FW

Bangladesh’s denim exports to the United States rose by 5.42 per cent in January to August, 2019.

In the same period, Vietnam’s denim exports to the US rose 34.43 per cent. Pakistan’s denim exports to the US rose 14.20 per cent. As the second-largest exporter of apparel goods, Bangladesh was supposed to gain from trade conflicts in capturing a bigger market share of denim products. However Bangladesh’s competitors, Vietnam and Pakistan, have gained a higher share. Most of China’s trade is shifting to Vietnam and Cambodia as US retailers and investors feel comfortable due to a shorter lead time and a better business environment. Vietnam has gained the most from the US-China trade conflict because of its readiness to welcome the redirected trade and it has a diversified product basket and received a large amount of FDI relocated from China. Buyers are not willing to come to Bangladesh as the ease of doing business is still lower compared to other competing countries. Vietnam and Pakistan have gained as they have devalued their currencies, while the appreciation of Bangladesh’s currency against the dollar is eating up Bangladesh’s competitiveness in global markets.

Bangladesh needs to offer better incentives such as quicker services by bringing in regulatory reforms to attract FDI and improving infrastructure to cut time in shipment.

The newly launched China Textile Association in Cambodia (CTAC) will encourage more Chinese investment into the garment industry in Cambodia and provide assistance to existing manufacturers.

CTAC is an association of Chinese textile enterprises, including garment manufacturers, as well as related suppliers such as accessories factories, trim suppliers and sub-contractors. It will provide legal advice to investors and those considering investing in Cambodia, as well as liaise with the government. Its services will particularly target Chinese investors.

Cambodia is the world’s eighth largest exporter of garments and footwear. Around half of these shipments go to the EU and a quarter goes to the US. The economy depends heavily on the garment industry, which accounts for more than 78 per cent of the country’s total merchandise exports and 20 per cent of its annual economic growth and is the main non-agrarian employer in the country with nearly 9,00,000 workers employed in over 1,000 factories. These factories are almost exclusively Chinese-owned, and China’s influence in Cambodia will continue to grow as it finances major infrastructure projects. However, risks in the financial sector persist, with particular exposure in the construction and real estate sectors. External risks include the potential withdrawal of the EU’s trade preferences for Cambodia.

India’s exports of cotton yarn declined 38 per cent during the first six months of the current fiscal.

In fact, the export quantity in June 2019 was the lowest monthly export in the last five years. China’s free trade agreement with Pakistan from April this year is seen as one of the major factors for the drop in India’s cotton yarn exports to China. In addition, exporters of cotton yarn are at a serious disadvantage vis-a-vis competing countries due to differential import duties in leading export markets. There is an import duty ranging from 3.5 per cent to five per cent on cotton yarns imported from India into major markets like China, EU, Turkey and South Korea. But imports from competing countries like Bangladesh, Cambodia, Pakistan, Indonesia and Vietnam enjoy benefits of zero duty in these markets.

Cotton yarn is a value-added product with substantial value addition taking place within the country. As a result of a decline in exports this year, the supply of cotton yarn has increased in the domestic market and in turn led to a drop in prices. Cotton yarn is not granted export benefits such as the Merchandise Exports from India Scheme and the three per cent interest equalisation scheme.

Indonesia is tightening restrictions on textile imports. Restriction is aimed at protecting domestic producers of products such as certain types of yarns, fabrics and other goods. The reasoning is that products that can be produced domestically should no longer be imported. Textile importers have to gain approval before they can ship in textile goods. With economic growth, and a shift in demand from basic clothing to functional clothing, such as sportswear, the national textile industry is building production capabilities and increasing economies of scale in order to meet the demand in domestic and export markets.

The country’s textile industry has weakened in the past three years due to an influx of imported textiles combined with sluggish consumption by Indonesian consumers. Imports of textile fabrics rose by 74 per cent between 2016 and 2018. Imports of textile products, such as some types of synthetic yarns, doubled in the three years to 2018. Indonesia imports products from China, South Korea, Thailand and Vietnam, among others. Companies are facing a cash shortage resulting from tough competition with imported products. Another problem Indonesia faces is smuggled used clothing. The country does not allow imports of secondhand garments. The industry hopes textile and garment rules are relaxed to help local businesses boost their exports. Companies that have been so far oriented to local markets are being encouraged to become more export oriented.

