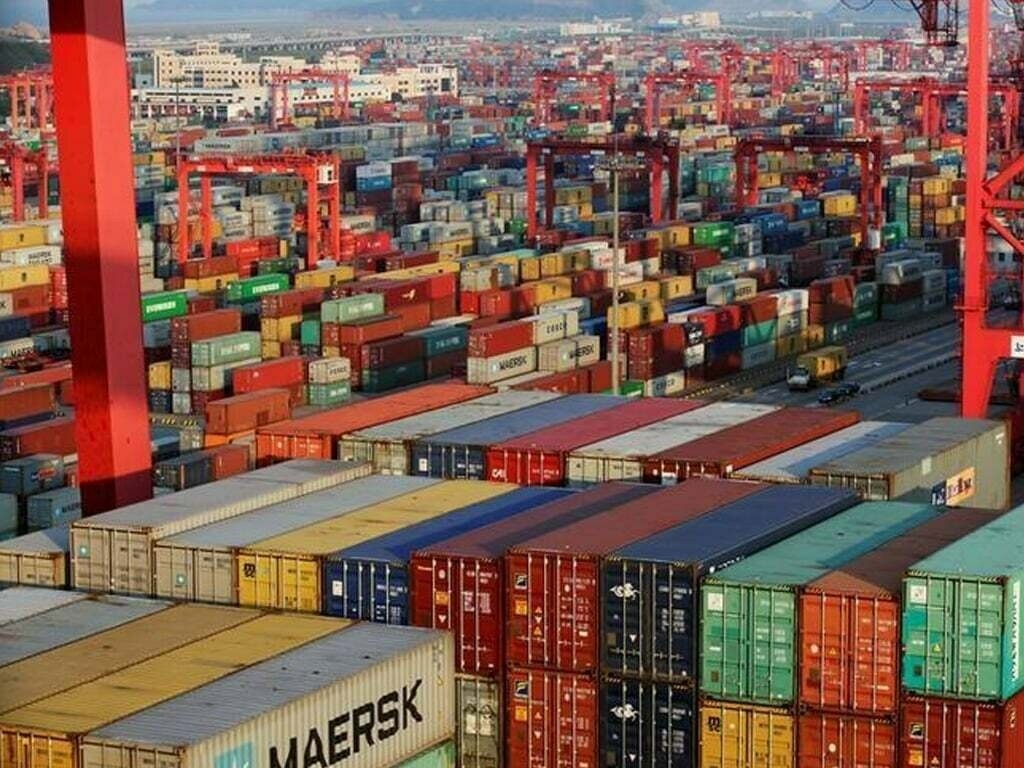

As global trade enters a period of recalibration, Asian exporters are bearing the brunt of escalating US tariffs while simultaneously rethinking their supply chain strategies. Nomura’s latest report reveals a telling picture: Asian exporters are absorbing nearly 20 per cent of US tariff costs, while passing on the remainder to American consumers. The implications stretch far beyond balance sheets, shaking the foundations of global supply chains, particularly in the apparel and textile industry.

The tariff shockwave

The US-China trade war of the late 2010s set the stage for today’s tariff regime, but the geopolitical climate of 2024-25 has intensified the disruption. Tariffs have become a tool of political negotiation as much as economic strategy. For Asian exporters, many of whom serve as critical nodes in global manufacturing networks the immediate question is how much of these tariffs they can afford to absorb without eroding competitiveness. As per Nomura’s findings, exporters across Asia are responding differently depending on the nature of their exports, cost structures, and market strategies.

Table: Country-wise strategy shifts and tariff impact

|

Country |

Share of tariff costs absorbed |

Strategy |

Sectoral impact |

|

Singapore |

>20% |

Leveraging high-value, advanced manufacturing exports |

Electronics, precision instruments |

|

China |

<10% |

Utilizing economies of scale, tech upgrades |

Electronics, apparel, machinery |

|

Vietnam, Cambodia, Thailand |

~0% (passed fully to consumers) |

Limited margin flexibility |

Garments, footwear, basic textiles |

|

India |

Tariff rate >50% (including penalties) |

Diversification & export incentives |

Textiles, garments, engineering goods |

Singapore, leveraging value over volume

The reports reveals Singapore’s high-tech and high-value manufacturing base has allowed it to absorb over 20 per cent of tariff costs, cushioning the impact for US buyers. “Singapore’s export ecosystem is less price-sensitive and more quality-driven,” notes the Nomura report. As a result, sectors like semiconductors, precision engineering, and medical devices remain resilient despite tariff pressures.

