FW

"Man-made fibre and synthetic yarn would be levied 18 per cent tax under GST regime while the fabric only 5 per cent. Industry experts feel that keeping the rates of key inputs at a higher level will negatively the competitiveness of small and medium synthetic textile manufacturers. Stating the same as concern of inverted duty structure problem, Confederation of Indian Textile Industry (CITI) chairman J Thulasidharan, recently said that the textile sector is suffering from various disadvantages like high energy costs and infrastructure bottlenecks."

Man-made fibre and synthetic yarn would be levied 18 per cent tax under GST regime while the fabric only 5 per cent. Industry experts feel that keeping the rates of key inputs at a higher level will negatively the competitiveness of small and medium synthetic textile manufacturers. Stating the same as concern of inverted duty structure problem, Confederation of Indian Textile Industry (CITI) chairman J Thulasidharan, recently said that the textile sector is suffering from various disadvantages like high energy costs and infrastructure bottlenecks. This announcement would further dent the growth of the industry.

According to him, India is already suffering a huge competitive disadvantage in the global textile market as the MMF based textile products are attracting higher rates of import duty. Keeping the GST rates at this rate will undoubtedly cripple hundreds of small and medium synthetic textile manufacturers. He further emphasizes and asked the government to reconsider the rates of MMF products and bring it at 12 per cent. He also pointed out that the high rates announced for MMF fabric and yarn, dyeing and printing units, embroidery items at 18 per cent can lead to an increase in input costs and can adversely affect the entire textile value chain.

Different viewpoints

Giving a different perspective, Synthetic and Rayon Textile Export Promotion Council (SRTEPC) chairman Narain Aggarwal that keeping the GST of 5 per cent on fabrics is quite favourable for the industry. The GST of 18 per cent on synthetic fibre is again not a bad news, because the tax rate is same as it was earlier. Meanwhile, The Southern India Mills’ Association (SIMA) and CITI have appealed to the government to exempt the textile jobs from service tax as it would benefit the predominantly decentralised and MSME nature of the industry, especially the powerloom, knitting, processing and garmenting sectors.

Shares of G-III Apparel Group jumped 15.2 percent, to 28 per cent for the quarter ended April 30, sales climbed 15.6 percent to $529.0 million.The net loss came to $10.4 million, or 21 cents per share, compared to net income of $2.8 million, or 6 cents, in the prior year’s comparable period. The latest quarter included $2.5 million, or 3 cents a share, in charges tied to professional fees, severance and one-time debt costs tied to its acquisition of Donna Karen International.

The clothing manufacturer and distributor swung to a loss of 18 per cent per share from a prior-year profit of 6 per cent a share, better than expectations for a 37-cent per-share loss. Revenue rose 16 per cent to $529 million as compared to forecasts for $500 million.

Excluding charges related to the acquisition of Donna Karan, the company had a loss of 18 cents a share, compared with a Fact set consensus for a loss per share of 40 cents. According to the company the Donna Karan business has reached an inflection point and is expected to turn profitable in the second half. Chief Executive Morris Goldfarb commented that the company is reducing operating costs in retail business, closing and repurposing stores and enhancing the store product offerings, overall helping the company and reducing the losses in the retail operations. The company stated it now expects full-year sales of about $2.76 billion and adjusted EPS of $1.20 to $1.30. The Fact Set consensus is for full-year EPS of $1.01 and sales of $2.72 billion. Shares have fallen 32 per cent in 2017 through Monday, while the S&P 500SPX, -0.28 per cent has gained 9 per cent.

DuPont Protection Solutions developed Tychem 2000 SFR a new chemical protective clothing to help safeguard men and women from chemical hazards that can and can’t be seen, such as dangerous vapors, liquids, and particles.

The company has designed the brand to reduce worker chemical exposure while performing their jobs. Plus, the company is helping to make the hazardous work a less hazardous to the worker. David Domnisch, global marketing manager for Tyvek Protective Apparel says that this is first of several new protective apparel solutions that Tyvek and Tychem product range will be launched during 2017 and the company will be celebrating 50th anniversary of Tyvek pay tribute to the past but to focus on the future.

