FW

Continuing their demand for higher minimum wages, thousands of Cambodian factory workers in two special economic zones (SEZs) in eastern Svay Rieng province's Bavet town continued their protests on Thursday. Around 30,000 workers from 39 factories in the Manhattan and Tai Seng SEZs are said to be on strike since Wednesday afternoon.

The agitation commenced after provincial labour officials announced the amount of increase in the minimum wage for the garment and footwear sectors that will take effect from next month. In October, the Cambodian government set the new monthly minimum wage for the garment and footwear sector at $140 for next year, up 9.4 per cent from the current $128. However, protesters are pressing for minimum $148 calling the announced increase too low.

The Garment Manufacturers Association in Cambodia (GMAC) has appealed to the government to take immediate effective and appropriate measures for the protection of security and safety of the investors and their properties. Garment and footwear sector, the kingdom's largest foreign currency earner, includes nearly 1,100 factories with some 700,000 workers, according to the government figures. The sector exported products worth $3.3 billion in the first half of 2015, accounting for about 80 per cent of the country's total exports.

Clean Clothes Campaign (CCC) on the other hand, recently joined more than 25 countries in a global call on major brands such as H&M, GAP, Levi's and Inditex to make sure Cambodian workers receive $177 as a first step towards a living wage.

www.gmac-cambodia.org

"AEPC is an empanelled assessment agency authorized by DGE&T under the Skill Development Initiative (SDI) to conduct MES Assessments in the apparel sector and by the Ministry of Textiles under the Integrated Skill Development Scheme (ISDS) to conduct assessments for apparel/garment and textile sector. In this endeavour, since its inception, AEPC’s Skill Assessment Cell assessed over 100,000 candidates under MES & NON MES category."

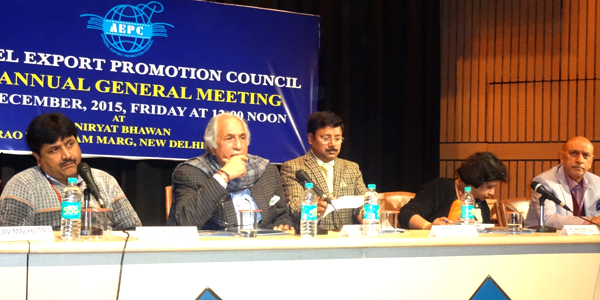

At the 36th Annual General Meeting of Apparel Export Promotion Council (AEPC), held in New Delhi, chairman Virender Uppal spoke about apparels exports industry’s achievements in FY15 and the roadmap for year ahead. The highlights of his speech included various initiatives undertaken by the council to boost export performance of the textile and apparel sector.

Export performance in FY15 and

Exports in dollar terms for the financial year 2014-15 were $16,846 million as compared to $15,001 million in the year 2013-14, representing an increase of 12.3 per cent. Apparel exports during the period from April to October 2015 were $9,793.6 million against $9,562.2 million reported during the same period previous fiscal, indicating an increase of 2.4 per cent.

During the year, AEPC apprised the government about various issues faced by the sector and appealed to resolve them at the earliest.

AEPC’s export promotion activities

Buyer Seller Meets were organized in Amsterdam, in June 2014 with 18 players participating; two meets in Barcelona and Madrid were also orgainsed in September with 29 participants.

At the Hong Kong Fashion Week and White Label the Council participated with 52 participants while in, Berlin, there were 17 participants. AEPC visited Apparel Shows in International Fashion Fair Tokyo, Japan (IFF) with 53 participants and Sourcing at Magic Fair, Las Vegas, USA with 70 participants, Australian International Sourcing Fair, Melbourne, Australia with 35 participants, Hong Kong Fashion Week with 51 participants, Sourcing at Magic Fair, Las Vegas, USA with 51 participants, Hong Kong Fashion Week, with 57 participants, Sourcing at Magic Fair, Las Vegas, USA with 65 participants, India Trend Fair (ITF) at Tokyo, Japan with 63 participants and International Sourcing Expo Australia (ISEA), Melbourne, Australia with 43 exhibitors AEPC’s members.

Domestic events and trade shows

The Council organised India Market Days at Apparel House, Gurgaon on April 24 and 25, 2014 with 78 participants at the fair; 32 buyers from 11 countries and 20 buying agents visited the fair. The 53rd India International Garment Fair was organised from July 14 to16, 2014 at Pragati Maidan, New Delhi with 387 exhibitors, 991 buyers and 548 buying agents.

Similarl India Market Days were held in October 2014 with 44 exporters, 33 buyers from 16 countries and 14 buying agents. Tex-Trends India, 2015 (incorporating 54th IIGF) was organised from January 28 to 30, 2015 at Pragati Maidan, New Delhi with 394 exhibitors participating.

