FW

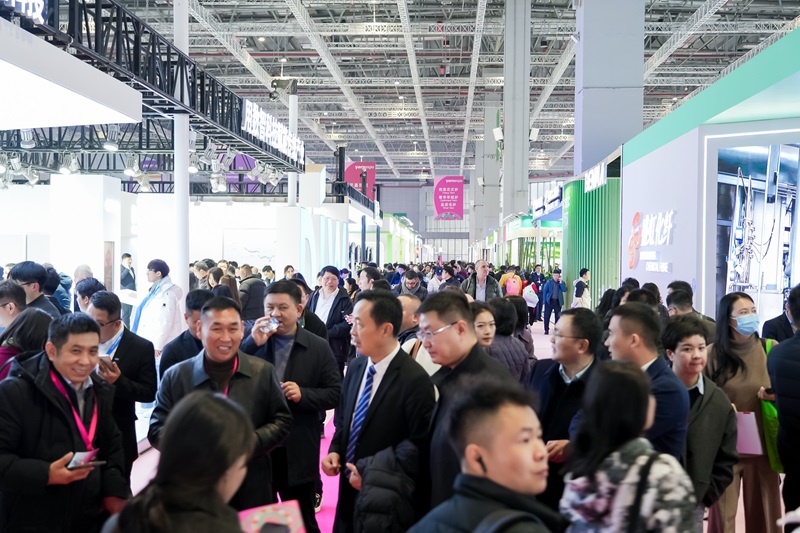

Cotton remains the most widely used natural fibre in the textile industry, with leading fashion houses and retailers increasingly adopting organic cotton. This shift is driving demand for sustainable yarns and fibres. Yarn Expo Spring, set for 11–13 March 2025, will provide a key platform for the cotton sub-sector, featuring nearly 90 dedicated exhibitors among over 500 participants from 12 countries and regions.

Rising demand for sustainable sotton

Sustainable cotton yarn is gaining traction, particularly recycled cotton, which aligns with the circular fashion movement and appeals to eco-conscious consumers. Manufacturers are capitalizing on this trend, with the global organic cotton market projected to grow at a CAGR of 44.4 per cent until 2030. India, the world’s second-largest spinner after China, holds a 31.2 per cent share of the global cotton yarn market and will play a prominent role at the expo. Exhibitors from China, India, Pakistan, and other major markets will present a diverse range of cotton products to meet rising global demand.

India Pavilion showcases premium cotton yarns

The India Pavilion, led by the Cotton Textile Export Promotion Council (TEXPROCIL), will highlight Indian expertise across various yarn and fibre categories. Offerings will include pure cotton carding, compact spinning, viscose, blended, synthetic, recycled, organic/GOTS-certified, spandex, and polyester-cotton blends. Key exhibitors include Amar International, a major exporter of Indian cotton yarns, raw cotton, and recycled cotton waste, with its ‘Amar’ products earning industry recognition. GDJD International Pvt Limited specializes in high-quality yarns meeting the 'Uster 5 per cent' standard, focusing on contamination control. Le Merite Fashions Private Limited integrates cotton yarn and greige fabrics, offering Oeko-Tex Standard 100-certified eco-friendly products.

Speaking at a previous edition, Murali Balkrishna, Joint Director of Texprocil, emphasized the expo’s role in boosting Indian suppliers global presence. He noted that India's competitive advantage in quality and pricing has attracted many buyers, especially for twisted cotton yarn. The vast Chinese market continues to drive participation, reinforcing Yarn Expo Spring as a critical business platform.

New global exhibitors make their debut

Several global players will make their Yarn Expo Spring debut. Turkiye’s Kenan Ozsoy Textile will showcase a diverse range of yarns, including cotton, polyester, blended, viscose, melange, bamboo, micro cotton, organic, textured, twisted, and dyed options. Indonesia’s PT Embee Plumbon Tekstil, an ISO 9001 and Oeko-Tex Standard 100-certified manufacturer, will highlight advanced yarns for weaving and knitting, catering to apparel, automotive, home, and technical textiles.