Tychem 2000 SFR provides an effective barrier against a range of inorganic acids and bases, plus industrial cleaning chemicals, as well as particles. In the event of a flash fire, Tychem2000 SFR garments will not ignite, and therefore do not contribute to additional burn injury if the wearer uses appropriate flame-resistant (FR) personal protective equipment (PPE). If a fire hazard exists, Tychem 2000 SFR garments must be worn over an appropriate FR garment, along with other PPE that protects workers' faces, hands and feet. Tychem 2000 features a respirator fit hood with DuPont ProShield 6 SFR fabric lining; chin flap with double-sided adhesive tape etc.

Talking about the protective apparel for industrial workers, it is among the first commercial applications for Tyvek®, a unique nonwoven material that has provided protection, security and safety in a wide variety of industries and applications.

Established in 1967 DuPont Protection Solutions is a global leader in products and solutions that protect what matters people, structures and the environment. The DuPont approach to solving global challenges is rooted in the science and engineering expertise.

Canada’s apparel retailers continue to grapple with a rapidly changing retail environment like fast fashion rivals and e-commerce. Reitmans will close 40 stores this year and Le Chateau will close 18. In 2016 Reitmans shuttered 104 stores, including the entire Smart Set chain (29 locations) and 42 Reitmans stores.

Le Château, meanwhile, is struggling with debt coming due in early June. Material uncertainties may cast doubt on the ability of the company to continue as a going concern.

Signs of progress at Le Chateau in 2016 included a slight increase in comparable store sales and an increase in online sales of 43.6 per cent.

Zara, H&M and Forever 21 have created a new league of competition, and new retailers continue to enter the market including Quebec-based Simon’s and Japan’s Uniqlo.

One challenge is that mall traffic is down at all but the biggest shopping centers. People go to the mall with a single item in mind, go to the store where they know they can buy it, buy the item they need and leave the mall.

Reitman is focused on making the remaining stores more inviting to customers. This year Reitmans will open seven stores and renovate 34. It is looking at ways to expand the wholesale business internationally in plus-size apparel.

There are already signs of improvement. Same store sales increased 7.6 per cent and sales were up 1.6 per cent despite a net reduction of 90 stores over the year. E-commerce sales increased 50.7 per cent.

Textile engineering industry, which contains of more than 2,800 units has shown a steady increase in the last five years.

According to R. Rajendran, president of Textile Machinery Manufacturers’ Association, all the spinning machinery manufacturers have a base in India and China now and these countries have slowly becoming a manufacturing hub for textile machinery.

S. Chakraborty, advisor of Textile Machinery Manufacturers’ Association, stated that the exports increased from Rs 1,523 crore in FY12 to Rs 2,466 crore in FY15.

Talking about the present scope for exports Rajendran commented that India is a major manufacturer of spinning and processing machinery and over here a huge amount of looms, knitting and garmenting machinery are imported by the textile industry.

Textile machinery like tools, accessories, garmenting, machinery and autoconersimports were Rs 7,643 crore in 2011-2012 and Rs 10,305 crore in 2015-2016.

This economic slowdown had affected investments by the domestic textile industry, investments continue in select pockets. Some States have come out with State-specific textile policies. Industries that focus on value addition, expansion, modernisation and replacements are driving investments in the domestic market. A lot of emphasis is given to the development of machinery for weaving and processing sector by the Union Government. It has supported loom development projects on public-private partnership mode and also cleared a project to set up a common engineering facility centre. As per Chakraborty, huge affection in investments are due to reduction in allocation of funds for Technology Upgradation Fund Scheme and backlog in payment of subsidies in the past.

Manmade fiber and synthetic yarn would have an inverted duty structure problem as they would be levied Goods and Services Tax (GST) at 18 per cent. The industry feels keeping the rates of key inputs at a higher level will affect the competitiveness of small and medium synthetic textile manufacturers.

The opinion is that India is already suffering a huge competitive disadvantage in the global textile market as the manmade fiber based textile products are attracting higher rates of import duty. Keeping the GST rates at this level would cripple the hundreds of small and medium synthetic textile manufacturers.

These manufacturers say the rates of manmade fiber products should be brought down to 12 per cent.

There is apprehension that the high rates announced for manmade fabrics and yarns, dyeing and printing units, embroidery items at 18 per cent can lead to an increase in input costs and can adversely affect the entire textile value chain.

The GST of five per cent on fabrics is thought to be quite favorable for the industry.

Mills in southern India say textile jobs should be exempt from service tax as this would benefit the predominantly decentralized and medium and small scale power loom, knitting, processing and garmenting sectors.

