FW

Budget fashion chain Primark is known for cheap, high turnover fashion and targets youngsters. The business model is designed to produce low cost goods. It keeps costs down by not spending on advertising and buying in bulk to achieve economies of scale.

Primark uses 1,700 supplier factories globally to stock its 290 stores in Britain, Europe and the United States. The factories used by Primark employ about 7, 50,000 people, which impact 2.4 million people, factoring in families of workers.

It started projects in the cotton fields of Gujarat in 2013 in a sustainable farming initiative known as Cotton Connect that recruits female smallholder farmers. It has now expanded to 10,000 farmers in India producing cotton.

Primark, in Ireland, offers women’s wear, lingerie, children’s wear, men’s wear, footwear, accessories, hosiery and home. It manufactures its own merchandise and its technology, efficient distribution and volume buying enable low prices. It doesn’t have an online store. The retailer’s main strengths are impressive depth and breadth of offering, daily replenishment strategy, elevated store service and alluring styling with basic apparel plus trendy accessories. It sells more clothes than any other retailer in Britain. The stores have a youthful décor, neon signage and smart phone charging stations.

To accelerate growth and human development in Bangladesh, the country needs to explore new zones for RMG markets. This would bring in more opportunities as the country has been exporting its RMG goods only in the European Union and North America over the past few years, said Gauhar Rizvi, international affairs adviser to the Bangladesh prime minister. He made the observation while speaking on the last day of the two-day BIDS Research Almanac 2016 in Dhaka.

Quashing reports that say that Bangladesh was unable to sustain garments export, Rizwi said export will go on. But even if not, there was lot of new markets that needed to be explored. Bangladesh only exports its RMG goods in two economic zones viz the European Union and North America while the whole world can become the sectors expected market.

He also suggested exploring new markets in Eastern Europe, Central Europe, Africa and Turkey to accelerate growth and development in the sector. He further said proper negotiating can improve bilateral relationship with these countries.

"While the ‘Made in China’ tag is ubiquitous in almost all products today, there are hardly any products with the tag ‘Designed in China’. While China is known as the factory of the world, there is no focus on producing its own creations. Many flourishing designers and prestigious design schools are thus waiting to tap this opportunity. It’s a strange irony that needs attention from the Chinese companies. In fact, nearly half of all the world’s luxury goods — almost 46 per cent — are bought by Chinese shoppers."

