FW

"If India decides to be a part of the TPP agreement, the country will have to focus on upgrading its production standards. But such measures could take a lot of time adversely impacting the country’s export industries. Additionally, India’s labour market will also have to undergo a sophisticated evolution. The labour market in India is dominated by informal employment that accounts for 92 per cent of the total labour force employment (as per the NSSO data 2011-12)."

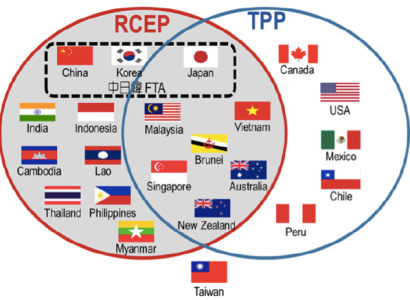

India and China two important economies are not a part of the coveted the Trans-Pacific Partnership Agreement (TPP), initiated by the US. Should India be a part of the deal to enjoy duty-free access to the US market or is there some other way, it can benefit by not being a part of it is the moot point now.

TPP benefits and India’s position

The US-led regional trade agreement, initiated in November 2009 under President Barack Obama’s administration concluded in October 2015. The treaty includes the US and 11 other Asia-Pacific countries, including Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam. The major motive of this movement is eliminating tariff and non-tariff barriers on trade in goods and services, push foreign investment among member countries, conform to the newly crafted labour and environmental standards, intellectual property (IP) rights framework and establish a level-playing field for state owned enterprises (SOEs) and private firms (Office of the USTR).

Highly condemned for its secretive nature, experts call TPP as something more than just a free trade deal. They say through this agreement, the US seeks to integrate its economy with the Asian economies. In the Indian context, TPP member nations such as the US, Japan and Singapore have traditionally been important trade partners. As per industry estimates, India’s trade with 12 TPP countries was recorded to be worth $31.6 billion in 2003, which increased to $152.3 billion in 2014, while the share of TPP countries in India’s world trade declined from 24 per cent in 2003 to 19.6 per cent in 2014. However, these nations continue to be the important export destinations for some Indian products like petroleum oils and bituminous minerals, textiles, agricultural products and motor vehicles. The US accounted for the largest share of 13.44 per cent in India’s world exports in 2014, followed by Singapore and Vietnam with 3.05 per cent and 2.06 per cent respectively.

Since around 48.5 per cent of India’s total textile exports are exported to the US at an average bound tariff rate of 27.3 per cent, the provision of a ‘yarn forward rule’ in the TPP, will benefit Hanoi textile industry, since it will have duty-free access to the US market post-TPP. This yarn forward rule, coupled with the need to harmonise domestic production standards upwards will considerably alter India’s position in the GVCs for textile products, leading to greater export losses for the country.

How India can cope-up with competition

If India decides to be a part of the TPP agreement, the country will have to focus on upgrading its production standards. But such measures could take a lot of time adversely impacting the country’s export industries. Additionally, India’s labour market will also have to undergo a sophisticated evolution. The labour market in India is dominated by informal employment that accounts for 92 per cent of the total labour force employment (as per the NSSO data 2011-12). The country is yet to ratify three of the five internationally recognised labour principles as laid down in the 1998 ILO Declaration that have been a basis for the labour standards set out in the TPP agreement, which again is a time consuming process.

Experts say India’s strong trade relations with most TPP economies viz. Japan, Singapore, Chile, Australia and Canada could help in further strengthening ties with these countries mitigate some of these export losses, making it less costly for India to stay out of the TPP. Moreover, the negotiations on other multilateral trade agreements such as the Regional Comprehensive Economic Partnership (RCEP) will have to be expedited.

The country also needs to focus on improving the bilateral investment treaty (BIT) with the US, to remain competitive in the post-TPP era and push for bilateral dialogues with other Asia-Pacific economies like China, Hong-Kong.

Along with reforms in logistics and other sectors and government support in the form of able export policy, India’s exports sector will also have to deal with the threat of being negatively impacted by the Trans Pacific Partnership, a trade agreement “Trans Pacific Partnership countries account for 25 per cent of India’s exports. So by not being a part of TPP, India risks losing out a significant chunk of its export market to rivals. Clearly, India needs to invest quickly in skilling its large manpower and developing infrastructure to be able to attract foreign investment and become a world-class exporting hub,” a recent report by Crisil exclaims.

www.crisil.com

Canada has joined Sustainability Compact which is partnership between Bangladesh government, EU, ILO and the US’s collective effort for better factory safety and workers’ rights. Prior to the second follow-up meeting of Compact in Dhaka, Benoit-Pierre Laramee, the Canadian High Commissioner to Bangladesh, proclaimed their joining. He even added that the idea was to ensure Bangladeshi clothes they wear were manufactured in safe working scenario.

The worst-ever factory disaster. the Rana Plaza building collapse of 2013 that killed 1,100 people has been the initiation point of ‘Sustainability Compact’ action plan in July 2013. Soon after the Rana Plaza collapse, the US withdrew GSP privilege stating few Bangladesh’s products -- not counting garments -- were enjoying in its market. It also sketched a separate action plan to improve safety standards as well as workers' rights.

