FW

With the daily output of masks touches over 20 million, China introduces new standards for KN95, effective from July 1, as a part of the comprehensive efforts to ensure an quality and safe supply chain as the mask goes global.

COVID-19 drove up market demand for special gear like protective wear, face masks and sanitary textiles for hospital purposes, stimulating business for the technical textile industry. The export of non-wovens from January to April amounted to $17.257 billion, up by 79.62 percent, whereas face masks up by 986.36 percent and hospital wear (protective garment) up by 565.6 percent.

China Nonwovens & Industrial Textiles Association (CNITA) reported in the non-woven sector, the first four months of the year not only saw a 254.62 percent of wow growth in profits, while production rose only by 2.34 percent, and sales income up slightly by 3.66 percent, profit rate reaching 13.22 percent, a lot better than that of the whole textile industry that had been hovering around 4-5 percent in good old days.

New standards for masks to protect quality

Starting from July 1, the new standard for KN95 face masks, known as GB 2626-2019, will come into force on compulsory basis with more stringent requirements of respiratory resistance, air tightness, practicality, cleaning and sanitization etc., more favorably reflecting the mask performance in use. The new standard will take effect in lieu of the old GB 2626-2006, leaving the grace period for the masks produced prior to July 1 to keep the label on the package indicating the outgoing GB 2626-2006.

Starting from July 1, the new standard for KN95 face masks, known as GB 2626-2019, will come into force on compulsory basis with more stringent requirements of respiratory resistance, air tightness, practicality, cleaning and sanitization etc., more favorably reflecting the mask performance in use. The new standard will take effect in lieu of the old GB 2626-2006, leaving the grace period for the masks produced prior to July 1 to keep the label on the package indicating the outgoing GB 2626-2006.

The COVID-19 outbreak goaded a galloping investment in the mask production and the melt-blown nonwovens, raising worries not only about the overcapacity problems when the virus ebbs away, but also about the quality concerns while too many masks are produced on short notice and delivered to the market on pressing time. A more rigorous demand out of the industrial standards comes nothing short of a remedy to ensure a quality supply in competitive business environment.

According to the Ministry of Industry and Information Technology (MIIT), the machinery utilization rate, or simply put, the operational rate of mask manufacturing industry outran 110 percent during the peak time of virus spreading in the country, reaching more than 20 million pieces of face masks produced a day, thanks to the complete value chain of nonwovens industry that had been expanding production capacity over the years with the product portfolios for everything for the masks, saying, core filter melt-blown nonwoven and upper and lower covers of spun-bonded nonwovens.

Unprecedented growth in Non-Wovens

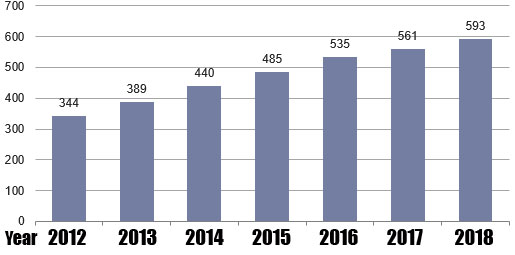

The official data shows that the market consumption of nonwovens came up to 107.1 billion Yuan in China in 2018 and stepped up to 114 billion Yuan last year that witnessed the nonwoven production for 5.03 million tons in 2019 to ensure the top seat both in consumption and production in the world. China Nonwovens & Industrial Textiles Association (CNITA) reported that the output added value of the technical textiles increased by 6.9%, higher than the averaged growth rate in the manufacturing industry of the national economy to take the lead in any other sector of the whole textile industry in China. Moreover, its nonwoven export was registered for 1.051 million tons in volume, up by 9.1 percent year-on-year.

The technical textiles stand out prominent in a sharp contrast to the other sectors of the whole textile industry, thanks to its particular areas of applications with its unique performance required of the products in non-apparel market consumption. And COVID-19 that emerged and spread rampantly in the first few months of this year drove up market demand for special gear like protective wear, face masks and sanitary textiles for hospital purposes, stimulating the technical textile industry to run at an amazing speed rarely seen before. The first four months of the year not only sees at a wow 254.62 percent growth of profit in non-woven sector, and it is all the more interesting to see that its production rose only by 2.34 percent, and sales income up slightly by 3.66 percent as against its gorgeous profit growth, making its profit rate reach 13.22 percent, a lot better than that of the whole textile industry that had been hovering around 4-5 percent in good old days.

