FW

Beyond the Bin: Refashion study unlocks secrets to circular textiles & footwear

Recycling used clothing, household linens (TLC), and shoes continues to be a major hurdle, primarily due to the intricate mix of materials and decorative elements prevalent in their design. However, a groundbreaking study update by Refashion in 2024, drawing upon research from ENSAIT (École Nationale Supérieure des Arts et Industries Textiles) and insights from industry stakeholders, pinpoints specific design choices as either major disruptors or crucial enablers in the recycling process.

The report, titled ‘Disruptors and facilitators of the recycling of Clothing Textiles, Household Linens and Footwear (TLC): State of play’, emphasizes the critical role of eco-design in integrating recyclability right from the initial stages of product creation. "Our updated study underscores a fundamental truth: the decisions made at the design table have a profound impact on whether a textile or shoe can be effectively recycled at its end-of-life," explains a Refashion spokesperson. "By understanding and minimizing disruptors while maximizing facilitators, we can significantly advance the circularity of the textile and footwear industries."

Decoding disruptors, the recycling saboteurs

The research identifies several ‘disruptors’ that complicate or even prevent efficient recycling. These can be external additions like buttons, zippers, and intricate embroidery, or internal elements inherent to the material composition. For example, a seemingly fashionable jacket made from a blend of cotton, polyester, and rayon with over 8 per cent elastane and adorned with numerous metal studs exemplifies a product riddled with disruptors. Separating the fibers is technically challenging, the high elastane content compromises mechanical recycling, and the metal studs necessitate manual removal, adding significant cost and time to the process.

Disruptors identified

• Complex material mixtures: Fabrics composed of three or more different fiber types pose a significant challenge for separation and subsequent recycling processes.

• High elastane content: The presence of elastane exceeding 5 per cent in textiles hinders mechanical recycling processes and can contaminate other material streams.

• All-over decorative elements: Features such as sequins, coatings, prints, and rigid embellishments not only complicate sorting but can also damage recycling machinery.

• Metalloplastic threads: These threads, often used for decorative purposes, are difficult to separate and can interfere with various recycling technologies.

• Electronic and electrical components: Increasingly found in smart textiles and footwear, these components require specialized removal and processing to avoid damaging equipment and contaminating material streams.

Facilitators, paving the way for circularity

Conversely, the study highlights design choices that significantly ease and improve recycling processes. These facilitators offer pathways towards a more circular system.

Facilitators identified

• Monomaterial composition: Textiles made from a single fiber type (e.g., 100 per cent cotton or 100 per cent polyester) are the most straightforward to recycle, allowing for efficient sorting and processing.

• Single-layer construction: Garments and linens made with a single layer of fabric, without bonded or laminated layers, simplify the recycling process.

• Monochrome fabrics without superfluous additions: Plain, single-colored textiles without purely aesthetic embellishments streamline sorting and processing.

• Hot-melt wires for dismantling: The use of heat-sensitive wires in shoe construction can facilitate easier separation of the upper and sole components.

"Imagine a simple T-shirt made from 100 per cent organic cotton, dyed with a single, eco-friendly color, and free of any unnecessary embellishments. This seemingly basic design is a recycling champion," states Anya Sharma, a textile sustainability expert consulted for the study. "It allows for efficient mechanical recycling, preserving the valuable cotton fibers for future use."

Shoe recycling, sector ripe for innovation

The study sheds light on the particularly complex landscape of shoe recycling, which is still in its nascent stages. The vast array of materials used, intricate assembly methods (welding, sewing, injection molding), and the frequent inclusion of metal and electronic components present significant hurdles. Currently, shoe recycling primarily relies on either crushing the entire shoe or manually/automatically separating the upper and sole.

The research emphasizes the urgent need for design innovation in the footwear sector to incorporate more facilitating elements and reduce the use of disruptive materials and complex constructions.

Eco-design for a circular future

Refashion's study serves as a crucial resource for designers, manufacturers, and policymakers. By clearly identifying disruptors and facilitators, it provides actionable insights for integrating recyclability into the very fabric of product design. This shift towards eco-design is paramount in achieving a truly circular economy for textiles and footwear, reducing waste, conserving resources, and minimizing the environmental impact of these industries. The report underscores that the future of textile and shoe recycling hinges on the choices made today at the drawing board.

