FW

India's textile sector—a symbol of resilience, rural prosperity, and export strength—is at a crossroad. As the 2025-26 fiscal unfolds, a complex challenge grips the industry: shrinking cotton exports, ballooning imports, and relentless pressure on the margins of domestic mills. For a country that once prided itself as a leading global cotton exporter, this shift signals more than a market correction—it underscores structural vulnerabilities that could reshape India’s textile trajectory.

At the heart of this transformation lies a contradiction. While India’s cotton yarn exports are showing faint signs of revival, raw cotton imports are rising at an alarming rate. The trend not only exposes Indian mills to global market volatilities but also raises fundamental questions about domestic cotton policy, pricing, and long-term competitiveness.

From export giant to import reliant

Historically, India was a dominant cotton exporter. But that narrative is quickly unraveling. Recent data points to a dramatic reversal: from October 2023 to April 2025, cotton imports have surged, often exceeding exports by wide margins.

Table: Indian cotton import vs. export (MT)

|

Month/Year |

Import (MT) |

Export (MT) |

|

Oct-23 |

11,226 |

26,190 |

|

Nov-23 |

9,434 |

34,182 |

|

Dec-23 |

8,990 |

37,954 |

|

Jan-24 |

4,937 |

47,781 |

|

Feb-24 |

7,209 |

120,166 |

|

Mar-24 |

9,940 |

64,441 |

|

Apr-24 |

16,761 |

38,567 |

|

May-24 |

13,305 |

39,830 |

|

Jun-24 |

14,481 |

36,884 |

|

Jul-24 |

25,267 |

17,387 |

|

Aug-24 |

35,620 |

10,087 |

|

Sep-24 |

46,987 |

8,641 |

|

Oct-24 |

61,391 |

17,880 |

|

Nov-24 |

61,922 |

28,696 |

|

Dec-24 |

87,307 |

40,750 |

|

Jan-25 |

73,502 |

37,652 |

|

Feb-25 |

58,001 |

29,982 |

|

Mar-25 |

49,126 |

21,934 |

|

Apr-25 |

34,152 |

21,035 |

Source: Indian Cotton Import Vs Export Chart

While the first half of the period (Oct ’23–Mar ’24) saw stronger exports, the trend flipped dramatically from mid-2024 onwards. By April 2025, monthly imports were outstripping exports by over 60%. This import-dependence is particularly concerning for a country that still ranks among the world’s top cotton producers.

So, what triggered this reversal? One factor is India’s high Minimum Support Price (MSP) for cotton. Designed to safeguard farmers, the MSP has made domestic cotton more expensive than international alternatives. While this supports rural incomes, it simultaneously erodes the competitiveness of Indian cotton on the global stage.

Add to this a shrinking domestic surplus—thanks to erratic weather patterns, lower yields, and stagnant acreage—and you get a market where mills are increasingly turning to imported fiber to stay operational.

Yarn exports recovery on fragile ground

While the raw cotton trade suffers, yarn exports tell a slightly more hopeful story. After dipping significantly between 2018 and 2022, India’s cotton yarn exports are staging a comeback. But the climb is slow—and precarious.

Table: Yearwise cotton yarn exports (MT)

|

Fiscal Year |

Export (MT) |

|

2016-17 |

1,088,083 |

|

2017-18 |

1,261,652 |

|

2018-19 |

1,003,735 |

|

2019-20 |

978,558 |

|

2020-21 |

1,181,313 |

|

2021-22 |

899,311 |

|

2022-23 |

927,062 |

|

2023-24 |

1,091,580 |

Source: Yearwise Indian Cotton Yarn Exports Chart

Despite nearing pre-2018 levels, yarn exports are still below their 2017-18 peak. And sustaining this recovery is difficult. Spinners are caught in a bind: they must import cotton at higher costs to remain operational, but they face stiff global competition from countries with cheaper input costs.

