FW

The 57th edition of Ukrainian Fashion Week (UFW) is set to be held in Kyiv from September 4- 8, 2025. This marks the third UFW event since Russia's full-scale invasion began in 2022.

For 28 years, UFW has been Ukraine's leading fashion platform and a vital cultural institution, shaping the country's fashion industry. The event continues to champion designers, inspire the creative sector, and share Ukraine's narrative globally despite current global uncertainties.

Ukrainian designers are reinterpreting their national heritage, showcasing a nation that continues to create, innovate, and affirm its cultural identity even amidst conflict. Their creations reflect the emotions of a nation that has been fighting for over three years in a full-scale war to defend its identity and existence, notes Iryna Danylevska, Founder and CEO, Ukrainian Fashion Week Through the universal language of fashion, they convey the values, spirit, and strength of the Ukrainian nation, she adds.

UFW made its physical return to Kyiv in September 2024, the first time since the full-scale invasion. This return came shortly after air raid sirens were lifted in the capital following a night of Russian strikes. The ongoing war has profoundly influenced the atmosphere of the fashion shows since 2022. Each runway show now begins with a moment of silence to honor those who have died, observed by designers, journalists, and guests. Shows also only commence after an announcement about the nearest bomb shelters in case of an airstrike.

The second Kyiv edition since the full-scale war, held from February 14–17, 2025, notably highlighted 'adaptive clothing' designed for veterans facing mobility challenges.

A leader in cutting-edge technology integration, Fotol AI has launched an AI virtual try-on technology- @ai-clothes-changer- poised to revolutionize online fashion retail.

Fotol AI’s virtual try-on technology streamlines the traditional launching process of new clothes. In this, Merchants need to simply upload product images (flat or hanging) and a model photo, and the AI generates flawlessly fitted, realistic ‘model-wearing’ images in under a minute. This drastically cuts expenses for models, photography, and retouching, reducing production time from days or weeks to instant results. The ability to generate high-quality product images at unprecedented speed allows businesses to launch new products faster, capitalize on trends, and boost operational efficiency.

Recognizing the power of video content, Fotol AI allows businesses to leverage the platform’s powerful AI video generation technology to effortlessly transform virtual try-on images into captivating product showcase videos. This brings products to life, significantly enhancing visual impact, capturing potential buyers' attention, and boosting purchase intent, ultimately driving higher conversion rates.

One of the biggest pain points in online clothing shopping is the inability to try items on, leading to uncertainty about fit and style and often resulting in returns. Fotol AI’s virtual try-on technology offers a game-changing solution for consumers. Shoppers need to simply upload a clear full-body photo and the desired clothing image. Using advanced AI algorithms, the system generates a lifelike image of the garment ‘worn’ on the shopper in under a minute. This allows users to clearly see how the clothing fits, drapes, and complements their personal style, providing a ‘what you see is what you get’ experience that reduces purchase uncertainty and minimizes returns caused by ‘imagination bias,’ enhancing overall shopping satisfaction.

Fotol AI aims to lower barriers to AI adoption by integrating world-leading AI capabilities into an All-in-One AI application platform. A single Fotol AI account provides access to a growing suite of cutting-edge AI applications, including AI image generation & editing, AI video creation, AI copywriting, and AI design. By continuously tracking and integrating the latest AI breakthroughs, Fotol AI ensures its users remain at the forefront of technology, making it an ideal partner for businesses seeking efficiency and individuals looking for convenience.

Fashion retail sales in North America experienced a slight slowdown in June 2025, though the sector still concluded the first half of the year with overall positive growth. Data released by the US Bureau of Commerce, shows, fashion retail turnover in the region increased by 2.4 per cent to reach $24.86 billion in June as compared to June 2024.

Despite this year-over-year rise, fashion retail sales in declined by 11 per cent M-o-M from $27.945 billion in May 2025.

