FW

India’s apparel exports have not benefited from the rupee depreciation. There was a 22.76 per cent fall for the month of April.

Readymade garment exports have fallen for the seventh consecutive month since October 2017. Exporters have seen the cost of working capital rising and are experiencing a fund crunch due to delays in the refund of taxes paid.

While consumption in the international market is growing at around one to two per cent, competition is increasing too as the business sees new entrants like Myanmar and Ethiopia. Competitors’ currencies are also depreciating, but they don’t have problems that Indian exporters do.

The fall in apparel exports has led to a decline in production. India's apparel production fell 18.6 per cent in March and saw a decline of eleven per cent for the period 2017-18. March saw the eleventh straight monthly decline in apparel production.

Availability of manpower is also a big concern in all the existing textile centers and productivity is low due to huge labor turnover.

If the rupee remains at these levels for the next few months, it can offset the loss of duty drawback to some extent and exports may see a growth of three or five per cent.

Rising cotton prices have hit Bangladesh apparel makers. If the price spiral continues, Bangladesh’s importers might face troubles as almost all the demand for the raw material is met through imports in the absence of domestic production.

The country has to import most of its cotton demand. Imports are from India, the US, the Middle Eastern countries and some African countries.

Cotton textiles is the largest imported category by Bangladesh, representing 55 per cent of total textile and apparel imports. This is followed by manmade textiles, others and apparel with a share of 35 per cent, 6.8 per cent and 3.2 per cent respectively.

China is the largest supplier accounting for a 58 per cent share. India is the second largest supplier of textile and apparel products to Bangladesh. Cotton textiles is the largest category with a share of 77 per cent in India’s textile and apparel exports to Bangladesh. This is followed by manmade textiles and apparel having a share of 17 per cent and four per cent respectively.

Currently Bangladesh imports yarn and fabric from China, India and other nations to fill the demand-supply gap. However, many new investments are planned in the spinning and weaving sectors of Bangladesh in the coming years.

"POINTERS • Lowest growth this fiscal year in four years • The annual index value dipped to 2.56 FY 2017-18 from 3.43 points in FY 2016-17 • The entire fiscal year was marked by low business sentiment • Even the festive period did not bring much cheer • Q4 was the best quarter, reflecting a recovery."

POINTERS • Lowest growth this fiscal year in four years • The annual index value dipped to 2.56 FY 2017-18 from 3.43 points in FY 2016-17 • The entire fiscal year was marked by low business sentiment • Even the festive period did not bring much cheer • Q4 was the best quarter, reflecting a recovery

POINTERS • Lowest growth this fiscal year in four years • The annual index value dipped to 2.56 FY 2017-18 from 3.43 points in FY 2016-17 • The entire fiscal year was marked by low business sentiment • Even the festive period did not bring much cheer • Q4 was the best quarter, reflecting a recovery

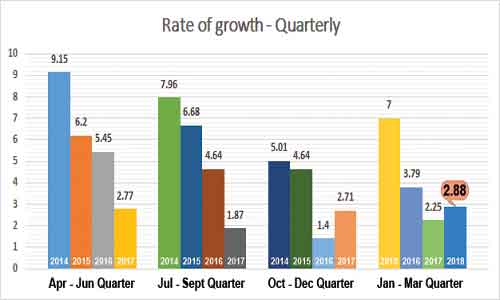

In all four quarters this fiscal year (2017-18), the index values were much lower than comparable quarters in previous fiscal. The annual index value dipped to 2.56 in FY-2017-18 from 3.43 points in FY-2016-17, 5.32 points in FY-2015-16 and 7.28 points in FY-2014-15 -- reflecting 'dismal' growth. The entire fiscal year was marked by low business sentiment including the festive period, perceived as best the time to make up for turnover losses, when buying is high.

The index value was the lowest for July-Sept 2017 (Q2) at 1.87; followed by 2.71 points in Oct-Dec 2017 (Q3); 2.77 points in Apr-Jun 2017 (Q1); and 2.87 points Jan-Mar 2018 (Q4). In fact, Q4 was the best quarter this fiscal, indicating a recovery. The positive aspect is: the Index has been growing in the last two quarters.

