FW

Cambodia may soon lose its tariff-free access to Europe. Less than two weeks remain until the European Union decides whether it will revoke Cambodia's trade privileges, granted under the Everything But Arms scheme for least developed nations, due to the country’s systematic violations of human and labor rights. Losing EBA privileges would add a 12 per cent tariff to Cambodian apparel exports to the EU and between eight per cent and 17 per cent for shoes. Europe is a crucial market for the country’s apparel and footwear export sector. Other countries competing in the cutthroat world of low-cost apparel will be keen to snatch market share from Cambodia.

Much work still needs to be done to n improve labor and living conditions in Cambodia. Much progress including wage increase and social security benefits, have been accomplished already. But this many not be enough for Cambodia to retain trade privileges. The EU feels the country has not done enough to maintain its EBA access. The EU also has the option of applying a partial suspension of trade privileges.

Despite the uncertainty, Cambodia’s total exports in the first 10 months of 2019 grew by 6.45 per cent. Exports of textiles, apparel, footwear, travel wear and headwear remained stable.

McKinsey has joined Global Fashion Agenda (GFA) as a strategic knowledge partner. Together, they will work to tackle the biggest challenges facing fashion. GFA and McKinsey will embark on a joint redesigning growth venture. The overall aim of the collaboration is to look beyond existing solutions, to seek inspiration from experts, academia, and other industries to identify the systemic changes needed for the industry to become leaders in sustainability. It seeks to challenge the traditional concept of growth and prosperity, by collaborating to identify solutions for the industry to meet the demands of the future within planetary boundaries. GFA and McKinsey will provide new assessments and reports for the industry to track and follow progress on sustainable development. The alliance is setting ambitious goals to accelerate the pace on sustainability and to push for real industry transformation.

GFA is the leadership forum for industry collaboration on fashion sustainability. Sustainability and corporate responsibility have risen to the top of every industry executive’s agenda. Still, the industry has a long way to go before achieving transformative change. Companies are not implementing sustainable solutions fast enough to counterbalance the negative environmental and social impacts of their rapid growth.

Mango is consolidating its presence in Africa. The brand is now present in Kenya, Angola, Egypt and South Africa, among other African countries. The African store count totals 52 retail outlets, including four Mango megastores, a retail concept that the company introduced in late 2013. Compared to the traditional average store format of 300 sq mts, megastores have surface areas of between 800 and 1,500 sq mts, while flagship stores could be as large as 3,000 sq mts. Mango was one of the first European fashion brands to expand in Africa when it opened its first store on the continent 18 years ago. The company founded in 1984 has an extensive store network extending across 111 countries.

Mango has a new logistics center in Spain. Approximately 600 people work six days a week at the highly automated facility, where around 400 operations are machine-driven, to process items for store deliveries. The 186,000 sq mt facility can stock up to seven million hung garments and 20 million folded garments and accessories at the same time. By incorporating the latest automation technologies, the center can process 75,000 garments an hour. As soon as hung garments arrive at the facility they are unloaded onto one of nine automatic loading bays, which can process 27,000 garments an hour.

Polyester or synthetic yarn could become cheaper in India. The anti-dumping duty on Purified Terephthalic Acid (PTA) has been abolished in this Budget. This will make imports of the petrochemical from Iran, China, Indonesia, Malaysia, Korea, Taiwan and Thailand cheaper. Removal of the anti-dumping duty will put pressure on realisations of domestic PTA manufacturers and will lead to accelerated imports at a time when the market is facing a glut emanating from large capacity additions in China recently. The duty removal will now allow Indian synthetic yarn spinners to access cheaper, good quality raw material from outside India, making their cost structure more efficient. The move will open up the manmade fiber value chain, benefiting technical textiles, home furnishing, sportswear, saris and dress materials, among others.

Once this key textile raw material becomes cheaper, domestic yarn manufacturers are expected to pass on the benefit to consumers. China has added huge capacities in recent quarters and there is a possibility of cheaper imports from that country after removal of this duty.

