FW

Owner of iconic brands like Gucci, Saint Laurent, and Bottega Veneta, luxury conglomerate Kering announced worse-than-forecast results in Q2, FY25. The group's sales contracted by 15 per cent Y-o-Y on a comparable basis to €3.7 billion ($4.27 billion), falling short of LSEG analysts' projection of €3.96 billion.

The most significant hit came from Gucci, which typically accounts for nearly half of Kering's total revenues. Sales at the high-end fashion house declined by 25 per cent over the quarter to €1.46 billion.

François-Henri Pinault, Chairman and CEO, says, though the numbers being reported by the company remain well below their potential, their comprehensive efforts of the past two years have set healthy foundations for the next stages in Kering’s development. The company reiterated commitment to achieving long-term profitable growth despite the uncertain economic and geopolitical climate.

Kering reported weaker sales across all its markets, with Japan and the wider Asia Pacific region leading the decline. Yanmei Tang, Analyst, Third Bridge, notes, the company is facing a tough reality as its two main luxury markets, China and the United States, are under strain.

The appointment of auto veteran Luca de Meo as group CEO in June, effective September 15, has brought a wave of positive sentiment. Carole Madjo, Head –Research, European Luxury Goods, Barclays, highlights de Meo's really strong track record in turning around businesses but also in branding.

However, de Meo faces significant headwinds. The luxury industry is bracing for potential new 15 per cent tariffs on imports into the US, alongside broader concerns about consumer spending, especially in the crucial Chinese market. Armelle Poulou, Chief Financial Officer, indicates, the company had factored in the 15 per cent tariff rate and would manage it through pricing adjustments, with some price hikes already implemented in Q2 and a potential second wave in the autumn.

Analysts suggest, Kering's more pressing challenge lies in reviving brand image and desirability, particularly for Gucci under the leadership of Demna Gvasalia, new Creative Director. Francesca Bellettini, Deputy CEO, Kering, confirms, Gucci will roll out their first collection in early 2026. The company is focused on creating product desirability rather than pondering over any tariff threat, Tang concludes.

The South India Garments Association (SIGA) is urging the Karnataka State Government to create a dedicated Special Economic Zone (SEZ) for small and medium-sized textile companies within the state.

Highlighting the current disparity, Anurag Singhla, President, SIGA, states, the State Government has established textile parks catering to the needs of large textile companies. However, as of now, there are neither textile parks nor Special Economic Zones designed to benefit the small and medium-sized textile companies that contribute significantly to state revenue and generate jobs. He appeals to the government to develop supportive regulations specifically for these smaller and medium-sized textile enterprises.

A significant number of small and medium-sized textile businesses are operating below capacity due to a decline in demand for clothing, Singhla points out. In the past, the average person would purchase ten outfits annually. Due to a shortage of funds, a person’s purchasing capacity has now decreased from ten clothes annually to two, he explains.

Emphasizing on SIGA's enduring role, Singhla says, the association has been supporting the apparel industry and trade for nearly three decades, serving as a crucial link between these sectors and the government.

Currently, SIGA is hosting the 30th SIGA Fair in 2025, a three-day event that commenced on July 29. Over 100 brands are showcasing their collections at the fair. Approximately 2,000 retailers from Karnataka and neighboring states are attending the exhibition, Singhla states.

Rajesh Chawat, Secretary, SIGA confirms, prominent textile companies from Mumbai, Ahmedabad, and Surat are participating in the three-day show. The exhibition is expected generate between Rs. 100 crore and Rs. 150 crore in revenue, projects Chawat.

Singaporean investment company Temasek has significantly increased its stake in the renowned Italian luxury Group, Ermenegildo Zegna. This strategic move underscores Temasek's confidence in the Italian luxury sector's global significance and Zegna's long-term growth potential.

Temasek has agreed to purchase 14,121,062 of Zegna's treasury shares at a price of $8.95 per share. This latest acquisition builds upon Temasek's previous market purchases of 12,699,981 ordinary shares. Upon completion of this transaction, Temasek's total holding will represent a 10 per cent stake in Ermenegildo Zegna Group's ordinary share capital.