2.77 points in Apr-Jun 2017 (Q1); and 2.87 points Jan-Mar 2018 (Q4). In fact, Q4 was the best quarter this fiscal, indicating a recovery. The positive aspect is: the Index has been growing in the last two quarters.

All quarters are reviewed and compared to previous year’s quarters and the comparison is done at the assumed base value of 100.The average off our indices belonging to four quarters of the financial year is the final annual apparel index value.

Slack indices add to slowdown

The Sales Turnover graph over first two quarters followed a downward trend; the fall in July-Sept 2017 was the highest, it then moved up in the remaining two quarters Oct-Dec 17 at 1.52 and Jan-Marc ’18 growing to 1.60. Overall, Sales Turnover was never high throughout the fiscal.

Sell Through, Investments and Inventory Holding though not very dynamic, were never strong enough to influence the index greatly, as the graphs indicates.

The graph below shows varying growth rates for all performance factors over four quarters.

A dip in Sales Turnover, Sell Through and Investment graph and index should not be mistaken as a dip in sales, instead it indicates the rate of growth slowed down but in value and absolute terms there was growth in sales turnover.

Trendspotting: Four year low, it’s a dipping Annual Apparel Index

Annual Year Index Value

A closer look at the last four financial years indicates Apparel Index was much higher in FY 2014-15 and FY 2015-16 at 7.28 and 5.33 respectively compared to FY 2016-17 at 3.44 and 2.56 in FY 2017-18 , which is almost 35 per cent growth rate of what it was in FY 2014-15.

The onus for the dismal performance in the last two years could be attributed to demonetization and implementation of GST which have disrupted market sentiment and overall growth.

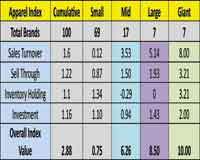

"CMAI’s Apparel Index for Q4 Jan-Mar FY 2017-18 indicates a growth recovery at 2.88 points. All the three sized brands termed as Big brands (Mid, Large and Giant) together recorded a growth of 7.61 points. Amongst these, Giant brands, with an impressive growth at 10.00 points led the way. While mid and large brands too were not far behind with growth of 6.26 and 8.50 points. Small brands, however, at 0.75 points, seem to be struggling for growth, indicating the gravity of recession pushing down these smaller players, who are not in a good position to outsmart their business practices, just yet."

CMAI’s Apparel Index for Q4 Jan-Mar FY 2017-18 indicates a growth recovery at 2.88 points. All the three sized brands termed as Big brands (Mid, Large and Giant) together recorded a growth of 7.61 points. Amongst these, Giant brands, with an impressive growth at 10.00 points led the way. While mid and large brands too were not far behind with growth of 6.26 and 8.50 points. Small brands, however, at 0.75 points, seem to be struggling for growth, indicating the gravity of recession pushing down these smaller players, who are not in a good position to outsmart their business practices, just yet.

CMAI’s Apparel Index for Q4 Jan-Mar FY 2017-18 indicates a growth recovery at 2.88 points. All the three sized brands termed as Big brands (Mid, Large and Giant) together recorded a growth of 7.61 points. Amongst these, Giant brands, with an impressive growth at 10.00 points led the way. While mid and large brands too were not far behind with growth of 6.26 and 8.50 points. Small brands, however, at 0.75 points, seem to be struggling for growth, indicating the gravity of recession pushing down these smaller players, who are not in a good position to outsmart their business practices, just yet.

Commenting on scenario, Satyen Momaya, CEO, Celio, that is one of the Large brands avers, “Stronger GDP growth rates in the last quarter and the current fiscal year have translated into handsome growth for discretionary categories such as apparel”. Talking on the similar optimism underling their product line, Neha Shah, Marketing Head, Pepe Jeans India says, “The denim industry has witnessed a slow and gradual growth over the last few years. However Pepe Jeans has witnessed a steady growth in the last couple of years by expanding into online channels and omnichannel retailing.

