FW

Lina Jasutiene, Recoupex presenting at recent Federation of Buying Agents (FBA) monthly meeting.

India’s textiles sector is one of the oldest industries in Indian economy. Textiles, textile goods semifinished and finished products have witnessed growth in demand recently. Despite the positive economic outlook for textile industry, many importers, exporters and freight forwarders face cargo damage in transit. In this article we discuss solutions on how to stop absorbing financial losses when cargo gets damaged in transit.

India’s textiles sector is one of the oldest industries in Indian economy. Textiles, textile goods semifinished and finished products have witnessed growth in demand recently. Despite the positive economic outlook for textile industry, many importers, exporters and freight forwarders face cargo damage in transit. In this article we discuss solutions on how to stop absorbing financial losses when cargo gets damaged in transit.

India based importers and exporters historically have been absorbing losses for cargo damage, even if they were not at fault for the damages. Freight forwarders also take part in the losses in order to keep customers due to very tight competition in the market. The trade volumes in and out of India increase, so is the frequency of cargo claims. Globally cargo claims have gotten really bad name in transportation industry and the reason for this is just because there are so many parties involved in international trade and oftentimes the blame for cargo damages is put on the weakest party in the transaction.

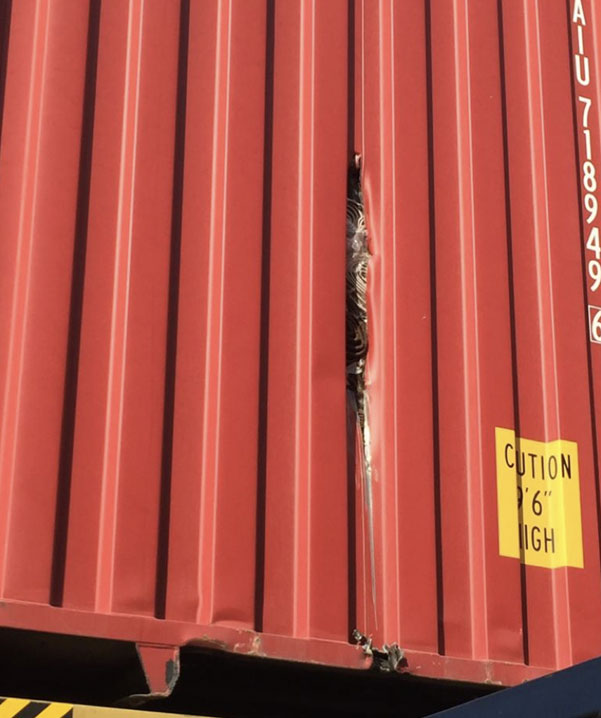

Typical damages in transit for textile and garment cargo are water ingress through holed, dented or rusty container. Textile goods and garments are sensitive to high humidity. After long exposure to humidity, different fabrics get damaged and often times become unsuitable for further use. Another cargo damage in transit is physical cargo damage due to mishandled container during loading, discharging operations. Cargo theft is also frequent in particular in certain port terminals. Cargo damages create friction between importers and exporters. International trade is growing, vessels are bigger, more transshipment ports get involved to transport container from origin to destination. This guarantees that witness cargo damages will not vanish.

Recoupex, one-stop platform for cargo claim refunds, aims to create a frictionless cargo claim refund experience through technology, globally active network of lawyers and experts to substantially reduce the losses for freight forwarders and cargo owners when cargo is lost or damaged in transit. Dr. Lina Jasutiene, Managing Director of the company, expounds on the scenario on cargo claims in India.

It is very hard to get compensation from a liable party. There is a lot of uncertainty about rights and responsibilities in this process adds Jasutiene. Industry statistics show, that eight out of ten claims are rejected by the liable parties. Only one claim out of the ten gets paid at one tenth of the original value,” she explains.

Eighty five percent of all cargo claims are claims 50,000 USD. Due to high operational costs they become delinquent and dropped as uneconomic to pursue. All these losses are shared between exporters, importers and freight forwarders, states dr. Jasutiene.

