FW

The 2018 Nanjing Wool Market Conference will be held in China from September 11 to 13. This is a major conference for wool and early wool processing industry in China and is attended by executives of all major Chinese wool buying and processing companies. Participants include growers, traders, primary processors, spinners, weavers and garment manufacturers.

The conference, held every year in September, enables international delegates to meet with China’s biggest wool buyers and processors. It also offers exhibition space for companies wishing to exhibit their products and is open to delegates from all around the world.

Domestic consumption of woolen products in China has grown dramatically in the last five years. If previously most processing was for export, today at least 50 per cent is for domestic use, and this is growing year by year. Although wool only represents 15 per cent of fibers consumed in China, volumes are so large that even 15 per cent represents a huge quantity. Even in Mongolia, a remote part of the world, women wear woolen coats.

With increased affluence and a tendency towards leading healthier lifestyles, discerning Chinese consumers are now favoring natural, long-lasting garments, following latest trends in fast fashion.

Bangladesh’s exports of apparel accessories increased 10 to 15 per cent in the last financial year. Among these are woven labels, leather badges, stone and metal motifs, rubber patches, gum tapes, satin and cotton ribbon hangers, price tags, buttons and zippers.

The country exports accessories to countries like Sri Lanka, South Africa, Malaysia, Vietnam, Cambodia and Myanmar. These are used in the readymade garment, leather, pharmaceutical and other sectors. In the readymade garment sector, accessory makers and packagers supply 34 types of products.

With proper policy support and financial incentives, both indirect and direct, Bangladesh hopes to increase export earnings in the sector by up to three times over the next couple of years. China used to be the biggest source of accessory items, but it has shut down many of its accessory factories on account of environmental issues and is shifting to high-tech industries. This is the opportunity Bangladesh hopes to make use of. Accessory makers have boosted their capacities and can almost fully meet the demands of garment exporters. They anticipate growth in business as local and international buyers have evinced increased interest in the sector this year with the recovery of the global economy. The Asian garment accessories market is 24 billion dollars.

"Today’s consumers are concerned about their personal comfort, and that may be part of the reason why the current population has been dubbed the indoor generation. A survey by Velux, a window manufacturing company, says on average people spend 90 per cent of their day, or about 21 hours, indoors. According to Peter Foldbjerg, Head, daylight energy and indoor climate, Velux, today’s generation is of indoor people where the only time they get daylight and fresh air midweek is on the commute to work or school. If consumers are constantly in a 70-degree environment, it makes sense for retailers and brands to offer apparel that work at that temperature. And since consumers are avoiding outdoor heat, humidity, and bugs of summer, as well as the ice, snow, and cold of winter, it stands to reason they would want clothes that are just as comfortable indoors any time of year."

Today’s consumers are concerned about their personal comfort, and that may be part of the reason why the current population has been dubbed the indoor generation. A survey by Velux, a window manufacturing company, says on average people spend 90 per cent of their day, or about 21 hours, indoors. According to Peter Foldbjerg, Head, daylight energy and indoor climate, Velux, today’s generation is of indoor people where the only time they get daylight and fresh air midweek is on the commute to work or school.

Today’s consumers are concerned about their personal comfort, and that may be part of the reason why the current population has been dubbed the indoor generation. A survey by Velux, a window manufacturing company, says on average people spend 90 per cent of their day, or about 21 hours, indoors. According to Peter Foldbjerg, Head, daylight energy and indoor climate, Velux, today’s generation is of indoor people where the only time they get daylight and fresh air midweek is on the commute to work or school.

If consumers are constantly in a 70-degree environment, it makes sense for retailers and brands to offer apparel that work at that temperature. And since consumers are avoiding outdoor heat, humidity, and bugs of summer, as well as the ice, snow, and cold of winter, it stands to reason they would want clothes that are just as comfortable indoors any time of year. Compared to manmade fiber clothing, the overwhelming majority of consumers say cotton clothing is the best for T-shirts (90 per cent), underwear and intimates (83 per cent), childrenswear (82 per cent), and casual clothing (80 per cent), according to Monitor research.

