FW

Chinese garment manufacturer to open new factory in Arkansas Chinese garment manufacturer Suzhou Tianyuan Garments which supllies to Adidas, Reebok and Armani brands will shortly open a factory in Arkansas that would create as many as 400 jobs. The state has signed a MoU with the company regarding. The manufacturer will invest $20 million in its Arkansas location that would most likely be in Little Rock. The job workers would be paid an average wage of $14 per hour.

The state's deal with the company calls for a $1 million infrastructure assistance grant. This would be $500,000 that would be used for training purposes and an estimated $1.6 million in rebates based on the company's annual payroll.

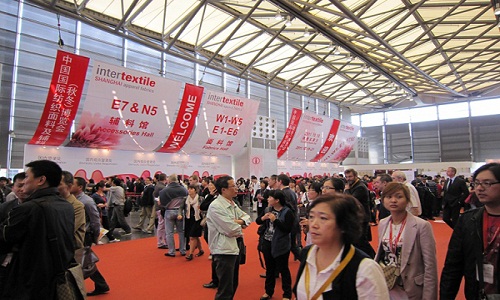

"The recently concluded Intertextile Shanghai Apparel Fabrics-Autumn Edition 2016 received praises from participants and visitors alike on the quality and internationality of the fair’s 22nd edition. After years of consecutive growth in the number of exhibitors, the 2016 show concluded similar in size as last year.

The recently concluded Intertextile Shanghai Apparel Fabrics-Autumn Edition 2016 received praises from participants and visitors alike on the quality and internationality of the fair’s 22nd edition. After years of consecutive growth in the number of exhibitors, the 2016 show concluded similar in size as last year. The 4,553 exhibitors from 29 countries & regions (2015: 4,642, 29 countries & regions) at this year’s fair attracted over 73,000 buyers from 90 countries and regions (2015: 66,256, 97 countries and regions), a roughly 10 per cent increase and a number, which includes those registered for concurrent Yarn Expo Autumn, PH Value and CHIC fairs, and attended Intertextile Shanghai as well. The gross area of the fair grew slightly to 260,000 sq mt (2015: 228,000).

“For the last few years, even though Intertextile Shanghai has continued to grow in size, our priority has been to focus on the quality of exhibitors and buyers that participate here to ensure it remains the global industry’s leading business event every March and October,” says Wendy Wen, Senior General Manager of Messe Frankfurt (HK) said at the conclusion of the show. “While we are aware that the current economic conditions are creating challenges in some sectors of the industry, we are confident that with the unrivalled range, internationality and quality of exhibitors here, this fair is increasingly viewed as the leading event where quality trade buyers come to conduct business, regardless of the prevailing economic conditions.”

Exhibitors, visitors return satisfied

Both new and returning exhibitors reflected this sentiment, including Third Office from Japan, a first-time participant in the fair’s Beyond Denim area. “During the fair, we met many high-quality buyers,” John Xu from the company’s Fabric Department explained. “Our priority is not the quantity of the buyers but the quality, so Intertextile Shanghai is a very effective trade platform for this, and it’s definitely the most influential one in Asia.” Xu also touched on the fair’s global nature. “Being in the high-potential Chinese market, Intertextile Shanghai creates a lot of valuable new business opportunities that other fairs cannot. Apart from local buyers, we also had visitors from the buying offices of overseas brands and manufacturers, and even from an existing customer from Japan who placed an order on the spot!”

Long-term exhibitors and leading industry brands such as DuPont also use the fair as a platform to connect with the industry. “Intertextile has been an important platform for us in the Asia Pacific region for a number of years. As we expand more into wearable technology area, this will be the best place for us to reach out and to connect with the market,” said Gordon Tseng, AP Regional Business Development Manager, Wearable Segment, DuPont Photovoltaic & Advance Materials.

While exhibitors appreciated the diversity and quality of buyers to the fair, conversely these same buyers valued Intertextile Shanghai for the ability to find quality exhibitors covering the entire supply chain under one roof. “Every time we come to this fair, we find old suppliers we have had success with, and new vendors as well. The quality of these suppliers is what brings us back again and again,” commented Dustin Rhodes from Pro Look Sports, US. Italian buyer Salvatore Parasuco, President & Creative Director of Parasuco Jeans says “We come to this show because we can see a lot of what’s available from China as well as many other countries. You can find a lot of interesting products and meet a lot of good vendors here. And through the various country pavilions here, we get to see what’s going on around the world. We can do a lot of research in this one place and accomplish a lot here.”

