FW

A digital textile printing conference will be held in the US, December 6 to 7, 2016. The program will feature the industry’s most well-known and respected experts presenting topics essential for those involved in digital textiles. The two-day event will deliver unprecedented content to conference registrants who will leave with a wealth of understanding and inspiration to take back to their respective jobs. Technology, color management, product performance, testing, design, and more are included in the jam-packed event.

The first day includes a manufacturer’s panel, color management for digital textiles, finishing, meeting your customer’s sustainability objectives, product testing for quality assurance, and research findings from North Carolina State University College of Textiles.

The second day includes designing for digital printing of textiles, fabric factors impacting digital printing, digital print inspiration and design, web-to-print, digital manufacturing, and more. Most commercially available fabric is rotary screen printed; each print run is typically several thousand yards. The high minimums are due to the cost and time required to prepare a unique set of screens, with each color in a design requiring a separate screen.

The main advantage of digital printing is the ability to do small runs of each design because there are no screens to prepare.

The just concluded London Fabric Fair drew visitors and participants from students to high-end designers. It attracted a steady stream of visitors across two days (October 12-13). Exhibitors were in awe of the busy first day that had packed stands as buyers came to source luxury fabrics with minimum orders.

The show, which turns 15 next year, offered more than 80 collections from the UK, France, Italy, the US and Japan while the exhibitor numbers rose from 42 to 44 set across two floors. Buyers came from firms including Harrods and Jasper Conran, while fashion designers, tailors, bridal specialists, costume designers and students went through a range of woollens, silks, laces, cottons, prints and leathers for daywear, evening wear, bridal wear, lingerie, children’s wear and accessories. Besides fabrics, suppliers also showcased buttons, zips and labels and demonstrated sampling and small-run garment manufacturing capabilities.

Rieter’s combing machines have achieved highest standards of productivity in the world. Producer of textile machinery and automobile components, Rieter is based in Winterthur, Switzerland. The company’s technological advantage is based on optimal interaction between machine and technology. According to company sources, there are various technological and economic advantages in using Rieter’s set of combing machines.

The E 36 Omega lap is the most economical combing machine, the company said, adding that an increase in production of 20 per cent to over 600 kg/h at a constant speed of up to 230 m/min has been achieved. At such a high production rate, the Omega lap is far superior than conventional machines.

The influence of the Omega lap, on the economic performance of a unit’s combing section, is great. The high production allows a reduction in the number of preparatory machines which noticeably reduces the number of can changes while fewer personnel are needed.

As an example, the company stated personnel requirement calculations for a combing set in a compact spinning facility with 76,000 spindles. Compared to other machine manufacturers, personnel requirement could be reduced by three workers.

The strength of the E 86 comber lies in a high level of cleaning as well as excellent running performance, with high nip rates. The E 86 achieves fewer imperfections in the yarn (thin places, thick places, neps) at the same noil removal level compared to combers made by other manufacturers. The high degree of cleaning has no effects on fibre quality, which means that fibre length remains unchanged and thus yarn tenacity remains at a high level.

Faced with a lot of harassment from authorities for two decades even for minor inadvertent mistakes made on packets when products are sold as ‘packaged commodities’, hosiery manufacturers can now expect some relief. Following repeated representations of hosiery manufacturers, the Director of Legal Metrology at the Centre has now issued fresh directions on the issue. The new directive issued to Controllers of legal Metrology in states has asked them to make field level officers understand the differences in circumstances when certain goods were packaged in bunch like hosiery products and sold piece-wise in retail vis-à-vis general packaged goods like edible items which cannot be opened and act accordingly while imposing penalties.

Commenting on the move, South India Hosiery Manufacturers Association joint secretary R Damodaran said this has come as a big relief at a time when manufacturers have been asking for an ordinance to exempt hosiery products from the Packaged Commodities Rules 2011 itself to avoid misinterpretations.

Earlier since products were classified under the packaged commodities rules, the authorities used to penalise manufacturers even when a vendor, to whom the products were sold in bulk packets, subsequently sold it piece-wise. Another grouse manufacturers have been is that hosiery products are never bought by customers in bulk and consumers usually prefer one or two inner garments from the main packet that contains large number of pieces packed together for convenience. Hence, these should be treated as pre-packaged commodity and not as a packed item, they say.