Woolmark’s ‘The Wool Lab Denim Edition’ presents new innovative wool blends

Woolmark has introduced a new resource in both physical and digital formats as a comprehensive guide for wool denim fabrics.

Titled, ‘The Wool Lab Denim Edition,’ the research material is presented in two books, organized in seven distinct categories: A Revised Classic, Special Treatments, Denim Shirting, The Denim Suit, Signature Denim, Thread Rebels, and Denim-Inspired Knits and Jerseys. This specialized Wool Lab highlights innovative new blends, such as wool-hemp, wool-lyocell, and even 100 per cent extra-fine wool spun with luxurious fibers like silk, cashmere, or paper. These blends offer unique benefits and applications for those on the cutting edge of innovation.

Additionally, Woolmark emphasizes wool’s natural thermoregulating properties, making wool denim suitable for all seasons by providing immediate warmth and mitigating the initial chill often associated with cotton jeans.

The accompanying toolkit offers in-depth insights into wool's performance in denim applications, providing guidance on fiber selection, fabric construction, finishing techniques, and sustainability practices.

While denim has historically been synonymous with cotton, Woolmark notes a growing demand for wool-infused denim, which it claims offers an ‘elevated sensibility to this timeless staple.’

Demand for wool denim swatch requests through The Wool Lab has been increasing over the past four years, states Julie Davies, GM for Processing Innovation & Education Extension. The timeless appeal of denim is enriched with wool’s skin-friendly softness, breathability, versatility, and durability, resulting in wardrobe essentials that transcend the ordinary, she adds.

Woolmark prominently featured the launch at Denim PV in Milan earlier this week, marking its first dedicated presence at the event. This space aimed to underscore the ‘versatility and iconic nature of wool denim.’

Gas shortage pushing Bangladesh T&A mills to the brink of collapse, warn industry leaders

Textile and apparel (T&A) industry leaders in Bangladesh have warned against a severe gas shortage, which, according to them, has crippled operations for nearly three years and pushed many mills to the brink of collapse.

At a joint press conference in Dhaka, Showkat Aziz Russell, President, Bangladesh Textile Mills Association (BTMA), emphasized, the industry needs a roadmap for gas supply as it cannot run its mills, he stated, urging the government to prioritize increased energy supply in the upcoming fiscal budget. Despite previous lobbying efforts against gas price hikes, rates were raised, yet supply failed to improve.

Russell also suggested, the government should engage Chinese investors to rapidly establish gas supply from Bhola to Dhaka and surrounding areas. Expressing skepticism about attracting foreign investment given the current struggles faced by local businesses, he noted, many entrepreneurs are now considering exit strategies due to unsustainable operating conditions. Most mills are currently running at only 50 per cent capacity.

Many mills are being forced to use expensive diesel, quadrupling costs, while the adviser reportedly favors diesel imports over liquefied natural gas (LNG) due to quicker payment collection from customers, Russell further noted. Furthermore, many businesses are not receiving gas despite substantial deposit payments to supply companies, he added.

Anwar-Ul-Alam Chowdhury (Parvez), President, Bangladesh Chamber of Industries (BCI), critiqued, the government has failed to meet its gas supply commitments, drawing a stark contrast to the severe penalties faced by businesses unable to fulfill their own obligations.

Hossain Mehmood, Chairman, Bangladesh Terry Towel & Linen Manufacturers & Exporters Association (BTTLMEA), confirmed, the gas crisis has resulted in five to six terry towel mills shutting down operations, with home textile mills also facing closure.

Attributing the crisis to a planning failure, Razeeb Haider, Director, BTMA, pointed out, last year's LNG imports were woefully inadequate. Calling for increased domestic gas drilling, particularly offshore, speakers urged the government to curb corruption in gas supply and immediately double LNG imports.

Md Saleudh Zaman Khan, Vice-President, highlighted the extreme low gas pressure in areas like Bhulta, making full mill operation impossible despite hefty monthly overheads. He warned, if the gas crisis isn't resolved by June, many mills might close permanently after Eid-ul-Azha.