The non-wovens are sought-after as much as in China as in the world market during this special period to combat the pandemic. The export of non-wovens from January to April amounted to $17.257 billion, up by 79.62 percent. If we itemize the product categories of the export, we see the export growth of face masks up by 986.36 percent, hospital wear (protective garment) up by 565.6 percent.

As the coronavirus is dying hard and threatening to come thick here and there with many lockdowns lifted and economy reopened globally, the demand for face masks is going to run viral, making it all the more important to invest in adequate production to catch the trend. And a more technically termed product, melt-blown fabric, continues to stand in the limelight.

Melt-blown Fabric vs Total Non-woven Production

| Non-woven Production Historical Trend (2012-2018) Unit: 10k ton |

|

As one of the non-woven series, melt-blown non-woven fabric is small in the production of the non-woven family, representing only less than 1 percent of the total if we look at 5.93222 million tons of non-woven turnout in 2018 when the actual volume of 53,523 tons of melt-blown fabric was given in spite of its 83,240 tons of the installed capacity.

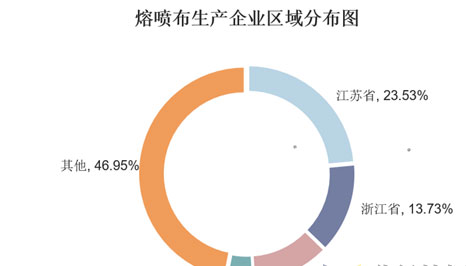

The melt-blown fabric is regarded as the heart of surgical masks and N95 healthcare masks and the producers of the non-wovens in general are found here and there across the country, but the melt-blown non-woven producers are not as many, they are largely concentrated in these important three provinces as in Jiangsu, accounting for 23.53 percent, in Zhejiang for 13.73 percent, in Henan for 11.76 percent, these three areas represent about half of the production in the particular sector of melt-blown fabric, and Hubei province is home to 2465 non-woven companies, the largest non-woven production in the country, but its melt-blown fabric is not as impressive, taking up merely 4.03 percent.

| Graphic I –Share of locations in total production of Melt-blown Nonwovens |

|

| (Provinces- Jiangsu 23.53%, Zhejiang 13.73%, Henan 11.76%. Hubei 4.03%, the rest by 46.95%) |

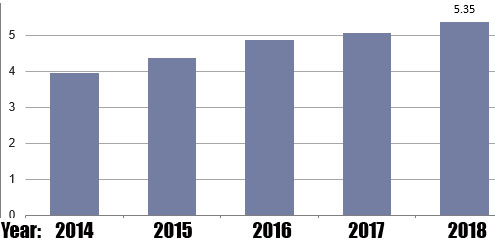

In fact, the non-woven production has been growing steadily over the years as the rapid economic growth expedited more consumption of technical textiles overboard and the nonwoven products are applied to many end-uses in growing volume across the sectors. The production of non-wovens is given below in the bar-graphics to illustrate the ramp-up in the years between 2012-2018.

Apart from the growing trend of total non-woven production, the melt-blown sector, though a little member of the big family, prospects a quick curve-up as its unique property in filtering, obstructing, isolating and absorbing performance will give an impetus to more application to the mask production which is running in full capacity now, with more new lines to be installed on investment spur.

| Non-woven Production Historical Trend (2012-2018) Unit: 10k ton |

|

In 2018, China produced 4.54 billion pieces of face masks, up by 17 percent over 2017 figure for 3.66 billion pieces. If you just think about one layer of melt-blown fabric for an ordinary medical mask and three layers for a high grade N95 mask as it is an essential filtering core for masks, what a sizable production of this particular product is going to be in store in the future with the pandemic not being mitigated by the pre-maturing reopened economic activities that are taking place in some continents in the world?

