FW

Aggressively expanding its quick commerce service, ‘Flipkart Minutes,’ the e-commerce company, Flipkart aims to establish 500-550 dark stores before its ‘Big Billion Days’ sale. The company expects to have around 300 dark stores operational by March, significantly increasing its presence and intensifying competition with Blinkit, Zepto, and Swiggy Instamart.

The Walmart-backed e-commerce giant entered the rapidly growing quick commerce segment around August of last year. It currently operates 120-150 dark stores with this expansion representing a rapid scale-up for the company. By March 2025-end, Flipkart aims to open over 300 dark stores, with the ultimate goal of over 500 stores in preparation for its major annual sale, typically held in October-November

Crucial for quick commerce, dark stores enable platforms to store a wide range of products and fulfill deliveries within 15-20 minutes. Flipkart has reportedly strengthened its market position in Bengaluru and expanded its offerings to include high-value items like electronics, appliances, and smartphones, mirroring recent strategies by Blinkit and Zepto.

Having reached 700 dark stores by December 2024, Swiggy Instamart took over two years to achieve that milestone. Zepto surpassed 900 stores in January, while Blinkit leads the segment with over 1,000 dark stores.

Last month, Flipkart appointed Kabeer Biswas, Co-founder, Dunzo, to lead its quick commerce venture. This move signals Flipkart's commitment to competing against Blinkit, Swiggy Instamart, and Zepto, which are all vying to deliver a wide range of products quickly.

Other quick commerce players are also investing heavily in scaling operations. With its current trajectory, Flipkart is poised to become the fourth-largest player in quick commerce. BigBasket’s BB Now also competes in this space, while Amazon is reportedly testing a 15-minute delivery service in Bengaluru.

According to Bofa Securities, the Indian quick commerce market is projected to grow from $21 billion to $31 billion by FY27, increasing its share of the retail market from 1.7 per cent to 2.4 per cent.

Leading integrated express logistics provider in India, DTDC has entered into the rapid commerce space with the launch of 2-4 hour rapid delivery and same-day delivery services. This expansion leverages DTDC's robust logistics network, advanced technology, and success in domestic e-commerce to enhance last-mile delivery solutions for businesses and consumers.

Building on its next-day delivery expertise, DTDC now offers rapid 2-4 hour deliveries, promising speed and reliability. The company has established its first dark store in Bengaluru, creating a hyperlocal fulfillment ecosystem to improve last-mile delivery efficiency. This initiative will empower D2C brands and social commerce sellers, enabling them to offer rapid delivery services across India.

DTDC plans to expand these rapid delivery options nationwide, further solidifying its role in transforming the logistics and e-commerce landscape. The expansion aims to meet the increasing demand for rapid delivery in today's fast-paced digital world.

Subhasish Chakraborty, Founder and Chairman & Managing Director, DTDC Express, states this launch is a significant milestone for DTDC, strengthening its commitment to growth in the evolving logistics and commerce sectors. He emphasized the goal of meeting the increasing demand in rapid commerce and becoming a key player in shaping the future of delivery services in India.

Abhishek Chakraborty, CEO DTDC Express, adds, they are excited to launch their first dark store in Bengaluru, a key e-commerce hub, to serve the growing needs of emerging brands and businesses. He opines, catering to the evolving demands of the digital marketplace, DTDC will redefine logistics solutions.

Bangladeshi recycled yarn producer, Simco is engaged in an intellectual property dispute with Swiss apparel and shoe brand ON over confusingly similar names. Based in Bhaluka, Simco manufactures yarn under the brand ‘Cyclo,’ supplying it to apparel manufacturers who export garments with Cyclo hangtags to European and American retailers. Simco registered the ‘Cyclo’ trademark in Singapore in 2014.

The Swiss company, ON, registered its apparel brand as ‘Cyclon’ in Switzerland in 2021 and markets its products under this name. Meanwhile, Simco created ‘Cyclo’ in 2014 as Bangladesh's first certified garment waste recycling facility and brand for its recycled fibers and yarns. The ‘Cyclo’ brand is trademarked and registered in over 20 countries, including Bangladesh, the EU, USA, UK, and Japan.

A major player in the performance sportswear industry with an estimated market capitalization exceeding $20 billion, ON launched a recycling program called ‘Cyclon’ around 2021 and subsequently attempted to limit Simco's use of the ‘Cyclo’ brand in key markets.

