FW

Hemp, a leader in the industrial hemp industry, said that sales for the 3rd quarter ending September 30, 2015 increased 53.8 per cent over the 2nd quarter.

Commenting on the company’s performance and prospects of hemp, Bruce Perlowin, CEO of Hemp, stated, “The industrial hemp industry is really booming. More states are beginning to realise it is more advantageous for them to legalise it. As you know, North Carolina, home to our industrial hemp commercial decortication facility, legalised hemp. Farmers in North Carolina now have the option to cultivate hemp crops with easy access to Hemp's multipurpose industrial hemp commercial processing facility.

” The legalization of industrial hemp in North Carolina has been a game changer for Hemp. The direction of the company has shifted towards more advanced processing in the milling line. Perlowin said the company will still continue to market its hemp-based cosmeceutical and nutraceutical product line. "In terms of generating profit, our multipurpose industrial hemp processing facility in Spring Hope, North Carolina by far outweighs any sales revenue generated from our product line, which is why we feel it best to shift focus," said Perlowin.

As the industry continues to boom, Hemp, Inc. is expecting millions of dollars in revenue to be generated per year pending the completion of its multipurpose industrial hemp processing plant that vertically integrates growing, decortification, milling, and more. The burgeoning demand for hemp, the plant used for thousands of years that became illegal decades ago, in the United States continues to increase.

The company recently also announced that it has entered into a definitive 5-year term agreement to sell its industrial hemp fiber from its decortication plant in North Carolina to a premium hemp denim apparel company, Hemp Blue. Hemp Blue, specialises in environmentally friendly clothing and advocates for the return of agricultural hemp as a sustainable crop in the United States.

Hempinc.com

Bigger brands lead the pack

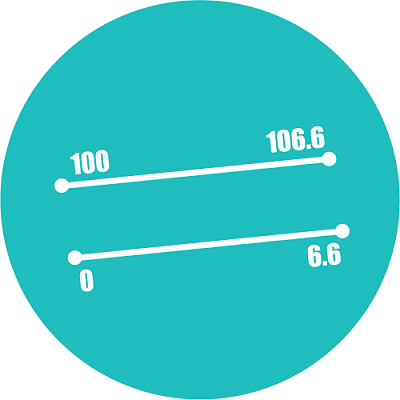

Q2 Apparel Index clocked in 6.68 points growth. This is approximately 56 percent higher than the index for Small Brands (with turnovers of Rs 10 to 25 crores) which stood at 4.28 points. For Mid Brands (turnover of Rs 25-100 crores), growth is 7.7 points. In fact, Mid Brands performed much better than Small Brands, but it’s the Large Brands with 8.95 points and Giant Brands with a high index value of 9.15 points that have shown a real growth.

This is a clear indication that Mid, Large and Giant Brands are doing much better compared to Small ones. Index pattern this quarter, much like earlier quarters, reflects as the size of brands goes up, performance improves. Interestingly, Mid Brands are racing ahead to catch up with the growth momentum of Large and Giant Brands. The gap between the rate of growth of Small Brands and Mid Brands is considerably high than previous quarters.

To an extent, this quarter’s growth has got a boost from sales as the results includes the EOSS period of July and August, where Large Brands usually offer high discounts, and the focus is on Top Line, resulting in high Sales Turnover. On the other hand, a period of heavy discount is normally accompanied by a reduction in Inventory. These factors probably explain why Large and Medium Brands are faring much better than the Small Brands, which typically are under some stress during this period.

Sales Turnover high for bigger sized company

The Index points out that Sales Turnover also increases in the same pattern as the size of the brand. For Small Brands, growth in sales turnover is just 3.38 and it grows on increasing. For example, for Mid brands it is 5.19, for Large - 5.33 and for Giant Brands, it is 5.54. This pattern follows a reverse order in case of Inventory Holding, clearly indicating that the impact of Sales Turnover and Inventory on the company’s performance.

As Vinod Kumar Gupta, MD, Dollar says, “It has been a satisfying year for us with the brand making inroads in newer territories and consolidating its position in existing hosiery markets of India and abroad. We have achieved a massive product growth of 88 percent across India as a result of the team’s aggressive marketing and advertising strategy backed by superior product range, technology upgradation and capacity expansion.”