Ermenegildo ‘Gildo’ Zegna, Chairman and CEO, Ermenegildo Zegna Group, emphasizes, the investment is a strong endorsement of their vision and reinforces their unique role as a custodian of authentic luxury brands. This partnership will further strengthen their global organic expansion, he opines.

Nagi Hamiyeh, Head- EMEA, Temasek, states, this investment reflects Temasek's ongoing commitment to supporting leading European businesses with strong track records and global potential. Temasek aims to be a thoughtful, long-term partner, empowering the Zegna family and management to execute their growth strategy and elevate their iconic brands and global footprint.

The transaction will provide Ermenegildo Zegna Group with a total cash consideration of $126.4 million, bolstering the Group's balance sheet. This enhanced financial flexibility will enable Zegna to capitalize on its brands' strong momentum and selectively pursue opportunities to accelerate organic growth. Temasek's extensive experience in the luxury sector and deep knowledge of the Asian market are expected to significantly contribute to Zegna's growth prospects, particularly in underdeveloped key geographies. Nagi Hamiyeh is also slated to join the Group’s Board of Directors in June 2026.

In a significant leap for India's textile and garment sector, the renowned Asmeeta Textile Park has officially rebranded and upgraded as Magus Fashion City (MFC).

Spanning 74 acre in Kongaon, Bhiwandi, Magus Fashion City embodies a renewed vision. Building on the successful legacy of Asmeeta Textile Park, which developed over 45 acre of industrial space, Magus now champions a stronger, smarter, and more sustainable future for fashion manufacturing in India.

More than just infrastructure, the company building an ecosystem, states Vinay Nile, Senior Vice President- Sales & CRM, Magus Infra Tech

Magus Fashion City is pioneering as India's premier destination designed to serve every facet of fashion manufacturing. This ranges from garments, accessories, and footwear to cosmetics, wearable technology, and even medical textiles. With over 940 operational units already in place and more than 1,000 in the pipeline, MFC is rapidly becoming a thriving hub for B2B manufacturing, trade, and innovation.

Magus Fashion City boasts world-class infrastructure, ensuring smooth business operations with 24/7 power, water supply, robust security, 100 per cent fire compliance, efficient storm water drainage, wide internal roads, truck terminals, and comprehensive logistics support. Critically, MFC is also green-zone compliant, promoting environmentally responsible manufacturing practices. This commitment to sustainability is designed to attract brands that prioritize eco-friendly supply chains.

Already home to hundreds of businesses, Magus Fashion City is being heralded as India’s answer to leading fashion-focused industrial parks across Asia. Its strategic location, with excellent proximity to Mumbai, Thane, and Navi Mumbai, and strong connectivity via road, rail, and the upcoming metro, positions it as the epicenter of India’s fashion manufacturing revolution.

As global demand for ‘Made in India’ products continues its upward trajectory, Magus Fashion City is poised to spearhead the next chapter in India’s fashion industrial evolution, one stitch at a time.

