FW

The newly launched portal, Thunaivan’ by Tiruchi Preventive Customs Department and the Apparel Export Promotion Council (AEPC) is designed to help streamline trade for garment exporters in Tiruppur.

Specifically tailored to digitally empower exporters in Tiruppur and enhance the ease of doing business, the portal offers a user-friendly interface to facilitate real-time interaction between Customs and exporters. It features fast-tracked grievance resolution and issue handling mechanisms. This initiative aims to boost transparency and accessibility, fostering a stronger public-private partnership for trade facilitation.

At the launch of this portal, SK Vimalanathan, Chief Commissioner-Customs, Tiruchi, stated, , during their previous visit to Tiruppur, custom officials had announced plans to create an interface addressing exporters’ grievances, and also appoint appropriate officers to review these issues, forward them to the relevant officials for resolution, and monitor their progress.

The data collected and analyzed through the Thunaivan portal will be valuable for policy development, noted Singh

A Sakthivel, Vice-chairman, AEPC, highlighted, Tiruppur's annual garment exports have exceeded Rs 45,000 crore. With an FTA with the UK already in place and a bilateral agreement with the US currently in the works, significant opportunities exist for Tiruppur's garment exporters, he emphasized. However, they need to build capacity and train their workforce, he noted.

The launch event for this portal was also attended by KM Ravichandran, Principal Commissioner- Customs (Preventive), Tiruchi, and K.M. Subramaniam, President, Tiruppur Exporters’ Association.

The All Pakistan Textile Mills Association (APTMA) has commended the Pakistani federal government's decision to impose an 18 per cent sales tax on imported cotton yarn, a move they say creates a level playing field for the local industry.

Kamran Arshad, Chairman, APTMA issued a press statement regarding the federal budget, highlighting that the government has addressed inconsistencies within the Export Facilitation Scheme (EFS). Arshad specifically called for the complete elimination of any remaining loopholes in the EFS.

He explained that previously, imported raw materials were tax-exempt, while local raw materials faced an 18 per cent sales tax. This discrepancy created significant issues in the local and imported value chains under the EFS. Zero percent sales tax on imported raw materials for exports, contrasted with an 18 per cent sales tax on locally purchased raw materials for the same purpose, had severely impacted the weaving sector, Arshad pointed out.

APTMA is advocating for an 18 per cent sales tax to be applied across the entire value chain of yarn and fabrics.

In a push for further protection of the domestic industry, Arshad urged the government to include cotton yarn and fabric in the negative list, which restricts or prohibits their import. The APTMA has also requested a 5 per cent customs duty on yarn and an 11 per cent duty on fabrics.

Arshad noted, local polycotton and polyester have become 35 per cent more expensive. Additionally, APTMA is demanding the abolition of the 18 per cent sales tax on cotton seed and cotton cake.

Hong Kong-based textiles trading firm, Epic Group with manufacturing facilities in Bangladesh, Ethiopia and Jordan, has teamed up with Indian vertical apparel and textile manufacturer, Creative Group to jointly build new state-of-the-art denim and bottoms manufacturing facility in the country.

With a production capacity of 700,000 units per month, this new facility is not only be one of the largest of its kind in India but it also position the country as a key player in the global denim market

The partnership is backed by an initial investment of $15 million, with a vision to achieve $60 million in the coming years. The partners plan to make a long-term impact by creating 3,000 jobs initially, expanding to 10,000 jobs over time.

With a clientele boasting of leading names like Walmart, Levi’s, Uniqlo, Kohl’s, C&A, Epic provides clients with design, sourcing and manufacturing support. It has strategic partnerships with mills across China, India, Pakistan and Bangladesh.

Creative Group offers end to end textile solutions for apparel, home textiles, outdoor, products and yarn. DKNY, Carrefour, US Polo, Calvin Klein, Kenneth Cole, and Zara are among the company’s garment division clients. The company produces over 20 million garments per year.

