FW

"In an effort to fulfil its High 5 mandate The African Development Bank (AfDB) has launched ‘Fashionomics’ the economy of fashion initiative during the Bank’s 2015 Annual Meeting to boost micro, small and medium-sized businesses (MSMEs) in the fashion and textile industry in Africa. The continent’s history of fashion and textile has a legacy of its own. From Aso Oke & Adire in Nigeria, Kente in Ghana, Shweshwe in South Africa, Kitenge in Kenya, Africa’s history of fashion and textile reflects the country’s ingenuity and creativity."

In an effort to fulfil its High 5 mandate The African Development Bank (AfDB) has launched ‘Fashionomics’ the economy of fashion initiative during the Bank’s 2015 Annual Meeting to boost micro, small and medium-sized businesses (MSMEs) in the fashion and textile industry in Africa. The continent’s history of fashion and textile has a legacy of its own. From Aso Oke & Adire in Nigeria, Kente in Ghana, Shweshwe in South Africa, Kitenge in Kenya, Africa’s history of fashion and textile reflects the country’s ingenuity and creativity. Africa currently accounts for 1.9 percent of the total estimated $1.3 trillion global trade. Africa’s entire textile/clothing market is already worth more than $31 billion and accounts for the second largest number of jobs in developing countries, after agriculture. In the next five years, the industry could generate $15.5 billion revenue.

Fashionomics to create a unique networking platform

The Fashionomics initiative will start off with creating a Business to Business (B2B) online platform by the first quarter of 2017. The dedicated website will be designed as a networking platform for all the links in the fashion and textile value chain- suppliers, brokers, designers, distributors and investors. It also acts as a place to share knowledge, tutorials and opportunities in the textile and fashion sector. The bilingual portal’s objective is to help members of the industry develop and boost their businesses. The Fashionomics Initiative will start off with Ethiopia and Cote d’Ivoire the two countries show the disparities and unique characteristics typical of the entire continent.

Initiatives to boost investment, employment

Africa’s fashion industry has already witnessed great growth and investments with AfDB’s initiatives. In Madagascar, AfDB is initiating an Investing Promotion Support Project (PAPI), investing about $10 million to boost the textile industry through the project. The Textile Sector Promotion Support Fund (FAPST) has been created under PAPI to support and improve the capacities of MSMEs within the textile sector. PAPI will also initiate the establishment of a Textile Special Economic Zone (SEZ). The fashion industry in Africa employs a large percentage of women. In Ethiopia, 78 percent of workers in the textile and apparel industry are women. Women own 80% of businesses in Cote d’Ivoire’s textile industry. Fashionomics will play a crucial role in creating the employment and empowerment opportunities for women. According to AfDB’s report, the clothing textile industry could generate 400,000 jobs in Sub-Saharan Africa and exports could double in the next 10 years.

In 2013, H&M, Swedish clothing retailer started sourcing for Ethiopian garment producers and the company has set up offices in Addis Ababa to get closer to suppliers. About 60,000 jobs have been created since H&M began chain operations in the country.

Challenges on the way

However, Fashionomics has a few challenges on the way. Africa has the lowest e-commerce penetration rate. In 2013, Africa and the Middle East accounted for only 2.2 percent of global business-to-business e-commerce. Textile production facilities are missing in most of the countries as they need more investment than apparel/clothing facilities. The huge capital requirement was one of the factors that led to the downfall of the textile industry in Nigeria. There is also constrained access to financing for entrepreneurs and SMEs as the cost of establishing a fashion business since electricity bills, labour costs, and taxes are high in Africa. Moreover, the cost of intra-African trade is relatively high as well. According to the World Bank, intra-African trade costs 50 per cent more in Africa than in East Asia. Also, Africa’s intra-regional trade costs are the highest of any developing region.

