FW

When it comes to high-waisted, super black, skinny-fit jeans, Just Black is the brand to go to. This US brand sells denim for women that is a little bit thicker than normal skinny jeans and super high rise.

Customers of varying shapes and sizes love the brand. While for instance a brand like Rag & Bones may be too saggy at the waist and too tight at the ankles. Or a brand like Cheap Mondays may be a little too cropped for ankle boots.

As makers of handcrafted denim, Just Black believes each jean is sewn to mold for every type of body. Each pair is sanded by hand and hand sewn to ensure the authentic details are captured. Quality, value and comfort are all co-dependent to make the perfect pair.

The attention to detail of the stone wash, hand sanding and distressed hems are what make the brand’s denim stand out from the rest.

Each piece is created with classic workmanship. The denim collection is curated to combine modern details with versatile silhouettes creating an easy to wear jean. Luxuriously soft and stretch fabrics are used to create the most comfortable pant ever. Just Black Denim is sold in boutiques across Europe and North America.

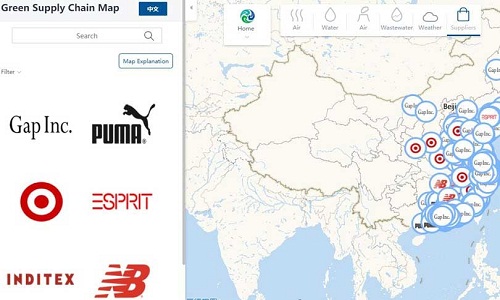

"IPE Green Supply Chain Map links major fashion brands such as Target, Esprit, New Balance, PUMA, Gap Inc, and Inditex with their suppliers’ environmental performance. Kurt Kipka, Senior Project Manager – Responsible Sourcing Initiative, NRDC, says each brand conducts a mapping process against a database of Chinese facilities that have publicly available real-time monitoring. In most cases, the brands have already made these lists available to the general public. In that case, the map simply takes existing information and improves upon its usability."

IPE Green Supply Chain Map links major fashion brands such as Target, Esprit, New Balance, PUMA, Gap Inc, and Inditex with their suppliers’ environmental performance. Kurt Kipka, Senior Project Manager – Responsible Sourcing Initiative, NRDC, says each brand conducts a mapping process against a database of Chinese facilities that have publicly available real-time monitoring. In most cases, the brands have already made these lists available to the general public. In that case, the map simply takes existing information and improves upon its usability. Access to data is a critical step in both identifying and curtailing highly polluting practices in the textile supply chain.

Increased transparency As per NRDC and IPE, with China expanding its industrial manufacturing base, as much as 25 per cent of carbon emissions have been linked to the manufacture of products for export. Air, water, and soil pollution problems have emerged. The impact was mentioned in the Ellen MacArthur Foundation’s Circular Fibers Initiative reports as well. Heavy chemical use is involved in making other cellulose-based fibers, in particular viscose. The processes used to make these fibers extract cellulose from trees or other plants using a variety of process-specific chemicals. By connecting supplier lists with publicly available information, brands and eventually consumers can use the tool to reduce the global impact of textile manufacturing by making more informed purchasing decisions.

The IPE Green Supply Chain Map, having English and Chinese versions, offers companies real-time information to ensure environmentally responsible operations from afar. When used correctly, the IPE Green Supply Chain Map can reduce the time and expense associated with factory audits, which often don’t identify hidden problems as well.

The functionality

With the help of data from the Chinese government, IPE’s database and map show real-time data and historical trends in air pollution emissions and wastewater discharge for nearly 15,000 major industrial facilities in China. The database also has environmental supervision records for more than 500,000 additional facilities. So far, the response for the map has been good.

One of the potential advantages of the IPE Green Supply Chain Map for participating brands is just-in-time identification of potentially egregious supply chain oversight and management issues. Recognising these issues can drastically reduce the time it takes brands to collaboratively address the concerns with their business partners, added Kipka. In addition, joining the map underscores a brand’s commitment to setting and upholding standards of performance. Although the map in its early stages of development, the company hopes it inspires more companies to follow the leadership of its inaugural brands and volunteer their supply lists to the effort. The company hopes that it should also be beneficial for other countries to adopt such a map and manage their supply chain eco-measures.

