FW

Italian fashion group Benetton reported a €180 million loss in 2017. Now, the group has formulated a new strategy to make a comeback which is expected to show results in 2019. As per the new strategy, Luciano Benetton, Founder of the group, will lead this comeback. Despite making way for non-family managers to take control of the group in 2006, Benetton assumed the office of executive chairman of his struggling namesake in January this year. This month he delivered his biggest revision yet of the group’s governance and organisational structure.

Luciano Benetton has established a new corporate vehicle, Benetton SRL, to direct and co-ordinate the two operating subsidiaries of the apparel textile sector: Benetton Group SRL (commercial activity) and Olimpias Group Srl (productive activity).

The board of directors of Benetton SRL is chaired by Luciano Benetton as executive chairman and composed of Christian Benetton, Franca Bertagnin Benetton, Sabrina Benetton, Marco Patuano, Christian Coco and Fabio Buttignon

Under Armour, known for its hoodies, crewneck sweatshirts, jackets, and other items, wants to move from being a performance brand to lifestyle label. The company’s aims to get as big as rivals Nike and Adidas but it’s facing big obstacle in its way: those brands may, like Under Armor, be rooted in sports, but they’re also lifestyle labels. Under Armour is trying to bust out of the gym and get people to wear its brand on the streets. Under Armour’s Palm Angels collection has recovery technology. This is a patterned bioceramic lining. The pattern includes special bioceramic particles that absorb infrared wavelengths emitted by the body and reflect back infrared energy, helping the body recover faster while promoting better sleep.

Chasing the hype of streetwear feels practically obligatory today. Streetwear has become one of fashion’s most powerful forces and brands such as Nike have collaborated with streetwear-affiliated designers. Another big move is to create a sneaker with a pop star. Adidas has Kanye West. Puma has Rihanna (and now Jay-Z as a top figure at Puma Basketball). And soon Under Armour will have A$AP Rocky.

Under Armour expects weakness in its North American wholesale business to continue well into the next year.

Cotton yarn imports into China have slowed down dramatically. In the first quarter of 2018, volumes declined 13 per cent and values fell 11 per cent. Vietnam, India, Pakistan, Indonesia and Uzbekistan account for 90 per cent of the cotton yarn imported by China. Vietnam has now become the largest supplier of cotton yarn to China. Vietnam accounts for 36 per cent of the total cotton yarn imported by China up from 31 per cent in the same quarter of 2017. But India’s share declined from 31 per cent in 2017 to 19 per cent in 2018. India remains the second largest supplier of cotton yarn to China.

Price-wise, Vietnam is the costliest, followed by Indonesia, India, Uzbekistan and Pakistan. The fact that Vietnam is the costliest supplier of cotton yarn is intriguing since most spinning capacities in Vietnam have come from Chinese investments due to low labor costs and trade agreements. So the high priced yarn implies higher margins which flow back into China.

Looking ahead China will meet its yarn demand from domestic production and from Vietnam and slowly reduce imports from other suppliers. In fact China has expanded its domestic spinning capacity. In 2017, China’s cotton import volumes were marginally up 0.6 per cent compared to a year ago while value rose 6.5 per cent.

Asos has published an updated animal welfare policy that outlaws the use of animal-derived materials. The list covers fur, including angora; anything from vulnerable, endangered, exotic or wild-caught species; feather and down, bone, horn, shell (including mother of pearl), mohair, cashmere, and surprisingly, silk. The new guidelines will come into effect by January 2019.

Angora became a poster child for cruel fashion after PETA disseminated horrific footage of the rabbits being skinned alive in Chinese factories, prompting brands including H&M to halt production of angora products in 2013. In March 2018, H&M and Zara discontinued the use of Mohair after a PETA campaign revealed animal cruelty at facilities in South Africa.

Many more fashion fans are anti-fur than they are anti-leather. Stella McCartney leads the way for producing collections that are authentically in line with her ethics and values. As a vegan, she has outlawed leather completely from her supply chain and produces beautiful PVC-free alternatives.

