For years, China has been the undisputed El Dorado for global fashion and luxury brands. A growing middle class, with its aspirations, desires and ever increasing purchasing power, makes the Chinese market a cornerstone of their global strategies. However, the market is evolving while a complete retreat is far from reality, there is a shift in approach due to realignments in consumer behavior, and emerging policy considerations.

The era of unfettered expansion

The past decade saw a gold rush of international brands establishing and expanding their presence across China. Flagship stores in cities like Shanghai and Beijing, while brands ventured into rapidly developing Tier II, III cities, eager to capture every segment of the booming luxury market. WealthBriefing stats show, while Tier I cities remain dominant, luxury spending in Tier II cities grew 22 per cent in 2024 . This growth was underpinned by several factors.

One major factor was China's remarkable economic growth that created a vast pool of affluent consumers with a penchant for luxury goods as status symbols and expressions of their newfound wealth. Also, the rapid adoption of digital technologies in China created unprecedented opportunities for brands to connect with consumers online through e-commerce platforms and social media. Chinese consumers, while embracing modernity, also developed a strong appreciation for the heritage and craftsmanship associated with established international luxury brands.

The winds of change

While China remains a critical market, several factors are now prompting global brands to re-evaluate their strategies, moving towards a more consolidated and strategic presence rather than relentless expansion. Topmost factor is China's economic growth has decelerated, accompanied by a real estate crisis and rising youth unemployment. As per Bain & Company, the Chinese mainland luxury market saw 18-20 per cent dip in 2024, reverting to 2020 levels. This has led to lower consumer confidence and a more cautious approach to discretionary spending, impacting the luxury market.

Meanwhile, the profile of the Chinese luxury consumer is evolving. Younger generations, particularly Gen Z, are displaying a preference for "quiet luxury" – subtle, high-quality items over logo-heavy designs. They also prioritize experiences, sustainability, and local brands that resonate with their cultural identity. And with the resurgence of international travel post-pandemic, a significant portion of Chinese luxury spending is shifting back to overseas markets due to favorable exchange rates and tax-free shopping. In the first half of 2024, almost 52 per cent of affluent Chinese consumers made luxury purchases abroad, a 16 per cent increase year-on-year.

Local Chinese luxury brands too are gaining ground, appealing to national pride and offering culturally relevant designs. These brands are increasingly seen as legitimate competitors by international players. While not a direct crackdown on luxury consumption, there's a growing emphasis on "common prosperity" and a subtle discouragement of excessive displays of wealth. This has led to a phenomenon known as "luxury shame," where affluent consumers are becoming more discreet in their purchases. Furthermore, evolving import policies and tariffs can influence pricing strategies and market access. Repeated price hikes by global brands in recent years have also led to increased price sensitivity among Chinese consumers, driving some to seek cheaper alternatives or make purchases abroad.

Consolidation, not retreat

The current trend indicates a move towards consolidation rather than a widespread retreat. Brands are focusing on:

• Optimizing existing footprint: Instead of aggressively opening new stores, brands are focusing on enhancing the performance of their existing boutiques, ensuring a premium and engaging customer experience. This might involve renovations, relocations to prime locations, or even selective closures of underperforming stores.

• Deepening digital engagement: Investing in sophisticated online platforms, engaging content on local social media like Douyin and Xiaohongshu, and leveraging livestreaming are crucial to reach and engage the digitally native Chinese consumer.

• Localization strategies: As per WealthBriefing 56 per cent of mainland Chinese consumers plan to buy more from Chinese luxury brands in 2025. Therefore, adapting product offerings and marketing campaigns to resonate with local tastes and cultural nuances is becoming increasingly important. This includes incorporating Chinese cultural elements in designs or collaborating with local influencers.

• Focusing on high-value customers: Brands are intensifying efforts to cultivate relationships with their most loyal and high-spending customers through personalized services and exclusive experiences.

• Channel optimization: Brands are carefully evaluating their distribution channels, including e-commerce, physical stores, and duty-free zones like Hainan, to align with evolving consumer preferences and spending patterns. Hainan's duty-free sales saw a 15 per cent year-on-year growth in 2024, highlighting its significance.

Impacts of reciprocal tariffs

Adding to the evolving dynamics of China's luxury market is the likely impact of recent reciprocal tariffs. The tit-for-tat escalation has introduced a new layer of complexity for global fashion and luxury brands operating in China.

As a result, US fashion and luxury brands importing goods into China now face significantly higher tariffs. This increased cost burden could lead to several outcomes for example, brands might be forced to raise prices for their products in China to maintain profit margins, potentially impacting demand and consumer willingness to purchase. If brands choose not to fully pass on the tariff costs to consumers, their profits in the Chinese market will dip.