For years, China reigned supreme as the undisputed king of US apparel imports. While still the largest supplier in aggregate terms, new data reveals a clear shift in sourcing landscape, as American brands strategically diversify their supply chains, seeking flexibility, risk mitigation, and cost control. This is reshaping the global apparel trade, with a host of other nations experiencing good growth in their exports to the US.

China's monthly imports see sharp decline

The latest figures, of US apparel imports year-to-date till April 2025, throws up an interesting pattern. While US apparel imports from China have seen a modest increase of just 1.8 per cent year-to-date, a deeper look into the monthly trends from January 2024 to April 2025 reveals a crucial dynamic.

As the table shows, US apparel imports from China saw a strong increase in mid-2024, peaking around July and August, nearing 1,000 million sq. mt. equivalents (SME). However, a distinct downward trend began in the latter half of 2024, with imports declining through the end of the year. This deceleration has continued into early 2025, with monthly import volumes in March and April 2025 hovering around the 500 SME mark – a sharp drop from their mid-2024 highs. This sustained decline highlights a tangible reduction in reliance on Chinese suppliers on a month-to-month basis.

The rise of alternative sourcing hubs

In stark contrast to China's recent monthly performance, other regions are experiencing significantly more dynamic growth in their apparel exports to the US. The percentage change in US apparel imports from April 2024 to April 2025 underscores this trend.

Countries like Bangladesh and Pakistan are leading the charge with remarkable double-digit increases, reflecting a conscious effort by US brands to expand their sourcing networks. Cambodia and India are also demonstrating strong growth, further highlighting the widespread diversification.

Table: Growth markets for US apparel imports (YTD 4/25 vs. YTD 4/24)

|

Country/Region |

% change (YTD 4/25 vs. YTD 4/24) |

|

Bangladesh |

~29% |

|

Pakistan |

~25% |

|

Cambodia |

~21% |

|

India |

~19% |

|

ASEAN |

~14% |

|

Indonesia |

~13% |

|

Vietnam |

~10% |

|

World |

~8% |

|

China |

1.80% |

|

USMCA |

~0.5% |

|

W. Hemi. |

-3% |

|

CAFTA-DR |

-5.50% |

Source: OTEXA (approximate values derived from attached chart)

ASEAN suppliers, as a collective, are particularly on the move, exhibiting robust double-digit growth. Vietnam, a key player within the region, has seen its apparel exports to the US rise over 10 per cent year-to-date. This collective momentum has propelled ASEAN’s share of US apparel imports to over 27 per cent, steadily eroding China's once overwhelming dominance, which now stands at 35 per cent and continues to drift lower.

Risk management and cost control

This changing scenario is not a sudden phenomenon rather the culmination of a "smart, deliberate pivot" by US brands. The reasons are many: managing geopolitical risks, optimizing costs, and building more resilient and responsive supply chains in an increasingly unpredictable global environment. The lingering effects of tariffs imposed by the Trump administration have also played a role in scrambling the market and encouraging alternative sourcing strategies.

As an analyst explained, "What we're seeing is a fundamental re-evaluation of sourcing strategies. It's no longer just about who's biggest. It's about who's flexible, dependable, and future-ready. And in 2025, that means looking beyond just one partner."

The shift is palpable. While China remains an indispensable component of the global apparel supply chain, its solo reign is clearly over. The burgeoning growth from a diverse array of nations signifies a new era in U.S. apparel imports – one characterized by strategic diversification and a proactive approach to global sourcing. As brands continue to prioritize resilience and adaptability, this trend is only expected to pick up speed, ushering in a more distributed and dynamic future for the apparel industry.

For years, China reigned supreme as the undisputed king of US apparel imports. While still the largest supplier in aggregate terms, new data reveals a clear shift in sourcing landscape, as American brands strategically diversify their supply chains, seeking flexibility, risk mitigation, and cost control. This is reshaping the global apparel trade, with a host of other nations experiencing good growth in their exports to the US.

