FW

William Skinner, Chairman, Savile Row Bespoke Association and managing director of Dege & Skinner, says tailors in London’s Savile Row street have called for rent reductions on their stores. Savile Row is a key destination for affluent shoppers visiting London and is also a tourist attraction with its status as the home of tailoring an important part of the overall package that makes the West End of London stand out.

The street has been under pressure for some time with relatively low margins, the rise of relaxed dress codes, higher business rates and rising rents all conspiring against it. Now a number of suit-makers on the street are asking for rent cuts and greater flexibility over payment terms.

The Pollen Estate is the biggest landlord in the area and has been mulling rent-free periods, rent deferments and monthly rents for reopening businesses. But recent periods have seen tailors like Hardy Amies, Chester Barrie and Kilgour either closing completely or exiting the street. And there are fears that after the crisis are over, if tailors can't afford the rents and if other retailers with deeper pockets are prepared to move in, the character of the street could change forever.

Policymakers worry the knock-down effects of April's historically low exports may cut short outbound trade in FY21 as the March-June period is crucial in the export cycle for many sectors such as apparels and engineering goods. Data released by the Commerce and Industry Ministry shows, India’s exports dipped 60.28 per cent in April to $10.36 billion shrinking for a second straight month as the COVID -19-induced lockdown took its toll on trade with other countries.

The rate of fall in outbound trade was the most since at least April 1, 1995, as manufacturing units remained shut for the first 20 days owing to the nationwide curbs, and faced major logistics and supply-side hurdles later on. The country’s exports had declined by 34.57 per cent in March.

Readymade garments, the sector in which India’s export competitiveness has steadily fallen over the past financial year, managed to push out just $126.31 million in April, registering a 91 per cent fall.

Receipts from the volatile processed petroleum exports fell by 66 per cent in April to just $1.24 billion as global oil prices crashed amid a major slump in -oil and non-gold imports declined by 52.08 per cent.

A recent webinar on retail and ecommerce by CommerceNext, for marketers in New York showed, the global apparel sector is cautiously optimistic as around 49 per cent apparel retailers reported a jump in their online apparel sales from March 29 to April. Sucharita Kodali, Vice President and Principal Analyst at Forrester Research, and J Bennett, Vice President Operations and Corporate Development at fraud protection platform Signifyd shared this view. Kodali said, apparel retailers are rapidly moving towards their sales goals by exploring the e-commerce platforms.

A recent webinar on retail and ecommerce by CommerceNext, for marketers in New York showed, the global apparel sector is cautiously optimistic as around 49 per cent apparel retailers reported a jump in their online apparel sales from March 29 to April. Sucharita Kodali, Vice President and Principal Analyst at Forrester Research, and J Bennett, Vice President Operations and Corporate Development at fraud protection platform Signifyd shared this view. Kodali said, apparel retailers are rapidly moving towards their sales goals by exploring the e-commerce platforms.

Around 43 per cent retailers reported their online sales tracking significantly ahead of their set goals. Another 56 per cent retailers credited this bump to store traffic migrating online, while 49 per cent attributed it to driving demand via marketing.

Intimate brands benefit as ecommerce sales surge

Rebecca Traverzo, VP-marketing at Thirdlove said, intimate brands are benefiting the most from this trend as consumers are feeling a lot more confident in the economy and are less concerned with a possible recession. They are spending money not only on essentials. Seeing this positive trend, the brand is cautiously planning its future actions.

in the economy and are less concerned with a possible recession. They are spending money not only on essentials. Seeing this positive trend, the brand is cautiously planning its future actions.

Bennett views fashion and footwear as the two e-commerce verticals to have overcome challenges and continue selling during the pandemic. Though both these categories saw a pullback early on as consumers flocked to essential retailers for their online shopping needs, they have seen resurgence in the weeks since.