A close look at Sell Through (Small-1.31, Mid-1.78, Large-2.36 and Giant-1.27) and Inventory Holding (Small-2.31, Mid-1.48, Large-0.83 and Giant-0.58) reveals that the reason for Small Brands not growing is related to the rise in Inventory Holding, which is higher than the improvement in Sell Through, whereas in case of Mid, Large and Giant Brands Sell Through improvement is much better and there’s much better control on Inventory Holding. Thus, index improves with size of brands.

Hemant Gupta, CFO, Blackberrys explains, “In the past two quarters, there is a major decrease in footfalls at stores, which is mainly responsible for decrease in Sales Turnover and impacts Sell Through as well. However, our conversion ratio and basket size has increased but due to lower sales the sell through has impacted. Increase in inventory holding also is one of the prime reasons for that. This is not with us only but with other brands as well. I am hopeful that situation will definitely improve in 3rd and 4th quarter of 2015-16.”

Speaking on the co-relation between Sales Turnover, Inventory and Sell Through, Rajiv Nair, CEO, Celio says, “Reducing inventory continues to be a core area of focus at Celio. Sales in the last quarter have been lukewarm. Hence, we ensured renewed focus on liquidation through specific promotions and EOSS. We are on our inventory targets which we keep reassessing every month. We avoid overfilling stores and focus on timely replenishment to avoid inventory risks.”

While Sooraj Bhat, Brand Head, Allen Solly opines, "An increase in inventory for us has been to fund aggressive expansion of company owned stores."

Future outlook positive

A comparison of Apparel Indices of Q2 July-Sept 2015 and 2014 reveals the Index Value was higher at 7.96 last year compared to 6.68 for 2015. The reason, it says is low performance of most of parameters except Inventory Holding in Q2 2015. Overall, the apparel industry failed to grow as much as it grew in the same quarter last year on all aspects be it Sales Turnover, Sell Through or Fresh Investments. On the other hand, Inventory Holding showed much lesser increase for good in 2015, as a lower increase reflecting better control on inventory causing lesser impact on bottom line.

However, nearly 41 percent of brands feel that the outlook for next quarter is good. Like last quarter 27 percent brands say their outlook is ‘Excellent’ for the next quarter. Nearly 30 percent, much higher than that of last quarter at 23 per cent, foresee an average outlook for next quarter and 2 percent feel that it will be ‘Below Average’. October-December being a quarter that enjoys better sales during festive seasons around Diwali, Christmas and New Year, brands predict an improvement in market sentiments.

Several global retailers and brands now plan to increase investments in their production facilities in Vietnam after it became clear that the country would significantly benefit from the Trans Pacific Partnership, once it reaches the concluding phase.

While American manufacturer and retailer of everyday apparels – HanesBrands has decided to increase its total investment in Vietnam to nearly $55 million by the end of 2015, up $11 million compared to last year, several other clothing and textile brands are exploring the destination. HanesBrands Vietnam is the largest consumer of US yarn in Southeast Asia, with over $1 billion of US yarn consumed by its sewing plants. It has two manufacturing plants in the northern province of Hung Yen and one plant in the central province of Thua Thien-Hue, with the annual capacity of 475 million units, accounting for 20 per cent of the group’s total production. Last year, with the inauguration of its third plant in Hung Yen, the company’s total exports surged to $334 million, and the figure is expected to reach $355 million this year.

However, the experts warn that as foreign direct investments in Vietnam increase, they will have an adverse impact on the country’s local manufacturing units. Smaller ones may have to shut shops, while big production houses may get reduced to small businesses.

www.hanes.com

CanopyStyle, the global campaign with the fashion industry to protect endangered forests has gained new influential champions in Topshop and their parent company Arcadia, C&A China and Lindex.

“With 55 brands representing $85 billion in annual sales now joining together to protect forests there is a clear market signal to fabric producers: eliminate sourcing from endangered forests,” said Nicole Rycroft, Founder and Executive Director of Canopy, adding, “What’s exciting is how this momentum is already translating back through the supply chain to alleviate stress on critical forest hotspots like Indonesia’s rainforests and Canada’s Boreal.

” Since the public launch of the CanopyStyle campaign two years ago, brands are working to ensure future supply doesn’t harm critical forests or contribute to deforestation while encouraging solutions such as manufacturing fabrics from recycled clothing instead. In their commitment, Arcadia Group declared their support for a future that does not use ancient and endangered forest for fabrics such as rayon and viscose.

