FW

India-UK FTA will help eliminate the existing duty handicap, which had hindered Indian textile and apparel exporters from increasing their market share in the UK, opines Rakesh Mehra, Chairman, Confederation of Indian Textile Industry (CITI).

With the new India-UK FTA, Indian textile and apparel goods will now benefit from zero duty access to the UK market, he adds. The agreement has the potential to significantly transform the fortunes of the entire Indian textile sector and provide the kind of impetus which is necessary to help India realize its ambitious goal of achieving textile and apparel exports of $100 billion by 2030, he opines.

Highlighting the good complementarities offered by trade with the UK, especially as India emerges as a potential supplier of raw materials like MMF (man-made fiber) filament and specialized non-woven fabrics, this FTA will allow Indian exporters to enjoy a more level-playing field vis-à-vis their peers from other countries when it comes to the UK market, Mehra says.

Currently, India is the fourth-largest supplier of textile and apparel products to the United Kingdom, holding approximately a 6.6 per cent share of the UK’s total T&A imports. In 2024, the UK imported T&A products valued at around $27 billion, with apparel and made-up goods accounting for 83 per cent of this total. China was the leading supplier to the UK with about a 25 per cent share, followed by Bangladesh (15 per cent) and Türkiye (8.5 per cent). An analysis of the UK's top 20 imported textile and apparel commodities (at the HS 6-digit level) reveals Bangladesh leading with a 23 per cent share, followed by China (22.6 per cent), Türkiye (10 per cent), and India (4 per cent).

CITI is actively working with the industry and local authorities to ensure Indian companies can fully leverage the opportunities presented by the India-UK FTA. The organization aims to raise the business competitiveness of local textile and apparel units, Mehra emphasizes,

This year marks a significant milestone for the global authority in sustainable chemical and environmental management for the textile and fashion industry, bluesign as the company completes 25 years of operations. To commemorate its 25th anniversary, the company plans to host a series of events, expert panels, and global activations throughout the year. These initiatives will celebrate the achievements of its partners and educate the industry on the future of sustainable textiles.

Founded in Switzerland in 2000, bluesign has been at the forefront of the global drive to build a sustainable future by developing a science-based, input stream management system. This innovative approach aims to eliminate harmful substances at the very source of textile production. Now encompassing over 900 system partners worldwide, bluesign continues to deliver measurable reductions in environmental impact on an unprecedented scale.

The company sets the global benchmark for responsible production with stringent criteria for chemical use, environmental performance, and resource efficiency. It also serves as a comprehensive resource for navigating evolving ESG and upcoming legislation, such as CSDDD, CSR, ESPR, and DPP. This support helps partners stay ahead of global compliance standards while integrating verified sustainability into every production stage.

The bluesign System enables partners to achieve verifiable and measurable progress toward their sustainability goals. Over 28,000 chemical products and 70,000 textile materials have earned the bluesign Approved status, signifying compliance with the strictest industry criteria and the elimination of hazardous substances, including CMRs and PFAS. Since 2019, bluesign System Partner manufacturers have collectively made substantial improvements in their environmental footprint. The bluesign network now boasts over 900 system partners, including chemical suppliers, textile mills, manufacturers, and brands, ensuring worker and consumer safety through transparency and accountability.

bluesign was formed with a vision to embed sustainability into the DNA of product creation, notes Daniel Rüfenacht, CEO of bluesign technologies. The company has evolved into a beacon of trust, innovation, and responsibility, and partners with industry leaders worldwide in building a more sustainable future together, he adds.

bluesign's unique value lies in its holistic system, which tracks and verifies impact at every stage—from chemical inputs to the final product. Its independent, science-based verification process goes beyond traditional certification, ensuring ongoing compliance and continuous sustainability improvements, building trust with stakeholders, and empowering the industry to move forward responsibly.

At this year’s Kingpins New York event, Eastman Naia showcases a four-look denim capsule collection made with Naia Renew- a circular cellulosic fiber produced using 60 per cent sustainably sourced wood pulp and 40 per cent GRS-certified recycled waste.

