FW

The textile and textile product industry (TPT) is one of the main drivers of Indonesia’s exports. The government provides an incentive of corporate income tax by 30 per cent for 6 years or 5 per cent annually. This incentive is needed for the domestic TPT industry to be competitive. Anne Patricia Sutanto, VP, Director of PT Pan Brothers Tbk (PBRX) says the tax incentive is like a breath of fresh air for this sector, however, the government must be serious in implementing these rules.

As an export-oriented textile industry player, it asks for a government reference effort with all competitor countries so that all government policies related to the textile industry can be competitive. The government should also look at the dynamics in the global textile industry to take advantage of opportunities in future because this sector is stable and can be one of the pillars of Indonesia's development efforts.

Sutanto says what is important to them is the seriousness of the government in negotiation FTA with the EU, Canada, Mexico and Asian countries as a whole. In addition, the government must also build a vocational school for textile industry equipped with industry-based curriculum facilities. Although the conditions are not yet ideal, PBRX set a growth target at 12 to 15 per cent this year.

Bhima Yudhistira Adhinegara, Economist of the Institute for Development of Economics and Finance (INDEF) says the regulation is timely. The reason for global textile demand is currently recovering and this year TPT exports are good prospects, so it can be a stimulus for production. The current fiscal incentives are needed to encourage investment in the textile sector, especially investments in the opening of new factories or the reversal of old textile machinery that has been less productive.

The mega business event for textile and textile engineering sector, the 2nd global textile technology and engineering show GTTES 2019 will be held from February 1 to 3, 2019 in Mumbai. The GTTES is a growth catalyst and optimum business platform with numerous business leads, new customers offering best sourcing solution to India’s surging demand for textile machinery.

India is one of the world’s largest producers of textiles and thus one of the biggest market for textile machinery as well. The size of Indian textile and apparel industry is expected to reach $223 billion by 2021. This is a clear indication of the size of the market opportunity awaiting exhibitors at GTTES 2019. India and its neighbouring countries are main contributors to the increased demand of textile machinery and this expo is an opportunity to translate this demand to supply.

India is one of the few countries in world which has production at every level of textile manufacturing viz. fibre manufacturing, spinning, weaving, knitting, processing and garmenting. The most significant change in Indian textiles industry has been the advent of manmade fibres (MMF). Except spinning, majority of the textile and apparel machinery demand of India is being catered by imports. Weaving sector needs an additional around 82,000 looms. The capacity of knitting segment would need to be scaled up with an addition of 24,000 knitting machines by 2020.

Processing capacity will also need to increase its present capacity, with additional 30,500 million. Additional sewing machines would be required in garment sector by 2020 to cater to the high export and domestic demand for apparel in India. The size of the textile machinery demand and the market opportunity is $75 billion. GTTES 2019 offers sourcing solution to this market in India by focusing on weaving, knitting, printing, garmenting, embroidery and technical textiles.

Reports indicate that the Federal government is all set to announce another package for the textile sector. The Ministry of Commerce and Textile has twice briefed Prime Minister Shahid Khaqan Abbasi on this issue, following which, around seven proposals have been finalised.

The package would be related to cost of doing business as the textile sector was determined to get relief in electricity and gas rates. It has been proposed that electricity rate for the textile segment should fall to Rs 1.45 per unit — presently the rate is around Rs 11 per unit. The prices of regasified liquefied natural gas (RLNG) for the textile sector is expected to fall to Rs 300 MMBTU as against the current gas tariff of Rs 1001 per MMBTU.

The Commerce Ministry has also proposed that the government pay Rs 35 billion sales tax refunds and around Rs 17 billion customs duty drawbacks to the textile sector.

The textile policy liabilities have touched Rs 15 billion, it has been suggested that the government should also address this issue. Further, it has also been proposed that the government should implement a zero rating on packaging material.

Besides, it has been purposed that turnover limit of income tax of the power loom sector should fall from 1 million to 0.5 million. The government had announced Rs 180 billion trade enhancement package in January last year, of which Rs 160 billion was set aside for the textile industry, however, the Ministry of Finance has so far released Rs 16 billion under the prime minister textile package. Officials at the Ministry of Commerce say that exports of the country have registered an upward trend in the first six month following this package.

Online sales project more than triple US$74 billion by 2025, involving one in every five luxury sales.

The Age of Digital Darwinism report says there is a growing need for luxury brands to have digital competency, with McKinsey expecting the bricks-and-mortar environment to become dependent on digital.