To capitalise on various business opportunities in the alpaca fiber market, the Ministry of Foreign Trade and Tourism (Mincetur) in Peru has launched a luxury fashion brand ‘Alpaca del Perú’ for the sale of high-quality alpaca fiber garments and accessories. The Ministry of Agriculture and Irrigation (MINAGRI), recently stated that Peru is the largest alpaca fiber producer with around 3.8 million alpacas in the country – which is 87 per cent of the world’s alpaca population. Annual production of alpaca fiber in Peru stands at over 4,501 ton and Peruvian alpaca fiber exports surpassed U$68 million by the end of 2017.

Mincetur stated that the country’s alpaca exports increased by over 110 per cent in 2017 within a span of one year, with the rise of over 14 per cent average per kilogram in the export price.

"Another successful edition of Pitti Uomo came to a close with 19,400 buyers and 30,000 total visitors visiting the show. It also witnessed increased country participation with Germany, the UK, the Netherlands, France, the US and Canada, Hong Kong and India being among them. While there was a slight decline of visitors from Japan, China and Switzerland, Italian buyers, after some seasons of decreasing traffic, are slowly returning to Florence."

Another successful edition of Pitti Uomo came to a close with 19,400 buyers and 30,000 total visitors visiting the show. It also witnessed increased country participation with Germany, the UK, the Netherlands, France, the US and Canada, Hong Kong and India being among them. While there was a slight decline of visitors from Japan, China and Switzerland, Italian buyers, after some seasons of decreasing traffic, are slowly returning to Florence.

Another successful edition of Pitti Uomo came to a close with 19,400 buyers and 30,000 total visitors visiting the show. It also witnessed increased country participation with Germany, the UK, the Netherlands, France, the US and Canada, Hong Kong and India being among them. While there was a slight decline of visitors from Japan, China and Switzerland, Italian buyers, after some seasons of decreasing traffic, are slowly returning to Florence.

Showcasing S/S ’19 designs, the fair presented highly energetic outdoor-inspired area hosting various under-the-radar apparel, footwear and accessory collections combining function and fashion. And Wander offered outdoor-meets-fashion semi-transparent protective parkas, micropattern functional sweats and shorts and innovative design nylon accessories. South2 West8, a Japanese fishing apparel brand, offered both a casual apparel line and a technical collection of jackets and tops characterised by cool camouflage patterns such as trout, duck and leaf prints. Special anti-mosquito nets are printed and employed for cool jackets. Woolrich Outdoor, a collection offering bright, colorful and ultra-functional materials pieces to be worn both in the open air and in the city, also debuted during the show.

Trending streetwear

Comfortable silhouettes and functional materials were the highlights of Roberto Cavalli’s new collection and Fumito Ganryu’s newly launched eponymous collection. His comfortable cool contemporary looks play with XXL hooded sweatshirts and anti-fit functional trousers. Siviglia, a Made In Italy men’s trouser specialist, presented its three most iconic trouser models–a five-pocket, a chino and a luxury denim style.

Fumito Ganryu’s newly launched eponymous collection. His comfortable cool contemporary looks play with XXL hooded sweatshirts and anti-fit functional trousers. Siviglia, a Made In Italy men’s trouser specialist, presented its three most iconic trouser models–a five-pocket, a chino and a luxury denim style.

North Sails, an eco-conscious brand, gave a sneak peek into a series of capsules and product emphasising its connection with life at the sea and regattas. It has launched a total-look collection entirely made by recycling PET bottles. And Italian outer jacket 100 per cent animal friendly brand Save The Duck launched its new line of Ocean is My Home jackets made with Nety, a fabric made from 100 per cent recycled nylon fishing nets. In addition, part of what the company will earn from selling this line of jackets, will be donated to the Surfrider Foundation Europe, which cleans beaches and seas. Sease, an ‘outdoor sports meets urban life’ brand created by brothers Franco and Giacomo Loro Piana debuted this season. It employs eco-friendly fibres such as Fulgar, a bio-based yarn Evo from castor seeds, regenerated denim by Italdenim and thermore Ecodown.

