FW

Gordon Brothers, the global advisory, restructuring, and investment firm, has acquired Laura Ashley brand, archives, and related intellectual property from the Laura Ashley group’s UK administrators.

As new owners of the brand, Gordon Brothers will partner with management to evaluate several go-to-market strategies for the business, some of which could include retaining a streamlined portfolio of retail stores in key markets within the UK and Ireland. Gordon Brothers intends to place a strong emphasis on building e-commerce, developing more strategic wholesale relationships, and expanding the portfolio of licensees and franchisees globally.

Founded in 1953 by husband and wife team Bernard and Laura Ashley with an eye for delivering quintessentially British goods with a modern flair, the brand developed a passionate following which has allowed it to maintain its relevance regardless of the way the winds of fashion have blown. More recently, the brand expanded globally with outposts in markets as varied as South Korea, the Ukraine, the United States, and Japan.

Gordon Brothers’ Brands division values, acquires, restructures, and invests globally in underleveraged, distressed, or dormant intellectual property to help revive and reimagine some of the world’s most iconic brands.

Pakistan Textile Exporters Association (PTEA) has stressed for expeditious disbursement of all outstanding refunds as the Covid-19 pandemic has significantly impacted the cash flow squeezing the financial streams.

Commenting over the prevailing situation here on Wednesday, Chairman PTEA Sohail Pasha expressed serious concerns over unnecessary delay in disbursement of pending refunds of exporters despite the commitment of the Government for liquidation of Rs 100 billion pending refund claims to save the export industry from the adverse impacts of Covid-19 pandemic.

PTEA's Patron-in-Chief Khurram Mukhtar was of the view that the most affected value chain for Pakistan was textiles and apparel which had faced large scale cancellation or deferral of export orders. He demanded restoration of zero-rated regime for five export sectors and sustainable energy tariff for five years. He urged for payment of textile policy incentives Technology Up-gradation Fund (TUF) and Mark-up Support subsidy to keep industrial wheels running and save the livelihood of millions.

Vice Chairman PTEA Haris Yousaf urged the government to take preventive measures and develop strategy to protect the pace of economic and trade progress of Pakistan from likely impacts of world economic slowdown.

German sportswear firm Adidas plans a multi-billion euro bond so that it no longer needs the state-backed loan it agreed to take earlier this month to help it get through the coronavirus crisis. Adidas first had to get a credit rating from a large ratings agency. The brand agreed to take a €2.4 billion government-backed loan on April 14 after it was hit by the closure of stores due to global coronavirus lockdowns and by the postponement of the Olympic Games and Euro soccer tournament.

Adidas, which reports first-quarter results next Monday, said it was still unable to provide an outlook for the full year. The company's €3 billion loan includes €2.4 billion from the KfW state developmen bank and €600 million in loan commitments from a consortium including UniCredit, Bank of America, Citibank, Deutsche Bank, HSBC, Mizuho Bank and Standard Chartered Bank.

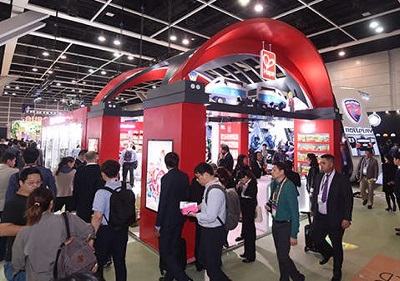

The safety of exhibitors and buyers has always been a priority for the Hong Kong Trade Development Council (HKTDC). Considering the current development of the novel coronavirus outbreak, and in line with the health measures taken by the Hong Kong SAR Government, a decision has been made in consultation with industry representatives to reschedule nine HKTDC trade fairs originally during April and May 2020.

The safety of exhibitors and buyers has always been a priority for the Hong Kong Trade Development Council (HKTDC). Considering the current development of the novel coronavirus outbreak, and in line with the health measures taken by the Hong Kong SAR Government, a decision has been made in consultation with industry representatives to reschedule nine HKTDC trade fairs originally during April and May 2020.

Under the new arrangement, the following fairs will be held will be held concurrently from 25 to 28 July 2020 at the Hong Kong Convention & Exhibition Centre.