The EU funded Switch Asia project ‘Smart Myanmar’ is focused on making social and environmental improvements in Myanmar's garment industry. The project aimed at boosting Myanmar's garment export sector has started its second phase with EU funding of €2.8million to the end of 2019.

In its first phase, it worked with local garment factories on social and environmental compliance issues, providing technical support and capacity building for local trade bodies. The project also helped the Myanmar Garment Manufacturers Association (MGMA) increase staffing and drafted a first-ever Code of Conduct for garment exporting factory members.

Smart Myanmar’s next stage will see the expansion of previous activities as well as new work promoting sustainable production and ‘transparency in procurement practices in Myanmar’ ,a county where more than a dozen major apparel brands, including GAP, H&M, Primark and Adidas are now sourcing.

The value of exports has more than doubled in less than two years and is projected to continue to grow almost exponentially for the next several years. The growth of the garment sector will contribute to the growth of the industrial sector and create many new jobs.

Continuing to work closely with Myanmar factories and the Myanmar Garment Manufacturers Association, the aim of the Smart project is to actively promote and support the sustainable production of garments.

Calik Denim, the Turkish denim manufacturer is contesting to earn the “National Public Champion” title in the current year’s European Business Awards (EBA). An independent panel of judges decided Calik as a National Champion in the Environmental and Corporate Sustainability category of the 2016 European Business Awards. The mill at present is grappling to attain maximum public’s vote to become “National Public Champion” for Turkey.

The EBA recognizes notable and innovative works of businesses in promoting success, innovation and ethics in the European business community. The previous winners have been from varied backgrounds such as pharmaceutical, engineering, fashion and many more.

Being in the league, Calik has publicised a video showcasing the story of their business, working employment conditions and their sustainability. The lines to vote are open till Feb. 26 and the winner will be declared on March 7. The video, along with a written entry, holds the scope to get reviewed better against other National Champions in a second judging. If Calik wins the “European Public Champion” award for Turkey, it would be by defeating 31 different countries as a whole. The winner will be determined through second round of polling from March 7 to April 26; results likely to be announced at the EBA Gala in June 2016.

Ebru Ozaydin, head of sales and marketing at Calik Denim acknowledged that these public votes are a feedback to their overall success which contributes to their sustainability.

The fifth edition of ITMA Asia + CITME attracted positive feedback from domestic as well as international manufacturers of textile machineries to meet better growth opportunities, while China continues to sustain quality products, higher productivity and use of green technologies. The new National Exhibition and Convention Centre (NECC) in Shanghai will hold the exhibition from October 21 to 25 October 2016 for which space applications will close by February 29, 2016.

Approximately 1,000 applications have been received from manufacturers, say to the show owners, CEMATEX, China Textile Machinery Association (CTMA), the Sub-Council of Textile Industry, CCPIT (CCPIT-Tex) and China Exhibition Centre Group Corporation (CIEC). Gu Ping, Vice President of CTMA said most applicants were Chinese manufacturers, while 30 per cent were first-time participants.

And as per CEMATEX President, Charles Beauduin, with deadline coming soon, more applications from both domestic and international manufactures have been coming in.

ITMA ASIA + CITME 2016 has become a leveraging unit for textile machinery manufacturers to explore and expand their latest technologies while China brings out its 13th Five-Year Plan (2016 – 2020), which is likely to prioritize and focus on upgradation and industrial transformation. According to CTMA, China’s textile industry has proven to be competitive through its huge investments. In 2015, it had about 15,235 new projects. From January to November 2015, fixed asset investments in textile projects of more than five 5 million yuan each amounted to 1.09 trillion yuan; representing a jump of 200 per cent from 2014.

ITMA ASIA + CITME 2016 is organised by Beijing Textile Machinery International Exhibition and co-organised by MP Expositions, Japan Textile Machinery Association stands to be the special partner of the show. Moreover, the last ITMA ASIA + CITME show in 2014 grossed 150,000 sq. mt. and lured around 1,600 exhibitors from 28 countries and a trade visitor ship of around 100,000 from 102 countrie.

Vietnam has seen a significantly growing inflow of investment from the US in the textile and garment sector in recent years, in anticipation of the Trans Pacific Partnership (TPP). A supplier of dyes and chemicals, Huntsman Textile Effects under the US-based Huntsman Group, is one of the many US investors in Vietnam that hopes to tap into the potential of the textile and garment sector.

Just after six months of operation, the warehouse, located in the Long Binh Industrial Park in the southern province of Dong Nai is operating at its full capacity of 250,000 tonnes. According to President of Hunstman Textile Effects Paul G Hulme, the warehouse aims to help the company cut down on delivery time, and added that it is expandable to meet the domestic market demands in the context of the TPP becoming effective.

Early this month, Avery Dennison RBIS under the US Avery Dennison Group inaugurated its factory in the Long Hau Industrial Park in the Mekong Delta province of Long An with a total investment of $30 million. According to the Group, the hi-tech factory aims to provide label solutions to renowned names in the domestic market, such as Uniqlo, North Face, Nike, or Adidas.