China, playing the long game

China, still the world’s factory floor, has absorbed less than 10 per cent of tariff costs a deliberate move to protect margins. Instead, it is doubling down on technological differentiation and economies of scale, offsetting tariff shocks through efficiency gains. This strategy is making Chinese textiles and apparel increasingly competitive compared to ASEAN peers, where tariffs are raising costs. As Wei Zhang, Trade Economist, Beijing University says, “China has the scale and the technological base to blunt tariff impacts, unlike smaller economies that rely purely on low-cost labor.”

Vietnam, Cambodia, Thailand, consumers pay the price

In Southeast Asia, labor-intensive economies such as Vietnam, Cambodia, and Thailand have no room to absorb tariffs. With razor-thin margins in garments and footwear, exporters have passed on the full burden to US consumers. This has caused export prices to increase, undermining the competitiveness of ASEAN-made apparel.

India, struggling, focusing on relief

India presents a more complex picture. Facing 50 per cent tariffs pushed up by a 25 per cent penalty on imports of Russian oil, exporters are under acute pressure. India’s textile exports, worth $17.6 billion in FY25, are vulnerable. Apparel and textile exporters are already squeezed by high raw material costs and global competition. To offset this, the government is charting a multi-pronged response. The focus now is on diversification of export markets targeting Africa, Latin America, and the Middle East. Various incentives for exporters are also being offered including subsidies, interest relief, and duty drawback schemes. Relief packages are being given in the form of fiscal cushion for export-oriented industries, especially textiles and garments.

Table: India’s textile exports

|

Metric |

Value ($ bn) |

|

Total Textile Exports |

17.6 |

|

Share to US Market |

6.3 |

|

Projected Impact of Tariffs (FY26) |

-15% to -18% |

Sunil Khandelwal, President, Confederation of Indian Textile Exporters points out the government is aware of the risks and is working on a relief package. But exporters must also innovate diversification is no longer an option, it’s a necessity.

Apparel and textile sector epicenter of turbulence

The apparel and textile sector is emerging as the most vulnerable. While ASEAN producers have raised export prices, inadvertently boosting China’s cost advantage, South Asian hubs such as Bangladesh and India are positioning themselves as viable alternatives. Meanwhile Vietnam’s apparel exports is up in value but falling in competitiveness. China’s apparel exports is stabilizing due to relative cost advantage. Bangladesh on the other hand is emerging as a low-tariff production hub, attracting investment. As for India struggling with tariff penalties, yet poised to benefit from diversification.

Supply chain rewiring resilience over cost

Nomura’s report highlights a shift in supply chain philosophy. For decades, cost efficiency drove decisions; now, resilience, market access, and geopolitical risk management are paramount.

• South Asia (India, Bangladesh): Attractive due to low costs and market diversification.

• Central & Eastern Europe (Poland, Romania): Gaining as near-shoring hubs for Western markets.

• Middle East (UAE, Saudi Arabia): Rising as logistics and re-export hubs.

Table: Shifting supply chain hubs

|

Emerging supply chain hubs |

Competitive advantage |

|

Bangladesh |

Low tariffs, strong apparel ecosystem |

|

India |

Scale, incentives, government support |

|

Poland |

Proximity to EU markets |

|

UAE |

Logistics, re-export capability |

The report concludes with a note for global investors: the winners in this new trade order will be those who combine strategic alignment with technological agility. Sectors such as textiles, electronics, and semiconductors are under intense transformation, with regional winners determined by their ability to innovate and withstand tariff shocks.

Thus the tariff battles of 2025 are not merely raising export costs they are redrawing the map of global manufacturing. For Asian exporters, the challenge lies in balancing short-term survival with long-term repositioning. While Singapore and China absorb costs strategically, ASEAN exporters pass them on, and India struggles under punitive tariff regimes. Yet, the broader narrative is one of adaptation: supply chains are rewiring, new hubs are emerging, and resilience is becoming the new mantra of global trade.