FW

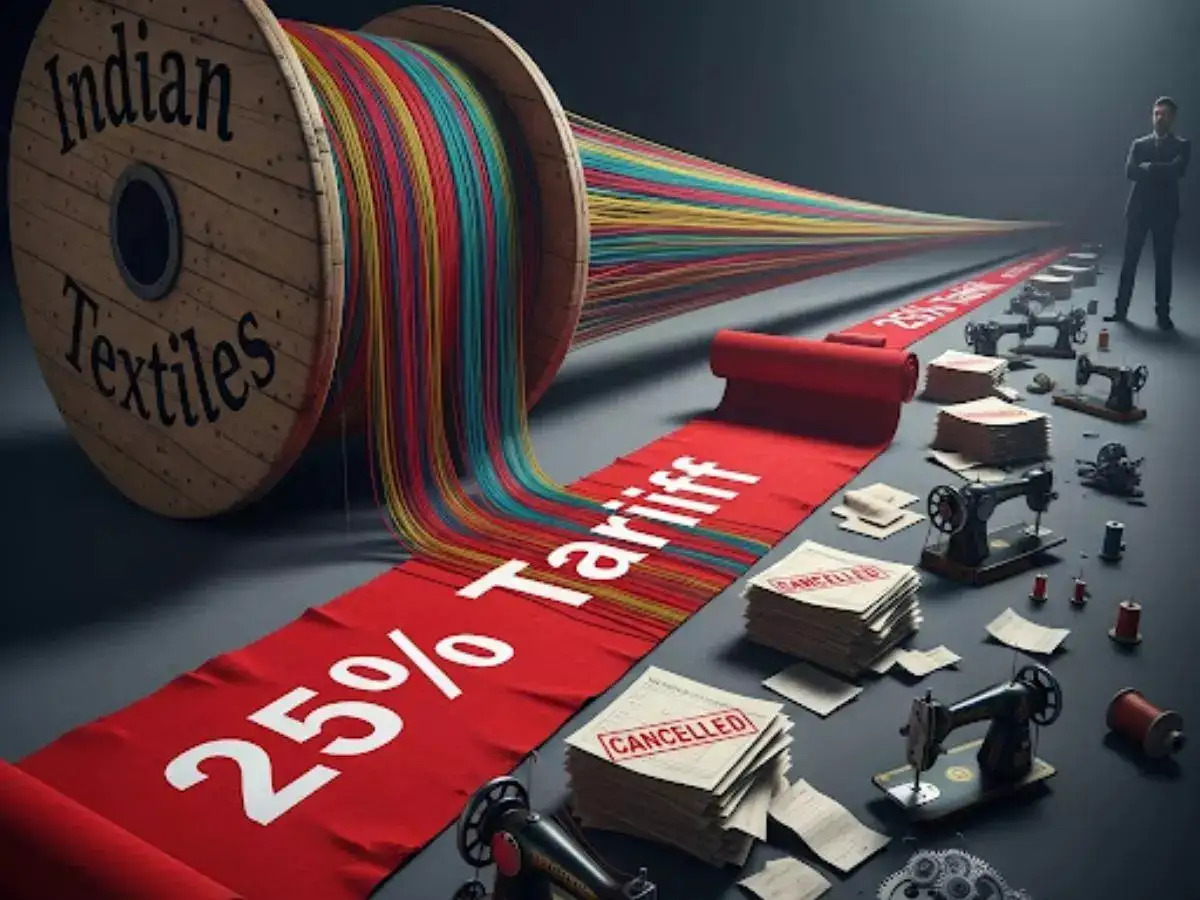

"Indian exporters are hoping for a revival in cotton yarn exports as Chinese cotton auction started at a 25 per cent premium over the prevailing fibre rate in India. Despite robust demand from Bangladesh, overall cotton yarn exports remained under pressure during the current financial year due to sluggish demand from China. For the April–December 2016, India’s cotton yarn exports slumped by 12 per cent to 872.19 million kg from 987.21 million kg in the corresponding period last year."

Indian exporters are hoping for a revival in cotton yarn exports as Chinese cotton auction started at a 25 per cent premium over the prevailing fibre rate in India. Despite robust demand from Bangladesh, overall cotton yarn exports remained under pressure during the current financial year due to sluggish demand from China. For the April–December 2016, India’s cotton yarn exports slumped by 12 per cent to 872.19 million kg from 987.21 million kg in the corresponding period last year. Cotton yarn exports from India rose by a marginal 4.29 per cent at 1,307.11 million kg for the financial year 2015-16 from 1,253.33 million kg for the previous year.

