Bigger brands lead the pack

Q2 Apparel Index clocked in 6.68 points growth. This is approximately 56 percent higher than the index for Small Brands (with turnovers of Rs 10 to 25 crores) which stood at 4.28 points. For Mid Brands (turnover of Rs 25-100 crores), growth is 7.7 points. In fact, Mid Brands performed much better than Small Brands, but it’s the Large Brands with 8.95 points and Giant Brands with a high index value of 9.15 points that have shown a real growth.

This is a clear indication that Mid, Large and Giant Brands are doing much better compared to Small ones. Index pattern this quarter, much like earlier quarters, reflects as the size of brands goes up, performance improves. Interestingly, Mid Brands are racing ahead to catch up with the growth momentum of Large and Giant Brands. The gap between the rate of growth of Small Brands and Mid Brands is considerably high than previous quarters.

To an extent, this quarter’s growth has got a boost from sales as the results includes the EOSS period of July and August, where Large Brands usually offer high discounts, and the focus is on Top Line, resulting in high Sales Turnover. On the other hand, a period of heavy discount is normally accompanied by a reduction in Inventory. These factors probably explain why Large and Medium Brands are faring much better than the Small Brands, which typically are under some stress during this period.

Sales Turnover high for bigger sized company

The Index points out that Sales Turnover also increases in the same pattern as the size of the brand. For Small Brands, growth in sales turnover is just 3.38 and it grows on increasing. For example, for Mid brands it is 5.19, for Large - 5.33 and for Giant Brands, it is 5.54. This pattern follows a reverse order in case of Inventory Holding, clearly indicating that the impact of Sales Turnover and Inventory on the company’s performance.

As Vinod Kumar Gupta, MD, Dollar says, “It has been a satisfying year for us with the brand making inroads in newer territories and consolidating its position in existing hosiery markets of India and abroad. We have achieved a massive product growth of 88 percent across India as a result of the team’s aggressive marketing and advertising strategy backed by superior product range, technology upgradation and capacity expansion.”

A close look at Sell Through (Small-1.31, Mid-1.78, Large-2.36 and Giant-1.27) and Inventory Holding (Small-2.31, Mid-1.48, Large-0.83 and Giant-0.58) reveals that the reason for Small Brands not growing is related to the rise in Inventory Holding, which is higher than the improvement in Sell Through, whereas in case of Mid, Large and Giant Brands Sell Through improvement is much better and there’s much better control on Inventory Holding. Thus, index improves with size of brands.

Hemant Gupta, CFO, Blackberrys explains, “In the past two quarters, there is a major decrease in footfalls at stores, which is mainly responsible for decrease in Sales Turnover and impacts Sell Through as well. However, our conversion ratio and basket size has increased but due to lower sales the sell through has impacted. Increase in inventory holding also is one of the prime reasons for that. This is not with us only but with other brands as well. I am hopeful that situation will definitely improve in 3rd and 4th quarter of 2015-16.”

Speaking on the co-relation between Sales Turnover, Inventory and Sell Through, Rajiv Nair, CEO, Celio says, “Reducing inventory continues to be a core area of focus at Celio. Sales in the last quarter have been lukewarm. Hence, we ensured renewed focus on liquidation through specific promotions and EOSS. We are on our inventory targets which we keep reassessing every month. We avoid overfilling stores and focus on timely replenishment to avoid inventory risks.”

While Sooraj Bhat, Brand Head, Allen Solly opines, "An increase in inventory for us has been to fund aggressive expansion of company owned stores."

Future outlook positive

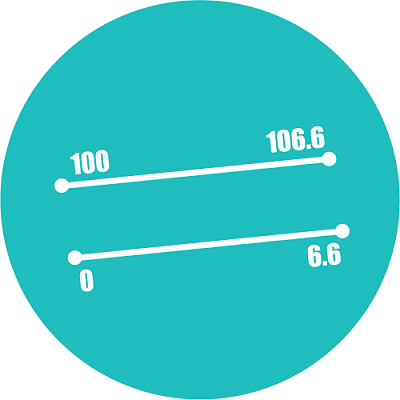

A comparison of Apparel Indices of Q2 July-Sept 2015 and 2014 reveals the Index Value was higher at 7.96 last year compared to 6.68 for 2015. The reason, it says is low performance of most of parameters except Inventory Holding in Q2 2015. Overall, the apparel industry failed to grow as much as it grew in the same quarter last year on all aspects be it Sales Turnover, Sell Through or Fresh Investments. On the other hand, Inventory Holding showed much lesser increase for good in 2015, as a lower increase reflecting better control on inventory causing lesser impact on bottom line.

However, nearly 41 percent of brands feel that the outlook for next quarter is good. Like last quarter 27 percent brands say their outlook is ‘Excellent’ for the next quarter. Nearly 30 percent, much higher than that of last quarter at 23 per cent, foresee an average outlook for next quarter and 2 percent feel that it will be ‘Below Average’. October-December being a quarter that enjoys better sales during festive seasons around Diwali, Christmas and New Year, brands predict an improvement in market sentiments.