FW

The Joint Apparel Association Forum (JAAF) has approved the levy of the new 20 per cent reciprocal tariff rate on Sri Lanka’s apparel exports to the United States. The organization praised the Government of Sri Lanka for its determined efforts in securing this favorable outcome, which is considered crucial for the nation's apparel sector.

The revised tariff brings Sri Lanka's apparel industry into closer alignment with other major regional exporters like Bangladesh, Cambodia, Vietnam, Indonesia, and Pakistan. This change creates a more level playing field and helps maintain the competitiveness of Sri Lankan apparel in the key US market.

JAAF reaffirmed its commitment to collaborating with the Sri Lankan government and its US counterparts to promote ethical labor practices, environmental sustainability, and innovation within the industry. The organization believes, these shared values, combined with ongoing diplomatic efforts, will deepen bilateral trade relations and potentially lead to further tariff reductions in the future.

A leading technology company owning Sports.com, Concerts.com, and Lottery.com, SEGG Media Corporation has launched its first apparel collection since the company’s strategic investment in Veloce Media Group.

Titled, ‘Quadrant Speedway,’ the collection blends motorsport heritage with streetwear aesthetics. The collection was launched by Lando Norris in the F1 paddock ahead of his pole position and podium finish at the Belgian Grand Prix last weekend.

Quadrant has always aimed to position itself at the centre of key motorsport subcultures, and this time, the brand embraced a more aggressive, rugged creative direction. With its raw energy and exhilarating atmosphere, Speedway provided the perfect backdrop.

Matthew McGahan, Chairman & CEO, SEGG Media, says, the Speedway Collection offers the first glimpse into SEGG Media powering the next generation of sport, fashion, and fandom since the acquisition.

Quadrant has emerged as one of the most influential brands targeting Gen Z and millennial audiences across motorsport, gaming, and digital content. With an audience reach of more than 750 million views per month and 55 million subscribers, Veloce’s platform gives Quadrant launches, such as the Speedway Collection, an unmatched global audience.

The Speedway collection also reflects SEGG Media’s long-term vision through Sports.com, its flagship platform aimed at reshaping how fans consume, engage with, and experience modern sport. Defined by gritty textures and bold distressed finishes, the collection celebrates the collision of racing, culture, and design.

Founded in 2018, Veloce Media Group is a multi-pillared gaming, motorsport, and lifestyle media business operating at the intersection of some of the world’s fastest-growing and most future-focused industries.

Headquartered in London, Veloce’s ecosystem spans the industry-leading gaming and racing platform Veloce Esports, the upcoming hydrogen-powered FIA Extreme H World Cup team, Veloce Racing, and a vast digital media network boasting over 55 million subscribers and 750 million monthly views.

SEGG Media is a global sports, entertainment and gaming group operating a portfolio of digital assets including Sports.com, Concerts.com and Lottery.com. Focused on immersive fan engagement, ethical gaming and AI-driven live experiences, SEGG Media is redefining how global audiences interact with the content they love.

Scheduled from September 2-4, 2025 in Shanghai, the upcoming autumn edition of Yarn Expo will feature over 500 international exhibitors, many highlighting their diverse sustainable practices and products. This year, exhibitors will undergo the independent Econogy Check, an initiative prioritizing environmental certifications. The event will accelerate the industry's collective journey toward a more sustainable future.

Beyond the booming recycled yarn market, projected to hit $8.31 billion by 2030, the demand for eco-textiles is manifesting in various forms. While some companies focus on groundbreaking solutions, others integrate existing green materials and processes, supported by recognized certifications. Yarn Expo continues to prove its effectiveness as a vital platform for sustainable industry exchange, with its extensive international reach, broad product offerings, and impactful fringe programs driving exposure to innovative trends.

Visitors to Yarn Expo Autumn will discover a wealth of exhibitors showcasing a spectrum of sustainable practices. Key participants include the Docotton Group AS from Türkiye, Vietnam-based Hai Thien Synthetic Fiber Limited Company, Jiangxi Hengbang Textile Co from China, Indian company Shri Madhusudan Rayons and The Movement BV from the Netherlands.