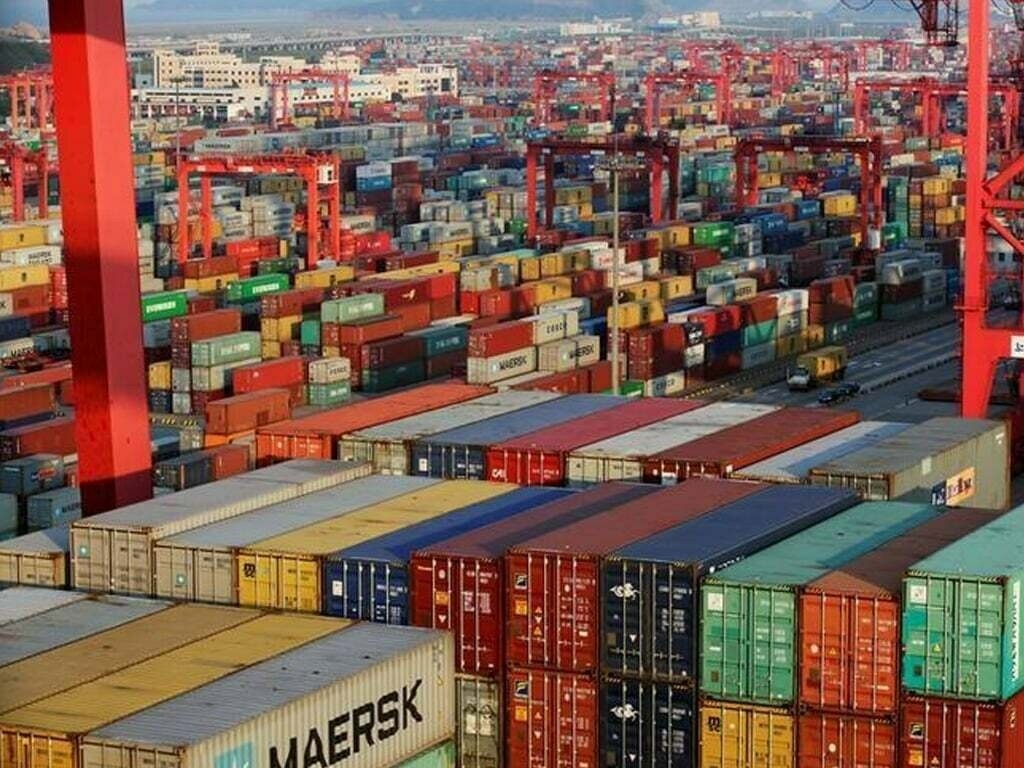

While the ‘Made in China’ tag is ubiquitous in almost all products today, there are hardly any products with the tag ‘Designed in China’. While China is known as the factory of the world, there is no focus on producing its own creations. Many flourishing designers and prestigious design schools are thus waiting to tap this opportunity. It’s a strange irony that needs attention from the Chinese companies. In fact, nearly half of all the world’s luxury goods — almost 46 per cent — are bought by Chinese shoppers. That indicates the burgeoning demand as well. It’s not just buying power that makes China the mightiest fashion consumer on the planet. It’s the workshop of the world, and that’s what actually drives its global potential.

Even though President Trump’s ‘Make America Great Again’ could impact China’s strategy but that won’t change the fact that almost every manufacturer on the planet has China incorporated into its supply chain in some way or another—and fashion brands are a crucial part of this chain.

Filling the gap between self creation and copy

Chinese designers aren’t short of talent or skill but the biggest problem they face is China doesn’t seem to be interested in its own brand. For the Chinese Swiss watches are an essential status symbol, and the country’s elite has developed a taste for high-end French wines. This is hampering the growth of homegrown talent and designers do not have a compelling vision to excel in their profession. For instance, Japanese labels have been successful by reworking blueprints set by the West to create something new and exciting. More recently, Gosha Rubchinskiy has done the same with his quintessentially Russian take on streetwear. Chinese designers showcasing their designs in Paris, New York and London are good but they have not managed to entice the world with an authentic story.

Home to factories

China is home to some of the most advanced textile factories in the world, and has a long legacy of artisanal craftsmanship but the ‘Made in China’ tag has wrongly been associated with cheap, disposable novelties. As Chinese designer, Xander Zhou says, China has become more closely integrated into the global community over the past decades, which means there is now a more enabling environment than ever for the fashion scene.

In mainland China distribution of trendy brands is extremely tight due to hefty import taxes on luxury goods. Luxury watches, for example, are subjected to 60 per cent import tariff, 17 per cent VAT, and in most cases an additional 20 per cent consumption tax. This makes high-end watches in China 97 per cent more expensive than those in Western markets. As a result, many shoppers have to rely on daigou—Chinese resellers—to buy. Based overseas, Daigou purchases luxury goods on behalf of friends, family and clients, allowing them to take advantage of favourable exchange rates and lower luxury tariffs. Daigou are often spotted strolling around luxury boutiques, snapping pictures of pieces for their clients or posting them on their own Weibo profiles. If anything takes their clients’ fancy, the daigou buys it on their behalf and ships it to the mainland at a commission. The Chinese government recently tried to crack down on daigou activity but that doesn’t seem to have curbed it. Successful daigou are social media-savvy, and that’s meant many resellers have since become influencers in China.

Stringent IP laws need of the hour

Intellectual property rights are not enforced tightly in China, and combine that with the country’s production prowess and consumers’ desire for latest piece emerging from the West, that’s when counterfeit clothing takes shape. Some of the most famous knockoffs are Yeezys, Supreme, Gucci and Off-White. However, short-term thinking is not the right approach to build a legacy in fashion and that’s where China is lacking. Knowing that China is a mysterious, exotic place, one with a deeply complex history and culture, having the right talent, the country needs to tell a story and that too by looking in, not out.

"Fashion is no more limited to elite these days. It has percolated down to the so-called common man who are the real drivers of fashion industry. Everyday individuals wear trendy and attractive outfits, dressing to impress. According to a study released by Statista, by 2025, the global market volume of apparel will amount to $2.1 billion. China will be the largest apparel market in the world, with a market volume of $540 billion. Statista's predicts, China will account for 25.6 per cent of the entire global apparel market."

Fashion is no more limited to elite these days. It has percolated down to the so-called common man who are the real drivers of fashion industry. Everyday individuals wear trendy and attractive outfits, dressing to impress. According to a study released by Statista, by 2025, the global market volume of apparel will amount to $2.1 billion. China will be the largest apparel market in the world, with a market volume of $540 billion. Statista's predicts, China will account for 25.6 per cent of the entire global apparel market.

As per the export value, the US, Japan, UK, Germany, and the United Arab Emirates were the top five export destinations for Chinese apparel industry in 2015. The total export value of Chinese apparel market stood at RMB 1,021 billion. The export value of the top five export destinations accounted for 44 per cent of the total export amount of the entire industry.

