FW

Multinational product companies and manufacturers are realising the need for real, effective sustainability strategies. There is a focus on recycling, waste reduction and lightweight packaging. The North Face is one such company. It is a leading driver of sustainability across the outdoor clothing and equipment market. It takes an all-encompassing approach to sustainability, developing waste reduction, recycling, product stewardship and other sustainability initiatives across various aspects of its platform.

Any of its retail outlets or stores will accept clothing or footwear in any condition. Aggregated clothing is then reused or repaired for prolonged use, or recycled into raw materials for products like carpet padding and insulation. As an incentive to drop off clothing, participants receive coupons and rewards that give discounts toward The North Face products.

In addition, The North Face has also partnered with bluesign technologies to reduce factory and processing center waste and increase efficiencies across its entire supply chain. This has resulted in considerable water, energy and chemical savings across the supply chain.

The company’s headquarters in California is run on 100 per cent renewable energy, utilises an indirect-direct evaporative cooling system to cut out the use of chemical coolants, and it even serves local organic food to employees.

https://www.thenorthface.com/

"The much awaited Intertextile Shanghai Apparel Fabrics–Spring Edition 2016 is scheduled to open its doors on March 16, 2016. The 3,000 plus apparel fabrics and accessories suppliers who will exhibit at the show will come from 20-plus countries and are expected to participate at the National Exhibition and Convention Centre (Shanghai) during the mega fair."

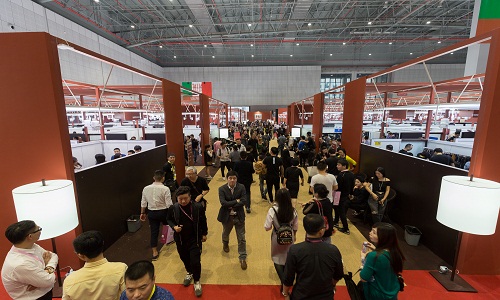

Asia’s most comprehensive trade fair for apparel fabrics and accessories is gearing up for its biggest ever Spring Edition scheduled for March 2016. Over 3,000 exhibitors from around the world have already confirmed their presence at Intertextile Shanghai Apparel Fabrics, which runs from March 16 to 18 at the National Exhibition and Convention Centre in Shanghai.

The much awaited Intertextile Shanghai Apparel Fabrics–Spring Edition 2016 isscheduled to open its doors on March 16, 2016. The 3,000 plus apparel fabrics and accessories suppliers who will exhibit at the show will come from 20-plus countries and are expected to participate at the National Exhibition and Convention Centre (Shanghai) during the mega fair. The event will feature a number of country and region pavilions as well as new and returning product zones to ensure exhibitors can more effectively meet their target buyers, and to make sure these buyers can more easily find the products they are looking for.

Sustainability in focus

The entire textile sustainability supply chain will be on offer at the fair. The a new area for the Spring Edition which caters to the fast-growing high-performance active wear market will feature ‘Accessories Zone’ with both garment and fashion accessories from China and abroad. In addition to these areas, group pavilions organised by the industry’s leading mills will present the latest innovative products, while domestic exhibitors will once again be grouped by product end-use as well as in various pavilions.

Opportunities for exhibitors and buyers

As one of the key dates on the global industry’s calendar, Intertextile Shanghai is more than just a place to source fabrics and accessories. Fairgoers can discover next season’s trends in the Intertextile Directions Trend Forum, which is created by experts from the NellyRodi Agency (France), Elementi Moda (Italy), Doneger Creative Services (USA) and Inoue (Japan) among others.

Opportunities for exhibitors and buyers

Intertextile Shanghai is more than just a place to source fabrics and accessories. Fairgoers can discover next season’s trends in the Intertextile Directions Trend Forum, which is created by experts from the NellyRodi Agency (France), Elementi Moda (Italy) and Doneger Creative Services (USA), as well as Ms Sachiko Inoue (Japan). What’s more, a wide range of design and trend ideas, the latest market news as well as industry technologies will be presented and discussed by experts in seminars and forums.

Further opportunities also will be there for exhibitors and buyers with four other textile fairs taking place concurrently. This includes the addition of Intertextile Shanghai Home Textiles – Spring Edition, and the return of Yarn Expo Spring, CHIC and PH Value.