Organized by Messe Frankfurt (HK) Ltd and the Sub-Council of Textile Industry, CCPIT, Yarn Expo Spring will run alongside Intertextile Shanghai Apparel Fabrics, Spring Edition, Intertextile Shanghai Home Textiles - Spring Edition, CHIC, and PH Value, offering exhibitors and buyers extensive networking and sourcing opportunities.

Building upon the brand’s foundational wardrobe of classic shape, H&M Atelier has launched its Spring-Summer 2025 menswear collection that reimagines heritage and workwear influences with a contemporary perspective.

The collection’s color palette features lighter neutrals, washed-out blues, sun-faded blacks, and a vibrant raspberry pink accent. Distinctive material washes, tactile finishes, and an understated sophistication define the collection. The collection is meticulously crafted with a strong focus on the quality of the materials, says Ana Hernandez, Designer-Menswear, H&M. The collection embraces a trasitional wardrobe while maintaining the essence of the Atelier label, she adds.

Layering and mixing pieces emphasize the collection's versatility. The collection focuses on relaxed tailoring with long-line coats and light Italian wool suits featuring sharp shoulders and contrast lining. Oversized cuts create a relaxed, casual feel. The cropped leather moto jacket, washed and treated for a worn-in look, has the character of a vintage find. Five-pocket trousers pair easily with workwear-inspired jackets. Fluid cotton-linen shirts are worn unbuttoned over tees, slim-fit knit tanks, and soft cotton jersey twisted-seam henleys.

Accessories add a West Coast touch to this collection with suede square-toe biker boots and a snakeskin leather belt completing the look.

The H&M Atelier Spring-Summer 2025 collection will be available in select H&M stores worldwide and online from February 27, 2025.

Despite policy-related uncertainty, the US economy entered 2025 with strong labor markets, consumer spending, and GDP growth. The IMF revised its global GDP forecast to 3.3 per cent for both 2025 and 2026, slightly higher than its October estimate. The US outlook improved, with growth projections raised to 2.7 per cent for 2025 and 2.1 per cent for 2026. The BEA’s first estimate for 2024 GDP came in at 2.8 per cent, near 2023’s 2.9 per cent.

China’s growth forecast increased to 4.6 per cent for 2025, while the Euro Zone’s projections were lowered to 1.0 per cent. In the US, holiday spending surpassed expectations, growing 4.0 per cent despite a shorter season. Consumer resilience is supported by low unemployment and wage growth outpacing inflation since mid-2023.

Employment remained strong, with 143,000 jobs added in January. Previous months saw upward revisions, while unemployment edged down to 4.0 per cent. Wage growth held steady at 4.2 per cent, exceeding inflation (2.9 per cent in December).

Consumer confidence fell for the second straight month, with the index dropping to 104.1 in January. However, spending rose 0.4 per cent month-over-month in December, with apparel spending up 1.7 per cent year-over-year. Clothing prices increased 1.4 per cent from 2023 levels, reaching their highest since the early 2000s.

Import costs rose slightly, with the average price per square-meter-equivalent reaching $3.68 in December. Import volumes accelerated, with cotton-dominant shipments up 10 per cent in the second half of 2024 compared to the first. The data reflects continued economic momentum, despite broader uncertainties.

Shima Seiki Mfg Ltd, a leading computerized flat knitting innovator from Japan, is set to exhibit at the 19th Dhaka International Textile & Garment Machinery Exhibition (DTG 2025) in collaboration with Pacific Associates Ltd. This marks the company's fifteenth participation in DTG since entering the Bangladeshi market in 1996.

As the world’s second-largest textile exporter, Bangladesh is focusing on innovation, digitalization, and sustainability. Shima Seiki aligns with this vision by showcasing its cutting-edge Wholegarment knitting technology, which enables the production of seamless garments in one piece, reducing material waste and enhancing efficiency.