E-commerce sales are growing rapidly, making up 8 percent of total luxury sales of online personal luxury goods of $20 billion. Monobrand online stores are currently dominating, by rapidly growing on multibrand platforms. These e-tailers or marketplaces were born digitally, giving them an advantage over brands having to adapt legacy systems, says the report.

Consumers have become more active in the luxury online sector, whether it is sharing content about brands on social media or participating as a secondhand seller or curator.

In an increasingly digital ecosystem, those hovering for success are adopting what McKinsey dubs a “Luxury 4.0” model. Which integrates customer data with production mechanisms and design, aiming to create a seamless process from concept to consumer. Luxury is centred on tradition and craftsmanship, 60 per cent of luxury managers see their brand selling 3D-printed goods within in the next decade.

Luxury brands are also facing competition from outside the industry. Amazon is changing customer behaviour, turning consumers into online buyers and making pushes into categories such as beauty and fashion. Amazon also accounts for 55 per cent of consumer product searches. Converging thriftiness and desire for sustainability is creating new models for consumption, such as rentals and secondhand marketplaces, the report notes.

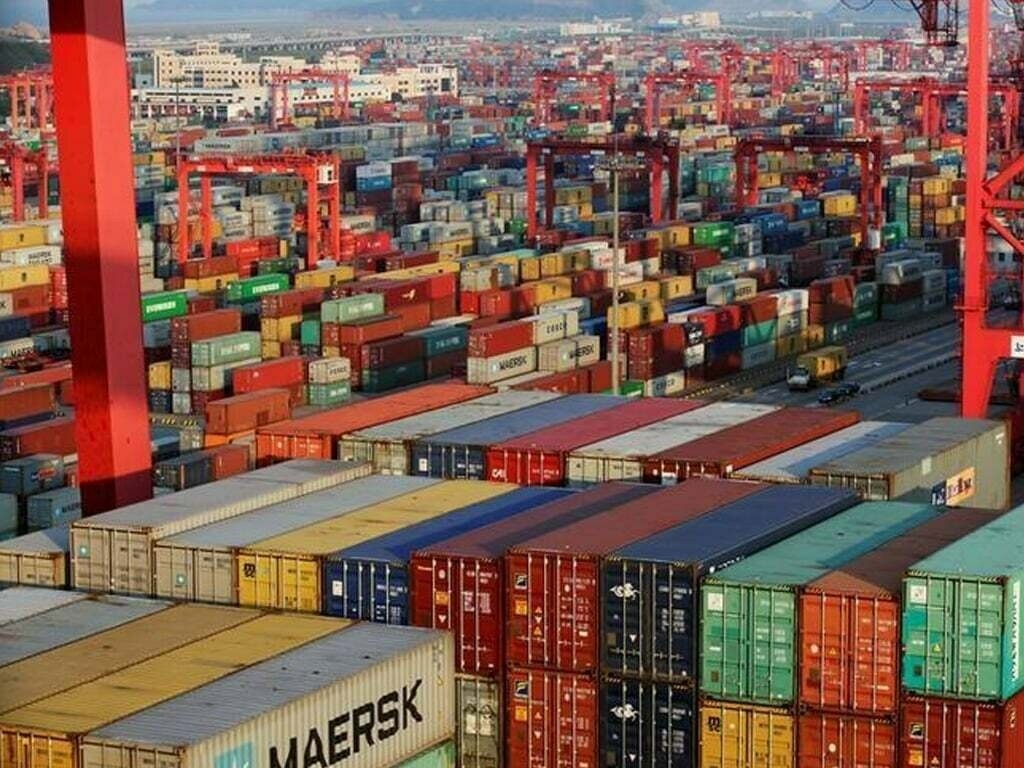

Indian fabrics which are a non-importable item, as per import policy order, are being surreptitiously brought into Pakistan in bulk. The textile sector, the country's major revenue generation sector, is seriously affected by these imports forcing power and silk looms operators to shut shop. Around 400 containers, with about 20 tons of Indian fabric in each container, are imported every month, of which, around 300 containers are directly brought to Karachi market while 100 containers are re-routed to the city as transhipment consignments to Quetta.