C&A Europe has launched a new down puffer jacket collection, its first such collection to be certified by the Responsible Down Standard (RDS). The jacket was developed by Textile Exchange.

The new collection strengthens C&A's public commitment to the responsible sourcing of down and feathers. The company has now confirmed that from fall 2016 onwards, all of the down and feathers in its products will be RDS-certified. The new range will be available in all C&A stores throughout Europe and online.

The Responsible Down Standard (RDS), an independent, voluntary global standard owned by Textile Exchange and certified by third party certification bodies, encourages best practices in welfare and prevents harmful practices such as force-feeding and live-plucking. In addition, it enables traceability from hatchling to the final product.

With inputs from animal welfare groups, industry experts, brands and retailers, RDS has been developed over the past three years. It is said that RDS has been developed by all applicable quality principles. As such, it is applied to all down supply chains and provides the strongest chain of custody assurance.

In its endeavour to promote various products including engineering and textile in the international market, the Bengal government is in the process of drafting a comprehensive export strategy for the micro and small scale enterprises (MSEs) in the textile sector. The main purpose is to create demand for Bengal’s myriad products in markets abroad. This will not only restore the past glory of Bengal’s textile and other industries, but also help in reviving the economy of medium and small sectors in the state, the ruling part has said.

In this regard, a MoU has already been signed between the state government and the Export Import Bank of India (Exim Bank). The Micro, Small and Medium Enterprises (MSME) department has been working towards building infrastructure so that the products could be exported to various countries, boosting sustainable growth in various sectors.

Earlier, the Bengal MSME department had taken up a series of new projects to contribute to the development of the socio-economic condition of artisans across the state by giving them a platform to showcase their handicrafts. It had also set up Rural Craft hub Project at 11 different locations for this purpose. The hubs, which are also recognised by UNESCO, have turned into tourist hotspots.

The latest data published by the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), shows the garment making industry in the country currently stands as the backbone of the country’s economy as it holds 82 per cent share of the total national export and accounts for 20 per cent of Bangladesh’s GDP with a turnover that exceeds $28 millions. More than 4 million people are employed in garment manufacturing among and 90 per cent women.

Figures reveal the impact of the sector on social fabric of Bangladesh to improve the working conditions in the ready-made garment industry. It needs investments and commitment to create a better productive pattern. This is what M&J Group has been doing everyday. It has been collaborating with local institutions to meet the growing global demand for higher standards in textile. By doing so, the company became a role model for peers and beyond.

Along with sustainable production methods the development of production efficiency, human resources enhancement is one of the core value of the M&J Group. And Genesis Fashion, one of its main enterprises, has been given the certification of Registered Training Organization by the Bangladeshi Government and the International Labour Organization (ILO) in the framework of the Ready-Made Garment Center of Excellence project (COE).

The COE Project was designed to establish a replicable model of industry-driven training and support services Centre of Excellence for the Ready Made Garment sector in Bangladesh. The project, financed by Swedish International Development Agency (SIDA) and the fashion company H&M, is based on the fundamental principle that with an industry-based training focus, the initiative can effectively increase employability and drive higher incomes for the working poor.

As a model centre, Genesis Fashion demonstrated a sustainable, self-funded approach to coordinate training and labour market expertise and investment amongst a group of enterprises and training providers within the framework of Bangladesh’s skills and labour policies and institutions.

"The Welspun controversy has thrown up questions on whether there is any foolproof technique to differentiate fake and original cotton fabric? There are various methods of finding out. With the news of US-based client, Target Corporation, terminating business contract with textile major Welspun India, on the grounds of using a different variety of cotton instead of Egyptian cotton in the production of sheets, it has become a reason for debate for many in the industry."

The Welspun controversy has thrown up questions on whether there is any foolproof technique to differentiate fake and original cotton fabric? There are various methods of finding out. With the news of US-based client, Target Corporation, terminating business contract with textile major Welspun India, on the grounds of using a different variety of cotton instead of Egyptian cotton in the production of sheets, it has become a reason for debate for many in the industry. For starters, Target sells luxury bath and bedding products under the Fieldcrest brand in the US.