• HKTDC Hong Kong International Lighting Fair (Spring Edition)

• HKTDC Hong Kong Electronics Fair (Spring Edition),

• HKTDC International ICT Expo

• HKTDC Hong Kong Houseware Fair

• HKTDC Hong Kong International Home Textiles and Furnishings Fair

• HKTDC Hong Kong Fashion Week

• HKTDC Hong Kong Gifts & Premium Fair

• Hong Kong International Printing & Packaging Fair

• Hong Kong International Medical and Healthcare Fair

Alongwith these nine concurrent fairs, the HKTDC will organise a Summer Sourcing Week from 25 to 28 July. Featuring nine fairs located at the same venue, it will provide a one-stop cross-industry platform for global buyers to replenish their stocks. Additionally, HKTDC is looking into O2O business-matching services at its fairs so that overseas buyers who cannot come to Hong Kong can locate target exhibitors in advance. Video conferences will be arranged between buyers and exhibitors to discuss business deals.

The assessment revealed that over 200 families of migrant workers from Uttar Pradesh and Bihar were stuck in two villages in Gujarat, Luna and Umraya, facing a dearth of basic necessities such as daily meals. Huntsman thereby provided 253 ration kits sufficient for 1012 migrant workers.

Moreover, there was a limited supply of N95 masks and other PPE for healthcare personnel at GMERS Medical College & Hospital, a dedicated COVID-19 hospital in Baroda. Citing the increasing number of cases, the situation was an extremely difficult one to work in, thereby putting the lives of these personnel at risk. Huntsman helped these warriors with 525 N95 masks and 50 PPE kits so that they could continue to work, while being safe.

hospital in Baroda. Citing the increasing number of cases, the situation was an extremely difficult one to work in, thereby putting the lives of these personnel at risk. Huntsman helped these warriors with 525 N95 masks and 50 PPE kits so that they could continue to work, while being safe.

Commenting on the initative, Rayomand Sabawalla, Head - CSR Committee, India Subcontinent, Huntsman Corporation, said, “Today, we find ourselves in the midst of one of the greatest challenges known to humanity. At Huntsman, community well-being has, and always will be a key priority.

In these trying times, we hope that our contribution will help protect the lives of healthcare workers, while also assisting migrant workers with their basic needs. We thank Fulcrum for having supported us through this initiative and look forward to doing our bit for the community in the fight against this pandemic.”

Huntsman Textile Effects runs a range of other community initiatives from its facility in Baroda, including its award-winning Anandi program. The program focuses on key community projects focused on education, livelihood projects like animal husbandry & agriculture and water & sanitation in the area.

With COVID 19 impacting all major fashion markets globally, the industry is facing its worst crisis ever. Stores are being close due and orders being cancelled, employees too are booing furlounged. The crisis has also disrupted previously planned strategies of brands, views the ‘State of Fashion 2020-Coronavirus’ report by Mckinsey & Company.

With COVID 19 impacting all major fashion markets globally, the industry is facing its worst crisis ever. Stores are being close due and orders being cancelled, employees too are booing furlounged. The crisis has also disrupted previously planned strategies of brands, views the ‘State of Fashion 2020-Coronavirus’ report by Mckinsey & Company.

Europe, US consumers to curtail apparel spending

The report states, fashion companies may face a harder time in future as over 70 per cent of the US consumers plan to cut back on their expenditure on apparel. The hardest hit amongst these is the US, which is also the largest apparel market in the world. Around a million people in this country have been infected with the virus with around 40,000 deaths already been reported. With people in the country being in a self-quarantine mode, their consumption patterns are also shifting. Around 56 per cent consumers surveyed in McKinsey & Company’s COVID-19 Consumer Pulse Survey reported cutting back on their apparel spending, while 48 per cent are being prevented from purchasing by the growing economic uncertainty.

Shorter lead times and personalisation to gain importance

The market post COVID-19 will also pose a significant challenge for brands. They will have to increase the speed with which their designers can bring a product from creative to consumer.

product from creative to consumer.

