FW

Kering is widely appreciated for its efforts and actions among a small number of high-performing companies out of thousands that were scored. The Group’s determination to cut emissions, mitigate climate risks and help develop a low-carbon economy have been highlighted. Focusing on becoming more energy efficient in the Group’s operations, these efforts has led to the reduction of 30% carbon intensity in the Group’s stores since 2015.

CDP’s annual environmental disclosure and scoring process is widely recognized as the gold standard of corporate environmental transparency. In 2019, over 525 investors with over US$96 trillion in assets and 125 major purchasers with US$3.6 trillion in procurement spend requested companies to disclose data on environmental impacts, risks and opportunities through CDP’s platform and over 8,400 responded.

The “Climate A List” comprises companies from around the world that have been identified as demonstrating a superior approach to climate change mitigation, only 2% of companies achieved an A score. For the 2nd year in a row, Kering is the only Luxury group to be included in this list.

“Our inclusion, once again, on the 2019 CDP Climate Change ‘A List’ reflects our continuous efforts to reduce our carbon footprint and rewards our recent decision to offset all our remaining emissions to support the conservation of biodiversity around the world.” said Marie-Claire Daveu, Chief Sustainability Officer and Head of international institutional affairs of Kering. “We are proud to be recognized as one of the top companies when it comes to take action to fight climate change and will persevere to meet our 2025 target of a 50% carbon footprint reduction.”

A global Luxury group, Kering manages the development of a series of renowned Houses in Fashion, Leather Goods, Jewelry and Watches: Gucci, Saint Laurent, Bottega Veneta, Balenciaga, Alexander McQueen, Brioni, Boucheron, Pomellato, DoDo, Qeelin, Ulysse Nardin, Girard-Perregaux, as well as Kering Eyewear.

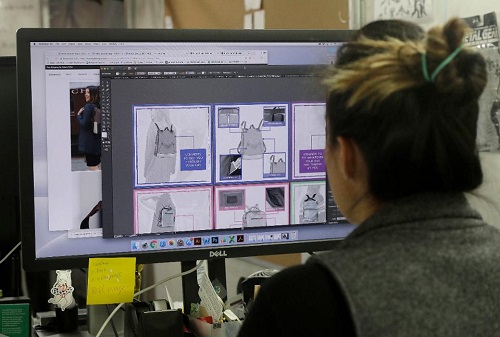

"Viewed as both an opportunity and threat, digital transformation enables manufacturers to save time and costs by enabling them to manufacture small quantities of products profitably. However, it also leads to a loss of human touch in fashion design and garment making. Digital transformation is necessary to deal with sustainability pressures that currently face the fashion industry. As natural resources are dwindling, the cost of raw materials and carbon and financial costs of manual garment sampling and shipping back and forth from manufacturers in Asia to Europe and the US is also increasing. The only way to meet this growing consumer demand is to digitise and streamline manual processes."

Viewed as both an opportunity and threat, digital transformation enables manufacturers to save time and costs by enabling them to manufacture small quantities of products profitably. However, it also leads to a loss of human touch in fashion design and garment making. Digital transformation is necessary to deal with sustainability pressures that currently face the fashion industry. As natural resources are dwindling, the cost of raw materials and carbon and financial costs of manual garment sampling and shipping back and forth from manufacturers in Asia to Europe and the US is also increasing. The only way to meet this growing consumer demand is to digitise and streamline manual processes.

Viewed as both an opportunity and threat, digital transformation enables manufacturers to save time and costs by enabling them to manufacture small quantities of products profitably. However, it also leads to a loss of human touch in fashion design and garment making. Digital transformation is necessary to deal with sustainability pressures that currently face the fashion industry. As natural resources are dwindling, the cost of raw materials and carbon and financial costs of manual garment sampling and shipping back and forth from manufacturers in Asia to Europe and the US is also increasing. The only way to meet this growing consumer demand is to digitise and streamline manual processes.

Lack of creativity slowing digitisation’s progress

However, the progress of digital transformation in fashion has been slow as digital design is based on CAD/CAM solutions, which are not creative enough to empower designers. The solutions that are currently in trend such as CLO3D are driven by technical specifications that do not bridge the gap between creative design and product creation.

designers. The solutions that are currently in trend such as CLO3D are driven by technical specifications that do not bridge the gap between creative design and product creation.

Secondly, solutions providers present the same tools to fashion as they do to automotive, aerospace and architecture. They ask the designers to drop their manual designs and techniques in favor of a mouse and keyboard instead of plugging their creativity seamless into the supply chain.