The consignments of Indian fabric, which have no stamp of country of origin, were first shipped to Dubai and then Karachi ports under fake Chinese certificate of origin. Then, the consignments were cleared under fake certificate which ensured a Rs 2.8 billion financial loss to the country. The embossment of the country of origin on imported fabric was a mandatory requirement for the clearance of such consignments. Despite knowing the rules, the customs department cleared the goods under fake certificates that lead to a revenue loss of Rs 240 million per month to the country.

Muhammad Javed Bilwani, Chairman Pakistan Apparel Forum (PAF) reportedly confirmed a huge quantity of Indian fabric is being imported, saying they kept requesting the government to provide level playing field to their local industry and ensure strict vigilance/policies to avoid imports of Indian fabric as the influx of the said commodity has caused suspension of operations of 90 per cent power-looms across the country.

The 26th edition of the Italian textile trade show Milano Unica is starting today. The show, dedicated to fabrics and accessories collections for Spring/Summer 2019, will be on till February 8 at the Fiera Milano Rho exhibition centre on the outskirts of Milan. The management says this time there is a 10 per cent increase in the number of exhibitors, from 427 in February 2017 to 470 now. The show will host 416 exhibitors, and 34 Japanese companies featured in the Japan Observatory section, dedicated to Japanese manufacturing excellence and 20 Korean exhibitors featured in the Korea Observatory section.

The show's President Ercole Botto Poala has said, “The satisfaction expressed by buyers last July confirmed our choice was the right one, as it was self-evident, since it enabled us to respond to the market's requirements. Milano Unica's duty has always been to act on the stimuli issued by the world of fashion, not just in the interest of its exhibitors but also of the industry at large." The opening conference will feature a presentation of latest figures on the Italian textile industry.

Also, the conference will give industry the chance to discuss new challenges facing Made in Italy manufacturers, "from sustainability to digital technologies, including fashion tech, new markets and Millennial consumers." Among the speakers, Milano Unica are David Orban, entrepreneur and thought leader on emerging technologies. For the first time, in the Area Tendenze (trends area) section, the show will feature a sub-section dedicated to eco-sustainable products. The Creative Director of Ermenegildo Zegna, Alessandro Sartori, will meet fashion academy students on February 8 to talk about his professional experiences.

Shekhar Agarwal, Chairman, MD and CEO of Bhilwara Technical Textiles whose term in office is to expire on March 31, 2018 has been re-appointed in the same position for another three years by the board of directors.

Agarwal, at 65 years is a B.Tech (Mech.) from the Indian Institute of Technology, Kanpur and has done his MS from the University of Chicago. He is the Group Vice Chairman of LNJ Bhilwara Group. The core business interest of the group includes textiles, graphite electrodes, power generations and power engineering consultancy services.

He is presently on the board of various companies such as RSWM, HEG and Maral Overseas. Earlier, he was the chairman of the Confederation of Indian Textile Industry and the President of the Northern Indian Textile Mills Association. He was also the President of National Committee on Textiles of the Confederation of Indian Industry (CII).

A new survey identifies Bangladesh’s readymade garment industry, and five other sectors, as the highest potential growth segment for the coming decades. LightCastle Partners, reported in its survey of 102 top executives across 12 leading Bangladeshi industries in Dhaka and Chittagong. The confidence index was targeted at gaining an in-depth understanding of the business of private sector players representing varied industries across the economy.

The survey showed business confidence went up from “low-to-moderate confidence of +39” in 2016 to “a cautiously optimistic confidence level of +43” in 2017. The index is determined on a scale of -100 to +100. Some serious areas of concerns were the classified loans condition, bureaucratic red tape for doing business, the fall in readymade garment prices, transportation and logistical issues and infrastructure problems such as port congestions which were decelerating the natural growth rate of business.

Further, power outages have increased production costs and final prices as businesses including apparel manufacturing are heavily depend on backup generators. Bijon Islam, Chief Executive Officer (CEO) of LightCastle, says Bangladesh needs to move export reliance on the garment sector, helping ease of doing business and improving infrastructure/logistics. A deeper look at the report suggests business leaders are confident about verticals like power and energy, ICT and agriculture, while cautious about sectors like readymade garment, banking and finance, real estate and logistics.

Consumers’ are demanding functional footwear so Polygiene technology has come to the rescue in Adidas’s outdoor and trail shoe using Stays Fresh Technology in their Terrex CC Voyager range of shoes. Adidas will extend Polygiene-treated products to its full Terrex footwear line so that with Polygiene technology, consumers can benefit from its functional capabilities without fear of sweat or weather conditions.