PTA is a key raw material in synthetic yarn production on which anti-dumping duty was imposed to protect domestic manufacturers. These produce nearly 3.5 million tons PTA for the domestic market. The rest is exported.

"Though brands remain committed to reduce greenhouse gas emissions, buy carbon offsets and develop new sustainable materials, experts have raised doubts over the genuineness of these commitments. This is owing to the fact that though the industry has been introducing innovations periodically besides running pilot projects, it hasn’t yet brought any of it to the scale that’s needed. Today, the industry produces about 8 per cent of the total carbon emissions."

Though brands remain committed to reduce greenhouse gas emissions, buy carbon offsets and develop new sustainable materials, experts have raised doubts over the genuineness of these commitments. This is owing to the fact that though the industry has been introducing innovations periodically besides running pilot projects, it hasn’t yet brought any of it to the scale that’s needed. Today, the industry produces about 8 per cent of the total carbon emissions. And, as per Ellen MacArthur Foundation, this is expected to rise to 26 per cent of the total emissions by 2050.

Though brands remain committed to reduce greenhouse gas emissions, buy carbon offsets and develop new sustainable materials, experts have raised doubts over the genuineness of these commitments. This is owing to the fact that though the industry has been introducing innovations periodically besides running pilot projects, it hasn’t yet brought any of it to the scale that’s needed. Today, the industry produces about 8 per cent of the total carbon emissions. And, as per Ellen MacArthur Foundation, this is expected to rise to 26 per cent of the total emissions by 2050.

Redesigning supply chain for sustainability

Though dozens of brands signed the Kering-led Fashion Pact last year, in order to be truly sustainable, the industry needs to transform its supply chain entirely. However, supply chain transformation is costly as most brands don’t own their suppliers. This separates them from associated environmental impacts — and benefits if they invest in upgrades.

Government policies play a major role

The industry’s progress on sustainability largely depends on government reforms. If the government fails to introduce appropriate policies, brands that invest on sustainability will be at a loss. To avoid this, brands must invest in sustainable supply chains through public financing of upfront costs for things like shifting agricultural practices. In turn, they should commit to buy materials from farms making changes.

introduce appropriate policies, brands that invest on sustainability will be at a loss. To avoid this, brands must invest in sustainable supply chains through public financing of upfront costs for things like shifting agricultural practices. In turn, they should commit to buy materials from farms making changes.

Fashion can also influence many government’s decisions as apparel and footwear manufacturing makes up a large portion of exports. For instance, though fashion comprises 84 per cent of Bangladesh’s exports, its government is currently planning an expansion of coal-fired plants.

Impact of legal policies

Similarly, a country’s laws can significantly influence the behavior of brands. UK’s Modern Slavery Act and California’s Transparency in Supply Chains Act have led to many brands introducing new reforms in their supply chains. Some of these brands have implemented ethical trade policies or commissioned audits on labor conditions at suppliers or recognised unionisation efforts.

Brands are redesigning supply chains to minimise costs at every step. However, to be truly sustainable, they need to amend their legal governing documents to balance profit and purpose. Though this may lead to increased costs for consumers, it will help the industry curb overconsumption and overproduction.

Exploring the rental market

Another way brands are being sustainable is by exploring the $1 billion rental market. Primarily a North American phenomenon, rental services are gaining popularity in Europe and Asia, although its impact on the consumers’ shopping behavior remains unclear.

"The focus of most denim brands in 2020 will be on sustainability as they introduce new initiatives to eliminate hazardous chemicals such as per- and polyfluorinated chemicals from their supply chains. Pioneering this campaign is G-Star, the Dutch denim brand which henceforth plans to use only 100 per cent sustainably sourced cotton, such as Better Cotton Initiative cotton, organic cotton and recycled cotton, by the end of next year. Of its non-cotton components, the company promises a target of 90 per cent."

