FW

The fashion industry stands at a crossroads, with mounting environmental concerns and untapped economic potential. Komal Hiranandani, Director, Dolcevee, a sustainable clothing brand, highlights during a knowledge session at Bharat Tex, the burgeoning resale market as a key solution. A recent study revealed that 24 per cent of Indians have purchased pre-owned fashion, indicating a strong consumer appetite. Beyond the obvious environmental benefits, resale offers significant economic advantages. The Ellen MacArthur Foundation estimates that consumers globally lose $460 billion annually by discarding reusable clothing. Unlocking the logistics of resale is crucial to capitalizing on this lost value.

While downcycling and fiber-to-fiber recycling are important, prioritizing resale for garments with remaining life is the most economically and environmentally sound approach. The global resale market is booming, growing at an 11 per cent compound annual growth rate. Leading brands, from Gap to Gucci, are embracing resale programs, recognizing its integral role in the future of fashion.

In India, managed marketplaces, where items are quality controlled, are deemed more suitable than peer-to-peer resale. This ensures brand integrity and customer satisfaction. Furthermore, integrating resale into return processing can significantly reduce waste. Optoro's 2022 data shows that retailers in the US landfilled 9.6 million pounds of returned products. Resale offers a viable alternative, allowing returned items to be resold, either on the brand's website or through managed marketplaces, generating revenue and minimizing waste. The key lies in establishing strategic partnerships and efficient logistics to unlock the full potential of the resale revolution.

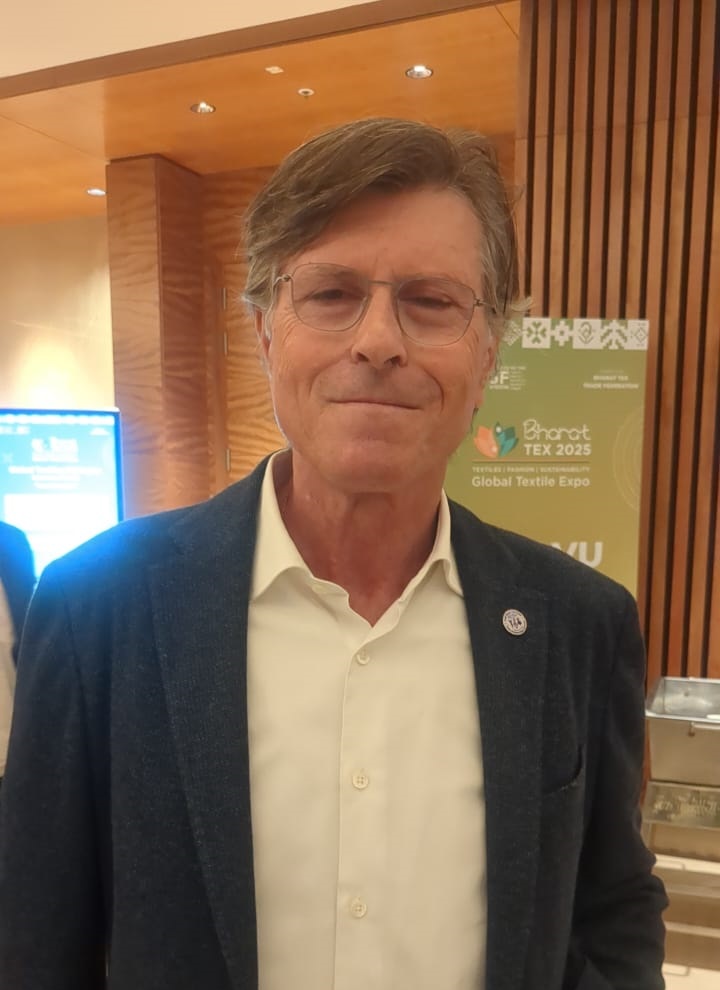

Juan Pares, soon to be President of the ITMF, was impressed by his first Bharat Tex visit. "Really, really good impression," he declared, speaking on the sidelines of a knowledge session at Bharat Tex, noting the well-organized event and the presence of key industry figures. His company, Santanderina Group, also had a strong presence and business with India.

Pares acknowledged the textile industry's challenging times, emphasizing the need for transformation. "We need to think more in margins than in volume," he stated, highlighting innovation as the key. This included innovation in products, techniques, digitalization, and even the industry's mindset. He stressed the importance of attracting young talent to the textile sector, competing with other industries like car manufacturing and digital businesses. "The key point is the talent," Pares insisted. "Human resource is the key." He linked talent to innovation, which required an open mindset.

Pares' connection with India goes back to 1986. Santanderina has a company in India, engaging in both sourcing and selling. They source garments, yarns, and fabrics, while selling protective wear and high-end fashion fabrics. They also source basic cotton fabrics, transforming them in Europe, as well as specialized yarns.