The similarities in name and the shared focus on circularity and recycling have forced Simco to defend its ‘Cyclo’ trademark across multiple jurisdictions. Simco claims ON has been unresponsive to attempts at amicable resolution, highlighting the power imbalances faced by smaller companies from developing nations.

Founded in Switzerland in 2010, ON produces premium footwear, apparel, and accessories for running, outdoor activities, training, all-day wear, and tennis.

Nilesh Ved, Founder and Chairman of AppCorp Holding and owner of Apparel Group, received the prestigious Lifetime Achievement Award for Pioneering Retail Entrepreneurship at the 2025 RLC Honors in Riyadh, Saudi Arabia, on February 4.

Recognized as one of the retail industry’s most transformative leaders, Ved has played a crucial role in reshaping global retail with his vision for innovation, expansion, and excellence. Under his leadership, Apparel Group has become a dominant force in the industry, setting new benchmarks for success.

The award ceremony, followed by an exclusive dinner attended by 150 top industry figures, celebrated Ved’s impact on retail. His contributions have not only redefined consumer experiences but also set the strategic course for the industry's future.

Upon receiving the honor, Ved expressed his gratitude, stating, “This award is a testament to our journey, driven by passion, resilience, and a commitment to excellence. Retail is about more than commerce it’s about creating meaningful connections that resonate globally. I am deeply humbled and inspired to continue shaping the industry’s future.”

The RLC Honors once again highlighted its mission to recognize trailblazers shaping the retail landscape. Ved’s Lifetime Achievement Award marks a defining moment in his career, cementing his legacy as a visionary leader whose influence continues to inspire the next generation of retail pioneers.

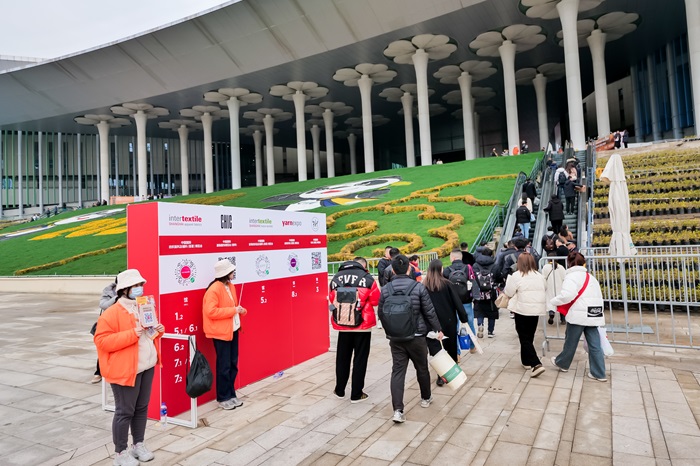

Intertextile Shanghai Apparel Fabrics - Spring Edition 2025 is set to spotlight sustainability and innovation, with over 3,000 exhibitors spanning 190,000 square meter at the National Exhibition and Convention Center. As the textile industry accelerates its shift toward eco-friendly practices, the event will emphasize the use of recycled materials and bio-based fibers in functional textiles.

Two key zones will highlight these advancements. The Econogy Hub, following its successful debut at last year’s Autumn Edition, will return alongside the Econogy Finder, enabling exhibitors who pass the independent Econogy Check to showcase their green credentials. Meanwhile, Functional Lab will introduce The Cube, a dedicated space for on-trend functional fabrics.

Leading industry players champion sustainability

With growing consumer demand for environmentally responsible products, leading functional apparel brands are integrating sustainable materials such as recycled plastics and organic cotton. At the fair, notable exhibitors in Functional Lab will include:

3M China Limited: Showcasing Thinsulate Insulation, a warm, lightweight microfibre with a high warmth-to-thickness ratio. The series includes varying levels of recycled content and features such as stretch, water resistance, and flame resistance.

Henglun Textile (Vietnam) Co Ltd: A producer of knitted denim and print knitted fabrics with sustainability certifications from BCI, GRS, and OEKO-TEX.

Jackie Liu, APAC Business Leader of 3M China Limited, emphasized, “Sustainable development, environmental protection, and digitalization are key industry priorities. We integrate sustainable technology into our products, making them recyclable while utilizing renewable raw materials.”

Certification and innovation drive green progress

Beyond functional textiles, other major exhibitors will present sustainable solutions across the fairground, including:

Eastman Chemical Company: Displaying Naia Renew fiber, made from 60 per cent sustainably sourced wood pulp and 40 per cent certified recycled waste material.

Esquel Enterprises Ltd: Aiming for net-zero emissions by 2050, Esquel repurposes leftover yarn and fabrics into accessories and packaging.