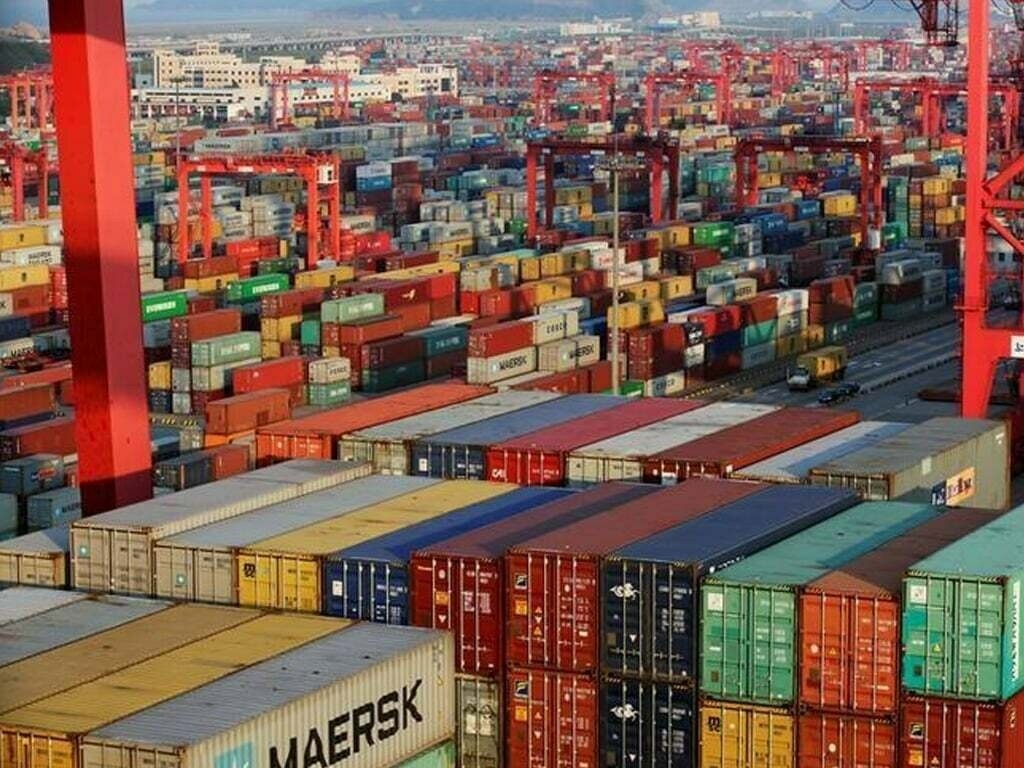

As the global textile industry deals with shifting trade dynamics, environmental mandates, and competitive diversification, one reality remains unchanged: China’s unyielding dominance, particularly in polyester production, remains the axis upon which the industry turns.

Despite intensifying trade wars—most notably the deepening rift between the US and China—and mounting calls for diversified supply chains, China is not only holding its ground but extending its reach.

Polyester, now accounting for approximately 57 per cent of all fiber production at 71 million tons in 2024, is set to continue its reign as the dominant textile fiber. China already commands over 65 per cent of this massive market. This entrenched position means that even as the US-China trade dispute intensifies, reaching a 22-year low in direct textile and apparel imports from China to the US, the globalized nature of the supply chain ensures an unavoidable reliance on Chinese-produced polyester. Products, regardless of their final assembly location, often trace their origins back to China's formidable polyester manufacturing base.

A new report by the International Textile Manufacturers Federation (ITMF) reveals that in 2024, 95 per cent of all new fiber and filament equipment for polyester production was sold to China. This is not merely a statistic—it’s a statement of intent. It underscores Beijing’s long-term industrial strategy, rooted in rigorous five-year plans and bolstered by scale, infrastructure, and control over raw materials.

Polyester, the fabric of global fashion

In 2024, polyester accounted for 57 per cent of global fiber production, amounting to roughly 71 million tons, of which China controlled over 65 per cent. As other fibers grapple with cost volatility or supply disruptions, polyester's synthetic, oil-based reliability continues to make it the textile of choice—from high-performance sportswear to fast fashion. "Even when a T-shirt is sewn in Bangladesh or Mexico, the fiber behind it likely originated in China,” notes a senior analyst at ITMF. “That’s the invisible thread that connects us all to Chinese manufacturing.”

Table: Global polyester market outlook (2024)

|

Metric |

Value |

Source |

|

Total Fiber Production |

~71 million tons |

ITMF |

|

Polyester Share of Total |

~57% |

ITMF |

|

China's Share of Polyester Production |

>65% |

ITMF |

|

Global Market Size (Polyester Fiber) |

USD 129.8 billion |

MarketsandMarkets |

|

New Polyester Equipment Sales to China |

~95% |

ITMF |

What’s fueling this growth? Market projections show the global polyester fiber market growing from $129.8 billion in 2024 to $207.4 billion by 2034. Another estimate, specifically for polyester textile applications, sees the market expanding from $12.85 billion to $15.89 billion by 2030—a testament to polyester’s centrality across fashion, home textiles, automotive fabrics, and beyond. This growth is due to polyester's versatility, cost-effectiveness, and essential properties like durability and wrinkle resistance, making it a staple across various applications.

Exporting dominance China’s textile juggernaut

Even amid geopolitical disruptions, China’s textile and apparel exports climbed to $301.1 billion in 2024, up 2.79 per cent from the previous year. Notably, textiles (largely polyester-based), saw a 5.7 per cent growth outpacing the 0.3 per cent growth in garments and accessory exports.

