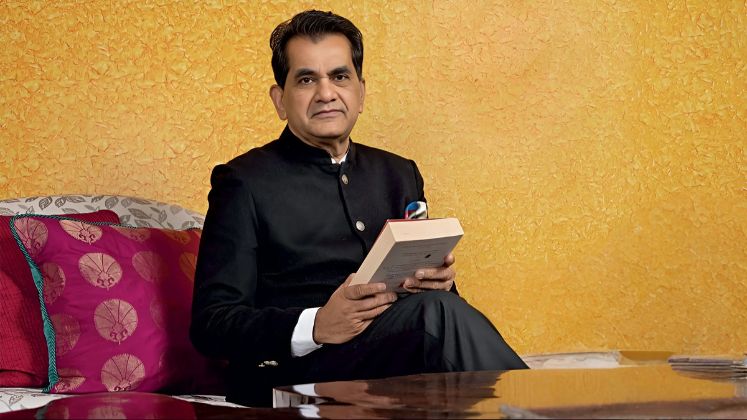

India's vision of becoming a global textile powerhouse and generating millions of manufacturing jobs is facing significant headwinds, largely due to policy hurdles surrounding man-made fibers (MMF). As highlighted by former Niti Aayog CEO and G20 Sherpa Amitabh Kant, the twin challenges of high import duties and stringent Quality Control Orders (QCOs) on MMF raw materials like polyester and viscose are stifling the industry's competitiveness and growth.

India's textile and apparel sector, despite being one of the largest employment generators, paradoxically lags behind global competitors such as China, Bangladesh, and Vietnam in MMF-based product exports. The core issue, as Kant says, lies at the raw material stage, where Indian manufacturers face a substantial cost disadvantage.

The cost burden, a 25 per cent premium

Kant's recent remarks underscore a critical point: raw materials for MMF are approximately 25 per cent more expensive in India compared to global competitors. This cost disparity, which increases as products move up the value chain, erodes the India’s competitiveness in the global market.

Historically, anti-dumping duties were a point of contention for the MMF industry, making imported raw materials more expensive. While these have largely been eliminated, a new formidable barrier has emerged in the form of Quality Control Orders.

Is QCOs, a double-edged sword?

QCOs, intended to ensure product quality and promote domestic manufacturing, have inadvertently become a non-tariff barrier, limiting the import of less expensive, essential raw materials. For polyester and viscose, QCOs mandate that both domestic and international suppliers obtain Bureau of Indian Standards (BIS) certification to sell their products in India.

Impact on polyester

The Quality Control Order for polyester fibre and yarn, initially slated for implementation in October 2022, was eventually enforced in April 2023. While domestic manufacturers largely possess the BIS license, many foreign manufacturers still face delays in obtaining this certification. This has led to:

• Supply disruptions: Importers struggle to source materials from non-BIS certified foreign suppliers, causing supply chain bottlenecks.

• Increased domestic prices: With limited competitive imports, domestic manufacturers can command higher prices, further contributing to the cost disadvantage.

• Capacity underutilization: Indian manufacturers, dependent on these raw materials, face unutilized production capacity due to limited access to affordable inputs.

In a partial relief, in June 2024, the Indian government exempted polyester staple fibre (PSF), filaments, and spun yarn imported under the Advance Authorisation Scheme from QCOs, specifically for goods intended for export. This move aims to ease procurement for export-oriented units.

Impact on viscose

Similar to polyester, Quality Control Orders on Viscose Staple Fibre (VSF) came into effect in March 2023, with a further notification in September 2024 suggesting QCOs on Viscose Spun Yarn (VSY). The industry, particularly in textile hubs like Tamil Nadu, has constantly urged the government to revoke these QCOs on viscose.

• Reliance on a single domestic source: Grasim Industries is reportedly the sole producer of VSF in India, and QCOs on VSF imports have significantly limited access to competitively priced VSF from countries like China, Thailand, and Indonesia.

• Higher input costs: Reduced competition forces Indian spinners to purchase VSF from the single domestic source at higher prices. Even with Free Trade Agreements (FTAs) that could offer cheaper imported VSF, the QCO negates this cost advantage.

• Production slowdown and job losses: The increased input costs and supply shortages have led to production slowdowns, unit closures, and job losses in the weaving and spinning sectors.

The Directorate General of Foreign Trade (DGFT) did provide some relief by exempting VSF imports from QCOs under the Advance Authorisation Scheme in March 2024 for export purposes. However, industry bodies argue this is insufficient, as only a handful of players can utilize this scheme, and a broader revocation of QCOs on MMF inputs is needed for widespread relief.

The global-local disparity, why MMF matters

Globally, MMF constitutes about 70 per cent of the textile and apparel market, while India's ratio is the inverse, with a greater reliance on cotton (approximately 60 per cent of fibre consumption in India is cotton, while only 40 per cent is MMF). This skewed reliance restricts India's global competitiveness, as MMF offers versatility, cost-effectiveness, and sustainability.

Table: MMF’s share in India and in global market

Feature Global textile market (MMF share) Indian textile market (MMF share) Market Share 70% 40% (opposite ratio to cotton) MMF Raw Material Cost Competitive 25% higher than global Major MMF Producers (Global) China (82% of global MMF capacity) India (8% of global MMF capacity) MMF Exports from India $6 billion per annum Lagging behind competitors

Source: Industry reports and government data (approximate figures)

Call for policy rethink

Kant's call for "zero import duties and QCOs on MMF" resonates deeply within the Indian textile industry. The current policies, while perhaps well-intentioned for quality control, are creating an artificial trade barrier, hindering access to crucial raw materials at competitive prices.

Industry associations, including the Confederation of Indian Textile Industry (CITI) and The Southern India Mills' Association (SIMA), have consistently urged the government to review and revoke these QCOs, emphasizing that they are detrimental to the downstream MMF industry, which has high employment elasticity. They argue that instead of ensuring quality, QCOs are creating supply disruptions and driving up domestic prices.

The path forward

To truly unlock the potential of millions of small enterprises, accelerate their growth, generate large-scale employment, and position India as a global textile powerhouse, policymakers must prioritize a shift towards a more liberal import regime for MMF raw materials. This includes:

Eliminating import duties: Reducing import duties to zero on key MMF raw materials would instantly lower input costs, making Indian products more competitive.

Scrapping or reforming QCOs: A thorough review of QCOs is crucial, perhaps adopting a more nuanced approach after extensive consultation with all stakeholders, particularly MSMEs. The focus should be on ensuring quality of end-products, rather than creating barriers at the raw material stage.

The Indian textile industry stands at a critical juncture. By addressing the fundamental issues of raw material competitiveness through a re-evaluation of import duties and QCOs, India can indeed weave a stronger, more competitive future in the global textile landscape.