP ( Exports), RSR Mohota Spg & Wvg Mills Ltd on ValueChain

From above apparently, it looks that excise duty + vat or s.tax has been added in most cases to arrive at GST , and by bringing fabrics under GST shall make this business recordable.

Rajeev Kathuria CEO, HUG Clothing LLP on Fabrics to Apparel and Retail

For textile value chain it is inflationary in its impact. Also various rates at different level only means resorting to malpractice to keep tax incidences lower .Tax on fabric stage in cotton value chain will increase input cost of garment manufacturers..and they will pass it on to retailers / wholesalers ... Tax of 12% on MRP over Rs 1000 MRP provides better competitive environment to corporate and mid size brands compared to unorganised players in this price band ....high rate will work as disincentive for tax compliance in this segment ....

Any small player working on mills fabrics can't keep MRP level below Rs 1000/- in today's economy

( even though they avoid marking MRP , as per governing rules , 50% mark up is considered for calculating MRP ...so any manufacturers selling over Rs 700/- is required to charge 12% ....more clarity required than available right now on this ) .This seems to be a half measure with an eye on uniform rates over 3-5 years horizon …Yet more info required to understand and reflect on its implication

K D Singh Tanwar, MD, Shree Sai creation on Twisting, Texturising and Dyeing of Synthetic Yarns

1) Input credit for packing material or coal or dyes & chemicals, may not be more than 3 to 4%.

2) That means we have to pay additional 9 to 10% out of GP.

3)Now under invoicing may come but even the consumer may not accept it.

4) Everyone will try to get over invoicing in buying and under invoicing in selling, which is a jam like situation.

5) Increasing rates may look like a mirage like solution.

Amit Jain, Consultant, on Home Textiles

Domestic Home Textiles has mainly 3 products, Bedsheet, Towels and Blankets.

1. In case of Bed sheets, the 100% cotton bed sheets will be marginally affected, as 80% are of MRP below 1000/-. The artificial or perceived pricing of bed sheets will become detrimental due to 12% GST instead of 5%. Fair pricing shall prevail. Higher GST of 18% on MMF, instead of 5% on cotton, should reduce sale of micro and pc bed sheets.

2. In case of towels, there shall be marginal benefit on price. Bulk of towels are below MRP of 1000/- and current VAT ranges from 0 in Maharashtra, Tamilnadu and West Bengal and bulk of other states having 5.5%.

3. The Blankets are mainly of 100% polyester. With 18% GST on fibre and 5% GST on Blanket below 1000/- and 12% above 1000/-, the prices shall increase or profit of Brands/ Manufacturers shall go down.

Overall it seems to make MMF costlier and reduce it usage.

Subhash Bhargava, MD, Colorant Limited on Dyes & Chemicals

18% of GST slab for dyes and chemicals is fine with our sector and we look at this as a positive step for organized industry, being part of textile value chain as the entire chain has come in GST net.

But in terms of textile, I think government has missed an opportunity to bring both cottons and synthetics to bring at par, giving possibility of misrepresenting blends. In any case, more details and notifications are expected to have more clarity on blends

Rajiv Varma, MD, DURST, Digital Printing Machines

All raw material for digital printing ink , paper , printer pre post treatment chemicals are under 18% gst .

If end product is under 12% then will job worker get credit back?

Ajay Kanwar, LCI Textile Solutions Pvt LTD , Director, Ex-MD Huntsman India on Dyes & Chemicals

Sir, mostly on dyes and chemicals, it's 18% and I think there is no major impact overall

Tarun Baxi, Independent Consultant on Exports

I am very positive about GST, yes there will be confusion for exporters till the notification come into force, but for export you have long period, Government must come out with clarification for exporters.

GST RATE final on GST Council Meeting held on 3rd June, 2017

Chapter No: 52, Cotton: 0%

Gandhi Topi, Khadi yarn

Chapter No: 52, Cotton: 5%

*Cotton, Cotton waste, Cotton sewing thread, Cotton yarn, other than khadi yarn, Cotton fabrics (5201 To 5212 )

Chapter No: 53, Other vegetable textile Fibres; paper yarn, woven fabrics of paper yarns

*Coconut, coir fibre [5305], Jute fibres, raw or processed but not spun : 0%

*All other vegetable fibres and yarns such as flax, true hemp, paper yarn, etc. [5301, 5302, 5303, 5305, 5306, 5307, 5308] Fabrics of other vegetable textile fibres, paper yarn [5309, 5310, 5311] : 5%