FW

Pakistan’s textile industry is unable to meet export orders and cannot expand its operations to create an export surplus. Among the factors hindering Pakistan’s textile exports are the withdrawal of the zero rating status, the high energy cost and the cotton shortage. The industry wants the energy package continued for another five years. Sales tax is collected on value added items at each stage but refunds are only available after export. The production cycle requires 185 days to complete. This has triggered a huge liquidity crisis. Adequate finance and credit availability are stressed as vital for the growth and enhancement of the industry. Over the last five years Pakistan’s cotton production has fallen by 22 per cent which has caused a loss of almost two per cent of the total GDP. The textile industry will have to import five million bales to meet the requirements in the ongoing financial year.

Over the last one year, interest rate has increased from 5.75 per cent to 13.25 per cent, further restraining investment in the sector, along with increased working capital requirements owing to the recent devaluation of the currency. One suggestion by the industry is that advanced seed technology be available for quality seed development. Seed technology controls weeds and insects.

Lenzing is committed to reduce its carbon dioxide footprint by half by 2030. The vision is to become a carbon dioxide-neutral group of companies by 2050. With the growing wellness trend among consumers, Lenzing is developing fibers that keep users pleasantly cool and dry with natural comfort and versatility. Tencel Active is a group of cellulose fibers of botanic origin that keep the body pleasantly cool and dry with their natural comfort and versatility, enabling freedom to move with confidence. Lenzing is focused on introducing its award-winning Refibra technology and Lenzing Ecovero fibers to the active wear segment as well as the Lenzing Modal Black solution for colored fibers. Lenzing’s pioneering Refibra technology reinforces circularity through recycling cotton scraps with minimal emissions. The fully sustainable Lenzing Ecovero branded fibers offer transparent identification ensuring these viscose fibers are cleanly sourced and produced.

Water conservation is another environmental concern in the industry. Synthetic materials that are frequently used for sportswear, such as polyester, are naturally hydrophobic, making them more difficult to dye. To tackle this, Lenzing has introduced Lenzing Modal Black fibers, a spun-dyed fiber that incorporates the pigment during the extrusion production process. It can help lower energy and water consumption by 50 per cent compared to conventional dyed fabrics.

US imports of textile and clothing increased in value by 4.9 per cent in 2018. In volume terms, these imports rose by 5.9 per cent in 2018. The average price of US textile and clothing imports fell in 2018 for the seventh year in succession. The average import price declined 14.2 per cent over the seven- year period. The main cause for this was a decline in the average price of imports from China. US textile and clothing imports from China were up by 4.8 per cent in value and by 6.7 per cent in volume. While the price per sq. m. equivalent dropped year on year, the value and volume increased. As a result, the share of US textile and clothing imports which came from China accounted for 49.3 per cent in volume terms and in terms of value it accounted for 36.5 per cent. Cambodia, Bangladesh, India and Vietnam also showed a rise in value and volume to the USA. However, the shares of US imports from these countries are not really significant in value and volume terms. From January to October 2019, US apparel imports increased 2.6 per cent year on year, of which the cumulative value from China was down by 5.6 per cent.

New investments by Bangladesh garment manufacturers are focused on compliance and technology to meet buyers' requirement and workplace safety. Some are also concentrating on producing value added products. The latest technology and innovations are core in the investment as consumers’ behavior and taste are changing very fast in the fashion industry. As of now, Bangladesh has capacity in excess for some products and segments. So the new investment and expansion are focusing on new products having scope to grow. New ventures need more investments, modern technology, enhanced efficiency, productivity, compliance and environment-friendly measures to be sustainable and competitive in the global supply chain.

In 2019, many knitwear manufacturers in Bangladesh, mostly small and medium, shut down, making thousands of people jobless. Non-compliance and lack of implementation of the new wage structure are largely blamed for the closures. Other reasons are a lack of enough work orders and loss of competitiveness due to a rise in production costs. Units also complain of not getting banking support in improving compliance and meeting other necessary expenses. This is a tragedy of sorts since small factories have the capacity to offer specialized and small quantity products, which would suit the changing tastes of consumers.