Director General of Avery Dennision RBIS, Deon Stander said the investment aims to contribute to the development of the textile and garment sector as well as the domestic market. The TPP will boost textile and garment production in Vietnam, thus facilitating the growth of the Long An-based factory by 2020, he commented. In July 2015, Avery Dennision RBIS established a distribution centre in Binh Tan District, Ho Chi Minh City, while building the factory in Long An simultaneously.

The first ever denim show in Vietnam, Denimandjeans.comvietnam is scheduled to be held at Gem Centre – a place with one of the most beautiful wood architecture seen in Vietnam. The show shall be held on June 16 and 17, 2016 at HCMC and shall bring some of the most reputed local and international mills and supply chain partners together at one place.

Vietnam is the fourth largest exporter of apparel after China, Bangladesh and Hong Kong. With the country likely to benefit from TPP and free trade agreements with EU, once they are signed. Vietnam is already the focus of many apparel companies around the world. The country is very optimistic about its potential of growth in the coming years.

The country has around 4,000 garment factories employing about 2.5 million workers. Garments and textiles are one of the core benefits for us with the TPP agreement, according to Deputy MoIT Minister Tran Quoc Khanh.

Increasing approximately at 19 per cent compared to 2013, Vietnam’s textile and garment exports have crossed $ 24 million in 2014 according to the Vietnam National Textile and Garment Group (Vinatex), the largest textile group in Vietnam. Denim is a growing segment of apparel sourced from Vietnam and is likely to witness significant growth in coming years.

FESPA Textile 2016, to be held from March 8 to 11, will witness daily seminars from industry professionals, with printers being supported by FESPA. Also on the agenda is a a one-day digital textile conference. The conference is likely to cover varied topics , such as: insights into the growth and creative development of digital textile markets by Ron Gilboa of Info trends, growing your business with fabric printing by Daniel Arzt of Sun Ski Sport s.r.o; Smart textiles by David Schmelzeisen, Academic, Institut für Textiltechnik der RWTH Aachen; and Digital print in fast fashion by Mike Horsten, General Manager Marketing EMEA, Mimaki Europe B.V.

The event also schedules a keynote Q&A with Bruno Basso & Christopher Brooke, Basso & Brooke renowned in the digital print process in fashion. Duncan MacOwan, FESPA’s Head of Events and New Media acknowledged that complete spectrum of speakers have been involved to ensure insightful DTC event imparting relevant information to people in the field.

3D printed clothing, ‘Direct to garment printing: should we or shouldn’t we?’ and Screen printing and direct to garment, are some of the topics to be featured in the four day seminar. Roz McGuinness, FESPA Divisional Director, said with the growth of FESPA Print Census, the event highlights the commitment to provide appropriate information and assist printers to diversify. In addition, the sessions are likely to be beneficial for all businesses.

A study commissioned by the Commerce Ministry of Thailand has found that the country’s economy could grow more than 0.77 per cent a year if it joins the Trans-Pacific Partnership. The study also found there would be challenges to confront by joining TPP including tougher competition and stringent protection of intellectual property rights.

The study done by the Panyapiwat Institute and International Institute for Trade and Development probes the benefits and negatives of Thailand joining the TPP. According to Sirinart Jaimun, DG, Trade Negotiations Department, Thailand would get large benefits from the TPP. According to the study, the GDP could grow 1.06 percentage points if other Asean countries, including Indonesia and the Philippines, join TPP. It also found the TPP would help promote growth in the automobile, electronic, computer, garment and textile sectors.

The pact would increase the development of the trade and service sectors as well as environmental protection and labour standards since member states would be encouraged to develop each sector to meet higher standards for sustainable growth. The study found the TPP would increase opportunities for Thai enterprises to invest overseas, and source raw materials from other countries.

It would also promote better awareness of intellectual property rights, leading to stringent protection, as well as support new innovations and research and the development of high technology.

Partners of ‘Bangladesh Sustainability Compact’ sat more needs to be done in ensuring labour rights and trade union rights to overhaul the sector as it faced a severe blow because of Rana Plaza collapse in 2013. During the second follow-up meeting of the Sustanablitiy Compact in Dhaka, they also acknowledged the importance of brands and retailers to adopt practices that promote responsible business conduct in global supply chains, and encouraged them to adopt an uniform code of conduct for factory audits in Bangladesh.

Sustainability Compact is a partnership between the Bangladesh government, the European Union, the United States and ILO, to take the stock of progress in its implementation since its last meeting. The partners recognised further the progress made by Bangladesh since the last follow-up meeting towards meaningful and sustainable changes in the RMG industry in Bangladesh, said a joint statement issued after the meeting.

The meeting appreciated the recent promulgation of implementing rules under the Bangladesh Labour Act, the near completion of initial safety audits by the government and hundreds of RMG factories, the launch of ‘Better Work Bangladesh’ programme with ILO/IFC and the continuation of efforts to improve the capacity of the some organisations like DIFE, Fire Service and Civil Defence Department, Rajuk, through increase in staff and budgetary allocations.