A collaborative effort with a global leader in sustainable denim manufacturing, Advance Denim and LA-based denim designer Loren Cronk, this collection seamlessly merges fiber innovation, responsible production, and bold design, aiming to transform denim from the inside out.

The heart of this collection is Naia Renew, Eastman’s circular cellulosic fiber produced from 60 per cent sustainably sourced wood pulp and 40 per cent GRS-certified recycled waste. The fiber is created using Eastman’s carbon renewal technology (CRT), a molecular recycling process that breaks down hard-to-recycle waste into its basic building blocks, creating an acetyl stream for new cellulose acetate fibers. This results in a high-quality fiber that offers both creative versatility and strong environmental responsibility.

The capsule collection brings Naia Renew fiber blends to life, making a bold, interactive statement in denim design. It encompasses three key style expressions - authentic, fashion, and performance - presented through four complete looks. Each style is crafted using Naia Renew fiber blends to provide exceptional wearing comfort, thanks to the fiber’s key benefits: cottony softness, breathability, lightweight feel, and moisture management. This combination ensures each look delivers not only standout style but also lasting comfort throughout the day.

For an authentic feel, the collection pairs Naia with cotton, resulting in a familiar, soft handfeel. The fashion look opts for a more elevated finish by blending Naia with lyocell. Meanwhile, the performance design infuses Naia with polyester, offering enhanced durability, odor management, and comfort ideal for all-day wear.

Each piece in the collection serves as a narrative canvas, making the technical qualities of the fibers - such as breathability, softness, and performance - visible and tactile. The collection embraces an inside-out design approach, showcasing the light blue weft made with Naia Renew, which is typically hidden within the fabric. By exposing this inner structure, Cronk creates a striking visual contrast.

As demonstrated at Kingpins New York, Naia Renew fiber blends exceptionally well with natural fibers, other man-made cellulose fibers (MMCFs), synthetic fibers, and various content yarns. This versatility makes it an ideal ingredient for denim, combining denim’s sustainable and stylish look with surprising, undeniable comfort for the wearer.

Duty-free access, expanded market share, and premium imports set to redefine India’s fashion and home textile trade landscape

The landmark trade deal India-UK Free Trade Agreement (FTA), signed yesterday by Prime Ministers Narendra Modi and Keir Starmer, will reshape India’s fashion and textile narrative on the global stage. The deal is being hailed as a transformative leap for India's textile, apparel, and home furnishing industries. The FTA will eliminate tariffs on 99 per cent of Indian exports and slash duties on 90 per cent of UK goods entering India, the agreement is expected to double India’s apparel and textile exports to the UK by 2030.

What it means for Indian fashion

Under the terms of the agreement—set to take effect by mid-2026—99 per cent of Indian exports will now enter the UK duty-free. For the textile and apparel sectors, this is a major shift. Currently, India’s ready-made garments (RMG), cotton products, and home textiles face tariffs of 8-12 per cent in the UK. These will now be eliminated entirely, improving competitiveness and margins. Conversely, India will gradually reduce tariffs of 10-20 per cent on high-end UK goods, including branded apparel, designer fashion, and premium home textiles, making luxury more accessible to India’s growing affluent class.

A trade windfall in the making

India exported $1.4 billion worth of apparel and home textiles to the UK in 2024. Of this, RMG accounted for $1.1 billion. By 2030, this figure is expected to double to $2.8 billion, as Indian market share in the UK’s import basket surges from 6 per cent to 12 per cent. “This is a Himalayan achievement,” opines A Sakthivel, Chairman of the Apparel Made-Ups & Home Furnishing Sector Skill Council. “India now has the opportunity to become a reliable alternative to Bangladesh and Vietnam in the UK market.” Industry estimates from ICRA suggest an 11-13 per cent CAGR in textile exports to the UK, with annual incremental gains of $1.1–1.2 billion—thanks to the elimination of duties, improved competitiveness, and a stable trade framework.