Intertextile Shanghai Apparel Fabrics – Autumn Edition 2016 was co-organised by Messe Frankfurt (HK) Ltd; the Sub-Council of Textile Industry, CCPIT and the China Textile Information Centre. The next Intertextile Shanghai Apparel Fabrics will be the Spring Edition from March 15 – 17, 2017.

"With around 130 Italian companies participating in ITMA ASIA + CITME 2016 has opened a plethora of opportunities for exhibitors and visitors in terms of tech exchange and innovative capabilities. Spread across 5,400 sq. mt, Italian companies are exhibiting as a part of the National Sector Group, organised by ACIMIT (the Association of Italian Textile Machinery Manufacturers) and ICE-Italian Trade Agency. The four Italian clusters are in the spinning and winding (Hall 1), nonwovens (Hall 2), digital printing (Hall 5) and finishing machinery areas (Hall 6)."

With around 130 Italian companies participating in ITMA ASIA + CITME 2016 has opened a plethora of opportunities for exhibitors and visitors in terms of tech exchange and innovative capabilities. Spread across 5,400 sq. mt, Italian companies are exhibiting as a part of the National Sector Group, organised by ACIMIT (the Association of Italian Textile Machinery Manufacturers) and ICE-Italian Trade Agency. The four Italian clusters are in the spinning and winding (Hall 1), nonwovens (Hall 2), digital printing (Hall 5) and finishing machinery areas (Hall 6).

The high number of Italian exhibitors testified a positive outlook on the future of Asian markets, and China in particular. Asia is one of the most crucial markets for Italian textile machinery manufacturers, capturing around 45 per cent of their sales abroad. “The high number of Italian exhibitors in Shanghai shows that our companies are confident in a further growth of the Asian markets, and China in particular. Compared to the last edition of ITMA ASIA, the space booked by Italian exhibitors has grown by 13 per cent,” saysRaffaella Carabelli, President, ACIMIT.

Betting big on China

The Chinese market is the prime destination for Italian exports. In the first half of 2016, the value of Italian machinery exported to China totaled €152 million (+11 per cent over the previous year), around 17 per cent of Italian total exports. The other main destinations of the area for Italian companies are India, Bangladesh, and Pakistan. The demand for machinery in Asia focusses mainly on machines capable of combining savings in production costs with respect to environmental issues. “Visitors at ITMA ASIA + CITME will once again be able to ascertain in person the extremely high quality and uniquely innovative character of Italian technology on display”, states Raffaella Carabelli. “Less than a year from ITMA Milan, Italian machinery manufacturers will be present in Shanghai with further proposals, aimed at providing rigorous production standards while cutting costs for energy, water, chemical products and other raw materials.”

Sustainable technologies at the fore

Around 40 Italian machinery manufacturers have signed up to ACIMIT’s ‘Sustainable technologies’ project, committing themselves to supplying increasingly sustainable machinery, both from an economic and environmental standpoint. The project is an initiative supported by the Ministry of Economic Development and by the ICE-Italian Trade Agency and is documented on the new website www.green-label.it, which was presented during the ACIMIT press conference at ITMA ASIA. “A website is an additional tool made available to textile operators, aimed at providing a better understanding of what we want to achieve in terms of sustainability,” comments ACIMIT’s President.

In addition to the 40 companies, other Italian exhibitors at ITMA ASIA are also displaying the progress made by their technology concerning cost reduction and production resource savings to visitors of the most important show in the sector in Asia, confirming Italian industry at the top for the supply of sustainable processes.

Asia, the growth market

ACIMIT brings together majority of Italian textile machinery companies (which account for 80 per cent of Italy’s turnover), has been organising active promotional program in Asia, to support the associated companies in their sales efforts. This program is run in cooperation with ICE-Italian Trade Agency.