Emphasizing on the industry's fight for survival, Abdullah Al Mamun, Director, BTMA, warned, widespread mill closures would severely impact the nation.

Andritz installs Rexline tearing system at Pacific jeans to facilitate waste recycling

An Austria-based international technology group, Andritz has installed a Rexline tearing system at Pacific Jeans, enabling the company to recycle waste generated during the jeans cutting process.

Processing up to 800 kg of fiber per hour, this new Rexline system allows Pacific Jeans to produce high-quality fibers for the spinning industry. These recycled fibers will then be used to manufacture new jeans, significantly reducing the carbon footprint and cost compared to using virgin cotton.

Bangladesh's garment industry is a major economic driver, with an estimated $50 billion in exports in 2024, making it the world's second-largest clothing exporter after China. While fast fashion has been a significant part of these exports, with brands like H&M sourcing heavily from the country, Bangladesh is actively working to address the growing issue of global textile waste. In 2023, the nation hosted its first Bangladesh Circular Economy Summit, bringing together local and international stakeholders to foster a more circular garment industry.

A premium denim producer in Bangladesh since 1984, Pacific Jeans Group is committed to sustainability and collaborating with partners like Andritz to improve circularity and achieve net-zero climate impact.

Syed M Tanvir, Managing Director, Pacific Jeans, says, Bangladesh’s dynamic clothing industry has great potential for post-industrial waste recycling. By transforming Pacific Jeans’ cutting waste and reusing this recycled fiber in fabric production, the company aims to close the loop and move the fashion industry towards a greener future.

Lenzing AG appoints Georg Kasperkovitz as COO to lead global fibre operations

Lenzing AG has named Georg Kasperkovitz as its new Chief Operations Officer (COO) and member of the Managing Board, effective June 1, 2025. With over 15 years of global leadership experience across Europe, North America, and Asia key regions for Lenzing’s operations Kasperkovitz is set to play a pivotal role in driving the company's operational transformation.

A mechanical engineer with a doctorate from TU Vienna and an MBA from Harvard Business School, Kasperkovitz has held senior roles at leading organisations including Mondi plc, Rail Cargo Austria AG, and McKinsey & Company. His expertise spans packaging, logistics, and strategic consulting, with a strong track record in performance improvement and operational leadership.

At Lenzing, he will oversee global fibre production, champion the ongoing performance program, and lead operations at the company’s main site in Upper Austria. His appointment expands Lenzing’s Managing Board to four members.

Chairman Patrick Lackenbucher noted that in light of macroeconomic pressures, including high energy costs and global competition, Lenzing must remain focused on profitability and operational efficiency. He emphasized that Kasperkovitz brings essential transformation skills and experience in the nonwovens sector.

CEO Rohit Aggarwal highlighted the company’s recent gains under its performance program and the need to enhance agility and resilience amid geopolitical shifts. He welcomed Kasperkovitz as a key driver in advancing operational excellence across Lenzing’s fibre production network and securing its leadership in sustainable cellulose fibres.

Europe's Textile Waste Mountain: New report reveals 10-Point plan, sparking debate on costs and impact

Europe is grappling with a colossal textile waste problem. Over 125 million tonnes of raw materials are devoured by the global industry each year, yet a mere fraction – less than 1% – of these fibres originate from recycled textiles. The majority faces an unsustainable fate in landfills, incinerators, or is exported. A pivotal new report by Systemiq, "The Textile Recycling Breakthrough," offers both a stark assessment and a strategic roadmap: Europe has the potential to amplify polyester textile recycling nearly tenfold by 2035, but this hinges on immediate, decisive action from policymakers and the industry.

The comprehensive study, backed by a 17-member Steering Group including industry giants like Arc’teryx, Eastman, Interzero, Textile Exchange, and Tomra, zooms in on polyester – a material constituting roughly 57% of global fibre demand. It champions advanced recycling technologies like depolymerisation, which can convert post-consumer polyester back into high-quality fibres with a reduced environmental impact compared to virgin material production.