At DTG 2025, Shima Seiki will present its MACH2XS153 Wholegarment knitting machine in 15L gauge, equipped with four needle beds and SlideNeedle technology for fine-gauge knitwear. The compact SWG091N2 ‘Mini’ Wholegarment machine in 15 gauge will also be displayed, offering versatility in seamless knitting. The N.SVR183 model, designed for Wholegarment production using every other needle, will be showcased in 21 gauge, making it ideal for entry-level production of 12-gauge items. Additionally, the N SVR122 shaping machine in 14 gauge will demonstrate conventional shaping capabilities.

Visitors can also experience Shima Seiki’s SDS-ONE APEX4 3D design system, which streamlines fashion creation from concept to production. This system enables virtual sampling, reducing time, cost, and material waste while ensuring smooth digital communication between design and manufacturing.

DTG 2025 runs from February 20-23 at the International Convention City Bashundhara (ICCB) in Dhaka.

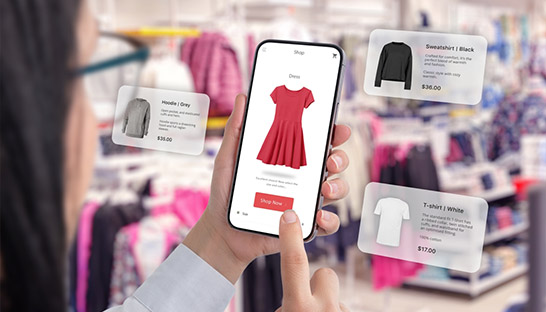

The global e-commerce apparel market is projected to reach $1.39 trillion by 2033, says a recent report. Its growing at 8.7 per cent CAGR from 2023's $602.3 billion, highlighting a fundamental shift in how consumers engage with fashion. This growth is due to factors like, ubiquitous smartphone use to the rise of influencer culture that is reshaping the fashion market and presenting both opportunities and challenges for businesses. “The e-commerce apparel market is poised for continued growth in the coming years. The ongoing shift toward digital-first shopping experiences is supported by factors such as increasing internet penetration, improved logistics infrastructure, and the growing popularity of smartphones, particularly in emerging markets," says the report.

The digital runway

The e-commerce apparel market covers the online sale of clothing, accessories, and footwear across men's, women's, and children's categories. The past decade has seen explosive growth, driven by increasing internet and smartphone penetration, coupled with evolving consumer shopping habits. The convenience of browsing a vast selection of brands and styles, coupled with easy returns, has made online shopping an increasingly preferred option. Brands like Zara and H&M exemplify how e-commerce enables rapid translation of runway trends into readily available online collections.

Several key trends are shaping this market.

The reign of marketplaces: Major players like Amazon and Alibaba dominate this space, providing platforms for countless brands to reach a global audience.

Mobile-first fashion: M-commerce is exploding, with consumers increasingly shopping via smartphones and tablets.

Social commerce takes center stage: Social media platforms are not just for browsing; they're becoming integral shopping destinations, with influencer marketing playing a pivotal role in driving sales.

Personalization is paramount: AI and machine learning are enabling personalized recommendations and seamless customer experiences, fostering brand loyalty. For example, services like Stitch Fix showcase the power of personalized styling and convenient subscription models.

Table: E-commerce market size and growth projections

|

Region |

Market size (2023) |

Projected market size (2033) |

CAGR (2024-2033) |

Growth drivers |

|

North America |

$210 bn (est.) |

(Data unavailable) |

8.7% (Global) |

Strong digital infrastructure, high consumer spending |

|

Global |

$602.3 bn |

$1387.1 bn |

8.70% |

Convenience, variety, personalization |

The report also highlights key segment trends. It shows women's apparel leads with 68.7 per cent market share in 2023. The category benefits from a wider variety of styles and sizes available online, coupled with the ease of home trials and returns. Women hold a 71 per cent share in the gender analysis, driven by their diverse product needs and more frequent purchasing habits. And the discounted pricing model remains popular, attracting price-sensitive shoppers in uncertain economic times. Meanwhile, platforms like ThredUp and Poshmark demonstrate the growing demand for second-hand and sustainable fashion.