Italy, with its high-tech and eco-friendly manufacturers, is one of the most important player in the textile machinery industry. “Italian high-quality machines will foster China textile industry’s quality and will provide environmental conservation,” explains Claudio Pasqualucci, Italian Trade Commissioner in Shanghai. China is implementing policies for the reduction of carbon emissions. “The new measures for low carbon economy are: low energy consumption, low material consumption, low-emission and low-pollution, one of the future choices in the economic development. For that reason, we think Italian textile machines eco-friendly technology, should be appropriate with Chinese policies.

China-based Andritz Wuxi Nonwoven Technology offers the full range of services including pilot plant and test stands for customer test trials. The Andritz facility hosts a state-of-the-art needle punch line on an industrial scale, including the A.30 aXcess needle loom, which is available with a down-stroke and an up-stroke set-up. This is particularly suitable for high-quality pre-needling when processing automotive felt, filtration, and geo textile applications at proven industrial speeds of up to 1,200 rpm, with working widths of up to six meters.

The roll service center comprises state-of-the-art grinding equipment and a test stand for various kinds of rolls up to one meter in diameter and 10 meters in length. The test stand enables a performance check on roll parameters, such as line force, speed, and temperature, under production conditions. All roll types can be repaired, reconditioned, and upgraded at the Andritz service center.

Andritz Nonwoven provides reliable solutions in all nonwovens segments, from hygiene to geo textiles, coating substrates, filtration, or automotive applications. The Andritz Nonwoven aXcess portfolio includes lines and individual machines for needle punch, spun lace, and calendaring processes, making it the ideal product for entering the nonwoven market. With one roll in production and one roll in stand-by position, the three-roll calendar offers the highest flexibility in the medium-capacity nonwovens market.

The US has asked India to consider relaxing local sourcing norms in single-brand retail trade to help American companies such as technology major Apple. The issue was highlighted at a meeting between Commerce and Industry Minister Nirmala Sitharaman and US Trade Representative Michael Froman. However, India pointed to reforms in foreign direct investment (FDI) norms that allow relaxation in local sourcing norms in specific cases. In July last, the government had announced relaxation of FDI norms by giving a three-year exemption to foreign players from local sourcing in single-brand retailing and a five-year relaxation for companies providing cutting edge technology. But companies like Apple had sought a blanket exemption.

After the rules were relaxed, Apple has not approached the commerce ministry yet. At present, 100 per cent FDI is permitted in single-brand retailing, but it requires 49 per cent permission from the Foreign Investment Promotion Board. India has pushed for a greater market access for agricultural export as well as institutional mechanisms to improve food export.

Universal Textile is one of Taiwan’s oldest manufacturers of textiles. The company specializes in synthetic woven fabrics and yarns. It has developed a range of linen fabrics using synthetic yarn. This fabric is easy to handle, does not pill after wash and, more importantly, comes at half the cost of linen. On the lines of the linen look, the company has also developed a jute look fabric from synthetic yarn. Universal has two weaving factories with a capacity of three million yards and one yarn factory with a capacity of 2,500 tons per month. Universal currently has 300 looms out, of which 192 are Picanol air jet looms and 72 Tsudakoma water jet machines. In the spinning unit, the company has machines from Muratec and TMT.

The company exports 90 per cent of its products to the US, Europe, Africa and the Middle East. Its current turnover is 75 million dollars. Universal has been supplying key customers in India, including Gokaldas, and many others in Sri Lanka and Bangladesh. It believes that India will become a huge market in the future and is eager to cater to a country with a GDP growth rate of 7.5 per cent and a young population.

Post the re-launch of its global textile business, Microban International, a leader in antimicrobial solutions, has expanded its global textiles team. The appointees include Thomas Case, Director of Business Development for textiles; Zsolt Huszágh, head of textile business development in Europe; Lance Li, senior formulations chemist; Jerry Wang, regional director of Asia Textile Services and Simon Zhao, senior technical engineer and business development specialist.

With the re-launch of Microban’s global textile division, it was vital to bring in additional assets to strengthen and manage customer relationships and product offerings, observed Lisa Owen, senior director of global textiles business at Microban. As director of business development for textiles, Case will be responsible for the Microban and Aegis brands in the Western US, Central America and Mexico. He would target marketing and materials innovation executives of leading active wear, apparel and footwear brands and coordinate programs globally with customer mill partners and Microban teams.