Deteriorating quality a cause of concern

However, the Chinese apparel industry has been facing quality issues of late. Owing to this, some world- renowned luxury brands are frequently recalled. In August, the General Administration of Quality Supervision, Inspection and Quarantine of the People's Republic of China issued a recall announcement for some imported luxury brand's Children's apparels, as their pH value and formaldehyde level exceeded China's mandatory standards. European Union (EU) have always been a major market for Chinese apparel industry. From 2011 to 2015, its export value accounted for 24.4 per cent of the total export value. ‘Clothing, textiles, and fashion’ is one of the product category under the Rapid Exchange of Information System (RAPEX) that is generating the most concern. According to statistics under RAPEX, 329 reports in total were related to clothing, textiles, and fashion items, among which, 171 reports involved clothing, textiles, and fashion items from China as the country of origin. This report accounted for 52 per cent of the total reported items.

Inspection, need of the hour

In 2013, cancer-induced aromatic amines were detected in a batch of winter school uniforms manufactured by a Shanghai-based fashion company, thus becoming a hotspot for ‘toxic school uniforms’. This further drew attention from the community. To address such risk, TUV Rheinland, with rich experience in inspections and testing, is able to exercise stringent control over apparel items in accordance with the Regulation (EC) No 1907/2006 concerning the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH), thereby eliminating the potential chemical risk involved in apparel.

As a global leader in testing, inspection and certification industry, TUV Rheinland's laboratories are accredited certified by Die Deutsche Akkreditierungsstelle GmbH (DAkkS) in Germany, China National Accreditation Service for Conformity Assessment (CNAS) in mainland China, and Hong Kong Laboratory Accreditation Scheme (HOKLAS) in Hong Kong, enabling it to provide the relevant testing and certification services to apparel items in accordance with the mandatory and recommended requirements under the international or national standard and provisions.

Prior to mass production of apparel items, TUV Rheinland assists manufacturers in conducting preliminary testing of samples, which will ensure the safety performance of those items manufactured. During the process of pre-production, production, and post-production of apparel, TUV Rheinland will conduct a sample inspection and testing over finished apparel items in many areas, including outer look, cohesive force, and sharp tips and edges to ensure the overall quality.

Advice for consumers

Apparels with zippers, buttons, rivets, sequins, or other decorative accessories, need attention to the sharp corners and edges of these small decorative parts. Small parts, including buttons, beads, decorative yarn balls, bows, and fine strings, will pose a potential safety threat to children under 36 months old. Such small parts attached to apparel must be reinforced to eliminate the potential risk of suffocation.

Dark-coloured apparel, as well as items that contain a large area of dye patterns, must be avoided, as these might contain an excessive level of phthalates, which easily poses a threat to the immune system, the digestion system, and the endocrine system. Meanwhile, TUV Rheinland also recommends to pay attention to information published by third-party testing, inspection and certification bodies for purchasing safe apparel items.

Texcare Forum was held in Singapore from November 9 to 10, 2016. This is an affiliated event of Texcare Asia and deals with the laundry, dry cleaning and textile rental industry. It saw 200 delegates from 11 countries and regions. On November 9, the full-day forum featured 10 speakers from Singapore, Malaysia, Indonesia and the Philippines, speaking on their local market situation, challenges and market trends. There were more than 150 attendees from Singapore as well as industry professionals from Belgium, China, Indonesia, Malaysia, the Netherlands, the Philippines, Singapore, Switzerland, Taiwan, Thailand and the US.

A visit to three large-scale laundry plants in Singapore was arranged. It offerd an opportunity to learn about the technologies and operating systems in use. After the summit, manufacturers, agents and laundry service users from Singapore were invited to a banquet, maximising the communication among equipment suppliers and users.

The laundry industry in Singapore is in need of new automation technologies and solutions to reduce the manpower required and provide an age-friendly and smarter work environment for the staff. The event was organised by Messe Frankfurt and the China Light Industry Machinery Association.

An acute cash crunch that followed the scrapping of high-value currency notes has highlighted the woes of ailing jute sector. Raw jute supplies are narrowing with only 40-45 per cent of the stock reaching the market. With it, concerns over the supply of balance stock are mounting as there is lack of cash to pay off farmers, sellers and stockists in the secondary and upcountry markets where raw jute has been stored. In value terms, raw jute of around Rs 4,000 crore is held up in the rural and secondary markets for want of the required payment arrangement.

Disposal of stock of raw jute has halted due to non-payment either in terms of cash or through bank for the past three weeks. The Jute Corporation of India is unable to continue the purchase of raw jute for the past few weeks in the absence of a facility for payment to farmers, transporters and labourers.

Despite a bumper crop size of nine million bales, farmers are in distress as adequate action has not been initiated for disposal of raw jute. Three government organisations namely the Jute Commissioner’s Office, National Jute Board (NJB) and Jute Corporation of India (JCI) are functioning to control the jute sector right from the producer (farmer) level to end user (jute goods manufacturing) level.