Pares sees immense potential for the Indian textile industry. He believes India needs to focus on eliminating trade barriers and negotiating better agreements with other countries to compete effectively with nations like Pakistan, Bangladesh, and China. He noted that cost isn't the only factor; developing new products and creating value are also crucial. While acknowledging India's current leadership in cotton, he pointed out the need to improve performance in polyester and polyamide to become a one-stop shop for global textile groups. He believes India has a bigger role to play, particularly by capitalizing on its strength in cotton.

The manufacturing landscape is undergoing a data-driven transformation, driven by climate change and increasing demands for sustainability. Akhil Sivanandan, CEO & Co-Founder of Green Story, a leading company in this space, while speaking in a knowledge session, highlights the importance of data capture in manufacturing. He explains how automated facilities with data capture enable faster and more cost-effective life cycle assessments and carbon footprinting. Green Story has been pioneering this approach for over a decade, helping brands understand their environmental impact through precise data analytics.

Impending regulations, particularly in Europe, are accelerating this shift. The 2027 Carbon Border Adjustment Mechanism (CBAM) will require manufacturers to provide detailed process-level information. Sivanandan emphasizes that having the right data empowers informed supply chain decisions, preventing wasteful investments in ineffective initiatives.

With growing pressure on manufacturers from investors and consumers for accountability, data mastery is no longer optional. Sivanandan believes that by harnessing data, companies can not only meet regulatory requirements but also spearhead a sustainable future. In this evolving manufacturing era, effective data capture and analysis are essential for survival and success in the green revolution.

Green Story collaborates with over 200 global brands, specializing in Product Carbon Footprint (PCF) methodologies and life cycle assessments. The integration of smart facilities enables real-time data capture, crucial for both regulatory compliance and competitive marketing. Sivanandan envisions real-time life cycle assessments as game-changers, shifting from static assessments to dynamic, actionable insights.

M Maniwanen, Chairman of Busana Apparel Group, Indonesia, envisions a textile industry where tradition and innovation intertwine. While acknowledging India's historical strength in cotton production, Maniwanen emphasizes the crucial need to embrace MMF to ensure the industry's future.

During an interview on the sidelines of Bharat Tex 2025, Maniwanen addressed the traditional divide between cotton and MMF. He pointed out the changing dynamics of the MMF market, noting that previously, a few large corporations dominated the sector. However, he sees significant opportunities arising from the Indian government's supportive policies, including incentives for land, labor, and capital, which are creating a fertile ground for smaller players and innovation. This support, he argues, is vital for the industry's evolution.

Maniwanen's vision centers on blending the inherent qualities of cotton with the advantages of MMF. He believes the future lies in creating fabrics that combine the softness and comfort of cotton with the durability and versatility of synthetic fibers. This approach, he contends, is not only about creating competitive products but also about achieving sustainability, a critical factor for the modern textile industry.

He actively fosters alliances with Indian textile manufacturers, sharing knowledge and resources to develop innovative and eco-friendly fabrics. The results of these collaborations are now visible. New collections showcase innovative designs blending cotton's rich textures with MMF's resilience.

Busana Apparel Group has emerged as a symbol of innovation, demonstrating that the future of textiles lies in embracing change, fostering collaboration, and weaving together the best of both natural and synthetic worlds.

Style Union, a rapidly expanding brand boasting over 100 stores across southern India, is a testament to the power of Indian sourcing. Mridul Tondon, who oversees buying and merchandising, emphasizes how their "Made in India" commitment has become the cornerstone of their success, during his visit at Bharat Tex as a buyer. They champion the quality, craftsmanship, and innovation India offers, showcasing it to the world. Style Union's growth is intrinsically linked to this philosophy.

The evolution of Indian retail, particularly the shift in consumer behavior among younger generations, has presented exciting opportunities. Style Union has adapted to this change, embracing boldness and experimentation while staying true to the unique Indian aesthetic. This has allowed them to leverage India's talented designers and manufacturers, fueling their rapid expansion.

Value drives the Indian market. It's not just about price; it's about quality and style. Style Union understands this. Their focus on Indian sourcing allows them to control quality and offer competitive prices, delivering true value and contributing to their growth.

Sourcing nearly 90 per cent of their products from India is more than a strategy; it's a core value. Style Union supports local artisans, manufacturers, and the Indian economy. This resonates with the growing national pride among consumers, a key factor in their expanding customer base.

India, with its vast population and burgeoning economy, has the potential to become a global retail powerhouse. Style Union is actively working to establish India as a key player on the international fashion stage.

While celebrating their successes, Style Union acknowledges challenges, such as sourcing specialized materials. They believe government support for local production and innovation is essential to develop high-quality, globally competitive sourcing within India.

Style Union, with its 100+ stores, is more than a brand; it reflects the dynamism of Indian sourcing. They are committed to showcasing Indian craftsmanship to the world, believing in the future of Indian retail and playing a role in shaping it. Their story is a testament to the power of ‘Made in India.’

RSWM’s Q3, FY25 net loss narrowed to Rs 9.23 crore as against a net loss of Rs. 34.07 crore loss in Q3, FY24. The company’s sales increased by 22.34 per cent to Rs 1195.62 crore during the quarter from Rs 977.32 crore in the corresponding quarter of the previous year.