The domestic mill squeeze

On the ground, India’s spinning mills are grappling with a perfect storm. Raw material cost inflation is eating into margins, with mills forced to choose between expensive domestic cotton and volatile imported alternatives. Worse, yarn and fabric prices haven’t kept pace with input costs, compressing profit margins to unsustainable levels.

Many mills are running below capacity, delaying modernization efforts, scaling down operations, and in some cases, laying off workers. For a sector that employs over 45 million people across its value chain, this is more than a business concern—it’s a social one.

Policy a balancing act

At the heart of the cotton conundrum lies a challenging policy tightrope. The government must balance farmer welfare (through MSP) with mill viability and export competitiveness. Industry insiders believe that the Cotton Corporation of India (CCI) has an important role to play. Transparent, predictable release of CCI-held cotton stocks at reasonable prices could ease pressure on mills. “A stable procurement calendar and parity pricing can bring much-needed predictability into the market,” says a senior industry executive.

Moreover, experts are calling for a review of duty structures. Reducing duties on cotton imports during deficit periods and providing export incentives for value-added products could boost sectoral health.

A roadmap for revival

To reinvigorate the cotton and textile ecosystem, stakeholders are pushing a multi-pronged revival strategy:

1. CCI Policy Transparency

Mills need predictable and transparent timelines for CCI stock releases. This would reduce procurement uncertainty and stabilize prices.

2. Affordable Domestic Cotton Access

Mechanisms like differential MSPs for industrial use or cotton pools for mills could make Indian cotton more accessible and competitively priced.

3. Focus on Value-Added Exports

Rather than focusing on raw cotton exports, India must move up the value chain—specialty yarns, technical textiles, and finished fabrics offer higher margins and job creation.

4. Sustainable & Traceable Cotton for Premium Markets

With ESG compliance gaining traction globally, investing in regenerative, organic, and traceable cotton can help India tap premium international markets.

A sector at the crossroads

India’s textile sector is no stranger to turbulence, but the current cotton crisis is unlike past cycles. It reflects deeper structural issues—pricing rigidity, policy imbalances, and a lag in modernization. Hence, without urgent and coordinated policy action, India risks ceding its leadership in cotton and textiles to more nimble competitors. Yet, within this crisis lies an opportunity. By reimagining cotton as a value chain—not just a raw material—and aligning farmer interests with manufacturing competitiveness, India can weave a stronger, more resilient future. As one industry veteran aptly put it: “We’re not just importing cotton; we’re importing risk. It’s time to spin a different story.”

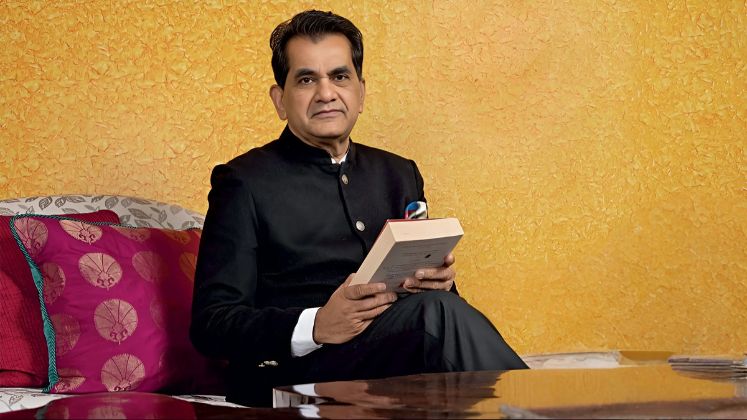

India's vision of becoming a global textile powerhouse and generating millions of manufacturing jobs is facing significant headwinds, largely due to policy hurdles surrounding man-made fibers (MMF). As highlighted by former Niti Aayog CEO and G20 Sherpa Amitabh Kant, the twin challenges of high import duties and stringent Quality Control Orders (QCOs) on MMF raw materials like polyester and viscose are stifling the industry's competitiveness and growth.