China's monthly imports see sharp decline

The latest figures, of US apparel imports year-to-date till April 2025, throws up an interesting pattern. While US apparel imports from China have seen a modest increase of just 1.8 per cent year-to-date, a deeper look into the monthly trends from January 2024 to April 2025 reveals a crucial dynamic.

As the table shows, US apparel imports from China saw a strong increase in mid-2024, peaking around July and August, nearing 1,000 million sq. mt. equivalents (SME). However, a distinct downward trend began in the latter half of 2024, with imports declining through the end of the year. This deceleration has continued into early 2025, with monthly import volumes in March and April 2025 hovering around the 500 SME mark – a sharp drop from their mid-2024 highs. This sustained decline highlights a tangible reduction in reliance on Chinese suppliers on a month-to-month basis.

The rise of alternative sourcing hubs

In stark contrast to China's recent monthly performance, other regions are experiencing significantly more dynamic growth in their apparel exports to the US. The percentage change in US apparel imports from April 2024 to April 2025 underscores this trend.

Countries like Bangladesh and Pakistan are leading the charge with remarkable double-digit increases, reflecting a conscious effort by US brands to expand their sourcing networks. Cambodia and India are also demonstrating strong growth, further highlighting the widespread diversification.

Table: Growth markets for US apparel imports (YTD 4/25 vs. YTD 4/24)

|

Country/Region |

% change (YTD 4/25 vs. YTD 4/24) |

|

Bangladesh |

~29% |

|

Pakistan |

~25% |

|

Cambodia |

~21% |

|

India |

~19% |

|

ASEAN |

~14% |

|

Indonesia |

~13% |

|

Vietnam |

~10% |

|

World |

~8% |

|

China |

1.80% |

|

USMCA |

~0.5% |

|

W. Hemi. |

-3% |

|

CAFTA-DR |

-5.50% |

Source: OTEXA (approximate values derived from attached chart)

ASEAN suppliers, as a collective, are particularly on the move, exhibiting robust double-digit growth. Vietnam, a key player within the region, has seen its apparel exports to the US rise over 10 per cent year-to-date. This collective momentum has propelled ASEAN’s share of US apparel imports to over 27 per cent, steadily eroding China's once overwhelming dominance, which now stands at 35 per cent and continues to drift lower.

Risk management and cost control

This changing scenario is not a sudden phenomenon rather the culmination of a "smart, deliberate pivot" by US brands. The reasons are many: managing geopolitical risks, optimizing costs, and building more resilient and responsive supply chains in an increasingly unpredictable global environment. The lingering effects of tariffs imposed by the Trump administration have also played a role in scrambling the market and encouraging alternative sourcing strategies.

As an analyst explained, "What we're seeing is a fundamental re-evaluation of sourcing strategies. It's no longer just about who's biggest. It's about who's flexible, dependable, and future-ready. And in 2025, that means looking beyond just one partner."

The shift is palpable. While China remains an indispensable component of the global apparel supply chain, its solo reign is clearly over. The burgeoning growth from a diverse array of nations signifies a new era in U.S. apparel imports – one characterized by strategic diversification and a proactive approach to global sourcing. As brands continue to prioritize resilience and adaptability, this trend is only expected to pick up speed, ushering in a more distributed and dynamic future for the apparel industry.

The air in numerous pockets of the country hangs thick with the stench of discarded refuse, a stark testament to a system teetering on the brink of its own waste. Mountains of discarded plastic choke landfills from Mumbai to Chennai, leaching toxins into the soil and water. The insatiable hunger for raw materials continues to strip our planet bare, driving deforestation and resource depletion. We label this a ‘waste problem’ yet the overflowing bins and environmental degradation are increasingly recognized as symptoms of a far more fundamental flaw: the very design of the products we consume.