Cluster impact from Tiruppur to Karur

Export-oriented hubs like Tiruppur, Surat, Ludhiana, Karur, and West Bengal are expected to scale operations significantly. These regions could attract fresh investments as exporters capitalize on improved margins due to tariff elimination and logistics support. Small and medium manufacturers, particularly artisan-led and women-run MSMEs in Tamil Nadu, Gujarat, and West Bengal, will also benefit from simplified trade procedures and improved access to UK buyers.

Rakesh Mehra, Chairman of the Confederation of Indian Textile Industry (CITI), expressed optimism regarding the agreement's potential. "The landmark FTA with the UK is a huge positive for India's textile and apparel domain," Mehra says. "It has the potential to transform the fortunes of the entire Indian textile sector and provide the kind of impetus which is necessary to help India realize its ambitious goal of achieving textile and apparel exports of $100 billion by 2030."

Home textiles get a boost

The home furnishings sector—including bed linen, towels, curtains, and upholstery—stands to gain substantially. Indian home textile brands like Trident and Welspun already have a presence in UK retail. The FTA will expand their scope and margins.

Retail shake-up in India

While exporters cheer, the Indian retail market braces for a wave of premium British imports. High-end British brands such as Paul Smith, Ted Baker, Burberry, and Marks & Spencer (already operating in India) will benefit from lower or zero import duties. Experts believe that affluent Indian consumers—whose numbers are expected to grow by 129 per cent by 2030 will increasingly prefer affordable luxury and quality imports.

Table: FTA impact on India-UK textile trade

|

Category |

CY 2024 Value (USD) |

Current Duty ( per cent) |

Projected by 2030 |

Comments |

|

India → UK: Apparel & Home Textile |

1.4 Billion |

8–12 per cent |

2.8 Billion |

Export share to UK doubles; CAGR 11–13 per cent |

|

India → UK: Ready-Made Garments |

1.1 Billion |

8–12 per cent |

2.2 Billion |

RMG import share grows from 6 per cent to 12 per cent |

|

UK → India: Branded Apparel/Textiles |

N/A |

10–20 per cent |

Tariffs phased to zero on 90 per cent of lines |

Surge in British premium fashion in Indian retail |

|

Additional Annual Export Gain |

N/A |

– |

1.1–1.2 Billion |

Boost driven by improved competitiveness, scale, and cost |

Exporters, stay ready; Retailers, brace for change

The India–UK FTA marks a defining moment for Indian textiles and fashion. It elevates India’s positioning in a high-value, trend-conscious market while opening the domestic arena to global competition.

To win, Indian exporters must double down on branding, innovation, and sustainable practices. For domestic retailers and designers, agility and strategic positioning will be key as the British invasion of premium fashion arrives—tariff-free.

Implications: Adapt or be disrupted

The India–UK FTA is more than a bilateral trade agreement—it's a strategic inflection point. Exporters must now double down on branding, design innovation, and sustainability to capture discerning UK buyers. Retailers and Indian designers must prepare for intense competition in the domestic market and potentially collaborate or co-create with British labels. MSMEs must leverage government incentives and global interest to scale ethically and efficiently. Ultimately, this FTA lays the foundation for India to pivot from a cost-based exporter to a value-based global fashion partner.

A defining decade ahead

As tariffs fall and opportunity rises, the India–UK FTA unlocks not just trade, but transformation. It enables Indian fashion to assert itself globally while inviting healthy competition at home. For a sector often caught between tradition and transformation, this could be the moment where India’s textile legacy meets its fashion-forward future.