A comparison between Small and Big Brands index value 0.75 and 7.61 respectively, indicates a very big gap in the growth performance. The biggest gap is in Sales Turnover. Big Brands increased their Sales Turnover to 4.90 points, against insignificant growth of 0.12 points for Small Brands.

the growth performance. The biggest gap is in Sales Turnover. Big Brands increased their Sales Turnover to 4.90 points, against insignificant growth of 0.12 points for Small Brands.

Increase in Sales Turnover

Sales turnover in Q4 reflected an index growth of 1.6 points. Nearly, 54 per cent brands reported an increase in sales this quarter. Giant and Large Brands, which grew at 14.3 per cent each. “The reason for an increase in our sales turnover was , we focused on increasing and streamlining our product line by categorizing production to increase productivity, explains Blazo’s owner Niyam.

Improvement in Sell Through

Nearly 54 per cent of the brands reported an improvement in their Sell Through in this quarter, while for 40 per cent brands the Sell Through remained the same, and around 6 per cent brands recorded a dip. In order to manage better growth and performance brands have been maneuvering their business, as Radhesh Kagzi, President, Creative Lifestyles Pvt. Ltd says, “We have reduced our quantities per style and done ISTs for goods. This has resulted in better Sell Through and reduced Inventory Holding/investment.

Inventory Holding: Inventory Holdings for almost 45 per cent

"As per latest Apparel Export Promotion Council (AEPC) figures, India’s apparel exports have dropped 17.78 per cent to reach $1.49 billion, with an overall dip of 3.83 per cent to $16.71 billion in 2017-18. At the same time, India’s overall goods exports increased 9.78 per cent to $302.4 billion in April-March 2017-18, but declined 0.6 per cent to $29.11 billion in March 2018. Commenting on the startling figures, HKL Magu, Chairman, AEPC, says the fall has been much more in the case of apparel exports. These figures clearly indicate apparel exports are not only stagnating but also heading towards a recession. Apparel manufacturing registered a decline for the tenth straight month in February."

As per latest Apparel Export Promotion Council (AEPC) figures, India’s apparel exports have dropped 17.78 per cent to reach $1.49 billion, with an overall dip of 3.83 per cent to $16.71 billion in 2017-18. At the same time, India’s overall goods exports increased 9.78 per cent to $302.4 billion in April-March 2017-18, but declined 0.6 per cent to $29.11 billion in March 2018. Commenting on the startling figures, HKL Magu, Chairman, AEPC, says the fall has been much more in the case of apparel exports. These figures clearly indicate apparel exports are not only stagnating but also heading towards a recession. Apparel manufacturing registered a decline for the tenth straight month in February. He revealed AEPC was working with policymakers for an early resolution of the sector’s problems, including working capital being stuck due to slow GST refund and reduction in drawback rates. The sector currently employs 12.9 million workers but due to the ongoing slide, several clusters have been impacted, Magu points out.

As per latest Apparel Export Promotion Council (AEPC) figures, India’s apparel exports have dropped 17.78 per cent to reach $1.49 billion, with an overall dip of 3.83 per cent to $16.71 billion in 2017-18. At the same time, India’s overall goods exports increased 9.78 per cent to $302.4 billion in April-March 2017-18, but declined 0.6 per cent to $29.11 billion in March 2018. Commenting on the startling figures, HKL Magu, Chairman, AEPC, says the fall has been much more in the case of apparel exports. These figures clearly indicate apparel exports are not only stagnating but also heading towards a recession. Apparel manufacturing registered a decline for the tenth straight month in February. He revealed AEPC was working with policymakers for an early resolution of the sector’s problems, including working capital being stuck due to slow GST refund and reduction in drawback rates. The sector currently employs 12.9 million workers but due to the ongoing slide, several clusters have been impacted, Magu points out.