Despite fast forward growth the e-commerce sector faces several hurdles and growth challenges. One major concern is the logistical hurdles. Delivery delays, high shipping costs, and complex return processes can negatively impact customer satisfaction. Size and fit inconsistencies are also a major concern, leading to high return rates. Moreover, intense competition necessitates strategic pricing models to maintain profitability. The fast-paced nature of fashion requires constant adaptation and product refreshes. Protecting customer data and ensuring secure transactions is also another concern for the e-commerce sector.

The textile industry is increasingly facing sustainability regulations, from the EU's sweeping green initiatives to national laws and global labelling standards. For brands to stay compliant and competitive, understanding these regulations is no longer optional; it's imperative.

Carbonfact, a leading environmental sustainability platform, has released an updated guide to textile sustainability regulations, offering a roadmap for brands to navigate this complex landscape. The guide provides a comprehensive overview of current and upcoming regulations, including the EU's Corporate Sustainability Reporting Directive (CSRD), the Ecodesign for Sustainable Products Regulation (ESPR), and the Digital Product Passport (DPP).

Highlights from Carbonfact guide

EU legislation takes center stage: The EU is at the forefront of sustainability regulations, with the European Green Deal setting the stage for a raft of new directives and regulations. The CSRD, for instance, requires companies to disclose their environmental and social impacts, while the ESPR sets standards for product performance and introduces the DPP.

National laws add another layer of complexity: In addition to EU-wide laws, individual member states are enacting their own regulations. France's Climate & Resilience Law, for example, requires products to carry an environmental label, while Germany's Supply Chain Due Diligence Act focuses on human rights and environmental standards in the supply chain.

Global labeling laws are evolving: Textile labelling laws are also evolving globally, with a growing emphasis on sustainability and transparency. The EU's Ecodesign for Sustainable Products Regulation (ESPR) and Directive on Green Claims are examples of this trend.

EU vs. US regulations

While both the EU and the US are moving towards stricter sustainability regulations, their approaches differ in several key aspects. The EU has adopted a more comprehensive and centralized approach with the European Green Deal setting the stage for a raft of new directives and regulations, that apply across all member states. The US, on the other hand, has a more fragmented approach, with federal and state governments developing their own legislative frameworks.

Table: Differences in EU-US green laws

|

EU |

US |

|

Centralized approach with EU-wide laws |

Fragmented approach with federal and state laws |

|

Strong emphasis on circular economy and waste reduction |

Focus on emissions reporting and climate risk disclosure |

|

Stricter regulations on green claims and labelling |

Less stringent regulations on green claims |

|

Digital Product Passport (DPP) initiative for product traceability |

No equivalent to the DPP |

|

Extended Producer Responsibility (EPR) laws for textile waste |

Limited EPR laws |

Besides the above mentioned differences, the EU's regulations often set minimum standards that member states can exceed, while the US regulations are typically more prescriptive. The EU also has a stronger focus on human rights and supply chain due diligence, with directives like the CSDDD. The US has a more developed system for financial disclosure of climate risks, with the SEC Climate Disclosure rule.

Data in the forefront

A recurring theme in the Carbonfact guide is the importance of data. Whether it's for reporting under the CSRD, substantiating green claims, or creating a Digital Product Passport, brands need accurate and granular data on their products' environmental impact. As Lidia Lüttin, Head of Marketing at Carbonfact, puts it, "Understanding regulations is just the start - the real challenge is consolidating and fixing your upstream data."

To help brands overcome this challenge, Carbonfact offers a platform that tracks emissions at the product level, streamlines reporting, and provides expert support. The platform ingests, cleans, and analyzes data, allowing brands to generate accurate reports and make informed decisions about their sustainability strategies. In fact, the Carbonfact guide features several case studies and quotes from industry experts, highlighting the importance of staying ahead of the regulatory curve. "We've designed our platform specifically for fashion, apparel, and footwear brands...to help you build a strong data foundation, reduce manual work, and generate accurate, product-level impact data," states the report.

