FW

Global Value Chains, also called GVCs, may represent a significant opportunity for African countries to improve their prospects for expanding non -commodity exports.

In the past, for a country to become an apparel exporter, it would need everything from design capabilities through to textile mills. But under GVC dynamics, a country can specialise in certain activities and import the necessary inputs.

GVCs have provided a first step for expansion of the economies of China and much of East Asia. In these regions, GVCs are at the heart of the open economy model that is responsible for the growth and poverty reduction success story of the region in recent decades.

With wages rising rapidly in China, parts of these GVCs are migrating elsewhere in the region and globally. Some estimates suggest that 85 million manufacturing jobs will migrate from coastal China over the next 20 years and Sub-Saharan Africa is expected to be a major beneficiary.

However joining GVCs is not enough. Countries must establish value-adding positions in these production networks and upgrade continuously if they are to use GVCs effectively as an instrument for inclusive growth.

The GVC spillover effects are the highest in Namibia, slightly lower in South Africa, and very low in Swaziland.

China’s overall economic growth slowed in 2015.The quarterly growth for 2015 was as low as 6.8 per cent. Though clothing categories and cosmetics recorded a 8.8 per cent increase in December.

In the physical space, online retail sales of food, clothing and commodities rose 40.8 per cent, 21.4 per cent and 36 per cent. Online retail sales of physical goods rose 31.6 per cent. Online retail sales of non-physical goods rose 42.4 per cent. Retail sales of consumer goods totaled rose 10.7 per cent over the previous year.

Retail sales of clothing, shoes and textiles increased by only 6.9 per cent in December 2015. Total retail sales were under 10 per cent, a record low for almost 30 years.

Market prices are higher today than they were in 2014, the year when China surpassed the US to become the world’s largest economy (in terms of purchasing power parity). But even at that time China’s economy was already slowing. The growth rate averaged 10 per cent in 1980-2010, but fell to seven to eight per cent from 2012 to 2014.

Moreover, China’s once seemingly inexhaustible surplus of rural labor willing to migrate to urban areas has largely disappeared, causing wages to rise and the country’s competitive advantage in labor-intensive manufacturing to weaken.

True Religion has turned to Aptos, a retail technology solutions company, to create an endless aisle for the Apple Watch app.

True Religion was challenged in offering its customers all washes, colors and cuts of its denim in its 1,500-square-foot stores. The brand didn’t want to risk turning away customers simply because they didn’t have the exact product shoppers desired in stock. Through Aptos’ endless aisle technology, True Religion is able to expand shelf space by connecting its complete catalog of products and ensure every opportunity for every sale is converted.

Through the app, sales associates in stores can access a comprehensive view of inventory and view, filter and quickly locate the exact size, style, color and wash they think the customer might like.

Once the associate finds the items they want, they can then cast the merchandise image from the watch to a large high-definition monitor for the customer to view. The image includes a bar code that allows sales associates to complete the sale by scanning the bar code via an Aptos mobile point of sale device. After the purchase has been completed, Aptos ensures the product is shipped directly to the customer’s home.

Through the app, True Religion hopes to meet the growing needs of customers and improve customer service.

www.truereligion.com/

Monsanto in cooperation with the Lubbock Economic Development Alliance (LEDA) is planning to begin construction of a new, state-of-the-art cotton seed processing facility in Lubbock, Texas. The construction of the new facility is expected to begin in March 2016 and be completed in the second half of calendar year 2017.

With a capital investment of $140 million, the new Lubbock is expected to employ 40 full-time personnel. The site will be established as Monsanto’s primary U.S. hub for all commercial cotton seed processing operations – to include cleaning, treating and bagging of cotton seed – while existing processing facilities will transition to support storage and warehousing, pre-commercial operations and research in various parts of the Cotton Belt.

According to Dave Penn, cotton manufacturing lead at Monsanto, the facility in Lubbock will boost collaboration and efficiency within the company’s manufacturing organization. Last October, Monsanto announced a number of strategic actions to help drive greater scale in its business and further enhance its overall operations. Location of the new hub facility, Monsanto’s established relationship with LEDA and the opportunity to leverage new production technology factored into the decision to consolidate and optimize its U.S. commercial cotton seed processing operations.

