FW

Researchers in Australia have found a way to separate blends of cotton and polyester. This has been hailed as a major breakthrough for recycling textile and other waste.

A significant hurdle to recycling waste clothing and other textiles into their original fibers was that most of this material is composed of blended fibers - the most common being polyester and cotton blends. While it is easy to recycle cotton and polyester individually, it is not possible to mechanically separate the blends where the fibers are closely bonded together.

However the researchers have developed a simple process to separate polyester and cotton blends into their individual components using an ionic liquid or a salt in a liquid state.

Unlike harsh solvents which have previously been used to dissolve polyester, ionic liquids provide an environmentally friendly solvent to chemically separate polyester and cotton blends. Another benefit of using ionic liquids is the ease with which the polyester and cotton can be separated.

The ionic liquid selectively dissolves the cotton component, with the added advantage that the liquid can then be recycled and reused. This cotton can then be regenerated into various forms, such as spun into fibers or cast as cellulose films, like cellophane.

The cotton, textiles and garment manufacturing, once flourished in Nigeria and this industry was bulwark of manufacturing in the country and provided jobs for as many as a million Nigerians.

There were well over 150 vibrant mills operating at close to full capacity and the sector was second only to government as an employer of labor. Now less than 20 textile companies are operational.

However it is now almost completely dominated by imports from Asia. Textile products are imported from India, while imports from China, Indonesia and Taiwan are much higher.Nigerians have become used to imported goods to the detriment of locally-manufactured ones.

The Nigerian government now has called on its people to buy products made in Nigeria than relying on imports. The argument is that Nigeria has the raw material, the cotton and the labor to rebuild a profitable garment industry.

The output of the textiles, apparel and footwear segment in the first quarter of 2015 represented around 2.2 per cent of constant price GDP and 21.7 per cent of manufacturing.

There are various challenges facing the industry, including smuggling and the problem of power shortage. About 35 per cent of manufacturing costs are energy related.

Bangladesh saw remarkable growth in export of ready-made garments (RMG) to the United States between 2005-11. However, since then growth has slowed down for both knits and woven garments. Between 2011 and 2014, total apparel export rose by 7.3 per cent, which was a little more than the increase in the US apparel import demand. This means that Bangladesh had a marginal rise of 0.1 per cent in its share of the US market. A decrease in exports of Bangladesh’s single largest export destination shows that there is a downtrend in garment exports.

AGOA may cause disruptions

Now Bangladesh has tough competition from Africa which is fast emerging as a sourcing destination for Europe and the US. The African Growth and Opportunity Act (AGOA) was passed by the US over a decade ago, where it offers tangible incentives to African countries. This is to continue their efforts to open up their economies and build free markets. Due to this, it is highly possible that Bangladesh may lose its competitiveness in the export of garments to the US.

Bangladesh currently pays 15.62 per cent duty for its garment exports to the US, whereas Vietnam pays 8.38 per cent. If the TPP (Trans-Pacific Partnership) comes through, Vietnam’s garment items will enjoy duty-free access to the US. Since US tariffs treat Bangladesh like a developing country and not like a LDC (least developed countries), it has to pay more tariffs than France does for one-15th of the exports. The high tariff rates levied on Bangladeshi apparels hinders RMG industry’s capacity to partake in a bigger share of the US market.

Vietnam’s apparel exports too could rise faster than the current rate, eventually capturing a larger share of the US market. Vietnam has done well through 2005 to 2014 compared to Bangladesh. Also, there’s a gradual dip in the price of Bangladesh garments in the US.

Competition on the rise

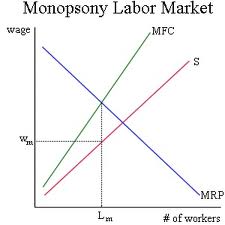

In the last couple of years, the prices of apparel items dipped significantly in the international market. This is because global buyers controlled the market and pressurised suppliers to lower prices. The reduction of price is through 'monopsony', (monopsony is a market condition similar to monopoly, where a large buyer, not seller, controls a major portion of the market, and drives prices down). It is sometimes referred to as buyer's monopoly this helps big buyers to put pressure to reduce the prices of products because the number of suppliers is much higher than that of buyers.

Garment products from China and Vietnam too have risen and Vietnam has already entered into a partnership agreement with some other countries including the US. The US-led trade pact, Trans-Pacific Partnership (TPP) involves 12 countries: Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, the US and Vietnam. This accounts for 40 per cent of the world GDP (gross domestic product) and Vietnam is the only garment-producing country that is included in the TPP.