RSWM’s revenue from the yarn segment increased to Rs 970.95 crore during the quarter as against Rs 844.12 crore in the corresponding quarter last year. Revenue from the fabric segment also increased Rs 299.68 crore from Rs 225.54 crore in the same period last year.

Flagship company of the LNJ Bhilwara Group, RSWM is a leading Indian textile manufacturer and exporter, operating for over 60 years. They produce a wide range of yarns, fabrics, and denim, exporting to over 70 countries.

Following a board meeting, the company appointed Rajeev Gupta as an Additional Director and Joint Managing Director for a three-year term, effective February 12, 2025, subject to shareholder approval. He will also serve as Key Managerial Personnel.

Trident Group, a leading home textiles conglomerate, announced a major expansion plan at Bharat Tex 2025, targeting a threefold growth of its India business by 2027. The company will invest Rs 1000 crore in FY25-26, focusing on sustainability, modernization, and asset enhancement across its home textiles, yarn, and energy businesses.

A key initiative is the launch of Luxehome by myTrident, a new luxury home textile line featuring premium bedding and towels priced between Rs 4,000 and Rs 40,000. This move positions myTrident to capture a significant share of India's growing luxury home furnishings market. myTrident also aims to expand its retail presence from 7,000 to 10,000 touch points, strengthening its domestic footprint. The brand will also target growth in the Horeca, institutional, and corporate gifting sectors, while collaborating with major e-commerce and quick commerce platforms.

Trident Group Chairman, Rajinder Gupta, emphasized the company's commitment to innovation and sustainability, highlighting India's potential as a textile powerhouse. myTrident Chairperson, Neha Gupta Bector, described Luxehome as a transformational step, bringing world-class luxury to Indian homes. myTrident CEO, Rajneesh Bhatia, outlined the brand's retail expansion plans and focus on diverse market segments.

Bharat Tex 2025 also served as the launch platform for myTrident's Spring Summer ’25 collection, inspired by India's rich textile heritage and blending traditional craftsmanship with modern techniques.

Nigeria aims to end its textile imports from China and India. As per John Enoh, Minister of State for Industry, Trade and Investment, the country plans to revive the domestic textile industry and its value chains by promoting ‘Made in Nigeria’ products. Nigeria imports textiles worth $6 billion annually form these two countries.

Enoh recently toured industries in Lagos and Ogun states, emphasizing the government's focus on economic growth through manufacturing and job creation. He cited the flourishing textile industry in neighboring Benin Republic, which targets the Nigerian market, as inspiration. He recalled a time when the Nigerian textile industry was a significant employer.

Researchers at IIT Guwahati have developed a water-repellent, conductive textile that converts electricity and sunlight into heat. This innovation aims to protect against the health risks of prolonged exposure to cold, such as blood clotting, breathing difficulties, and weakened immunity.

Published in Nano-Micro-Small, the research was led by Prof Uttam Manna and his team, including Prof Roy P Paily. Extreme cold can be fatal, and traditional solutions like bulky clothing or heaters have limitations. Conductive textiles offer a lightweight alternative, but existing versions often lack durability and water resistance.

The IIT Guwahati team sprayed ultra-thin silver nanowires onto cotton fabric, making it conductive. These nanowires, thinner than a human hair, allow electricity to flow, generating heat while maintaining softness and flexibility. Silver nanowires were chosen for their high conductivity and ability to convert both electricity and sunlight to heat. Their low electrical resistance allows safe electro thermal conversion at low voltage.

To prevent tarnishing, the researchers applied a water-repellent coating inspired by lotus leaves. This coating's microscopic texture causes water to roll off, keeping the textile dry and ensuring long-lasting conductivity, even in damp conditions. The coating also protects against sweat, rain, and spills.

The textile can be powered by a small rechargeable battery or solar energy, maintaining a temperature between 40°C and 60°C for over 10 hours. Tested in wearable knee and elbow bands, it shows promise for providing sustained warmth to those working in cold environments or arthritis patients needing localized heat therapy. Other applications include on-demand water heating and accelerating chemical reactions.

The textile is self-cleanable, breathable, flexible, and scalable, with potential for various controlled heating applications, states Prof. Uttam Manna. The team has filed an Indian patent and is working to integrate the material with miniaturized electronics for product development. They are also seeking industry collaborations for dry thermos-therapy applications, he adds.

The European Commission has formally requested fast-fashion giant, Shein to provide detailed information about its product recommendation system and user data protection measures. The request requires Shein to disclose internal documents and details about how its algorithms suggest products.

The Commission is also seeking information on Shein's consumer protection practices, specifically how it safeguards user data and mitigates risks related to potentially illegal product sales, public health, and user well-being. Shein has until February 27, 2025 to comply. Failure to do so could result in a formal investigation and legal action.

This demand for transparency follows increased scrutiny of online marketplaces and their impact on consumers. The EU's Digital Services Act (DSA), now fully in effect, mandates greater transparency and accountability from large online platforms concerning hosted content and algorithms.