The International Zone is housed in hall 7.2, while domestic exhibitors are in halls 6.1, 6.2, 7.1, 8.1 and 8.2. Domestic and international denim exhibitors are grouped together in Beyond Denim (hall 7.2), while Chinese and overseas accessories suppliers are located in hall 8.1. A relatively new addition to hall 7.2 is the France Zone, which expands in size this year after a strong debut showing at the 2015 Spring Edition. Some of France’s leading suppliers have already confirmed to take part, including Malhia Kent with its fabrics for luxury pret-a-porter and haute-couture, as well as high-end lace and embroidery producer Solstiss Sarl. Malhia Kent exhibited at last October’s Autumn Edition.

Located inside SalonEurope, the France Zone is the destination to find high-end apparel fabrics and accessories producers from Europe. The leading brands returning to the fair this year include Miroglio Textile from Italy, Turkey’s Soktas Tekstil and Liberty Art Fabrics from the UK. And a highlight for many buyers at the fair is the Milano Unica Pavilion from Italy, which this year features around 100 of Italy’s best textile producers showcasing their latest collections for women’s wear and men’s wear.

This year will see the addition of Intertextile Shanghai Home Textiles – Spring Edition to the line-up of concurrent fairs held alongside Intertextile Shanghai Apparel Fabrics. Taking place in Hall 5.2, it is complemented by Yarn Expo Spring in hall 5.1, CHIC in halls 1, 2, 3 and 4.1, and PH Value in hall 1.

Asian pavilions to focus on innovation and products

The Asian pavilions will be the place to find a range of innovative offerings. The Japan Pavilion returns with over 20 exhibitors, while the Korea Pavilion with more than 70 participants features a large selection of man-made and functional fabrics to cater the strong demand for Korean products.

One of the largest zones at the fair is the Taiwan Pavilion, organised by the Taiwan Textile Federation (TTF), which have over 50 exhibitors of accessories, cotton, denim, embroidery, jacquard, knit, lace, polyester, spandex and wool blended & woven fabrics suitable for mass to luxury markets. Rounding out the pavilions from Asia are the Pakistan Pavilion featuring cotton fabrics for casual wear and jeanswear and organised by the Commercial Section, Embassy of Pakistan, and the Texprocil (The Cotton Textiles Export Promotion Council) Pavilion from India.

Enhancing sourcing options

The fair being held in Shanghai after two years, has truly established itself as the key sourcing destination in Asia for the spring / summer season, with a growing variety of trendy and creative products and ideas for the apparel fabrics and accessories industry on offer. Next month’s fair will once again play host to the Verve for Design area, where design studios from around the world display their original fabric pattern designs to an increasingly eager market for these products.

The Spring Edition 2016 will see more countries represented in Verve for Design compared to the 2015 spring fair, with exhibitors from Japan, Russia and Switzerland taking part this edition, in addition to returning countries Australia, France, Italy and the UK. The new countries are represented by Atelier Mineeda and Nix from Japan, Solstudio Textile Design from Russia and Gibson Design Studio from Switzerland. Longina Phillips Designs and Creations Robert Vernet, from Australia and France, respectively, return to the fair again, while the Italy contingent includes Anteprima Disegni, Bernini Studio, Blue Studio, Musticstyle, New Age and Studio 33. Confirmed exhibitors so far from the UK include Acorn Conceptual Textiles, Amanda Kelly Design Studio, Circleline Design Studio, Design Union, Fairbairn and Wolf and Westcott Design.

Intertextile Shanghai Apparel Fabrics – Spring Edition 2016 is co-organised by Messe Frankfurt (HK) Ltd; the Sub-Council of Textile Industry, CCPIT; and the China Textile Information Centre.

The National Garment Fair will be held in Mumbai, January 27 and 28, 2016. This edition of the fair will have 283 stalls displaying over 330 brands. About 15,000 retailers and trade visitors from all over India are expected to visit. Exhibitors will present a wide range of men’s, women’s and kids’ wear. Also on display will be ethnic wear, intimate wear, sportswear etc. for Spring/Summer 2016.

Meanwhile, the Indian apparel industry is eagerly awaiting the implementation of the Goods & Service Tax (GST). The industry wants readymade garments to be included in the list as the textile industry is the single largest employer after agriculture in the country. Presently, the domestic apparel industry is facing a slowdown but is confident that after the implementation of GST, market sentiments will improve. On the export front, uncertainty still prevails in Europe, which is a major market. However, if the Chinese yuan continues to depreciate, it could hurt Indian apparel exporters as both India and China see the US and Europe as crucial markets.