In June of 2015, Canopy, H&M, Inditex/Zara, Stella McCartney, Eileen Fisher and Marks & Spencer hosted a summit of global brands and the world’s largest viscose producers in China. “C&A is excited to join such an important effort and one that aligns with our global sustainability strategy. We are starting with our operations in China, as it is a key retail market for us,” said Jeff Hogue, Chief Sustainability Officer C&A Global.

Lindex too has formed a strong policy to allow their customers to mix and match styles and functionality that don’t cost the earth. “Lindex has a strong handle on our supply chain, we see Canopy as a well-positioned partner to help us build a clear picture of who our viscose suppliers should and shouldn’t be moving forward”, said Anna-Karin Dahlberg, Production Support Manager at Lindex.

www.canopyplanet.org

Leading for over two decades

“What you see here is compilation of two decades of ongoing research, development and refinement in technology” says Masaki Karasuno, Incharge for Planning Group (Total Design Centre), adding further, “Perhaps it was before time then in 1995, it has improved over time and is more relevant to industry now. Earlier, one worker could manage just 5 machines, whereas the latest machine needs one worker for 35 machines.”

Shima Seiki proposes several novel ways to produce WholeGarment knitwear even more efficiently by exploiting 3D shaping and tubular knitting characteristics. Furthermore with Italy and the rest of Europe in its radar, Shima Seiki emphasizes on the economic and logistic advantages of WholeGarment knitting for local production in domestic markets, which further increases the sustainability factor by eliminating time, cost and energy otherwise spent in shipping from off-shore locations.

Looking at the world's market conditions and taking into account possible future scenarios in the manufacturing and distribution of goods, technology reflects a much bigger picture as how technology users can successfully maintain a profitable business; how the industry can transform itself from one relying on labor to one fueled by information and creativity; and how a sustainable material-to-manufacture-to-distribution system can be established with limited resources and limited factory capacity despite steady growth in global population.

“Technology is sustainable as it reduces manpower thereby reducing cost. Furthermore, machines can be installed where the market is, closer to the consumption centre, producing straight from yarn to garment, cutting processes in between, saves lot of costs giving economic and logistic benefit beside being quick to market.”

WholeGarment was inspired from glove manufacturing, recalls Karasuno. Today Shima Seiki enjoys 10 per cent share of knitting machines worldwide, contributing much higher in production volume, as their machines produce much higher and quicker than others. Italy being the largest market for WholeGarment, followed by the US, Shima Seiki is world leader in knitting technology.

Shima Seiki machines both WholeGarment as well as conventional knitting machines are used for various end applications including fashion, home furnishing, sports, medical, automotive, aerospace and other industrial textiles.

As foreign direct investment is pouring into Vietnam’s textile and garment industry, it is causing concern in the country. Foreign investors, especially Chinese, are pouring huge capital into textile and dyeing projects in Vietnam. Local authorities have been asked to examine projects thoroughly before licensing to be sure that the projects can satisfy requirements of occupancy rates in industrial zones, and technological and environmental standards.

An increase in textile and garment complexes has been seen as a threat to the environment. There are also fears the complexes will import and use outdated energy consuming technologies. Many provinces in Vietnam now don’t welcome textile and dyeing projects. They have decided to say no to projects with high environmental risks.

Of the $11 billion worth of foreign direct investment poured into Vietnam so far this year, $3.5 billion went to textile and garment projects. The investment wave in textile and garment projects began in 2014 when foreign investors heard Vietnam was going to sign the Trans Pacific Partnership Agreement (TPP).

The TPP has encouraged many foreign textile and garment firms to boost investments in Vietnam. The yarn forward rule under the TPP requires that yarns, fabrics and final garments to be exported within the TPP should be produced in TPP member countries.

To draw attention to a global campaign demanding long term compensation to the families affected by the Ali Enterprises factory fire in 2012. Shahida Parveen and Farhat Fatima from Pakistan will visit KiK in Berlin from November 23 to 27 2015. During her stay in Germany, Parveen intends to deliver #MakeKikPay petition to KiK representatives. Parveen is a widow of one of the workers who was killed in the fire. Fatima, from the Pakistan Institute of Labour Education and Research (PILER) will accompany Parveen. PILER is an organisation that signed a legal agreement with KiK for a negotiated settlement of long-term compensation to the survivors and victims’ families of Ali enterprises tragedy.

A fire broke out in the garment factory Ali Enterprises in Karachi, Pakistan on September 11 2012 in which around 254 workers were killed and many more injured as doors were locked, escape routes were blocked and windows were barred.