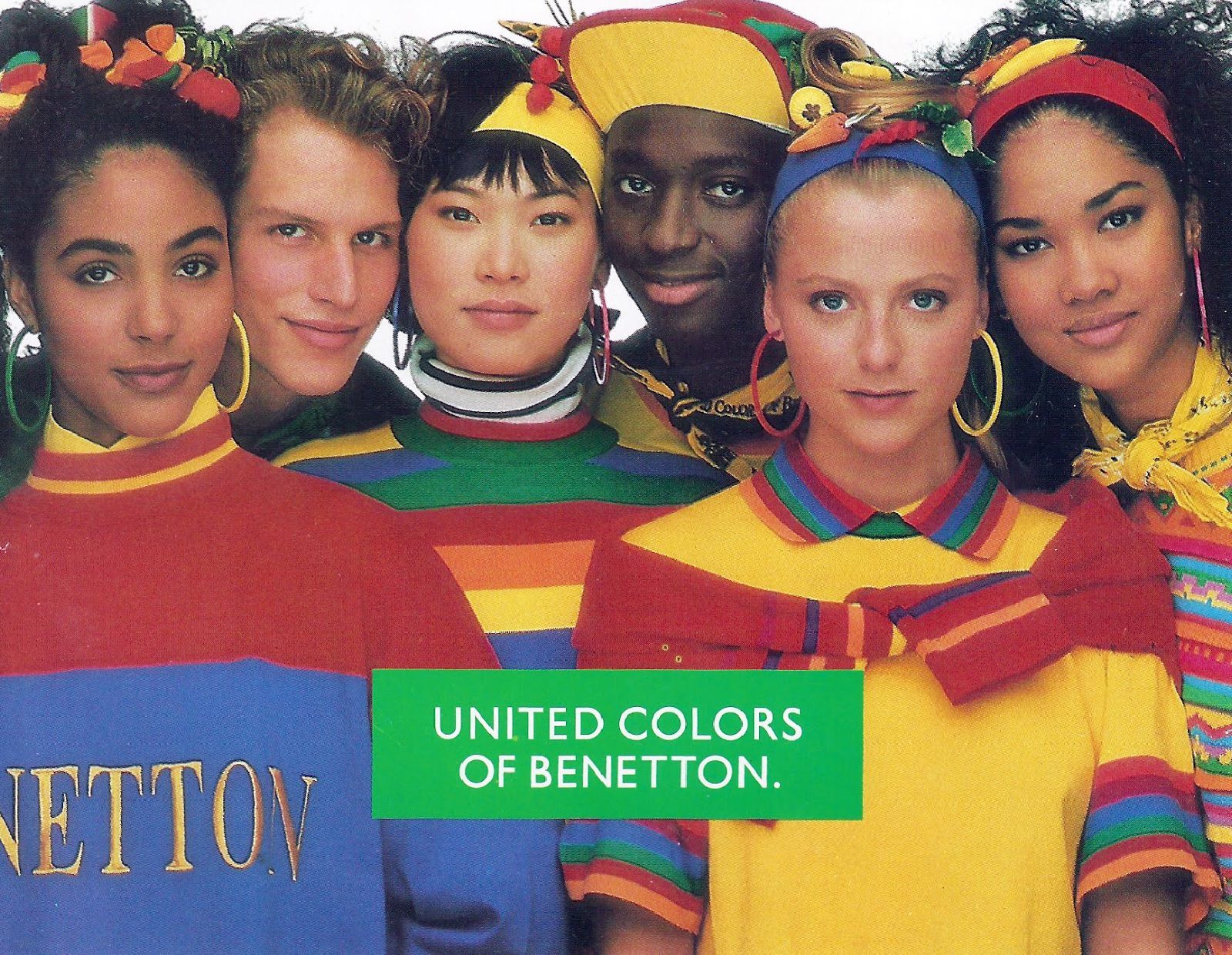

From global icon to retail relic, Benetton's vibrant legacy has unraveled, caught between a rigid past and a rapidly evolving fashion future. So what went wrong for the brand that once united the world in color?

In the late 20th century, the name Benetton was synonymous with more than just clothing; it represented a bold, socially conscious ethos, a ‘United Colors of Benetton’ that transcended fashion. Its vibrant knitwear and provocative advertising campaigns, spearheaded by photographer Oliviero Toscani, made it a global phenomenon. From depicting AIDS patients to challenging racial stereotypes, Benetton's ads sparked debate and cemented its place in popular culture. By 1996, the Italian brand boasted of 7,000 sales outlets across over 100 countries, ranking 75th in Interbrand's global brand list in 2000. This was Benetton at its zenith – a brand that was both commercially successful and culturally significant.