New talents, data analysis, digitisation to ensure good returns

To fasttrack digital transformation in fashion, brands need to hire new talent graduating from fashion colleges with 3D design skills and an appetite for creative digital design in place of traditional methods of fashion design. These new recruits should be appointed alongside the current crop of designers and tasked with developing the next collections collaboratively, to leverage both approaches. Their designs should be integrated with the actual designs and development of products.

The top three solutions that promise good return on investments for fashion retailers include data analytics solutions, consumer engagement and the digital avatar the use of CGI to be able to have digital experiences around the products. A potential future direction that the fashion industry can adopt is to implement digitised fashion illustration at the first stage to connect it to 3D CAD/CAM software and equipment for on-demand manufacturing, then eventually the digital product presentation tools at the consumer end.

3D digital design is still notably absent from the curriculums of top fashion colleges as the preference for hand-drawing and painstaking manual design techniques still dominates amongst senior designers and creative directors. However, a new generation of designers is emerging who are exploring 3D digital designs through online tutorials and forums in place of being taught formally at university. Bucking the tradition of fashion college education, these designers are redefining the future of fashion.

Apparel manufacturers and exporters can no longer avail of the Merchandise Exports from India Scheme (MEIS). The decision is expected to hit their cash flows and bottom line.

Under MEIS, garment and made-up firms were receiving four per cent of the free on board value of exports as incentives. MEIS has been scrapped retrospectively since March 2019. Apparel exporters have already booked orders by exact costing and they say if they had known they were not going to get the incentive, they would have acted differently. As it is the decision is expected to lead to losses and cash flow issues because between March to December whatever has been shipped will not get the MEIS benefits.

Also, the rebate on state and central taxes and levies has been compared with rebate on stare levies, creating a lot of confusion. And finally bringing in DGFT for correcting disbursal of benefits is expected to create problems. There is a special one-time additional ad hoc incentive of up to one per cent of free on board value for exports of apparel and made-ups with a cap of Rs 600 crores to offset the difference between the new rebate on state and central taxes and levies and the previous rebate on state levies plus MEIS from March 7, 2019 to December 31, 2019.

Many multinational clothing brands, which source billions of dollars worth of garment from Bangladesh, have contacted BGMEA to open their outlets in the country with a burgeoning economy. The BGMEA on its part plans to urge the government to make it mandatory for all global brands to source all the garment items from local manufacturers if they want to open retail outlets here.

However, a number of foreign retailers have recently complained that the complex local tariff structure is holding them back. For instance, a French company has to pay 130 per cent customs duty for many of the garments and shoes it imports, even for those made in Bangladesh. The tariff structure and the process the company follows to remain compliant in Bangladesh are restricting it to offer a reasonable price-quality ratio and support its endeavour to protect the environment, according to the letter. Over the past 10 years, the company has opened 60 big-box stores in India and over 50 per cent of the items it sells in the Indian stores are ‘Made in India.’

A footwear supplier and a tent supplier of an European company located inside the export processing zone in Chattogram have already received regulatory approval to sell 10 per cent of last year’s unsold inventory to the local market. This allows the company to reduce the price of our items by approximately 50 per cent and make them accessible to more Bangladeshi sportspeople. The company plans to seek BGMEA’s support for research and find legal possibilities to get similar permissions for its garment suppliers.

H&M’s online sales increased 30 per cent in 2019 thanks to a strategy of integrating online and in-store experiences. Over the past couple of years, the fashion retailer has been slowing down its physical store expansion strategy. Profit has been negatively affected by a weak sales development in the physical stores of the H&M brand. H&M has a physical store presence in 71 markets worldwide, but it only sells online in 47 of those, four of which were added in 2018. This suggests that improving its online presence has been a real focus for H&M. The threat from rival retailers, both online and offline, is partly responsible for H&M’s change of strategy. Over the last ten to fifteen years H&M and other fast-fashion brands have enjoyed great success in the fashion sector thanks to trend-led products, a speedy production process and large store networks. Now, the disruption is happening online, and H&M has been relatively slow to adapt.

Mobile is especially important, as H&M’s target market of under 25s are heavy mobile users. H&M only started selling online in 2010. Apparently the retailer was slow to see the opportunity that e-commerce presented, or else thought that its store network was enough to see off online competition.

Following a meeting with Thorsten Bargfrede, Head of Political, Trade and Communications Section of the delegation of the European Union to Sri Lanka and Maldives and EU representatives, Prasanna Ranatunga, Minister of Industry, Export, Investment Promotion, Tourism and Aviation, claimed that the European Union’s Generalised Scheme of Preferences Plus tax concessions to Sri Lanka will continue until 2023 and there would be no change to the related observation process.

