FW

The Brexit vote has fashion designers, including some Chinese designers based in Britain, worried about the future of the sector. The designers are established brands, with many employees, and exporting to Europe, China and America. However, their greatest fear is of the UK leaving the European Single Market, the tariff-free marketplace. Seventy per cent of UK fashion sales go to Europe, with the balance to China, America and the Middle East, so access to Europe is important for their businesses.

Some Chinese designers produce in China, so the fall in the value of the sterling might raise costs a bit. Sourcing fabrics in Europe has become more expensive for them. Nevertheless the cheap pound has meant the UK has seen a bounce in sales in luxury and retail businesses since the vote, which is benefitting fashion.

Organisers of fashion weeks have been reassuring designers that the vote to leave the EU doesn’t mean an end to international partnerships and collaborations. They want to keep attracting talent and drive home the message that the UK is open to outsiders and is a place of business opportunity. London is a major hub of international designers.

American retailer The Limited has come out with a line of premium denim, which offers one universally flattering fit for every body shape a woman can have. The denim collection offers fabulous fit every woman longs for when shopping for and wearing denim. The fabric provides just the right amount of stretch while conforming to a woman’s unique shape and complementing her body perfectly. The soft hand of the fabric provides a level of comfort that is unparalleled in the market. The denim collection comes in a multitude of washes and leg shapes.

The retailer also has a recycling program which will help keep denim out of landfills. People can drop off any brand of denim at any of The Limited’s retail stores. This will be recycled into raw materials for other products such as insulation, carpet padding, and even fiber for new apparel. This reduces waste, preserves material resources, protects the environment, and enables sustainable consumption. The system aims to keep apparel in a closed loop production cycle where these goods can be reprocessed and reused again and again.

The Limited offers high quality, private label apparel. Design-driven, fashionable styles include suitings, sweaters, dresses, denim, outerwear, and accessories.

Bangladesh Prime Minister Sheikh Hasina has urged the US to give duty-free access to Bangladesh garment products. This would also be vital for the US in helping increase employment and promote empowerment of more women, she said. This would also help to establish a modern society in her country, she observed.

The Prime Minister was speaking at a luncheon meeting hosted by the Business Council of International Understanding (BCIU) in New York . Giving proof, she said that 52 other countries including Australia, Canada, New Zealand, China, Japan, India and the European Union have provided Bangladesh with duty and quota-free access to their markets. Bangladesh used to enjoy duty-free access to the US market for around 5,000 items under the preferential trade scheme. But these trade benefits were revoked in mid-2013 after the Rana Plaza building collapse and Tazreen Fashions fire which left more than 1,200 people dead.

The suspension, however, did not directly hit Bangladesh’s garment exports, as garments were not among the products that enjoyed the facility. The Prime Minister also urged US businesses and investors to become Bangladesh's partner in trade and development.

Despite a turbulent economic and political environment, the upcoming Paris fashion show from October 10 to 14, organised by Messe Frankfurt has sent out reassuring signals of doing a good business. Exhibitors who would be part of the show with their new fashion ware and innovative products have already sensed a certain buoyancy in the market. Messe Frankfurt France had a significant drop in visitor numbers in the last few weeks. Considering the circumstances, the show recorded a limited decrease of 4.6 per cent. Visitors to the upcoming show seem to be more international. Around 80 per cent visitors are expected from abroad.

However, number of visitors coming from countries that recently been subjected to visa restrictions would be low. In contrast, the American continent, represented by Colombia, Argentina and Mexico posted good results that were up by 5 per cent. This demonstrates how attractive the show is. And this is what helps them to draw in customers across the globe.

The trend is confirmed by the good results from Australia (+20 per cent). Northern and Eastern Europe have as a whole increased visitors (from +13 to +20 per cent on an average) following the example of Norway, Finland, Denmark, the Ukraine, Romania, Lithuania, Bulgaria, Austria and Switzerland to name a few. Following increase in number of French visitors, this show confirms the interest shown by domestic buyers with a significant rise of +11 per cent.

Driven by international health and fitness trends, performance apparel is now one of the fastest growing sectors of the global textile industry. A recent report from Morgan Stanley Research estimates that the performance of the apparel market could add $83 billion dollars in sales by 2020, or more than 30 per cent growth, while Asia is forecast to be the biggest contributor to this sales growth.