The size of the Indian apparel industry is estimated to be around Rs 3,50,000 crores, out of which Rs 2,50,000 crores is the size of the domestic apparel industry.

Garment exporters in India want authorisation, inspection and classification norms to be simplified. In fact, the Apparel Export Promotion Council (AEPC) has urged the Textiles Ministry to simplify the new foreign trade policy’s authorisation, inspection and classification norms. They have urged the government to withdraw the need for a landing certificate for exported goods, required as proof to claim benefits under the Merchandise Exports from India Scheme (MEIS). Introduced in April 2015, the scheme aims to boost sagging exports, covering tariff lines for 5,012 items that earn duty credits. Exporters say getting the documents to show proof of landing at the destination country entails cost and delay.

While filing shipping bill, exporters are required to declare they are claiming rewards under MEIS and to mark Y in the reward item box. Recently many had complained of inefficient customs house agents inadvertently ticking N in the reward item box while filing the shipping bills with customs. Thus even though the item in many cases was eligible, once an N has been ticked, such shipping bills are not transmitted to the online system run by the Directorate General of Foreign Trade (DGFT).

To help exporters claim MEIS benefits in such cases, DGFT has allowed them to give physical copies of the shipping bills after filing an MEIS application to its regional authorities. However, this relaxation is restricted to exports made in April and May 2015. An extension on this has been demanded. Calls for proper identification and classification of goods have also been demanded, going forward from the current challan system currently followed. Meanwhile, AEPC Chairman Ashok G Rajani has called for a stimulus from the government, stating that the garment export industry has the potential to generate 2,200 jobs on every investment of Rs 30 crores. They have urged the government to follow Bangladesh by, allowing vehicles carrying finished export merchandise and headed towards exit points like sea ports, airports and rail heads to display ‘On Export Duty’ signage. So, too, for vehicles carrying input material for production of export merchandise, with a signage of ‘On Export Processing Duty’, to facilitate easier transportation and to avoid corruption.

Garment exporters in India want authorisation, inspection and classification norms to be simplified. In fact, the Apparel Export Promotion Council (AEPC) has urged the Textiles Ministry to simplify the new foreign trade policy’s authorisation, inspection and classification norms. They have urged the government to withdraw the need for a landing certificate for exported goods, required as proof to claim benefits under the Merchandise Exports from India Scheme (MEIS). Introduced in April 2015, the scheme aims to boost sagging exports, covering tariff lines for 5,012 items that earn duty credits. Exporters say getting the documents to show proof of landing at the destination country entails cost and delay.

While filing shipping bill, exporters are required to declare they are claiming rewards under MEIS and to mark Y in the reward item box. Recently many had complained of inefficient customs house agents inadvertently ticking N in the reward item box while filing the shipping bills with customs. Thus even though the item in many cases was eligible, once an N has been ticked, such shipping bills are not transmitted to the online system run by the Directorate General of Foreign Trade (DGFT).

To help exporters claim MEIS benefits in such cases, DGFT has allowed them to give physical copies of the shipping bills after filing an MEIS application to its regional authorities. However, this relaxation is restricted to exports made in April and May 2015. An extension on this has been demanded. Calls for proper identification and classification of goods have also been demanded, going forward from the current challan system currently followed. Meanwhile, AEPC Chairman Ashok G Rajani has called for a stimulus from the government, stating that the garment export industry has the potential to generate 2,200 jobs on every investment of Rs 30 crores. They have urged the government to follow Bangladesh by, allowing vehicles carrying finished export merchandise and headed towards exit points like sea ports, airports and rail heads to display ‘On Export Duty’ signage. So, too, for vehicles carrying input material for production of export merchandise, with a signage of ‘On Export Processing Duty’, to facilitate easier transportation and to avoid corruption.

China’s demand for viscose filament yarn (VFY) in 2015 and there was less stimulus from popular varieties. The uptrend in the export market was also reversed on the back of falling consumption in major consumers of India and Europe and sales in overseas market are expected to decrease by 10 per cent year on year.

In China, sales of fine-denier products improved, but the volume was not large enough to fill the gap. Although exports remained unsatisfied, there were still divergences in different grades of products.

Continuous spinning and fine-denier viscose filament yarn among high-end products as well is widely applied in the downstream sector like knitting fabric, so the demand is not largely restrained by the environment of industry.