Seeking for the compensation from the shipping line is a legal right importers and exporters have regardless if they are based in India and other countries. Recoupex helps shippers to obtain compensation they are entitled to at no win, no pay basis. Only if Recoupex is successful in getting compensation back they charge 20% service fee. Otherwise customers pay nothing. Global network of Recoupex highly specialized lawyers and technology enables higher value and faster settlements. Majority of Recoupex customers are importers and exporters who don’t have conventional insurance, or are undercovered. Some of our customers have insurance, however they prefer to obtain compensation through us as they don’t want their premiums to go up. Another group of customers wants to outsource legal support in claims handling. Either they don’t have capacity in house or it is not economically viable for them to have expertise in house,” adds dr. Jasutiene.

The future for the Indian textile industry looks promising, buoyed by both strong domestic consumption as well as export demand. With consumerism and disposable income on the rise, the retail sector has experienced a rapid growth in the past decade. To ensure sustainable profitability for importers and exporters remains of immense importance, while seeking compensation from the liable party as regard the damaged cargo in transit is one of the most untapped resource that needs to be explored.

Increasing diversion of trade from Bangladesh to its close competitor Vietnam is causing the nation to lose sleep. As recent Export Promotion Bureau stats reveal, RMG exports from Bangladesh declined by 7.59 percent to $15.77 billion due to a decline in global demand. One reason for declining export is Bangladesh’s overdependence on only five items: men’s and women’s T-shirts, trousers, shirts, jackets and sweaters. Vietnam exports around 10 types of products to the US alone. The country also has free trade agreements with the European Union, the Asean, Hong Kong, Singapore, South Korea and China. It exports apparels to countries like the United States, Europe, Japan and South Korea. Of this, the US has traditionally been the biggest market for Vietnamese apparels and has benefitted the most from the US-China trade war.

Increasing diversion of trade from Bangladesh to its close competitor Vietnam is causing the nation to lose sleep. As recent Export Promotion Bureau stats reveal, RMG exports from Bangladesh declined by 7.59 percent to $15.77 billion due to a decline in global demand. One reason for declining export is Bangladesh’s overdependence on only five items: men’s and women’s T-shirts, trousers, shirts, jackets and sweaters. Vietnam exports around 10 types of products to the US alone. The country also has free trade agreements with the European Union, the Asean, Hong Kong, Singapore, South Korea and China. It exports apparels to countries like the United States, Europe, Japan and South Korea. Of this, the US has traditionally been the biggest market for Vietnamese apparels and has benefitted the most from the US-China trade war.

Shorter lead times enhances infrastructure ranking

Having 1,900 miles of coastline and 320 ports, Vietnam offers shorter lead times for apparel shipments compared to others. It was ranked 80th by the World Economic Forum in terms of quality of port infrastructure, with an average score of 3.80 on a scale of 1 to 7 between 2006 and 2018. Vietnam also offers shorter lead times for procuring skilled manpower and reaching its production capacities.

Cheap labor reduces production costs

The country has a low labor cost which reduces production costs compared to other competitive sourcing countries. However, Vietnam has increased its minimum wage by 5.7 per cent from January 2020. Wages will be based on the living expenses and regional distance from the workplace. In July 2019, Vietnam enacted a new competition law that limits unfair competition among Vietnamese and foreign companies in the domestic market. Though Bangladesh too launched such an act, it has not been effectively implemented.

Developing industries to curb import costs

Another challenge that Vietnam faces is the high import cost of machinery and raw materials. To counter, this, Vietnam government is making heavy investments in the development of support industries. It has developed its cotton and knitting industry. Production of input materials lowers production costs besides opening doors to the competitive market. Also, Vietnam takes shorter time to import raw materials from China than other sourcing countries.

Currency devaluation adds advantage

The export-oriented country recently depreciated its currency Dong against the US dollar. Its better market access, zero tariffs on certain markets, shorter lead times, and competitive exchange rates, give it an advantage over other countries. On the other hand, Bangladesh does not plan to devalue its currency as the country’s economy mostly depends on import rather than export. This is causing it to lose competitiveness in the global market as it offers higher prices than other competitors.