With 20 years of experience in B2B industry sales, marketing and business development, combined with his knowledge of the textile industry, Huszágh will be responsible for leading business development in Europe. Additionally, he holds a textile chemistry degree, and his background includes seven years of leading international sales teams, and eight years of international marketing and communication.

Interacting with the R&D teams, engineering groups and testing laboratories, Li will develop technologies and protocols to assess the performance of surface treatments. He designs new, or improves existing, liquid base coating formulations that keep surfaces cleaner through the reduction of bacteria, odours and soils. Li has more than 10 years of experience in formulations, synthesis, purification and characterization of small molecules, monomers, polymers and nanocomposites using standard analytical tools. Additionally, he has work published in more than 15 papers in his respective fields of expertise.

Working with Asian textile mills, Microban R&D, Microban sales and distribution partners, Wang will leverage his expertise in textile processing through integration of Microban odour control solutions into customer textile products.

Zhao has been with Microban since 2013 and will take on additional responsibilities in his new role, providing technical sales support to China based brands and manufacturers, while continuing to work technically with apparel customers throughout Asia. He has more than 10 years of experience working in textile chemistry and functional textiles industries. Through his past work, Zhao has proved to be an expert in the field of textiles production involving pre-treating, dyeing, printing and post-finishing.

After the presidential elections conclude on November 8, the US fashion industry will convene a meeting to discuss the results and likely impact on trade and transportation for the apparel supply chain. The United States Fashion Industry Association (USFIA) and American Import Shippers Association (AISA) will host the 28th Apparel Importers Trade & Transportation Conference at the Tribeca Rooftop on November 9. This meeting would bring together several hundred executives working in compliance, logistics, sourcing, supply chain management, government relations and social responsibility, it is learnt.

Julia K Hughes, President of USFIA says this was a critical time for the fashion industry because for the first time in recent memory, both presidential candidates are calling for protectionist trade policies. The industry was eagerly awaiting passage of the Trans-Pacific Partnership (TPP) and the transportation community is trying to figure out the path forward after the Hanjin bankruptcy. All these issues will be discussed at the meeting.

Confirmed speakers include: Todd Owen, Executive Assistant Commissioner at U.S. Customs & Border Protection’s Office of Field Operations; J. Berrye Worsham, CEO of Cotton Incorporated; David Spooner of Barnes & Thornburg LLP, former Chief Textile & Apparel Negotiator at the Office of the US Trade Representative and former Assistant Secretary of Commerce for Import Administration; and, executives from American Eagle Outfitters, Macy’s and Anthropologie/Urban Outfitters among others. The conference will also feature a Transportation Executive Forum, with speakers from CMA CGM Americas, Maersk Line North America, The Port of Long Beach and the Transpacific Stabilization Agreement speaking their hearts out. The United States Fashion Industry Association represents the fashion industry: textile and apparel brands, retailers, importers, and wholesalers based in the US and doing business globally.

The cost of clothing in the UK could rise post Brexit. Shoppers have already seen clothing prices increase by 0.1 per cent in September 2016 as the falling value of the sterling makes imports more expensive. Many UK fashion chains import yarn and some manmade materials from abroad, making them vulnerable to currency fluctuations. If they import from China or India, the cost of yarn and raw materials are US dollar denominated. That impacts the cost. Aside from rising costs, there is the potential impact on tariffs from a hard Brexit.

If the UK does not reach a post-Brexit trade agreement with the EU by 2019, the nation could be forced to use World Trade Organisation rules. This would mean tariffs on food and clothing rising sharply, with clothing and footwear prices going up by 16 per cent. Brexit could also affect consumer behavior.

Critical to the UK is immigration. The country’s success is dependent on immigration. It may be necessary to manage the amount of immigration but a ban on immigration could be disastrous. Trade relationships will have to be maintained and new trade relationships have to be found. Continued single market membership would be helpful.

"Due to government’s negligence, Pakistan’s textile exports have been bearing the brunt. Industry representatives asserted if you see the progression of industrial sectors and exports of regional players, they don’t stand anywhere. Bangladesh, India, Sri Lanka, Taiwan, Malaysia, Hong Kong and Indonesia have leaped miles away in exports and industrial growth."