India's textile and apparel sector, despite being one of the largest employment generators, paradoxically lags behind global competitors such as China, Bangladesh, and Vietnam in MMF-based product exports. The core issue, as Kant says, lies at the raw material stage, where Indian manufacturers face a substantial cost disadvantage.

The cost burden, a 25 per cent premium

Kant's recent remarks underscore a critical point: raw materials for MMF are approximately 25 per cent more expensive in India compared to global competitors. This cost disparity, which increases as products move up the value chain, erodes the India’s competitiveness in the global market.

Historically, anti-dumping duties were a point of contention for the MMF industry, making imported raw materials more expensive. While these have largely been eliminated, a new formidable barrier has emerged in the form of Quality Control Orders.

Is QCOs, a double-edged sword?

QCOs, intended to ensure product quality and promote domestic manufacturing, have inadvertently become a non-tariff barrier, limiting the import of less expensive, essential raw materials. For polyester and viscose, QCOs mandate that both domestic and international suppliers obtain Bureau of Indian Standards (BIS) certification to sell their products in India.

Impact on polyester

The Quality Control Order for polyester fibre and yarn, initially slated for implementation in October 2022, was eventually enforced in April 2023. While domestic manufacturers largely possess the BIS license, many foreign manufacturers still face delays in obtaining this certification. This has led to:

• Supply disruptions: Importers struggle to source materials from non-BIS certified foreign suppliers, causing supply chain bottlenecks.

• Increased domestic prices: With limited competitive imports, domestic manufacturers can command higher prices, further contributing to the cost disadvantage.

• Capacity underutilization: Indian manufacturers, dependent on these raw materials, face unutilized production capacity due to limited access to affordable inputs.

In a partial relief, in June 2024, the Indian government exempted polyester staple fibre (PSF), filaments, and spun yarn imported under the Advance Authorisation Scheme from QCOs, specifically for goods intended for export. This move aims to ease procurement for export-oriented units.

Impact on viscose

Similar to polyester, Quality Control Orders on Viscose Staple Fibre (VSF) came into effect in March 2023, with a further notification in September 2024 suggesting QCOs on Viscose Spun Yarn (VSY). The industry, particularly in textile hubs like Tamil Nadu, has constantly urged the government to revoke these QCOs on viscose.

• Reliance on a single domestic source: Grasim Industries is reportedly the sole producer of VSF in India, and QCOs on VSF imports have significantly limited access to competitively priced VSF from countries like China, Thailand, and Indonesia.

• Higher input costs: Reduced competition forces Indian spinners to purchase VSF from the single domestic source at higher prices. Even with Free Trade Agreements (FTAs) that could offer cheaper imported VSF, the QCO negates this cost advantage.

• Production slowdown and job losses: The increased input costs and supply shortages have led to production slowdowns, unit closures, and job losses in the weaving and spinning sectors.

The Directorate General of Foreign Trade (DGFT) did provide some relief by exempting VSF imports from QCOs under the Advance Authorisation Scheme in March 2024 for export purposes. However, industry bodies argue this is insufficient, as only a handful of players can utilize this scheme, and a broader revocation of QCOs on MMF inputs is needed for widespread relief.

The global-local disparity, why MMF matters

Globally, MMF constitutes about 70 per cent of the textile and apparel market, while India's ratio is the inverse, with a greater reliance on cotton (approximately 60 per cent of fibre consumption in India is cotton, while only 40 per cent is MMF). This skewed reliance restricts India's global competitiveness, as MMF offers versatility, cost-effectiveness, and sustainability.