Cotton the most favoured fiber

More than 4 in 5 consumers (82 per cent) say cotton is their favorite fiber to wear, according to the Cotton Incorporated Lifestyle Monitor Survey. This is followed by a distant 3 per cent who choose polyester, silk (2 per cent), then spandex, rayon, linen, and wool (all 1 per cent). Because cotton pieces are lighter and more breathable, they can easily be layered in cooler months, or worn alone in warmer, more humid seasons. Compared to manmade fiber clothing, more than 8 in 10 consumers say cotton clothing is the most comfortable (86 per cent), according to Monitor data. This is a significant increase from February 2017 (80 per cent). In further comparisons to synthetics, consumers say cotton clothes are the most sustainable (86 per cent), the softest (83 per cent), highest quality (78 per cent), and most versatile (63 per cent).

followed by a distant 3 per cent who choose polyester, silk (2 per cent), then spandex, rayon, linen, and wool (all 1 per cent). Because cotton pieces are lighter and more breathable, they can easily be layered in cooler months, or worn alone in warmer, more humid seasons. Compared to manmade fiber clothing, more than 8 in 10 consumers say cotton clothing is the most comfortable (86 per cent), according to Monitor data. This is a significant increase from February 2017 (80 per cent). In further comparisons to synthetics, consumers say cotton clothes are the most sustainable (86 per cent), the softest (83 per cent), highest quality (78 per cent), and most versatile (63 per cent).

Further, the majority of consumers are bothered when brands and retailers substitute synthetic fibres in apparel items they expect to be made from cotton. For example, 61 per cent (up significantly from 53 per cent in 2017) are bothered when brands use synthetics instead of cotton in T-shirts, according to Monitor data. Consumers are also bothered when synthetics are substituted for cotton in underwear (60 per cent, up significantly from 54 per cent in 2017), denim jeans (57 per cent, up significantly from 52 per cent in 2017), casual clothes (56 per cent, up significantly from 46 per cent in 2017), activewear (50 per cent), business clothes (47 per cent), and childrenswear (45 per cent).

Brands and retailers would benefit from the majority of consumers who would pay more money to keep cotton from being substituted with synthetics like polyester in everything from underwear and intimates (70 per cent) to tees (65 per cent), denim (62 per cent), businesswear (57 per cent), activewear (55 per cent), and children’s clothes (52 per cent), according to Monitor research.

Where’s the future headed

The concept of clothes that easily transit from one season to the next makes sense from a consumer standpoint as well as an environmental one. For consumers, it means buying key, quality pieces that can be worn virtually year round, both because their weight isn’t too light or heavy, and their colors can be mixed with others to bring an outfit into the next season. Keeping a certain number of items in the closet as a base, means less churn and overhaul each season.

Robert Babigian, key account executive – apparel, Timberland points out the company is focussing on casual, comfortable pieces heading into spring/summer 2019. The company is offering retro elements like track suits, color-blocking, and logo pieces for next season, and focusing on archival pieces heading into fall 2019. It is offering a lot of fleece and tees, mostly 100 per cent ring-spun cotton, and some cotton blends in its fleece. There is an aspect of the outdoor trend that’s more mainstream and it’s not as focussed on technical fabrics. These are pieces that can be worn anywhere and that resonate with the younger consumer.

"Like previous quarters, the biggest brand group -- Giant brands are still growing the most, outgrowing recessionary trends. However, growth rate was moderate this quarter compared to previous quarters and in the same quarter previous year when it grew at 11.00 points. Small brands, at 1.20 points, seem to be pulling along and to an extent overall growth is being pulled down by smaller players, who are still not in a position to outsmart their business practices. In fact, Small brand’s dipping Sales Turnover (at -0.1 points) is certainly a cause of concern , however, they managed to grow at an index value of 1.2, riding on increased investments to hold inventories as lesser sales were recorded."

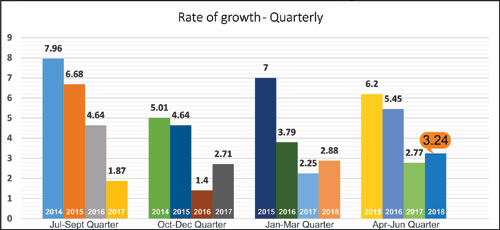

CMAI’s Apparel Index, as researched by DFU Publications for Q1 April-June FY 2018-19 reveals cumulative growth is at 3.24 points which is higher than 2.88 points last quarter; Big Brands (Mid, Large and Giant together) together clocked in growth at 6.55 points (less compared to 7.61 points last quarter); Small Brands in contrast are still lagging with low growth at 1.2 points (higher than last quarter’s 0.75 points).