Signifyd also revealed though gross merchandise value (GMV) for fashion purchases that averaged $250 or less was at its lowest in the week of March 16, it has skyrocketed more than 50 per cent by April 13. A reason for this could be that retailers have been able to refocus efforts to delivering online, opined Bennett. They’ve gotten their fulfillment centers deemed to be essential, set up safety requirements so that their employees can work safely in these.

Product launches, efficient marketing mantra for success

Bennett also emphasized that many of these sales are driven by promotions, which makes it unclear just how much of these need to be maintained. In fact, there was a major difference in the dynamic between fashion purchases averaging $250 or less, versus the much smaller segment of those averaging between $250 and $550. These purchases peaked during the week of March 23 due to excessive promotions timed with new product launches, before leveling off in the two weeks afterward. Bennett said new product launches, when handled with efficient marketing are experiencing excellent success.

Though ThirdLove too experienced similar rebounds from both CommerceNext and Signifyd starting from April, the company has not done promotions or discounts for its brand throughout the pandemic. Moreover, they are seeing a drop in returns during COVID-19. It has also opened up a partnership with Returnly for customers to be able to return packages at their local establishes. Even Signifyd revealed a 25 per cent decline in returns due to lack of access to process a return, and new users typically generating lower return rates.

E-tailer Boohoo has raised almost £200 million in extra funding for acquiring new brands. Recently it raised £197.7 million in just 24 hours via a share placing, and that’s on top of the £240 million+ in net cash it had at the end of February.

The cash will used to acquire new brands to add to its existing portfolio of Boohoo, PrettyLittleThing, Nasty Gal, MissPap, Karen Millen and Coast. The company aims to take advantage of numerous opportunities that are likely to emerge in the global fashion industry over the coming months and is looking at a number of possible merger and acquisition deals.

Boohoo is focusing on deals in Europe and the US. However, currently it doesn't want to move out of its online comfort zone. The company is unlikely to continue to operate any physical shops if it bought them.

The Cambodian government has approved a request of the Garment Manufacturers Association in Cambodia (GMAC) to produce all kinds of face masks, medical equipment, and protective clothing for both domestic consumption and export.

As masks, medical equipment, and protective clothing are being sought after by the world to help curb the COVID-19, the government supports and encourages factories to produce the aforementioned items, according to the Ministry of Economy and Finance’s letter sent to GMAC president.

Spokesperson of the Cambodian Ministry of Labour and Vocational Training Heng Sour earlier said the export of garments and footwear is forecast to drop by 50-60 percent in the second quarter of this year due to the impact of the pandemic.

The Q1 exports nosedived by 80 percent year-on-year when the COVID-19 broke out in the EU and US – the two largest markets of Cambodian garment products – in February, he said.

Over 180 apparel factories have now suspended operation, and another 60 are thought to be close to suspension, affecting lives of about 200,000 workers.

According to the Cambodian Ministry of Industry, Science, Technology and Innovation, the Southeast Asian country is home to 1,099 factories operating in textiles, footwear and handbag industries.

While China has agreed to purchase an unspecified amount of hemp fiber from the United States in a recently signed agriculture trade deal, there are currently no suppliers of the material in the US

The leading company that had been processing hemp for fiber, Kentucky-based Sunstrand LLC, filed for bankruptcy late last year, in part due to its inability to source raw material. The company had been turning out fabric fibers for apparel maker Patagonia, and claimed to be producing hemp-fiber based door panels for BMW as well as filters for water treatment and hemp fiber products for the construction industry.

Wyndrige Farm, a private company based in southeastern Pennsylvania, USA buys purchasing Hemp Train decortication technology from Canadian Greenfield Technologies for $1.5 million to be installed in an 80,000-sq-ft fiber processing facility.

Dallas-based Panda Biotech has signed a contract with an international equipment manufacturer for construction of the largest hemp decorticator in the country, with plans to process hemp grown in Texas exclusively into textile-grade fibert and cellulose. But Texas farmers are yet to get licenses to grow the hemp fiber.