The Ali Enterprises factory was solely producing jeans for German low-cost retailer KiK when tragedy struck. In December 2012, KiK signed a Memorandum of Understanding (MoU) with PILER after the disaster. However, KiK is yet to fulfil the terms of the legal agreement, notably to engage in good faith negotiations to determine long-term compensation for the victims and to pay $ 250,000 for future labour standard enforcement more than three years after the incident.

The families of those who were killed or injured in the fire have been negatively impacted with many struggling to make ends meet. Several international groups and labour unions, including the Clean Clothes Campaign (CCC), and global unions IndustriALL and UNI, have supported Parveen’s global petition.

For the first four months of this year, China’s apparel and accessories exports increased by 1.8 per cent. China’s exports of clothing and jewelry products to the EU dropped 12.1 per cent but exports to the US and Japan rose six per cent and 4.8 per cent respectively. Exports to these three markets account for 53.7 per cent of China’s clothing and jewelry products during the same period. Clothing products were mainly made of cotton.

China’s chemical fiber and industrial textiles exports had a 2.5 per cent year-on-year drop. Exports of natural fiber products to Vietnam saw a four per cent year-on-year growth. Exports of textile machinery to India and the UAE decreased consistently but there was growth in sales to Indonesia. Exports of polyester products to the European Union and the US showed a significant rise. Exports of chemical fibers and textiles for industrial use showed a rise of 28.6 per cent. Combined exports of the top 10 enterprise accounted for 4.8 per cent of the total export amount.

Over the year, the textile industry in China has seen a fall in exports and a rise in the cost of raw materials and payments. In addition, there was a sharp drop in the export of textile raw materials, products and textile machinery.

Unless Bangladeshi exporters can satisfy Indian authorities by December 16, India may impose anti-dumping duty on jute goods imported from Bangladesh. An investigation into import of jute products from Bangladesh and Nepal has already been launched by the authority,Directorate General of Anti-Dumping and Allied Duties (DGAD) on request of the Indian Jute Mills Association (IJMA).

Sources say, to nullify the impact of ‘export subsidies’ given by Bangladesh, Indian manufacturers, want penal duties to be imposed on jute products imported from there, making its products cheaper in India in the absence of import duty. Some mills, including a majority belonging to IJMA, are illegally importing jute bags from Bangladesh and Nepal at a cheaper price to sell the same at higher prices to state-owned food procuring agencies, say sources. This has been discovered by the Indian Jute Commissioner, state these sources.

The DGAD has decided to conduct the investigation in response to queries and it has issued a letter, with a copy of Initiation Notification of anti-dumping duty investigation against Bangladesh jute products, to Bangladesh High Commission in Delhi on November 6 this year, as part of the investigation.

With regards import of jute products originating in or exported from Bangladesh the DGAD advised Bangladesh exporters and parties concerned to respond to the queries of DGAD. The DGAD stated they could do this through a prescribed form within 40 days of the date of issuance of the letter. Moreover, all the mills concerned were asked to respond to the Indian authorities individually replying to the information they ask for by the Bangladesh Tariff Commission after they held a meeting in this connection.

The sales tax levied by Pakistan government is causing great distress among exporters. The value-added textile exporters are worried about the ‘sales tax trap’, which is eating into their liquidity and making their products costlier in the global markets. The incumbent PML-N government is being blamed by exporters for continuing the bad sales tax policy. During its rule from 2008-2013, this tax, started by the PPP was slapped on them with two percent. The exporters termed the irrational tax as a ‘stumbling block’ in the country’s exports growth.

Muhammad Javed Bilwani, Chairman, Pakistan Apparel Forum (PAF) said that at the end of PPP government’s tenure, it had imposed 2 per cent sales tax on exports, which was then strongly opposed by the PML-N. However, he said that now the PML-N government is continuing with the same tax it had opposed in the past. The country has seen a substantial fall in exports standing at 13.42 per cent during July-October 2015-16, due to the soaring cost of doing business, added Bilwani. The country's global competing nations, such as Bangladesh had grown its exports by almost five percent and Vietnam by 9.20 percent during the same period, though, he added.

Bilwani also believes that the government's economic policies were on a ‘wrong’ track and added that the figures once again clearly prove that the government is consulting only with those whose agenda is to decrease exports for their personal gains. He said that in the last fiscal year, 2014-15, Pakistan’s overall exports dipped by 5 percent. The 50 per cent rise in tax, Bilwani believes will scale down the value-added textile exports.