FW

Dhaka hosts 6th edition of SAF

The 6th Sustainable Apparel Forum (SAF) concluded successfully in Dhaka, reinforcing Bangladesh’s commitment to responsible sourcing. Organized by Bangladesh Apparel Exchange (BAE) in collaboration with the Embassy of the Kingdom of the Netherlands, the event brought together policymakers, industry leaders, and entrepreneurs to discuss critical sustainability challenges in the apparel sector.

This year’s SAF focused on climate action, environmental conservation, and decent work. The event featured an opening ceremony, four insightful panel discussions, five impactful presentations, and two engaging breakout sessions. More than 40 distinguished speakers and 20 innovators shared their expertise with over 550 national and international delegates.

High profile speakers emphasize sustainability

The forum featured prominent speakers, including Syeda Rizwana Hasan, Adviser at the Ministry of Environment, Forests, Climate Change, and Water Resources; H E Michael Miller, Ambassador and Head of Delegation, European Union Delegation to Bangladesh; H E Andre Carstens, Ambassador of the Kingdom of the Netherlands in Bangladesh; Chowdhury Ashik Mahmud Bin Harun, Executive Chairman (Senior Secretary) of BIDA; and Mostafiz Uddin, Founder & CEO of BAE.

Syeda Rizwana Hasan stressed the need for shared responsibility in sustainability, urging both importers and exporters to collaborate on renewable and sustainable energy initiatives. H E Michael Miller highlighted the EU’s ongoing partnership with Bangladesh, encouraging the country to increase its focus on renewable energy.

H E Andre Carstens reaffirmed the Netherlands’ commitment to supporting Bangladesh’s efforts in sustainability, circularity, and traceability in the apparel sector. Chowdhury Ashik Mahmud Bin Harun expressed Bangladesh’s ambition to lead in sustainable apparel by 2040, calling for collective action. Mostafiz Uddin emphasized the importance of collaboration, investment, and business integration in driving sustainable progress.

Netherlands circular textile trade mission

A key highlight of the forum was the announcement of the Netherlands Circular Textile Trade Mission to Bangladesh, scheduled from February 10-13. Organized by the Embassy of the Kingdom of the Netherlands and the Netherlands Enterprise Agency (RVO), with support from Export Partner, Clean & Unique, BGMEA, and BAE, the mission aims to foster circularity and renewable energy solutions. The participation of 18 leading Dutch companies will provide networking and business collaboration opportunities.

The SAF 2025 reaffirmed Bangladesh’s leadership in sustainable apparel manufacturing. With global partners and industry stakeholders working together, the forum served as a crucial platform for setting sustainability goals and driving impactful initiatives. As Bangladesh aims to become a global leader in sustainable apparel by 2040, events like SAF play a vital role in shaping a greener and more responsible future for the industry.

eVent Fabrics is rebranding its plant-based, ePTFE-free ‘Bio Waterproof” and ‘Bio Windproof” laminates as ‘stormST’ and ‘windstormST for the SS 2026 season. This move aligns with its brand evolution and new tagline, ‘defy the elements.’

The renaming reflects eVent’s commitment to sustainable, high-performance laminates for outdoor, activewear, fashion, hunt, fish, golf, cycling, and footwear markets. The company introduced Bio in 2016 but now sees the term as diluted in the marketplace.

“With sustainability at the forefront, we wanted names that better emphasize our products weather protection while reducing confusion,” said Chad Kelly, President of eVent Fabrics. The updated names align with the brand’s architecture and highlight performance attributes.

Starting February 2025, eVent will phase out Bio branding, including for footwear, ensuring a smooth transition for brand partners. Existing Bio products will remain in the market through mid-2026 to accommodate sales cycles.

eVent will debut stormST and windstormST at Performance Days in Munich this March, reinforcing its leadership in sustainable performance materials.

Kering reported a 12 per cent drop in 2024 revenue, totaling €17.2 billion, as challenging market conditions hit luxury demand. Recurring operating income fell 46 per cent to €2.6 billion, while net income attributable to the Group was €1.1 billion.

Gucci, Kering’s flagship brand, saw revenue tumble 23 per cent to €7.7 billion, with direct retail sales down 21 per cent and wholesale plunging 28 per cent. However, the performance of its leather goods, particularly the Jackie handbag, showed signs of resilience.

Yves Saint Laurent’s revenue declined 9 per cent to €2.9 billion, impacted by a 7 per cent drop in direct retail sales and a 25 per cent dip in wholesale. Meanwhile, Bottega Veneta bucked the trend, growing 4 per cent to €1.7 billion, with direct sales up 10 per cent.

Revenue from Kering’s Other Houses, including Balenciaga, Alexander McQueen, and Boucheron, fell 8 per cent to €3.2 billion. Balenciaga’s leather goods performed well, while Alexander McQueen struggled amid its transition.