Specifically in China, the potential in the sportswear market is huge. According to figures from the Shanghai Sports Bureau, 47 per cent of Chinese did more exercise in 2015 than the year before. They also report that the total sports market is set to be worth RMB 5 trillion ($749 billion) by 2025, of which apparel will constitute a large amount.

To capture the opportunities in this promising market, Functional Lab is making its return at Intertextile Shanghai Apparel Fabrics – Autumn Edition 2016 that would on from October 11 to 13. Exhibitors from China, Hong Kong, Israel, Japan and Korea, including key players such as Unifi, Protect Accessory, Nilit and Toyobo will showcase a broad variety of innovative fabrics with thermo-regulation, moisture wicking, increased durability, elasticity, windproof functions at the National Exhibition and Convention Center (Shanghai).

Driven by international health and fitness trends, performance apparel is now one of the fastest growing sectors of the global textile industry. A recent report from Morgan Stanley Research estimates that the performance of the apparel market could add $83 billion dollars in sales by 2020, or more than 30 per cent growth, while Asia is forecast to be the biggest contributor to this sales growth.

Specifically in China, the potential in the sportswear market is huge. According to figures from the Shanghai Sports Bureau, 47 per cent of Chinese did more exercise in 2015 than the year before. They also report that the total sports market is set to be worth RMB 5 trillion ($749 billion) by 2025, of which apparel will constitute a large amount.

To capture the opportunities in this promising market, Functional Lab is making its return at Intertextile Shanghai Apparel Fabrics – Autumn Edition 2016 that would on from October 11 to 13. Exhibitors from China, Hong Kong, Israel, Japan and Korea, including key players such as Unifi, Protect Accessory, Nilit and Toyobo will showcase a broad variety of innovative fabrics with thermo-regulation, moisture wicking, increased durability, elasticity, windproof functions at the National Exhibition and Convention Center (Shanghai).

The US men’s underwear market is estimated to register a CAGR of 5.1 per cent from 2015 to 2021. The women’s lingerie market revenue is anticipated to expand at a CAGR of 5.4 per cent. This growth is attributed to increased proliferation of modern retail formats such as supermarkets, discount stores, and pharmacy stores, rising personal income of households, rising fashion consciousness, change in lifestyle, and rising awareness regarding health and fitness and personal hygiene among men and women in the country.

The mid-range segment is anticipated to contribute the highest in value terms by 2021. By age group, the 65 plus segment is expected to generate the maximum revenue by 2021 in terms of value. Based on prices, revenue from the premium range is expected to register a CAGR of 6.8 per cent over 2015 to 2021. In women’s lingerie, the bra segment is expected to register the highest CAGR in terms of both value and volume between 2015 and 2021. For men the boxer brief segment is expected to remain dominant throughout the forecast period, with a high revenue contribution.

In terms of size, the XXXL size segment is expected to expand at the highest CAGR over the forecast period.

Trident is one of the world’s largest vertically integrated home textile manufacturers with a strong presence in the terry towel segment. Trident exports its products to nearly 70 countries across the globe and 70 per cent of the revenue is earned through exports. Trident is strengthening its presence in new markets like the UK, Italy, France, Japan, Australia, South Africa and Canada.

The company has an installed capacity of 5.55 lakh spindles and 5,500 rotors capable of manufacturing 1,15,200 tons a year of cotton, compact and blended yarns. It has ten manufacturing units. The product range services the needs of the knitting, weaving, denim, hosiery, shirting and suiting segments. Yarn used to account for 60 per cent of its total revenues, whereas in FY’16 higher margin home textiles accounted for 60 per cent of its total textile revenues. In the next two years, the group expects high margin bath and bed linen products to contribute about 80 per cent.

The company has expanded its value-added range such as air rich, low tint, fade-resistant bed and bath linen products to cater to the premium segment. In India Trident is in 260 MBOs and is in all major e-commerce portals.

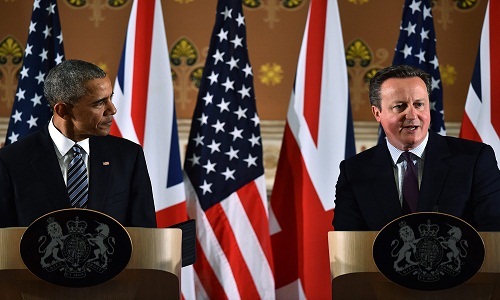

"The US opinion on Brexit and its impact and interests of US with United Kingdom and Europe , will soon be clear as the Senate Foreign Relations Committee is expected to hold a hearing with the Obama Administration. However, as the Obama administration will soon leave office, the hearing may not clarify the complete range of US opinion on the same. The discussion however, is expected to set a clear agenda for the future of US relations with Britain post Brexit."