CMAI’s Apparel Index, as researched by DFU Publications for Q1 April-June FY 2018-19 reveals cumulative growth is at 3.24 points which is higher than 2.88 points last quarter; Big Brands (Mid, Large and Giant together) together clocked in growth at 6.55 points (less compared to 7.61 points last quarter); Small Brands in contrast are still lagging with low growth at 1.2 points (higher than last quarter’s 0.75 points).

At 3.24 points, Q1 index is certainly better than previous quarter’s (Jan -March FY 2017-18) 2.88 points; and Q1 in previous year (April-June 2017-18) at 2.77 points. While Big brands together have grown at 6.55 points, individually Mid, Large and Giant brands have grown at 6.33, 5.95 and 8.07 points respectively (previous quarter figures were: 6.26, 8.50 and 10.00 points). In fact, Mid brands have shown slight buoyancy and Large and Giant brands grew lesser than previous quarter. Growth is mainly triggered by Big Brands expansion and them pumping in fresh Investments.

Like previous quarters, the biggest brand group -- Giant brands are still growing the most, outgrowing recessionary trends. However, growth rate was moderate this quarter compared to previous quarters and in the same quarter previous year when it grew at 11.00 points. Small brands, at 1.20 points, seem to be pulling along and to an extent overall growth is being pulled down by smaller players, who are still not in a position to outsmart their business practices. In fact, Small brand’s dipping Sales Turnover (at -0.1 points) is certainly a cause of concern , however, they managed to grow at an index value of 1.2, riding on increased investments to hold inventories as lesser sales were recorded.

Sales Turnover, Inventory Holding & Investments on the rise

Sales Turnover: Sales Turnover in Q1 reflected an Index growth of 1.88 (higher than previous quarters 1.6 points). Nearly, 53 per cent brands reported an increase this quarter. The highest percentage of brands that recorded 41 per cent or more growth, were in the Mid Brands group followed by Large Brands. Small Brands lost Sales Turnover by 0.1 points, the second time in last four years. As French menswear brand Celio’s CEO Satyen P Momaya says, “Increase in sales turnover is a combination of store growth and expansion. Our store growth has been between 0-6 per cent and overall growth is better.”

increase this quarter. The highest percentage of brands that recorded 41 per cent or more growth, were in the Mid Brands group followed by Large Brands. Small Brands lost Sales Turnover by 0.1 points, the second time in last four years. As French menswear brand Celio’s CEO Satyen P Momaya says, “Increase in sales turnover is a combination of store growth and expansion. Our store growth has been between 0-6 per cent and overall growth is better.”

Most have reported higher sales turnover riding on new store openings. “Our sales turnover is increasing as expansion is going on and more stores are being added. Around 10 to 12 new stores were added,” explains Deepak Singhla, Sales Head, Cantabil. Similarly, Bhushan Gupta, Head of Business Development, Breakbounce points out, “Our sales turnover increased as Breakbounce is a new brand with a rapid growth pattern. Every year, new sales points are being added and there is an increase in sales turnover.”

However, nearly 24 per cent brands said their sales turnover remained the same. As brand Era’s partner Nikhil Furia says, “We saw an increase in sales turnover by targeting a lot of new territories in Tier II, III cities.”

Sell Through: Recorded an index growth of 1.23 this quarter. Nearly 51 per cent brands reported an improvement in Sell Through. However, 42 per cent brands saw no change in their sell through as it remained the same; and around 7 per cent brands recorded a dip in sell through growth. “Our sell through rates have improved compared to last year over merchandises, which has led to faster realization of inventory and hence, expenditure has not increased much,” says Momaya.

Inventory Holding: Growth under this head is at 1.58 points in Q1, higher than 1.1 points recorded in the previous quarter. Almost 55 per cent respondents across brands have said their inventory holding moved north this quarter, a significant number, indeed. Increase in inventory holding impacts overall index negatively. Higher inventory holding indicates more leftovers on shop shelves or lower sales in previous quarter.