The global luxury apparel market is expected to expand at a CAGR of 13.2 per cent from 2016 to 2024. Big brands such as Louis Vuitton, Prada, and Versace are expanding to developing economies, which has not only improved their geographical reach, but also won them a newer consumer base.

The global luxury apparel market is segmented into leather, cotton, denim, silk, and others. Cotton dominates the global market and it held a share of 35.87 per cent in 2015. The material has become ubiquitous in the clothing and fashion industry due to high absorbency, comfort, and the breathable nature of the fiber. High cotton production in India and China has also made Asia Pacific a frontrunner in the global market.

Leather is the next emerging segment in the global market. This material is being preferred due to its durability and ability to adapt to myriad designs that characterize high fashion. The expensive nature of leather also makes it ideal for luxury brands, who work on the premise of premium pricing of what they feel is the exceptional quality of products.

Silk is also gaining momentum due to its smooth texture, softness and the elegance it bestows on the overall design. The production of silk in India and China has also once again lent an impetus to the luxury apparel market of the Asia Pacific.

Egypt wants to have stronger trade relations with Africa. Steps include taking part in international exhibitions in the African continent and setting up an Egyptian-African free trade zone. The main countries Egypt is interested in are Kenya, Zambia and Ivory Coast.

Challenges include the weakness of the banking sector in many African countries and the poor infrastructure. In addition, the lack of maritime ports is a challenge, since many African countries are landlocked. There is also the problem of a lack of logistical centers that makes establishing permanent exhibitions for Egyptian products more difficult.

The problem is that of improving shipping lines and finding shipping lines that directly target a large number of African markets. Working to make Egypt a leading international trade center in the Middle East requires work to increase the capacities of Egyptian ports in order to attract more container ships as well as working on the development of logistics capabilities and infrastructure to support this trend.

Egypt’s main exports to Africa are engineering industries, pharmaceuticals, chemical garments, food industries, and construction materials. Egypt wants to increase exports to the African continent by 35 per cent in 2017. Other important markets for Egypt’s exports are the United States and European Union countries.

Cambodian garment exports get preferential access in markets like Canada, Japan and especially the EU. The EU is its largest export market, accounting for 45 per cent of its total garment exports. The EU grants Cambodia duty-free access under the generalized Scheme of Preferences (GSP) Everything But Arms (EBA) arrangement.

Cambodia’s total exports of garments and footwear to Japan increased by 32.7 per cent in the first half of the year, that is, January to June 2016. Cambodia has lower production costs than has Japan and so Japan doesn’t produce much of garments and footwear.

The main products that Cambodia exports to Japan are garments, footwear, sugar, fish and seafood. Imports from Japan are mainly machinery, automobiles, electronic products, beef, iron, steel and pharmaceutical products.

Companies which buy from Cambodia include H&M, Inditex, Marks & Spencer, New Look, Adidas, Nike, Levi’s and Uniqlo.

The garment industry of Cambodia earns 80 per cent of Cambodia’s foreign exchange earnings and employs an estimated 3,50,000 people in more than 300 factories.

Cambodia relies heavily on garment exports to earn foreign earnings. There are now plans to shift from low-priced garment manufacturing to higher end manufacturing of automobile, machinery and electronic parts, which will help it diversify its export basket and maintain the overall health of the economy.

Global cotton prices are likely to remain firm amid tight demand-supply conditions. International prices have remained high. Consumption is expected to outpace production thereby leaving less room for a bearish trend in cotton prices.

World cotton production for the 2016-17 crop year is estimated at 22.83 million tons — higher by 1.76 million tons than the 21.07 million tons produced in 2015- 16.

Global consumption of the fiber for 2016-17 is estimated at 24.25 million tons, up 0.05 million tons than the consumption of 24.20 million tons during 2015-16.

The fall in production during 2015-16 crop year was not anticipated and has led to a 14 per cent decline in both world ending stocks and in stocks outside of China. This pushed cotton prices up till the end of the last cotton season.

In India cotton prices were at lower levels almost during the entire 2015-16 season, resulting in lower realisations. This has led to a reduction of over 10 per cent in the acreage under cotton during 2016-17.

However, due to the improvement in productivity expected on account of better weather conditions across all cotton growing regions of the country, the country expects to produce about 345 lakh bales during 2016-17.