G-Star Raw has entered into voluntary administration in Australia, despite reportedly not experiencing any major debt. The decision leaves an uncertain future for G-Star Raw’s 57 stores across Australia and 200 employees.

Ernst & Young’s Justin Walsh, Stewart McCallum and Sam Freeman have been appointed administrators of G-Star Australia and are conducting an urgent assessment of the company’s affairs and will determine the strategy for the administration as soon as possible. The administrators named major commercial landlords as the company’s most significant creditors.

The Australian operations of G-Star Raw previously went into voluntary administration in 2015. States and territories in Australia, which has 97 reported deaths from COVID-19, are easing restrictions since the country shut its boarders to all non-citizen and on March 19, 2020.

Since the start of 2020, Australian department store Harris Scarfe shut more than 20 stores and several specialty retailers have collapsed. Jeanswest, a denim chain store with 146 stores in Australia, also entered voluntary administration, citing online competition and tough market conditions.

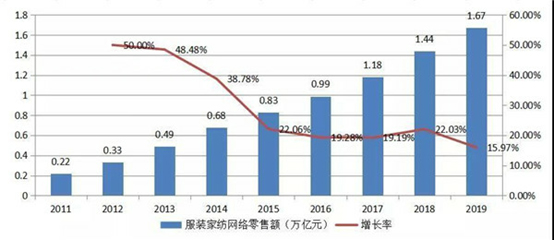

In the pre Corona period, statistics show 2019 as an year of continued growth in textiles and apparel online sales to conclude 6.69 trillion Yuan, up by 12.06 percent Year- on- Year. B2B ecommerce sales topped taking a lion-share of 73.24 percent at 4.9 trillion Yuan. Online retail sales of apparel/home-textiles maintain an impressive share of 19.6 percent of all the online shops, selling all types of goods in the country. Also, it is significant to know; online share of sales of offline players is growing and reaches touches up to 22percent.

On May 13, China Commercial Circulation Association of Textile and Apparel (CATA) issued an annual report (E-Commerce of Textile and Apparel 2019) that gives a panoramic view of the textiles and apparel sales online, a very good source of information for readers to understand shopping behaviour, in spite of the slowdown in brick-and-mortar.

Executive summary

The year of 2019 witnessed a stable growth in textile industry in the process of the reforms on the front of supplies, industrial transformation and upgradation while putting efforts to withstand the risks of the economic down. As e-commerce system has been evolving and growing to a big scale, the textile and apparel online sales, that had experienced high-speed growth in the e-commerce during pre-matured phase, is now getting into an evolved new model, new business practice and new consumption phase through increased digitalization process. 2019 was a year of continued growth in textiles and apparel online sales to conclude 6.69 trillion Yuan, up by 12.06 percent Year- on- Year.

| Online Business for the whole textile industry in trillion Yuan |

|

| unit: trillion Yuan in blue bar, red curve for growth rate |

B2B leads the total e-commerce pack

As calculated, the total turnover of online sales for textiles and apparel reached 6.69 trillion Yuan, B2B stood out at the top, amounting to 4.9 trillion Yuan, taking a lion-share by 73.24 percent, while apparel and home-textiles combined to reach sales of 1.67 trillion online retail. While the overall growth continues to drop from 32.14 percent in 2012 to 12.06 percent in 2019 (indicated above in red), as in the initial years, the total base value wasn’t as high.

| B2B online deal in trillion Yuan |

|

| unit: trillion Yuan in blue, growth rate in red curve, and share of total sales in green curve |

Textiles/apparel sector enjoys 19.5% share in sales

Although B2B is growing by 10.61 percent and still dominating in value in the total sales of textiles/apparel sector, but it is 15.97 percent growth rate of the online retail of apparel/home-textiles that speaks louder. Just to mention, online retail of apparel/home-textiles has an impressive share of 19.6 percent across the all goods online shops in the country, observing from 14 important e-commerce retail platforms monitored by Ministry of Commerce ( MoC). The statistics from MoC databank show that there are 19.469 million online retail shops, out of which the apparel and home-textile shops takes up leading 33.1 percent in total share.