Post COVID -19, consumers will desire more personalised and customised products. They are likely to prefer fewer but higher quality garments. Consumers will also become socially and environmentally conscious and expect brands to demonstrate a strong commitment to sustainability as well. As J Kirby Best, Chairman of US-based OnPoint Manufacturing noted, both buyers and sellers will need to make a concerted effort to rethink their business model, expel hidden costs and analyse operating practices. Brands will have to now look at their business as a whole and not be separated into silos, which could lead to the adoption of a new supply chain approach.

US Department of Labor says, the crisis will also create a stop-gap in the supply chain of the USA as businesses across the country have been forced to hold their businesses.

Shift to PPE to lead to apparel reshoring

The COVID-19 crisis has also pushed several companies to shift their operations quickly to manufacture PPE. Factories across the US have increased their manufacturing of gloves, masks, gowns, etc. However, despite this, US faces critical shortages of PPE at the moment. This is putting considerable strain and risk on the country’s healthcare workers. Many micro and small manufacturers in the garment business are shifting to PPE manufacturing, keeping their political differences,

Apparel brands like Nike and Gap have instituted the Military Industrial Act to allow factories to retool for both regular production and PPE. This is helping them support some of their business financials. This model may also open up a new competitive market of medical apparels in the long term.

Smaller companies are taking on this initiative as being pro-bono, while others are being funded by the FDA and going through certification to help the cause. This will also compel them to reshore some of their apparel production. However, it will depend on new trade deals and possible tax breaks provided by Governments to corporations.

They were seen as unexpected alliances when sneaker brands like Jordan Brand and luxe label Dior collaborated. A lot of hype was generated tickling consumer interest. However, pandemic put paid to their efforts with store closures and supply chain bottlenecks and once bankable collaborations faced troubled times. Both brands now plan to delay their international online collaboration for the launch of the Air Dior capsule collection.

They were seen as unexpected alliances when sneaker brands like Jordan Brand and luxe label Dior collaborated. A lot of hype was generated tickling consumer interest. However, pandemic put paid to their efforts with store closures and supply chain bottlenecks and once bankable collaborations faced troubled times. Both brands now plan to delay their international online collaboration for the launch of the Air Dior capsule collection.

Similarly, New Balance also postponed its anticipated collaboration with luxury men’s fashion house Casablanca on the 327 silhouette. While many of these brands are waiting for the economy and retail to stabilize, experts say demand for collaborations between athletic and luxury labels will continue despite the present hiccups.

The NPD Group senior sports industry adviser Matt Powell believes fashion houses gain more from these collaborations than athletic counterparts. He believes associating themselves with an athletic brand gives luxury makers some credibility as an activewear makers.

believes associating themselves with an athletic brand gives luxury makers some credibility as an activewear makers.

Insights into sportswear making

These collaborations also provide luxury labels first-hand lessons on the construction of modern sneakers. For instance, through her Puma x Balmain collection, designer Cara Delevingne, was able to apply her signature feminine and floral design aesthetic to some of Puma’s classic, best-selling sneaker styles and in turn, provide customers something new and unexpected. She believes that due to the attention these brands get from media outlets and influencers, a product can be validated instantly.

Making activewear more exciting

However, this is not a one sided affair as TV personality, Tamara Dhia was quoted by Footwearnews, activewear has since long being inspired by luxury brands. Adam Petrick, Global Director, Puma too believes the lines between fashion and athletic-streetwear brands have become increasingly blurred and these collaborations give something fresh and exciting to consumers.

Kelly Fatouretchi, Director of the sport style category at Asics, also believes these partnerships allow brands to explore different avenues of creativity on a different scale. It enables designers to create fun and fresh silhouettes that serve as more fashion-forward options for working out and beyond. The best fashion-focused collaborations allow the partner to lead on creative and to provide a new aesthetic for the brand or create a new lens for the product to shine through.

A boost by social media channels

Joe Grondin, Product Manager, New Balance Collaborations feels social media and digital marketing are the main reason for this. These brands are now represented by high-profile musicians, athletes and entertainers who actively share product, runway shows and parties on social platforms. This visibility lends itself nicely to sneakers, an item that already has a massive culture and following.