As Pepe Jeans’ regional manager Manish Kapoor says, “We have been prudent in our orders and accordingly since our input have increased inventory has gone down.” On similar lines Gupta explains, “Each year the number of customers we cater to is growing. Hence, stock holding and inventory holding is proportionate to the last year’s parameters.”

Investments: One positive aspect of Q1 is that fresh Investments have gone up nearly 1.70 as against 1.30 points last quarter. Overall nearly 77 per cent respondents reported a rise in investments which is much higher than 54 per cent in previous quarter, indicating most brands had to invest to manage and grow which means growth doesn’t seem to be coming easily. “We are exploring new markets and are on an expansion mode,” says Mayank Jain, Marketing Head, Monte Carlo.

‘Good to Excellent’ outlook for the festive quarter

Around 56 per cent brands say the outlook for next quarter is ‘Good’, while 11 per cent believe it will be a ‘Excellent’. Around 32 per cent feel the quarter will be average in terms of business however, only 1 per cent say, it will be ‘Below Average’. Comparatively the outlook recorded previous quarter was ‘average to good’. Generally, in Q2 of the financial year numerous festivals are lined up and sales picks up, so the overall mood is positive.

CMAl's Apparel Index

CMAl's Apparel Index aims to set a benchmark for the entire domestic apparel industry and helps brands in taking informed business decisions. For investors, industry players, stakeholders and policymakers the index is a useful tool offering concrete and credible information and is an excellent source for assessing the performance of the industry. The Index is analysed on assessing the performance on four parameters: Sales Turnover, Sell Through (percentage of fresh stocks sold), number of days of Inventory Holding and Investments (signifying future confidence) in brand development and brand building. The Apparel Index research is conducted by DFU Publications.

"While global fashion industry is a major business generator, it still hasn’t been able to gain strong IP rights and protection. Even the world’s biggest economy, the US hasn’t shown any willingness to address this issue. For some critics, fashion designs are not art, and therefore, do not require similar protection, or that current laws sufficiently protect apparel and luxury brands. Added to that, the rapid turnover of new fashion designs makes IP protection useless because registrations do not typically issue until after copied designs reach the market. The ease of pirating fashion designs has outperformed legal developments especially in the US, which requires fashion companies and designers to become more strategic in their approach to IP protection."

While global fashion industry is a major business generator, it still hasn’t been able to gain strong IP rights and protection. Even the world’s biggest economy, the US hasn’t shown any willingness to address this issue. For some critics, fashion designs are not art, and therefore, do not require similar protection, or that current laws sufficiently protect apparel and luxury brands. Added to that, the rapid turnover of new fashion designs makes IP protection useless because registrations do not typically issue until after copied designs reach the market. The ease of pirating fashion designs has outperformed legal developments especially in the US, which requires fashion companies and designers to become more strategic in their approach to IP protection.

While global fashion industry is a major business generator, it still hasn’t been able to gain strong IP rights and protection. Even the world’s biggest economy, the US hasn’t shown any willingness to address this issue. For some critics, fashion designs are not art, and therefore, do not require similar protection, or that current laws sufficiently protect apparel and luxury brands. Added to that, the rapid turnover of new fashion designs makes IP protection useless because registrations do not typically issue until after copied designs reach the market. The ease of pirating fashion designs has outperformed legal developments especially in the US, which requires fashion companies and designers to become more strategic in their approach to IP protection.

Added to this, the ambiguities within copyright laws limit the protection of these designs, with different results in different countries. Fast fashion retailers have attempted to legitimise and defend their production and sale of copied designs. Forever 21 has been charged over 50 times by different designers and has never actually lost a case, instead resolving lawsuits in settlements. In 2017, the retailer found itself involved in three of the most significant fashion lawsuits of the year with adidas and Gucci, and it still has not been deterred from producing and selling its copies of fashion brands’ products. In fact, in March 2017 Forever 21 went on the offence, making the bold decision to file suit against adidas, calling the German sportswear brand a ‘bully’. Industry insiders and IP lawyers alike are keeping a cautious eye on these cases to see which way the IP pendulum may swing.