Meanwhile, some US brands might explore shifting their supply chains to countries not subject to these tariffs, although this can be a complex and time-consuming process. Brands from countries without such high reciprocal tariffs might gain a competitive edge in the Chinese market due to potentially lower prices. European brands, for instance, could see an opportunity to capture a larger market share if US brands become more expensive.

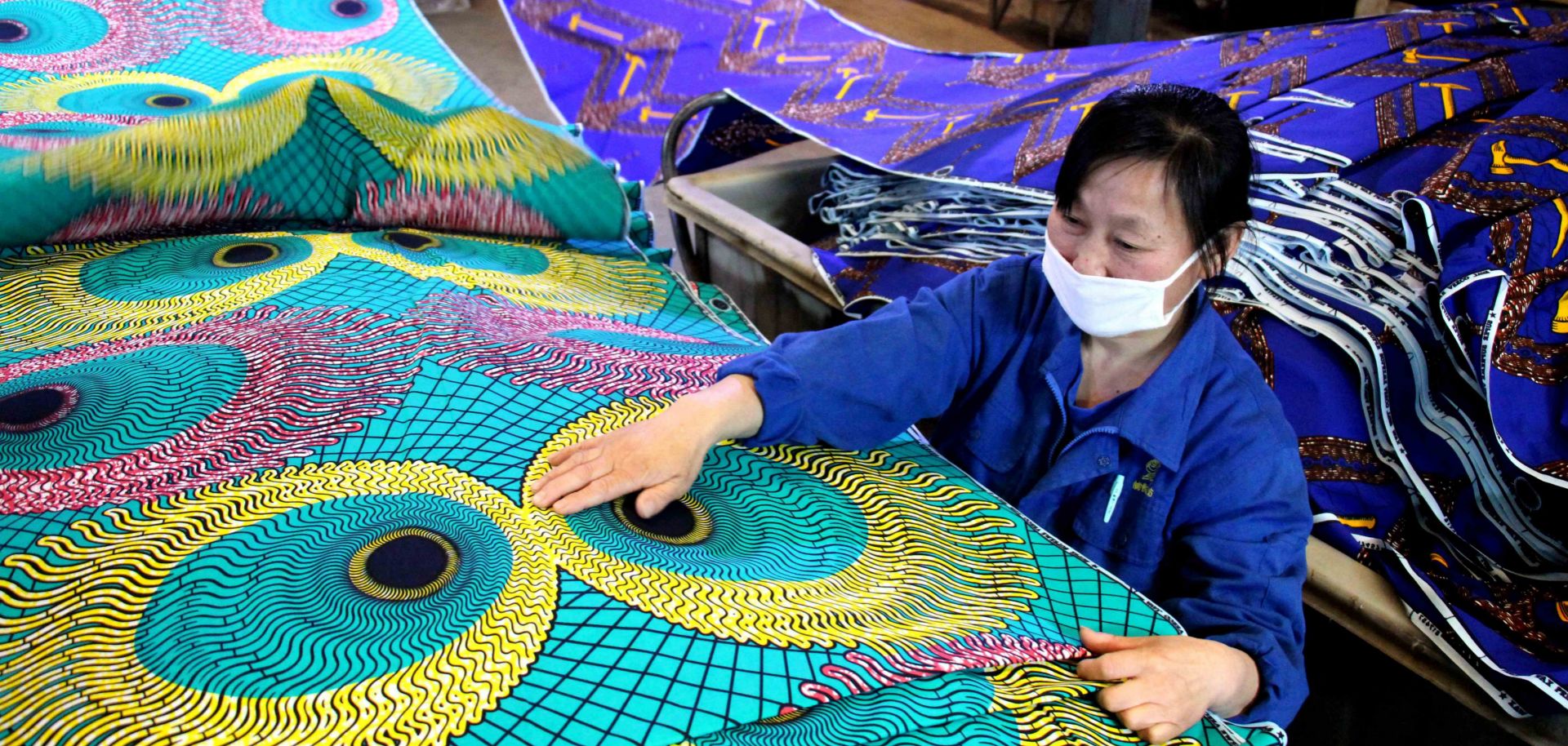

The increased cost of imports might incentivize US brands to further invest in local production within China, reducing their reliance on imports and mitigating tariff impacts. This aligns with the broader trend of localization discussed earlier. Higher prices due to tariffs could further increase the shift towards "value-conscious" luxury consumption and increase the appeal of domestic Chinese brands or luxury goods purchased through overseas channels or the grey market, where prices might be more competitive.

Some reports suggest a concerning possibility of China easing restrictions on counterfeit goods, particularly those targeting American luxury brands, as a retaliatory measure. This could severely damage the brand equity and sales of US luxury companies in China.