However, a strong performance earlier in the year has ensured that the cumulative figure for the first half of 2025 remains positive. US retail fashion sales for the first six months increased by 3.6 per cent to $142.604 billion, compared to the same period last year.

This sector's performance outpaced the first six months of the year, coinciding with President Donald Trump's initial months in office. The report notes, full effect of his first tariff announcement in April on inflation and sales may not yet be entirely visible.

In contrast to fashion, overall consumption declined by 5.2 per cent in in June 2025 compared to June 2024, a significant reversal from the 3.1 per cent rise observed in May. Total US retail trade turnover stood at $713.652 billion during the month, reaching a cumulative $4.2 trillion for the first half of the year.

Poised for substantial expansion, the global recycled cotton market is projected to nearly double from $5.02 billion in 2023 to $9.95 billion by 2033, demonstrating a robust CAGR of 7.08 per cent over the forecast period. This optimistic outlook comes from a recent research report by Spherical Insights & Consulting, highlighting the growing emphasis on sustainable practices within the textile industry.

The recycled cotton market revolves around transforming used or discarded cotton textiles into new, usable fibers. This eco-friendly approach not only reduces the environmental footprint of conventional cotton production but also decreases the demand for virgin cotton and diverts textile waste from landfills.

Several factors are fueling this market's momentum. Stricter environmental regulations and policies globally are pushing for minimized textile waste and increased recycling. Governments are actively promoting the use of recycled materials through various initiatives and incentives. Furthermore, rising consumer awareness about environmental issues is a significant driver. As individuals increasingly seek sustainable products, brands and manufacturers are integrating recycled cotton into their offerings, especially within the fashion industry. Major fashion brands and retailers are embracing recycled cotton to meet the surging demand for eco-friendly clothing and accessories.

In 2023, the recycled cotton yarn segment held the largest market share and is expected to maintain significant growth. Recycled cotton yarn is widely utilized in fashion and home textiles for knitting and weaving, valued for its quality and sustainability.

By application, the apparel segment dominated the market in 2023 and is anticipated to continue its strong growth. Recycled cotton is extensively used for a variety of clothing items, driven by increasing consumer preference for eco-friendly apparel.

Asia Pacific is projected to hold the largest share of the global recycled cotton market throughout the forecast period. This region is a major hub for textile manufacturing, with countries like Bangladesh, India, and China emphasizing sustainability, thereby boosting the demand for recycled cotton.

North America is expected to experience the fastest CAGR growth in the recycled cotton market. This growth is attributed to strong consumer awareness and supportive regulations that encourage the use of sustainable materials. Prominent fashion brands in the US and Canada are actively launching sustainable collections, setting a precedent for recycled cotton adoption.

Continuing with its international expansion, Lululemon has forayed into the Italy market with the launch of its first store at Vittorio Emanuele in Milan.

Spanning approximately 5,700 sq ft across two floors, this new store offers a thoughtfully designed environment for shoppers. It features distinct areas dedicated to Lululemon's signature technical innovations, showcasing both men's and women's collections. All products at the store are designed with a focus on high-performance and high-style, suitable for a wide range of activities including yoga, running, training, tennis, and golf.

Paying tribute to Italy's rich design heritage, the store's architectural concept blends traditional craftsmanship with modern materials. A standout feature of this store is the Lululemon Glide sculptural façade - a striking, custom 3-D printed installation. This design is inspired by Lululemon's iconic Define Jacket pattern, with flowing geometry that appears to expand and move across the storefront, mimicking fabric on an architectural scale.

In line with Lululemon's omni-channel strategy, the Milan store aims to provide a fully integrated shopping experience. Customers will have seamless access to the brand's complete product range through the Endless Aisle BBR (Back Back Room) solution, ensuring product availability beyond what's physically in stock. International visitors can also benefit from Global Blue Tax-Free Shopping, enhancing their experience in one of Europe's top tourist destinations.