The company’s existing cotton seed processing facilities in Arizona, Mississippi and Texas will continue to support manufacturing operations until summer 2017, at which point they will transition to support storage and warehousing, pre-commercial operations or research. Manufacturing employees who are offered the opportunity to relocate will also have the option to receive a severance package in the event they choose not to relocate. All remaining affected employees will be offered enhanced benefits under Monsanto’s Separation Plan.

Indonesia’s garment and footwear manufacturers are hoping that the agreement with the European Free Trade Association (EFTA) will give them greater access to the European market. EFTA consists of Switzerland, Norway, Iceland and Liechtenstein. These countries are small in size and population but have high per capita incomes and exhibit strong fashion trends. So they are seen as holding great potential for Indonesian textile products through the four seasons of the year.

Indonesian textile products are currently subject to import tariffs between 11 and 30 per cent in these four countries. Reducing tariffs to zero per cent would make Indonesian goods more competitive. Indonesia is struggling to come out of a stubborn economic slowdown. Footwear and apparel are among Indonesia’s foremost export goods to the EFTA countries. Indonesian footwear exports to EFTA more than doubled in 2014, when they accounted for almost 18 per cent of total Indonesian exports to the four countries. Woven and knitted apparel contributed a further 20 per cent of Indonesian exports to EFTA countries.

Indonesia is seeking lower tariffs on processed agricultural goods from the EFTA countries this year. It is also seeking more investment from the four countries and transfer of technology and a greater involvement in the global value chain.

Bangladesh’s growth may accelerate to 6.7 per cent this year, making it one of the world’s fastest-growing economies. Export growth is likely to become stronger as the year goes on, as global demand picks up and manufacturers continue to look at Bangladesh as a cheap alternative location for their factories.

The country boasts of a large and youthful population, as well as relatively low labor costs. As the world’s large emerging markets falter, frontier economies like Bangladesh and Vietnam are holding steady. Bangladesh’s increasing market share in the European Union and recovering US demand shield it from China’s slowdown, while better demographics offer it an edge over other Asian nations.

Per capita income rose past $1,000 in 2015 and hopes are that it will rise fourfold by 2021. Exports contribute about 20 per cent to Bangladesh’s gross domestic product. Garments account for about 80 per cent of overseas shipments and two-thirds of these go to the US and the European Union.

However, there are looming dangers. Competition from Vietnam means Bangladesh has to diversify from cheap garments. There is a prolonged slowdown in the European Union which buys 61 per cent of Bangladeshi garments. And implementation of the Trans-Pacific Partnership would threaten the US market, which purchases 20 per cent of Bangladesh’s textile exports.

The National Textile Corporation is looking at economising on power front and increasing productivity. It has also taken up short-term modernisation. The first phase of this project, involving Rs 70 crores, will be completed shortly and the second phase will start in March this year and will see an investment of Rs140 crores. NTC will modernise all its mills through generation of funds from the sale of its surplus assets.

NTC exported yarn and fabric worth Rs 110 crores last financial year and wants to increase it. A road map is being prepared for NTC mills to meet market demand and upgrade technology. The plan will look at expansion, consolidation of the smaller units, limited modernisation and diversification to products such as technical textiles.

NTC incurred a cash loss, which was two per cent to three per cent of the total turnover, last financial year and it is expected to be at almost the same level this fiscal too. The National Textile Corporation was incorporated in 1968 for managing the affairs of sick textile undertakings in the private sector which were taken over by the government. It has a number of showrooms all over the country.

Multinational product companies and manufacturers are realising the need for real, effective sustainability strategies. There is a focus on recycling, waste reduction and lightweight packaging. The North Face is one such company. It is a leading driver of sustainability across the outdoor clothing and equipment market. It takes an all-encompassing approach to sustainability, developing waste reduction, recycling, product stewardship and other sustainability initiatives across various aspects of its platform.

Any of its retail outlets or stores will accept clothing or footwear in any condition. Aggregated clothing is then reused or repaired for prolonged use, or recycled into raw materials for products like carpet padding and insulation. As an incentive to drop off clothing, participants receive coupons and rewards that give discounts toward The North Face products.