The Steep Climb: Cost and accessibility challenges

Despite technological promise, the journey towards a circular textile economy is fraught with significant economic hurdles. The Systemiq report highlights a substantial "cost gap": producing recycled polyester via depolymerisation is currently estimated to be about 2.6 times more expensive than virgin polyester sourced from Asia. Shivam Gusain, Water Engineer, Dyestuff Chemist & LCA analyst in his linkedin post analysis suggests this gap could be even wider; with recent virgin PET prices in China hovering around €750-€800 per ton (lower than the report's €950 estimate), the premium for recycled content could be nearly threefold.

2025 Estimated Cost Comparison: Virgin vs. Recycled Polyester (per ton)

|

Feedstock Source |

Estimated Cost (Systemiq Report Basis) |

Potential Actual Market Cost Gap |

|

Virgin Polyester (Asia) |

€950 (report estimate) |

Base |

|

Recycled Polyester (T2T Depolymerisation) |

~€2,479 (implied 2.6x) |

Potentially >€1,600 (near 3x) |

(Note: This table contrasts the Systemiq report's cost gap with industry expert analysis suggesting a potentially larger current market gap.)

Critically, as the industry expert points out that the common assumption that scaling up T2T processes will dramatically lower costs is challenged by the report itself, which indicates that such scaling might only reduce costs by about 15 percent. This suggests that economies of scale alone may not be the panacea for the textile recycling cost dilemma.

Adding to the complexity, less than 1% of post-consumer textile waste is currently even suitable and accessible for these advanced recycling methods.