Grasim Industries Limited: A key producer of cellulosic fibers and sustainable fashion materials under the Aditya Birla Group.

Certification and traceability remain crucial for ensuring industry-wide sustainability. The Econogy Hub will host leading certifiers and testing institutes such as Ecocert, Hohenstein, and Testex AG. Marc Sidler, Group CMO at Testex AG, noted, “The fair has become much greener and more digital. Strong interest in our Made in Green certification underscores the demand for transparent supply chains.”

Co-organized by Messe Frankfurt (HK) Ltd, the Sub-Council of Textile Industry, CCPIT, and the China Textile Information Centre, Intertextile Shanghai Apparel Fabrics - Spring Edition 2025 will run from 11-13 March. It will be held alongside Yarn Expo Spring, Intertextile Shanghai Home Textiles - Spring Edition, CHIC, and PH Value.

The fusion of sustainability and creativity took center stage on January 19 at Fondazione Sozzani, where Italian designer Marcello Pipitone presented M:A M,M A Fashion: Art, Materials, Music. Action. The event blended fashion, visual art, and music, spotlighting Pipitone’s street couture and the innovative materials of Eastman Naia Renew.

A key highlight was Pipitone’s collection featuring Sherpa fabric, a premium blend of wool and Naia Renew, a fiber made from 60 per cent sustainably sourced wood pulp and 40 per cent recycled waste. Developed in collaboration with Eastman Naia, the fabric was produced in Prato by Lady V and finished with expert dyeing by Tintoria Emiliana, showcasing Italian craftsmanship.

The event also featured a second collection by Pipitone, crafted from recycled denim and vintage football jerseys, reinforcing his commitment to upcycling. Complementing the showcase, Milanese footwear designer Sangi introduced a capsule of repurposed technical football boots transformed into stylish urban trainers.

Naia, in partnership with Tintoria Emiliana, played a key role in developing the event’s sustainable fashion pieces, reinforcing its versatility and eco-conscious innovation. The evening embodied a seamless blend of artistry and responsibility, proving that high fashion and sustainability can go hand in hand.

Spring Fair 2025 concluded its 75th edition at NEC Birmingham, bringing together over 38,000 retail buyers and industry professionals. The UK’s largest retail trade show for home, gift, and fashion showcased trends, fostered business growth, and strengthened industry connections.

Retail growth and innovation at the forefront

The event welcomed top retailers, including Marks & Spencer, John Lewis, Tesco, ALDI, Wayfair, The Walt Disney Company, and many more. With a mission to drive retail growth, Spring Fair expanded significantly, with a 14 per cent rise in exhibitors and 18 per cent more new exhibitors. Buyers at the event reported increased budgets and higher spending thresholds.

Event Director Soraya Gadelrab emphasized the show’s evolution beyond size, focusing on its impact on retail businesses. “Spring Fair is building the ultimate retail experience, helping the UK retail sector thrive,” she said. Many exhibitors shared success stories, with businesses forming new partnerships and securing major deals.

Supporting new brands and emerging talent

The show placed strong emphasis on supporting emerging brands through initiatives like the #SBS Village and New Business Pavilions. First-time exhibitors gained valuable exposure, with some making key connections that had previously been out of reach. The event introduced several enhancements, including the New Licensing Lab stage, an immersive Buyers Lounge, and the Gift of the Year Showcase. These initiatives provided retailers with hands-on experiences and insights into market trends.

Both major chains and independent boutiques praised the event for its business opportunities." The Buyer Lounge, designed to resemble a high street experience, allowed visitors to interact with products in real-life settings. The launch of Heritage 75 fragranced candles and diffusers added a commemorative touch to the anniversary edition.

Moda x Pure made its debut at Spring Fair, expanding the fashion sector with a diverse range of clothing, footwear, accessories, and jewellery. The fashion catwalk showcased contemporary trends, highlighting emerging designers and brands. Exhibitors secured new stockists and large orders, reflecting strong buyer interest.

Shaping the future of retail

Throughout the event, keynote speakers and panel discussions provided industry insights. Laurence Llewelyn-Bowen discussed licensing and creativity, while Theo Paphitis encouraged small businesses to remain confident in their unique offerings. Retail trend forecasting sessions emphasized sustainability, individuality, and experiential retail, offering actionable strategies for buyers.

The show also featured Ambiance Clinics, offering personalized business advice on productivity and revenue growth. Industry leaders and exhibitors highlighted the importance of community collaboration in reimagining the future of retail.