As a part of the Texpertise Network, Yarn Expo Autumn consistently prioritizes its own sustainability efforts. Held concurrently with Intertextile Shanghai Apparel Fabrics – Autumn Edition, CHIC, and PH Value, the fair also fosters synergy across the fiber, yarn, apparel, fashion, and knitted garment industries, maximizing business opportunities for all participants.

Quashing rumors about the Roberto Cavalli business being up for sale, Hussain Sejwani, Owner, Damac Group says, the group has been investing in the growth and success of the company since acquiring it in 2019 and continues to remain interested in acquiring strategic partners who can add value to the business, he adds.

Robert Cavalli has faced the same challenges that have hit the rest of the luxury sector in recent years. However, the brand continues to open new boutiques and launching regular collections as well as collaborations. This year alone, the brand opened new stores in Ibiza, Dubai Mall and Los Angeles besides collaborating with Skims and LeSportsac.

Launched in 1970, the label’s founder died a little over a year ago. The company had been bought just before the pandemic by DAMAC, which is a multi-billion-dollar business conglomerate founded and headquarted in the UAE by Hussain Sajwani. The parent company also invests in luxury real estate, capital markets, hotels/resorts, manufacturing, catering, and data centers.

Small-cap company with a market cap of $75.39 million, Loop Industries has unveiled a new circular polyester resin made entirely from textile waste.

Called Twist, the polyester resin is designed to provide the fashion and textile industries with a sustainable alternative to virgin polyester. The product is created using Loop's patented depolymerization technology, which breaks down old polyester textiles into their core chemical components. These components are then purified and repolymerized, resulting in a resin that is chemically identical to polyester made from fossil fuels.

Giovanni Catino, Chief Revenue Officer, Loop Industries states, Twist is a major step forward in closing the loop for textiles. The company claims, production of Twist can reduce greenhouse gas emissions by up to 81 per cent compared to fossil fuel-based resin. These figures have been independently validated by Franklin Associates, a ERG division.

Twist features embedded chemical tracers that allow for complete traceability. This technology enables products to be tracked back to their original textile waste inputs, verifying the recycling process. The resin is designed to work seamlessly with existing spinning and manufacturing equipment, allowing for easy integration into current production lines without major modifications. It will be produced at Loop Industries' Terrebonne facility and at the planned Infinite Loop India facility. The India plant is strategically located to serve global textile and apparel brands.

Oeko-Tex has become an official member of United Nations Fashion and Lifestyle Network (UNFLN), a global platform dedicated to fostering collaboration and innovation in support of the UN's 2030 Agenda for Sustainable Development.

This new partnership enhances OEKO-TEX's role in global sustainability efforts significantly by providing a direct channel for its expertise in certification, traceability, and responsible sourcing.

As a member of the UNFLN, OEKO-TEX gains a unique opportunity to engage in high-level discussions and contribute to global policy dialogues. Represented by its official partner, Testex, the organization will actively provide its technical and scientific knowledge to accelerate collaborative action on the Sustainable Development Goals (SDGs). The network connects industry leaders, policymakers, and civil society, creating a structured ecosystem for knowledge exchange and promoting best practices.

By joining this UN-recognized platform, OEKO-TEX and Testex will increase the visibility of certified best practices and contribute crucial scientific data to international initiatives that are shaping the future of textiles and lifestyle goods. This strategic move strengthens their position as leaders in sustainable supply chain management and reinforces their commitment to a more transparent and responsible global fashion industry.

Having set an ambitious goal of increasing its exports to $100 billion by 2030, the Indian textile industry has been shaken by the imposition of 25 per cent tariffs on India’s textiles and clothing by the US. This move comes as a major shock, especially as India was making strides in negotiating a Bilateral Trade Agreement (BTA) with the US to lower tariffs.