Table: MMF’s share in India and in global market

Feature Global textile market (MMF share) Indian textile market (MMF share) Market Share 70% 40% (opposite ratio to cotton) MMF Raw Material Cost Competitive 25% higher than global Major MMF Producers (Global) China (82% of global MMF capacity) India (8% of global MMF capacity) MMF Exports from India $6 billion per annum Lagging behind competitors

Source: Industry reports and government data (approximate figures)

Call for policy rethink

Kant's call for "zero import duties and QCOs on MMF" resonates deeply within the Indian textile industry. The current policies, while perhaps well-intentioned for quality control, are creating an artificial trade barrier, hindering access to crucial raw materials at competitive prices.

Industry associations, including the Confederation of Indian Textile Industry (CITI) and The Southern India Mills' Association (SIMA), have consistently urged the government to review and revoke these QCOs, emphasizing that they are detrimental to the downstream MMF industry, which has high employment elasticity. They argue that instead of ensuring quality, QCOs are creating supply disruptions and driving up domestic prices.

The path forward

To truly unlock the potential of millions of small enterprises, accelerate their growth, generate large-scale employment, and position India as a global textile powerhouse, policymakers must prioritize a shift towards a more liberal import regime for MMF raw materials. This includes:

Eliminating import duties: Reducing import duties to zero on key MMF raw materials would instantly lower input costs, making Indian products more competitive.

Scrapping or reforming QCOs: A thorough review of QCOs is crucial, perhaps adopting a more nuanced approach after extensive consultation with all stakeholders, particularly MSMEs. The focus should be on ensuring quality of end-products, rather than creating barriers at the raw material stage.

The Indian textile industry stands at a critical juncture. By addressing the fundamental issues of raw material competitiveness through a re-evaluation of import duties and QCOs, India can indeed weave a stronger, more competitive future in the global textile landscape.

In a meeting with Shahidullah Azim, Vice President, Bangladesh Garment Manufacturers and Exporters Association (BGMEA), a delegation from the Uzbekistan Textile and Garment Industry Association (UZTEXTILEPROM) discussed potential collaborations to foster mutual trade benefits in the apparel and textile sectors. Focusing on identifying areas for trade and investment, the meeting signified a growing interest in inter-regional cooperation within the global textile industry.

The UZTEXTILEPROM delegation included key figures such as Mukhammadsaidov Bakhtiyor, Head-Department of the Textile, Garment and Knitwear Industry, Ministry of Investment, Industry and Trade; Sherzod Akbarov, Head of Department, UZTEXTILEPROM; and Mehdi Mahbub, Advisor, UZTEXTILEPROM. Their presence underscored the importance Uzbekistan places on strengthening international partnerships in this vital sector.

During the discussion, the Uzbek delegation presented an overview of their nation's textile and garment industry, emphasizing its significant competitive advantages. A key highlight was Uzbekistan's strategic geographical location, offering close proximity and easy access to Commonwealth of Independent States (CIS) countries. This access to a substantial market presents a compelling proposition for potential partnerships. To further explore these opportunities, the UZTEXTILEPROM representatives extended an invitation for a business delegation from BGMEA to visit Uzbekistan.

In turn, Azim highlighted Bangladesh's evolving focus on product diversification, particularly in high-value man-made fiber (MMF)-based garments. He emphasized Bangladesh's proactive efforts to penetrate new export markets, specifically citing the CIS region, which boasts an estimated $55 billion apparel market. Azim proposed a collaborative approach, inviting the Uzbek delegation to work together to explore avenues for Bangladesh's ready-made garment (RMG) exports to CIS markets via Uzbekistan. This strategic alliance could leverage Uzbekistan's established access to the CIS bloc, creating a mutually beneficial trade corridor for both nations.

Following a meeting with Ursula von der Leyen, President, European Commission on July 27, 2025, US President Donald Trump announced the signing of a trade deal introducing a 15 per cent tariff on most goods from the European Union entering the US, including cars.

Notably, certain products like aircrafts, their components, chemicals, and pharmaceuticals will be exempted from these tariffs. This new rate will not be added to existing tariffs. Earlier this month, President Trump had threatened a 30 per cent tariff on the EU, to which the bloc had prepared retaliatory measures.