And as Shangguan Zhe, Founder, Sankuanz points out, diversified integration is also one of the characteristics of this era. She says most athletic brands have gradually shifted their emphasis to casual shoes and clothing brands. However, in order to expand into new markets, these athletic brands need to introduce more creative concepts and marketing promotion topics.

Workers in the South Africa clothing manufacturing industry have become the first in country to receive an industry-wide COVID-19 Unemployment Insurance Fund (UIF) relief pay-out

Workers in the South Africa clothing manufacturing industry have become the first in country to receive an industry-wide COVID-19 Unemployment Insurance Fund (UIF) relief pay-out

This follows on the ground-breaking collective agreement which was concluded under the auspices of the clothing industry bargaining council, on 23 March 2020, and which was promulgated as law by the Minister of Employment & Labour on 26 March 2020.

The provisions of that unique collective agreement caters for clothing industry employees to be paid their full wages, made up of a combination of voluntary employer contributions and worker UIF monies, for a 6-week lockdown period.

The agreement was concluded between the COSATU-affiliated Southern African Clothing & Textile Workers’ Union (SACTWU), the Apparel & Textile Association of South Africa (ATASA), and the South African Apparel Association (SAAA).

Association of South Africa (ATASA), and the South African Apparel Association (SAAA).

On Friday 17 April 2020, the bargaining council received its first tranche of worker UIF funds, which was to compensate workers for loss of wages for the first full day of the lockdown, 27 March 2020, and which was the last day of that pay-week in the clothing industry.

On the same day that the funds were received, these worker UIF monies were seamlessly transmitted from the bargaining council’s special dedicated COVID-19 bank account to the wage-bank accounts of 367 companies employing 38 751 employees.

While there are still very serious delays in the receipt of COVID-19 UIF monies due to clothing and textile workers, our bargaining council is pleased that this innovative payment transmission system which we had designed in conjunction with the UIF, has concretely proven to be efficient and effective. It is now our hope that the outstanding worker UIF funds still due to clothing and textile workers will now be speedily processed and transmitted to the bargaining council for transfer to workers.

The signatory parties of our COVID-19 Lockdown Collective agreement remain committed to work closely with the UIF, to help resolve the remaining practical difficulties which we are still confronted with.

Usha Periasamy, Director, Brands & Operations, Classic Polo

“Consumer spending is dramatically curtailed during a recession. Consumers have adopted short-term behaviour during the pandemic that in many cases will become permanent, as a lesson learned from such unprecedented occurrences. Not only do consumers become more financially conservative but also credit may become less available and a large cohort may go into default on their debt, dramatically limiting purchasing power. Consumers will wake up from the pandemic in a new economic reality, changing their commercial behaviours in extreme ways.

“Consumer spending is dramatically curtailed during a recession. Consumers have adopted short-term behaviour during the pandemic that in many cases will become permanent, as a lesson learned from such unprecedented occurrences. Not only do consumers become more financially conservative but also credit may become less available and a large cohort may go into default on their debt, dramatically limiting purchasing power. Consumers will wake up from the pandemic in a new economic reality, changing their commercial behaviours in extreme ways.

In this climate, discount retailers and value-oriented brands stand to win. This will also boost the trend toward value-oriented store brands. Spending will aggregate on need-based categories, with discretionary categories declining. Classic Polo is a value for money brand and therefore, presumes to stay stable with remodelling of strategies along with the advantage of in-house manufacturing. Future is cloudy and ambiguous for all brands and Classic Polo is no exception. How quick we understand consumer sentiment and resign the marketing blueprint with various permutation combinations will decide the business outcome.”

What is the current situation of India’s garment industry?

The COVID-19 pandemic forced retail down shutters, prompting an atypical disruption of economy. Retailers and brands will face numerous short-term challenges related to cash flow, supply chain, labour force, health and safety, consumer demand and marketing. Post pandemic a very different world would emerge. In order to ensure a future where businesses not only survive but also move ahead, it is critical to predict what a post-pandemic world has in store for us, and then we will begin to remodel to match the new reality.

How would be the consumer spending be affected?