The cold, hard numbers paint a damning picture. As per Food and Agriculture Organization of the United Nations Globally, an estimated 1.3 billion tonnes of food are lost or wasted annually. Closer home, India grapples with its own immense food waste, contributing significantly to environmental and economic losses. Our personal vehicles, status symbols and essential tools, remain parked for an astounding 92 per cent of the time, representing a massive underutilization of resources and embodied energy. Consider the humble drill: studies in Europe have shown an average usage of just 12-13 minutes over its entire lifespan, lying dormant in sheds and garages, a monument to infrequent need and a linear consumption model.

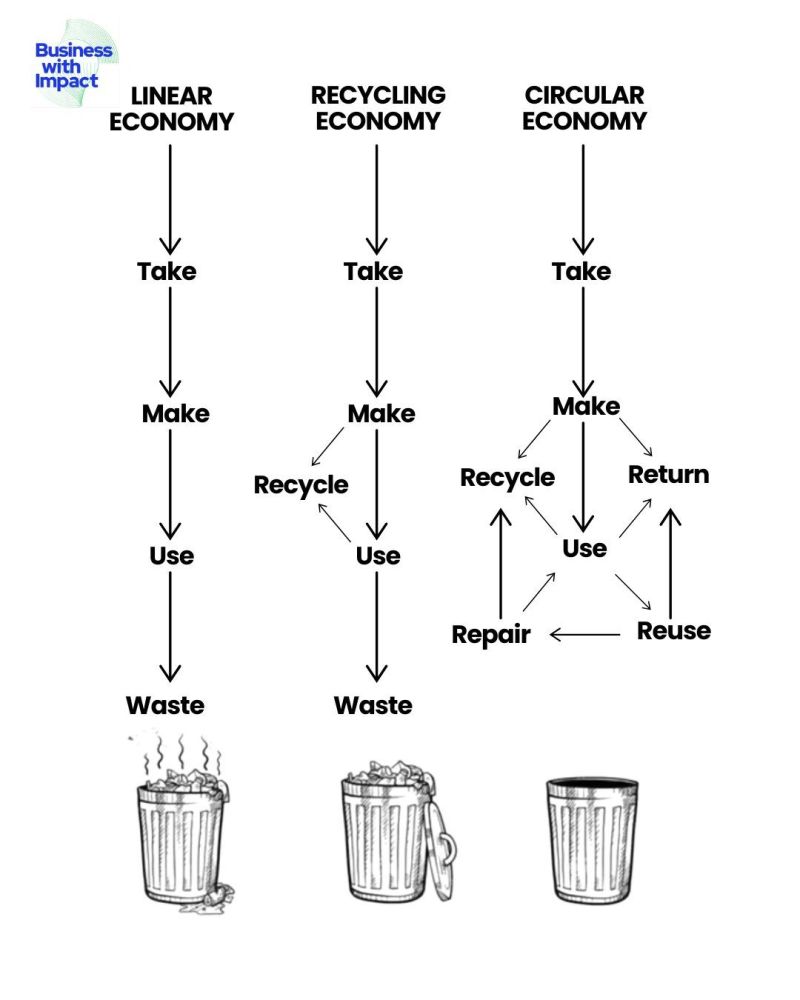

Where does this all end up? The answer, as the attached image grimly illustrates, is the landfill. Our dominant economic paradigm, the Linear Economy, operates on a disturbingly simple, and ultimately unsustainable, principle: Take → Make → Use → Waste. It's a one-way street with a dead end, a system that inherently treats the Earth's resources as infinite and its capacity to absorb waste as boundless. The visual representation of overflowing garbage bins serves as a potent symbol of our collective failure to account for the long-term repercussions of our consumption patterns.

The promise of ‘recycling’ as a panacea for our waste woes offers a mere illusion of a solution. While undeniably a necessary component of a more sustainable future, the "Recycling Economy" depicted still culminates in waste. It's a system of temporary reprieve, a detour on the inevitable journey to disposal. Globally, only an estimated 9 per cent of all plastic waste ever produced has been recycled (UN Environment Programme, 2018). The energy and resources invested in the recycling process itself, coupled with the limitations of current recycling technologies and the contamination of waste streams, mean that it cannot be the sole answer to our escalating waste crisis.

