FW

Ahead of the Minimum Wage Board meeting in Bangladesh, to set the new statutory minimum wage for garment industry workers in the country, Clean Clothes Campaign, the International Labor Rights Forum and Maquila Solidarity Network jointly urged major brands sourcing from Bangladesh to publicly support workers’ demands. These demands include the minimum wage of 16,000 taka, a statutory framework to govern pay grades and promotion and other welfare measures.

Additionally, brands expressed commitment to fully respect and support the outcome of the wage negotiation process. Multistake holder initiatives including Fair Wear Foundation, Dutch Agreement on Sustainable Garments and Textile, and the German Partnership for Sustainable Textiles also urged the Bangladeshi government to take the workers’ and unions’ collective demand into account, and highlighted the overall support for the payment of living wages.

Beside the minimum wage increase to 16,000 taka, workers’ demands include the streamlining of the job grades that determine workers’ pay from seven to five; the introduction of currently inexistent promotion criteria; a 10 percent annual pay increase; and a shortening of apprenticeship periods to the maximum of three months, along with a wage increase for apprentices from 4,180 taka to 10,000 taka.

"To keep up with rising demand, fast fashion companies have started resorting to measures which can enhance quality control standard operating procedures. Big brands have in-house quality control teams, whose job is to design, mandate, and audit processes for vendors to follow throughout production. One of the mandatory processes in garment manufacturing is fabric relaxation. Many fabrics, especially knits, need to be carefully handled to account for stretch that can be warped and affects the overall drape and fit of the final product. But at times, before the fabric pieces are sent through the sewing line, the fabric rolls are mishandled during spreading. Ram Sareen, Head Coach and founder, Tukatech, stated typical ‘relaxation’ necessitates that a factory takes a perfectly rolled fabric, open it onto a table, and leave it there for a day or two to settle. In this process, not only is the integrity of fabric harmed due to the handling and friction, but also one to two days are lost in the production cycle."

To keep up with rising demand, fast fashion companies have started resorting to measures which can enhance quality control standard operating procedures. Big brands have in-house quality control teams, whose job is to design, mandate, and audit processes for vendors to follow throughout production. One of the mandatory processes in garment manufacturing is fabric relaxation. Many fabrics, especially knits, need to be carefully handled to account for stretch that can be warped and affects the overall drape and fit of the final product. But at times, before the fabric pieces are sent through the sewing line, the fabric rolls are mishandled during spreading. Ram Sareen, Head Coach and founder, Tukatech, stated typical ‘relaxation’ necessitates that a factory takes a perfectly rolled fabric, open it onto a table, and leave it there for a day or two to settle. In this process, not only is the integrity of fabric harmed due to the handling and friction, but also one to two days are lost in the production cycle.

To keep up with rising demand, fast fashion companies have started resorting to measures which can enhance quality control standard operating procedures. Big brands have in-house quality control teams, whose job is to design, mandate, and audit processes for vendors to follow throughout production. One of the mandatory processes in garment manufacturing is fabric relaxation. Many fabrics, especially knits, need to be carefully handled to account for stretch that can be warped and affects the overall drape and fit of the final product. But at times, before the fabric pieces are sent through the sewing line, the fabric rolls are mishandled during spreading. Ram Sareen, Head Coach and founder, Tukatech, stated typical ‘relaxation’ necessitates that a factory takes a perfectly rolled fabric, open it onto a table, and leave it there for a day or two to settle. In this process, not only is the integrity of fabric harmed due to the handling and friction, but also one to two days are lost in the production cycle.

It is often seen that about 8-10 workers handle fabric spreading, which increases manual dependency. When it is time for production spreading, that fabric is usually handled by at least eight, and sometimes by as many as fourteen or fifteen people, who catch and pull the fabric out of proportion as they lay it down. This creates uneven stretch about the fabric, and completely negates any relaxation that might have happened while the fabric was lying in a pile the day before. Factories are following the procedures as they are given, but sometimes these practices diminish the very quality they are seeking.

time for production spreading, that fabric is usually handled by at least eight, and sometimes by as many as fourteen or fifteen people, who catch and pull the fabric out of proportion as they lay it down. This creates uneven stretch about the fabric, and completely negates any relaxation that might have happened while the fabric was lying in a pile the day before. Factories are following the procedures as they are given, but sometimes these practices diminish the very quality they are seeking.

The same practices are often applied uniformly across all types of fabric, even if the necessity is not there. For example, fabric handling procedures for knit fabrics may be applied to denim, simply because it is a ‘stretch’ denim. Sareen highlighted that the stretch for denim is only in the width. You can relax the denim for ten years and it is never going to come back in length. These procedures become ingrained in local production culture, and changing these fixed processes becomes very difficult.

Fabric handling

Labour in the some countries is cheap, but labour accounts for less than 20 per cent of the total production cost. The cost of fabric, on the other hand, equates to 60-75 per cent of the garment cost. It is in the best interest of both brands and vendors to focus on handling fabric carefully, so that the human and material resources are not wasted, and the number of steps and time for manufacturing are reduced. Simplifying the fabric spreading process means reduction in the cost of labour, better product quality, and a shorter lead time. When fabric spreading is done automatically with a machine or on a mechanised trolley system the capacity increases.