Skill assessment cell and ATDC

AEPC is an empanelled assessment agency authorized by DGE&T under the Skill Development Initiative (SDI) to conduct MES Assessments in the apparel sector and by the Ministry of Textiles under the Integrated Skill Development Scheme (ISDS) to conduct assessments for apparel/garment and textile sector. In this endeavour, since its inception, AEPC’s Skill Assessment Cell assessed over 100,000 candidates under MES & NON MES category. AEPC entered into nine MoUs with implementing Agencies (IAs) namely Technopak Advisors, ILFS Clusters, Wazir Advisors, Karthikeya Spinning & Weaving Mills, Sri Lakshmi Cotsyn, ARTJS, CMAI, Modelama Exports and Matrix Clothing for conducting skill assessment.

Meanwhile ATDC was awarded ‘Best Training Institution-National’ by Education Award (Franchise India) at ‘Indian Education Awards 2015 in June, 2015, for its contribution to large scale quality skilling of youth especially women in rural areas. ASSOCHAM honored ATDC with the ‘Best Institute: Innovation Award’ at its Skilling India summit in New Delhi. ATDC was recognized for its innovative training initiatives.

www.aepcindia.com

To promote the state as textile hub textile parks will be set up in each district where cotton is grown as a major commercial crop. Some of these districts are: Karimnagar, Adilabad, Khammam and Medak. Warangal is envisaged as a major textile hub.

The policy will also aim at strengthen procurement of raw cotton and extend remunerative prices to farmers besides creating marketing linkages for products produced by the weaver and handloom societies.

The new policy will be operational for a period of five years from the date of its announcement. Incentives will be provided to investors who come forward to set up garment cotton based ancillary industries. Neighboring states like Maharashtra, Karnataka and Tamil Nadu have already implemented textile policies for the development and welfare of handloom weavers. All these measures are expected to be incorporated in the new policy thus benefiting cotton farmers in Telangana.

Although Telangana produces long staple cotton, there is no proper value addition and raw cotton is exported and the policy will try to address these things in detail. Besides the government is planning to promote and bring back artisans, who have migrated to other states.

The 17th edition of Tex-Styles India Fair will return from February 22 to 24, 2016 at Pragti Maidan in New Delhi. The fair would provide a platform to exhibitors across fields of cotton, silk, wool, synthetics, powerloom, jute, blended and other fibres to showcase their latest collections.

Since its inception in 1995, Tex-Styles India has emerged as an ideal forum for presenting the multi-faceted splendour of the Indian textile industry and has established itself as the leading fair of its kind in South East Asia. The annual B2B textile show witnesses over 4,000 buyers from across the globe visit the venue to ink business deals.

The textile show organised by India Trade Promotion Organisation (ITPO) provides buyers a one-stop platform for purchase of every conceivable textile products produced in India such as home furnishings and made ups, fabrics, fabrics for furnishings, apparel including outer wear and jackets, pants, skirts, one-piece dresses, blouses, shirts, tunics, cut and sewn garments, textile gifts, knits, shawls, yarn, fibres, threads, trimmings, embellishment and accessories.

Products displayed are specially adapted for overseas markets and cater to the forthcoming Spring/Summer and Autumn/Winter seasons. Special pavilions and facilities like Theme Pavilion, Fabric Folio Pavilion depicting the collection of swatches from all sectors of the Indian textile industry including participating firms and others are set up during the event. Forecasters will also depict designer interpretation of Spring/Summer 2016 trends at the venue.

www.texstylesindia.in

According to Benin, Burkina Faso, Chad and Mali, also known as the ‘Cotton Four’ (C4), have asked the US and the EU to eliminate subsidies and pay compensation to cover economic losses caused by them. The issue is expected to be discussed at length at the World Trade Organisation Ministerial Conference.

It was originally raised in the General Council and Agriculture committee by the C4, who wanted the conference in Cancun, Mexico, in 2003 to insist that the developed nations eliminate subsidies and pay compensation. The countries appealed that it was difficult to compete with the subsidies of the rich nations and it is making difficult for them to be a part of the international trading system.

Their plea was supported by the WTO Director-General, Supachai Panitchpakdi, who urged the assembly of ministers to consider the proposal seriously since according to him, the C4 were seeking a solution based on a fair multilateral trading system. During the discussions, the proposal received support from Canada, Australia, Argentina, Cameroon, Guinea, South Africa, Bangladesh , Senegal and India who voted either for the whole proposal or key parts such as phasing out subsidies.

However, the US was of the opinion that imbalances in cotton are not caused by subsidies but other underlying factors such as country-specific industrial policies that support production for synthetic fibres, high tariffs on finished products and good harvests caused by favourable weather. They suggested that the distortions should be addressed through the production chain. Also the EU said that its production and exports were too small to have an impact on world cotton prices, and that it was changing its programme for cotton producers. It pledged to contribute to reaching agreement on a solution.