The first day of Chinese auction quoted cotton prices between Rs 51,000 and Rs 56,000 a candy (356 kg) as against Rs 42,000 a candy currently prevailing in most local markets here. This means, Chinese cotton is costlier by a wide margin. Also, the cotton being auctioned in China is up to seven-year old. By nature, the quality of natural cotton starts deteriorating after two-three years as the fibre starts growing yellow. Still Chinese spinning mills are buying cotton for blending with fresh cotton. But, because of high prices, India tends to gain despite 3.5 per cent levy of duty by China on import from India.

Demand Trends

India is competing with Vietnam as China allows zero duty import from there. So, instead of cotton, Chinese textiles mills would move to purchase cotton yarn from India. As Siddhartha Rajagopal, Executive Director, The Cotton Textiles Export Promotion Council (Texprocil) says, “Cotton yarn exports will turn positive this year after a steep decline last year.”

Cotton yarn demand from domestic mills have also revived owing to prices rise by five to seven per cent in the last two-three weeks. Yarn price follows the trend of cotton price movement with a lag of 1-2 months. Today, cotton prices have risen sharply this calendar year with the benchmark Shankar 6 variety hitting to the level of Rs 12,188 a quintal, the highest in five months. Cotton (Shankar 6) price has jumped by over 10 per cent this calendar year. This level of cotton price was earlier seen on October 8, 2016. International price of cotton at 79 $-cents per pound is also all time high.

Yarn demand from overseas buyers remained slow since October price hike in cotton as importers held their orders in anticipation of price fall. But, now they believe that cotton prices are not going to come down. So, they are booking cotton and cotton yarn. The overall demand has revived in the last few weeks, opines Manikam Ramaswami, Chairman & MD, Loyal Textile Mills.

Recent Care Ratings report forecasted India’s cotton yarn output to decline by five to seven per cent to 3,936 million kg for the financial year 2016-17 riding on sluggish demand in past months with substitution taking place from manmade fibre (MMF) as well as distressed direct yarn exports due to lower demand from China. Yarn demand in other export markets will be healthy, the report said. After declining by 10 per cent in 2011-12 cotton yarn production increased by over 14 per cent y-o-y to 3,583 million kg in 2012-13. In 2013-14, production increased by about 10 per cent to 3,928 million kg. High cotton prices and easy availability of MMF at competitive rates led to slower growth of production of cotton yarn. Meanwhile, spinning mills have urged the government to extend 2 per cent tax benefit to yarn sector under Merchandise Exports from India Scheme (MEIS).

Standards relating to the treatment of birds throughout the supply chain will be merged. Responsible Down and Global Traceable Down Standards will be merged into one global standard. It’s hoped that combining and improving the best attributes from each of the current standards will result in a best practice standard. The two organizations active in this field are: Textile Exchange and NSF International.

Currently more than 80 brands have chosen to certify their down supply chain to either the Responsible Down Standard or the Global Traceable Down Standard. Together Textile Exchange and NSF International are committed to an open and transparent process to merge the standards by creating an international working group with representatives from brands, suppliers, animal welfare groups and other interested parties. These same stakeholders were involved in the development of the current standards.

US-based Textile Exchange founded in 2002, is a non-profit organisation that works to minimize the negative impacts on water, soil, air, animals, and humans created by the textile industry.

NSF, founded in 1944, develops standards and tests and certifies products to these standards for the water, food, health sciences and consumer goods industries to minimize adverse health effects and protect the environment.

Lenzing wants to explore investment opportunities in Indonesia. The Austrian company has been operating in Indonesia since 1978 through a subsidiary named South Pacific Viscose (SPV), which operates as a producer of staple fiber and sodium sulphate viscose. Customers are supplied with high-quality fibers for textile and nonwovens not only in the Asian region but in nearly all continents as part of the global market presence of the Lenzing group.

Asia is an important market for the Lenzing group. It’s where Lenzing generates more than half of its fiber revenues. More than half of the group’s fiber production capacity is located in Asia. Its largest plant is located in Indonesia. Indonesia has a significant textile industry, which represents one of the largest industrial sectors of the southeast Asian island state.

Lenzing, based in Austria, supplies the global textile and nonwoven industry with high quality, botanic cellulose fibers. Its portfolio ranges from dissolving wood pulp to standard and specialty cellulose fibers. Lenzing has a focus on profitable growth based on environmentally friendly specialty fibers. The company will expand its production capacities for specialty fibers. It will also expand and modernize its existing dissolving wood pulp production. The company produces 9,65,000 tons of fiber for the global textile and nonwoven markets.