The inconvenient truth, increasingly echoed by scientists, economists, and environmentalists, is that we don’t have a waste problem — we have a design problem. Products are frequently conceived with planned obsolescence embedded within them, intentionally engineered to become outdated, malfunction, or fall out of fashion, thereby leading to a cycle of continuous consumption. This isn't merely an environmental oversight; it's a fundamental flaw in a system that appears to have developed amnesia, tragically forgetting the basic ecological principle that every "end user" inhabits the same finite planet. This ‘capitalism with amnesia’ as critics incisively label it, prioritizes short-term profit margins over the long-term well-being of both the environment and society.

However, a viable and increasingly compelling alternative exists, a model that isn't radical but rather, as the image powerfully suggests, common sense imbued with a survival instinct: the Circular Economy. This transformative paradigm reimagines our relationship with resources, breaking free from the linear "take-make-dispose" model and embracing a closed-loop system. Its core principles are elegantly simple and profoundly impactful: Take → Make → Use → Reuse → Repair → Return → Recycle. And crucially, repeat. Over and over again, creating a regenerative system where waste is minimized and resources are kept in circulation for as long as possible.

Imagine a world where smartphones are designed with easily replaceable batteries and modular components, extending their lifespan and reducing electronic waste. Picture clothing designed for durability and made from recyclable materials, with manufacturers offering take-back schemes to close the loop. This isn't a distant utopia; it's a tangible future being built by innovative businesses and forward-thinking policymakers.

The benefits of transitioning to a circular economy extend far beyond mere environmental responsibility. For businesses, this shift unlocks a wealth of opportunities and tangible advantages:

Fewer raw materials = lower costs: By designing products for longevity, reuse, and remanufacturing, the demand for virgin resources diminishes significantly, leading to substantial cost savings and greater resource independence. For example, Renault's remanufacturing plant in Flins, France, reconditions engines, gearboxes, and other vehicle parts, achieving cost savings of up to 50 per cent compared to producing new parts.

Longer product lifecycles = more value: Durable and repairable products retain their value for longer, fostering stronger customer relationships built on trust and longevity. This can also pave the way for innovative business models centered around leasing, sharing platforms, and performance-based contracts, shifting the focus from selling products to providing services. Consider the success of companies offering "lighting as a service," where customers pay for illumination rather than owning light bulbs, incentivizing manufacturers to produce long-lasting, energy-efficient products.

Built-in sustainability = more customer loyalty: In an increasingly environmentally conscious world, businesses that demonstrably prioritize sustainability attract and retain customers who align with these values. A Nielsen study found that 66 per cent of global consumers are willing to pay more for sustainable brands. Integrating circular principles into product design and business operations becomes a powerful differentiator and a driver of brand loyalty.

The growing "right to repair" movement, gaining momentum globally and in India, underscores the public's dissatisfaction with planned obsolescence. Consumers are demanding access to the necessary parts, tools, and information to repair their own devices, pushing back against manufacturers who deliberately restrict repairability. This isn't just about saving money; it's a fundamental assertion of ownership and a rejection of a system designed for premature disposal.

Furthermore, inspiring case studies demonstrate the real-world viability of circular business models:

• Patagonia: This outdoor clothing company is renowned for its commitment to durability, repairability, and recycling. Their "Worn Wear" program encourages customers to repair and reuse their gear, offering repair services and selling used Patagonia products, effectively extending product lifecycles and reducing waste.

• Fairphone: This Dutch company designs and manufactures modular smartphones that are easier to repair and upgrade, challenging the industry's trend of disposable electronics. Their focus on ethical sourcing and product longevity provides a compelling alternative for conscious consumers.