The cracks appear

The new millennium, however, brought a shift in the retail world, one that Benetton was ill-equipped to navigate. The rise of fast fashion giants like Zara and H&M fundamentally altered consumer expectations. These new players mastered the art of rapid trend replication and swift supply chains, bringing runway styles to stores in mere weeks at affordable prices. Benetton, with its more traditional production cycles and extensive, less centralized franchise model, found itself outmaneuvered.

"The rigidity of Benetton's approach to distribution did not enable the company to rapidly match changing customer's needs, a capability that was perfectly managed by competitors such as Zara and H&M," noted a study on the brand's decline. This inability to adapt quickly to evolving trends and consumer demands for constant newness was a critical misstep.

The fading ‘colors’

Beyond operational rigidity, Benetton's once-revolutionary advertising began to lose its potency. While Toscani's campaigns were initially groundbreaking, some later efforts, such as the 2000 campaign featuring death-row inmates, proved controversial to the point of alienating consumers and retailers, leading to Toscani's departure and a dip in sales.

As the digital age dawned, Benetton struggled to find a new, compelling voice. Competitors embraced social media, influencer marketing, and direct-to-consumer models, forging new connections with younger demographics. Benetton, by contrast, fell behind. "The brand struggled to stay relevant as newer brands took over the youth market. Benetton lacked strong influencer collaborations and a strong presence on social media," highlighted a report from The NoName Company. The ‘United Colors’ messaging once so powerful, became muted in a crowded and digitally-driven marketplace.

Financial erosion & internal strife

The operational and branding missteps translated directly into severe financial losses. The company, delisted from the stock exchange in 2012 to become a fully owned subsidiary of the Benetton family's Edizione holding, has continued to bleed money.

Table: Benetton Group reported losses (approx figures)

|

Year |

Reported loss (€ million) |

Source |

|

2017 |

180 million |

Wikipedia |

|

2022 |

80 million |

The NoName Company |

|

2023 |

230 million |

The NoName Company |

|

2024 |

100 million (projected) |

Wikipedia (Luciano Benetton's accusation) |

The mounting debt, reportedly surpassing €460 million, also led to internal discord. In May 2024, co-founder Luciano Benetton publicly accused then-CEO Massimo Renon and other executives of mismanagement, citing a €100 million loss. This public spat further underscored the deep-seated issues plaguing the company's leadership and strategy. Claudio Sforza has since been appointed as the new CEO.

The franchise fumble

What was once a cornerstone of Benetton's global expansion—its extensive franchise model—paradoxically became a contributing factor to its decline. While it allowed rapid scaling, it also diluted control over brand consistency, store experience, and inventory management. In an era demanding seamless omnichannel experiences and precise stock control, Benetton's decentralized structure proved cumbersome compared to the tightly integrated operations of its rivals.

A bleak outlook?

Today, Benetton is in a desperate fight for survival. The brand has announced plans to close over 400 stores globally by the end of 2025, with 180 already shut in 2024. Restructuring plans are underway, aiming to reduce losses and achieve a break-even point by 2026. However, the challenges are immense.

From its failure to adapt to the fast-fashion paradigm and its inability to refresh its once-iconic brand identity, to its crippling financial losses and internal turmoil, Benetton serves as a cautionary tale. The vibrant ‘United Colors’ that once captivated the world have faded, leaving a brand scrambling to find its place in an industry that has relentlessly moved on. The path to recovery is steep, demanding not just a new strategy, but a complete reimagining of what Benetton stands for in the modern world.

Led by Walid Gamal El-Din, Chairman, Suez Canal Economic Zone (SCZONE) has signed three significant contracts with leading Chinese textile and ready-made garment companies, attracting approximately $52.6 million (EGP 2.58 billion) in new investments.

These projects are projected to generate around 3,500 direct job opportunities in Egypt. One of these new agreements is with a major Chinese firm and certified global supplier, Changzhou East Noah Printing and Dyeing Co to establish an integrated textile factory on an 80,000 sq m in the Qantara West Industrial Zone.