Aditya Birla Group firm Grasim Industries has proposed to increase foreign portfolio investors’ investment limit to 45 per cent from 30 per cent to enhance its weightage in the indices floated by Morgan Stanley and other large global financial institutions. The move will attract fresh investment in the stock from large foreign pension funds which mimic the index for their investment strategy.

Current FPI investors in the company include Aberdeen Emerging Markets Fund, Aberdeen Global India Equity, New World Fund and Citibank besides a clutch of foreign depositories. Morgan Stanley Capital International created its first global index in 1968 and now manages about 1.60 lakh indices including country-specific and various sectors.

Aditya Birla Group is in the midst of reorganisation of the promoters’ holding in the group company. It is in the process of merging Aditya Birla Nuvo with Grasim Industries and spinning off the financial services into a listed entity.

Last October, the company split the face value of the equity shares to Rs 2 each from Rs 10 each as a pre-cursor to the proposed merger and listing of the financial services business. Post-restructuring, Grasim will have a consolidated annual turnover of Rs 61,500 crores with a 68 per cent contribution from the manufacturing sector which includes cement, textile, chemicals, insulator and solar and 32 per cent from financial services and telecom.

Christian Dior has emerged the world’s largest apparel company, according to Forbes. The second is Nike. In the third place is Inditex. Among all the top 2000 companies named by Forbes, there are 29 apparel companies that made it to the final list. After measuring their revenue, profit, assets and market value, Christian Dior, Nike and Inditex were crowned the top three spots in the global apparel market.

Christian Dior notched up sales worth $41.6 billion dollars in 2016 and a profit of $1.7 billion. Its assets were worth $68 billion. Through its over 40 per cent stake in luxury goods conglomerate LVMH, Christian Dior also benefits from the financial performance of respected product lines such as Dom Pérignon, De Beers, Veuve Clicquot, and Givenchy.

Nike is a US sportswear giant. It recorded more than $32 billion in sales and $3.8 billion in profit over the fiscal year ending 2016. The brand has an intensive celebrity athlete endorsement. Nike’s financial performance in the global market is expected to be even better over the next few years.

Inditex owns some of the world’s most popular high street fashion brands such as Zara, Pull & Bear, Bershka, Massimo Dutti etc. The company achieved revenues of $23 billion in 2016.

"Cotton and yarn prices have been upbeat in the last three months. China however hasn’t participated in this rally much – typically Yarn Expo is a time for bulk buying as both buyers and sellers meet physically. “For last couple of years, it’s been a buyers’ market, however I feel this Expo will see a shift towards sellers. This Expo has been keenly looked at by all to see Chinese buyers will embrace global yarn prices or not,” says Sanjay K Jain, MD, TT & Chairman NITRA."

Cotton and yarn prices have been upbeat in the last three months. China however hasn’t participated in this rally much – typically Yarn Expo is a time for bulk buying as both buyers and sellers meet physically. “For last couple of years, it’s been a buyers’ market, however I feel this Expo will see a shift towards sellers. This Expo has been keenly looked at by all to see Chinese buyers will embrace global yarn prices or not,” says Sanjay K Jain, MD, TT & Chairman NITRA. They are exhibiting the full range of cotton yarn from 20/1 to 60/1 in both organic and conventional cotton. Carded and combed yarn for both weaving and knitting are being offered.

Highlighting business dynamics in China, Jain says yarn imports have been negligible from January as China refused to accept higher prices – however shipments have been brisk till Mid Feb. Volatility always impacts business flow and this year is no exception. There is a lot of confusion in the minds of people and no one knows what position to take. Yarn exports to China which were high in October to December, have almost dried up now. The Expo will decide the shipment flow for the next two months. The changed dynamics have kept prices within control, if China accepts higher prices, then we can expect higher prices in the days to come.

Strategies to deal with current crisis

Trends in global yarn production and yarn stocks low margins and losses have kept yarn production low, while consumption is marginally up hence, yarn stock levels are low. China’s decreasing yarn import is causing exporters to search for new markets. In the wake of this, Bangladesh is always the next best market.

He says, Vietnam and Indonesia yarn export to China is increasing, on the back of no import duty, while India and Pakistan lose due to the levied import duties. To which, he says that it’s a common story for India everywhere. “We are losing to non-preferential tariffs vis-à-vis our competition. Government is also not giving MEIS to yarn despite us being at a disadvantage and having so much surplus yarn. The main focus should be the domestic demand from India due to increase in fabric and garment production in India.”