The focus of most denim brands in 2020 will be on sustainability as they introduce new initiatives to eliminate hazardous chemicals such as per- and polyfluorinated chemicals from their supply chains. Pioneering this campaign is G-Star, the Dutch denim brand which henceforth plans to use only 100 per cent sustainably sourced cotton, such as Better Cotton Initiative cotton, organic cotton and recycled cotton, by the end of next year. Of its non-cotton components, the company promises a target of 90 per cent.

The focus of most denim brands in 2020 will be on sustainability as they introduce new initiatives to eliminate hazardous chemicals such as per- and polyfluorinated chemicals from their supply chains. Pioneering this campaign is G-Star, the Dutch denim brand which henceforth plans to use only 100 per cent sustainably sourced cotton, such as Better Cotton Initiative cotton, organic cotton and recycled cotton, by the end of next year. Of its non-cotton components, the company promises a target of 90 per cent.

Launching the most sustainable jeans ever

In 2017, G-Star employed 57.3 per cent sustainable materials and 69.8 per cent sustainable cotton. In 2018, it launched its most sustainable jeans ever. As a part of the process, the brand developed the world’s first denim fabric to be certified Gold by the Cradle to Cradle Products Innovation Institute’s rigorous standards, which take into account factors like material health and reutilisation, renewable energy, water stewardship and social fairness. Made with 100 per cent organic cotton, the jeans were dyed with 70 per cent fewer chemicals, used no salts and are 98 per cent recyclable at the end of their life.

launched its most sustainable jeans ever. As a part of the process, the brand developed the world’s first denim fabric to be certified Gold by the Cradle to Cradle Products Innovation Institute’s rigorous standards, which take into account factors like material health and reutilisation, renewable energy, water stewardship and social fairness. Made with 100 per cent organic cotton, the jeans were dyed with 70 per cent fewer chemicals, used no salts and are 98 per cent recyclable at the end of their life.

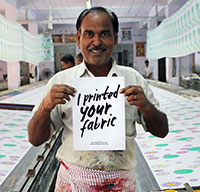

The company also aims to focus on transparency. It has introduced a “Where is it Made?” button that discloses not the just country of origin of each of its garments but also the name and address of the originating factory, any special programs or certifications that distinguish the facility and the number and gender breakdown of its workers.

On its part, Levi’s aims to slash its carbon emissions by 90 per cent and use 100 per cent renewable energy in all owned-and-operated facilities. It also vows to reduce carbon emissions across its global supply chain by 40 percent, which is proving both a challenge and opportunity because it requires directing so many moving parts. The brand is also working on its goal to make 80 percent of Levi’s products using its water.

Chasing globally relevant goals

For Wrangler, it is important to achieve globally relevant goals that reflect its most material issues. By 2020, the company plans to use 100 per cent “preferred chemistry” throughout its supply chain besides conserving 5.5 billion liters of water. Five years hence, the brand aims to source only sustainable cotton and power all owned-and-operated facilities with 100 percent renewable energy. Having its own manufacturing facilities gives the brand multiple opportunities that other brands many not have.

Eyeing carbon neutrality by 2025

Aiming to be the world’s most sustainable denim company, by 2020, Nudie Jeans aims to increase the number of own-brand jeans it takes back by 20 percent and the number of own-brand secondhand jeans it sells by 30 percent globally. That same year, at least one style in its collection will comprise post-consumer recycled Nudie Jeans from its garment-collection scheme. All targets are at their midway point and just require one final sprint, Gelsi noted. By 2025, the company wants to be carbon neutral along its entire supply chain, from raw materials to finished product.

Conserve 10 billion liters of water

Old Navy has set one of its most ambitious goals till date. The brand plans to conserve a total of 10 billion liters of water by the end of 2020. Till date, its parent company Gap Inc has saved 5.7 billion liters.

In 2020, Gap Inc. signed a 90-megawatt virtual power purchase agreement for a wind project with Enel Green Power North America. One of the largest offsite renewable energy contracts by an apparel retailer, the partnership will generate enough wind energy to power the equivalent of more than 1,500 Gap Inc. retail stores By 2030, Gap Inc. aims to reach 100 percent renewable energy across all owned-and-operated facilities globally.