This $20 million self-financed project will cover spinning, weaving, and fabric production, creating around 1,000 direct jobs. The factory will produce home textiles like blankets and bed linens, with a daily capacity of 80 tons and an annual output of up to 8 million finished items. Notably, 90 per cent of its production is earmarked for export, with the remainder for the local market.

A second contract was signed with Changzhou Golden Spring Textile Co, an integrated textile player exporting to over 40 countries. This company will invest $24 million (fully self-financed) in an 85,000 sq m factory, also in Qantara West, focusing on luxury textiles and home furnishings. This project is expected to create another 1,000 direct jobs. With an annual capacity of 15,800 tons of fabrics and 2 million finished textile products, 90 per cent of its output, including blankets and bed linen sets, will be exported to the Middle East, North Africa, Europe, and the Americas.

The third agreement involves establishing an $8.6 million (self-financed) RMG factory on 40,000 sq m in Qantara by a Soho Holdings Group-company, Jiangsu Sainty Corporation. This project is set to create approximately 1,500 direct jobs, with 100 per cent of its production dedicated to export markets, leveraging the company's four decades of experience exporting to about 100 countries worldwide.

These agreements underscore SCZONE's successful collaboration with the Chinese business community, a crucial strategic partner, highlights Gamal El-Din. The latest contracts bring the total number of Chinese projects in the Qantara West Industrial Zone to 18.

With three new additions, the Qantara West Industrial Zone now boasts 28 contracted projects, representing total investments of approximately $734.1 million. These projects span nearly 1.8 million sq m and are projected to create 38,455 direct job opportunities, reinforcing SCZONE's growing role as a leading industrial hub that supports Egypt's ambition to strengthen its global position in textiles and ready-made garments.

As per a new new report titled, ‘World - Babies' Garments And Clothing Accessories (Knitted Or Crocheted) - Market Analysis, Forecast, Size, Trends And Insights’ by IndexBox, the global market for babies' knitted or crocheted garments and accessories is expected to experience a moderate growth rate of +1.4 per cent in volume and +2.0 per cent in value from 2024 to 2035.

This growth will be driven by an increasing demand for baby clothing worldwide, positioning the market for continued expansion in the coming years.

The global market for babies' garments and clothing accessories (knitted or crocheted) is forecast to expand with an anticipated CAGR of +1.4 per cent for the period from 2024-35, which is projected to bring the market volume to 4.9 billion units by the end of 2035.

In value terms, the market is forecast to increase with an anticipated CAGR of +2.0 per cent for the period from 2024-35 to $106.9 billion (in nominal wholesale prices) by 2035-end.

An Emirati investment firm based in Abu Dhabi, Multiply Group has finalized its acquisition of a majority stake in the Spanish fashion company, Tendam. Valuing Tendam at approximately €1.3 billion, this deal marks Multiply Group's ‘first major investment’ in Europe. The firm has acquired 67.91 per cent of the capital in Castellano Investments SÀRL, which owns Tendam Brands SAU and its subsidiaries. Minority shareholders Llano Holdings SÀRL and Arcadian Investments SÀRL, corporate investment vehicles of CVC and PAI Partners funds, will retain their stakes.

Multiply Group aims to ‘lead the next phase of Tendam's growth.’ This phase will prioritize further international expansion across Europe, Latin America, and the Middle East. A key strategic component will involve the integration of artificial intelligence (AI) across all business areas, from procurement to customer experience, by leveraging Tendam's existing digital infrastructure. Additionally, Multiply Group plans to support Tendam through ‘selective acquisitions (M&A)’ to broaden its portfolio with new brands and categories.

Samia Bouazza, CEO and Managing Director, Multiply Group, states, this acquisition marks Multiply Group's strategic entry into the retail and fashion sector. By securing a controlling stake in a leading omni-channel platform, the group invests in a high-performing, future-focused business model backed by an exceptional management team. She emphasizes on the potential to expand into new categories and scale emerging brands globally, with Multiply's expertise in synergy creation, AI application, and M&A execution poised to accelerate growth and generate long-term value.