Beyond tariffs, the agreement includes substantial economic commitments. The EU will purchase US energy worth $750 billion and invest an additional $600 billion in the US over time. As announced by President Trump, ‘hundreds of billions of dollars worth military equipment would also be purchased,’ He lauded the agreement as ‘a very powerful and big deal, it's the biggest of all the deals,’ he asserted.

The deal received a mixed but generally positive reception. Ireland acknowledged trade would become ‘more challenging and expensive’ but welcomed the clarity. Praising the deal, German Chancellor Friedrich Merz highlighted its benefits for Germany's auto industry as it reduced tariffs from 27.5 per cent to 15 per cent. Dick Schoof, Prime Minister, The Netherlands, commended the EU for securing the ‘best deal possible.’ The US-EU trade relationship is valued at nearly $2 trillion.

After a dip in May, UK retail sales volumes increased by an estimated 0.9 per cent M-o-M and 1.7 per cent Y-o-Y in June 2025, shows a report by the Office for National Statistics (ONS). This positive trend follows a significant 2.8 per cent M-o-M decline in May, indicating a renewed consumer activity.

However despite this recent growth, overall re tail volumes in June remained 1.6 per cent below their pre-COVID-19 levels recorded in February 2020, highlighting the ongoing recovery still needed in the sector.

Showing encouraging signs, retail sales volumes in Q2, FY25 increased by 0.2 per cent Q-o-Q and 1.8 per cent Y-o-Y during the quarter, as per the ONS release. This increase suggests a steady, albeit modest, improvement in consumer spending habits.

A notable highlight in June was the robust performance of non-store retailers, whose sales volumes increased by 1.7 per cent. This growth pushed non-store sales to their highest level since February 2022, underscoring a continued shift towards digital purchasing. While less dramatic, non-food store sales volumes also saw a marginal increase of 0.2 per cent M-o-M in June, with department stores and clothing retailers experiencing month-over-month growth.

The rise in online activity was particularly pronounced in terms of spending. The amount spent online, or ‘online spending values,’ increased by 2.3 per cent M-o-M and 4.5 per cent Y-o-Y in June 2025. This digital growth extended into the second quarter, with online spending values rising by 3.3 per cent Q-o-Q.

Consequently, total retail spend - combining both in-store and online sales - increased by 1.1 per cent M-o-M. This led to a slight but significant rise in the proportion of sales made online, which grew from 27.4 per cent in May 2025 to 27.8 per cent in June 2025, further solidifying the growing importance of e-commerce in the UK retail landscape.

Telangana is actively pursuing stronger economic ties with Taiwan, with D Sridhar Babu, IT and Industries Minister announcing plans to establish dedicated manufacturing zones and exclusive textile clusters in the state for Taiwanese companies. This offer was extended during a meeting with an 11-member Taiwanese textile delegation, led by Taiwan Textile Federation President Justin Huang, at the Secretariat in Hyderabad.

Urging Taiwanese industrialists to invest in Telangana's rapidly growing textile sector, Minister Babu emphasized the state's significant opportunities compared to other Indian states. He highlighted, Telangana has swiftly risen as a formidable player in the textile industry, making a notable contribution to the state's economy. The Gross State Value Added (GSVA) from industries for 2024-25 stood at Rs 2.77 lakh crore, with textiles playing a key role. Telangana produces some of the finest quality cotton in India, he stated.

A key highlight presented by the Minister was the Kakatiya Mega Textile Park (KMTP), a state government initiative described as a ‘game-changer.’ KMTP offers integrated, world-class infrastructure covering the entire textile value chain, from ginning and spinning to weaving, processing, and garmenting. Leading international companies such as Youngone, Kitex, and Ganesha Ecosphere have already invested in the park, which benefits from its strategic location along the Hyderabad–Nagpur–Vijayawada Industrial Corridor and excellent logistics.