Just as the news broke, Welspun’s shares took a beating on the and market capitalisation declined by more than Rs 5,000 crores that particular week. As a result, share trading was suspended for two consecutive sessions and Welspun arranged an urgent conference call with investors and analysts to put across its version of the news.

“In the manufacturing process, we source a lot of raw materials, such as cotton, cotton yarn or greige fabric, from various vendors. We, thus, want to revalidate all our supply processes and systems,” Rajesh Mandawewala, Group Managing Director, Welspun, said. To solicit its claim, the company has taken Ernst & Young on-board to audit its supply systems & processes. This entire incident has acted as warning for other global partners such as Walmart and Bed Bath & Beyond, to be extremely cautious while sourcing products from India.

Lacking tech arm

Earlier in March, the Cotton Egypt Association, the world’s only trademark and licensing authority for the commodity, had tested home textile products labeled as Egyptian cotton and found that around 90 per cent of the products did not contain the premium cotton variety at all. Welspun was licensed to use the Egyptian cotton logo too and the Association has now launched an investigation following the Target case. Is this the case of counterfeiting & mislabeling? Ask trade pundits.

Lack of tools & technologies to verify the authenticity of Egyptian cotton can be the probable reason towards increasing cases of counterfeiting in the industry. Cotton Incorporated, a US-based industry-funded body, highlights there is no physical test to determine the authenticity of cotton products once the fibre is converted into yarn. But agencies like the Cotton Egypt Association have turned to DNA testing of cotton products.

Years of research has led Mohamed AM Negm of the Interregional Cooperative Research Network on Cotton for the Mediterranean & Middle East Regions & Suzan H Sanad of the Cotton Research Institute, Egypt, to develop the CTAB (cetyl trimethylammonium bromide) method to extract DNA from Egyptian cotton fibres throughout the supply chain, from farming till the finished product. The isolated DNA is then used to identify varieties of cotton, thereby establishing authenticity of the product.

For India to make its mark globally, counterfeiting has to end. With increased pressure to produce at the lowest cost, much of the ELS cotton manufacturing and final assembly has migrated to other countries, mainly China, India, Portugal, and Pakistan. The incentive to substitute lesser quality Upland cotton in place of the premium ELS cotton is high and opens the door for mislabeling, feel experts.

Some even think that the reducing supply of Egyptian cotton and its higher price are giving rise to clones. Stats show in 1980s, Egypt grew cotton on as much as 500,000 hectares of land per year but the area under cotton fell to 223,000 hectares by 2000-01, says US Department of Agriculture (USDA).

Drop in production of Egyptian cotton is mainly due to changes in consumer preferences and new technologies. Over time, consumer preference has shifted to garments, which require short- or medium-staple cotton such as denim and T-shirts. This shift in demand has overtaken the demand for clothing and bedsheets made of extra-long and long-staple cotton varieties.

The slump in Egyptian cotton production has also occurred in other countries, including India, China, Pakistan, and Brazil. Global production has decreased by 18 per cent to 21.3 million tonnes in 2015-16, according to Negm.

"Digitisation of the production chain is going to dramatically transform the entire apparel manufacturing space, believes Holger Max-Lang, newly appointed MD of Lectra Germany. Talking about the transformational journey over the decade, he said that Lectra is moving strongly in the direction of mobile production lines. For example, there are container solutions that can be integrated into a pop-up store - individual production for local sales, made possible by automation and robotics. The key question will be which functions clothing will assume in the future. Here, two areas are increasingly merging, nanotechnology and the textile industry."

Digitisation of the production chain is going to dramatically transform the entire apparel manufacturing space, believes Holger Max-Lang, newly appointed MD of Lectra Germany. Talking about the transformational journey over the decade, he said that Lectra is moving strongly in the direction of mobile production lines. For example, there are container solutions that can be integrated into a pop-up store - individual production for local sales, made possible by automation and robotics. The key question will be which functions clothing will assume in the future. Here, two areas are increasingly merging, nanotechnology and the textile industry. The result is so-called smart textiles, intelligent fabrics with woven-in electrical engineering. The resulting opportunities will transform the clothing industry and production.