According to Dr SK Sundararaman, Chairman, Southern India Mills’ Association (SIMA), this unexpected tariff poses a serious setback that could negatively impact India’s export performance in the short term. With the festival season approaching, the new tariff could severely affect summer export orders.

A critical market for India, the US accounts for nearly 30 per cent of its total garment exports. India currently exports about $11 billion worth of textiles and clothing to the US and has seen its market share grow from 4.5 per cent in 2020 to 5.8 per cent in 2024. Before this new tariff, Indian exports faced duties of up to 16 per cent on readymade garments, which already hurt their competitiveness.

While a 25 per cent tariff may seem manageable compared to those on other countries, the real concern for the industry is the penal tariff, the full impact of which is not yet clear. Dr. Sundararaman has appealed to the Indian Prime Minister to intervene with the US President to withdraw the penal provisions and expedite the bilateral negotiations scheduled for later this year.

Reacting to US President Donald Trump's announcement of a 25 per cent tariff and a penalty on Indian imports, Sudhir Sekhri, Chairman, Apparel Export Promotion Council (AEPC), stated, though higher than anticipated, the impact of the new tariffs will be mitigated with the signing of the interim Bilateral Trade Agreement (BTA) between India and the US between October and December 2025.

Sekri noted, the ‘penalty’ is a ‘grey area’ and hoped the Indian government would negotiate a resolution with the US before August 1, 2025.

Accounting for a 33 per cent share of India's total garment exports in 2024, The US is a critical market for India's ready-made garment (RMG) exports. India's market share in US garment imports has steadily increased from 4.5 per cent in 2020 to 5.8 per cent in 2024, placing it as the fourth-largest RMG exporter to the U.S.

Globally, China remains the top exporter to the US, holding a 21.9 per cent market share in 2024, a decrease from 27.4 per cent in 2020. Together, China, Vietnam, and Bangladesh supplied 49 per cent of all U.S. apparel imports in 2024.

The top three apparel products exported by India to the US include cotton T-shirts making up for 9.71 per cent of India's total RMG exports to the US; women's or girls' cotton dresses accounting for 6.52 per cent of exports and babies’ cotton garments representing 5.46 per cent of exports.

These three products hold a significant share of the total US imports for their respective categories, with shares of 10 per cent, 36 per cent, and 20 per cent respectively.

Once celebrated as a textile stronghold bridging East and West, Türkiye’s garment and textile sector now faces numerous crises. From runaway inflation and soaring wages to a depreciating currency and tightening environmental regulations, the very fabric of the country’s textile dominance is under pressure. The once-iconic ‘Made in Türkiye’ label—synonymous with quality, speed, and proximity to Europe—is increasingly at risk, particularly in the mass-market segment, as manufacturers scout for more cost-effective production bases abroad. This reckoning marks more than a cyclical downturn; it highlights a fundamental restructuring of Türkiye’s position in the global textile value chain.

Economic strains fray the edges

At the heart of Türkiye’s textile woes is a potent cocktail of economic instability. Inflation, which exceeded 75 per cent year-on-year in 2024, has battered business confidence and dramatically inflated production costs. While the increase in Türkiye’s minimum wage to 17,002 TRY (about $520) is a welcome boost for workers, it has hit labor-intensive sectors like textiles especially hard. Garments produced in Türkiye are now estimated to be 60 per cent more expensive than those from East Asia, and about 45 per cent costlier than equivalents made in North African countries.

Adding to the strain is the Turkish Lira’s relentless slide, depreciating from 18.6:$1 in 2022 to nearly 40:$1 in 2024. This devaluation may seem advantageous for exporters, but it inflates the cost of imported raw materials and machinery—essentials for Türkiye’s vertically integrated production chains.

Moreover, electricity and logistics costs have nearly doubled. In April 2025, household retail electricity tariffs rose by 25 per cent, with a 10 per cent hike for industrial consumers, directly impacting operating budgets. The outcome? Shrinking margins, falling output, and vanishing jobs. Textile production is currently operating at just 50-60 per cent of normal capacity, and the workforce has contracted by over 300,000 in two years, from 1.25 million in 2022 to under 950,000 in 2024.