In addition, The North Face has also partnered with bluesign technologies to reduce factory and processing center waste and increase efficiencies across its entire supply chain. This has resulted in considerable water, energy and chemical savings across the supply chain.

The company’s headquarters in California is run on 100 per cent renewable energy, utilises an indirect-direct evaporative cooling system to cut out the use of chemical coolants, and it even serves local organic food to employees.

https://www.thenorthface.com/

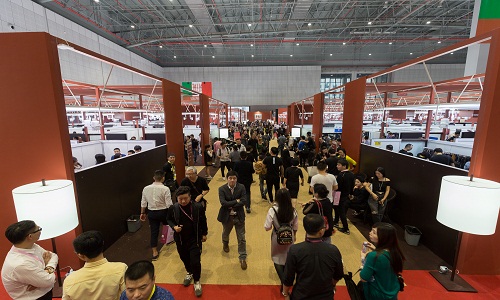

"The much awaited Intertextile Shanghai Apparel Fabrics–Spring Edition 2016 is scheduled to open its doors on March 16, 2016. The 3,000 plus apparel fabrics and accessories suppliers who will exhibit at the show will come from 20-plus countries and are expected to participate at the National Exhibition and Convention Centre (Shanghai) during the mega fair."

Asia’s most comprehensive trade fair for apparel fabrics and accessories is gearing up for its biggest ever Spring Edition scheduled for March 2016. Over 3,000 exhibitors from around the world have already confirmed their presence at Intertextile Shanghai Apparel Fabrics, which runs from March 16 to 18 at the National Exhibition and Convention Centre in Shanghai.

The much awaited Intertextile Shanghai Apparel Fabrics–Spring Edition 2016 isscheduled to open its doors on March 16, 2016. The 3,000 plus apparel fabrics and accessories suppliers who will exhibit at the show will come from 20-plus countries and are expected to participate at the National Exhibition and Convention Centre (Shanghai) during the mega fair. The event will feature a number of country and region pavilions as well as new and returning product zones to ensure exhibitors can more effectively meet their target buyers, and to make sure these buyers can more easily find the products they are looking for.

Sustainability in focus

The entire textile sustainability supply chain will be on offer at the fair. The a new area for the Spring Edition which caters to the fast-growing high-performance active wear market will feature ‘Accessories Zone’ with both garment and fashion accessories from China and abroad. In addition to these areas, group pavilions organised by the industry’s leading mills will present the latest innovative products, while domestic exhibitors will once again be grouped by product end-use as well as in various pavilions.

Opportunities for exhibitors and buyers

As one of the key dates on the global industry’s calendar, Intertextile Shanghai is more than just a place to source fabrics and accessories. Fairgoers can discover next season’s trends in the Intertextile Directions Trend Forum, which is created by experts from the NellyRodi Agency (France), Elementi Moda (Italy), Doneger Creative Services (USA) and Inoue (Japan) among others.

Opportunities for exhibitors and buyers

Intertextile Shanghai is more than just a place to source fabrics and accessories. Fairgoers can discover next season’s trends in the Intertextile Directions Trend Forum, which is created by experts from the NellyRodi Agency (France), Elementi Moda (Italy) and Doneger Creative Services (USA), as well as Ms Sachiko Inoue (Japan). What’s more, a wide range of design and trend ideas, the latest market news as well as industry technologies will be presented and discussed by experts in seminars and forums.

Further opportunities also will be there for exhibitors and buyers with four other textile fairs taking place concurrently. This includes the addition of Intertextile Shanghai Home Textiles – Spring Edition, and the return of Yarn Expo Spring, CHIC and PH Value.

The International Zone is housed in hall 7.2, while domestic exhibitors are in halls 6.1, 6.2, 7.1, 8.1 and 8.2. Domestic and international denim exhibitors are grouped together in Beyond Denim (hall 7.2), while Chinese and overseas accessories suppliers are located in hall 8.1. A relatively new addition to hall 7.2 is the France Zone, which expands in size this year after a strong debut showing at the 2015 Spring Edition. Some of France’s leading suppliers have already confirmed to take part, including Malhia Kent with its fabrics for luxury pret-a-porter and haute-couture, as well as high-end lace and embroidery producer Solstiss Sarl. Malhia Kent exhibited at last October’s Autumn Edition.