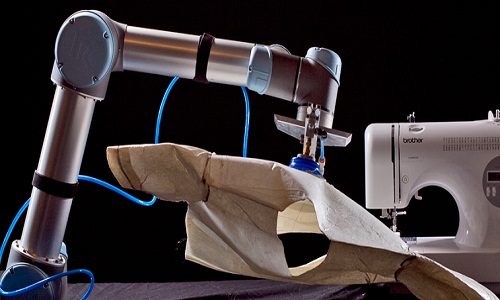

Automatic fabric spreading ensures that every inch of fabric is aligned and gently handled from the time the roll is opened, until the pieces are cut and ready for sewing. Automatic fabric spreading machines come with tension-free mechanisms to unwind material from the roll, and constantly monitor the tension during spreading to keep consistent tension throughout the fabric. This means that relaxation for most types of fabric can be reduced or even eliminated from the production process, which saves one or two days, plus the required labour cost, and potential for lost fabric integrity.

Automation saves time

In addition to automatic fabric spreading, CAD systems help automate fabric planning and utilisation, as well as other pre-production practices. Accounting for fabric shrinkage, for instance, automatically adjusts the piece geometry, even for very tricky fabrics. Cut-planning applications then run order scenarios to ensure the best lay plans, and nesting algorithms calculate the best utilisation of the width of the fabric actually received. Such practices could save three to five days, 20 per cent of staff, and 3-12 per cent of fabric, as well as result in better quality garments.

Nike is a favorite brand among Gen-Z, aged 13 to 20, in the US. Teens are moving away from traditional youth brands such as Abercrombie & Fitch. In the apparel sector, youth brands such as Hollister and Aeropostale have also lost ground with Gen-Z consumers in the last five years.

Reduced interest in these heavily mall-reliant retailers could well reflect a wider trend, as young consumers move away from destination retail, increasingly preferring convenience store-style spaces. Athletic shoe brands such as Reebok, Converse, Vans and Puma have also lost out among Gen Z over the last five years.

Gen Z is highly social, online and offline, with greater conversational engagement than adults in most consumer categories. Discussions about brands are behind on an average 19 per cent of consumer purchases, accounting for somewhere between seven and ten trillion dollars in annual sales.

Nike is the most talked about apparel and footwear brand, discussed by 11.2 per cent of teens, up 34 per cent since 2013. There is also a decline in discussions concerning retailers such as Nordstrom, JCPenney, Kohl’s, Macy’s, Kmart, Sears, and TJ Maxx. However, important as trends may be, there are plenty of brands that are succeeding despite them.

In the first four months of the current year, knitwear exports from Tirupur have fallen 13 per cent. One reason is GST and the consequent reduction in duty drawback and rebate of state levies. Tirupur garment exporters have greeted the increase in basic customs duty from 10 to 20 per cent on specified garments.

The duty hike on import of 23 knitted garment items and one knitted fabric is expected to help protect the domestic textile industry. Knitwear exporters had been appealing for swift action in this regard as textile imports from countries such as China, Bangladesh, Vietnam and Cambodia have increased significantly.

Exporters say there is a need to restrict import of textile products. They have prepared a white paper detailing the threat from China, with Chinese companies setting up factories in countries bordering India to take advantage of labor, low wages and customs exemption available to these countries in EU and Canada. Under the South Asian Free Trade Area agreement, specified garment items imported into India from Bangladesh are also exempted.

The Tirupur knitwear cluster is looking forward to the Indo-Pacific economic corridor as it would open up traditional apparel markets abroad. The corridor is a treaty of 12 countries, including India, the US, Australia, Indonesia, Japan and New Zealand among others.

Première Vision Paris to be held from September 19 to 21, will see the launch of a B2B marketplace. Targeting an international database of 2,50,000 upstream professionals, the marketplace aims to bring together 1,500 companies and 70,000 textile products, leather, accessories, designs and clothing.

Initially, limited to sample orders, before a possible opening to massive orders, the offer is currently reserved for 756 weavers for the launch. The products are put online by the companies themselves or, with their consent, via the Première Vision photo studio, as a part of the selection of materials that will comprise the trends of future editions. This offer to professionals is complemented by various services, mainly geared towards connecting manufacturers and contractors, plus an editorial content dedicated to market trends and developments.

The project is part of a wave of progressive digitization of various fashion and textile trade shows. It is a strategic project that will support the commercial development of the show’s exhibitors by providing them with a permanent connection with their customers. It is also a way to adapt to production processes that have become very diverse and fragmented.

Premiere Vision aims at supporting the evolution of the sector, whose new players are waiting for new tools.

The Philippines is aiming at a free trade agreement with Turkey. The aim is to help revive the garment industry and take advantage of Turkey’s weak currency. The Turkish lira has suffered a major beating following the country’s trade standoff with the United States. The Philippines sees this is an opportunity for garment manufacturers because Turkish textiles have become more price competitive with the depreciation of the exchange rate.