Environmental ambitions, a double-edged sword

Compounding the economic pressures is Türkiye’s shift toward a green economy. While commendable for its long-term vision, the government’s stricter environmental regulations—especially for pollution-heavy operations like textile dyeing—have imposed additional burdens on manufacturers.

Factories are now required to invest in cleaner technologies, obtain new environmental permits, and comply with tougher compliance standards. While these steps are necessary for sustainability, they add another layer of cost and operational complexity. Many industry insiders warn that such requirements, if not paired with government support or phased implementation, could accelerate the decline of small and mid-sized textile firms.

Exodus vs. evolution

As domestic conditions tighten, many Turkish manufacturers are actively relocating operations abroad to preserve competitiveness. Bangladesh, Pakistan, and Egypt have all received significant interest, but Uzbekistan has emerged as a breakout star.

What works for Uzbekistan is its proximity to CIS markets as its geographically positioned as a logistics bridge to Russia, Kazakhstan, and Kyrgyzstan. Lower labor cost is another attraction and a substantial cost advantage in wages and overheads. Favorable energy prices and policy support is another plus as the Uzbek government actively promotes textile sector investment, particularly from Turkish firms. Meanwhile, Uzbekistan has achieved 100 per cent conversion of its domestic cotton into yarn, offering a full supply chain in-country. And it has duty-free EU access, unlike many Asian competitors.

The transformation isn’t hypothetical as case studies abound. For example, ModaNova Textiles, a Turkish firm, has partially shifted production to Egypt while retaining design and administrative functions in Türkiye. Similarly, Denim Pro, a renowned denim brand, has opened a new facility in Egypt for cost-effective manufacturing. Entrepreneurs from Istanbul are already establishing warehousing facilities in Uzbekistan, with future plans to begin local production.

Table: Turkish textile industry at a glance

|

Indicator |

2022 Data |

2024 Data (approx.) |

Change/Notes |

|

Inflation (YoY) |

96% |

75% (currently) |

Persistently high, impacting production costs |

|

Minimum Wage (TRY) |

8,506 TRY |

17,002 TRY |

Doubled, increasing labor expenses |

|

TRY:USD Exchange Rate (approx.) |

18.6 TRY:1 USD |

40 TRY:1 USD |

Significant depreciation, imports costly |

|

Textile Workforce |

1.25 million |

< 950,000 |

Over 300,000 jobs lost |

|

Textile & Raw Materials Exports |

$9.5 billion (2024) |

-0.6% decline from 2023 |

Indicative of declining competitiveness |

|

Ready-to-Wear Exports |

$17.9 billion (2024) |

-7% decline from 2023 |

Signals pressure on finished goods sector |

Note: Data for 2024 and 2025 are approximate based on available reports and projections, and some figures may vary slightly across different sources.

Rebranding ‘Made in Türkiye’

While the flight of mass-market production seems inevitable, Türkiye still retains critical strengths. It is unlikely the country can or should compete with low-wage nations on volume. Instead, the opportunity lies in refocusing on high-value, premium textile production. The country’s niches include:

• Luxury & designer apparel: Türkiye’s craftsmanship and design acumen are ideal for short-run, high-margin fashion production.

• Technical & sustainable textiles: Innovations in bio-based fibers, smart textiles, and recycled yarns align with EU mandates and global demand.

• Custom and quick-turnaround manufacturing: Türkiye’s location enables faster deliveries to Europe compared to Asia—an edge for brands focused on agility and reduced inventory risks.

Efforts are already underway. Associations are promoting standards like GOTS (Global Organic Textile Standard) and OEKO-TEX, while companies increasingly adopt waterless dyeing, renewable energy sources, and traceability platforms to attract discerning international buyers.

Reinvention or retreat…

Türkiye’s textile sector stands at a juncture: on one path lies further deindustrialization, with factory closures and lost livelihoods; on the other, an ambitious reinvention into a leaner, greener, more premium manufacturing hub.