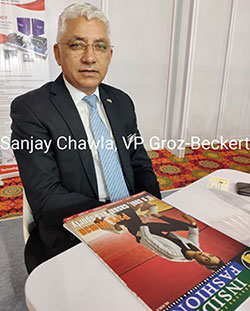

The world’s leading provider of industrial machine needles, precision parts and fine tools, Groz Beckert Asia offers its customers systems and services for production and joining of textile fabrics. The company, founded in 1852, employs more than 9,000 people and has production sites in Germany, Belgium, the Czech Republic, Portugal, the USA, India, China, and Vietnam. Sanjay Chawla, Vice President-Sales of the company expounds on its operations and the Ludhiana market.

A manufacturer of fabric forming machinery components, Groz Beckert Asia makes components for knitting and sewing, weaving, felting, tufting machines and card wires. “Our innovations help us to increase the productivity of our machines besides improving the quality of our final products and the efficiency of our systems,” notes Sanjay Chawla, Vice President-Sales of the company.

A manufacturer of fabric forming machinery components, Groz Beckert Asia makes components for knitting and sewing, weaving, felting, tufting machines and card wires. “Our innovations help us to increase the productivity of our machines besides improving the quality of our final products and the efficiency of our systems,” notes Sanjay Chawla, Vice President-Sales of the company.

Demand for machinery increases in Ludhiana

Winter has led to good sales in Ludhiana. The city is a big hub for suppliers to the domestic market. “These suppliers have already sold out their entire production, and are now adding more machines,” observes Chawla. Industry in the city is also getting more organised as focus on quality, productivity and efficiency is increasing. “This is not only increasing the demand for better machinery and components but also encouraging a better work culture and adoption of better systems,” adds Chawla

However, the knitting industry in the city is a bit stressed and facing a liquidity crunch. “As most of the knitting and garmenting manufacturers are unorganised, they are grappling with GST issues,” avers Chawla

Vertically integrated units to counter competition

The consumption of non-wovens is rising in India. “To deal with this, knitting and organised factories need to increase their production,” notes Chawla. Garment making costs are lower in Vietnam and Bangladesh as per unit time consumed in making a garment is lower in these two countries. “To compete with these two countries, India needs to set up vertically integrated units that make everything from fabrics to garments in one place,” adds Chawla.

Though India has the capability to emerge as the world’s major production hub, it first needs to cater to its domestic market which looks quite promising. “However, things move at a very slow pace in the country. On one end, we have units thinking of adopting the 4.0 technology, while on the other hand, there are units completely engaged in basic job works,” views Chawla

In future, the consumption of manmade fibers is set to rise while the knitting segment is likely to move toward finer gauges. Fashion is likely to become more sustainable,” adds Chawla.

"After a successful four decades experience in the home furnishing segment, Medusa Source ventured into the fashion apparel business. The company supplies garments to some of the top brands of North America, Europe, Latin America, Middle East, Asia Pacific and Australia. It follows the best modern supply side practices with added refinements based on its experience in the segment. Medusa constantly innovates to reduce costs that help in making the clients more competitive in the market. Sonal Jindal and Chetan Mathur, Managing Partners of the company elaborate on their operations and future plans."

After a successful four decades experience in the home furnishing segment, Medusa Source ventured into the fashion apparel business. The company supplies garments to some of the top brands of North America, Europe, Latin America, Middle East, Asia Pacific and Australia. It follows the best modern supply side practices with added refinements based on its experience in the segment. Medusa constantly innovates to reduce costs that help in making the clients more competitive in the market. Sonal Jindal and Chetan Mathur, Managing Partners of the company elaborate on their operations and future plans.

After a successful four decades experience in the home furnishing segment, Medusa Source ventured into the fashion apparel business. The company supplies garments to some of the top brands of North America, Europe, Latin America, Middle East, Asia Pacific and Australia. It follows the best modern supply side practices with added refinements based on its experience in the segment. Medusa constantly innovates to reduce costs that help in making the clients more competitive in the market. Sonal Jindal and Chetan Mathur, Managing Partners of the company elaborate on their operations and future plans.