• Interface: This global flooring company has embarked on a "Mission Zero" to eliminate any negative environmental impact by 2020 (and is now pursuing "Climate Take Back"). They have pioneered innovative approaches to material sourcing, product take-back, and closed-loop recycling in the carpet industry.

Table: Comparative product lifecycle across various economic models

|

Feature |

Linear Economy |

Recycling Economy |

Circular Economy |

|

Resource Use |

High reliance on virgin resources |

Reduced reliance, but still significant |

Minimal reliance on virgin resources |

|

Product Design |

Often designed for obsolescence |

Design for function, less focus on end-of-life |

Design for durability, repair, reuse, and recyclability |

|

Waste Generation |

High waste at end-of-life |

Reduced waste, but still present |

Minimal waste, resources kept in loop |

|

Value Retention |

Value lost at end-of-life |

Some value recovered through recycling |

High value retention through reuse, repair, remanufacturing |

|

Economic Model |

Primarily focused on sales of new products |

Includes recycling as an end-of-life process |

Emphasizes service models, product longevity, and resource efficiency |

|

Environmental Impact |

High resource depletion, high pollution |

Lower than linear, but still significant |

Significantly lower resource depletion and pollution |

The transition to a circular economy is not merely an environmental imperative; it is an economic opportunity. It demands a fundamental shift in design thinking, manufacturing processes, consumer behavior, and supportive government policies. It necessitates collaboration across industries, from material producers to product designers to waste management companies, and a collective willingness to embrace innovation and long-term thinking.

The image highlights a clear and critical choice: persist on the linear path towards an overflowing bin, a metaphor for a system choking on its own excesses, or embrace the cyclical wisdom of a circular economy, where resources are cherished, products are engineered for longevity, and waste is minimized by design. The future of our planet, the resilience of our economies, and the well-being of generations to come hinge on the choices we make today. The time for "common sense with a survival instinct" is not just approaching – it is here.

Luxury home decor brand D’Moksha has announced the appointment of Shailendra Singh as Co-Founder and Chief Operating Officer (COO), marking a significant step in its growth journey as it prepares to launch full-scale operations in India. Singh previously served as Business Head - Physical Retail at Nykaa.

Founded in 2020, D’Moksha has built a loyal customer base in the United States with its premium, sustainably crafted home textiles such as stitched curtains and table linens. With operations rooted in India, the brand has optimized a vertically integrated supply chain to offer fast deliveries and boutique-quality products. The entry of Singh signals D’Moksha’s commitment to replicating this model in India.

“Shailendra’s leadership arrives at a pivotal moment for D’Moksha,” said Co-Founder and CEO Manav Dhanda. “His deep expertise in retail and operations will be instrumental as we scale in India.”

Singh, an alumnus of IIM Lucknow, brings over two decades of experience across leading consumer brands. At Hindustan Unilever Limited, he led key digital and retail initiatives before joining Nykaa, where he helped expand its offline retail network.

“D’Moksha’s mission-driven and innovation-led approach immediately resonated with me,” Singh said. “It’s an exciting opportunity to redefine home decor shopping in India.”

The brand has been piloting a unique ‘curtains-at-home’ experience in select Indian cities, offering expert consultations, real-size fabric trials, and digital previews. A nationwide rollout is expected soon, promising a new level of personalization and convenience for Indian consumers.

D’Moksha was founded by Manav and Nimisha Dhanda and operates from India with a growing presence in the US, combining sustainability, technology, and design excellence in every product.

The International Textile Manufacturers Federation (ITMF) has released its 32nd Global Textile Industry Survey (GTIS), conducted between May 12–22, 2025, revealing wide regional disparities in performance and outlook within the global textile sector.

While the overall global business situation remains challenging, with a negative balance of -20 percentage points, Africa stands out with a robust +23 pp, followed by South America at +6 pp. In contrast, East Asia faces significant headwinds, recording the weakest performance with -48 pp. Despite current challenges, future expectations are more optimistic, registering a global balance of +24 pp. North America leads confidence levels with +65 pp, trailed by Africa at +54 pp, whereas East Asia remains cautious with -18 pp.