The global supply chain is evolving rapidly, rewarding adaptability and specialization. Türkiye’s future in textiles may no longer rest in quantity, but in quality, sustainability, and innovation. With strategic recalibration, the nation can still weave a compelling story for its iconic Made in Türkiye label—one not defined by cost alone, but by craftsmanship, credibility, and conscious manufacturing.

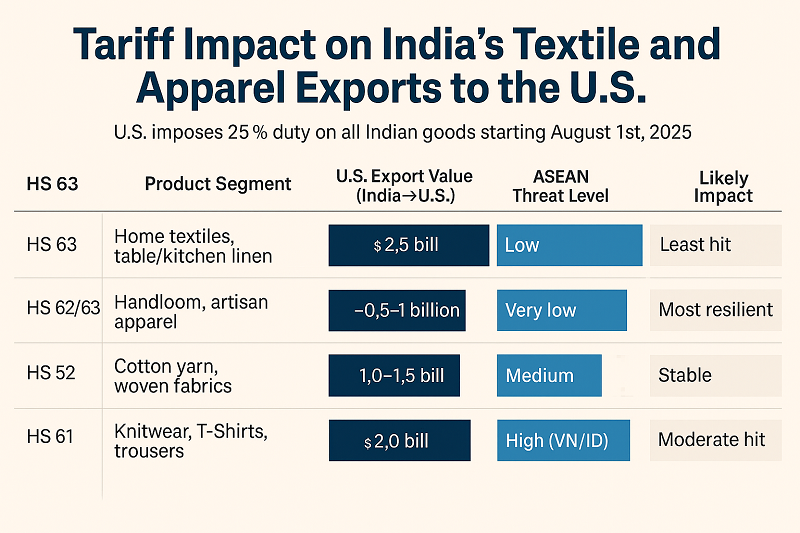

In a significant trade development, the United States has imposed a 25% tariff on all Indian imports, effective from Aug 01, 2025. This move deals a strong blow to India’s export sectors, particularly textiles, garments, and home furnishings. Announced by President Donald Trump on July 30, the tariff comes in response to India’s “high tariffs, non-monetary trade barriers, and continued energy trade with Russia.”

While the tariff raises concerns across India’s export-dependent sectors, a closer look at product categories reveals a mixed picture. Some segments appear more insulated due to limited competition, while others are exposed to cheaper alternatives from ASEAN nations.

US Imports From India: $10 bn textile pipeline at stake

In 2024, India exported nearly $10 billion worth of textiles and apparel to the US, accounting for approximately 28–29% of its global Textile & Apparel (T&A) exports. Globally, the U.S. imported $107 billion worth of textiles, making India its third-largest supplier.

However, India’s product-wise advantage isn't uniform. According to UN COMTRADE and Moneycontrol, India holds over 50% market share in key U.S. imports such as:

|

Product Category |

Imports from India ($ Mn) |

India’s Share of U.S. Imports (%) |

|

Cotton bed linen |

817.5 |

59.40% |

|

Textile fabrics printed/laminated with plastics |

273.6 |

56.60% |

|

Carpets knotted |

176.4 |

59.70% |

|

Carpets tufted |

141.8 |

72.40% |

|

Table linen, of cotton |

129 |

72.90% |

|

Toilet and kitchen linen |

78.1 |

50.50% |

|

Basketwork, wickerwork (partially textile) |

140 |

56.00% |

In total, more than $3 billion worth of U.S. textile imports have over 60% dependence on Indian suppliers, making them less vulnerable to sourcing shifts, even with the new tariffs.

Who’s Hurt Most? : HS Code impact breakdown

HS 61 – Knitwear & Cotton Apparel-Includes: T-shirts (6109), knitted trousers (6103)

● India’s U.S. Export: ~$2 billion

● Competitive Landscape:

○ Vietnam (20%) and Indonesia (19%) are now 5% cheaper than India post-tariff.