For the US, subsidies is an issue

The other negative news for Indian apparel industry is, as per latest reports, the US, which is one of the biggest importers of Indian apparel and textiles, is all set to preempt apparel export subsidies after the US had challenged Indian export subsidy programs at the WTO. The US government is contemplating taking India to the World Trade Organisation forum for continued export subsidies in apparel and other sectors. As a counter measure, the Indian government plans to challenge the US contention at WTO, bearing in mind that if the decision of the world body goes against India, it would adversely impact India’s apparel and other key exports to the world. India’s apparel export to the world between April 2017 and January 2018 was $13,783.14 million. In 2010, India crossed the threshold in apparel and textiles sector by attaining a 3.25 per cent export slot in the global export market, reflecting India’s export competitiveness in the sector.

importers of Indian apparel and textiles, is all set to preempt apparel export subsidies after the US had challenged Indian export subsidy programs at the WTO. The US government is contemplating taking India to the World Trade Organisation forum for continued export subsidies in apparel and other sectors. As a counter measure, the Indian government plans to challenge the US contention at WTO, bearing in mind that if the decision of the world body goes against India, it would adversely impact India’s apparel and other key exports to the world. India’s apparel export to the world between April 2017 and January 2018 was $13,783.14 million. In 2010, India crossed the threshold in apparel and textiles sector by attaining a 3.25 per cent export slot in the global export market, reflecting India’s export competitiveness in the sector.

As per the provisions, once the threshold is crossed, the country gets an eight year reprieve to phase out subsidies. The extension is about to get over by the end of this year. According to WTO norms, subsidies can be non-actionable or prohibited as stipulated by the Subsidies and Countervailing Measures (SCM) agreement. Specifically, subsidies that are prohibited include the ones given to a firm or industry as in the case of apparel and textiles. The SEZ policy and the MEIS scheme which are applicable to the textiles and apparel industry come under this prohibited category. As per SCM norms, WTO member countries can take remedial action against India for such schemes and policies. In short, if India fails to curb the subsidies mentioned under the prohibited list to the apparel and textiles industry within the stipulated eight year period, member countries can refer the issue to the Dispute Settlement Board of the WTO. In this case, the US being the complainant, has the options of imposing countervailing duty on imports from India, which will result in Indian exporters losing competitiveness in the US textiles and apparel market. If that happens, the ultimate beneficiaries will be Bangladesh, Taiwan and Vietnam.

Trump Administration’s new Generalised System of Preferences (GSP) country eligibility assessment process outlined in October 2017, and GSP country eligibility petition imply for India, the GSP country eligibility review is based on concerns related to its compliance with the GSP market access criterion. India has implemented a wide array of trade barriers that create serious negative effects on the US commerce. The acceptance of these petitions and GSP self initiated review will result in one overall review of India’s compliance with the GSP market access criterion, the USTR statement said.

"Indonesia is ranked among the top ten largest textile producing countries. However, the nation is far away from threatening China's dominant position. Whereas China controls about 35 per cent of global textile markets, Indonesia controls only about 2 per cent. The Indonesian government targets to increase the nation’s value of exported textiles and garments to $75 billion by the year 2030, implying that this industry would contribute around 5 per cent to global exports. The recent TheInsiderStories data points out that Indonesia has cheaper labour than other textile producing countries."

Indonesia is ranked among the top ten largest textile producing countries. However, the nation is far away from threatening China's dominant position. Whereas China controls about 35 per cent of global textile markets, Indonesia controls only about 2 per cent. The Indonesian government targets to increase the nation’s value of exported textiles and garments to $75 billion by the year 2030, implying that this industry would contribute around 5 per cent to global exports. The recent TheInsiderStories data points out that Indonesia has cheaper labour than other textile producing countries. For example, Vietnam as one of its main competitors in ASEAN has the minimum wage at the average of $122-176, as compared to Indonesia at the range of $109-274. Notably so Indonesia’s textiles industry in the past had contributed significantly to Indonesia’s economy, representing 10.1 per cent of the total export.