The Milan store opening is a significant step in Lululemon’s international expansion, building on its presence in key markets like the UK, Ireland, Germany, France, Spain, the Netherlands, Norway, Sweden, and Switzerland. Entering Italy is part of Lululemon’s broader ‘Power of Three ×2’ growth plan, which aims to quadruple international revenue from 2021 levels by the end of 2026.

Marking a shift towards platform-based growth, leading supply chain solutions partner, Li & Fung has acquired UK-based hosiery, innerwear and loungewear specialist, Orrsum. This marks Li & Fung's first acquisition in over a decade and since its privatization in 2020, signaling a strategic shift towards platform-based growth.

Established in 1998, Orrsum is recognized for its extensive product expertise, agile development, and robust customer relationships, delivering over 50 million pairs of socks annually to more than 5,000 retail locations worldwide.

This acquisition helps Orrsum scale high-demand categories, expand its customer offers and drive faster and more flexible execution by combining the company’s category leadership and product development capabilities with Li & Fung’s digital infrastructure and global reach, states Destan Bezmen, President of LF Europe.

William Orr, CEO. Orrsum, adds, with the access to Li & Fung’s global platform and advanced technology, the company can expand its footprint, enhance service levels, and unlock new growth opportunities for customers and partners.

Orrsum will continue to operate under the leadership of William Orr as a part of LF Europe, ensuring a seamless integration. The company plans to leverage Li & Fung’s AI-enabled digital infrastructure and vast sourcing network across 40 economies to enhance supply chain agility, accelerate speed-to-market, and expand into new geographical regions and sales channels.

The collaboration between Li & Fung and Orrsum aims to scale category excellence, drive innovation, and deliver enhanced value within the increasingly complex global trade landscape.

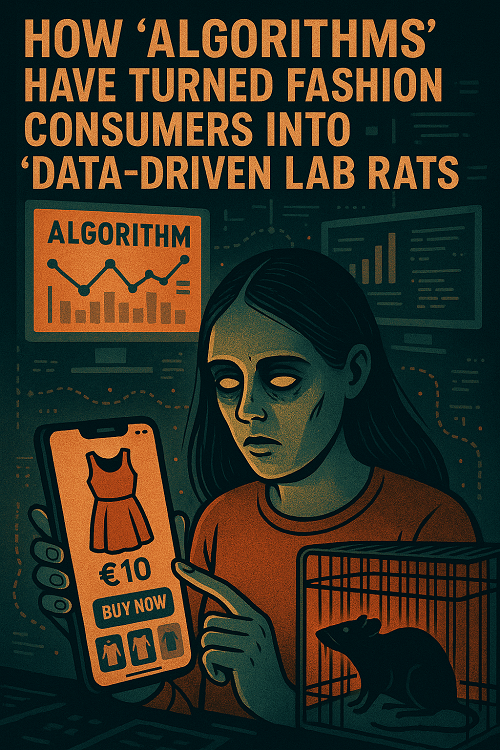

In the golden age of high street fashion, taste was seasonal, inspiration came from the runway, and consumers chose style over speed. Today, the opposite is true: the runway runs after the algorithm. The ultra-fast fashion economy, spearheaded by brands like SHEIN, Temu, and TikTokShop sellers, has quietly transformed consumers into test subjects in a behavioral experiment designed for infinite scrolling, impulse buying, and psychological capture.

This isn’t a fashion revolution—it’s algorithmic colonization.

The rise of the “Algorithmic Wardrobe”

Unlike traditional retail, which curated and sold collections based on forecasted trends, ultra-fast fashion is built on real-time feedback loops powered by artificial intelligence and machine learning. Every click, linger, scroll, return, and purchase becomes an input in a recommendation engine that tweaks what you see next. This is not personalization—this is manipulation at scale.