Copyright laws in different countries

James Donoian and Margarita Wallach, McCarter & English, LLP in their analysis stated that France is the only country providing full copyright protection to fashion designs. French copyright laws protect ‘any original work expressed in any form’. The French system provides copyright protection regardless of the medium of the work. In addition: ‘originators of all creations of form, even the most modest, receive a generous bundle of economic and moral rights for a term of life plus 50 years from creation.’ While copyright laws in the United States offer minimal protection. In the US, functional objects such as articles of clothing are not protected by copyright. However, under the concept of separability, copyright may protect authorship in pictorial, graphic or sculptural designs that can be identified separately from or exist independently of the utilitarian aspects of the article (ie, when the design can be separated from the garment and stand on its own as a copyrightable work).

protection to fashion designs. French copyright laws protect ‘any original work expressed in any form’. The French system provides copyright protection regardless of the medium of the work. In addition: ‘originators of all creations of form, even the most modest, receive a generous bundle of economic and moral rights for a term of life plus 50 years from creation.’ While copyright laws in the United States offer minimal protection. In the US, functional objects such as articles of clothing are not protected by copyright. However, under the concept of separability, copyright may protect authorship in pictorial, graphic or sculptural designs that can be identified separately from or exist independently of the utilitarian aspects of the article (ie, when the design can be separated from the garment and stand on its own as a copyrightable work).

Counterfeits

Fashion companies and designers should register their brand names as trademarks to deter counterfeiting. Ideally, one should prioritise those countries where the brand is or imminently will be sold or manufactured. While certain jurisdictions recognise common law rights, registration provides the most protection; having an already registered trademark means there is no battle over who has the rights. Filing a trademark early may also prevent trademark squatting. Not only has e-commerce attributed to growth in sales of copycat designs; fast fashion retailers are also constantly opening new physical stores. Research has shown that some e-commerce fast fashion retailers present an astounding 700 new styles per week.

Design protection

To address copying of designs more fully, some countries are leading the way by adopting a new type of protection, sometimes simply referred to as ‘design rights’ or the ‘design law’. In 2001, the European Union recognised an expansive definition of ‘design’: The appearance of a whole or part of a product resulting from the features of, in particular, the lines, contours, shape, texture and/or materials of the product itself and/or its ornamentation. This concept has since been adopted by Japan, Brazil, India and Israel.

Under EU law, design protection exists as a registered or unregistered right. A registered right protects original designs for a renewable period of five years, with a maximum duration of 25 years from the original filing date. An unregistered right protects designs from blatant copies for a maximum of three years from the date the design was first made available to the public. As a result, the new design laws offer protection from infringers to both registered and unregistered designs. In addition, both design rights and copyright can protect fashion designs in countries that allow for cumulative protection.

In Japan by comparison, design law is determined by the Design Act. Under the Design Act only registered designs are legally protectable. Protection may still be provided under unfair competition law if the infringing garment is a dead copy of the original garment and if the infringing copy would raise confusion with the original garment in the minds of consumers.

Turkey’s exports of textiles and raw materials increased by eight per cent in the first half of 2018.

Exports to Italy, the most important export market for Turkey in this sector, rose by 5.8 per cent. Exports of textiles and raw materials to Germany, the second important market, were up 8.3 per cent compared to the same period of the previous year. Exports to Bulgaria, the third major export market, declined by 13.7 per cent.

The most exported product in the first half of 2018 was woven fabrics. Woven fabric exports increased by 8.3 per cent compared to the same period of 2017. The second most exported product was yarn, which constitutes 18.1 per cent of total textile exports from Turkey. Exports of the third important product group, knitted fabrics, increased by 2.3 per cent. Turkey is one of the world's leading manufacturers of knitted fabrics. Fiber exports, the fourth most exported product group, increased by 16.9 per cent.

Turkey’s technical textile exports increased by 20.1 per cent.

As Turkey’s textile exports grow, the country’s textile manufacturing companies will have to upgrade their machinery, parts and components, as well as the manufacturing processes. Turkish textile companies are also being encouraged to consider technical collaboration with foreign partners.