Regardless of these challenges, the regional governments need to foster the development of local suppliers, entrepreneurs, and regional value chains, ensure access to low-cost financing, build a more conducive business climate, buy from locally owned companies, invest in infrastructure and establish more educational institutions. Textile and apparel suppliers also need to improve productivity by investing in new equipment and training, upgrade and diversify product portfolio, and establish long-term partnerships with buyers thereby increasing their customer base. Along the way global recognition and strategic investments need to flow in the continent.

The spread of Zika virus has led to an increase in sales of apparels with built-in insect repellent. Now a supplier has recently unveiled a line of insect-repelling activewear in response to the concern. Since early 2015 when Brazil first notified the World Health Organization (WHO) of an illness characterized by a skin rash in its northeastern states, the Zika virus has been rapidly spreading across the Western Hemisphere. The virus is now present in almost every country from the United States, through Central America and south to Argentina.

So far, Florida’s Miami-Dade County is the only area with cases of Zika fever being passed via mosquito bite in the United States while all other US cases are travel-associated. In other words, this means that patients traveled to countries that had active Zika transmission, contracted it there and brought it back to the U.S.

Expert Brand has officially announced it has partnered with startup Nobitech to offer a line of insect-repelling activewear. The collection includes T-shirts, pullovers, hoodies and pants treated with Nobitech’s Skintex technology, which contains Permethrin, a synthetic insecticide that repels ticks, ants, flies, fleas, chiggers, midges and mosquitoes, including those carrying the Zika virus.

Other companies like OMNi Apparel Inc. and Gamehide offer apparels treated with Insect Shield that uses a formulation also containing Permethrin. OMNi Apparel has been a licensee of Insect Shield International since 2008 and manufactures and distributes Insect Shield/Zorrel Dri-Balance Moisture Management Tees.

The insect shield process involves binding a proprietary Permethrin formula, a registered EPA product since 1977 that’s proven effective in repelling insects, to fabric fibers, resulting in an odorless insect protection that lasts the apparel’s lifetime, the equivalent of 70 launderings.

The Surat Municipal Corporation (SMC) is taking smart initiatives for the country's largest man-made fabric (MMF) sector. In its latest decision, the civic body has decided to upgradate its existing tertiary treatment plant (TTP) at Bamroli by increasing the capacity at 40 million liters per day (MLD).

The new facility will supply 40 MLD extra water to the textile dyeing and printing mills at Pandesara, GIDC. For this, the civic body will be spend close to Rs 100 crore for the construction of the TTP plant at Bamroli. The waste water will be collected through pipelines and brought to the TTP where it will be treated as per the industrial grades.

There are around 325 dyeing and printing mills at Sachin, Pandesara, Kadodara and Palsana. Pandesara GIDC has the highest presence of 100 dyeing and printing mills. The total turnover of the dyeing and printing mills is pegged at Rs 125 crores per day. Pandesara GIDC has 100 dyeing and printing mills that need round the clock water supply. Bore well water is not suitable to maintain quality in the textile industry that need 85-90 MLD water. The present 100 MLD tertiary plant of SMC at Bamroli is capable to supply about 40 MLD treated waste water to industries. Industrialists of Pandesara have requested the SMC to set up second 40 MLD capacity tertiary plant.

A new tertiary treatment plant with the capacity of 40 MLD per day is going to be set up soon. This will help the place gets around 40 MLD industrial water in the next three to four months. This will take the total treated water supply at 80 MLD, informed Vakharia, president of South Gujarat Textile Processors Association.

As the cotton season draws to a close this year, small spinning mills are seen churning out yarn in large volumes from factories in Tamil Nadu though they are winding up the year on a disappointing note with cotton prices remaining at higher levels dashing hopes of any relief. After reports of short supply coupled with frenzied speculation by traders Cotton prices have spiraled and touched close to Rs 50,000 a candy over the last few months.