Indonesia is ranked among the top ten largest textile producing countries. However, the nation is far away from threatening China's dominant position. Whereas China controls about 35 per cent of global textile markets, Indonesia controls only about 2 per cent. The Indonesian government targets to increase the nation’s value of exported textiles and garments to $75 billion by the year 2030, implying that this industry would contribute around 5 per cent to global exports. The recent TheInsiderStories data points out that Indonesia has cheaper labour than other textile producing countries. For example, Vietnam as one of its main competitors in ASEAN has the minimum wage at the average of $122-176, as compared to Indonesia at the range of $109-274. Notably so Indonesia’s textiles industry in the past had contributed significantly to Indonesia’s economy, representing 10.1 per cent of the total export.

Back in 2005, the textile industry, which employs around 1.2 million people in 4,500 factories, became the biggest net exporter with a surplus of around $7 billion. Previously in 2004, Indonesia was the biggest textile and clothing exporters in Southeast Asia. Globally, the country reached the ninth rank among the world’s leading clothing exporters and tenth among textiles exporters. But the recent reports trigger a bit of complexity and the challenging scenario for the Indonesian textile industry as the industry has remained uncompetitive due to its high dependency on imported raw materials, high costs of energy and logistics, and market access. As a matter of fact, during the last five years, the Indonesian textile industry has been declining, despite its increasing demand at the global market. During the textile bullish market in 2016, Indonesia’s textile market share only reached 1.8 per cent of the world textile market, which has slipped to 1.6 per cent today.

The country has lost this opportunity to Bangladesh and Vietnam, as its market share is far below Vietnam at 5 per cent and Bangladesh at 7 per cent. Last year, Indonesia only managed to realise total textiles exports at $12.53 billion, far lower than Vietnam which managed to reach at the total $30 billion. Such figures reflect that cheap labour alone can’t do wonders to attract investments, the country needs to brace up on aspects too to win over global trust.

year, Indonesia only managed to realise total textiles exports at $12.53 billion, far lower than Vietnam which managed to reach at the total $30 billion. Such figures reflect that cheap labour alone can’t do wonders to attract investments, the country needs to brace up on aspects too to win over global trust.

Factors restricting growth

The country needs to work on four factors, which include energy cost. Electricity tariff in Indonesia is more expensive than Vietnam and Bangladesh. Indonesia’s electricity tariff is about $0.12 per kWh, much higher than Vietnam and Bangladesh which is only $0.7 and $0.5, respectively. Secondly, Indonesia is still dependent on imports of textile raw materials, so it cannot get cheap raw materials. The high dependence on imports has also made Indonesian textile industry highly susceptible to the changes in the global economy. Indonesia currently imported almost 100 per cent of cotton as Indonesia’s cotton production is only 4 per cent of the total demand. Indonesia imports more cotton from America, Brazil, and Australia.

The textile industry in Indonesia is also hampered by high logistics cost, which is the highest in Southeast Asia. Logistics cost including transport, warehousing, and inventory in Indonesia has so far accounted for 24 per cent of the country’s GDP. The country’s logistics cost-to-GDP ratio is far higher than those of neighbouring countries, including Thailand and Malaysia where the ratio reached 15 per cent and 13 per cent, respectively. Indonesia is also poorly scored in the World Bank’s 2016 Logistics Performance Index (LPI), as it got the 63rd rank out of 163 countries. Indonesia’s logistics infrastructure, international shipment, and logistics competence are elements scored the least.

Lastly, Indonesian textile exports are also hampered by market access. When exporting to the European Union, Indonesian products are still subject to import duty in the range of 11 per cent. Meanwhile, Indonesia’s competitors, namely Vietnam, Bangladesh, Thailand, and Ethiopia, enjoyed 0 per cent of import duty from EU. If Indonesia wants a greater foreign access, it needs to work on these four major factors to remain competitive and win global textile contracts.