Walls of Benin is a brand from Africa that makes sleepwear and loungewear for high-end shops in Europe. It uses fabrics like silk-and-cotton blends, silk and Tencel. Currently, Walls of Benin operates from Kenya and Rwanda and it is importing silk and Tencel from Portugal. The production is the first of its kind on the continent.

A thousand loungewear items are made a week using digital screen prints. The company helps create jobs by working with eucalyptus farmers and other suppliers who produce raw materials. Eucalyptus pulpwood is industrially spun to produce fabrics that are breathable and cooling. Kenyan cotton producers have got training from Walls of Benin to spin and twist fiber into yarn, weave and knit the yarn into fabric, and bleach, dye and print the fabric to create fashionable sleepwear.

The African Growth and Opportunity Act (Agoa), a US law that seeks to expand trade and investments with sub-Saharan Africa, gives duty-free access to the US for selected sub-Saharan African countries. Africa hopes to tap into the $12 billion US loungewear market through Agoa, which was recently extended to 2025.

The Southern African Clothing and Textile Workers’ Union (Sactwu), an affiliate of Cosatu, has revealed members of clothing industry in the metro areas of South Africa would receive a 7.5 percent wage increase and workers in the non-metro areas would receive an 8 percent package increase – of which 7.5 per cent will go on wages and 0.5 per cent to improve employer contributions to the provident fund.

This second-year wage increase would be in line with the consumer price index (CPI) as at November 2018, plus an additional 1 per cent. In the event of CPI plus 1 percent resulting in the total labour cost increase being less than the rand value increase for 2018, the adjustment would be the rand value equivalent of the 2018 total labour cost increase. The wage settlement was arrived after three rounds of ordinary negotiations, the declaration of a dispute and two conciliation sessions to attempt a settlement of the dispute.

The agreement covers more than 60,000 clothing workers, employed in 745 factories nation-wide. The wage increase component alone, combined for all the workers, will mean a total cash amount injection of R250m into the domestic economy, over the next year.

India is likely to outdo China in the textile sector. Contributing factors are cheap labor and modernization. With quality and skilled labor and machinery, India can easily overcome Chinese competition in the textile industry as labor costs in China are very high compared to India’s.

India aims at doubling the annual revenue from textiles by 2025. Foreign direct investment is being encouraged in the textile sector, which has the potential to create millions of jobs. High-tech machines which help deliver quality goods will enable India to reach the set targets at the production level. Tamil Nadu alone accounts for 39 per cent of the total textile production in the country. There are 4.13 lakh handlooms in Tamil Nadu providing employment to 6.08 lakh weavers while the 3.66 lakh power looms and 1,889 spinning mills provided employment to another 2.40 lakh people. Knitwear and woven garment production units provide employment to over five lakh people.

The textile sector in India is showing signs of recovery. The stressed advance ratio of the textile sub-sector has improved in March 2018 from the levels of September 2017. The sector was heavily hit by demonetization, GST, rupee appreciation and high domestic cotton prices. Packages and incentives are expected to create a strong turnaround in the textile and clothing sector.

In an assessment carried across the company last year, Canadian apparel manufacturer Gildan has reset its strategic priorities to fulfill its vision of ‘Making Apparel Better’, by working towards human and labour rights, health and safety along with water management, for long term success of its operations.

The assessment was done in partnership with an independent third party to analyse the social, environmental and economical issues most critical to its stakeholders. ‘Traceability’ and ‘chemical management’ were also indicted as the material issues of special concern for safety and sustainability.

With this, the company plans on focusing safe and ergonomics workplace, empowering women at work, respecting freedom of association, and ensuring fair wages for workers. It will also take steps to reduce the water usage, ensuring safe chemical management and addressing the climate change.

Highlighting its initiatives for last year, the company has decreased its water intensity by 10 per cent as a result of its refurbishment efforts which has resulted in the replacement of its jet dyeing machines at its textile facility in Honduras. Also, the company has recycled its 86 per cent of its waste.

As its environmental goals, the company has increased its green house gas emission intensity by 20 per cent per kg of product since 2015. Also, it has increased its energy intensity by 9 per cent and landfill waste intensity by 40 per cent, compared with its 2015 base year.