Besides demand from high-end products, there is room of further increase in new areas. This increase mainly comes from the substitution of high-grade silk. Currently, the super fine-denier viscose filament yarn produced by first-grade and several third-grade plants are mainly used to replace silk products. With the joint development of upstream and downstream sectors in recent years, the whole substitution trend has been improved significantly.

VFY producers are putting in more efforts on the development of new products as well as the expansion of new applications.

Free trade agreements are expected to help bring foreign direct investment into Vietnam. Firms with FDI have an advantage in low cost price, competitive selling price and stable material source. Most Vietnamese companies do not have these advantages. The biggest difficulty they face is a shortage of raw material, putting them in possibly severe competition in material origin rules as per FTA commitments.

Most FDI backed companies in garments and textiles follow closed production process from materials to finished products, design and distribution. Local firms must improve themselves in both business thought and ways. Authorised agencies need to work with associations to issue policies encouraging enterprises to transfer from processing into export under free on board term, original design manufacturers or original brand manufacturers.

Vietnam should have a high determination to develop into a fashion hub of Southeast Asia in future, feel experts. There should be policies to promote equipment manufacturing for the support industry, including those in fiber production lines, dyeing, and chemicals for wastewater treatment. There should be a basis for local firms to exploit opportunities and tax incentives. These policies will work to reduce cost price of support products. Customs and tax procedures should be reformed.

Indians in the US have objected to T-shirts and tank tops made by Print Syndicate which feature images of Hindu gods. They say, Lord Ganesha is revered in Hinduism and is meant to be worshipped in temples or home shrines and not to be trivialised on consumer products. They want the Ohio-based brand to withdraw these products and offer a formal apology. They say Hindus are all for free artistic expression and speech as much as anybody else but that faith is something sacred and attempts at trivialising it would hurt its followers.

Print Syndicate claims to offer consumers access to timely, curated, well-designed and high-quality products that allow them to express who they are. It says it adheres to values like integrity, compassion and fairness. Its products (apparel, phone cases, house wares, etc.) are sold through the company’s six e-commerce brands.

In Hinduism, Lord Ganesha is worshipped as the god of wisdom and the remover of obstacles and is invoked before the beginning of any major undertaking. There are about three million Hindus in the US. Hinduism is the oldest and the third largest religion of the world with about a billion adherents.

Australia’s wool production is forecasted to fall by seven per cent. The decline comes following six season of relatively stable wool production. Seasonal conditions in a number of major sheep producing regions of Australia have been drier than expected, which has resulted in lower fleece weights.

The major sheep regions of Queensland continue to see tough conditions and the sell-off of sheep continues in the state. Even in New South Wales, there are areas where seasonal conditions have been more difficult than expected. Tough conditions are being partially offset by good to very good conditions in north-eastern South Australia and parts of New South Wales.

For the 2015-16 season to November, tests show a reduction in volumes of wool between 20.6 and 24.5 microns, with smaller declines for finer merino wool and for crossbred wool. This resulted in a 0.1 micron decline in the mean fiber diameter for Australia to November.

There has been a release of on-farm stocks held over from previous seasons as well as the forward offering of wool held in brokers’ stores and earlier than usual deliveries of recently shorn wool in response to the spike in wool prices in May and June. But these stocks may not be available in 2015/’16.

Gap is committed to cutting its absolute greenhouse gas emissions. The company plans to halve emissions at its stores, offices and distribution facilities around the world from 2015 levels by the end of 2020, after successfully reducing them by 38 per cent from 2008 levels as of the end of 2015.

Much of the reductions so far have come from installing long-lasting, more efficient LED lighting and smart thermostats at stores, turning off unnecessary lights at night and using an industry shipment program to improve fuel efficiency. Shuttering stores has also contributed, but to a lesser extent.

Gap’s commitment only extends to facilities it owns or operates, and therefore the factories that produce its clothes but not the third-party factories that produce its clothes. The retailer will also try to divert 80 per cent of the waste from its US facilities away from landfills by 2020. In 2014, it diverted just 29 per cent of that waste.

The fashion industry hasn’t been kind on the planet. Toxic chemicals are used to make some clothes, lots of wasted and polluted water and the mountains of apparel tossed into landfills every year. And huge amounts of energy are expended along the life of a garment, from manufacturing to transportation to a sales floor.

www.gap.com/