Table: China's textile & apparel exports (2024)

|

Category |

Export value ($ bn) |

Year-on-year growth |

|

Total T&A Exports |

301.1 |

+2.79% |

|

Textile Products |

141.96 |

+5.7% |

|

Garments & Accessories |

159.14 |

+0.3% |

Source: Fibre2Fashion

This growth occurred even as US imports of Chinese textiles hit a 22-year low. Yet, through indirect trade routes and value-added processes in third countries, China’s polyester yarn and fabrics continue to underpin finished products globally.

Rising Challengers: The new textile cartography

Though China’s hold is firm, global players are manoeuvring to challenge its supremacy. Trade reconfigurations, ESG (Environmental, Social, and Governance) considerations, and foreign investment are shifting toward alternate hubs.

India, warming up the loom

India’s textile and apparel exports rose to $36.3 billion in 2024, a 7.1 per cent increase, driven by an 8.4 per cent rise in apparel exports. As Western retailers seek “China+1” alternatives, India’s legacy in cotton and growing capacity in man-made fibers is helping it inch up the value chain.

Indonesia, investment surge

The Indonesian textile and garment industry grew by 2.64 per cent year-on-year in Q1 2024, with textile and garment exports marginally growing by 0.19 per cent to $2.95 billion in the first three months of 2024 as per Textile Insights. Foreign direct investment in the sector also rose significantly by 70.2 per cent to $194.3 million in January-March 2024. In 2023, Indonesia exported $13.4 billion in textiles globally as per OEC World.

Thailand, quiet but strategic

Thailand’s fabric exports reached $1.08 billion in 2024. While less visible than its neighbors, Thailand is banking on trade agreements and niche strengths to boot its textile and apparel exports.

Recycled polyester takes hold

Even as virgin polyester grows, sustainability narratives are beginning to reshape industry priorities. Recycled polyester, primarily made from discarded PET bottles, is gaining momentum. In 2024, the recycled polyester yarn market was valued at $328 million, projected to hit $1.93 billion by 2033, growing at a CAGR of 16.8 per cent. The broader recycled polyester market stood at $15.52 billion, with projections reaching $26.18 billion by 2030. China and the Asia Pacific region again lead here—producing 65 per cent of recycled polyester yarn globally in 2023.

Table: Global recycled polyester market (2024)

|

Metric |

Value |

|

Recycled Polyester Yarn Market Size |

$328 million |

|

Recycled Polyester Market Size |

$15.52 billion |

|

Asia Pacific Share |

47.78% (Recycled Polyester)/65% (Recycled Polyester Yarn) |

Yet, this progress hides an inconvenient truth: most recycling is bottle-to-fiber, not textile-to-textile. Industry experts caution that unless closed-loop systems become mainstream, polyester’s ecological footprint may persist despite "green" branding.

Stitching the future

Looking ahead, the industry’s evolution hinges on sustained investment. The global textile machinery market—a barometer for future capacity—was worth $29.49 billion in 2023 and is forecasted to grow at 5.5 per cent CAGR through 2030. Asia Pacific again leads, claiming 46.5 per cent of the market in 2023, reflecting capital flow into the region. In geopolitical terms, while a full decoupling from China remains unlikely, the textile map is being redrawn. Countries like India, Vietnam, and Indonesia are no longer just “alternatives”—they’re rising centers of gravity.

Interdependence in a divided world

China’s polyester empire may be built on synthetic fiber, but its foundation is strategic foresight. For now, it’s clear: the global textile supply chain—even when rerouted—inevitably passes through China. But the increasing push for sustainability, combined with geopolitical churn and consumer awareness, is opening doors for a more diversified and circular industry. If the future of fashion is to be greener and more balanced, the threads of innovation, collaboration, and investment must be woven just as tightly as China has done with polyester.

A global leader in home textiles, Trident Group has forayed into UK with an aim to capture a significant share of the lucrative $6.68 billion UK home textile market.

This expansion of the group across the UK and Europe is being spearheaded by the its European subsidiary, Trident Europe with the launch of a new premium brand, Trident Threads. A design-driven initiative crafted for the modern, sustainability-conscious global consumer, this brand specifically targets the luxury segment. It offers a refined collection of luxurious bed and bath linens, blending timeless craftsmanship with contemporary design sensibilities.

