FW

"CMAI’s Apparel Index for Q2 July-Sept FY 2016-17 indicates the industry has recorded moderate growth with overall Index Value at 4.64 points compared to previous quarter (April-June FY 2016-17) when the overall Index Value was 5.45 points. However, in the same quarter last year, the Index Value had touched 6.68 points."

CMAI’s Apparel Index for Q2 July-Sept FY 2016-17 indicates the industry has recorded moderate growth with overall Index Value at 4.64 points compared to previous quarter (April-June FY 2016-17) when the overall Index Value was 5.45 points. However, in the same quarter last year, the Index Value had touched 6.68 points.

Large and Giant Brands, maintained their growth trajectory in Q2, which is still much higher than Small and Mid brands. Interestingly, unlike previous quarters, Large Brands fared better than Giant Brands in Q2. In fact, growth this quarter for Large Brands at 7.16 points is higher than last quarter’s 6.72 points but lower than the same quarter (8.95 points) previous year. The trend is different for Giant, Mid and Small Brands, as they performed much better last quarter compared to this quarter.

The overall Index value being restricted to 4.64 points, is mainly due to restricted increase in Sales Turnover (3.44 points compared to 3.92 points in the previous quarter), Sell Through (1.31 points over 1.69 points in the previous quarter) and Investments (1.42 points compared to 1.56 points in the previous quarter) relatively. However, Inventory Holding this quarter at 1.53 is better than 1.72 points of previous quarter. It may be noted that the lower value in inventory holding helps in the growth of index value.

Q2 Apparel Index growth slower that last quarter

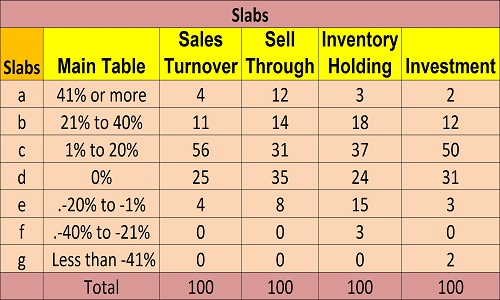

CMAl's Q2 Apparel Index for the July-Sept (FY 2016-17) clocked in 4.64 points growth. This is approximately 32.19 per cent higher than the index for Small Brands (with turnovers of Rs 10 to 25 crores) which stood at 3.51 points. For Mid Brands (turnover of Rs 25-100 crores), growth is 5.35 points. They have performed much better than Small Brands. However, it’s the Large Brands that have led the growth story this quarter with 7.16 points that has grown the most, even higher than Giant Brands with an index value of 6.44 points. In fact, Large and Giant Brands have consistently being doing well. Notably, index value for Large Brands is 54.31 per cent higher than the Overall Index value.

The Index once again shows Large and Giant Brands are consistently doing better compared to Mid and Small ones. Small Brands have grown the least since positive attributes like Sales Turnover, Sell Through and Investments are dragging down growth and not contributing enough. However, overall Inventory Holding at 1.27 against 1.53 is better this quareter. Both Small and Large Brands have shown lower inventory holding than overall index. The index pattern like earlier quarters continues the trend, as size of the brands goes up from Small to Mid and from Mid to Large, but difference this time is it comes down from Large Brands to Giant Brands. Giant Brands at 6.44, have not performed as good as Large Brands at 7.16. Much higher Inventory Holding in case of Giant Brands at 3.44 against 1.41 for Large Brands, as well as lower growth in Investments in Giant Brands at 1.25 points comparing to 2.38 points for Large, are the two reasons for Giant Brands’ relative lower index value, in spite of having highest growth in Sales Turnover (6.00 points) and in Sell Through (2.63).

Large Brands fare better

What has worked in favour of Large Brands this quarter, having the highest index of 7.16 points that is 54.31 per cent higher than the Overall Index value, is mainly lower Inventory Holding at 1.41 and the highest Investments at 2.38 across all groups of different size of brands.