Jain says irrespective of TPP withdrawal, India will continue to be a big force in the global yarn trade for a long time to come. In times of crisis, a company should live by the day – world is too volatile and uncertain to make any predictions and strategy. It’s dangerous to carry open positions in today’s market – they could be some nasty surprises, concludes Jain.

Bangladesh had fixed a target of reaching $50 billion in apparel exports by 2021. But now it seems like an unlikely target. Achievement would require an export growth of more than 12 per cent while growth currently hovers around three per cent.

The country is losing competitiveness globally. Buyers are shifting to Vietnam and other neighboring countries. Another factor is the devaluation of the euro. The Bangladeshi currency remains strong against the dollar. Its competitors are taking advantage of devaluation of their currencies against the dollar. Turkey and Vietnam have devalued their currencies and this is helping their export growth.

Another problem Bangladesh has had to face is a fall in price of apparels in the EU and US markets. In 2015, prices of Bangladeshi apparels dropped 3.81 per cent and 0.76 per cent in the US and EU. Last year, prices came down by more than one per cent in the US and 3.19 per cent in EU countries.

In the last two years, production costs in Bangladesh have increased by up to 17 per cent due to several reasons including a hike in gas prices. Bangladeshi exporters have lost a seven per cent market share in Canada and six per cent in the UK.

Synthetic fibers have a 62 per cent share of the world fiber market. Synthetic fibers are used in sectors like fashion and apparel, healthcare, aerospace, packaging, electronics and automotives. Rapid industrialization, low production cost, changing consumer preferences for textiles, and increasing disposable income are projected to drive the global synthetic fiber market over the next few years.

Weak supply of natural fibers such as cotton and wool is another factor driving the global synthetic fiber market. Synthetic fibers refer to textile fabrics that are manmade, such as nylon, acrylic, polyester and carbon fiber. Apart from their superior characteristics of adaptability, durability, elasticity, and strength, synthetic fibers are cost effective to make and easier to maintain as compared to other natural fibers such as cotton and wool.

China is the biggest manufacturer of synthetic fibers in the world. India is the second largest. India surpassed Taiwan and the United States as a fiber powerhouse in the mid-2000s, thanks to its huge polyester fiber capacity increase. The demand for synthetic fibers is still high in North America, especially in the US, making it the leading market for synthetic textile fibers produced in Latin America and Europe.

Functional changes are being incorporated in synthetic fibers with little or no hazardous impact on the environment.

The next edition of ITMA, the world’s largest textile and garment technology exhibition, will be held in Spain from June 20 to 26, 2019. It is expected to feature over 1,500 exhibitors from 45 countries. ITMA. It is a unique showcase of live machinery demonstrations and innovative solutions that boost productivity and profitability.

The 2019 edition will focus on innovation, which creates a competitive advantage for manufacturers. Sustainable innovation that drives growth for the textile and garment industry will be emphasised at the exhibition. A host of exciting highlights and knowledge-sharing activities have been planned which give added value to exhibitors and visitors alike.

When ITMA was last held in Spain in 2011, there were more than a lakh of visitors from 138 countries. A huge majority of visitors came from outside Spain.

ITMA has a 64-year history of displaying the latest in machinery and software for every single work process of textile making. It is held every four years in Europe. It is a showcase of the latest technological innovations and a place where suppliers and customers from the whole world can meet.

ITMA is owned by CEMATEX (European Committee of Textile Machinery Manufacturers), which comprises the national associations of the following nine countries: Belgium, France, Germany, Great Britain, Italy, Netherlands, Spain, Sweden and Switzerland.

In 2016, Rieter’s net profit fell 14 per cent as sales decreased nine per cent. EBIT margin was six per cent. Rieter supplies systems for short-staple fiber spinning. In the full year, order intake rose 13 per cent year-on-year. In the first half of 2016, orders were at a good level, mainly driven by solid demand from Turkey. In the second half of the year, the dynamism in Turkey and India slowed significantly due to increasing political uncertainties, with the result that orders declined.

Sales in China increased 33 per cent and in India it rose 28 per cent. In other Asian countries, sales declined 12 per cent but remained at a good level. In North and South America, following the completion of deliveries of large orders in the previous year, sales declined. In Turkey, a large portion of good order intake from the first half year was delivered on schedule by the end of the year. Despite this, sales in Turkey fell by 17 per cent compared to the previous year.

Despite low visibility in the sales markets, Rieter expects sales and profitability for 2017 to be at the level of the previous year (before restructuring costs).