Kering Eyewear and Corporate revenue rose 24 per cent to €1.9 billion, driven by Kering Beaute and a strong performance in eyewear, which marked its 10th anniversary.

In Q4 2024, revenue mirrored the annual trend, dropping 12 per cent, with direct retail sales down 13 per cent and wholesale revenue down 10 per cent. Japan was the only region where trends did not improve.

Free cash flow from operations reached €1.4 billion, but excluding real estate transactions, it was €3.6 billion, up 7 per cent from 2023. Net debt stood at €10.5 billion.

Kering proposed a €6 per share dividend, with a final payout of €4 scheduled for May 7, 2025.

Looking ahead, Kering aims to enhance brand desirability, optimize distribution, and drive efficiency while maintaining financial discipline. The Group remains cautious amid economic and geopolitical uncertainties but is focused on a return to growth.

The India Sourcing Conclave (ISC) 2025, organized by the Buying Agents Association (BAA), will be held from February 12-15 at India Exposition Mart Ltd (IEML), Noida, alongside Bharat Tex. The event features an exhibition and knowledge seminars, with a strong focus on ESG in global trade.

BAA, which facilitates over $4 billion in annual export orders across handicrafts, textiles, home decor, and apparel, aims to enhance India’s merchandise exports through ISC. The conclave will attract global buyers, sourcing consultants, embassy representatives, exporters, and logistics professionals, along with BFSI firms, compliance bodies, and testing agencies.

Supported by the Export Promotion Council for Handicrafts (EPCH) and IEML, ISC 2025 is backed by industry partners like SAR Transport Systems, Cotecna Inspections, and Marudhar Chemicals.

The Union Minister for Textiles, Giriraj Singh, will inaugurate Bharat Tex 2025 on February 12 at Expo Mart, Greater Noida. The event, building on the success of its inaugural edition in 2024, will bring together global buyers, policymakers, and industry leaders to drive business opportunities and partnerships.

Sudhir Sekhri, Chairman of AEPC, emphasized the event’s strong sustainability focus. "Bharat Tex 2025 is committed to promoting eco-friendly practices with innovations in organic fabrics, recycled materials, and energy-efficient technologies," he said. He also highlighted the rising global trust in India’s textile sector, with the readymade garment (RMG) industry experiencing significant growth.

"India's RMG exports saw an 11.6 per cent increase from April-December 2024-25 over the same period last year. Free trade agreements (FTAs) and supportive state policies have further boosted the sector. The Union Budget 2025-26 has also reinforced growth by providing MSME credit support and rationalizing customs duties,” Sekhri added.

The event will feature participation from 110 countries, along with global brands and retail giants. High-level government-to-government (G2G) and business-to-business (B2B) meetings, strategic MoUs, and joint ventures are expected to drive foreign investment.

Bharat Tex 2025 aims to position India as a key player in the global textile market. It will showcase advancements in sustainability, circularity, and digitization. Attendees can explore fabric testing zones, product demonstrations, thematic discussions, and master classes by industry experts.

With top policymakers, global CEOs, and industry stakeholders in attendance, Bharat Tex 2025 is set to be a landmark event, strengthening India’s role as a reliable textile hub.

The 2nd edition of Bharat Tex 2025-Handicrafts will take place from February 12-15, 2025, at the India Expo Centre & Mart, Greater Noida. This major event, part of the global Bharat Tex 2025 trade fair, will highlight India’s handicraft traditions alongside modern innovations.

Organized by the Bharat Tex Trade Federation (BTTF) and supported by the Ministry of Textiles, the event will run concurrently at two venues Greater Noida (Feb 12-15) for handicrafts, garment machinery, and chemicals, and Bharat Mandapam, New Delhi (Feb 14-17), covering the entire textile value chain.

With backing from 12 Textile Export Promotion Councils, including EPCH, the event is set to attract over 5,000 exhibitors, 6,000+ buyers from 110+ countries, and 1,20,000+ visitors. It aims to drive global partnerships, showcase sustainable practices, and highlight cutting-edge textile technologies.

EPCH Chairman Shri Dileep Baid stated, "This event blends our rich textile heritage with innovation, reaffirming India's leadership in sustainable and modern textiles."