Attracting foreign direct investments

With increased urbanisation, growing employment and income, Vietnamese people spend the second-highest on clothing after food. The domestic market attracts investments from the major international brands. The country, with skilled laborers and sophisticated techniques, is currently attracting many Chinese and Korean investors.

Comparatively, despite being the strongest source of economic growth for Bangladesh for three decades, the textile and apparel sector faces various challenges. Poor shipment facilities, higher production costs due to compliance, pegging of taka against US dollar, increased wage structure, false promise by buyers of giving fair prices, less diversified products, lack of diversified market and more importantly, unskilled workforce and the lack of mid-level management are some major roadblocks.

If Bangladesh wants to indeed compete with Vietnam, it needs to start producing high-end diversified products, look for diversified markets, train its workers to maximize efficiency, and start catering to small orders to get hold of the e-commerce platforms.

India became the largest producer of cotton in the year 2014-15 and continues to be the leader in cotton production in the world by accounting 37% area under cotton. India produces 330 to 400 lakh bales and consumes 300 to 320 lakh bales of cotton per year thus becoming a net exporter of cotton. Indian cotton has been the engine of growth for the predominantly cotton based Indian textile industry and currently textile exports account 80% of the textiles exports. The Technology Mission on Cotton and BT cotton technology helped the country to become the world leader in cotton textile exports. However, Indian cotton quality has been far below the standard especially in terms of trash content, contamination, etc., that stalled the value addition and also affected the revenue of the cotton farmers.

Cotton Corporation of India (CCI), established in the year 1974, started its Minimum Support Price operation during the year 1985 and is greatly helping the cotton farmers and the cotton textile industry that has been functioning under the Ministry of Textiles. The industry has been pleading the Ministry of Textiles to standardize and brand Indian cotton.

In a press release issued, Mr. Ashwin Chadran, Chairman, The Southern India Mills’ Association (SIMA) has stated that CCI started enforcing the fair average quality norms from the cotton season 2018-19 and was successful in its venture. He has stated that at a function held at Mumbai, the CCI has launched its first Indian brand “HIRA” and is planning to market the same shortly. Mr. Ashwin has appreciated the Hon’ble Union Minister of Textiles, Smt Smriti Zubin Irani and Chairman-cum-Managing Director of CCI, Dr P. Alli Rani for the historical initiative taken by CCI. He has stated that the Ministry is also planning to launch a scheme “Nirmal Cotton Mission” with CCI as a nodal agent that would go a long way to make Indian cotton to become the best quality cotton in the world and would enable the Indian cotton textiles & clothing manufacturers to produce all high value added items using home grown cotton.

SIMA Chairman has appealed to the Hon’ble Prime Minister to launch the Technology Mission on Cotton in a revised format to increase the productivity which is only around 460 to 500 kgs per hectare as against 1500 to 2200 kgs per hectare achieved by over 20 countries in the world. He has said that adopting global best practices and acquiring appropriate technology would be essential to achieve the mission of doubling the farmers’ income and make India as the true global clothier of cotton textiles.

US companies don’t take a chance on new fashion or new ideas. They are all hiding behind tried and true apparel such as denim. The main problem is the lack of passion that pervades the industry. Executives are afraid to be on the forefront of creating a new look.

Outrageous new ideas come from Paris, London, and Milan. But no one puts these ideas to work and creates a new boutique with interpretations of what is seen in foreign lands. The US delights in selling secondhand clothes, denim, and markdowns. That little black dress is gone, cargo pants are a thing of the past. Macy’s, JC Penney, Madewell and Gap sell secondhand clothes instead of introducing new fashions. The merchandise has been cleaned and scrubbed, but all the same shopping in these stores is about buying hand-me-downs. These sell and they add to profits but they do not create an image that a store can be proud of. However Nordstrom has taken a different approach. Nordstrom is stocked with merchandise that has been returned by its customers. Each item is cleaned, refurbished, and sold at about half its original price. That makes sense, since it does not introduce new brands that the store did not carry, and it does not confuse the fashion message Nordstrom is trying to create.