With the arrival of global crop priced around Rs 45,000 a candy and the Centre's announcement restricting cotton with the government procurer Cotton Corporation of India (CCI) for small mills, prices dropped nominally. Now, the Gujarat Cotton, Shankar-6, trades at around Rs 43,400 a candy and is expected to slide some more but industry representatives rule out the possibility of normalisation.

While the government banks on monsoon to offset the 10 per cent reduction in cotton acreage, entrepreneurs believe that pre-emptive action by the government can insulate the industry against price shocks. Mill owner Prabhu Remarked Damodharan says they had exported cotton at Rs 94 a kg in the middle of the season and within one quarter they are importing the same type of cotton at an average of Rs 124 a kg.

When cotton prices raged recently, entrepreneurs in Tamil Nadu had scaled down their manufacturing time. And after prices zoomed, the same mills lessened work weeks in a production cut to not hurt operating margins. Manufacturers in Andhra Pradesh had even announced weekly holidays till the price rise passed over. The trend had emerged even as a brightening market recovery in European nations offered hope to Indian millers.

Over the last year, yarn manufacturers have been calling for the government to create a cotton reserve that could be sold in market in times of supply shortfall to conytol prices. After the inflation this year, mill associations have begun lobbying the Centre for procuring 70-80 lakh bales every year.

Leading viscose speciality fibre manufacturer, Kelheim Fibres, is looking into a new area of applications and exploring the suitability of its innovative hydrophobic Olea fibre for emulsion separation. Olea is a viscose fibre with durable hydrophobic properties. The additives used in production are approved for food contact by the FDA and the BfR and at the same time free of silicones.

In a series of tests in the coming months, the company will analyse how these hydrophobic properties influence the separation of water/oil mixtures. Initial trials have shown an accumulation of oil on the fibre’s surface which then enables the separation of the larger oil droplets.

As a follow up, Kelheim will examine the efficacy of separation of different emulsions as well as the influence of the nonwoven construction and suitable blend partners. The incorporation of functional additives into viscose fibres is said to allow the optimization of the fibres in respect of the intended application, for example for the removal of tannins from beer.

One of the advantages of use of functional viscose fibres is that they do not affect the physical properties of the filter and cannot migrate into the filtered product but can still function effectively as additives are incorporated in the fibres. As these fibres are manufactured from renewable raw materials, the incineration at the end of filter life is CO2 neutral, or if the residue in the filter allows, they can be composted, an ideal disposal route for precoat filter cakes in the beverage industry.

According to Kelheim, the use of viscose speciality fibres from the manufacturer is completely safe both for people and for the environment. This is one of the reasons why fibres are being used in medical products. ISEGA certifies the fibres for food contact and the absence of harmful substances in the products is confirmed by their certification to the Oeko-Tex Standard 100 in the most demanding product class.

Finnish clothing brand Torstai is the world’s first sports clothing brand to take part in the Fairtrade Cotton Programme. The company aims for a strong growth in Europe’s sports clothing markets and is committed to grow its Fairtrade cotton purchases at least with 100 per cent during the next five years. Torstai’s first collection that is produced using Fairtrade cotton was released in Finland this summer. In addition to the Nordic countries, the new collection will be available in Germany, Austria, France, Switzerland, The Netherlands, Italy and Russia.

The Fairtrade Cotton Program comes up with new methods to connect the Fairtrade cotton farmers with growing number of businesses seeking to make sustainable cotton a core part of their business. Resultantly, more and more companies are going in for the particular cotton brand.

Riikka Karppinen, Head of Marketing and Commercial Relations at Fairtrade Finland At the moment said that the cotton used by Torstai comes from Fairtrade farmers in India, and for them the long trade relationship means that they venture to acquire fertilizers and tools and plan the future. On the other hand, Finnish sportswear company Luhta Sportswear Company. The company happens to be the world’s first sports brand to acquire all of its cotton from Fairtrade farmers.