The sixth edition of Copenhagen Fashion Summit 2018, held from May 15 -16, 2018, in Denmark, launched a new component, Innovation Forum - an exhibition space for sustainable solutions to address the urgent need to support and accelerate the decision-making process for fashion businesses.

The summit was attended by over 1,300 visitors from over 50 countries. It hosted around 50 exhibitors including some of the most noteworthy sustainable solution providers to the fashion industry, such as ISKOTM, I:CO, Piñatex, Econyl, and Sustainable Angle, etc.

Organised by Global Fashion Agenda, the summit comprised roundtables, conversations, and business meetings, and a panel discussion featuring the Strategic Partners of Global Fashion Agenda: Kering, H&M, Target, Li & Fung.

Sustainable Apparel Coalition addressed the issue of why sustainability should be a leadership priority and also discussed some of the recommendations from the recently released Pulse of the Fashion Industry 2018 report.

Fespa will be held in Spain, March 24 to 27, 2020.

After three successive years in Germany, the event is moving back to a southern European host city in 2020. Madrid was a clear favorite among exhibitors and visitors for a Fespa event.

The profile of Fespa as the leading European exhibition for textile printing continues to increase. Vendors offered new textile printing solutions. The aim is to move the Fespa global print expo to an annual cycle and make every event a comprehensive showcase of all processes and products.

Fespa covers screen, digital and textile printing. It includes printed interior décor applications. Printers and sign makers attend the event. It brings together a buoyant specialty printing community. Visitors can have access to a comprehensive line-up of suppliers of technology, materials for printing and sign-making, consumables and accessories. It will be co-located with European Sign Expo.

The expo is a forum for meeting customers face-to-face, making concrete sales and developing business pipelines.

The Spanish capital is the third largest city in the European Union.

European Sign Expo is Europe’s leading exhibition for non-printed signage and visual communications. Visitors can experience the latest products and innovations on display from dedicated signage exhibitors and Fespa exhibitors.

Model Zara Peerzada is the official spokesperson for Mango in Pakistan. Recently, she was asked to do the brand’s first ever cover and fashion shoot in Pakistan.

Mango has been her go-to store for long and it’s become a real collaboration. International brands are now choosing to work with Pakistani talent. Mahira Khan is with L’Oreal, Ayesha Omar with Maybelline and now it’s Zara Peerzada for Mango.

Mango launched in Pakistan in 2013 and has done well for the market since then. The brand serves customers in almost 2,500 cities globally and 108 countries, Pakistan being one of them.

Mango is a Spanish clothing design and manufacturing brand for women. The Mango concept arises from the interrelation between a quality product with a distinctive design and a coherent and unified brand image. The brand dresses the young, modern and urban woman for her daily needs. The target group is urban women aged between 18 and 40.

The brand also has a line targeting Muslim customers. The collection will include casual clothes such as jackets, kaftans, leggings, tunics and oversized shirts, in addition to festive outfits including long dresses, midi skirts in fantasy fabrics and double-layer body wraps.

The 91st Textile Institute World Conference (TIWF) will be held from July 23-26, 2018 at the University of Leeds, UK.

The conference will focus on the theme of integrating design with sustainable technology.

The event will be sponsored by James Heal, XIROS, Taylor & Francis Group, etc, while Bangladesh Textile Today will be the media partner.

The conference will be encompass Advanced Fibers and Materials Manufacture, Biomaterials, Business, CAD/CAE Technology, Circularity and New Business Models, Clothing, Coloration and Finishing, Comfort Science, Composites, Costume, Craft, Design, Economy & Supply Chain Management, Fashion, Fiber and Fabric Functionalisation, Floor covering, Footwear, Industry, Household/Interiors, Innovative Fabric Structures/Products, Leather, Modeling & Simulation, Nanotechnology, Printing, Retailing & Branding, Smart Textiles, Sustainability, Technical Textiles, Testing and Materials Analysis, Textile Machinery, Textile Manufacturing – Knitting, Nonwovens and Weaving, Textile Recycling, Textile Cultural Heritage Science, Textile Education, Yarn Structures and Spinning.