Muhammad Amjad Khawaja vice chairman Pakistan Hosiery Manufacturers and Exporters Association (North Zone) in a press conference stated that the textile sector has been forced to come on the road as the government has failed to fulfil its commitments and resolve the issues confronted by this sector.

According to Amjad Khawaja textile export is main stay of the national economy. Its share in total export is around 60 per cent but unluckily it is facing a steep decline only due to the ill-conceived policies of the government and there should be immediate release of Rs 180 billion with a withdrawal of Gas Infrastructure Development and Fuel Surcharge. He also added that along with leading textile exporters had repeated meetings with concerned government sectors and apprised them of the issues faced by the textile exporters.

He strongly criticized the step-motherly treatment with this foreign exchange earning sector of the country and cautioned that they are now not ready to take their begging bowl to anyone. This had led them to take a decision on coming to road along with their workers if government failed to fulfil its commitments. The protest will take place immediately after ramzan.

He wishes to have a real assurance from the government side because for a longer period government as yet not given any assurance to release funds under textile package in addition to the payment of refund claims.

Further he stated that they are ready to negotiate and resolve the issues provided if the government shows a positive attitude. Rizwan Ashraf - FCCI says that already issued RPOs were cancelled last month which is an indicative of the non-seriousness of the They also want that federal budget and government must approve the relief on the foreign exchange earning sector of textile.

The water footprint of synthetic fibers is way lower than that of cotton, wool or viscose products.

Some companies in the manmade fiber industry are fully committed to the constant monitoring and control of water resource consumption in their various processes, as well as bringing to the market yarn dyed by the solution dyeing process, which requires less water and energy compared to traditional yarn dyeing or piece dyeing.

In solution dyeing, the color is added upstream in the extrusion phase, and is thus incorporated into the polymer matrix. In this way, the environmental sustainability of the products offered to customers is enhanced during production. This production chain can really be made sustainable through cooperation among all the players involved.

Solution dyed yarns have a lower environmental impact than traditional yarn dyed yarns. Solution dyed yarns offer a number of further advantages, which include color and additives incorporated into the fiber, high light color fastness, high color consistency, and lower oligomer release.

Together with some of their customers in the polyester fiber area, these companies have projects in progress that reflect their determination to be an environmentally aware player in the production value chain: solution-dyed yarns manufactured from recycled polymer combining technical and environmental performance.

Amir Fayyaz Sheikh Chairman All Pakistan Textile Mills Association (APTMA), at the time of the press conference stated that textile industry contributed 60 per cent in total exports of the country, which was considered backbone of the economy.

He welcomed Rs 180 billion “Export enhancement package” stating that this package would give huge relief to the textile sector for improving the exports in the sector.

According to him availability of energy at regionally competitive price was important and that budget for the 2017-18, Rs 4 billion will be allocated for “Export enhancement package”.

The Chairman APTMA stressed for the implementation of this package which also gave relaxation on the import of textile machinery for the modernization and enhance the capacity of the sector. The package would strengthen the country’s economy by increasing the country’s exports and that the that energy is the important element of cost of production particularly for spinning, weaving and processing industry, says Amir and he wishes to compete with regional competitors including India, Bangladesh and Vietnam for improving the country’s exports.The Chairman APTMA urged for proving ease of doing business in the country.

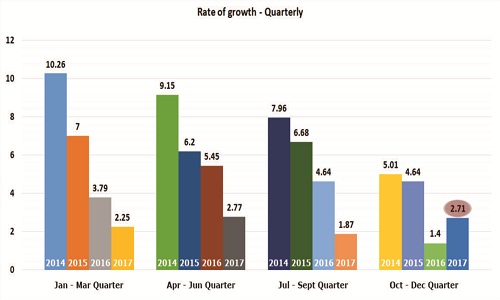

CMAI’s Apparel Index for Q3 (Oct-Dec FY 2017-18) gives out positive signals about the market as there is a clear growth recovery at 2.71 points, which is much higher than the same quarter previous year Q3 (Oct-Dec FY 2016-17) with overall Index Value at 1.4 points, market had registered the lowest growth, in the quarter that faced the implementation of demonitisation.

Giant Brands remain resilient

One year post-demonization and a few months after GST’s implementation, despite the push and pulls, Giant Brands have remained resilient and buoyant. In Q3, they maintained their lead with an index value of 11.25 points, growing multiple times compared to other brand groups. Large Brands on the other grew at 5.56 points; Mid Brands clocked in 3.69 points growth; while Small Brands grew least at 1.3 points. Compared to previous quarters, Giant Brands are growing much faster than others, as their rate of growth in the previous quarter was 8.72 points. Large Brands growth rate was 6.65; and 1.25 points for Mid and 0.29 for Small Brands respectively.