The moot point is that the regulatory landscape for the textile industry is complex and constantly evolving. Carbonfact's updated guide provides a valuable resource for brands seeking to stay compliant and competitive. By embracing data-driven strategies and leveraging tools like the Carbonfact platform, brands can turn the challenge of sustainability regulations into an opportunity for innovation and growth.

The textiles and apparel industry a global behemoth employing millions and touching every life, stands at a critical juncture. While it provides essential clothing and fuels economies, its traditional practices have left a significant environmental and social footprint. Enter ESG (Environmental, Social, and Governance), a framework that’s rapidly transforming how the industry operates, moving beyond conventional sustainability and green chemistry to encompass a holistic approach to responsible business.

Compliance and regulations globally and India

ESG is not a monolithic concept. Its implementation varies significantly across regions, driven by differing regulatory landscapes and market demands.

European Union: The EU is a frontrunner in ESG regulations. The EU Strategy for Sustainable and Circular Textiles aims to make textiles more durable, repairable, recyclable, and resource-efficient. Specific regulations like the upcoming Ecodesign for Sustainable Products Regulation will set mandatory requirements for textiles, including recycled content targets and restrictions on harmful substances. The EU Taxonomy provides a classification system for environmentally sustainable economic activities, influencing investment decisions.

US: While the US doesn’t have a comprehensive federal ESG mandate like the EU, it’s increasingly focusing on disclosures. The Securities and Exchange Commission (SEC) is pushing for standardized climate-related disclosures, impacting publicly traded apparel companies. Furthermore, California’s SB 253 and SB 260 require companies doing business in the state to disclose their greenhouse gas emissions, pushing for greater transparency.

Asia: Asia, a major manufacturing hub, sees a diverse ESG landscape. Countries like India, Bangladesh, and Vietnam are facing increasing pressure from international brands and consumers to adopt better ESG practices. While regulations are evolving, initiatives like the Sustainable Apparel Coalition (SAC) and its Higg Index are driving industry-led efforts toward standardization and improvement. China, a dominant player, is incorporating ESG principles into its national development strategies, with guidelines for green manufacturing and social responsibility.

India: India’s textile industry, a significant contributor to the nation’s economy and employment, is increasingly recognizing the importance of ESG. While a comprehensive national ESG mandate is still evolving, the Securities and Exchange Board of India (SEBI) has introduced Business Responsibility and Sustainability Reporting (BRSR) requirements for listed companies, pushing for greater transparency on ESG performance. This is a crucial step, encouraging companies to integrate ESG factors into their operations and reporting.

Beyond sustainability and green chemistry

ESG goes beyond the traditional understanding of sustainability by integrating environmental concerns with social and governance factors. It moves beyond just ‘green’ processes to encompass a broader spectrum:

Environmental: This includes reducing carbon emissions, water consumption, and waste generation, promoting circularity, and using sustainable materials. It goes beyond just using organic cotton to encompass the entire lifecycle of a garment.

Social: This focuses on fair labor practices, safe working conditions, respecting human rights, promoting diversity and inclusion, and supporting communities. It addresses issues like living wages, worker safety in factories, and eliminating forced labor.

Governance: This involves ethical business practices, transparency, accountability, board diversity, and risk management. It ensures that ESG considerations are integrated into decision-making processes at all levels.

ESG recognizes the interconnectedness of these factors. For instance, a company might use recycled polyester (environmental) while ensuring fair wages and safe working conditions in its factories (social) and having a diverse and independent board overseeing its operations (governance). This holistic approach distinguishes ESG from earlier, more limited sustainability initiatives.

Challenges and concerns

Implementing ESG in the textiles and apparel sector comes with its own set of challenges:

Supply chain complexity: The industry’s complex and globalized supply chains make it difficult to trace materials, monitor working conditions, and ensure compliance with ESG standards at every stage.

Cost of implementation: Investing in new technologies, implementing robust traceability systems, and improving working conditions can be expensive, particularly for smaller manufacturers.

Greenwashing: The risk of ‘greenwashing’ where companies make misleading claims about their sustainability efforts, is a significant concern. Robust verification and transparency are crucial to maintain credibility.

