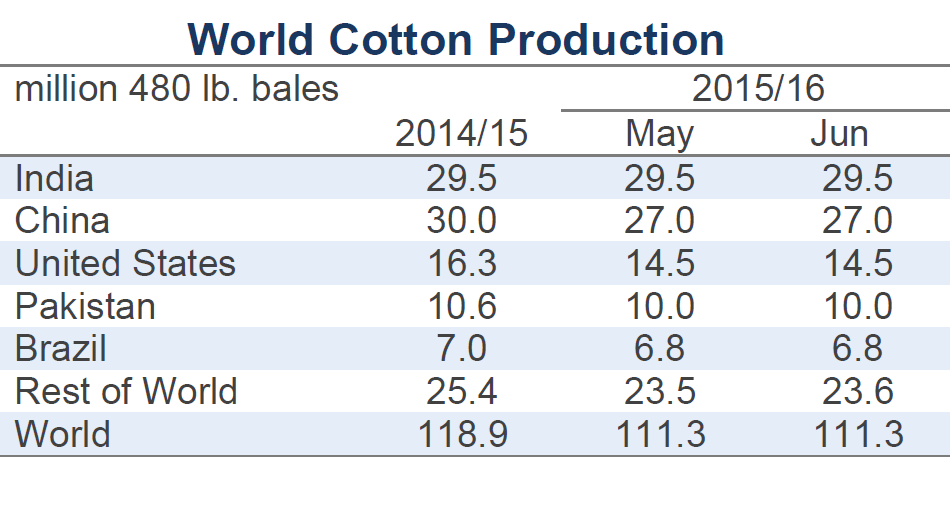

Few significant changes were made to cotton market forecasts for 2015/16 in the latest USDA report. The world production figure increased only 70,000 bales and was essentially unchanged at 111.3 million bales. The world consumption estimate increased only 30,000 bales and was essentially unchanged at 115.3 million bales. The projection for world ending stocks was lowered slightly 217,000 bales from 106.3 million to 106.1 million.

At the country-level, there were no significant changes to 2015/16  harvest forecasts, with only

harvest forecasts, with only

minor revisions made to several West African countries. In terms of mill-use, the only notable country level revision was for Turkey with over 100,000 bales, from 6.3 million to 6.4 million. Trade figures increased 130,000 bales, with the change to global figures primarily resulting from a slight increase to the Turkish import number of over100,000 bales, from 3.6 million to 3.7 million and minor increases in export forecasts from Turkmenistan and West Africa.

Major changes in global cotton outlook

There were several changes made to 2014/15 estimates. The largest was a 500,000 bale reduction to the Indian crop forecast from 30 million to 29.5 million. Along with a 100,000 bale increase to the estimate for Benin, the world production estimate for the current crop year increased 415,000 bales from 118.9 million to 119.3 million. The global mill-use number for 2014/15 was virtually unchanged to over 20,000 bales at 111.5 million, with a slight increase in Turkish consumption offset by minor decreases in Zambia and Zimbabwe. The Turkish import estimate also increased 100,000 bales. In combination with a 300,000 bale increase to the Chinese import figure, these changes lifted the global import figure by 450,000 bales. The corresponding increase in exports was primarily a result of a higher forecast for India with over 300,000 bales, from 3.8 million to 4.1 million.

The 2014/15 crop year can be seen as a period of transition. This transition was made evident by the decreases in prices between the planting and harvesting of last year's crop. The easing in prices was a product of changes in the world's supply and demand situation, with the most significant developments in terms of fundamentals stemming from reforms in Chinese policies. These reforms emphasized increased use of domestic cotton supplies and resulted in sharply lower imports. Since China is the world's largest source of demand, lower Chinese imports were a significant factor contributing to the increase in stocks in many exporting countries in 2014/15. In turn, this increase in available supply was been a primary reason why prices declined.

In the upcoming 2015/16 crop year, it appears that the most important transitions relative to price direction that were made in 2014/15 will be maintained. Significant year-over-year declines in acreage and production are expected and, although it remains a point of contention among cotton analysts, the USDA is also forecasting a relatively strong increase in mill-use to follow the decrease in prices.

Global trade and stockpile direction

While these changes are notable, recent crop years have highlighted the importance of trade and the allocation of stocks to price direction. Examination of forecasts for both trade and stock allocation in 2015/16 suggests only small changes that may not be enough to push prices outside of recent trading ranges. Chinese import demand is predicted to continue to be depressed. At 6.0 million bales, the current forecast calls for imports in 2015/16 to be 25 per cent below the 2014/15 volume and 70 per cent below the average level of imports during the period of aggressive reserve purchases between 2011/12 and 2013/14. Global cotton trade in 2015/16 is expected to total 33.8 million bales, which is only 1 per cent below the total volume in 2014/15.

With the decrease in Chinese imports in 2014/15, stocks outside of China increased to a record level. Despite declines in acreage and production in most countries in 2015/16, stocks outside of China are expected to change little in the coming crop year and are projected to decrease only 2 per cent from 43.4 million to 42.5 million.

Since trade figures and stocks outside of China levels are expected to be stable, it may be appropriate to think of 2015/16 as a period of consolidation, when the most important transitions relative to price direction made in 2014/15 were upheld. Considering that global stocks remain extremely high by historic standards, and assuming China will release reserves if prices move higher, this consolidation may signal the beginning of an era of consistently low prices.