Jaume Miquel, Chairman and CEO, Tendam, adds, together with the shareholders and management team, the company will fully deploy their potential, expanding their brands into new formats, markets, and channels, supported by advanced artificial intelligence and digital technology to achieve stronger growth and profitability through a unique and unrivalled omni-channel ecosystem of brands.

Formerly known as Grupo Cortefiel, Tendam boasts a diverse portfolio of a dozen retail brands, including well-known names like Women'secret, Springfield, Cortefiel, and Pedro del Hierro. Other brands under its umbrella include Hoss Intropia, Slowlove, High Spirits, Dash and Stars, OOTO, Milano, Fifty, and Hi&Bye. The conglomerate operates over 1,760 points of sale, comprising its own stores, department store concessions, and franchises, across more than 80 markets worldwide.

As of the end of June 2025, Tendam reported sales of €1.4 billion over the preceding twelve months, with an EBITDA of €340.7 million.

A major cellulose fiber manufacturer under Tangshan Sanyou Group, Sanyou Chemical Fiber and a US-based textile-to-textile recycling innovator, Circ have entered into a strategic partnership to significantly accelerate the scaling of recycled cellulosic fibers, specifically lyocell, within the global textile sector.

As a part of this agreement, Sanyou has committed to purchasing pulp for five years from Circ’s first commercial-scale facility, which is expected to be operational in 2028.

This partnership between Sanyou and Circ will focus on producing lyocell staple fibers with 30 per cent recycled content, enhancing access to and scaling of sustainable recycled fibers in the market. Peter Majeranowski, CEO, Circ, emphasizes, as one of the leading global MMCF producers, Sanyou’s commitment to Circ demonstrates both the quality of its product and the future of the industry. Such strategic partnerships are crucial for the realization of Circ's mission to create a truly circular economy in the global fashion industry, he emphasizes.

The collaboration underscores the vital need for cooperative relationships to effectively scale textile-to-textile recycling innovation. Sanyou’s commitment ensures its customers will have access to high-quality recycled Circ Lyocell at a time when demand for sustainable options is outpacing production, and brands are actively seeking to diversify their production markets.

Zhang Dongbin, Deputy General Manager, Sanyou, states, both Sanyou and Circ are dedicated in their commitment to fostering sustainable practices that reduce the environmental impact of the fashion industry. This strategic partnership will establish new benchmarks in the textile industry thanks to its shared vision for a sustainable future and circular economy, he adds. Sanyou has already received the highest rating under Canopy’s 2024 Hot Button Report, which assesses man-made cellulosic fiber (MMCF) producers' forest sourcing and leadership in Next Gen production, further cementing their role in supporting the growth of the sustainable fibers market.

Sanyou Chemical Fiber is recognized as a National High-tech Enterprise and a leading cellulose fiber manufacturer, producing viscose staple fiber, modal fiber, and lyocell fiber. Circ, headquartered in Danville, Virginia, is known for its patented technology that recycles post-consumer and post-industrial textiles into virgin-equivalent materials, building a circular economy for the fashion industry.

Continuing to push boundaries, the denim industry constantly experiments with new fibers, fabrications, dyes, and processes to achieve fresh aesthetics while prioritizing sustainability. At the forefront of this innovation is Arvind Ltd which aims to showcase its latest denim advancements at the upcoming Kingpins Show in New York on July 23-24, 2025.

Arvind Ltd will feature two distinct booths. One will present its Autumn/Winter 2026 denim collection, emphasizing comfort, performance, and sustainability. The second booth will be entirely dedicated to showcasing the company's groundbreaking innovations.

The company engineers denim with purpose with the integration of recycled materials, regenerative cotton, and low-impact dyeing to create responsible and authentic textiles, says Karan Ojha, Chief Marketing Officer – Wovens, Denim and Knits, Arvind Ltd. Innovation is a tool at Arvind Ltd with sustainability being a standard and decarbonization a commitment that drives every process toward a lower-impact future, he adds.