The issue was discussed again at the Hong Kong Ministerial Conference in 2005, where it was agreed that export subsidies on cotton would be eliminated, and that developed countries would allow cotton from least developed countries into their markets duty-free and without quotas. It was once again tabled at the Bali Conference in 2013 where the members reiterated their commitment to “on-going dialogue and engagement”, which were agreed at the Hong Kong Ministerial Conference, providing some respite to the C4 nations.

The Sustainability Consortium (TSC) announced today that one of the world’s largest denim brands, Wrangler, has joined the organization in an effort to strengthen supply-chain sustainability for the brand and the apparel industry at large.

“We are delighted to welcome a powerhouse brand like Wrangler to The Sustainability Consortium. Wrangler will bring tremendous influence, expertise and leadership to the goal of creating sustainable apparel.” said Sheila Bonini, TSC CEO, adding, “The Wrangler team is already engaged in the work of our clothing, footwear and textiles group. Their commitment is a great endorsement of the impact that TSC is having in the sector and beyond.”

The Sustainability Consortium is an independent global non-profit organisation working at the intersection of science and business to create transparent tools, methodologies and strategies for product and supply networks that address environmental, social and economic imperatives. TSC collaborates with more than 100 members from civil society, NGOs and corporations, such as Unilever, Campbell’s, P&G and Walmart.

Wrangler is one of a large family of brands including The North Face, Timberland and Smartwool that benefits from the sustainability commitment of parent company VF Corporation. It’s a commitment built upon a robust Global Compliance Program for suppliers, as well as leadership in industry groups like Worldwide Responsible Accredited Production (WRAP) and the Better Cotton Initiative (BCI). This will be the first industry membership distinct to the Wrangler brand.

www.sustainabilityconsortium.org

The COSATU-affiliated Southern African Clothing &Textile Workers’ Union (SACTWU) has welcomed the increase in employment in the clothing, textile, footwear and leather (CTFL) manufacturing industry, as recorded by the most recent Quarterly Employment Survey (QES). The QES was released yesterday by Stats SA, for the 3rd quarter ending September 2015.

The QES records that by September 2015, employment in the CTFL manufacturing sector stood at a little over 90,100 workers. Over the last 12 months - between September 2014 and September 2015 – employment in the CTFL industry increased by 1.8 per cent. This was driven by growth in the clothing sector (676 new jobs), textile sector (1,197 new jobs) and the leather sector (268 new jobs).

The September 2015 CTFL employment numbers are the highest among the past 30 months. For instance in March 2014, employment in the industry was just above 87,300 workers. Although the recent increases in employment remain small, they stand in contrast to the enormous levels of job losses which decimated the industry for over two decades. They also compare favorably to the declining fortunes of the manufacturing sector as a whole, in which employment decreased by 0.3 per cent over the same recent 12 month period. This reinforces SACTWU’s opinion that the CTFL manufacturing industry is entering a new period of greater stability.

SACTWU said that much of this positive employment turn is attributed to continued strong support for the industry from national government since 2009, coupled with its aggressive “Save Jobs” campaign. Also, this is the second consecutive quarter that employment has grown, following the 3 per cent increase recorded in the previous quarter.

Sactwu.org.za

Prolexus Group, a leading name in the Malaysia's apparel industry is in the process of establishing a new knitted fabric plant as a part of its plans to become a vertically integrated company.

The company will invest $ 10 million in the new circular knitting mill which will be located in Johor, about 60km from the group’s current main factory in Batu Pahat, and will have an annual production capacity of producing around 15 million yarns of fabric.

The company is looking forward to start developing the new factory in 2016. The completion of this project is expected to get over by 2017, and an initial production capacity is projected to be about 4.5 million pieces annually. The new knitting mill will also let Prolexus expand its garment production business. The production of its own knitted fabrics would allow better control over the supply chain of its garment production and position the group to conform to the yarn forward rule of origin under the TPPA.

Construction will be funded through the new share issue. Prolexus also plans to start a new garment manufacturing plant in Vietnam’s in Tien Giang province to take advantage of the various benefits expected under the Trans-Pacific Partnership Agreement (TPPA). It already has three manufacturing plants located in Malaysia and China to serve customers requirement while the retailing business has its own brands under Be Elementz and Bixiz Kids.

www.prolexus.com.my

American clothing brand Woolrich John Rich & Bros has launched two new versions of its Arctic Parka, made from 100 per cent Merino wool and resistant to both wind and water.