A user viewing a neon crop top at 3 a.m. in Marseille will find their entire feed reorganized by morning: hundreds of similar items, dozens of “timed” deals, and influencer hauls showing how to pair it with fast accessories. The cycle is endless, engineered to reduce friction, resist reflection, and reward impulsivity.

Data Snapshot: The consumption cost of “Cheap”

A recent ADEME-L'ObSoCo study in France revealed a stark contradiction: the supposedly economical ultra-fast fashion actually leads to higher annual spending and more buyer regret. Here's a quick breakdown:

|

Fashion Type |

Annual Clothing Budget (€) |

|

Prêt-à-Porter (Ready-to-Wear) |

330 |

|

Fast Fashion |

442 |

|

Ultra-Fast Fashion |

446 |

|

Hybrid / Influenced Mix |

613 – 810 |

Paradoxically, consumers buying “cheap” fashion spend up to 2.5x more annually than prêt-à-porter buyers, while amassing wardrobes with over 200 pieces, many of which go unworn.

The Invisible Cage: Behavioral design meets AI

What makes algorithmic consumption so powerful—and dangerous—is that it bypasses critical thinking. Every design feature is a trap:

● Endless scrolls and flash sales destroy decision-making windows.

● Gamified pricing (“Buy 2, get 15% off in the next 5 minutes!”) triggers loss aversion.

● Social proofing via influencers erases individual judgment.

● AI-generated content creates a constant illusion of relevance and scarcity.

This creates a kind of “auto-consumption” habit loop—what psychologists call cue-triggered behavior. But here, the cues are artificially planted, the triggers algorithmically sharpened, and the rewards fleeting.

Case Study: SHEIN and the 7-Day Feedback Loop

SHEIN, the Chinese fashion juggernaut valued at over $60 billion, is often cited as the blueprint for algorithm-driven fashion. Its backend operations rely on a 7-day design-to-shelf cycle, powered by an AI that processes billions of data points daily—from trending hashtags to video watch time, to geographic click-through rates.

According to Reuters, SHEIN adds 6,000+ new SKUs daily, using micro-batch production to test styles in limited quantities. Those that perform well are instantly scaled up. Those that don’t? Buried by the algorithm.

In this model, the consumer is the guinea pig and the product simultaneously. They don’t just buy the fashion—they train the AI.

Health and environmental fallout

Aside from the psychological traps, the physical implications are no less concerning. Fast fashion garments are frequently made from petrochemical-derived materials, often dyed with toxic substances that are banned or restricted in manufacturing, but find their way back through imports.

In France, 44% of consumers buying for their children monthly choose fast fashion—unknowingly putting their kids at risk of exposure to endocrine-disrupting chemicals and skin irritants.

Social Media: The ‘Trojan Horse’

Nearly 30% of French consumers follow fast fashion brands on social media, and over 60% of ultra-fast fashion customers admit their purchase volume increased after engaging with brand content. Influencer partnerships, AR filters, and micro-hauls flood attention spans with aspirational FOMO—Fear Of Missing Out—disguised as style advice.

Yet, as studies show, 48% of these consumers later regret their purchases, citing poor quality, size issues, and the realization of having too much.

The Road Ahead: Regulate the algorithm, not just the product

The current policy focus on sustainable materials and circularity is necessary, but insufficient. The real battlefield is the interface—the algorithmic storefront where decisions are silently shaped. Governments need to urgently address:

● Dark pattern regulations on shopping apps

● Algorithmic transparency in product recommendation systems

● Stricter import laws on chemical compliance in ultra-fast fashion

● Digital literacy education focused on consumption psychology

Until then, consumers will remain pawns in a digital dopamine casino, styled in polyester and marketed to by bots. Ultra-fast fashion isn’t just a business model—it’s a data-driven behavior machine. And consumers are no longer just buyers; they’re the trained responses to algorithms designed to extract maximum lifetime value. It's time we asked: In the age of algorithmic fashion, who is really dressing whom?