The directorate of handlooms and textiles was recently inaugurated at Lamphel, Imphal by the state commerce and industries minister Govindas Konthoujam. The newly launched directorate will promote the sales of handloom and handicraft products produced in Manipur. It will also help to enhance the quality of handicraft and handloom items.

The handloom and handicraft sector is one of the main economic contributors in Manipur. Under the Ambedkar Hastshilp Vikas Yojana (AHVY), handicraft cluster projects were also launched by Konthoujam along with a handicraft museum at the inaugural programme. AHVY aims to promote the handicraft sector by creating artisans who have capability to manage things professionally.

As per the Manipur Handlooms and Handicrafts policy 2016 that was released at the inaugural programme, 50 per cent of the state’s handloom and handicraft products will be sold to the state government while a mere 20 per cent will be given to private buyers, said the minister.

He also urged the weavers and artisans of Manipur to increase the quality of the handicraft and handloom products that will increase the scope of getting better price internationally. The state government will provide the required assistance to increase the production quality, according to a leading daily.

The programme also witnessed distribution of awards for distinguished contribution in handicraft and handloom sector. State handicraft and handloom awards were bagged by six persons for their outstanding contribution in the field. Incentives were also distributed to one state level handicraft cluster project and nine district level cluster projects. Konthoujam also handed over 10 merit awards to persons from handloom and handicraft sector.

Buyer delegations from across the world will attend the third edition of the Morocco International Home Textile Fair scheduled to take place in Casablanca, North Africa from February 24 to 27. At this event, National and international companies will promote their skills to form new partnerships with various international brands that will attend the fair.

Pyramids Group Fair and Expotim are organising the Morocco Hometex. Items like bed linen, curtains, bath textiles, upholstered furniture, kitchen textiles and more will be exhibited at the event. Thousands of professional buyers will come together at the Fair along with the country’s Buyer Delegation Programme from its target countries such as Italy, Spain, Quatar, Gambia, Ghana, UAE, Egypt, Nigeria, Liberia, Senegal, Kuwait, Guinea, Jordan, Algeria, France and Tunisia, the organizers informed.

The second edition of the fair saw delegations from countries like Turkey, Morocco, Egypt, USA, Portugal, Greece, Italy, China, Pakistan and India in attendance. Over 12,308 local and international visitors from West Africa, North Africa, Middle East and Gulf Countries, European countries such as Italy, Germany, Spain, Portugal, France, Belgium, Greece, Netherlands, England and America had attended the Morocco Style Fair that was also held simultaneously in Casablaca.

On a recent visit to Brandix India Apparel City near Visakhapatnam, textile commissioner Dr Kavita Gupta heaped plaudits and called it a great success story and an example that other Textile Parks in India should follow. In particular, she appreciated the world class infrastructure that Brandix has set up. This would help boost Indian textile and apparel exports, she said.

A news website quoted the textile commissioner complementing Brandix for its water treatment and effluent plants that helped units inside the park, meet global standards. She advised the management of the Apparel City to develop an integrated value chain across all segments like spinning, weaving, garments and also technical textiles. While being the largest textile park in the country, the Brandix India Apparel City is also the biggest employer of women workforce at a single location, which totals to over 15,000.

As a means to apply for FDI and benefit from lower duties, Japanese sportswear brand Asics is in plans for local sourcing in India. Considering that its competitors like Nike and Puma have already got FDI clearance to start their own stores, Asics has to wait till it completes the 30 per cent local sourcing norm before it can get away from the franchise model.

Unlike its peers that are looking at manufacturing ‘Make in India’ products, Asics is still an imported footwear brand although it has started some amount of local production for apparel recently. Currently, Asics imports its footwear primarily from China and Indonesia much like other international brands including Clarks and Skechers, despite having Indian partners for their ventures.

While both Clarks and Sketchers have forged JVs with Future Group, Asics had decided to have a distribution pact with Reliance Retail which ended in 2015. The UK-based footwear major Pavers England was the first footwear company to get 100 per cent FDI and was the initial player to utilise the single brand FDI opportunity.

In India, Asics is now positioning itself from a sportswear to a lifestyle brand. Currently, Asics has 14 mono brand stores and expects to add another 12 such stores this year. It has also been spending on events like the Mumbai Marathon by becoming the official sponsors for three years to build its brand in the country. Asics, which has its headquarters in Kobe in Japan, has its biggest markets in the US and Europe and considers Japan as its second largest market.