The free trade agreement could introduce a zero-tariff regime. Rates are between 10 and 20 per cent currently. Since the abolition of textile quotas by the World Trade Organization in 2005, garment and textile enterprises in the Philippines which relied on quotas faced difficulties leading to closure of factories and downsizing.

Spinners, who turn raw material to yarn then to fabrics for garment factories, have dropped in numbers. Out of more than 30 spinner companies, only two have remained. At present, 39 per cent of the industry is composed of exporters, and 61 per cent is subcontractors, which include small contractors catering to garment exporters, or backyard businesses.

The industry is gearing up to jumpstart its resurgence and gain back its reputation as a competitive player in the domestic and international markets.

The Bangladesh readymade garment industry is undoubtedly safer, and lives have been saved. After the 2013 Rana Plaza tragedy, global apparel brands no longer ignore dangerous working conditions at their supplier factories.

The Bangladesh Accord on Fire and Building was an unprecedented, independent, legally binding agreement between trade unions and brands. Expert fire and building safety engineers working for Bangladesh Accord have inspected more than 1,600 factories making garments for over 200 brands and retailers. Initial inspections identified 1,18,500 fire, electrical and structural hazards of which 84 per cent have been corrected. The Accord training team has conducted 2,838 safety committee training sessions with workers at over 1,000 factories.

Five years on, Bangladesh Accord stands as a model for industrial relations, and shows that brands and unions can work together to solve systemic problems. However, the work of the accord, which expired at the end of May 2018, is not complete. Too many life-threatening hazards at supplier factories remain, which is why more than 180 brands have signed the new Transition Accord.

This accord has greater scope to cover home textiles and footwear and, crucially, gives more power to workers. The new agreement recognises workers are not peripheral to the due diligence process, but core to it. It upholds the importance of freedom of association in ensuring workers have a genuine say in protecting their own safety. It will also establish a training and complaints protocol to ensure that this right is respected.

Kornit’s direct to garment machines, inks and consumable spare parts and other relevant products will now be distributed in India by Arrow Digital, which will also provide service and application support to Indian customers. Kornit is a digital textile printing company. It’s looking at increasing its presence in India’s the digital printing segment. Kornit’s portfolio of direct-to-garment products is the perfect fit for its aggressive growth strategy in the digital textile market. Its goal is to continuously improve its customers’ experience in every aspect. Expanding its network of sales and support personnel and being close to where its customers are located is a key initiative towards achieving that.

Arrow Digital is a distributor of materials and equipment for the digital printing and cutting markets. Arrow aims at taking the direct-to-garment market to the next level, combining its support and expertise with Kornit’s cutting-edge technology for this segment.

The Indian garment industry, with the rise in the skilled labor market, is now moving towards mass customization. Also people are now switching from screen to digital printing. Green technologies, better quality and on demand short runs are now the trend. Social media and e-commerce are contributing to the demand for digital technologies.

Indorama is investing in modern cotton and textile production in Uzbekistan. This will include the cultivation of raw cotton, corn, or another crop on crop rotation basis. It also includes the organization of deep processing of raw cotton and the production of cotton yarn.

Indorama, based in Singapore, is one of Asia’s leading chemical holding companies. It started in 1975 as Indo-Rama Synthetics, which was a yarn spinning company and manufactured cotton yarn. During the 1990s, the company diversified into the production of synthetic spun yarns and polyester fibers. Its strategy to drive sustainable and profitable growth in both high-volume necessities and the stable but high margin and high value-added HVA business continues.

Currently, Uzbekistan is the world’s sixth-largest cotton producer among 90 cotton-growing countries. It produces about 3.5 million tons of raw cotton annually and 1.2 million tons of cotton fiber annually.

Uzbekistan accounts for about six per cent of global cotton production and about 50 per cent of the cotton fiber produced is shipped for export. One of the policy priorities of Uzbekistan is further development of its textile industry. Uzbekistan takes consistent steps to increase the volume of cotton fiber processing. Investors from Germany, Switzerland, Japan, South Korea, the USA, Turkey and other countries have invested in its textile enterprises.

Following China’s trade war with the US, India can export more cotton, corn, almonds, wheat and sorghum to China. In fact, there are at least 100 products where India can replace US exports to China by benefiting from the higher import duty China has imposed on products originating in the US.

Fresh grapes, cotton linters, fluecured tobacco, lubricants and certain chemicals, including benzene, are a few products which the US has been exporting to China. India too has been exporting these products to China but now there is scope for India to increase exports of these products because of the tariff differential and the substantial demand in China.

While China has imposed 15 to 25 per cent tariff on these goods coming from the US, other countries are subject to a five to a 10 per cent duty. Moreover, India has been granted additional duty concessions under the Asia Pacific Trade Agreement, making its exports more competitive.

Corn is of specific interest to India as the country is a huge corn exporter. While American corn is subject to 25 per cent duty, APTA countries can get up to 100 per cent concessions on corn exports to China.