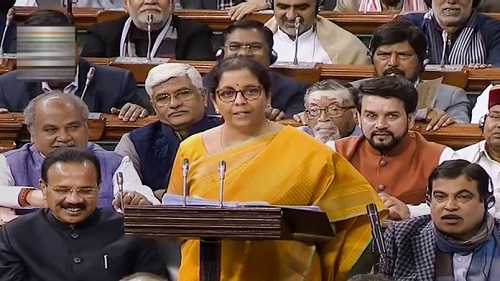

Finance Minister Nirmala Sitharaman presented Union 2020-21, on Saturday, February 1, 2020. The Budget addressed following important points related to textile, apparel and fashion industry:

Finance Minister Nirmala Sitharaman presented Union 2020-21, on Saturday, February 1, 2020. The Budget addressed following important points related to textile, apparel and fashion industry:

• Anti-dumping duty on PTA abolished

• National Technical Textiles Mission to be set up

• Review of Rules of Origin in FTAs

• Schemes for Remission of Duties & Taxes levied on Export Products ( RODTEP)

• Budget Grant for Procurement of Cotton by Cotton Corporation under Price Support Scheme has reduced to Rs 0.01 Cr for 2020-21 compared to Rs 2,017.57 Cr in 2019-20

• Customs duty raised on items like footwear (from 25 to 35 per cent; 15 to 20 on footwear parts)

Removal of Anti Dumping Duty on PTA-A potential game changer

On the proposed abolishan of anti-dumping duty on PTA (Purified Terephthalic Acid), the FM said PTA is a critical input for textile fibres and yarns. Its easy availability at competitive prices is desirable to unlock the immense potential in textile sector which is a significant employment generator. The textile industry has been demanding abolition of anti-dumping duty levied on PTA, the basic raw material used for manufacturing polyester staple fibre and filaments, to remain globally competitive. The Ministry of Textiles envisaged to increase the textile business size from the current level of around US$169 billion to US$350 billion by 2025 and to US$650 billion by 2030 in its draft Textile Policy.

critical input for textile fibres and yarns. Its easy availability at competitive prices is desirable to unlock the immense potential in textile sector which is a significant employment generator. The textile industry has been demanding abolition of anti-dumping duty levied on PTA, the basic raw material used for manufacturing polyester staple fibre and filaments, to remain globally competitive. The Ministry of Textiles envisaged to increase the textile business size from the current level of around US$169 billion to US$350 billion by 2025 and to US$650 billion by 2030 in its draft Textile Policy.

To achieve this ambitious target this step is being seen in the right direction to make polyester fibre and filaments available at international prices as there is a limitation in increasing fibre base within the country.

All industry leaders across board have applauded the removal of anti dumping duty on PTA. “This will give a major boost to Indian textile industry and will go a long way in helping downstream industry staying competitive,” says T Rajkumar, Chairman, CITI. Elaborating on the same Rahul Mehta, Chief Mentor, CMAI says, “The most important step in this Budget is the removal of the anti-dumping duty on PTA, which was a long standing demand of the textile manufacturing value chain, as PTA is a crucial input for polyester production. This will potentially open up the MMF value chain, and give a fillip to the entire MMF industry and enhance its global competitiveness. Technical textiles, home furnishing, sportswear, saris, dress materials etc, will all benefit greatly from this move. It has the potential of being an important game changer for the MMF segment of the Industry.”

Reacting to the Budget proposals 2020-21, Ashwin Chandran, Chairman, Southern India Mills’ Association (SIMA), stated PTA being imported from different countries including China, Indonesia, Taiwan, Iran, Malaysia, attracts anti-dumping duty between US$27 to US$160 per metric tonnes depending on the country of origin, while India often faces shortage of PTA that curtail capacity utilization of polyester segment industry. It shall greatly help the country to enhance its global competitiveness, boost exports and enable domestic manufacturers to compete with cheaper imports.