Generally, Q2 is known for EOSS period in the month of July, that boosts Sales Turnover but the next two months of August and Sept being pre-festive season months generally sales are not high. Higher Inventory Holding period specially in case of Giant Brands perhaps indicates that Giant Brands have been building inventories just before the festive seasons to achieve peak in sales on the back of buoyancy in spend by consumer during festive, winter and wedding seasons across the country.

Treading the tight rope between Sales Turnover, Inventory Holding

The correlation between Sales Turnover and Inventory Holding explains the difference in index value of different brand groups. A close look at Sales Turnover and Inventory Holding reveals that a cautious and tight control over inventories has an impact on the growth of sales turnover and hence the reason for index value not growing as much.

As the industry moves its learning curve over time, cautious inventories are restricting growth in general. As Rajeev Nair, CEO, Celio points out, “At Celio, we have kept a tight control on inventory over the last two years, we have seen progressive improvement in; End of Season’ inventory. We also work on progressive markdowns on slow movers so that season end inventory is limited. We have also started the practice of pilot stores where we test market new products as all fashion products don’t necessarily behave as we predict. Once successful, we roll across all stores. This increases our sell through rate.”

At the same time, especially indicated by few Giant Brands which have more focus on sales growth to tap opportunities during festive season, have been building higher inventories and infusing more Investments. Anant Daga, CEO, W and Aurelia says they increased investments as they saw an increase in Sales Turnover and improved Sell Through in the quarter, “Our brands W and Aurelia are expanding, products are being received well in the market and we are seeing good sale growth.”

For a winter focus products like thermals that have a narrow period of sales, inventory building is important, as Vinod Kumar Gupta, Managing Director, Dollar Industries, points out, “Some of our products i.e. thermals are seasonal in nature and production has done in the month of July and August. So, taking this into consideration our inventory is higher. But, since these products are seasonal in nature, it will be sold in the winter months. Which will lower our inventory and the closing stock will go down.” For Turtle on the other hand, the emphasis is on Sales Turnover keeping a close check on supply chain, Narendrra Parekh, Marketing Head, Turtle says, “We checked our supply chain management, keeping good fit and quality our major focus on products and refillment (replenishment) and last but not the least focus on marketing activities 360 degrees” have been the reasons for good performance.

Looking ahead to positive Q3

Around 65 per cent brands compared to 61 per cent in previous quarter feel the outlook for next quarter is ‘Good’, surely, a significant jump in outlook expectations. Another 17 per cent (previous quarter 19) brands say their outlook is ‘Excellent’ for the next quarter. Nearly 18 per cent, (same as last quarter), foresee an average outlook and no one feels (previous quarter 2) that it will be ‘Below Average’. Sept-Dec being a quarter for EOSS and the festive season, with Diwali falling in this period, may improve market sentiment, feel many brands, with a strong optimism. CMAl's Apparel Index CMAl's Apparel Index aims to set a benchmark for the entire domestic apparel industry and helps brands in taking informed business decisions. For investors, industry players, stakeholders and policymakers the index is a useful tool offering concrete and credible information, and is an excellent source for assessing the performance of the industry. The Index is analysed on assessing the performance on four parameters: Sales Turnover, Sell Through (percentage of fresh stocks sold), number of days of Inventory Holding and Investments (signifying future confidence) in brand development and brand building.

"The recently held 75th Plenary Meeting of International Cotton Advisory Committee (ICAC) in Islamabad, Pakistan, from October 30 to November 4, 2016 put the spotlight on key issues faced by the cotton fibre. The meeting was attended by 378 persons, including representatives from 14 members, four international organisations and four nonmember countries."

The recently held 75th Plenary Meeting of International Cotton Advisory Committee (ICAC) in Islamabad, Pakistan, from October 30 to November 4, 2016 put the spotlight on key issues faced by the cotton fibre. The meeting was attended by 378 persons, including representatives from 14 members, four international organisations and four nonmember countries.

Cotton demand exceeds production for the second consecutive year. The Secretariat reported that cotton output in 2015-16 fell due to pest attacks, competitive prices from other crops, climate change, etc., resulting in the reduction in world stocks. Although inventories are still higher than usual, the excess has started to be trimmed. Cotton continues to be challenged with an extremely competitive environment.