Highlight your company’s operations and achievements over the years.

A supply chain management company, Medusa Source provides product-sourcing solutions to brands, retailers, labels and wholesalers worldwide. Our work includes identifying and evaluating factories, design and development assistance, production follow-ups, stringent quality control, logistics and shipping consolidations. We have a wide network comprising 150 suppliers and manufacturers across India, Nepal and Sri Lanka.

What is the vision behind the company?

We have been involved with product sourcing for over four decades. However, our method of functioning has transformed over years as we have adopted new methods of doing business to suit client’s interests.

business to suit client’s interests.

What has been your experience so far?

A production-oriented business faces new challenges every day. However, these challenges teach a manufacturer to deal with people in changing demographics, different working conditions, and different cultures. So far, our journey has been extremely rewarding and we plan to elevate our business to new highs in future.

Which services and solutions do you provide to your partner brands?

We are involved in complete supply chain management cycle. From identifying the right vendor, factory audits and compliance checks, assisting product development, order follow-ups, quality control to shipping consolidations, we provide complete sourcing solutions.

Who are the people responsible for growth and journey of your company?

Our Managing Partners, Sonal and Chetan navigate the ship. They are ably supported by a young and enterprising team of designers, merchandisers, quality controllers, audit and compliance managers, IT, admin & HR. Each member of the team is committed to his or her job responsibilities and understands the importance of delivering quality and efficiency. Some team members have been with us for over 20 years, and have contributed immensely to the company’s growth. They are trained to handle delicate situations especially ground level production issues and response time to the clients, etc.

What are the new opportunities in this segment?

India is seen as a major production hub for value-added garments and accessories. However, we are capable of delivering much more than this. With adequate access to raw materials, and investments in machinery and technology, our manufacturers can produce high quality and fashionable products at similar or better quality levels than Western countries.

What challenges do you face as a supply chain management company? Fluctuating currencies, rising labor and material costs, increasing competition, lack of skilled labor, political changes, complicated and high tax structure, traceability and accountability in the production cycle and lack of infrastructure are some of the challenged we currently face.

Which is the most scalable segment for you? Who are your competitors?

Amongst all categories that we currently handle, Ready-to-Wear (RTW) garment is the most scalable product segment. Our competitors are large sourcing and supply chain management companies. However, we consider them more as peers rather than competitors and look up to them to achieve the same level of technological advancements that they have achieved. We are also investing in IT-driven tools to make our processes more sustainable, improve our performance levels and be a leader in the industry.

What is your take on the global and domestic apparel and fashion market?

The emergence of e-commerce companies and penetration of fast fashion product lines have changed the whole ball game for both global and domestic apparel and fashion makers. Changing trends, looks, themes and fashion are giving established brands a run for their money. Consumers can buys outfits similar to those offered by high-end luxury brands at a fraction of price. This has pushed manufacturers and sellers to focus on price-driven product lines rather than only quality driven.

What are your future plans?

We plan to increase RTW exports to the European and American markets in the next two years.

The world's sixth-largest economy, India also has the world’s youngest population. According to India Brand Equity Foundation, this will boost consumer expenditure in the country to $3.6 trillion by next year as emerging new technologies is changing the overall shopping experiences.

The world's sixth-largest economy, India also has the world’s youngest population. According to India Brand Equity Foundation, this will boost consumer expenditure in the country to $3.6 trillion by next year as emerging new technologies is changing the overall shopping experiences.

As Prasad Shejale, Founder and CEO, Logicserve Digital says, personalization, ultra-convenience, social commerce-marketing products via inspirational blogs, celebrity engagement posts, etc, and smart mirrors equipped with AI and VR will be the four leading trends to rule the industry in 2020.

Unified and API-driven commerce, visual search to rule

The traditional retail industry will observe massive changes in coming years as stores will function more like websites, while websites will function more like stores. Other trends to rule the industry are: unified API-driven commerce architecture, the direct-to-consumer approach and visual search.

websites will function more like stores. Other trends to rule the industry are: unified API-driven commerce architecture, the direct-to-consumer approach and visual search.