Innovation expanse

Fashion and textile companies are investing heavily in the digitisation of the fashion and textile sector as market pressure increases and product lifecycles decrease. With its Speedfactory and the ‘Knit for You’ storefactory concept, Adidas has created groundbreaking examples of the future. According to Max-Lang, customers are particularly interested in 3D virtual prototyping and PLM (Product Lifecycle Management). The cutting room is also moving in the direction of industry 4.0 – digital, networked and intelligent. Robotics certainly plays a role in this respect, but the same degree of automation will not be possible sooner as is the case with the automotive industry.

Biggest challenge & PLM as solution

The biggest challenge for fashion companies is to become faster and more agile. Big players like Amazon, but also new digital startups, raise the bar further. This is one reason why Lectra has developed its current solutions, such as Lectra Fashion PLM, 4.0 compliant. The modular solutions meet the new requirements of companies and adapt to their changing business models. A PLM in a digital supply chain links all departments of a clothing manufacturer, simplifies communication and accelerates the development and production of products. This enables fashion companies to react quickly to trends. In addition, manufacturers are becoming more agile and can offer individual products, for example by allowing customers to influence parts of the design.

Cutting Room 4.0

In Lectra's new Cutting Room 4.0, all departments of a production facility are digitally networked. In this way, it enables profitable mass production with single pieces in series. The topic also plays a major role in the apparel sector, especially in the sports industry in the field of team sports. Tailor-made clothes, but at a price of mass production. Here too, Lectra will offer the right solution.

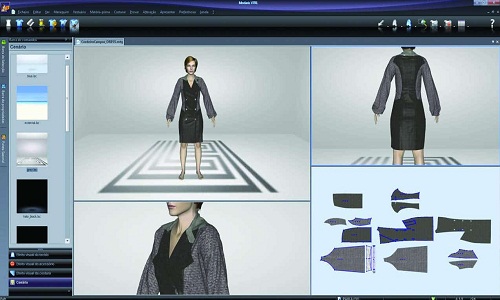

Talking about the possibilities of the 3D design, Max-Lang elaborated that correctly implemented, prototypes are no longer necessary with the 3D simulation. This saves time and money. This approach is a major step towards the digital development process. Especially companies for women’s wear as well as men’s wear use the Lectra 3D solution Modaris, as this system offers a pool of pre-fabricated cuts. This is the basis on which designers develop their designs. All subsequent departments also benefit from this because information such as grading can automatically be implemented and passed on.

Fit & stretchability in check

For the 3D simulation of fabrics on models, information about the elasticity (chain, weft, diagonal), bending resistance as well as the weight and thickness of the fabric is digitally determined. The techniques used include FAST (Fabric Assurance by simple testing) and KES F (Kawabata Evaluation System for Fabrics). Based on this existing data, users can create their own fabrics or have them digitised by a laboratory. Lectra system already contains more than 300 fabrics.

For some time, Jeanologia has been promoting the Mexican textile sector with sustainable technologies that help increase productivity and competitiveness. The leading Spanish company in the development of sustainable solutions for the finishing of jeans is presenting Exintex 2016 innovations that will transform the Mexican industry towards automation and efficiency.

The company has helped reduce 90 per cent water and chemical consumption and 50 per cent power thanks to the combination of its three sustainable technologies: laser, ozone and e-Flow nano bubbles. Also, its integration of these three technologies power new creative possibilities scalable to large productions.

At Exintex, the company will showcase its latest developments that have been applied to laser, ozone G2 and E-Flow nano bubbles technologies. One can see vintage clothing, novel designs and trends with a common denominator: authentic eco efficient products. Using Light PP Spray and Light Scraper solutions, it is possible to produce pollution-free jeans as the use of the dangerous potassium permanganate has been removed and it’s possible to clone the authentic look of the antique denim in an efficient and ethical manner.

From the October 18th to the 21st Jeanologia will also perform live demonstrations of Flexi HS 3D laser machine that adapts to the needs of each manufacturer or designer and offers maximum versatility. It allows multiple combinations of dial-up thanks to its Swivel Head and optical system that allows you to work both in horizontal and vertical mode on jeans, shorts, shirts, t-shirts, jackets and accessories.

The Mexican clothing industry is a pioneer in the introduction sustainable technologies for manufacturing garments and has become a leading producer in the American market. Currently, 95 per cent of finished garments using laser and ecological processing techniques is done with developments from Jeanologia. Jeanologia has been present in Mexico for last 10 years and works with major brands and manufacturers.