Located inside SalonEurope, the France Zone is the destination to find high-end apparel fabrics and accessories producers from Europe. The leading brands returning to the fair this year include Miroglio Textile from Italy, Turkey’s Soktas Tekstil and Liberty Art Fabrics from the UK. And a highlight for many buyers at the fair is the Milano Unica Pavilion from Italy, which this year features around 100 of Italy’s best textile producers showcasing their latest collections for women’s wear and men’s wear.

This year will see the addition of Intertextile Shanghai Home Textiles – Spring Edition to the line-up of concurrent fairs held alongside Intertextile Shanghai Apparel Fabrics. Taking place in Hall 5.2, it is complemented by Yarn Expo Spring in hall 5.1, CHIC in halls 1, 2, 3 and 4.1, and PH Value in hall 1.

Asian pavilions to focus on innovation and products

The Asian pavilions will be the place to find a range of innovative offerings. The Japan Pavilion returns with over 20 exhibitors, while the Korea Pavilion with more than 70 participants features a large selection of man-made and functional fabrics to cater the strong demand for Korean products.

One of the largest zones at the fair is the Taiwan Pavilion, organised by the Taiwan Textile Federation (TTF), which have over 50 exhibitors of accessories, cotton, denim, embroidery, jacquard, knit, lace, polyester, spandex and wool blended & woven fabrics suitable for mass to luxury markets. Rounding out the pavilions from Asia are the Pakistan Pavilion featuring cotton fabrics for casual wear and jeanswear and organised by the Commercial Section, Embassy of Pakistan, and the Texprocil (The Cotton Textiles Export Promotion Council) Pavilion from India.

Enhancing sourcing options

The fair being held in Shanghai after two years, has truly established itself as the key sourcing destination in Asia for the spring / summer season, with a growing variety of trendy and creative products and ideas for the apparel fabrics and accessories industry on offer. Next month’s fair will once again play host to the Verve for Design area, where design studios from around the world display their original fabric pattern designs to an increasingly eager market for these products.

The Spring Edition 2016 will see more countries represented in Verve for Design compared to the 2015 spring fair, with exhibitors from Japan, Russia and Switzerland taking part this edition, in addition to returning countries Australia, France, Italy and the UK. The new countries are represented by Atelier Mineeda and Nix from Japan, Solstudio Textile Design from Russia and Gibson Design Studio from Switzerland. Longina Phillips Designs and Creations Robert Vernet, from Australia and France, respectively, return to the fair again, while the Italy contingent includes Anteprima Disegni, Bernini Studio, Blue Studio, Musticstyle, New Age and Studio 33. Confirmed exhibitors so far from the UK include Acorn Conceptual Textiles, Amanda Kelly Design Studio, Circleline Design Studio, Design Union, Fairbairn and Wolf and Westcott Design.

Intertextile Shanghai Apparel Fabrics – Spring Edition 2016 is co-organised by Messe Frankfurt (HK) Ltd; the Sub-Council of Textile Industry, CCPIT; and the China Textile Information Centre.

The National Garment Fair will be held in Mumbai, January 27 and 28, 2016. This edition of the fair will have 283 stalls displaying over 330 brands. About 15,000 retailers and trade visitors from all over India are expected to visit. Exhibitors will present a wide range of men’s, women’s and kids’ wear. Also on display will be ethnic wear, intimate wear, sportswear etc. for Spring/Summer 2016.

Meanwhile, the Indian apparel industry is eagerly awaiting the implementation of the Goods & Service Tax (GST). The industry wants readymade garments to be included in the list as the textile industry is the single largest employer after agriculture in the country. Presently, the domestic apparel industry is facing a slowdown but is confident that after the implementation of GST, market sentiments will improve. On the export front, uncertainty still prevails in Europe, which is a major market. However, if the Chinese yuan continues to depreciate, it could hurt Indian apparel exporters as both India and China see the US and Europe as crucial markets.

The size of the Indian apparel industry is estimated to be around Rs 3,50,000 crores, out of which Rs 2,50,000 crores is the size of the domestic apparel industry.