Lack of standardization: The lack of globally standardized ESG reporting frameworks can make it difficult for companies to measure and compare their performance.

India-specific challenges: In India, the large number of small and medium-sized enterprises (SMEs) in the textile sector presents a unique challenge. Many SMEs lack the resources and expertise to implement robust ESG practices. Moreover, the informal nature of parts of the industry makes it difficult to monitor and enforce ESG standards. Issues like water scarcity, particularly in textile clusters, add another layer of complexity to the environmental aspects of ESG.

A compelling business

While ESG implementation can involve upfront costs, it also presents a compelling business Consumers, particularly millennials and Gen Z, are increasingly conscious of the social and environmental impact of their purchases. Companies with strong ESG credentials enjoy a better brand image and attract loyal customers. A 2023 study by McKinsey found “consumers are willing to pay a premium of up to 10 per cent for sustainable products.

Moreover investors are increasingly incorporating ESG factors into their investment decisions. Companies with strong ESG performance are more likely to attract investment and secure better financing terms. Proactive ESG management can help companies mitigate risks related to environmental regulations, social unrest, and reputational damage. And implementing sustainable practices can often lead to cost savings through reduced resource consumption and waste generation.

For Indian textile companies, embracing ESG can unlock significant opportunities. It can enhance their competitiveness in the global market, attract foreign investment, and improve their access to international buyers who are increasingly prioritizing ESG compliance. Also, a strong focus on social aspects, such as fair labor practices and community engagement, can contribute to social harmony and create a positive impact on local communities.

Treading the future

The future of ESG in the textiles and apparel sector is promising, driven by increasing regulatory pressure, growing consumer awareness, and evolving investor expectations.

First technologies like blockchain will play a crucial role in enhancing transparency and traceability across supply chains, enabling consumers and brands to make informed decisions. Second the industry will move towards circular economy models, where textiles are designed for durability, recyclability, and reuse, minimizing waste and resource depletion. Third, collaboration among brands, manufacturers, NGOs, and governments will be essential to address the complex challenges of ESG implementation. And also, the development of globally standardized ESG reporting frameworks will enable companies to measure and compare their performance more effectively.

In India, the focus on ESG is expected to intensify. The BRSR framework is likely to be strengthened, and more specific regulations related to environmental and social aspects of the textile industry are anticipated. Initiatives like the Sustainable Apparel Coalition (SAC) and its Higg Index are gaining traction, providing platforms for Indian companies to benchmark their ESG performance and collaborate with global brands. The Indian government is also promoting sustainable textile practices through initiatives like the National Mission for Sustainable Textile Development. The rise of conscious consumers in India is also driving demand for sustainably produced clothing, creating a market incentive for companies to adopt ESG practices. A greater emphasis on skill development and capacity building will be crucial to enable SMEs to implement ESG effectively. Public-private partnerships and industry collaborations will play a vital role in accelerating the adoption of ESG across the Indian textile sector.

The Indian apparel industry, a major contributor to our GDP and employment, is changing with the infusion of advanced garment manufacturing technologies. As per India Brand Equity Foundation (IBEF), India’s textile and apparel industry is the second largest employer after agriculture, contributing 2.3 per cent to the GDP and 12 per cent to export earnings. From traditional, labor-intensive processes to automated, data-driven systems, the industry is recognizing the need to embrace innovation to remain competitive in the global market.

Winds of change

India’s apparel industry has historically relied on manual labor, particularly for intricate tasks like stitching and embroidery. While this approach has provided employment to millions, it often results in longer lead times, inconsistent quality, and limitations in scaling production. The global apparel landscape is changing rapidly, with consumers demanding faster fashion cycles, personalized products, and higher quality. This shift necessitates a move away from traditional methods.

The present scenario is marked by a gradual adoption of advanced technologies. Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM) are becoming increasingly common for pattern making, design, and cutting. While 3D printing is still in its nascent stages, its potential for creating customized designs and prototypes is being explored. Robotics, though less prevalent currently, is finding applications in areas like fabric handling and automated sewing. Software solutions for production planning, inventory management, and supply chain optimization are also gaining traction.