Danish start-up Son of a Tailor works on the strategy of make to order. Garments are knitted in one piece. For ordering, customers need to first provide their weight, height, age and shoe size. Then an algorithm creates a perfect fit using these four criteria, which helps the brands with low return rates due to the sizing challenge. Manufacturing of all its garments is done in the European Union.

The brand founded in 2014 specialises in men’s outerwear. Its zero waste pullover uses 3D knitting technology to eliminate textile waste and overproduction of garments. Convention clothing production wastes up to 12 per cent of fabric in the cutting process and Son of a Tailor’s method reduces the waste to under one per cent. As the company is made to order it has no stock inventory.

The apparel industry produced around 92 million tons of textile waste last year. Garment production and transportation account for around ten per cent of global CO2 emissions. Conventional clothing production wastes up to 21 per cent of fabric in the cutting process. At the same time, 15 per cent to 20 per cent of clothes are wasted in unsold inventory and 60 per cent of purchased clothes are discarded after just one year.

Pakistan is framing a long term and comprehensive textile policy. The aim is to increase Pakistan’s share in world garment exports. Its small and medium sector will be promoted and developed. A task force will focus on facilities and incentives to attract investors to this sector. The task force will also work on the development of genetically-modified cotton seeds and ensure consistency in business policies. The industry wants levies on cotton imports removed so that textile exports can go up. The country’s textile exports constitute more than 60 per cent of total exports. Knitwear exports comprise 14.4 per cent of total exports. Readymade garment exports have a share of 12.5 per cent in exports. Bedwear has a 10.7 per cent share in exports. A special energy package was extended early this year to the erstwhile zero-rated industry to provide it a competitive energy tariff to expand and increase exports.

Pakistan’s textile industry has become viable after a gap of 10 years, especially through the provision of regionally competitive energy tariffs. The industry witnessed a record 26 per cent growth in quantitative terms.

Previous textile policies have not been much of a success story. The policy for 2014-19 failed to achieve its targets including doubling value addition, increasing textile exports as well as the creation of three million jobs in five years.

Trident’s net sales were Rs 1346.55 crores during Q2 (period ended September 30, 2019), as compared to Rs 1318.51 crores during the period ended June 30, 2019. Net profit was Rs 139.81 crores as against Rs 122.43 crores for the period ended June 30, 2019. EPS was Rs 2.81 for the period ended September 30, 2019, as compared to Rs 2.46 for the period ended June 30, 2019.

Net sales were Rs 1346.55 crores during the period ended September 30, 2019, as compared to Rs 1411.53 crores during the period ended September 30, 2018. Net profit was Rs 139.81 crores for the period ended September 30, 2019, as against Rs 110.25 crores for the period ended September 30, 2018. EPS was Rs 2.81 for the period ended September 30, 2019, as compared to Rs 2.21 for the period ended September 30, 2018.

Net sales were Rs 2665.06 crores during the six month period ended September 30, 2019, as compared to Rs 2556.89 crores during the six month period ended September 30, 2018. Net profit was Rs 262.24 crores for the six month period ended September 30, 2019, as against Rs 169.14 crores for the six month period ended September 30, 2018. EPS was Rs 5.27 for the six month period ended September 30, 2019, as compared to Rs 3.40 for the six month period ended September 30, 2018.

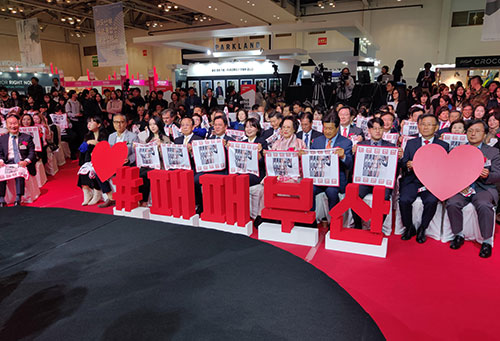

The 2019 Busan International Footwear, Techtextile & Fashion Fair, hosted by Busan Metropolitan City and supervised by the Busan Economic Promotion Agency, was held at BEXCO’s Exhibition Center from October 31through November 2.

The fair is a combination of three major exhibitions (Busan International Shoe Show, Busan Fashion Week, and Busan International Footwear, Techtextile & Fashion Fair), the event began in 1993 as the Busan International Shoe Leather Exhibition. Based on 27 years of experience, it offers intensive business and marketing opportunities in Korean/overseas techtextiles, footwear, and fashion.