GSP+ tax concession is mostly granted to the garment industry in the country and 60 percent of Sri Lanka’s garment exports go to EU member countries. The garment industry represents about 43 per cent of the country’s total exports and earns around $5 billion to the country annually. Noting that EU investors were keen on investing in Sri Lanka, Bargfrede requested for a resumption of flight services by the Sri Lankan Airlines to EU countries.

The hosiery industry in Ludhiana, Punjab has taken a big hit because of policies adopted by successive governments. Demonetisation and shoddy implementation of the Goods and Services Tax (GST) by the present central government led by Prime Minister Narendra Modi added to the woes initiated by the earlier Manmohan Singh led UPA government that allowed free access to 46 textile items for Bangladesh. The adverse impact on the 12, 000 hosiery units has been deepened by the shutdown of Kashmir, with a major impact on sales in the Valley.

Since August last year, very few Ludhiana made sweaters, pullovers, caps, jackets, gloves and blankets have made their way into Kashmir. Dozens of units have shut down on account of the fall in demand. This has led to unemployment and despair among the former employees. This cut in production has led to a cut in the income of those in the professions of packaging, local and outstation transportation of produce.

Meanwhile, the provision of duty free access to hosiery items from Bangladesh continues to play havoc with the hosiery manufacturers in Ludhiana. Misusing these incentives many Indian traders have opened export units in Bangladesh. However, quite a large number of these items are not manufactured in Bangladesh but in China, Vietnam and Taiwan.

The recent plenary meeting of the International Cotton Advisory Committee (ICAC) appointed several new officers in the Standing Committee for the coming year. They include: Maha Zakaria of Egypt as Chair, Selman Kurt of Turkey as First Vice Chair and Anshul Sharma of India as Second Vice Chair respectively. The Standing Committee meets in Washington, DC, at the ICAC Secretariat’s offices or a member’s embassy, every two months to receive updates on the ICAC’s activities.

According to ICAC Executive Director Kai Hughes, With Zakaria serving as Chair of the Standing Committee, the ICAC is well positioned to continue improving its strategic initiatives — adding value for members, increasing the effectiveness of our communications, increasing demand for cotton and forming partnerships with key industry organisations. The experience she gained while serving as Chair ad interim during the second half of 2019 will serve her well. The appointment of Selman Kurt and Anshul Sharma as the First Vice Chair and Second Vice Chair, respectively will also benefit the committee.

Bardot plans to close almost 60 stores across Australia. The brand employs 800 people at its stores across the country. The move comes after poor performance of the company’s brick and mortar outlets, despite promising activity in other segments. The brand has recently expanded into the US and Europe. In the last five years, business has grown significantly offshore and capitalised on its Australian heritage by distributing through high-profile international department stores.

Bardot opened 25 years ago as a women’s fashion brand. It is a coquettish, sensual, and sophisticated brand. Each piece has a perfect balance of femininity and naughtiness. The line features jaw-dropping dresses and tops. Over the next two months, Bardot’s retail network will shrink to just 14. Despite double-digit growth in online sales, Bardot’s retail stores in Australia have had to compete in a highly cluttered and increasingly discount-driven market. Bardot joins a growing list of fashion brands that are facing troubled waters in Australia, including Karen Millen, Ed Harry and Roger David.

The year gone by was a tough one for Australian retailers. Australian consumers have kept their cash close over the last year, leading the retail sector to broadly suffer considerable declines in sales.

As the per recent SLAEA data, Sri Lanka’s apparel exports grew by 2.8 percent to $459 million in November 2019 due to an increase in production capacity and re-routing of supply chains amid the US-China trade war. Its total apparel exports from January to November 2019 grew by 5.8 percent to $4.85 billion.

Sri Lanka’s total apparel exports to the EU grew by 10.99 percent to $191.0 million in November 2019 compared to the same period in 2018. The total exports to EU from January to November in 2019 grew by 5.7 per cent to $2.03 billion. These exports increased on account of the continued leverage of GSP Plus preferential tariff benefits and market certainty with Brexit coming to a conclusion.

However, the country’s exports to the US declined by 4.8 per cent to $208 million in November 2019. This decline was mainly on account of a continuous slowdown in sales of Victoria Secret, which is a large customer of Sri Lanka. Victoria’s Secret posted a 7 percent fall in same-store sales in the US and Canada in the third quarter ending November 02. Its parent company L Brands posted a loss of $0.91 per share, dragged down by Victoria’s Secret’s performance.