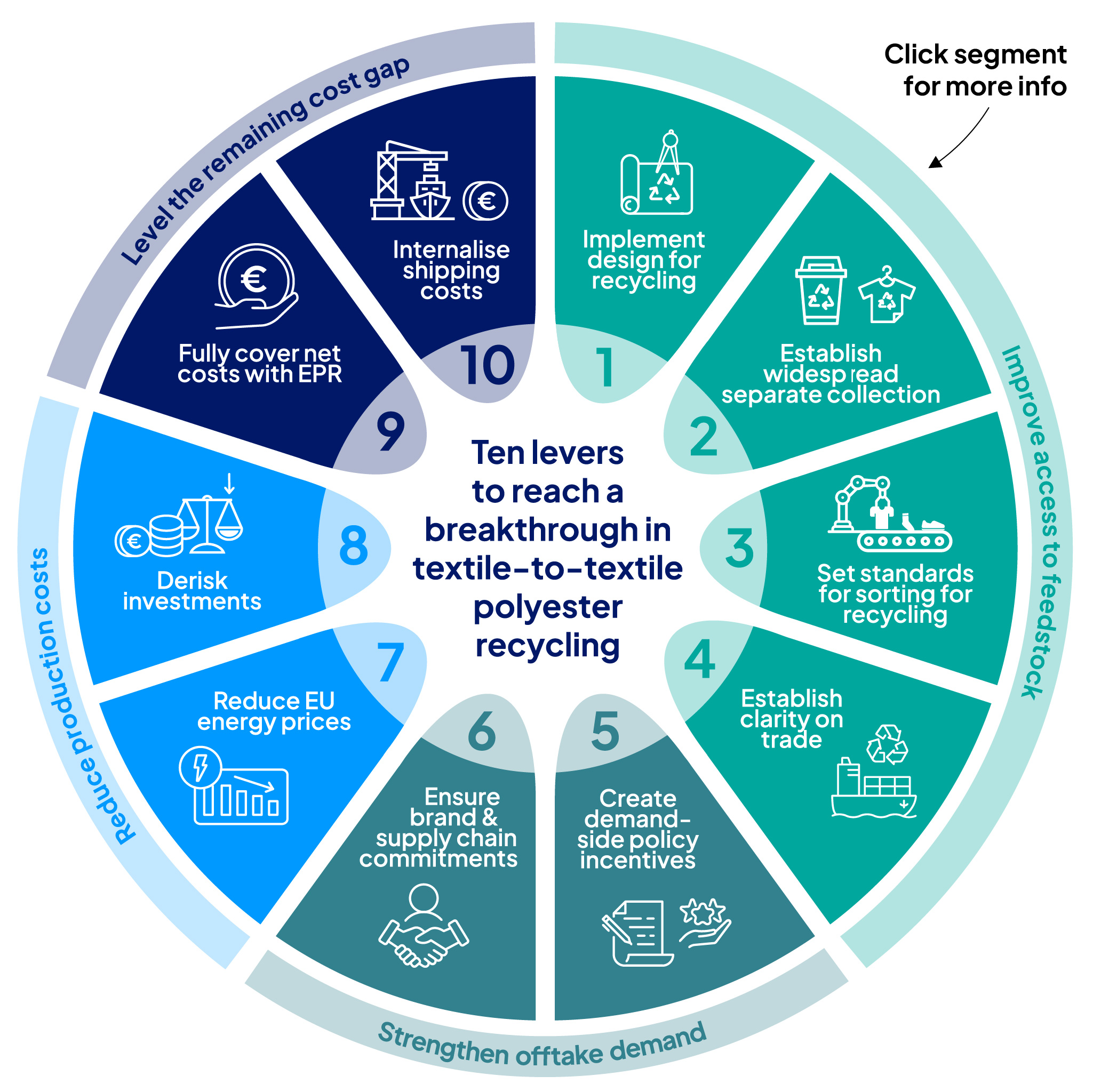

A Ten-Lever blueprint for a recycling revolution

"The Textile Recycling Breakthrough" proposes a strategic ten-lever approach across four key intervention areas, designed to steer Europe towards a "tipping point" where recycled polyester becomes the more viable and attractive option:

I. Unlocking feedstock:

● Implement design for recycling: Mandating designs that simplify end-of-life processing.

● Establish widespread separate collection: Ensuring textiles are diverted from general waste.

● Set standards for sorting for recycling: Creating clear, harmonised guidelines.

● Establish clarity on trade: Implementing responsible policies for textile waste exports.

II. Bolstering demand:

● Create demand-side policy incentives: Driving market appetite for recycled content.

● Ensure brand & supply chain commitments: Encouraging industry pledges. As Kyle Wood, Senior Director Strategy at Arc'teryx, notes, the report "helps chart a path forward for brands... It's also a powerful reminder that design does not exist in isolation, and must proceed in partnership with long term commitments and policy frameworks."

III. Optimising production costs:

● Reduce EU energy prices: Addressing a key operational expense for recyclers.

● Derisk investments: Providing financial safeguards for new recycling infrastructure.

IV. Bridging the financial divide:

● Fully cover net costs with EPR: Implementing Extended Producer Responsibility schemes, with the report suggesting fees around €250–€330 per tonne of polyester.

● Internalise shipping costs: Potentially via a ~5% brand-level green premium to make virgin materials reflect their true costs.

Julia Haas, Head of Commercial Partnerships at Interzero, emphasized the collaborative effort required: "Through the interplay of both political and industry-driven levers, Europe has a great opportunity to make circularity in textiles a reality... Bold, long-term policy action is needed to help create stable market conditions and reduce investment risks."

Scrutiny and Questions: EPR burdens and environmental data

The report's reliance on EPR fees to cover a significant portion of the cost gap – roughly 55% (€829 of the €1,529 per ton difference) – has raised questions among some industry observers. A key concern is whether using EPR fees to subsidize recycled materials essentially reroutes costs that brands would have incurred anyway, ultimately passing them down to consumers. This could mean end-users footing the bill for scaling recycled fibres for years before substantial volumes become available, effectively pre-paying for future output.

Further Shivam debate surrounds the environmental impact data. The report references CO₂ savings from a 2023 JRC study which, according to some analysts, predominantly focuses on general plastics like bottles and packaging, not the more complex textile-to-textile recycling processes. Extrapolating data from bottle-to-bottle recycling to textiles is seen as a potential oversimplification, suggesting the true CO₂ impact of T2T recycled fibres might be higher than reported.

One specific figure drawing scrutiny is the 0.4 kilograms CO₂ equivalent per kilogram reported for glycolysis, a chemical recycling method. For context, mechanical PET recycling typically registers around 0.45 kilograms CO₂ equivalent per kilogram. The notion that a more energy and chemically intensive process like glycolysis could have a lower footprint than mechanical recycling is being questioned by some experts, who anticipate further exploration of this data.