Haymo Strubel, Director, Commercial operations for Polygiene in Europe says smelly shoes is a problem almost everybody has experienced and our odour control treatment is the solution. The footwear segment is prime for Polygiene and the launch of Adidas footwear marks an important milestone. As a lightweight Polygiene outdoor shoe, the Terrex CC Voyager features many functional capabilities including breathability, grip and ventilation.

A special climacool open mesh provides breathability to the wearer’s foot, while Adidas’s Stealth rubber gives extra grip on rough terrain and the shoe’s midsole sidewall ensures ventilation during physical activity. Additional features include a dual injection EVA midsole for comfort and a hard outside rim for foot stability as well as quick drying during warmer days.

Wearers will also benefit from Polygiene’s advanced fabric technology. Polygiene is an additive applied on foam, plastics or textiles that prevents the growth of odour-causing bacteria using silver salt (silver chloride)—a natural inhibitor of bacterial growth that is found in soil and water.

"Wazir Advisors’ ‘Business Confidence Index’ is a barometer of what businesses think is going to happen in the near future. In India, so far there has been no textile and apparel sector specific confidence index which could provide forward looking data set or ‘lead indicators’ about the sector’s anticipated performance. With an aim to fill this gap, Wazir Advisors commissioned a biannual Business Confidence Survey for the Indian textile and apparel industry. The first survey was undertaken in November 2017 wherein responses from companies across size, sub-segment and geography were obtained using a structured questionnaire."

Wazir Advisors’ ‘Business Confidence Index’ is a barometer of what businesses think is going to happen in the near future. In India, so far there has been no textile and apparel sector specific confidence index which could provide forward looking data set or ‘lead indicators’ about the sector’s anticipated performance. With an aim to fill this gap, Wazir Advisors commissioned a biannual Business Confidence Survey for the Indian textile and apparel industry. The first survey was undertaken in November 2017 wherein responses from companies across size, sub-segment and geography were obtained using a structured questionnaire. The survey summarises the performance expectations of firms over the next 6-months for Indian economy, textile and apparel industry; and their own organization. Around 80 per cent of the respondents were involved in garment manufacturing.

Six Months Ahead: Positive expectations

In the survey undertaken 40 per cent of the respondents had less than Rs 100 crore of revenue; 54 per cent of the respondents were export oriented; 73 per cent of the respondents employed more than 500 persons and 40 per cent of the respondents said that the current overall economy is worst relative to the last six months. However, 80 per cent of the respondents said that they are expecting a better overall economy in the next six months. 53 per cent of respondents have shown a negative sentiment for the industry’s current scenario, somewhat similar to the feedback received for current economic scenario. However, almost two-thirds of the respondents expressed that conditions will be better in next six months.

Almost 73 per cent respondents said demand and profits have decreased because of GST while almost two-thirds reported increase in unemployment. Lower demand during initial months of GST implementation was a procedural issue rather than an economic one. Consumer demand got postponed in certain instances, but never decreased. Manufacturers reporting lower demand thus indicate depletion of stocks in the supply chain. Eventually, the supply chain will look to replenish stock levels and that would mean a much stronger demand from the suppliers in next 6 months. The impact of GST on input cost did not have a clear trend as 33 per cent said it has decreased while 47 per cent said input costs have increased. At the firm level, the current scenario seems neutral to negative as 40 per cent respondents said there is no change compared to the last six months while one-third said that they are negatively impacted. However, 40 per cent of the respondents reported higher orders than last six months while one-third reported status quo. Majority of respondents nearly 73 per cent, held an optimistic outlook for the next six months with respect to the firm’s performance.

For order book volume, 67 per cent expect it will increase further but a same number of respondents reported no change in investments in the next six months. Almost half the respondents expect the input costs to reduce in next six months but 40 per cent expect them to increase. On the employment expectations, the answers were again mixed with 40 per cent expecting increase while 33 per cent expecting decrease 67 per cent of the respondents view increasing wages as the major constraint to business growth. imports, low demand, rupee appreciation and rising raw material costs were cited by 47 per cent of the respondents as a key constraint. Unavailability of skilled labour was cited as a major challenge by 40 per cent of the respondents. The survey findings point out that Indian textile and apparel industry is at an inflection point today. The responses received indicate that on one hand, firms are feeling a lot of pain because of recent policy changes but on the other hand, they are extremely hopeful of the turnaround.