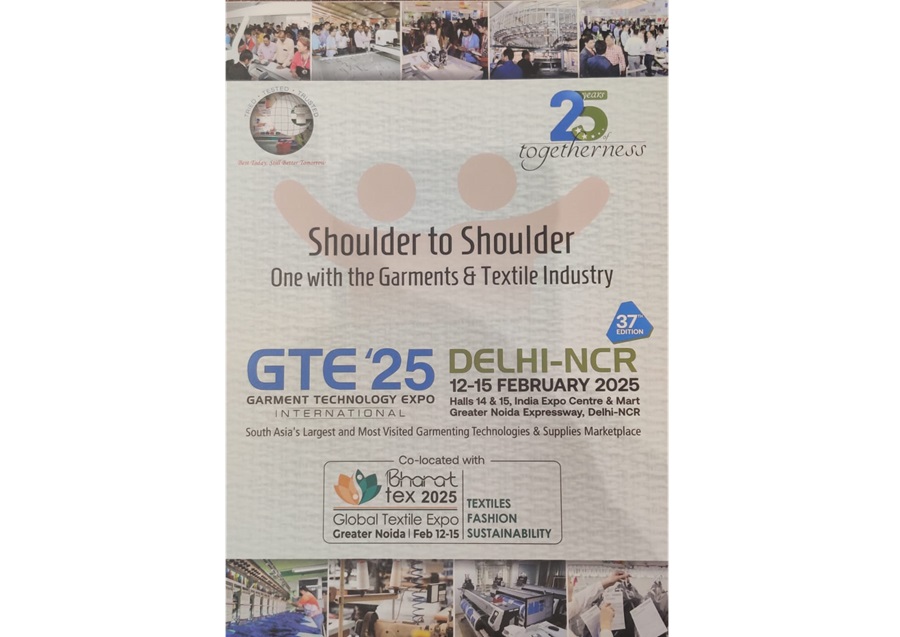

The 37th Garment Technology Expo (GTE) 2025 will take place at the India Expo Centre and Mart, Greater Noida, alongside Bharat Tex 2025. This premier event, set for February 14-17, will feature cutting-edge garment manufacturing technology, innovations, materials, and services.

GTE 2025 will host 170 exhibitors representing over 600 brands across 120,000 square feet in two halls. The expo will highlight advancements in machinery, consumables, infrastructure, processes, trimmings, logistics, and communication solutions.

Bharat Tex 2025, organized by textile export councils and supported by India’s Ministry of Textiles, will run concurrently at Bharat Mandapam, New Delhi, and Greater Noida. The event aims to position India as a global textile leader, covering the entire supply chain from raw materials to finished products.

A recent price comparison study by the Confederation of Indian Textile Industry (CITI) highlights significant cost competitiveness challenge for Indian yarn manufacturers against their Chinese counterparts in January 2025. The data, focusing on the price trends of Polyester Staple Fiber (PSF) and Viscose Staple Fiber (VSF), indicates a considerable price difference impacting the Indian industry. This challenge gets escalated further due to broader trends in the global textile market, opines Sanjay K Jain, Chairman ICC National Textiles Committee & MD, TT Limited.

The CITI report compares domestic prices for MSME (Micro, Small, and Medium Enterprises) spinners in India with international prices as given by the China Chemical Fibre Website (CCF), a key source of chemical fiber market information in China. The analysis reveals Indian MSME spinners paid a substantial premium for both PSF and VSF throughout January.

Growing PSF price disparity

The data shows a fluctuating but consistently high price difference for PSF between the Indian domestic market and international prices. The following table summarizes the weekly PSF price comparison:

Table: PSF prices difference

|

Week of January |

Exchange Rate ($/Rs) |

CCF Price ($) |

CCF Price (Rs) |

Domestic Price (Rs) |

Price Difference (Rs) |

Price Difference (%) |

|

1st |

85.75 |

0.85 |

72.75 |

99 |

26.25 |

36.08% |

|

2nd |

86.25 |

0.85 |

73.46 |

99 |

25.54 |

34.77% |

|

3rd |

86.4 |

0.87 |

75.13 |

100.13 |

24.99 |

33.27% |

|

4th |

86.44 |

0.87 |

75.13 |

100.5 |

25.37 |

33.78% |

As the table reveals, the price difference ranged from Rs 24.99 to Rs 26.25 per kg. As a percentage of the international price, the difference remained consistently above 33 per cent, highlighting a significant cost disadvantage for Indian spinners.

VSF prices also higher in India

Similarly, VSF prices in the Indian domestic market were also significantly higher than international prices. The following table illustrates the weekly VSF price comparison.

Table: VSF price difference

|

Week of January |

Exchange Rate ($/Rs) |

CCF Price ($) |

CCF Price (Rs) |

Domestic Price (Rs) |

Price Difference (Rs) |

Price Difference (%) |

|

1st |

85.75 |

1.61 |

137.8 |

160 |

22.2 |

16.11% |

|

2nd |

86.25 |

1.61 |

138.74 |

160 |

21.26 |

15.32% |

|

3rd |

86.4 |

1.61 |

139.14 |

160 |

20.86 |

14.99% |

|

4th |

86.44 |

1.62 |

139.73 |

160 |

20.27 |

14.50% |

The data reveals a price difference ranging from Rs 20.27 to Rs 22.20 per kg. In percentage terms, the difference fluctuated between approximately 14.50 per cent and 16.11 per cent of the international price. While the percentage difference is lower for VSF compared to PSF, it still represents a notable cost disadvantage for Indian manufacturers.