Shorter lead times will be another trend to gain importance as customers will emphasise on same day delivery of products. Kalpataru Retail is trying to keep pace with this drastic change by studying the changing trends in-depth and strategising accordingly. The company advises marketers to ensure that these trends are on-par with the technologies available in the market.

Disruptive strategies to help maintain market relevancy

On the other hand, Makani Creative advises retailers to create disruptive strategies that will help them stay relevant in this e-commerce driven age. The company says, listing of Big Bazaar on Amazon India will open new avenues for retail marketers, and provide shoppers more agility and efficiency from the retailers. This partnership will also provide retail stores new horizons across the country and enhance the overall buying experience for the shoppers.

As change is the only constant, retailers need to adapt to changing trends by innovating their retail experiences. Only then can they expect to thrive in a competitive market.

Consumers are continuing to show strong interest in athleisure. Searches for active wear are up 59 per cent. Demand for leggings was consistently high whole of last year and has seen an additional 15 per cent rise since the first week of January. Following the shape wear renaissance, leggings and workout bottoms that sculpt have become a favorite among the fashion set.

Searches including key terms like shaping, lift and sculpting are up 392 per cent collectively over the last three months and waist-contouring/sculpting leggings have all significantly increased in page views heading into this year. Also strong are super-high-waisted leggings with searches up 65 per cent and at an all-time high.

There’s growing interest in one-piece workout-wear. Demand for leotards and unitards rose 83 per cent last year and surged another 21 per cent in 2020. Sports unitards are having a moment with brands such as Adidas benefiting, while plain black is the favorite color. Eco-conscious active wear is in demand. Words like sustainable and recycled are increasingly being used in searches for sneakers. Also, search for specific sustainable materials commonly used in active wear have risen as well.

Curve will be held in the Los Angeles area from February 23 to 24, 2020. This is a lingerie, swimwear and loungewear trade show focusing on the autumn/winter 2020–2021 season as well as the spring/summer 2020 season. About 50 vendors will exhibit. The show will be organized around a salon-showroom experience, which will feature an open-booth format, show activations, as well as free food and beverages. Workshops on intimates and swimwear also will be held. There will be seminars on social media, merchandising, bra fitting, as well as employee relations and operating a business. Curve also will produce networking events as well as matchmaking events between vendors and buyers. The show taps into the epicenter of celebrity-driven fashion trends, a substantial and growing segment of the US market. Stylists, influencers and entertainment media will have a front-row seat to the intimates and swimwear trends that will be seen on celebrities throughout the coming year.

Curve is owned by Eurovet, a French trade show producer that runs trade shows. Eurovet is the global industry leader in bringing together brands, buyers, mills, suppliers, distributors, the media and all facets of the intimate apparel, swimwear and performance wear industries for its signature Curve and Interfilière events. The company is exploring the possibility of a show in Canada.

A footwear and leather fair will be held in Sri Lanka, February 7 to 9, 2020. The aim is to promote the country’s leather goods to international businesses, including the Indian market. The trade show intends to present the country as an ideal sourcing destination due to its strategic location, skilled workforce, well developed infrastructure, and ethical compliance record. The trade show will feature a wide range of product categories including footwear, leather accessories, travel goods, components and accessories, machinery, raw materials, and other related services. The show will exhibit only finished goods made in Sri Lanka but international businesses can showcase raw materials, machinery, and components. Along with stalls to showcase products and brands, the event will also feature a designer award ceremony, fashion show, and best stall competition.

The industry hopes to attract large-scale orders by reducing lead times with locally-sourced fabrics instead of importing fabrics. Although Sri Lanka has faster shipping times to the US and EU markets, due to its strategic location, apparel exporters are unable to capitalise on this as the country has to import fabrics from overseas, which contributes to a significant increase of lead time. With locally-sourced fabrics, exporters can target much bigger orders and will also be saving a lot of foreign exchange spent on fabrics as the local value addition increases.