Bangladesh though, has signed Trade and Investment Framework Agreement (TIFA),a bilateral agreement between the US and another country. TIFA 2005 stressed the need to ‘encourage and facilitate the exchange of goods and services and to secure favourable conditions for long-term development and diversification of trade between the two countries’. Next, there could be negotiation of a bilateral free trade agreement between Bangladesh and the US.

Bangladesh could take an interim measure, improve compliance, take an initiative to take protection of the Competition Act and coordination and close relations with the US lawmakers and the Washington administration, to get favourable terms of trade. It can even ask for protection from monopsony from small US buyers. This can lead to control over price and market by retailers. Moreover, it can follow the Chinese strategy of enhancing productivity and manufacturing high value-added products to increase its market share in the US.

A Tencel fibre indigo chambray collection 'Tencel 24: Day into Night' will be launched by Lenzing, a worldwide leader in the production of cellulose fibres. The breadth and beauty of ‘the’ most recognisable type of fabrics made out of Tencel is what the new ladies collection will comprise of. Lenzing’s commitment to fibre innovation and environmental responsibility is the result of this new line. As Tricia Carey, Director of Business says introducing sustainable new ideas for the denim market required collaboration across the entire supply chain including garment processing. Thus, the Tencel24: Day into Night range is a conscious effort to express that there is not need to sacrifice aesthetic excellence while adopting the new environmentally responsible laundry techniques, she added.

Lenzing has collaborated with Jeanologia, a global leader in sustainable garment finishing technologies, to create the collection’s fresh take on classic product. These cutting-edge finishing techniques were the result of Chambray indigo fabrics made with TENCEL fibre. Use of the fabrics also gave aesthetics, which previously would not have been possible to achieve.

Enrique Silla, Jeanologia co-founder points out the true beauty of the special chambray fabrics goes beyond the surface. Years of innovation has been put into producing both, the fibre and finishing technologies and Silla states that this new range surpasses anything they have previously produced, which in itself is proof that the product need not be sacrificedto be green.

The Tencel 24: Day into Night collection uses complementary fibre blends across five fabrics made out of Tencel fibres.

Alok Industries has reported a 77.64 per cent fall in its net profit at Rs 9.72 crores for the quarter ended June 30, 2015, as compared to Rs 43.48 crores for the same quarter in the previous year. The company’s total income decreased by 8.33 per cent to Rs 3,446.62 crores for the quarter under review from Rs 3,759.96 crores for the corresponding quarter of the previous year.

Alok Industries evolved from a small trading business into India’s largest integrated textile player. It has a dominant presence in the cotton and polyester segments. It is present across various verticals of the textile value chain - from yarn manufacturing to garmenting.

Over the years, it has expanded into weaving, knitting, processing and home textiles. To ensure quality and cost efficiency it has integrated backward into cotton spinning and manufacturing partially oriented yarn through the continuous polymerisation route. It also provides embroidered products.

The company was established in 1986. The first polyester texturising plant was set up in 1989. The company sells directly to manufacturers, exporters, importers, retailers and to some of the world’s top brands.

A significant portion of Alok’s products is cotton based-manufactured from both organic cotton and regular cotton. There are blended and polyester yarn offerings as well.

Lakshmi Machine Works income from operations slipped marginally to Rs 564.19 crores at the end of the first quarter of the current fiscal compared to Rs 571.51 crores during the corresponding quarter of the earlier year. Its net profit also dipped from Rs 48.57 crores a year ago to Rs 43.86 crores at the end of the just concluded quarter.

Notwithstanding the dull investment climate LMW’s order book stood at over Rs 2,650 crores (excluding export orders). Funding is an issue and high interest costs are forcing mills to keep away from investing in a big way. Lakshmi is a textile machinery manufacturing major. It feels the south is an attractive market for its range of products. More than 40 per cent of its textile machinery sales happen in the southern zone. While the south topped in sales, inflow of new orders was primarily from the west, followed by the south and the north. The company’s capacity utilisation levels have, for some time, hovered around 65 to 70 per cent and that is expected to continue for this quarter.