Technology need of the hour

Adapting to advanced technologies is not merely a choice but a necessity for the Indian apparel industry to survive and thrive in the increasingly competitive global market. Countries like Bangladesh, Vietnam, and China have invested heavily in automation, gaining a competitive edge in terms of cost and efficiency. India needs to modernize to remain attractive to international buyers.

Plus fast fashion, personalized clothing, and on-demand manufacturing require agile and responsive production systems, which can be achieved through technology adoption. Automated processes minimize human error, leading to higher quality and consistent output, crucial for export markets. It improves quality and consistency. It leads to shorter lead times enable quicker response to market trends and faster delivery, enhancing customer satisfaction. And most importantly, automation optimizes resource utilization, reduces waste, and increases throughput, leading to higher productivity and improved profitability.

India’s challenges and concerns

The adoption of advanced technologies in India’s garment manufacturing sector faces several challenges. High initial investment is a major challenge, the cost of acquiring and implementing advanced machinery and software can be prohibitive, especially for small and medium-sized enterprises (SMEs) that constitute a significant portion of the industry.

Moreover, operating and maintaining sophisticated equipment requires specialized skills. There is a need for training and skill development programs to bridge the gap. What’s more, traditional mindsets and a reliance on established practices can hinder the adoption of new technologies. Then there are infrastructure limitations. Reliable power supply and internet connectivity are crucial for running advanced systems. Infrastructure bottlenecks can pose a challenge. Job displacement is another major concern. While automation can create new, higher-skilled jobs, there are concerns about potential displacement of existing workers, particularly those with limited skills.

Despite the challenges, the adoption of advanced garment manufacturing technologies presents a compelling business case for India. By leveraging its existing strengths, such as a large workforce and a well-established textile industry, combined with advanced technology, India can position itself as a global apparel manufacturing hub. And modernized facilities and efficient production processes will attract foreign investment, boosting the industry’s growth. Improved quality, shorter lead times, and competitive pricing will boost India’s export competitiveness. Ministry of Commerce and Industry, India’s textile and apparel exports stood at $40.8 billion in FY22.

A technologically advanced industry can better cater to the growing domestic demand for high-quality and fashionable apparel. And it will help in creating a skilled workforce as investing in training and skill development will create a pool of skilled workers, enhancing the industry’s long-term sustainability.

Tech adoption by Indian companies

In fact some prominent Indian apparel companies have already adopted advanced technology and experienced positive change. For example, Shahi Exports, one of India’s largest garment exporters, has invested heavily in CAD/CAM technology for pattern making, marker planning, and cutting. They’ve also implemented enterprise resource planning (ERP) systems for better production planning, inventory management, and supply chain visibility. These technologies have enabled Shahi Exports to reduce lead times by 15-20 per cent; improve fabric utilization by 5-10 per cent; enhance quality and consistency; increase production efficiency; gain better control over their supply chain

Arvind Mills, a leading textile and apparel manufacturer, has embraced automation in its denim manufacturing facilities. They’ve implemented automated weaving, dyeing, and finishing processes, along with robotics for material handling. This has resulted in increased production capacity; reduced labor costs; improved product quality; enhanced sustainability through reduced water and energy consumption.

Raymond Group a top brand in the men’s apparel segment, has adopted 3D body scanning technology in some of its retail stores. This allows for precise measurements and personalized tailoring, enhancing the customer experience. This technology has helped Raymond to offer customized fits and personalized service; improve customer satisfaction; enhance brand image and gain a competitive edge in the retail market.

Similarly, Gokaldas Exports, another major garment exporter, has implemented lean manufacturing principles and integrated them with technology solutions. They’ve used software for production planning, shop floor control, and real-time data analysis. This approach has enabled Gokaldas Exports to streamline production processes; reduce waste and improve efficiency; enhance productivity and profitability; improve on-time delivery performance.