Hermes 2019 revenue rose 12.4 per cent. Recurring operating income was up 13 per cent. The company has been upgrading stores and opening new ones. Revenue generated in own stores rose 13 per cent last year. In Asia, excluding Japan, revenue rose 17.8 per cent. The firm saw strong growth in Greater China and in South Asian countries. The region benefited from sore revamps and openings as well as the continued development of its digital platform and it rolled this out in Singapore and Malaysia in October. Japanese sales rose 8.2 per cent. The Americas saw a 12 per cent revenue rise. Europe, excluding France, was slower but still grew eight per cent, driven by the United Kingdom and Italy. In November, Hermès opened its first store in Poland. Meanwhile, France posted an eight per cent growth.

In Q4 growth continued in all regions, with revenue rising 13.4 per cent in the quarter, although that figure and the 10.7 per cent constant currency rise did represent a slowdown.

France-based luxe brand Hermes, despite global economic, geopolitical and monetary uncertainties has an ambitious goal for revenue growth at constant exchange rates.

Indorama Ventures registered a volume growth of 18 per cent in 2019. Core ebitda fell 20 per cent. Operating cash flow in 2019 increased by 33 per cent.

The company has undertaken several transformative initiatives that are expected to generate benefits starting in 2020 and targeted to lead to run rate cost savings by 2023. Key strategic priorities for the group are expansion in India; formation of a dedicated team to grow the PET recycling business; and a continued focus on working capital optimization coupled with an increased emphasis on leadership development.

Indorama Ventures is a chemical producer. It continues to build durable competitive advantages through its diversified portfolio, supported by a responsible approach to sustainable business, people and the environment, creating value for society and for customers. It has a global reach, with around 80 per cent of capital invested in Europe and America. The business model is resilient to events happening in any particular country or region. Indorama has strong growth engines. One is the combined PET segment, which includes its key feedstocks and recycling business. Another is the integrated oxides and derivatives segment. And there is the fibers segment, which serves the mobility, hygiene and lifestyle verticals.

The India International Textiles expo will be held in Mumbai from March 5 to 7, 2020. This three-day textile trade show will feature product categories including yarn, textiles, readymade garments, industrial textiles, cottons, blended textiles, silk, knitted textiles, suiting textiles, saris, and accessories. Trade visitors from the UK, US, Europe, Bangladesh, UAE, and China are expected. The event aims at giving Indian powerloom textile producers a platform from which to showcase their products and link up with international distributors.

The event is being organized by the Powerloom Development and Export Promotion Council, which is a non-profit working to promote India’s powerloom sector. It works to increase exports of fabrics and made-ups produced by powerloom manufacturers and also works on the industry’s trade practices and technology. The council gathers market information and gives information on the latest developments in the export front. It takes up various issues of the powerloom sector with the relevant authorities. It organizes buyer-seller meets at different locations in India for promotion of powerloom fabrics and made-ups and organizes training programs, workshops, seminars to educate entrepreneurs on various business related issues. The council has established a design studio at Erode for providing training and filling the skill gap in the industry.

Operating profits of polyester yarn manufacturers in India are set to rise next fiscal. Reason: a rise in operating margins, healthy demand for polyester, and higher blending in garments and other products.

The price of purified terephthalic acid (PTA) – a key raw material that accounts for more than half of the sales price of polyester yarn – is expected to be under pressure in the near term. Moreover, PTA capacities in Asia are set to rise 20 per cent over the next couple of years, which will keep prices in check. The removal of the anti-dumping duty will make India’s PTA imports cheaper, given more avenues for sourcing. Consequently, the input cost for polyester yarn manufacturers would be three percent to four per cent lower. Falling prices and adequate availability of PTA will, in turn, help polyester yarn manufacturers step up production and utilisation levels, too, given the healthy demand and better export competitiveness.

Given the high degree of competition, polyester yarn manufacturers will have to pass on a part of the cost savings to end consumers. However, their operating profits should get a 15 per cent to 20 per cent boost even if they retain half of it.