This increasing consumer preference for eco-friendly products perfectly aligns with Trident's sustainable bed and bath linen range, which is well-suited for the discerning British consumer interested in circular textiles. These products are soon expected to be available as private labels across renowned UK retail chains.

Andrew Kingsley, CEO, Home Textiles International Marketing UK & Europe, emphasizes, blending Indian manufacturing excellence with European design sensibilities, Trident Threads represents a bold shift from traditional supply to a brand-led, innovation-first model. Our new product line, encompassing yarn, bath and bed linen, and eco-packaging, prioritizes performance, aesthetic value, and low-impact production consistent with circularity principles. This expansion leverages the evolving UK–India Free Trade Agreement, enhancing bilateral market access and reinforcing Trident's commitment to ethical, efficient trade.

With its High Net Worth (HNW) individuals and Ultra-High Net Worth (UHNW) individuals population set to grow at 11-15 per cent CAGR through 2034, India is emerging as a crucial market to watch with in the global personal luxury goods market.

As per a report by the Boston Consulting Group /(BCG), coupled with a young and brand-savvy consumer base, this rapid wealth growth is elevating India to a significant strategic priority for international luxury brands.

To capitalize on this shift, luxury brands are investing in more localized and customized strategies, emphasizing exclusivity, craftsmanship, and immersive brand experiences. As aspiration increasingly aligns with growing incomes, the Indian luxury consumer is becoming even more pivotal to the industry's future.

The BCG report advocates a fundamental rebalancing of strategy. It urges luxury brands to return to their core values and focus on quality and emotional connection instead of pursuing mass-market expansion. Key recommendations of this report include enhancing client service through high-touch, human-centric experiences supported by generative AI, ensuring vertical control over product quality, and extending luxury into wellness and lifestyle spaces.

Titled, True Luxury Global Consumer Insights 2025, the report reveals, the Global personal luxury goods market is facing an unprecedented period, with projections for 2025 indicating either stagnation or even a decrease – marking its first such downturn in over a decade.

As per the report, a significant divergence is emerging between consumer groups in the market. Having previously dominated nearly 70 per cent of the market, aspirational consumers are now pulling back, their representation dropping by almost 15 percentage points. This shift is attributed to mounting cost pressures and evolving consumption habits. Conversely, a tiny fraction of the global population (less than 0.1 per cent), ultra-high net worth (UHNW) individuals now account for a staggering 23 per cent of total luxury expenditure. These UHNW and HNW consumers are rapidly becoming the primary growth engines for the luxury industry.

Luxury brands that heavily relied on aspirational consumers are starting to feel the pinch, while those catering to high-end clientele remain more resilient. This elite segment, typically spending over $387,950 annually on luxury items, is expanding at nearly 10 per cent per year, with over 900,000 HNWIs globally. However, to attract these affluent customers, luxury brands need to focus on creating deeper, more personalized experiences that foster a profound connection to the brand.

Privately-operated contemporary lifestyle brand, Rebecca Minkoff aims to unlock new growth channels and global scalability by transitioning to a licensing model.

Launched in 2005 by designer Rebecca Minkoff, the bespoke model made a significant entry into the fashion world with Minkoff’s highly sought-after ‘Morning After Bag; quickly becoming a favorite among celebrities like Lindsay Lohan and Hayden Panettiere. The privately operated contemporary lifestyle brand was later acquired by Sunrise Brands in 2022.

Now, in a strategic pivot, the Rebecca Minkoff brand aims to leverage the operational, manufacturing, and distribution expertise of specialized licensing partners.’ This shift aligns with broader industry trends, allowing them to maintain creative control while efficiently scaling through partners experienced in their respective categories, the brand emphasizes.

This model allows the brand to focus on innovating through design and storytelling — while its partners help bring that vision to life at scale, states Minkoff. These licensing partnerships will help build a business that can evolve with culture, not just chase it, she adds.

The transition is also expected to optimize capital deployment by shifting away from heavy inventory investment towards a royalty-based revenue model. This financial restructuring is anticipated to fuel brand innovation through more focused research, development, and experiential marketing initiatives.