Amidst tensions between India and Pakistan, reports say that Pakistan has rejected a consignment of 10,000 bales of cotton worth $3.3 million from India. This was done citing violation of plant quarantine rule by importers. The shipment of ginned cotton, lying at the Karachi Port, was imported by seven textile mills. It was rejected by the Plant Quarantine and Certification Services Office, Ministry of National Food Security and Research Department of Plant Protection.

The customs deputy collector informed that the consignment was imported in violation of the ‘Pakistan Plant Quarantine Act 1976 and Rules 1967’ and said the consignment would be returned to India at the expense of importers. The rejection sent shock waves in the textile industry which has been striving for permission to import cotton from India, the report said. Last year, 2.7 million bales worth $800 million were imported from India to make up for the shortfall after the failure of the cotton crop.

The private sector has imported around 1.2 million cotton bales from different countries and orders for 0.3 million bales of Indian cotton have been placed, it is said. According to textile industry leaders, cotton imported from countries other than India was cleared by the customs authorities without any issue. Zahid Mazhar, senior vice-chairman, All Pakistan Textile Mills Association (APTMA), was critical of the government policy for not allowing cotton imports from India. He revealed the industry needs around four million bales of imported cotton this year to meet supply shortfalls. The country is expected to produce around 10.05 million bales this year against an estimated demand of 15 million bales.

For the third quarter of 2016 Hanes Brands reported a net margin of 8.55 per cent and a return on equity of 61.39 per cent. The firm, an innerwear, active wear and basic apparel retailer, earned $1.76 billion during the quarter. Revenue was up 10.7 per cent compared to the same quarter last year.

Strong e-commerce business and replenishment-driven nature of products as well as strategic buyouts helped it to maintain topline. However, sales have been soft in the active wear and direct to consumer segments for the past few quarters. Limited international exposure and a deep focus on premium brands remain a concern.

It was able to keep its trend of posting year-on-year growth in both top and bottom lines during the period. Hanes Brands’ dividend payout ratio is presently 33.85 per cent. It posted in line earnings in the third quarter of 2016 after reporting a negative earnings surprise in the second quarter.

About 94.28 per cent of the stock is currently owned by hedge funds and other institutional investors. The company, based in the US and founded in 1901, has been consistently innovating to maintain market share and a loyal customer base.

To ensure material for sustainable development, many textile and garment enterprises in Vietnam are investing in textile and dyeing complexes. And to avail themselves of business opportunities from the Trans-Pacific Partnership (TPP) agreement, many textile and garment firms have started building textile and dyeing complexes over the last two years. For instance, 10 enterprises have invested hundreds of millions of US dollars in those complexes in southern Binh Duong Province.

However, US President-elect Donald Trump said his country would leave the TPP but investment to those industrial complexes would still continue for long-term development strategies. Esquel Garment Manufacturing Vietnam has operated in Vietnam for 10 years and mainly imported material from China. In 2015, the company invested in a textile and dyeing factory in Binh Duong for availing business opportunities from the TPP. The factory has completed construction of the building in the first stage and it will begin operations in a year.

With information emerging that the US could leave the TPP, the company would carefully consider its investment plans for the factory in the second and third stages. However, Nguyen Van Luong, DG of Esquel Garment Manufacturing Vietnam said that the decision on investment was under the company’s long-term development strategy in Vietnam but not only for TPP.

Textile and garment enterprises said TPP has prompted them to increase investment in textile and dyeing for production of garment products. In the long-term, development of textile and dyeing would help Vietnam complete its production process for garment products and avoid dependence on material imports as being done at present.

The made-up sector in India will get production incentives and subsidies similar to what the garment sector gets. Made-ups include products like towels, bed sheets, blankets, curtains, crochet laces, pillow covers, towels, zari, embroidery articles and this is the second largest employer in the textile sector after apparel.

The permissible overtime has been increased up to 100 hours per quarter in the made-up manufacturing sector. Employees’ contribution to EPF has been made optional for employees earning less than Rs 15,000 per month. These incentives are part of the Rs 6,006 crores package announced for the apparel sector in June and are expected to help India in creating huge employment, earning foreign exchange and creating traction for the fabric and yarn sectors.

An additional 3.67 per cent share of employer’s contribution in addition to the 8.33 per cent covered under the Pradhan Mantri Rozgar Protsahan Yojana will be given for all new employees enrolling in EPFO for the first three years of employment as a special incentive to the made-up sector. Since the maximum sourcing done by the made-up sector is from domestic industry, it will also help in the Make in India plan. The capital investment subsidy rate for made-ups has been increased to 25 per cent with value cap revised to Rs 50 crores.