Meanwhile LMW is planning to roll out new products. In the next four years, LMW plans to offer the entire range of machinery from blow room to ring frame.

www.lakshmimach.com/

Sales and exports of Indonesia’s textile products are expected to remain sluggish in the second half of the year. The textile industry started to slow down in 2014 following a decline in global oil prices and an increase in gas and electricity rates in January this year. Imported products, particularly from China, have crushed the market share of local textile products. In the first half of this year, domestic industry’s market share reached 30 per cent but is expected to decline to 16.6 per cent in the second half.

Many businesses choose to be traders by importing products from China. Another competitor is Vietnam. Indonesian textile products cannot compete with Vietnamese products pricewise. Indonesia’s electricity costs are higher than Vietnam, which affects production costs. Indonesian textiles are charged an import duty of 11 to 30 per cent while entering the US market. Free trade agreements with the European Union and the US can help boost exports three times.

The industry has urged the government to lower electricity rates and help domestic players compete with foreign-made products. Indonesia has set an export target of $12.7 billion this year, the same as last year.

Unions are furious with Cambodia’s garment factories as they have shown inclination towards meeting worker’s demands for increasing the minimum wage next year. As per a survey among members of the Garment Manufacturers Association in Cambodia (GMAC), 63 per cent do not want a raise and 26 per cent support only marginal hike of $1-$5. The GMAC represents the country’s more than 500 factories. The factories and unions are to hold talks next month regarding the demand for a hike from the current monthly $128 minimum to $177 in 2016. A final decision will be made in October.

Ken Loo, Secretary General, GMAC says they asked members how much hike they could afford, but the members stated that could not afford any rise in wages. The garment industry is the largest economic sector in the country. However, it seems it’s going to be hard to sustain the $5 billion sector now. An increase in wages could placate workers, but will make the country uncompetitive, while protests by unions could scare investors away.

The garment industry in Cambodia has created 600,000 jobs that sustain rural families and has grown phenomenally through the years. However, strikes by increasingly assertive and politicised unions have become troublesome. The unions were outraged and threatened to go on strike if factories were unwilling to revise the wages.

Chea Mony, President of Free Trade Union said that if factories don’t hike pay, they could face problems of having no workers. Pav Sina of the Collective Union Movement of Workers, agreed with Mony saying that their workers would not be quiet as there would be no choice left for them.

A strategic cooperation agreement was signed regarding the purchase of polyester fibre produced by Dinh Vu PetroVietnam Petrochemical and Textile Fibre JSC (PVTEX) was signed by Petrovietnam oil and gas group (PVN) and Vietnam National Textile and Garment Group (Vinatex). After over a year of commercial operation Dinh Vu Polyester plant, they signed this agreement.

Vinatex committed to purchasing as much fibre products as possible from Dinh Vu PVTEX and also to use no less than 50 per cent of that purchased in its production. Meanwhile, PVN would direct Dinh Vu PVTEX to provide polyester fibre products of good quality and competitive prices for Vinatex. Besides, as per the agreement when Vinatex uses polyester fibre products of Dinh Vu PVTEX as inputs for export production lines, they would would work closely in the development of markets.

Its products have been domestically and internationally credible so far and the quality too has improved to be on par with imported goods. PVN said that now, the background was stable for close and comprehensive relation between the two groups in various fields such as polyester provision, export market extension cooperation, staff training and product evaluation. Also, they could work closely on other aspects for the mutual benefit and enhancement of trademark value for both.

With this cooperation, the product competitiveness would increase, as well as the market extension for Vinatex enterprises. However, besides this, the cooperation would also help Vietnam garment trademark promotion and wouldincrease domestic rate of textile industry to 60 per cent.

Pakistan's textile sector has been struggling to stay afloat as it battles high costs and high electricity surcharges. The country could lose billions in export orders if moves aren’t made to reverse the downward trend.

Pakistan’s exports for July have declined 17 per cent. The Pakistan rupee is overvalued, and that, coupled with a harsh tax regime (electricity surcharges alone can run as much as 45 per cent more than regional competitors pay), has what has killed the country’s competitiveness. A gas infrastructure development tax plus taxation on export-oriented goods has added to the burden.

The government has the option to either devalue the rupee by 12 per cent to 15 per cent or remove the additional taxes on export industries to make them zero-rated.

The government has promised to remove the bottlenecks in the way of exports. It would address the high costs and surcharges by the end of this month.

The textile sector in Pakistan has an overwhelming impact on the economy, contributing 57 per cent to the country’s exports. In today’s highly competitive global environment, the textile sector needs to upgrade its supply chain, improve productivity, and maximise value addition to be able to survive.