○ Bangladesh (35%), Cambodia (36%), and China (30%+) remain more expensive.

HS 63 – Home Textiles & Crafted Linen-Includes: Bed linens (6302), towels, table linens

● India’s U.S. Export: ~$2.5 billion

● Advantage: India’s design-led, artisan-rich goods face minimal ASEAN competition.

According to Moneycontrol, India supplied:

● 83% of U.S. carpets & rugs

● 73% of table linen

● Over 60% of 13 key textile lines

This makes HS 63 India’s most resilient export category despite the tariff hit.

HS 52 – Cotton Yarn & Fabrics

● India’s U.S. Export: $1–1.5 billion

This is a less competitive segment where India enjoys a significant scale advantage; ASEAN nations do not dominate here.

HS 62/63 – Handloom & Ethnic Fashion-Includes: Sarees, GI-tagged scarves, embroidered apparel

● India’s Share: ~$0.5–1 billion

These are unique products without mass-production competition from ASEAN.

Tariffs May Bite Short-Term, But India’s Position Remains Strong:Experts say

Rahul Mehta, Chief Mentor, CMAI, explains, “This will make our products 7% to 10% more expensive than some of our competitors, and it will certainly hurt our apparel exports to the US... but it’s not beyond our ability to face.”

Sanjay K Jain, Chairman, ICC National Textiles Committee, observes, “Vietnam & Indonesia have a 5% advantage—but China, Bangladesh, Myanmar, Cambodia are at a disadvantage. USA buyers want to reduce dependency on China & Bangladesh—so where will they go?” He adds, “India does not have capacity for more than 10% growth right now—but buyers already committed to India will continue. Yes, it's a 5% hit, but it's manageable.”

He warns, however, of a bigger concern: “The penalty threat linked to Russia is the real worry. India must act—remove the 11% import duty on U.S. cotton and use savings from oil to subsidize export duties on U.S.-bound goods.”

Competitor Tariffs: Who benefits?

|

Country |

Tariff to U.S. (Post-2025) |

|

Vietnam |

~20% |

|

Indonesia |

~19% |

|

Bangladesh |

~35% |

|

Cambodia |

~36% |

|

China |

~30% + extra duties |

|

India |

25% (new) |

Despite India’s setback, the tariff differential still positions it at par with or ahead of several major exporters, especially in home and ethnic textiles.

Near-term disruption, long-term opportunity?

According to Mehta, “Fortunately, this set-back has come at a time when we’ve just signed an FTA with the UK and are proceeding rapidly with the EU. So yes, it’s tough times—but not panic time.” Sanjay Jain echoes, “Maybe the bullish feel is gone—but certainly not bearish. Apparel growth will continue—India is in a neutral position globally.”

Strategic Takeaway: Where India stands strongest

|

HS Code |

Segment |

U.S. Value |

ASEAN Threat |

Tariff Advantage |

Outlook |

|

HS 63 |

Home textiles, table/kitchen linen |

$2.5 B |

Low |

High |

Least Hit |

|

HS 62/63 |

Handloom, artisanal fashion |

~$1 B |

Low |

High |

Most Resilient |

|

HS 52 |

Cotton yarn & woven fabrics |

$1–1.5 B |

Medium |

Moderate |

Stable |

|

HS 61 |

Knitwear, T-shirts, trousers |

~$2 B |

High (VN/ID) |

Low |

Moderate Hit |

Tactical response needed, not panic

The 25% tariff poses a challenge, but India’s dominance in key U.S. categories like home textiles, carpets, and ethnic linens acts as a natural buffer. The real exposure lies in cotton apparel, where Vietnam and Indonesia now gain an edge.The path forward may lie in policy action—as Jain suggests—removing cotton duties and incentivizing value-added exports using savings from Russian oil.

As global sourcing shifts and FTAs with the UK and EU move forward, India’s textile sector remains challenged but not cornered. Its resilience may yet convert this crisis into a competitive advantage.