Consumer spending is dramatically curtailed during a recession. Consumers have adopted short-term behaviour during the pandemic that in many cases will become permanent, as a lesson learned from such unprecedented occurrences. Not only do consumers become more financially conservative but also credit may become less available and a large cohort may go into default on their debt, dramatically limiting purchasing power. Consumers will wake up from the pandemic in a new economic reality, changing their commercial behaviours in extreme ways.

In this climate, discount retailers and value-oriented brands stand to win. This will also boost the trend toward value-oriented store brands. Spending will aggregate on need-based categories, with discretionary categories declining. Classic Polo is a value for money brand and therefore, presumes to stay stable with remodelling of strategies along with the advantage of in-house manufacturing. Future is cloudy and ambiguous for all brands and Classic Polo is no exception. How quick we understand consumer sentiment and resign the marketing blueprint with various permutation combinations will decide the business outcome.

China has played a pivotal role in the garment industry but after this, can we look at India as the next sourcing hub?

China being the major and main source for all industries, the slowdown will surely have an impact on overall business in a negative way. Significant qualities of our woven fabrics come from China and naturally if goods do not arrive on time, readymade garments industry is affected. If the crisis in China is prolonged, the impact would be severe. It is not easy to shift sourcing destination overnight. But buyers will have to look for alternative sources. Are the buyers ready to pay more is a million dollar question? So, it is not that easy. But yes, companies will look beyond China to survive in the long run. Need to wait and watch.

How is Classic Polo overcoming this challenge?

Those that sell high-demand pandemic necessities online are/will aggressively hire to meet demand they are increasing employee pay and boosting their supply chains. These retailers could well emerge with growth on a consistent scale.

How do you foresee this fiscal year performing?

The net result for retail may be that a few retailers emerge stronger and many specialty stores and independents no longer exist. Even well-positioned retailers may find they have to permanently close under-performing stores and make drastic cost cutting efforts to bolster their balance sheets. It’s easy to imagine India having 20-30 per cent less retail space by the end of the pandemic.

Has the government done enough to take care of the garment industry during this challenging time?

Apparel industry bodies are approaching government with various pleas and suggestions to support and combat the situation, which are yet to formalise. Common support on extension of tax payment and other deferments are being extended, while how much this will support businessmen and industry to overcome the pandemic’s residual effect is inexplicable. A significant consolidation of retailers will fundamentally result in emergence of new competitive landscape and partner ecosystem, this is a puzzle to solve.

American Apparel & Footwear Association (AAFA) recently collaborated wtith 65 industry groups in a call to governments and international financial institutions to enact coordinated efforts to address the economic crisis caused by the COVID-19 pandemic. Representing the textile, apparel, footwear, travel goods, and fashion industry, the groups represent companies, workers, and consumers in each and every part of the global supply chain.

American Apparel & Footwear Association (AAFA) recently collaborated wtith 65 industry groups in a call to governments and international financial institutions to enact coordinated efforts to address the economic crisis caused by the COVID-19 pandemic. Representing the textile, apparel, footwear, travel goods, and fashion industry, the groups represent companies, workers, and consumers in each and every part of the global supply chain.

As companies have closed retail locations in response to social distancing needs, revenue used to employ millions of workers around the globe has dried up. This lost revenue has had knock-on effects through the global supply chain. To respond to this economic crisis, the groups ask that governments and international financial institutions:

- Enact temporary stimulus measures to ensure liquidity; - Undertake temporary duty deferral and tariff relief to support liquidity and cash flow, and keep workers employed; and - Refrain from imposing new trade restrictions and not impede production or delivery of PPE, its intermediate products, or raw materials.

In the statement, the organizations recognise that many of these items were addressed in a G-20 statement released in March, but add that, “words mean a lot, but the actions will determine how fast and how well we can emerge from this crisis.”

“Companies are desperate for cash to pay their workers and suppliers, while at the same time access to revenue is down due to closed stores,” said Steve Lamar, president and CEO of the American Apparel & Footwear Association. “This is why we need governments – both the U.S. and globally – to work together with international financial institutions to make sure financial resources are available to keep supply chains solvent and workers employed. If this is not done quickly and thoughtfully, we risk burning a hole in the global supply chain. It is essential that leaders act now to support these networks that employ millions around the world.”