Luhta Sportswear Company is a Finnish family business founded in 1907 in Lahti, Finland. The company makes a turnover of about EUR 241 million and employs 1,592 people. Exports activities cover in total over 50 countries. In addition to these brands, Torstai has other brands such as Luhta, Rukka and Icepeak.

"CENTRESTAGE, the new fashion brand promotion and launch platform of Hong Kong Trade Development Council (HKTDC) ended last Saturday on a high note. The four-day international fashion event was house to some 200 fashion brands from 20 countries and regions showcasing their latest fashion collections. In all, the trade show attracted close to 8,300 buyers from 71 countries and regions, with nearly 40 per cent of buyers coming from Asia other than Hong Kong."

CENTRESTAGE, the new fashion brand promotion and launch platform of Hong Kong Trade Development Council (HKTDC) ended last Saturday on a high note. The four-day international fashion event was house to some 200 fashion brands from 20 countries and regions showcasing their latest fashion collections. In all, the trade show attracted close to 8,300 buyers from 71 countries and regions, with nearly 40 per cent of buyers coming from Asia other than Hong Kong.

HKTDC Deputy Executive Director Benjamin Chau said that CENT RESTAGE was s an ideal promotion and launch platform for international, especially Asian, fashion brands and designer labels. The HKTDC is pleased that the event has captured the attention of the Asian fashion industry successfully attracting fashion brands and buyers keen on expanding their Asian business to come and promote, source and launch new collections and explore cooperation opportunities. And it provides a platform for local new designers to showcase creative designs to media and buyers in the region. He added that CENTRESTAGE was an effective event for driving regional fashion exchange and development while solidifying Hong Kong’s position as a fashion capital.

Excellent Response

In order to understand the industry players’ views on the outlook for the fashion industry and product trends nicely, the HKTDC commissioned an independent market research agency to conduct on-site surveys during CENTRESTAGE, interviewing some 270 exhibitors and buyers. The survey found that most respondents were cautiously optimistic about overall sales in 2017. Nearly 60 per cent of respondents expect overall sales in the coming year to remain steady, while 27 per cent expect overall sales to increase.

Thirty three per cent of respondents were of the view that production costs or sourcing prices would increase but 65 per cent of them said that they would not increase the FOB price or retail price indicating that the industry is generally reluctant to transfer the increased costs to customers or consumers. In terms of markets, the respondents expect Hong Kong, Japan and Korea to have the best growth prospects among traditional markets in the coming two years. 60 per cent of respondents considered that the Chinese mainland to be most promising among emerging markets.

The survey also sought to understand the product trends of the fashion industry. 60 per cent of respondents consider women’s wear to have the best growth potential followed by men’s wear and kids’ wear. Nearly half of the respondents said that they have engaged in e-tailing business selling mainly women’s wear (69%), casual wear (41%) and fashion jewellery (12%).

Besides the stalls, a number of trend seminars were held during the event. Michael Leow, Asia/Pacific Sales & Marketing Head for Fashion Snoops, said Nowstalgia will be a key trend in the coming year. The trend blends nostalgic and contemporary elements while incorporating the convenience of modern technology.

In another seminar, Erica Ng, WGSN’s Senior Editor, Retail Intelligence, Asia Pacific, said the millennial lifestyle was transforming traditional retail. Retailers will need to find synergies between mobile apps, online shopping, physical retail and social media to effectively capture market share among this generation.

Hong Kong best place to contact new suppliers

The survey also found that nearly 90 per cent of fashion buyers consider Hong Kong trade shows a major channel to contact new suppliers. At the same time, 92 per cent of exhibitors use Hong Kong trade shows to find new buyers. These findings indicate that CENTRESTAGE being a regional fashion promotion and launch platform was an important channel to promote industry cooperation and generating business opportunities.