Projecting the Future: A transformed textile landscape?

Despite these debates, Systemiq's projections, if the ten levers are effectively deployed, are ambitious: depolymerisation capacity in Europe could surge nearly tenfold by 2035.

Projected EU Textile Waste Recycling: 2035 Vision (with Levers)

|

Metric |

Impact by 2035 |

|

Depolymerisation Capacity |

Near 10x increase |

|

Overall Recycled Volume |

Substantial Growth |

|

Landfill/Incineration/Export |

Significantly Reduced |

|

Consumer Cost (400g jumper) |

Approx. €0.15 (for EPR & green premium) |

|

Annual Value Generation (2040) |

€5.5 billion (broader PET/polyester system) |

|

Net New Jobs (2040) |

28,000 (broader PET/polyester system) |

(Source: Systemiq, The Textile Recycling Breakthrough)

Eric Dehouck of Eastman Circular Solutions France remains optimistic about the technological readiness: "Europe has the opportunity to lead the transition to circular textiles, and technologies like depolymerization are ready to play a central role."

The Path Forward: Beyond recycling

The Systemiq report, while championing a recycling breakthrough, also underscores that recycling alone is not a silver bullet. A truly circular textile economy, as noted by the Ellen MacArthur Foundation's Matteo Magnani, requires "deeper changes in how we design, produce, consume, and value clothing," alongside scaling circular business models like resale, rental, and repair.

The critical analysis emerging alongside the report's launch suggests that while the proposed levers offer a direction, the financial mechanisms and environmental accounting will be key areas for ongoing debate and refinement. The overarching question posed by some experts is whether the current trajectory, with its potential consumer costs and debated environmental gains, represents the most effective multi-billion-euro investment for Europe's textile future.

"The Textile Recycling Breakthrough" has undeniably ignited a crucial conversation, providing a data-rich foundation for the complex journey ahead. The challenge now lies in navigating the economic realities, refining the impact assessments, and fostering the multi-stakeholder collaboration essential to turn Europe's textile waste into a sustainable resource.

VF Corp forecasts 3-5 per cent decline in Q1, FY26 revenues

US holding company and owner of brands like The North Face, Timberland and Vans, VF Corp forecasts revenues in Q1, FY26 to decline between 3 per cent-5 per cent. The company expects adjusted operating loss to range between $110 million and $125 million, significantly higher than the average analyst estimate of a $73 million loss.

In FY25, VF Corp registered a 4 per cent decline in net sales to $9.5 billion as against $9.92 billion in the previous fiscal year.

Marking a significant improvement in profitability, the company’s operating profit increased to $303.77 million during the year as against an operating loss of $143.93 million in 2024.

Performance among its diverse brand portfolio remained mixed. Revenues of its brand The North Face increased by 1 per cent to $3.70 billion while revenues of the brand Vans declined by 16 per cent to $2.35 billion. Timberland’s revenue rose by 3 per cent to $1.61 billion, while Dickies’ turnover contracted by 12 per cent to $542.1 million.

Geographically, the Americas region struggled with a 7 per cent decrease, totaling $4.83 billion. EMEA (Europe, Middle East, and Africa) also saw a decline of 3 per cent, reaching $3.25 billion. The APAC (Asia-Pacific) region was more stable, posting a 1 per cent increase to $1.42 billion.

In Q4, FY25 which concluded on March 29, VF Corp. fell short of revenue estimates. Concerns over tariffs introduced by the Trump administration led many retailers to scale back orders, resulting in a 5 per cent decline in revenue to $2.14 billion, below analysts' projections of $2.18 billion. The company reported an operating loss of $73 million, though its adjusted operating profit was $22 million.

Bracken Darrell, President and CEO, VF Corp, states, the company’s sales in Q4 aligned with its forecasts and, excluding Vans, showed an increase over the previous year, primarily driven by The North Face and Timberland. The company is well positioned to deal with the increasing volatility in the macroeconomic environment. The actions it takes will enable brands to return to growth and VF to generate solid and sustainable value, he adds.