Swedish brand H&M Move is launching the new SoftMove pilates collection for Summer 2025 Season. Featuring clean-lined, feminine sets and accessories, this collection is specifically designed for sculpting and toning practices. It aims to offer gentle support, helping users cultivate strength, resilience, and a radiant glow.

Emphasizing slow, intentional workouts that promote a deep sense of well-being, the collection offers a feeling of calm confidence through designs created for optimal comfort and freedom of movement, both on and off the mat, during the high summer months.

Crafted with refined simplicity, the collection is made with the softest and lightest performance materials to keep customers cool even on the warmest days, says Marie Fredros, Head - Design at H&M Move. The range also includes training essentials, such as an insulated water bottle and ankle weights, that are easy to throw in our new mesh bag and go, she adds.

The collection includes a SoftMove bra in deep black with graceful, scallop-edge trims, reminiscent of a scallop shell. This can be perfectly paired with matching hotpants or flared leggings. The scallop-edge design also reappears on a yoga mat, adding an artful touch to the studio essential. Another notable piece is the twisted training bra in supple SoftMove fabric, designed to make an effortless statement on its own or layered under the new knot top or T-shirt.

The collection also introduces versatile sets of SoftMove bras and cycling shorts available in a timeless palette of black, clean white, grounding clay, and a vibrant hint of pistachio. These pieces can be seamlessly mixed and matched for a personalized look. The new pistachio hue is also featured on a spaghetti-strap playsuit, combining effortless chic with everyday ease.

Textile Exchange is set to launch the approved criteria for its groundbreaking Materials Matter Standard on December 12, 2025, marking a pivotal moment for sustainable practices within the global textile industry.

The Materials Matter Standard is a voluntary sustainability initiative designed to elevate the production and initial processing of raw materials used in textiles. It establishes a framework of best practices covering a wide range of materials, from agricultural origins to recycling facilities. The standard is specifically crafted to align with critical global objectives: supporting climate goals, upholding human rights, and championing animal welfare.

The official launch on December 12, 2025, will introduce the detailed criteria for the standard. Following this, organizations currently holding certifications under existing Textile Exchange standards will be able to request audits by approved certification bodies starting in 2026, once the new standard becomes effective. Mandatory compliance is anticipated to be phased in by 2027.

A hallmark of the Materials Matter Standard is its holistic approach. It seamlessly integrates crucial climate and nature outcomes with practices at the very beginning of the supply chain. This includes a strong emphasis on regenerative agriculture principles and responsible material sourcing, aiming for a comprehensive positive impact.

The introduction of the Materials Matter Standard signifies a significant shift towards a more unified and impactful strategy for sustainability in the textile sector. It is poised to incentivize practices that not only enhance material quality but also deliver substantial environmental and social benefits across the entire industry.

This new standard is central to Textile Exchange's overarching mission: to fundamentally transform how materials are produced, selected, and repurposed, ultimately benefiting both people and the planet. As the launch date approaches, Textile Exchange will provide further details on the implementation and transition processes to all stakeholders.

To be held from November 12–16, 2025 in Las Vegas, the debut edition of Vegas Fashion Week aims to elevate Las Vegas a global fashion destination. It will help establish fashion as a powerful force of culture, creativity, and commerce through a dynamic week of runway shows, citywide activations, and immersive experiences.

Presented by the Las Vegas Fashion Council, Vegas Fashion Week will feature a diverse program including fashion presentations and captivating live model showcases, educational talks and exciting design competitions, in-store activations, exclusive trunk shows, and VIP shopping experiences, and community engagement initiatives and vibrant entertainment.

The week-long event will bring together residents, visitors, and industry professionals in a citywide celebration of fashion, beauty, and innovation.

More than a celebration of style, Vegas Fashion Week is a statement about the power of fashion to shape culture, drive innovation, and build community, says Carrie Carter Cooper, Founder & Executive Director, Las Vegas Fashion Council.