For the first time, French women’s fashion brand Edward Achour Paris was exhibiting in Hong Kong. Edward Achour, the brand’s designer commented by saying that CENTRESTAGE offers a great opportunity for their brand to open new markets. The results have been encouraging. Here, we met many buyers from the Chinese mainland, Taiwan, Indonesia and other countries. Four Chinese mainland buyers even placed orders on-site.

Hong Kong’s Anagram, a brand that specialises in upmarket women’s fashion collections, had come to CENTRESTAGE to develop its international market. Its Brand Director, Winnie So, said that international buyers have shown keen interest in our brand. It was here where his company could establish connections with wholesalers from Malaysia, Singapore and the US and a distributor from Vietnam. A buyer from New York has already confirmed orders and expects more orders after the show. And it was an awesome experience when CENTRESTAGE opened its gates to the public on the last day.

China’s street fashion brand Ilovechoc also attended the event. The brand has a sales network of more than 300 retail stores across the mainland. Gu Yu, the brand’s Vice President said that they were participating in CENTRESTAGE to broaden their sales presence in the international market. The show was instrumental in drumming up extensive interest and helped the company to establisg contact with many buyers from Southeast Asia.

He also informed that a number of buyers from Thailand, Malaysia and Indonesia even wanted to explore cooperation. Hong Kong is a major fashion hub in Asia and CENTRESTAGE can bring together industry players from around the world. This platform can certainly facilitate our business expansion, he added.

Finding new brands

La Rinascente, a long-established high-end department store group in Italy, saw CENTRESTAGE as an ideal opportunity to explore business opportunities in Asia for the first time. They found that the event was an ideal platform to find new brands and understand the fashion industry in Asian markets. Commented Andrea Bonecoo, Buying Manager, la Rinascente SpA that the business matching service introduced Hong Kong’s I.T Group to them. Officials of the company held useful talks to exchange ideas and establish initial contact. Finally he exclaimed by saying that this show was the start of the company’s effort to get to know more about Asia.

Indonesian fashion boutique, Lucy House, joined CENTRESTAGE to source more new brands for its customers according to Lucy Kurniawan who operates the company. In all, he found that the event offers a good platform to meet designers and was instrumental in generating good business opportunities. He further informed that he was now negotiating with a Hong Kong designer for the evening wear collection. An initial order would involve about 100 pieces in different styles.

Fida Alkaud, a buyer from Harvey Nichols, Riyadh, Saudi Arabia came to CENTRESTAGE to look out for contemporary evening wear. She said that she felt very happy to have found new brands which suit the tastes of their customers which include Marquess & Homa, Guy Laroche Furs, Shelina and Camelia. She was all praise of HKTDC's business matching service because it saves one a lot of time finding the right brands. Fida went to the extent of saying that the fashion shows at CENTRESTAGE were also very fascinating.

Also attending the event was Meili Inc. one of the mainland's largest fashion e-tailing brands. Margaret Yao, Business Cooperation Director said that she visited CENTRESTAGE to find new brands and explore cooperation opportunities. She expressed her happiness of the business matching meetings arranged by the organiser as they helped in generating positive results. She was aso of the say that she found a Hong Kong designer and a US brand offering some suitable products to sell on her website. She also established contacts with four fashion brands from Thailand saying that she would be in further discussions with them.

Korea’s biggest department store operator Lotte that runs 40 stores across the country also made its presence at CENTRESTAGE. Lotte’s buyer Hyeon Ji Sun observed that she visited CENTRESTAGE to find new brands, especially sportswear and lifestyle wear brands. People in Korea love sports and outdoor activities. Hence demand for related fashion items was very strong. She was very happy to inform that she was very happy to have established contact with two brands from Hong Kong.