Assuring the delegation of the Telangana government's commitment to fostering industrial growth through global partnerships, Minister Babu pointed to vast investment opportunities in areas like functional textiles, eco-friendly dyeing, and textile recycling. He underscored the state's attractive offerings including customized land parcels, plug-and-play facilities, a skilled workforce, effective leadership, a stable government and strategic geographic advantage.

Beyond textiles, Minister Babu identified other sectors ripe for collaboration with Taiwanese enterprises, including technical textiles, electronics system design and manufacturing (ESDM), sustainable manufacturing, and innovation and research and development. This proactive outreach aims to strengthen bilateral industrial cooperation and attract significant Taiwanese investment into Telangana, he affirmed.

India's Goods and Services Tax (GST) Council plans to evaluate a proposal to implement a uniform 12 per cent GST across the entire textile value chain. Expected to be discussed before September as part of the next phase of GST reforms, this reform aims to correct the long-standing inverted duty structure that has plagued the sector, as per a report by Moneycontrol.

Likely to be part of the Group of Ministers' (GoM) rate rationalization report, the proposal is being supported by the Centre. Currently, cotton is taxed at 5 per cent, yarn at 12 per cent, and synthetic fibers and their chemicals at 18 per cent. Additionally, garments priced below Rs 2,000 attract a 5 per cent GST, while those above Rs 2,000 are taxed at 12 per cent.

The proposal is to bring everything to 12 percent. The lower 5 per cent GST on cotton was originally intended to benefit farmers and keep raw materials affordable, given its status as a primary agricultural commodity. However, this rate mismatch has led to working capital getting stuck in refund claims, distorted pricing, and disincentives for investment.

The proposed reform may also eliminate the price threshold on garments, applying a flat 12 per cent rate irrespective of value for simplification.

The current rate structure not only distorts pricing but also impacts cash flow due to reliance on inverted duty refunds, which the government aims to limit. This move is part of a broader effort to streamline the GST framework, reduce hidden costs, and enhance the global competitiveness of India’s textile industry. A uniform rate is expected to simplify compliance, reduce reliance on refunds, and potentially attract new capital into textile manufacturing, particularly benefiting the synthetic segment which currently faces heavier taxation despite its mass consumption.

The global apparel trade and retail sector continues to evolve, balancing between post-pandemic recovery, macroeconomic uncertainties, and changing consumer behavior. Wazir Advisors July 2025 Apparel Trade & Retail Update reveals a complex picture: while some markets are charting strong growth, others are seeing sluggish demand and competitive pressures. From a rebound in UK imports to Vietnam's booming export performance and India’s growing domestic retail, the global apparel map is dotted with diverse paths.

Apparel Imports: UK moves ahead, US stalls

May 2025 witnessed sharply contrasting import trends among major apparel-consuming nations. The United States, traditionally the world’s largest apparel importer, saw its imports decline 8 per cent year-on-year, falling to $5.5 billion. This downturn reflects persistent inflationary pressure, inventory adjustments by large retailers, and a slight consumer pullback amid economic uncertainty.

In contrast, the European Union recorded a 4 per cent YoY increase in apparel imports, touching $7.2 billion. The EU’s demand resilience is likely tied to a strong summer fashion cycle, restocking across mass-market retailers, and improved consumer sentiment in economies like Germany and France.

The UK, however, emerged as the star performer. With a 36 per cent YoY increase in apparel imports, reaching $1.9 billion, the UK appears to be in the middle of a fast-fashion revival, boosted by aggressive buying from e-commerce giants and early festive season shipments.

Meanwhile, Japan showed a 7 per cent YoY growth in apparel imports to $1.6 billion, indicating stable recovery in consumer demand and a return to workwear and occasion wear purchases.