It was all about colour trendy apparels this season. Colours such as orange, yellow, pink, red, green and blues made the entire show vibrant. Brands such as Blauer, Woolrich, K-Way and Ten C and Original Penguin, made them a part of their ensemble. Pony, the US historical sneaker brand, launched its new capsule collection Pony x Yong Baek Seok at Pitti. This collection’s signature is strong geometric colourful elements on both the upper and soles. This Korean designer has created important sneaker collections for Dolce & Gabbana, Diesel and Bally and is now head of design at the men’s sport division of Tod’s.

Harmont & Blaine, as a part of its Heritage Collection, launched ‘Camicia 8 Tessuti’, an iconic shirt model made with a patchwork of eight fabrics from past successful shirt models. Lotto is also celebrating its 45th anniversary and launched a series of new colorful running sneakers and a special model for Marco Cecchinato, the Italian tennis player who recently competed in the Roland-Garros semi-finals.

The launch pad

Giada, an Italian jeans manufacturer debuted the show by launching Hand Picked, a complete total-look collection 100 per cent accurately made in Italy, employing Japanese denims for jeans and Loro Piana fabrics for polo shirts. Replay has launched Replay Sportlab, a 25-piece capsule inspired by street and board sports and characterised by comfortable fits and made with functional fabrics that can be worn when playing sports. These include a special indigo material that looks like denim but is as soft and comfortable as a sweatshirt. Maurizio Donadi’s Atelier & Repair project focussed on upcycling old casual pieces into new items has launched a new brand – Produce Better. This new line only offers jackets and tops made with raw Candiani Denim Fabric’s Re-Gen, a newly launched 100 per cent regenerated denim treated with organic substances only.

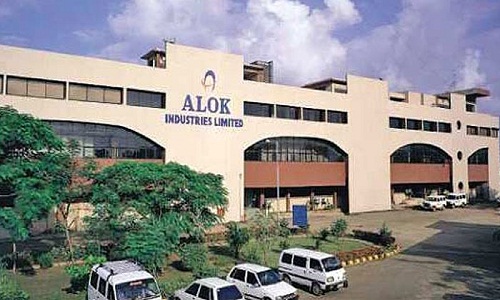

"Alok Industries, one of the most formidable players in Indian textile space, has been reeling under financial pressure and may soon be declared bankrupt if the dues aren’t paid. The current 270-day deadline for resolution set under the insolvency code is already over and the company management is trying to get some more time to get out of such a bad state but it seems that plan has been rejected by the committee of creditors in April as it received 70 per cent votes against the minimum requirement of 75 per cent then. A recent amendment to the Insolvency and Bankruptcy Code, however, lowered the threshold to 66 per cent. As per the plan, submitted by JM Financial Asset Reconstruction and Reliance Industries, was the only one on the table. The two had offered Rs 5,000 crore against close to Rs 30,000 crore in dues to creditors. Lenders rejected this resolution plan, putting the company at risk of liquidation. However, some of the company’s operational creditors and employees opposed this and approached the NCLT."

Alok Industries, one of the most formidable players in Indian textile space, has been reeling under financial pressure and may soon be declared bankrupt if the dues aren’t paid. The current 270-day deadline for resolution set under the insolvency code is already over and the company management is trying to get some more time to get out of such a bad state but it seems that plan has been rejected by the committee of creditors in April as it received 70 per cent votes against the minimum requirement of 75 per cent then. A recent amendment to the Insolvency and Bankruptcy Code, however, lowered the threshold to 66 per cent. As per the plan, submitted by JM Financial Asset Reconstruction and Reliance Industries, was the only one on the table. The two had offered Rs 5,000 crore against close to Rs 30,000 crore in dues to creditors. Lenders rejected this resolution plan, putting the company at risk of liquidation. However, some of the company’s operational creditors and employees opposed this and approached the NCLT.