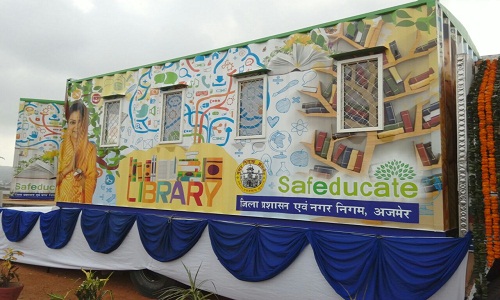

Vasundhara Raje, Chief Minister of Rajasthan inaugurated Safeducate Container Library. Safeducate Container Library is a mobile library that will move to different locations across Ajmer so that maximum number of people can benefit from it.

“Safeducate Container Library is a unique endeavour by us to create a mobile library. This container library is made out of a refurbished container, as a part of our Go Green initiative. The Safeducate Container Library can be easily moved to any location across India. Many such Container Libraries will be set up in the near future” said Divya Jain, Founder & CEO, Safeducate.

The Safeducate Container Library is a learning hub where students can gain knowledge on a variety of subjects. Millions of people across Rajasthan will benefit from this endeavour of Safeducate.

The library has a vast collection of books and periodicals meant for people of various age groups. We need to channelize the energy of our youth into education in a big way, and this library will help drive that, especially from the perspective of those who do not have the access to high quality books.

Jain concluded by saying that Safeducate has been working towards bridging the huge skill gaps prevalent in the Indian economy.

Europe’s first fashion social commerce platform, Trendy (www.trendy.guru) has been launched. The platform connects consumers directly with designers and sellers through the influencers and social channels they follow, on one user friendly platform. Often customers are unhappy as they do not get what they had ordered for after seeing an advertisement in the social media. Trendy addresses this by facilitating direct purchase from recommendations and social channels with a simple two click system. Furthermore, the platform helps influencers to monetise their work and supports young/up and coming designers and fashion retailers by exposing them to a wider, targeted audience.

Juan Cruz Aliaga, founder of Trendy states, “In the UK, social media still only accounts for a small share of total retail sales but its impact on people's shopping and buying activity is rising fast. We can look to the US for things to come. Last year the US the top 500 retailers earned $3.3billion through social comers, up by 26% on the previous year.

For designers the process is simple and connects easily with existing social channels and connects them with a whole new audience and advocates in no time. Trendy offers bloggers and fashion influencer highly competitive benefits including a 5 to 7 per cent commission rate up to £300 credits to purchase as well as gifting from sellers.

The time is right for social commerce in the UK and Trendy offers designers, sellers and influencers a simple, safe and cost-effective solution to engage in social commerce. Trendy thus creates an effective and easy way for influencers to monetise their art.

Garment exports from Vietnam has been falling in the recent past. For example, Thanh Cong Garment, one of a few Vietnamese garment companies that owns a yarn – fabric – garment production line that has a strong demand from South Korea and the US, has seen a contracts decrease considerably from foreign partners in the first six months of the year. As far as consumption is concerned, Thanh Cong has stable consumption outlets as its large shareholder Eland Asia Holding Pte is usually responsible for 60 per cent of the company’s output. However, even with great advantages and support, the outfit, like other enterprises in the industry, is still going through difficulties.

The annual revenue from fabric accounts for 10 per cent of net revenue, while yarn brings 30-40 per cent and garment 50 per cent of revenue. The company’s revenue in the first six months of the year increased compared with the same period last year but its post-tax profit dropped sharply by 42 per cent from VND 86 billion to VND 50 billion. The company’s business efficiency also fell, with gross margin down.

Thanh Cong’s decline in business performance is attributed to a decline in exports. In the first half of the year, the company’s export turnover fell by 12 per cent in comparison with the same period last year. As far as yarn production is concerned, Thanh Cong took a loss with the gross margin of minus 5 per cent. The selling price has stayed unchanged for a long time while input material prices have been increasing sharply since the first quarter of the year.

Many Vietnamese companies are losing orders to companies in Laos, Myanmar and Bangladesh that have the advantage of making products at lower prices thanks to preferential tariffs offered by some large markets. Vietnam may have the same preferences obtain by 2018 if the TPP is ratified.