Reasons for price gap and impact

The CITI report suggests international prices considered are not Indian landed prices. If these raw materials were to be imported into India, additional costs such as CIF (Cost, Insurance, and Freight), Basic Customs Duty (BCD), and other related charges would be added to the international prices, potentially narrowing the gap. However, the existing disparity still poses a challenge for Indian manufacturers. The report also highlights that domestic prices are specifically for MSME spinners and include discounts, indicating that larger players might face even higher input costs.

This price differential significantly impacts Indian yarn makers competitiveness, squeezing their profit margins and hindering their ability to compete with Chinese manufacturers in the global market. The higher raw material costs could force Indian manufacturers to raise prices for their finished products, making them less attractive to international buyers.

Jains analysis offers a crucial context to these price disparities, highlighting the dominance of Man-Made Fibers (MMF) in the global textile market, with a 70 per cent share. This reinforces the importance of PSF and VSF pricing for India's competitiveness. Jain also points out the stagnation of India's cotton sector, with declining yields, making the focus on MMF even more critical.

He emphasizes the significant price disparity in raw material sourcing between India and China, raising concerns about India's ability to compete effectively. He questions the reliance on tariffs and advocates for a more robust competitive structure that allows for the free flow of raw materials. Drawing attention to the success of countries like Bangladesh and Vietnam, Jain underscores the importance of sourcing flexibility, even without abundant domestic raw materials. This suggests that India needs to strategically adapt its policies to facilitate access to competitive raw materials internationally.

The report also notes that CCF was closed from January 25 to February 4, 2025, due to the Chinese New Year holiday, and this period was not included in the analysis. The closure could potentially influence price dynamics in the subsequent weeks, a factor that warrants further observation.

What lies ahead…

CITI’s data, and Jain's expert analysis, underscores the need for a comprehensive analysis of the factors contributing to the price disparity between domestic and international prices of PSF and VSF. It also highlights the importance of policy interventions and industry initiatives to enhance the competitiveness of Indian yarn manufacturers in the global arena. Continuous monitoring of price trends and proactive measures, including potentially rethinking raw material sourcing strategies, are crucial for the sustained growth and development of the Indian textile industry.

Patagonia has successfully streamlined its color management process using Discover e-Solutions (DeSL) Color Lifecycle Management (CLM) software. This technology enhances efficiency, sustainability, and collaboration with suppliers.

DeSL, a leader in digital transformation for fashion and retail, highlights Patagonia’s success with CLM, reinforcing the brand’s commitment to innovation and environmental responsibility. “With DeSL’s CLM, we’ve improved our color evaluation workflow, automated lab dip reviews, and tracked production yardage using spectral data,” said Matt Swartz, Sr Color & Surface Design Manager at Patagonia. “The web portal also centralizes communication and documentation with suppliers.”

The CLM solution enables Patagonia to manage both spectro-readable and non-spectro-readable submits, reducing errors and improving color accuracy. By automating key processes, the brand enhances operational efficiency while aligning with its sustainability goals.

DeSL values its ongoing partnership with Patagonia and remains dedicated to supporting its technological and environmental advancements.

The Global Sourcing Expo, recognized as one of the Top Global Fashion Expos by Forbes, is set to return to Sydney from June 17-19, 2025, before heading to Melbourne in November. This highly anticipated event continues to build on its 15-year legacy, attracting thousands of leading global suppliers in apparel, footwear, textiles, and homewares.

Last year’s Sydney expo saw a 48 per cent year-on-year rise in attendance, with over 4,450 visitors attending the three-day event. Marie Kinsella, CEO of International Expo Group, says this growth reflects the increasing need for a centralized sourcing hub.

“The show was designed to solve a major challenge for Australian trade buyers eliminating the need to travel abroad to connect with global suppliers. Here, they can engage with hundreds of manufacturers, brands, and industry experts, all under one roof,” she said.

The 2025 edition promises an enhanced experience with a dynamic exhibitor lineup, insightful seminars, and key industry partnerships. The Sourcing Seminar Series will return, featuring experts discussing the latest trends, eCommerce strategies, AI in marketing, sustainability, and supplier management.

“With an outstanding speaker lineup and pressing industry topics, this year’s seminar series is set to be our best yet,” Kinsella added.

Once again, the event will feature the China Clothing Textile Accessories Expo, showcasing high-quality products from diverse global brands.

Exhibitor registration is now open, and booths are filling fast. “With just four months to go, we encourage exhibitors to secure their stands and stay updated via our social media channels,” said Kinsella.

The Global Sourcing Expo Sydney is a must-attend event for fashion buyers, retailers, and sourcing professionals looking to connect, collaborate, and stay ahead of industry trends.