| Apparel and Hometextiles Retails in trillion Yuan |

|

| unit: trillion Yuan in blue bar, and growth rate in red curve |

Online sales share of offline players reaches upto 22%

In the report, China Commercial Circulation Association of Textiles and Apparel (CATA) particularly pointed out that the brick-and-mortar textile and apparel-specific wholesale markets (yarn, fabric, home-textiles, knitwear, and garment buildings/complexes, sales center or specialty markets, etc) through e-commerce to touch 1.47 trillion Yuan, up by 8.89 percent, representing 21.97 percent the total online retails for textiles and apparel. Apparently, that is the way forward for all the off-line specialty shops or garment buildings/complexes to align with the tide of online boom.

Contributed by Mr. ZHAO Hong

He is working for CHINA TEXTILE magazine as Editor-in-Chief in addition to being involved in a plethora of activities for the textile industry. He has worked for the Engineering Institute of Ministry of Textile Industry, and for China National Textile Council and continues to serve the industry in the capacity of Deputy Director of China Textile International Exchange Centre, V. President of China Knitting Industry Association, V. President of China Textile Magazine and its Editor-in-Chief for the English Version, Deputy Director of News Centre of China National Textile and Apparel Council (CNTAC), Deputy Director of International Trade Office, CNTAC, Deputy Director of China Textile Economic Research Centre. He was also elected once ACT Chair of Private Sector Consulting Committee of International Textile and Clothing Bureau (ITCB)

The Havaianas brand, which is known all over the world for its rubber flip-flops, has opened a new chapter in its history with the launch of its first ready-to-wear collection for the 2020 spring-season.

Over the years, Havaianas has considerably expanded its range of rubber-soled summer shoes. But the brand has now embarked in a new direction for the 2020 spring-summer season with the presentation of its very first ready-to-wear collection for men and women, which is mainly composed of beachwear.

Not surprisingly, this first collection launched in Europe is inspired by the Brazilian style so dear to Havaianas, which emphasizes vibrant colors and comfort as do the brand's flip-flops.

The collection consists of a wide selection of swimsuits, pool shorts, T-shirts (in short, fitted, and oversize styles), dresses, shorts, and jumpsuits. Note that some of the designs in the ready-to-wear collection perfectly match those of Havaianas flip-flop models.

Havaianas is already selling a selection of these beachwear pieces in its online store.

Japan's Renown Inc, part of Chinese fashion empire Shandong Ruyi, filed for bankruptcy with 13.9 billion yen ($130 million) in debt, the country's highest-profile business to collapse amid the coronavirus outbreak.

Renown, a century-old textile company which sells clothes under brands such as Arnold Palmer, Hiroko Koshino and D'Urban filed for bankruptcy protection after a month-long closure of department stores brought the already-struggling business to its knees.

It joins a list of global fashion companies, including retailers such as J. Crew and Neiman Marcus, which have collapsed due to the pandemic.

Renown, which at one point owned British clothier Aquascutum, had reported losses for years. Shandong Ruyi emerged as a leading shareholder in Renown a decade ago and has since become its majority stakeholder.

Earlier this year, Renown was seen struggling to collect more than 5 billion yen ($45.2 million) in debts from its Chinese parent. Its top executives were also recently voted out of its board by the parent firm.

The Chinese group has been facing increasing refinancing pressure after spending billions of dollars to buy a range of European luxury brands and Asian labels, including French fashion house SMCP and Aquascutum.

So far more than 140 Japanese companies have gone bankrupt since February due to the outbreak of the coronavirus, according to research company Tokyo Shoko Research.

Prime Minister Shinzo Abe's government last month declared a state of emergency in response to the coronavirus crisis. While this did not involve a strict lockdown as seen in other countries, department stores and bars have been closed.