Polyester posing a threat

Polyester fibre is causing the biggest trouble for cotton. Presentations made during the session on inter-fiber competition highlighted the increasing share of the world fibre market occupied by polyester. The results showed that polyester had made considerable gains in the market for downstream products, such as yarn, filament, staple and apparel. This trend is witnessed due to cheaper polyester prices caused by current oil prices and underutilised industrial capacity in the polyester industry.

The committee highlighted three challenges faced by the textile industry viz., water, energy and the need for creative new ideas. The cotton industry needs to use less water, by concentrating on reducing energy consumption in cotton gins and transportation, and by creating and applying new ideas, especially for increasing efficiency and reducing costs. One example would be to use High Volume Instrument cotton classing systems throughout the industry to replace the ancient practice of visual classing.

Costs of cotton production

The world average net cost of production (excluding land cost) of cotton lint was $1.16/kg in 2015-16. Reducing the water footprint of cotton and increasing farmers’ income go hand in hand. Growth in demand for water, climate change and increasing population are putting ever more pressure on the use of water in agriculture in general and in cotton cultivation, in particular. Presentations were made by researchers on topics such as application of critical assessments of the performance of irrigation systems; reduction of conveyance losses; implementation of precision agriculture; deficit irrigation; use of irrigation scheduling models; maximisation of yield per unit of water used; innovative methods of irrigation, such as short furrows and laser leveling of furrows; and breeding for high-yielding drought-resistant varieties through conventional breeding and genetic engineering. Practical examples showed that the water footprint of cotton can be significantly reduced, while improving the incomes to the farmers.

Bt cotton changes the textile industry

Cultivation of Bt cotton has changed the pest complex in many countries, so changes in pest control methods are required. Bt cotton benefitted farmers by reducing the need for insecticide sprays and positively impacted yields without raising the cost of fertilisers and agronomic operations. Pink bollworm in some countries has developed resistance to the earlier insect-resistant biotech technologies. They caused huge losses in yield in India and Pakistan during 2015, demanding a reversion to traditional varieties of cotton and traditional methods of insect control in some countries. Although the situation improved in the current season, pests still require vigilance. The dusky cotton bug and the cotton mealybug have also emerged as major pests; the whitefly and leaf curl virus is becoming greater concern. Biotech cotton resistant to the whitefly is at advanced stages of development. When commercialised, these new varieties will bring a big relief to growers. Experts reported similar progress on transgenic cotton resistant to the leaf curl disease.

Focused cotton policies the way ahead

Presentations on public policy for the cotton sector emphasised that cotton faces great threat from Man Made fibers, especially polyester. Cotton producers must innovate, adopt and implement cutting edge technologies that improve productivity at lower costs to stay ahead of the curve. Government policies should focus on allowing prices to fluctuate with market forces, increasing funding for agricultural research, and implementing science based regulations that allow technology development and adoption.

The next plenary session will be held in Uzbekistan during October 2017 on the theme ‘Opportunities and Challenges for Technology Transfer in Cotton’.

The European Union (EU) is planning to enter into a five-year strategic partnership with Pakistan as the current relationship between the two has reached a mature level. The textile industry in Pakistan contributes 8.5 per cent to GDP and 60 per cent to exports while employing 38 per cent of the workforce. The EU has provided Pakistan GSP Plus status.

Pakistan wants brand owners of textiles from the EU to divert the bulk of their buying from Pakistan since it is well placed for the production and supply of high quality textile goods at attractive prices. Fighting poverty and helping the country on its path towards inclusive and sustainable growth are the aims of EU support to Pakistan. The EU considers that such goals will only be achieved by increasing political stability, improving the rule of law, bringing about human and social development, creating productive and decent work opportunities and diversifying the economy.

Although the EU is regarded a strong economic player it is still seen as a weak political power. The EU intends to change that view by using its position as a development and aid donor as its main strategy to foster democracy and strengthen Pakistan’s institution-building.

Some PET plants in China have curtailed production or lifted maintenance schedules ahead of time. Trading levels increased six to seven per cent compared with the previous low level. PET resin losses enlarged on soaring polyester feedstock. Till November 10, polyester feedstock cost was calculated at 6230.8 yuan a meter, but actual cost is supposed to be higher considering IPA and road transportation fees.