National Technical Textiles Mission: Boost investments, reduce imports

The FM proposed the setting up of a National Technical Textile Mission with four-year implementation period from 2020-21 to 2023-24 at an estimated outlay of Rs 1,480 crore.

from 2020-21 to 2023-24 at an estimated outlay of Rs 1,480 crore.

“This can position India as a global leader in technical textiles, which includes development of rainwear, sportswear, retarded apparel, fire resistance garments,” opines A Sakthivel, Chairman, AEPC. Agrees Sanjay Jain, former president CITI and says, “This is a fantastic announcement, it will lead to capacity building and import substitution. It has tremendous scope, however we are waiting for the fine print.”

Elaborating further T Rajkumar explains, “The mini mission on technical textiles is welcome. Technical textiles has to be encouraged as a lot of fabrics we use in the sector are being imported, the move will help in starting production of specialised input in our country, a lot of investment will come which will also boost employment in the sector.”

Chandran believes India has an importing technical textiles segment estimated at US$16 billion per year, this Mission would help strengthen the sector which can take advantage of benefits already extended under different State Textile Policies and also the Technology Upgradation Fund Scheme. He also appreciated the enhanced allocation of Rs761.90 crores for A-TUF Scheme as against Rs700 crores allotted previous year. Ujjawal Lahoti, Past Chairman, Textile Export Promotion Council (Texprocil) welcomed the base support given to Technical Textile saying “It will result in to setting up production of import substitute textiles items.”

Review of the Rules of Origin in FTAs to curb imports from Bangladesh

All industry leaders welcomed the intent to review the rules of origin in FTAs. It was being observed that imports under Free Trade Agreements (FTAs) are on the rise. Undue claims of FTA benefits have posed a threat to domestic industry. Such imports require stringent checks. As per the Budget announcement, suitable provisions are being incorporated in the Customs Act and in coming months review of Rules of Origin requirements, particularly for certain sensitive items, shall be done, to ensure that FTAs are aligned to the conscious direction of our policy.

A lot of Chinese fabrics and raw materials converted into garments were entering into India through these FTAs. “The move will help reduce imports from Bangladesh etc, which plaguing textile industry. However, a complimentary step in this direction would be expediting FTAs with EU, Australia, Canada and initiating FTA with UK,” Shaktivel says.

Industry hails RODTEP, NIRVIK and other measures taken

As per A Sakthivel “The AEPC is studying the proposed Scheme for Revision of duties and taxes on exported products where exportr to be digitally refunded duties and taxes levied at the Central, State and local levels, which are otherwise not exempted or refunded. This is an important area which has seen significant shrinkage in policy support in last few months. The new NIRVIK scheme for higher export credit disbursements with greater coverage, reduced premium and simplified procedures for claiming settlements is a welcome step given the increased uncertainties in the global market. We look forward to further details of the scheme.”

AEPC also congratulated the finance minister on effectively addressing some key issues of the sector especially in the areas of Ease of Doing Business, National Logistics policy for making MSMEs competitive, simplified return with features like SMS based filing for nil return and improved input tax credit flow, enhancing digital connectivity, support for working capital, financing for MSMEs, five year exemption from audit for MSMEs & easing of tax filing for startups are some import steps towards easing the day to day functioning of MSMEs as also providing a conducive ground for investors.

On similar lines Chandran hailed the announcement of the Schemes for Remission of Duties & Taxes levied on export products and NIRVIK for extending competitive credit facilities and higher insurance coverage with lesser premium and also simplified procedure for claim settlements. “Happy to note that FM announced again that Refund of Taxes scheme (RODTEP) will be soon implemented for exporters. As exporters of cotton textiles products are suffering due to a sharp decline in exports of yarn, and retrospective removal of MEIS, it is important to get this scheme implemented for exports all textile products at the earliest,” says Lahoti

SIMA also welcomed the announcement of addressing inverted duty structure in GST as textile industry has been suffering with huge accumulation of inverted duty of capital goods and certain services. Prem Mallik, a veteran in textile industry and past president CITI, states, “The announcement on refund of taxes including electric duty, mission on technical textiles and intent to incorporate rules of origin in FTA,S are welcome steps. I request the government to implement these positive steps, immediately.”