Apparel Group India partnered with Green Honchos to improve their e-commerce capabilities. They focused on website development, UI/UX improvements, and better integration with their technology infrastructure. This led to 30x increase in e-commerce sales; 30 per cent of total sales coming from e-commerce; improved customer experience and website performance; increased ‘add to cart’ rate by 12-14 per cent.

Future outlook

The future of garment manufacturing in India is linked to the adoption of advanced technologies. In future, there will be greater use of robotics, AI, and automation in all stages of production. Seamless integration of CAD/CAM, 3D printing, and other digital tools will create a connected and data-driven manufacturing ecosystem. Technologies that promote sustainable practices, such as reducing waste and conserving water, will gain prominence. 3D printing and other technologies will enable on-demand and personalized production, catering to individual consumer preferences. And the integration of garment manufacturing with Industry 4.0 technologies, such as IoT and cloud computing, will create smart factories with enhanced efficiency and connectivity.

Source Fashion, Europe’s leading responsible sourcing show, has revealed key catwalk trends for its upcoming event from 18th to 20th February 2025 at Olympia London. The Source Catwalk will showcase a fusion of innovation, sustainability, and immersive fashion experiences, highlighting the future of responsible design alongside a bespoke collection by headline designer Stuart Trevor.

For AW25-26, three macro trends - Multisensory, Transformative, and Rejuvenating, will shape womenswear collections. Under these, several micro trends emerge. ‘CircusPlay’ takes inspiration from the whimsical world of the circus, featuring bold colors, exaggerated silhouettes, and rich textures. Key pieces include the Bubble Hem Dress, Volume Draped Top, and Exaggerated Shoulder Top, embracing theatrical fashion with modern wearability.

‘Hyper Tactile’ makes fashion an immersive sensory experience with an organic color palette, including hues like Organic Matter and Enchanted Forest, evoking warmth and nature’s enchanting textures. ‘Reconstructed’ celebrates sustainability through upcycling, using patchwork, mixed textiles, and artistic repurposing. The color scheme blends earthy neutrals with Desert Architect tones, balancing warm golds and cool stony greys.

‘Plant Power’ focuses on botanical beauty and plant-based materials, featuring innovative textiles like Pinatex (pineapple leaf fabric) and organic cotton. With dominant green and brown tones, this trend redefines sustainable luxury.

Stuart Trevor, known for his craftsmanship and innovation, will present a bespoke collection from his eponymous label, adding a unique touch to the Source Catwalk. The show promises a forward-thinking vision of fashion, merging creativity, sustainability, and next-generation materials.

Eastman Naia returns to Premiere Vision Paris to highlight the transformative potential of Naia Renew staple fibers. Known for their luxurious comfort and eco-conscious design, these fibers redefine sustainable fashion with versatility and performance.

Naia Renew staple fibers, made from 60 per cent sustainably sourced wood pulp and 40 per cent recycled waste through a low-impact, closed-loop process, blend seamlessly with premium materials like wool, cashmere, and linen. The result: lightweight, breathable fabrics with quick-drying properties, a refined pearl-like luster, and superior comfort.

At Stand 6R30, Eastman Naia presents a curated selection of garments and fabrics developed with leading brands, demonstrating their market-ready appeal. With a focus on circularity, Eastman partners with top European mills like Riopele in Portugal and Pakipek in Turkey to integrate Naia Renew into sustainable textiles. “Through innovation and creativity, we transform Naia Renew into high-performance, eco-friendly fabrics,” says a Riopele spokesperson.

Naia Renew also supports nearshoring, reducing lead times and transportation emissions while ensuring high-quality, responsibly sourced textiles. At Premiere Vision, Eastman Naia celebrates these partnerships, reinforcing its commitment to sustainable textile production.

Ruth Farrell, General Manager of Eastman’s Textiles Business, will further discuss bioengineered and bio-based materials in the panel “How savoir-faire is reinventing the living world”.

Premiere Vision Paris offers Eastman Naia a key platform to connect with designers and brands, shaping the future of sustainable fashion with innovative, high-performance materials.