In all, PET bottle chip rigid demand remains supportive, indicating a healthy fundamental. Recent strength in the commodity market has boosted market sentiment. The PET bottle chip market may shortly retain a stable-to-strong tone. Players could eye an year-end plant operating status as well as sustainability of pre-holiday refilling activities.

PET resin demand has seen a gradual improvement since end October as the beverage turnaround season came to an end. Downstream purchasing volume has lifted from a tentative one week to half-to-one month or plus. This heralds a pre-year-end holiday refilling intention on the one side, while on the other, players are concerned over the overheating polyester feedstock cost. Some plants also purchased via diverse suppliers to spread risks.

PTA futures for January deliveries climbed to the limit. PET bottle chip factory stock stands low.

Pakistan’s trade deficit has surged to $7 billion during the first quarter of the current fiscal year. This is principally due to a decline in exports. Many manufacturing facilities in the textile industry have shut down. Policy measures decided for export-led growth include the elimination of customs duty on cotton from January 1, 2017; duty free import of raw materials like manmade fiber not manufactured domestically; graduating drawbacks of local taxes on yarn, greig fabric, processed fabric, home textiles, made-ups and garments; extension of long-term finance facility to indirect exports; input tax adjustment on packing materials; new gas connections for captive and process use; multi-year tariff for industry without incidence of surcharge for provision of electricity at a regionally competitive rate.

These measures are expected to remove the bottlenecks in operation of the textile industry. Providing an enabling environment would remove the hindrances presently impeding proper industry performance and have brought about a decline in exports.

The global textile market operates on very low margins due to its fiercely competitive character. Countries that have prospered by export-led growth include Germany, Japan, China, South Korea, Malaysia, Bangladesh and Vietnam. Pakistan’s export industry contributes heavily to GDP, foreign exchange earnings and employment.

Novibra is leading company in spindle technology and the biggest exporter of spindles worldwide will be among the exhibitors at the upcoming ITME in Mumbai. Spindles in modern ring spinning machines reach speeds of up to 25,000 rpm. In these high-speed applications energy consumption is an important issue. Novibra is now introducing the new LENA (Low Energy consumption and Noise Absorption) high speed spindles. The Noise Absorbing System Assembly (NASA) ensures minimum neck bearing load, vibration and noise level at high speed. The unique wharve diameter of 17.5 mm and the footstep bearing diameter of 3 mm lead to a lower energy consumption. LENA is designed for tube lengths up to 200 to 210 mm. LENA high-speed spindles reduce the energy consumption in spinning machines.

Another new product is the clamping and cutting crown CROCOdoff, which is also available as the version CROCOdoff Forte for coarse yarns. The crown is operated by the spindle speed and has been designed for machines with auto doffer. The improved design of the teeth guarantees a reliable clamping and cutting of the yarn. In addition, the CROCOdoff reduces the risk of yarn breakage during start-up, decreases energy consumption, minimizes material loss and reduces maintenance. CROCOdoff is suitable for use with new machines as well as an upgrade for existing machines.

Groz-Beckert a leading supplier of industrial machine needles, is ready to exhibit it its products and solutions in knitting, weaving, felting, carding and sewing at the upcoming India International Textile Machinery Exhibition (ITME), to be held from December 3 to 8, in Mumbai. Groz-Beckert will focus on round and flat knitting, as well as warp and sock fabrics. The transparent exhibits – detailed replicas of real knitting machines – will provide visitors insights into the interplay of knitting machine needles and system parts. The lite speed plus needle is designed to lower machine temperature and increase service life, while reducing oil consumption and enabling energy savings in the knitting process of up to 20 per cent. There are also compound needles and warp modules.

The special application needle SAN 5 is a proven performer for working with technical textiles. The improved SAN 5.2, which meets the more demanding requirements in the area of technical textiles, boasts a unique geometry. The thread guide has been improved for both linear as well as multi-directional sewing processes by the double groove in the point. Moreover, the SAN 5.2 has an additional scarf chamfer on the left side to ensure more secure loop formation.