However not all are happy with the Budget proposals as R D Udeshi, President Polyester Chain, Reliance Industries opines “Disappointing Budget, as very little has been done for textile industry. More concrete steps were required for growth of the industry. Vision of $400 bn will remain only on paper,” he summed up.

Apparel Sourcing and Texworld were held in the US, January 19 to 21, 2020. The shows made news because of a greater focus on sustainable practices. They are seen as the premiere platform for sourcing and product discovery in the marketplace. Attendance increased eight per cent. Exhibitors were from Canada, the United States, Colombia, India, China, Hong Kong, Japan, Thailand and Ukraine. Country pavilions were organized to represent the offerings of Mauritius, Korea, Nepal and Taiwan. Lenzing showcased products using Tencel and Lenzing Modal. The show floor equipped retailers, designers and apparel buyers with knowledge about new materials, technology and trends to grow their businesses. Industry leaders discussed trends and advancements, including blockchain technology, circular tracing and biosynthetic materials.

As sustainability continues to reflect an expanding umbrella of progressive initiatives such as ecologically sound manufacturing, closed-loop apparel manufacturing, ethical sourcing and empowerment of developing communities, this edition provided the needed clarity to help attendees make decisions regarding their next steps. The push toward sustainability in the garment industry is growing with rising concerns about environmental impacts and social awareness.

For the third quarter Trident’s net profit fell 27.7 per cent. Consolidated profit before tax slumped 74.1 per cent. Tax expense dropped 70.1 per cent. Net debt jumped 10.42 per cent. This year Trident saw growth in the first two quarters. However, the third quarter brought some headwinds due to which overall revenue declined as compared to the previous quarter as well as compared to the corresponding period of last year. Lower traction in the home textile segment along with reduced realizations in the yarn and paper segments impacted revenue as well as profitability for the quarter. The company is expecting an improvement in capacity utilization in the bath linen segment in the next quarter and is looking at the order book for the sheeting segment for the next quarter.

Trident is a vertically integrated textile and paper manufacturer. Trident believes in offering innovative solutions and delivering high-quality value-added products to customers. Trident is expanding spinning capacity at its Madhya Pradesh plant. The project, expected to begin commercial production by January 2021, will help strengthen Trident’s existing home textile business and further expand its market presence. Trident’s existing capacity is 5,43,744 spindles and 6,464 rotors, and the current capacity utilisation is 99 per cent. Trident has planned for maintenance capex at Rs 100 crores for fiscal ’20 and the same will be utilized toward small maintenance capex in the form of de-bottlenecking and upgradation of capacities.

Myanmar has begun investing in environmental sustainability. Till now, only one garment manufacturer in the nation has been certified Leadership in Energy and Environmental Design platinum. Two other facilities, both operated by garment manufacturer Guston Amava, comprise 34 per cent recycled building materials, such as reclaimed steel, in their construction, along with rooftop solar panels, an evaporative cooling system and water-reduction features.

However, Myanmar has a long way to go. Factories are missing cost-saving benefits of making their operations greener and securing higher investments as buyers pay closer attention to sustainable production. Myanmar is one of the world’s fastest growing garment, footwear and travel goods suppliers. But this growth also results in increased environmental impact, which requires best-practice solutions for improved production efficiency, energy, water and waste management.

At a time when retailers and consumers are paying close attention to the conditions under which their garments are produced, ethical and sustainable production is a big deal. Making their operations more environmentally friendly will help factory owners compete with other sourcing markets and give them a better chance of retaining existing orders and securing new business. Else they face the danger of ceding business to competitor countries.