Apparel Exports: Vietnam shines, Bangladesh slips

In June 2025, China maintained its dominance as the world’s top apparel exporter, clocking $14.8 billion, a 2 per cent YoY increase. While this growth is modest, it signals resilience amid geopolitical scrutiny and rising production costs. Chinese exporters continue to focus on high-margin segments and nearshoring strategies.

Vietnam, meanwhile, posted the strongest export performance among major Asian exporters, registering 18 per cent YoY growth to reach $3.3 billion. The country is reaping the benefits of free trade agreements, relocation of manufacturing from China, and investments in sustainable production.

On the flip side, Bangladesh faced a setback, with exports dipping 7 per cent YoY to $2.8 billion. The decline may be attributed to energy shortages, compliance pressures, and cooling orders from Europe. Concerns about cost competitiveness and environmental compliance continue to challenge the industry.

India, however, saw its exports hold steady at $1.3 billion, showing no YoY change. While not a decline, the stagnant figure underlines India's ongoing struggle with price competitiveness and supply chain fragmentation despite global buyers’ interest in supplier diversification.

Retail Markets: India’s boom, UK’s digital edge, US recovery

On the retail front, apparel sales showed encouraging trends in most major economies during June 2025, signalling firm consumer confidence and gradual demand normalization.

In the US, apparel and home furnishing store sales rose 2 per cent YoY, reflecting steady foot traffic in physical stores. Though not dramatic, the rise indicates that brick-and-mortar retail is holding its ground against e-commerce, supported by ongoing promotions and early back-to-school demand.

The UK saw similar store-based growth, with June apparel store sales reaching £4.7 billion, a 2 per cent YoY increase. More notably, e-commerce clothing sales grew by 2 per cent in Q2 2025, a sign that online fashion retail continues to mature even as pandemic-era spikes normalize.

India, however, emerged as the most dynamic retail market in the current update. June 2025 apparel retail sales jumped 10 per cent over the previous year, pushed up by a young consumer base, digital payments penetration, and a flourishing ethnic and value-fashion ecosystem. The growth, spread across Tier-I and Tier-II cities, reflects strong domestic consumption fundamentals.

The bigger picture, world of divergence

The global apparel industry is no longer moving in lockstep. Instead, it is a story of regional divergence, multi-speed recovery, and structural adaptation.

• Manufacturing centers like Vietnam are growing, due to its agility and policy support.

• Traditional giants such as Bangladesh face hurdles, requiring urgent modernization and energy resilience.

• Consumer markets like India are witnessing a domestic boom that could reshape sourcing and retail strategies.

• Developed markets, including the US and UK, show cautious optimism, with a strong tilt toward omnichannel and discount-led buying patterns.

As supply chains rewire and retailers recalibrate, July 2025’s data is a timely reminder that agility, digital adaptation, and sustainability will define future winners in global apparel.

Outlook for Q3 2025

With peak holiday seasons on the horizon in the West and festive buying cycles beginning in South Asia, the third quarter is likely to bring more pronounced trends. Stakeholders across sourcing, retail, and logistics will be watching closely to see whether these early signals of growth sustain—or fragment further.

In a fragmented but fast-evolving market, one thing is clear: apparel’s global footprint is shifting, and those who adapt fastest will define the next chapter of fashion commerce.

As a direct consequence of a pre-announced steep US tariff hike, Bangladesh apparel exporters are facing intense pricing pressure from European buyers. Set to take effect from August 1, this looming tariff is pushing Bangladeshi manufacturers to aggressively seek new orders in the European Union to fill production gaps.

Most US buyers are currently hesitant to place new orders due to the uncertainty surrounding the potential tariff increases. This reluctance has prompted thousands of Bangladeshi exporters to turn more actively to the EU market, where, according to industry insiders, European buyers are capitalizing on the situation by demanding lower product prices.

SM Majedur Rahim, Director, Giant Group, notes, orders from US buyers have halved. Even when US buyers are placing orders, the volumes are small. Some have already offered lower prices for repeat orders, citing tariff pressure. It's unfair to expect exporters to bear the cost of tariffs, he states. Major EU retailers like H&M and Inditex, who also have significant US business, have reportedly cut their order volumes by 10-20 per cent in anticipation of the tariffs.