Sam Hafif, CEO, Concept One, a key licensee, avers, as the licensee of the handbag, accessories, and and travel categories, the company plans to expand its products range, and distribution points globally. Concept One has hired several key members of the Rebecca Minkoff team to utilize their product development and sales expertise to support the business, he confirms.

Currently, Rebecca Minkoff products are available in over 900 distribution points worldwide. Parent company Sunrise Brands also owns other contemporary fashion labels, including Current/Elliott, NYDJ, Donald Pliner, and Joie.

Following a successful debut this past February at Spring Fair, Moda x Pure is set to return to Autumn Fair 2025 from September 7-10 at the NEC Birmingham. This second edition will be energized by a larger brand lineup and a renewed mission to champion the evolving needs of independent fashion retailers.

With a strong emphasis on conscious consumerism, inclusivity, and season-ready stock, Moda x Pure will bring together a carefully curated community of trend-driven and ethically minded brands. Positioned at the heart of Autumn Fair – the UK’s most influential B2B event for home, gift, and fashion – this dedicated sector promises high-impact product discovery, timely retail insights, and a dedicated space for networking and business conversion.

Serving as the ultimate buying destination for boutiques and fashion independents, the second edition of Moda x Pure will feature a bold mix of returning favorites and first-time exhibitors, injecting fresh energy onto the show floor. Attendees can expect to see brands like Powder, Killstar, Lisa Angel, Nomads Clothing, and Manhattan Portage, alongside new exhibitors such as One Summer (showcasing resortwear and casual staples), Betty Basics, Baily Bag, Nudie Jewellery, and Arya Fashion.

More than just a platform for product discovery, Moda x Pure aims to be a launchpad for forward-thinking retail. Beyond its curated brand lineup, the sector offers a comprehensive program of expert-led content designed to help independent retailers stay ahead of shifting trends and evolving customer expectations.

At the core of this content is The Retail Corner, where visitors can attend daily seminars, exclusive interviews, and hands-on masterclasses. Topics will span everything from trend forecasting and social commerce to visual merchandising and brand storytelling. The learning continues in the Buyers Retreat, an exclusive oasis offering a relaxing space for buyers to unwind, plan, and connect. Highlights here include sessions on ‘Powering Digital Growth for Small Businesses: How eBay Helps Independents Scale Online’ and ‘Sustainability That Sells,’ focusing on refining eco-strategies and communicating sustainability stories effectively.

UK’s largest B2B retail trade show for Home, Gift & Fashion of the season, Autumn Fair will host over 800 leading brands and 12,000+ retail buyers for four days of high-impact product discovery ahead of the busiest retail season.

Valued at $3.7 billion in 2024, the global market for high-speed knitting machines is projected to grow at a 5.61 per cent CAGR to reach $5.7 billion by 2032.

According to a report by MarketsAndResearch.com, this growth is primarily fueled by the escalating demand for efficient, automated textile manufacturing across the apparel, sportswear, and technical textiles sectors.

These advanced machines are critical for the rapid production of seamless garments, socks, and industrial fabrics, offering programmable patterning and significantly reduced labor requirements. Key manufacturers are intensifying their focus on developing electronic flat knitting machines, incorporating features like multi-gauge compatibility, enhanced stitch accuracy, and reduced energy consumption to boost overall productivity.

Market expansion is further fueled by the burgeoning fast fashion production, continuous innovations in sportswear, and the ongoing expansion of textile industries, particularly in Asia-Pacific regions such as China, Bangladesh, and Southeast Asia.

However, the market faces challenges, including the high initial cost of equipment and a shortage of skilled operators required for programming and maintenance of these sophisticated electronic systems.

Evolution in this market is being driven by recent technological advancements including the Mach2XS high-speed knitting machine featuring wholegarment technology by, Shima Seiki

This innovation enables the company to produce seamless garments with enhanced patterning flexibility and significantly reduces material wastage for apparel manufacturers worldwide.

The comprehensive market outlook also provides an in-depth analysis of the impact of ongoing supply chain disruptions and geopolitical issues, including trade tariffs, regulatory restrictions, and production losses. It also considers the effects of inflation and correlates past economic downturns with current market trends, offering crucial insights for stakeholders navigating the evolving business landscape.