The Customer Portal is a continuously expanding knowledge platform that makes available comprehensive information on sewing technology and many details on sewing products from Groz-Beckert. The Ideal Needle Handling for the sewing industry involves a patented process that allows trouble-free and time-saving handling of broken and damaged sewing machine needles. Groz-Beckert also has felting and structuring needles for flat-needled and structured nonwovens.

N. Schlumberger that makes textile machinery dedicated to the processing of long fibers will show its wool spinning technologies at ITME India. The machineries on show from the France-based company include: GC40 chain gills, GN8 intersecting drawing machine, ERA 40 combing machine and the new range of worsted and semi-worsted cards.

The GC40 chain gill is a high performance drafter with speeds of up to 600 meter per minute, while offering high productivity and quality. The GC40 offers optimal textile control at high speeds and has a high cleaning system and comes with a drafting head with a light moving assembly.

The new range of worsted and semi-worsted cards is adaptable for wool between 17 and 33 µ. It incorporates a progressive process technology, while respecting the wool fibers. It comes with a hopper with a continuous flow and constant feeding density and also has an integrated suction and an input auto leveler.

The cards come with high power for removing burr and have a low inactive angle for a high material yield. The high productivity is based particularly on swift high speed. In the ERA 40 combing machine, progressive combing is achieved by a circular comb pinned over 360° and turning at a constant speed by producing tops, featuring new quality standards. It has precise and recordable adjustments, ensuring consistent high levels of cleanliness, while offering reduced operational and maintenance costs.

The ERA 40 works on a specific combing principle while being very gentle on the fibers and offers fairly high production efficiencies of more than 50 kg per hour for 21/22 µ wool. Adjustments of the nip distance and other parameters are possible from the machine screen or remote without stopping the machine.

Profits for Page Industries in the July to September quarter are expected to be up 22 per cent compared to the year-ago period. Revenue may be up 21 per cent year-on-year while EBIDTA (earnings before interest, tax, depreciation and amortisation) may grow 17 per cent. Margin may contract 100 basis points to 21 per cent in the second quarter. Page Industries is a garment manufacturer. Men’s wear/sportswear is expected to sustain revenue growth of 26 per cent and women’s wear is expected to have 21 per cent growth. Both men’s wear and women’s wear may have 17 per cent volume growth.

Operating leverage and improved mix are expected to drive EBITDA margin but higher cotton prices may impact margins year on year. Bangalore-based Page Industries is the exclusive licensee of Jockey International USA for manufacture, distribution and marketing of the Jockey brand in India, Sri Lanka, Bangladesh, Nepal and the UAE.

Page Industries commands a pan India distribution encompassing over 44,000 plus retail outlets in 1,400 cities and towns. As of June 2016 there were 285 exclusive Jockey outlets across India. Page is also the exclusive licensee of Speedo for the manufacture, marketing and distribution of the brand in India. Speedo products include swimwear, water shorts, apparel, equipment and footwear.

Italian fashion trade show White Milano will organize a series of worldwide trunk shows through some of the key international fashion capitals. One will be in Germany, November 17.

The event will present some of the trade show’s participating brands including both established Italian ones and upcoming designers, through a live modeling performance. The aim of the initiative is to show insiders what White Milano offers and how its exhibitors are always different with over 200 new entries for each edition.

Participating in White Milano’s event will be Lucio Vanotti and Stefano Mortari (clothing lines), Peter Non and Manfredi Manara (shoe brands), and sophisticated bags by Giancarlo Petriglia.

The live modeling event will host a selection of designers characterized by a more avant-garde twist and conceptual approach to fashion which better matches the German taste. The evening will also host an opening talk presenting designers who are rooted in Germany. Sharing their experiences will be two Italian designers who are based in Germany, Lulù Poletti from Melampo and Ludovica Diligu, founder of Labo.Art.

White wants to be seen as a brand - rather as merely a tradeshow - through communication projects with a cultural twist. Subsequently White will present a series of events in strategic markets, such as the Far East and North Europe, with avant-garde designers and those Italian businesses that represent the trade show’s success stories.