Alok Industries, one of the most formidable players in Indian textile space, has been reeling under financial pressure and may soon be declared bankrupt if the dues aren’t paid. The current 270-day deadline for resolution set under the insolvency code is already over and the company management is trying to get some more time to get out of such a bad state but it seems that plan has been rejected by the committee of creditors in April as it received 70 per cent votes against the minimum requirement of 75 per cent then. A recent amendment to the Insolvency and Bankruptcy Code, however, lowered the threshold to 66 per cent. As per the plan, submitted by JM Financial Asset Reconstruction and Reliance Industries, was the only one on the table. The two had offered Rs 5,000 crore against close to Rs 30,000 crore in dues to creditors. Lenders rejected this resolution plan, putting the company at risk of liquidation. However, some of the company’s operational creditors and employees opposed this and approached the NCLT.

Beginning of the end

It all started with company’s aggressive expansion plan between 2004 and 2013, when the company spent more than Rs10,000 crore on building up its spinning, weaving, processing & garmenting units. Most of this was funded through debt. But the strategy didn’t go down well and as a result, its domestic retail plans failed to take-off and the share of exports slipped as the company could not maintain market share amidst global competition. To add to this, the company’s diversification into sectors like real estate weakened its finances further, eventually pushing the company into bankruptcy.

spinning, weaving, processing & garmenting units. Most of this was funded through debt. But the strategy didn’t go down well and as a result, its domestic retail plans failed to take-off and the share of exports slipped as the company could not maintain market share amidst global competition. To add to this, the company’s diversification into sectors like real estate weakened its finances further, eventually pushing the company into bankruptcy.

Analysts say, not only did the company over-invest, it also over-produced. Sameer Kalra, Founder, Target Investing feels large capex and high inventory maintained in anticipation of demand impacted the company. The demand scenario in the textile industry keeps on changing very quickly so very few companies can address it efficiently. Similarly, Bhavesh Chauhan, analyst, IDBI Capital, added that Alok Industries’ choice of investments was also questionable. For instance, Alok Industries invested in the spinning business which already had excess capacity in India. This failed to generate commensurate revenues for the company. Experts averred that in the textile industry, companies need to have periods of consolidation and expand only once the existing capacity is well utilised. Alok Industries ignored this fact and expanded its capacity continuously. As a result, Alok Industries failed to utilise its assets well. Its asset turnover ratio, which indicates the efficiency of deploying assets to generate revenue, remained below one times and declined sharply over the last few years.

Diversification – failed prop?

Alok Industries aggressively expanded into the retail market in India through ‘H&A Stores’. It also forayed into the UK market with ‘Store Twenty One’. At its peak, in financial year 2011-12, the company had nearly 350 retail stores in India and 221 stores in the UK. It didn’t even work as planned and it had to close down all its stores in India. In the UK, the company still has close to 100 stores and is planning to ‘exit this business at the earliest opportunity’. In 2007, the company also entered the real-estate business by acquiring commercial property in Lower Parel though its real estate subsidiary – Alok Infrastructure Ltd. This locked up large amounts of capital.

Between March 2007 and September 2013, the company saw its debt jump six times to Rs 20,230 crore. However, during the same time period, company’s cash flow from operations were much lower, putting its ability to repay in doubt. Adding to the company’s woes, interest rates started increasing. Between 2009 and 2011, the benchmark repo rate rose from 4.75 per cent to 8.50 per cent. The company’s own interest costs jumped to about 13 per cent from 7.5 per cent, ultimately putting the pressure on the company’s ability to service debt. This entire episode resulted in interest costs becoming the second largest expense for Alok Industries after raw materials.

"While outwardly, predictive analytics may appear to be antithetical to creativity; design houses, manufacturers, and retailers have always engaged in analysis, albeit perhaps not in a formal sense. Reviewing what has sold well previously, researching the history of a brand to inform future styles and staying on top of things like color trends are all basic analytics that have always being used by designer teams and merchandisers. However, the newer role of data is meant to give more developed insight into what consumers want."