Exhibitors reported strong sales and new partnerships, with some securing 40-50 per cent new customers. Many businesses highlighted the show’s impact on brand visibility and expansion into new markets. The success of Spring Fair 2025 reinforced its status as the UK’s premier retail trade event, setting the stage for further growth in 2026.

Growing at a 5.4 per cent CAGR from 2024 to 2033, the global textile yarn market is projected to reach $22.7 billion by 2033, from $13.6 billion in 2023. This growth is likely to be fueled by an increasing textile demand across apparel, home furnishings, and industrial sectors, driven by rising global population, urbanization, and disposable incomes.

The growing popularity of sustainable textiles is also driving innovation in organic and recycled yarns. Government investments in textile-producing regions, supporting infrastructure, innovation, and SMEs, create a favorable environment. Stricter regulations on environmental impact and labor practices are pushing manufacturers toward cleaner production and sustainable sourcing.

Opportunities for both new and established players exist in this market that involves the production and distribution of yarns used in fabrics, apparel, and industrial textiles. While new entrants can focus on niche markets like organic, recycled, or specialty yarns, established players can leverage their expertise to explore emerging markets and diversify product portfolios, investing in automation and smart manufacturing. They can also collaborate with fashion brands and sustainability advocates to enhance market presence.

Key market segments include plant-sourced yarns (55 per cent share), cotton yarn (65 per cent), and apparel applications (70 per cent). Growth in the market is being driven by factors including fast fashion industry’s demand for diverse yarns, growth in technical textiles requiring specialized yarns, development of sustainable fibers, athletic wear requirements for performance yarns, and manufacturing automation improving quality and efficiency.

The Asia Pacific region leads growth in this segment with a 37 per cent share. Driven by large-scale textile production in countries like China, India, and Bangladesh, this growth is attributed to the region’s large-scale textile production, strong manufacturing capabilities, and growing demand for both synthetic and natural yarns. Cost-effective manufacturing and technological advancements further fuel this growth. Rising middle-class populations and increasing disposable incomes also contribute to the demand for high-quality apparel.

The Lyst Index, a quarterly ranking of fashion's most coveted brands and products, has released its highly anticipated report for the fourth quarter of 2024 (October to December). This definitive guide to the industry's hottest trends offers valuable insights into consumer behavior and the ever-evolving landscape of fashion.

Miu Miu's dominance continues

For the third time in 2024, Miu Miu has claimed the top spot, cementing its status as the year's most influential brand. The Prada-owned label has consistently captured the zeitgeist, resonating with fashion enthusiasts through its innovative designs, strategic marketing efforts, and a knack for setting trends that resonate across demographics.

Table: Lyst Index top 10 brands

|

Rank |

Brand |

Movement |

|

1 |

Miu Miu |

Same |

|

2 |

Saint Laurent |

+2 |

|

3 |

Prada |

Same |

|

4 |

Loewe |

-2 |

|

5 |

Coach |

+10 |

|

6 |

Bottega Veneta |

Same |

|

7 |

Alaïa |

-2 |

|

8 |

Moncler |

+5 |

|

9 |

The Row |

Same |

|

10 |

Ugg |

New |

Highlights from the Q4 2024 report

Saint Laurent's Ascent: Saint Laurent climbed two spots to secure the second position, driven by its successful "Emilia Pérez" film project, starring brand ambassador Blackpink's Rosé, and continued popularity among celebrities and influencers. The brand's sleek tailoring and classic yet edgy aesthetic continue to resonate.

Coach's Resurgence: Coach made a remarkable leap of 10 places to reach number five, fueled by its strategic focus on Gen Z consumers and competitive pricing during sale seasons. The brand's Brooklyn Bag emerged as the quarter's hottest product, with searches growing by 65 per cent quarter-on-quarter. Collaborations with popular musicians and a strong emphasis on accessible luxury have proven successful.

Ugg's comeback: Ugg made its debut on the list at number 10, capitalizing on the ongoing nostalgia for 2000s fashion and the brand's resurgence among trendsetters. Searches for Ugg boots skyrocketed by 358 per cent over the quarter. The brand's inclusive sizing and focus on comfort have also contributed to its renewed popularity.

Quiet luxury's lingering influence: The "quiet luxury" aesthetic continued to influence consumer preferences in Q4. Brands like The Row, which maintained its position in the top 10, benefited from this trend. Consumers are increasingly drawn to understated elegance, high-quality materials, and timeless designs.