Indeed, all brand groups across the board have recorded higher growth this quarter. Except, Large Brands (growth dropped this quarter to 5.56 from 6.65 earlier). Surprisingly, Large Brands grew 7.23 points in the same quarter previous year. A closer look at Large Brands’ performance during Q3 and Q2 of FY 2017-18, reflects in both these quarters, Sales Turnover growth is same but Sell Through grew better in previous quarter compared to this quarter; Inventory Holding too increased this quarter compared to previous quarter impacting negatively. Giant Brand’s remarkable growth improvement is on account of better Sales Turnover growth compared to previous quarter and better Sell Through growth.

Q3 Apparel Index once again indicates Giant Brands have outdone Large, Mid and Small Brands. Being more organized and networked with organized retail through MBOs, EBOs and Large Format Stores Giant and Large Brands managed their business and sales turnover better. Moreover, they increased sales turnovers significantly at 8.0 points and 4.4 points respectively.

Inside Story: Sales Turnover rise and so do fresh Investments

In Q3, Sales Turnover reflected an Index growth of 1.52. Nearly, 49 per cent brands or almost half reported an increase this quarter. However, it seems, the festive season didn’t bring much cheer to all brands, as many reported a dip in sales turnover. And a significant 30 per cent reported a loss this quarter. Incidentally, maximum number of respondents who reported a loss in sales turnover were in the Mid Brands bracket. In fact, no Giant Brands indicated a loss in turnover in Q3.

Explaining the dip in sales turnover, Narendra Shah, Proprietor, Vogartino says “The dip in sales turnover is partly due to us changing location and majorly due to the pattern of business followed by corporate brands. End of season sale hit not only us as a brand but also MBO’s, small industries and manufacturers. Big corporate brands gave away goods at throwaway prices which has had a great impact on our business hence, the dip in sales turnover.” Nearly 45 per cent brands indicated an improvement in Sell Through. But for the other 44 per cent, Sell Through remained the same “The increase in sell through is connected, if sales turnover increases automatically sell through will increase as sales have been managed well,” explains Sameer Patel, Proprietor, Deal Jeans.

Almost 46 per cent respondents across all brand groups said their Inventory Holding went up this quarter. Patel opines, “Inventory holding increased as fashion is fast changing and the inventory is managed and controlled well at our end.” The higher value in Inventory Holding indicates a negative impact. The increase in inventory could be a carryover of inventory from previous quarters and less than expected sales during the festive season. Rajesh Giani, Proprietor, Toffy House points out, “Last quarter was for winter wear, hence, demand was good and stocks were stored for winter. We had some previous stocks and with late production of fresh stocks, we were able to meet demand. This is why inventory holding went up.”

Fresh Investments went up by 1.30 points overall with nearly 59 per cent respondents reporting a rise in investments. As Seema Mehta, Proprietor, Exile explains, “The reason behind an increase in investment is a government scheme which helped us with a bank loan to enhance business. We opted for it and infused money to increase our investments.” Agrees Ketan, Owner, Goof who goes on to explain “We increased our investments by opting for a bank loan to widen our horizons.”

As for outlook for the next quarter around 48 per cent brands say it is ‘Average’, while 38 per cent believe the outlook is ‘Good’. Generally, Q4 of the financial year, is seen as quarter that has EOSS in January and only a small period of fresh and growth in sales that is second half of March when exams are over and holidays start and summer season picks up. Looking for fresh goods, post first quarter of GST, consumers too are expected to return to stores. GST and new processes would be settled especially by last quarter of this financial year and this could augur well for growth in Q1 of FY 2018-19.

CMAl's Apparel Index

CMAl's Apparel Index aims to set a benchmark for the entire domestic apparel industry and helps brands in taking informed business decisions. For investors, industry players, stakeholders and policymakers the index is a useful tool offering concrete and credible information, and is an excellent source for assessing the performance of the industry. The Index is analysed on assessing the performance on four parameters: Sales Turnover, Sell Through (percentage of fresh stocks sold), number of days of Inventory Holding and Investments (signifying future confidence) in brand development and brand building. The Apparel Index research is conducted by DFU Publications.