FashionatingWorld took the opportunity to interact with some of the prominent exhibitors at the event. One of these included Adage Korea lead by Kim su guen,Director & Kim yoo soo,CEO. Soo opines that though there is some slow down trickling in but his company is quite capable of navigating it by offering more and more variety and constant innovation in our products. The company exports a good volume of products to US & Philippines on constant basis. It participates in BISS on regular basis and we get local buyers and international buyers generally come from China & other Southeast Asian countries.

Another exhibitor Leepyo Hong,Overseas Manager-Treksta part of Hypergrip Korea. Treksta manufactures outsole and hypergrip high tech shoes mostly for Korea Government.Under Treksta, the company has its own facilities in Myanmar and Vietnam. Hong said, “global trade is shrinking which is quite a worrisome factor top on global buyers' minds as of now. But fortunately for us situation is so far so good. Looking ahead we need to invest more seriously in branding & marketing.”

"Robotics demonstrates its new robotic pillow filling system and will provide details of how it has been upgraded till 2019, with several commercial systems still in place.“We believe many visitors to Hemitextil 2020 who saw the demonstration last year will be astonished to hear of the potential gains we are making,” says ACG Kinna CEO Christian Moore."

Heimtextil is a huge show, has attracted well over three thousand visitors to Frankfurt. Heimtextil exhibition is significantly expanding its focus on textile technologies in 2020 reportedly it has received amazing responses from members of TMAS, Swedish textile. Heimtextil this year also looks up to participation coming from all the corners of world.

Heimtextil is a huge show, has attracted well over three thousand visitors to Frankfurt. Heimtextil exhibition is significantly expanding its focus on textile technologies in 2020 reportedly it has received amazing responses from members of TMAS, Swedish textile. Heimtextil this year also looks up to participation coming from all the corners of world.

Robotics demonstrates its new robotic pillow filling system and will provide details of how it has been upgraded till 2019, with several commercial systems still in place.“We believe many visitors to Hemitextil 2020 who saw the demonstration last year will be astonished to hear of the potential gains we are making,” says ACG Kinna CEO Christian Moore.

Meanwhile, in the first quarter of 2020, Automatex ES, the specialist in automated cutting, sewing and folding equipment, is planning to launch another innovation in advanced manufacturing for the bedding industry.“We have developed a new fitted sheet machine which is able to sew ninety-degree corners and the elastics simultaneously, in a single operation,” explains the company’s CEO Stefan Persson.

Further to this three TMAS members will be exhibiting for the first time at a joint stand show. Central to the technologies of both IRO AB and Eltex is advanced sensor technology. IRO AB has consistently introduced new milestones in the field of yarn feeding technology for weaving machines and at Heimtextil 2020 will be providing information on new introductions to its product range. This includes the ZTF Zero Twist Feeder which keeps yarns or fiber tows constantly stretched to avoid the risks of any snarls or twisting and the ATC-W advanced tension controller for constantly regulating weft feeders at high speeds.

Svegea of Sweden has over 60 years of experience in exclusively designing, manufacturing and installing bespoke bias cutting, roll slitting and rewinding and inspection machines. The company’s complete Bias System includes a tube sewing unit a bias cutter/winder for opening up a previously-formed tube material – spirally on a bias – and strip cutter. Circular woven materials are fed to the cutter via the revolving winder to be slit at angles, so that both the warp and weft of the weave are skewed at specified angles rather than just in the vertical and horizontal directions, as is usual. This allows the slit fabrics to drape and form much more easily to complex shapes, with a range of potential applications in areas such as indoor and outdoor furniture, as well as bedding etc.

Heimtextil 2020 the focus will be on its advanced systems for the sewn products sector, including the UPG-Stitch thread break sensor, which is based on the piezoelectric principle and is suitable for all types of yarns while being insensitive to dust, dirt and humidity variations.

Wrangler, the leading denim brand has launched a new foam dyed technology called Indigood that eliminates 100 percent of water waste generated through conventional dyeing methods in denim manufacturing.

The technology reduces energy consumption and energy waste by 60 per cent as compared to other methods of dyeing. This new technique was created in partnership with Texas Tech University and a Spanish fabric mill, Tejidos Royo in Valencia. This new Indigood™ foam-dyed denim represents consistent commitment for using global scale to advance the denim industry.

Usually, to prepare a single pair of jeans, it requires gallons of water and chemicals to transfer the indigo to yarn. This new process uses a foaming agent instead of chemicals and that too without wasting water to give the the denim its blue color.

Having a potential to revolutionise sustainability standards for denim, Wrangler also plans to include other brands to get on board for this technique in future.