A long tradition

While outwardly, predictive analytics may appear to be antithetical to creativity; design houses, manufacturers, and retailers have always engaged in analysis, albeit perhaps not in a formal sense. Reviewing what has sold well previously, researching the history of a brand to inform future styles and staying on top of things like color trends are all basic analytics that have always being used by designer teams and merchandisers. However, the newer role of data is meant to give more developed insight into what consumers want.

‘Edited’ is a retail technology company that helps retailers and brands around the world ensure they have the right product at the right time for the right price. Among other things, it creates dashboards where executives can compare their own successes and failures from the previous season, and that of their competitors. Planning toolkits also help companies set up trend parameters, identify key growth areas, and the subcategories that drove that business.

price. Among other things, it creates dashboards where executives can compare their own successes and failures from the previous season, and that of their competitors. Planning toolkits also help companies set up trend parameters, identify key growth areas, and the subcategories that drove that business.

Use of smart apps

Use of data can help brands develop a closer relationship with their customer. As per a Cotton Incorporated Lifestyle Monitor™ Survey, nearly half (46 per cent) of all consumers would like apparel brands and retailers to use information from their purchase history to personalise their shopping experience, Additionally, 46 per cent consumers wish apparel brands and retailers knew more about what they like and how they shop. And more than one-third would like brands and retailers to focus more on local trends and styles in their cities.

Data can be a guide when a designer feels creatively stifled or when his team feels that the data is pointing out something new and different which they should try, even if that’s not the case. The study points out, nearly 40 per cent of consumers use apparel brand and retailer apps on their smartphones or computers to shop online or in-store. And 54 per cent consumers are more likely to buy clothes from a store that offers personal clothing collections based on previous purchase history and preferences.

No guessing games

This is the type of data that brands and merchandisers can mine for future collections. According to Tableau Software fashion retailers are using embedded analytics to validate orders for certain styles, size, and color to avoid incurring additional manufacturing costs for small production run sizes. Fashion Snoops is another forecasting agency that works with companies to act on future trends. Their perspective is to understand how the consumer lives, what they eat, what kind of music they listen to, where they travel. All this sets the tone and intention on product that will serve and resonate with them. The company also identifies cultural macro and micro trends using news articles and social media. They follow the trends throughout the year and then help inspire design themes based on that. This includes color, texture, shape, and material. For brands and retailers, having these various data points will help take the guesswork out of how best to reach consumers.

American cotton farmers are worried about the trade war with China. The US cotton market has been fluctuating because of the dry weather and rain or no rain and the threat of tariffs. Currently, cotton is at a good price due to high demand and the rough weather conditions making it less available. But farmers feel it's only a matter of time before this changes and that if something is not done now it could be worse later. They feel China has had enough control already and it’s time for the US to do something.

The feeling is the trade war will not impact farmers in the short term, however, over time long-term consequences are feared. If every year prices are about six or seven per cent lower because of the tariffs prospects are not seen as good for US cotton. In response to the US’ 25 per cent tariff placed on Chinese goods, China has placed a 25 per cent retaliatory tariff.

China wants the US to set aside threats of tariffs on Chinese goods and US investment restrictions on Chinese companies. China also wants a relaxation of US export controls that ban American firms from selling certain high-technology products to China.

The US has imposed tariffs on steel and aluminium imports from India. India, in return, will raise duties on about 30 US imports, including certain iron and steel goods and even fruits, vegetables, almonds and apples. However, India may lose much more than the US in this trade war. US exports are barely 12 per cent of its GDP. India, on the other hand, is the largest exporter to the US after China.

India was earlier on the US radar over India’s imposition of 50 per cent duty (earlier 100 per cent) on Harley Davidson bikes. There were just 84 of these expensive bikes sold in India last year. The US is also reviewing the General System of Preferences that India enjoyed after the US dairy and medical equipment sectors complained over not having easy access to India’s markets. They are especially irked by price controls on items like stents.

The US has always had a grouse on India being categorised as a less developed country. It feels India is no longer an LDC as its per capita income is over $1000 a month and wants India to end the subsidies it gives its exports, particularly in agriculture and the electronics hardware technology parks scheme.