Due to government’s negligence, Pakistan’s textile exports have been bearing the brunt. Industry representatives asserted if you see the progression of industrial sectors and exports of regional players, they don’t stand anywhere. Bangladesh, India, Sri Lanka, Taiwan, Malaysia, Hong Kong and Indonesia have leaped miles away in exports and industrial growth.

Exports of textile made-ups, hosiery, garments, leather products and accessories, marble and onyx products, surgical instruments, sport goods, carpets, jewellery and wooden furniture have been declining. Additional regulatory duty on industrial raw material has drastically impacted exports and increased production cost. Imposition of additional regulatory duty on 797 goods including industrial raw material would not only increase import duty but also shrink volumes of exports due to higher production cost.

Industry recommendations

The leather industry of Pakistan is second largest export industry with total export value of $1.220 billion (2007-08) and the industry can grow double in three years and to the level of $5.00 billion in next 10 years if provided stimulus. Surgical industry can start earning at least $700 million within some years, provided, it was given due attention by the concerned government departments. Estimated world market of surgical instrumentation industry is currently around $36 billion and growing gradually, whereas our exports were hovering $245 to $276 million for last two years.

Similarly, hosiery and knitwear exporters are unable to compete in the global market due to higher utility costs, delays in refunds of sales tax, reduction in duty drawback rates and increased rates of export refinance, according to Pakistan Hosiery Manufacturers Association.

Production scenario

Cotton production crossed 10 million bales in the world’s fourth largest cotton producing country, according to the Pakistan Cotton Ginners Association (PCGA). The PCGA urged the government to introduce a five-year cotton policy to raise production to 22 million bales and exports to 3 million bales through crop insurance incentives and quality premium for farmers. Drawing attention to the issue of government and private enterprises failing to supply qualitative, well-germinated and heat- and virus-resistant seeds to the farmers, PCGA said the area under cotton crop should be increased to 4.2 million hectares from the current 3.2 million hectares.

The Pakistan Readymade Garments Manufacturers & Exporters Association (PRGMEA) in November urged Prime Minister Shahid Khaqan Abbasi to personally direct an early release of funds to implement the package as non-payment of refunds and a sharp rise in cotton yarn prices had adversely hit the value-added textile sector.

In December, Pakistan Hosiery Manufacturers and Exporters Association (PHMA) appealed for withdrawal of duty on the import of cotton yarn, a raw material for the value-added knitwear sector, following the proposed withdrawal of custom duties on raw cotton import from India. The sharp rise in cotton yarn prices has hit the value-added garment sector hard. The package had declared a number of incentives on cotton yarn import, but no such step has been implemented so far, said PHMA. The PREGMEA also asked for revision of the textile policy by formulating regulations for specific sectors therein to tackle decline in exports. Foreign buyers are demanding new garments based on raw material, which are neither available in Pakistan nor produced by Pakistani weavers.

Imposing restrictions

The Pakistan Yarn Merchants Association (PYMA) critisised the National Tariff Commission for imposing anti-dumping duties between 3.25 and 11.35 per cent on import of polyester filament yarn (PFY) from China and 6.35 per cent on such imports from Malaysia. Three-fourths of the domestic requirement of such yarn is met through imports. The APTMA in October opposed the suggestion to stop the 4 per cent rebate on yarn exports on the basis of drawback of duties, local taxes and levies on exports. Export of yarn needs patronage, else it may lead to closure of mills. The spinning sector is incurring losses now by selling yarn below its cost due to poor demand from domestic consumers, APTMA felt. As the domestic industry consumes around 70 per cent of the total yarn production, a substantial amount is left unsold, and needs to be exported.

The International Apparel Federation opened its first regional office at the PRGMEA House in Sialkot in September. It will extend support to Pakistani apparel firms in exports, capacity building and compliance. PRGMEA also signed an agreement with the Dutch National Fashion & Textile Association Netherlands on the occasion to support the Pakistani apparel industry. In August, PRGMEA considered setting up a Pakistan Apparels Export Council to facilitate business in the sector.