A 35 per cent reciprocal tariff on Bangladeshi exports to the US is expected. This means that if the proposed tariff is implemented, the total tariff burden on Bangladeshi goods in the US could rise to a challenging 50.5 per cent, up from the current average of 15.5 per cent. European buyers are leveraging this uncertainty to renegotiate and reduce apparel prices. For instance, Fazlee Shamim Ehsan, CEO, Fatullah Apparels, shares, a Dutch buyer offered 25-30 cents less per unit on a $750,000 order, citing ‘Trump-era tariff policies,’ a price he couldn't accept, making factory operations difficult.

The United States is Bangladesh's largest single export destination, accounting for $5.05 billion- or 58 per cent - of Bangladesh's total exports in FY25. Over 800 Bangladeshi firms rely on the US for more than half their exports, making them highly vulnerable.

Industry leaders fear that if Bangladesh faces higher tariff rates than competitors like Vietnam, India, and Pakistan, it will severely impact their export sector, risking millions of jobs and potential labor unrest. This ripple effect from US tariffs, combined with shrinking orders from non-traditional markets like India and South Korea due to other barriers, poses a significant threat to Bangladesh's market competitiveness.

The textile and apparel sector in Sri Lanka is reinforcing its commitment to environmental, social, and governance (ESG) transparency with the launch of a significant new sustainability program. The Improving Transparency for Sustainable Business (ITSB) initiative aims to embed world-class ESG reporting practices, enhancing the industry's resilience, competitiveness, and global standing.

Jointly launched by the Global Reporting Initiative (GRI) South Asia, the Sustainable Development Council (SDC) of Sri Lanka, the Sri Lanka Export Development Board (EDB), and the Joint Apparel Association Forum (JAAF) of Sri Lanka, the ITSB program is backed by the Swedish International Development Cooperation Agency (SIDA). It focuses on building long-term capacity for textile and apparel companies, from large multinationals to small and medium-sized enterprises.

Participating companies will receive comprehensive training on utilizing the globally recognized GRI Standards to transparently report on crucial sustainability topics. These include labor practices, climate impact, energy use, economic impact, and waste management. Beyond direct business engagement, the initiative will also collaborate closely with national and international stakeholders, including regulators, investors, industry bodies, worker groups, media, and academia.

The inaugural capacity building session, held on July 16, 2025, at Courtyard by Marriott Colombo, saw strong attendance from public and private sector leaders, including EDB Chairman Mangala Wijesinghe, JAAF Secretary General Yohan Lawrence, and SDC Director Jeevanthie Senanayake.

Rahul Singh, Senior Manager, South Asia, GRI, emphasized the program's significance: "ITSB is designed to elevate sustainability practices and transparency across South Asia’s textile and apparel sector, positioning it for long-term resilience, profitability, and global leadership." He added that adopting GRI Standards boosts corporate transparency, investor confidence, international positioning, and regulatory preparedness.

This program aligns with Sri Lanka’s Action Plan to Develop Inclusive and Sustainable Business Capacities and comes as global buyers increasingly prioritize traceability and ethical sourcing. Emerging regulations, such as the EU’s Corporate Sustainability Due Diligence Directive (CSDDD), are further reshaping international trade dynamics.

Highlights from the session included a preview of the draft GRI Textiles and Apparel Sector Standard (2025), interactive workshops, and a high-level roundtable discussion on integrating ESG with business, policy, and investment goals. Notably, the ITSB initiative is set to expand to India and Bangladesh later this year, making Sri Lanka a regional early mover.

With apparel accounting for over 40 per cent of Sri Lanka’s total export revenue and employing over 350,000 people, the ITSB represents a strategic move towards a future-ready, consciously sustainable industry.