The European Union’s exports of fashion goods have increased 48.4 per cent compared to 2010. Holland’s exports of fashion goods in 2019 were 98 per cent more than in 2010. The country is also the logistic heart of fashion in Europe due to its strategic location since its radius of influence covers cities such as Paris, London, Berlin, Milan or Dusseldorf. Spain’s fashion sales abroad have grown by 90.3 per cent since 2010. Italy’s fashion exports in 2019 were 46.9 percent more than they were ten years ago and two per cent more than in 2018. France’s exports of fashion products in 2019 were 78.2 per cent higher than they were 10 years ago.

Eastern Europe has become one of the main supply hubs and one of the largest exporting giants in Europe. Poland and the Czech Republic have doubled their fashion exports in the last ten years. Between 2018 and 2019, Poland’s fashion exports increased 1.23 per cent. This increase is due to the modernization of industrial fabric of the country, which began ten years ago. The fashion and clothing industry plays an important role in the Czech market, being the fifth most important sector in the country.

"Comprising freight forwarders, courier companies, and other companies integrating and offering subcontracted logistics and transportation services, third party logistics (3PL) companies, help textile manufacturers and fashion retailers to grow their businesses and boost profits. These companies typically provide warehousing and transportation services that can be scaled and customised as per customer requirements."

Comprising freight forwarders, courier companies, and other companies integrating and offering subcontracted logistics and transportation services, third party logistics (3PL) companies, help textile manufacturers and fashion retailers to grow their businesses and boost profits. These companies typically provide warehousing and transportation services that can be scaled and customised as per customer requirements.

Comprising freight forwarders, courier companies, and other companies integrating and offering subcontracted logistics and transportation services, third party logistics (3PL) companies, help textile manufacturers and fashion retailers to grow their businesses and boost profits. These companies typically provide warehousing and transportation services that can be scaled and customised as per customer requirements.

A third party logistic provider helps manufacturers meet customer’s request for a particular kind of fabrics for garments. They also reduce delays and iron out logistical details by streamlining the movement of textiles between destinations. European fabric manufacturers hope to withstand growing competitive pressures by focusing on sustainable fabrics, including those with traceable origins. A 3PL can enable these companies to respond to global customer preferences instead of falling behind the curve.

Helping manufacturers provide season-specific garments

Besides catering to changing demands of customers, the fashion industry must provide shoppers with season- specific garments. To accurately predict their demands, many manufacturers utilise artificial intelligence (AI) to detect fabric defects or predict customer demand during a given period.

specific garments. To accurately predict their demands, many manufacturers utilise artificial intelligence (AI) to detect fabric defects or predict customer demand during a given period.

At times, smaller manufacturers find it difficult to maintain flexibility in their operations; especially when they need to ramp up their processes in a relative short. By providing services that would otherwise be out of reach of these manufacturers, 3PL companies fulfill their need for three primary services of transportation, warehousing and information technology.

Enabling market expansion

At times, textiles originate from countries located far away from those that sell apparels made with these fabrics. A 3PL provider can bolster the chances of success of manufacturers and retailers by moving into new, international markets. A 3PL provider can help manufacturers and retailers source materials faster or at cheaper rates. 3PL can also help a retailer meet latest demand by launching operations in a new marketplace and serving customers there.

Changing apparel procurement for store shelves

Many customers have faced the disappointment of wanting to purchase a particular garment and discovering it out of stock. To avoid this scenario, fashion retailers work with 3PLs to procure goods faster. They also plan to outsource most of their e-commerce order fulfillment to 3PL businesses who can ship their products directly to the consumers who order them, reducing delays and meeting expectations.

Though fashion customers are happy with what their purchases, whether in stores or through a website, factors like fit, feel and durability can ruin their happiness. To address these requirements, 3PL organisation can smoothen the process of returns.

The fashion industry moves at a lightning speed. In order to remain profitable, textile manufacturers and garment retailers need to match this rapid pace. Specialised resources provided by 3PL companies can help these manufacturers and retailers to accomplish this.