The rise of ‘Gorpcore’: While not explicitly dominating the top 10, the Lyst Index noted a growing interest in ‘gorpcore’ – a style blending outdoor and technical wear with everyday fashion. Brands like Arc'teryx and Salomon saw increased search volume and engagement, hinting at a potential trend for future quarters.

Sustainability's growing importance: The report also highlighted the increasing importance of sustainability in consumer purchasing decisions. While not a primary driver of brand rankings in Q4, Lyst noted a growing number of searches for sustainable fashion and brands that prioritize ethical production practices.

Emerging brands to watch

The Lyst Index also highlighted several up-and-coming brands that experienced significant growth in Q4. These include:

Charlotte Simone: The vintage-inspired outerwear brand saw a 242 per cent search surge after being worn by Taylor Swift.

Our Legacy: This Stockholm-based label gained traction with its minimalist and contemporary designs.

Demellier: The handbag brand's popularity soared, driven by its chic and functional styles.

Auralee: This Japanese brand's focus on high-quality materials and timeless designs resonated with consumers.

The Lyst Index report delves into specific case studies to illustrate the factors driving brand success. For instance, it highlights Coach's strategic approach to engaging Gen Z through social media campaigns and collaborations with popular influencers. The report also examines Ugg's resurgence, attributing it to the brand's ability to tap into the Y2K nostalgia trend and its clever use of TikTok marketing. Furthermore, the report analyzes Miu Miu's consistent success, noting its ability to balance high-fashion creativity with commercial appeal.

The Lyst Index for Q4 2024 offers a fascinating snapshot of the ever-changing fashion landscape. It underscores the importance of brand authenticity, consumer engagement, and the ability to adapt to evolving trends. As the industry continues to evolve, the Lyst Index remains an invaluable resource for understanding the forces that shape our fashion choices.

Pakistan's textile and apparel sector, faces a critical juncture as the European Union (EU) scrutinizes its commitment to human rights and governance under the Generalised Scheme of Preferences Plus (GSP+). Recent statements from EU officials, while acknowledging Pakistan's progress and its status as the largest GSP+ beneficiary, also carry a stark warning: continued trade benefits hinge on demonstrable progress on human rights and other key areas. This uncertainty casts a long shadow over the sector, raising concerns about potential economic fallout should the preferential trade access be revoked.

The stakes are high

GSP+ provides significant advantages to Pakistan's exports, particularly in the textile and garment sector. Zero-rated or preferential tariffs on nearly 66 per cent of tariff lines have led to a substantial increase in exports to the EU market. Between 2014 and 2022, Pakistan's exports to the EU rouse by 108 per cent, reaching €14.85 billion, with textiles playing a dominant role. The sector contributes significantly to Pakistan's GDP, employs millions of workers, and is a crucial source of foreign exchange. Withdrawal of GSP+ would not only impact export volumes but also reverberate throughout the entire value chain, affecting employment, investment, and overall economic stability.

The EU's concerns

While the EU acknowledges Pakistan's economic significance and its positive trajectory in some areas, the emphasis on human rights and rule of law remains paramount. The EU's concerns, though not explicitly detailed in recent statements, are around freedom of speech, rights of minorities, labor rights, and the implementation of international conventions related to these areas. Ambassador Skoog's statement underscores the need for "tangible reforms" and continued progress on these issues as Pakistan prepares for reapplication under the new GSP+ regulation.

What's at stake

For Pakistan a lot is at stake primarily it could lead to economic losses as reduced export earnings, job losses, decreased investment, will have negative impact on GDP. Withdrawal of GSP+ would also signal concerns about Pakistan's commitment to human rights and governance, potentially affecting foreign investment and international relations. What’s more, Pakistan's textile sector would lose its competitive edge in the EU market, potentially losing market share to other exporting nations.

Therefore, Pakistan needs a multi-pronged approach to address the EU's concerns and secure continued GSP+ status. First it needs to focus on diplomatic engagement or proactive and transparent dialogue with the EU to understand specific concerns and demonstrate progress on reforms. It als needs to take concrete actions, tangible improvements in human rights, labor rights, and governance, supported by legislative and administrative measures is the need of the hour. And close collaboration between government, industry, and civil society is needed to address the challenges and ensure compliance with international standards.

The future of Pakistan's textile sector is inextricably linked to its GSP+ status. A concerted effort to address the EU's concerns is crucial to safeguard this vital sector and ensure its continued growth and contribution to the national economy. Failure to do so could have significant and lasting consequences.