Order intake continues to be a concern, declining steadily for four months and landing at -21 pp in May. Africa is the only region showing positive momentum (+18 pp), while Europe (-45 pp) and East Asia (-41 pp) remain subdued. Nevertheless, global order backlogs show signs of recovery, now averaging 2.3 months.

Capacity utilization reached 72 per cent in May, with Asian countries maintaining leadership. Upstream sectors, particularly spinning, are operating at higher rates than downstream segments.

Demand weakness is the leading concern for 61 per cent of survey respondents over the next six months, followed by trade tensions and rising operational costs. However, order cancellation rates remain low and stable across all regions, indicating some resilience in the supply chain.

The ITMF findings suggest a global industry under pressure but with emerging bright spots and a cautiously improving sentiment in several key markets.

The Aid by Trade Foundation (AbTF) has announced the appointment of Louisa Losing from the Global Nature Fund (GNF) to its Cotton Advisory Board. Losing brings valuable experience in integrating biodiversity into agricultural supply chains, a focus that aligns closely with AbTF’s mission to promote sustainable cotton production.

With biodiversity a strategic priority, AbTF implements its commitment through standards such as Cotton made in Africa (CmiA), CmiA Organic, and the Regenerative Cotton Standard (RCS). These initiatives aim to preserve ecosystems while supporting cotton producers in enhancing resilience to climate change and market pressures.

The Global Nature Fund has worked globally for over 25 years to protect biodiversity through international environmental and sustainability projects. Since 2005, it has also focused on supporting biodiversity in the private sector, including in African regions where it runs initiatives related to water security, food systems, and climate adaptation.

As deputy head of business and biodiversity at GNF, Losing supports companies in applying biodiversity-relevant due diligence and developing action plans for nature protection.

“Standard setters are essential to integrating biodiversity into supply chains. We’re excited to contribute to AbTF’s work,” said Losing.

Tina Stridde, managing director at AbTF, welcomed the appointment, noting Losing’s expertise in biodiversity, CSRD, and CSDDD compliance. “We’re pleased to have her join us and look forward to fruitful collaboration.”

AbTF’s Cotton Advisory Board includes members from NGOs, government, and industry, providing a rich forum for strategic dialogue in sustainable cotton.

Vietnam’s spinning industry is facing a growing challenge in finding skilled machine operators, as rapid industrialization drives young talent towards other sectors. For yarn manufacturer Tra Ly Hung Yen, this posed a serious threat to operations that rely on precision and consistency. To address the labor shortage and sustain production quality, Tra Ly turned to German textile machinery specialist Trutzschler.

The family-owned company, known for producing carded and combed cotton yarn (Ne 20 to Ne 40) using standard and compact spinning methods, has a daily capacity of 60 tons, with 50 per cent of its output exported to China, Pakistan, and Bangladesh. Faced with hiring difficulties and the need for skilled intervention due to raw material variability, Tra Ly sought automation to reduce dependence on manual adjustments.

Trutzschler’s automated solutions have helped Tra Ly stabilize yarn quality and boost efficiency. Key machines include the T-SCAN TS-T5 for foreign part detection and ejection, the intelligent card TC 19i with T-GO for real-time carding gap optimization, the autoleveller draw frame TD-10 with self-adjusting features, and the 12-head comber TCO 21XL, which increases productivity by 50 per cent.

Local support from Trutzschler’s Vietnam team ensures quick maintenance and process optimization. Tra Ly has also implemented Trutzschler’s digital mill monitoring system, My Mill, allowing for real-time performance tracking and remote audits.

Thanks to this partnership, Tra Ly is overcoming workforce limitations while maintaining high standards. Director Do Thi Lan Phuong emphasized the value of working with Trutzschler, praising their technical expertise and collaborative approach.