The US opinion on Brexit and its impact and interests of US with United Kingdom and Europe , will soon be clear as the Senate Foreign Relations Committee is expected to hold a hearing with the Obama Administration. However, as the Obama administration will soon leave office, the hearing may not clarify the complete range of US opinion on the same. The discussion however, is expected to set a clear agenda for the future of US relations with Britain post Brexit. The committee is further expected to highlight the fundamental interest of US and formally conclude a free trade agreement as Britain will regain its freedom to negotiate its own trade agreements post the exit from European Union. The Committee is expected to discuss US’s important interests in Europe that do not relate to the EU most importantly, NATO, which any way will not be affected by Brexit.

Senate hearing to emphasise US interest post Brexit

The Senate hearing gains more significance as US interests and policy changes will have to base its future policies on the impending impact of Brexit. Thus US should have a fundamental interest in clean and quick Brexit. Before the referendum, voters opposing the move asserted that Brexit would cause the British economy to suffer, however, since the referendum, the British economy has strengthened, while the economies of the Eurozone have shown a deflationary spiral. Experts feel, being interdependent economies, the US, the EU, and Britain, need to tackle the uncertainty in business and economy rising over Brexit. Political leaders and policymakers in all 10 of the world’s largest economies, except France and Italy – have already expressed interest in negotiating free trade with Britain after it leaves the EU. In the US, Senators Tom Cotton (R-AR) and Mike Lee (R-UT) introduced the “United Kingdom Trade Continuity Act” on June 30, which would oblige the US. to continue its existing commercial relations with the UK until the US and Britain negotiate a free trade area. The US, therefore, should offer to assist Britain by seconding a trade expert from the office of the US. Trade Representative to Britain’s Department for International Trade. While Britain cannot conclude formal negotiations on any free trade area until it formally exits the EU, it can begin discussions now.

Talks advance for the U.S –UK free trade area

There are also talks of US-UK free trade area which would have the greatest value in practice if it focused on liberalizing trade in high-value goods, avoided any effort to harmonize regulations, clearly aligned the UK with the US as a nation outside the EU’s regulatory reach and sought over time to bring other nations that share the value that the US and Britain place on free, open, and competitive markets into their partnership.

It needs to be emphasized that US interests in Europe have never been limited to economics, rather new immigration rules that Britain will adopt after it leaves the EU will have to be considered by the United Sates.

This year's Stakeholder Conference of Cotton made in Africa (CmiA) and the Competitive African Cotton Initiative (COMPACI) was held from September 7 to 8 in Munich. This was attended by over 100 experts in the textile value chain from over 20 countries. This was also where the two ends of the textile production chain met. Companies and brands like OTTO, Ernsting's family, Engelbert Strauss, Sportscheck and Jack & Jones were at one end while cotton producers from Africa were at the other. They discussed how to achieve sustainability in the field, transparency along the supply chain, and new communication strategies for trading sustainable products. .

Helmut Fischer, Head of the Division "Sustainability Standards" at the Federal Ministry for Economic Cooperation and Development (BMZ), inaugurated this year's annual conference and underlined the importance of CmiA as one of the main standards for sustainable cotton.

Like always, the conference followed the thread from the field of fashion. Since the increased significance of sustainable cotton and textiles is fuelling demand for transparency in the supply chain, therefore Cotton made in Africa offers solutions which can be easily put into practice with the help of new technologies and expert knowledge.

CmiA is an initiative of the Aid by Trade Foundation (AbTF) and has set itself the goal of helping people to help themselves through trade in order to improve the living conditions of cotton farmers and their families in sub-Saharan Africa while on the other hand, COMPACI (Competitive African Cotton Initiative) was founded in 2008 by the Bill and Melinda Gates Foundation and the Federal Ministry for Economic Cooperation and Development (BMZ) on the back of the successful Cotton made in Africa (CmiA) pilot with a view to subsidizing the income of African cotton farmers.