The Woolrich John Rich & Bros brand having presence across Europe and Japan, for this year’s European Autumn/Winter season, launched two new versions of its famous Arctic Parka – the Polar Parka and the Mackinaw Parka – both made with Loro Piana’s 100 per cent Merino wool Storm System fabric. With support from The Woolmark Company, the company has also undertaken an advertising campaign across Europe, promoting the Merino outerwear in Italy, Switzerland, Germany, France, the UK and the Netherlands.

No Finer Feeling branding is establishing Merino as the fabric of choice for fine, contemporary apparel. The initiative is helping The Woolmark Company to promote the natural benefits of Merino wool to international consumers through collaborating commercial partners.

The Lora Piana Storm System fabric consists of a double barrier fabric. Firstly, a water repellent Rain System treatment ensures that drops of water slide on the outer surface of the fabric, enhancing its water repellency and protecting it against dust, dirt and liquid stains. Secondly, a thin and extremely light microporous absorbent membrane, applied to the back of the fabric, is windproof and allows the skin to breathe.

www.woolrich.com

"A coalition of Cambodian unions are joining together to demand that the brands immediately ensure a minimum wage of $177 is paid in their Cambodian suppliers and negotiate directly with Cambodian unions a binding agreement to achieve living wages, decent purchasing practices, stable employment, and union rights for the long-term. They have also urged the government to refrain from passing the law until genuine consultation has taken place with independent unions."

On International Human Rights Day, labour network Clean Clothes Campaign (CCC) joined more than 25 countries in a global call on major brands such as H&M, GAP, Levi's and Inditex to make sure Cambodian workers receive $177 as a first step towards a living wage. In addition, the organization has pledged its support to the Cambodian union coalition to make sure a controversial Trade Union Law will not be passed before genuine and inclusive consultation with civil society and trade unions is guaranteed by the government of Cambodia.

IndustriALL, one of the largest federations of trade unions around the world, recently said that it was disappointed with the group of major international brands that appear to have largely ignored a pledge made last year to help Cambodian factories pay their workers a higher minimum wage.

Fight for Cambodian workers’ rights intensifies

In September 2014, IndustriALL appreciated the announcement made by eight brands to raise the prices they paid to Cambodian factories for their garment orders so that the factories could in turn pay higher wages to its workers. The Garment Manufacturers Association in Cambodia (GMAC) also welcomed the move. Even the government raised the garment sector’s monthly minimum wage twice since then, first from $100 to $128 and then to $140.

According to Clean Clothes Campaign, the Labour Advisory Council (LAC), voted to approve a new minimum wage of $140, to be implemented in January 2016 for Cambodia’s 700,000 garment workers, despite objections from a number of unions. This insufficient $12 wage increase is a slap in the face of workers who have been organising for over a year to demand a fair minimum wage of $177, it said.

Amid all these developments, the eight brands appear not to have raised their prices, said IndustriALL. Among the brands that joined the pledge were Swedish clothing giant H&M, which places more orders in Cambodia than any other buyer. It was joined by C&A, Inditex, New Look, Next, the N Brown Group, Primark and Tchibo.

In September, GMAC said 99.4 per cent of the member factories it surveyed said that they were receiving the same prices from their buyers as the year before, sometimes even less. It said a third of the factories that responded claimed to be getting up to 10 per cent less. Now Clean Clothes Campaign has decided to organise demonstrations in front H&M, Adidas and other stores in the US, Europe and Asia. In Cambodia, thousands of workers from a coalition of eight unions will rally the streets in three provinces, wearing stickers saying: ‘We need a living wage!’

Workers fainting over fashion

Cambodia recently saw another wave of mass fainting in garment factories. In August 2015, nearly 400 workers fainted in four factories across Cambodia. On July 2, 2015 alone, 38 workers lost consciousness in a factory in Phnom Penh. In 2014, the Ministry of Labor recorded that more than 1,800 workers collapsed in 24 factories. Mass fainting has been linked to malnutrition, high targets and long working hours, as a consequence of low wages and the need for workers to survive.

A coalition of Cambodian unions are joining together to demand that the brands immediately ensure a minimum wage of $177 is paid in their Cambodian suppliers and negotiate directly with Cambodian unions a binding agreement to achieve living wages, decent purchasing practices, stable employment, and union rights for the long-term. They have also urged the government to refrain from passing the law until genuine consultation has taken place with independent unions.

Athit Kong, Vice President of C.CAWDU, an independent union in Cambodia, says “After years of campaigning, it is clear that the only way Cambodian workers will get a decent wage they can live on, is collective bargaining between brands, as the principle employers, and the garment unions. A minimum wage of $140, as its set now, is like throwing bread crumbs at your impoverished workers. To simply survive, we need $177 as a very first basic step.”

Clean Clothes Campaign has now urged brands to make sure $177 is paid immediately to the workers and genuine consultation takes places between the coalition of independent unions and the government regarding the Trade Union Law.

Cleanclothes.org www.industriall-union,org