Trident Ltd posts Rs 133.42 crore net profit in Q4, FY25

A diversified textile manufacturer, Trident Ltd posted a net profit of Rs 133.42 crore in Q4, FY25. This marks a 126.1 per cent Y-o-Y increase compared to Rs 59.01 crore in the same quarter of FY24.

The company’s revenue for Q4, FY25 increased by 10.82 per cent Y-o-Y to Rs 1,864.34 crore from Rs 1,682.26 crore recorded during the corresponding period last year. Trident’s EBITDA for the quarter rose by 19.3 per cent Y-o-Y to Rs 245 crore with the EBITDA margin improving to 13.14 per cent.

By product category, the towel segment saw the most significant revenue growth, generating Rs 752.86 crore. The yarn division maintained stable performance, recording revenue of Rs 908.28 crore Y-o-Y. Meanwhile, the bedsheets category brought in Rs 315.14 crore in revenue for the quarter.

Trident operates across multiple segments, including Home Textiles, Paper, Chemicals, and Yarn, and continues to strengthen its position as a key player in the Indian and global textile industry.

Suit Direct launches first dedicated boys’ suits collection

To meet the growing demand for coordinated family occasion wear, menswear specialist Suit Direct has launched its first dedicated boys’ suits collection.

This launch marks the brand's entry into the children's formalwear market. The new collection is designed to ‘echo the style of its popular menswear lines while prioritizing comfort.’ The boys' range is specifically designed ‘to retain the premium quality and detailing Suit Direct is known for while addressing the unique needs of younger wearers.’

The collection is available for ages 4-14 years, both online and in select Suit Direct stores. To accommodate teens and older boys, the brand is also offering additional smaller sizes in men’s suiting, starting from a 34" jacket and 28" waist.

The new range features lightweight, breathable fabrics, wrinkle- and stain-resistant materials, and tailoring that allows for easy movement. This ensures children stay comfortable throughout the day, ‘whether they are walking down the aisle as a page boy or posing for family photos.’

Each suit comes as a three-piece set - jacket, pants, and waistcoat - and is available in a choice of navy check, dark green, tan check, and stone. Crucially, every design corresponds with one of Suit Direct’s menswear styles, making it ‘perfect to pair with dad.’ To support this new category, Suit Direct is also offering in-store fittings and styling advice.

Reju to build polyester recycling plant in the Netherlands

A new venture from a Dutch engineering and fossil fuel company, Reju plans to build a polyester recycling plant in the Netherlands, aiming for an impressive annual output equivalent to 300 million articles of clothing.

In just 18 months since its launch, Reju has already established a ‘Regeneration Hub Zero’ demonstration plant in Frankfurt, Germany, slated for official operation this year. Patrik Frisk, CEO and former CEO, Under Armor, notes, the company has secured partnerships with textile collectors and sorters, and engaged with over 100 brands and retailers to cultivate interest in its ‘Reju Polyester’ product across both American and European markets.

The initiative addresses a critical environmental challenge: polyester, a fossil fuel-derived fiber, now accounts for two-thirds of new clothing. Annually, the world produces 33 million metric tons of plastic-based fibers, yet a mere 3 per cent is recycled, according to the Ellen MacArthur Foundation. This mounting waste problem is increasingly pressuring fashion brands and retailers, especially with the advent of extended producer responsibility (EPR) regulations in the European Union and California.

While several companies are investing heavily in creating a circular economy for polyester, Reju stands out due to its deep connection to parent company Technip Energies. With nearly 70 years in the polyester business, Technip Energies' technology is integral to 40 per cent of the world's steam crackers, which produce ethylene, a polyester building block. Reju leverages IBM’s VolCat technology, co-developed with Under Armor, capable of breaking down polyester molecules into monomers for rebuilding, even handling dyes and pigments.

Reju's efforts are a part of Technip Energies' broader transition towards a lower-carbon future. The startup is strategically targeting densely populated areas for post-consumer clothing waste, with plans for a new US plant and a garment recycling pilot with Goodwill and Waste Management. However, the company faces a key challenge to convince brands to pay a premium for recycled fibers until cost parity is achieved.