Contributed by Mr. ZHAO Hong

He is working for CHINA TEXTILE magazine as Editor-in-Chief in addition to being involved in a plethora of activities for the textile industry. He has worked for the Engineering Institute of Ministry of Textile Industry, and for China National Textile Council and continues to serve the industry in the capacity of Deputy Director of China Textile International Exchange Centre, V. President of China Knitting Industry Association, V. President of China Textile Magazine and its Editor-in-Chief for the English Version, Deputy Director of News Centre of China National Textile and Apparel Council (CNTAC), Deputy Director of International Trade Office, CNTAC, Deputy Director of China Textile Economic Research Centre. He was also elected once ACT Chair of Private Sector Consulting Committee of International Textile and Clothing Bureau (ITCB)

As Coronavirus spreads across Europe and the US, international fashion brands began delaying, reducing or cancelling their payments to Turkish apparel manufacturers. Some brands failed to inform suppliers about the status quo of their operations leaving Turkish manufacturers with$1.5 billion to $2 billion worth of stocks.

As Coronavirus spreads across Europe and the US, international fashion brands began delaying, reducing or cancelling their payments to Turkish apparel manufacturers. Some brands failed to inform suppliers about the status quo of their operations leaving Turkish manufacturers with$1.5 billion to $2 billion worth of stocks.

This led to the Turkish clothing sector shrinking by a staggering 65 per cent by the end of April, huge fallout for an industry sustaining over 1.5 million workers. Brands just didn’t understand it was a matter of survival for many people in the country, points out Hadi Karasu, Head, Textile Clothing Manufacturers Association. The world’s sixth biggest exporter of textiles and Europe’s third biggest source of ready-to-wear garments, Turkey is hugely dependent on its apparel industry for survival. The country is a rare net exporter — contributing up to 15 per cent of the country’s exports.

Surface-level changes make matters worse

However, tensions between brands and their suppliers began to ease in April and May, as big fashion groups such as Levi Strauss & Co, Adidas and Nike Inc started cooperating with these manufacturers. They either started making or scheduling their payments. Western governments also supported these brands in reassuring payments to suppliers. This led to a reduction in inventory to around $200 million to $300 million worth.

Adidas and Nike Inc started cooperating with these manufacturers. They either started making or scheduling their payments. Western governments also supported these brands in reassuring payments to suppliers. This led to a reduction in inventory to around $200 million to $300 million worth.

Though welcome, these changes are only on the surface level as some brands are still not ready to pay, says Seref Fayat, Chairperson-Clothing Committee, TOBB. He claims the support given by the Turkish government is less comprehensive in nature as it is mostly in the form of loans and limited wage support, rather than furlough schemes, interest-free lending and grants.

Mustafa Gültepe, Head, Istanbul Apparel Exporters Association blames British brands most for nonpayment of orders. British brands are opportunists as they forced discounts and threatened not to pay at all, observed Gültepe.

Difficult time for Turkish manufacturers

These COVID-19 related issues began plaguing Turkish manufacturers at a time when the industry was recovering from an economic setback caused by a range of issues, including a coup attempt in 2016 and several terrorist attacks. The lira had lost value making Turkey more competitive against developing countries. Since then, the country had been promoting itself as a vertically integrated industry with a skilled workforce.

This worked for Turkey as its ready-to-wear exports hit $17.7 billion last year. Similarly, exports in January and February totaled $3 billion raising hopes of increased capacity, new factories and innovation. As COVID-19 forced brands to divert orders to Turkey, manufacturers moved fast to capitalize amid hopes that the disease would remain localized.

Hopes for revival remain alive

There are still hopes for revival for the clothing sector as online retail is helping Turkish businesses complete orders from companies such as the UK’s Asos and Germany’s Zalando. The country has already launched certain digital projects such as the EU-funded business-to-business project to make the latest technology available to Turkish businesses, enabling them to design and show collections on virtual models in a digital setting without the need for samples.

There is little chance for domestic demand to plug gaps. However, Turkish brands are likely to pick up orders from international buyers. Turkish fashion leaders also expect international buyers to demand a reduction in prices. The US-China trade war has shifted focus of American manufacturers to Turkey with many brands like Ralph Lauren, Levi’s and Newtimes Sourcing Group, opening offices in the country. The clothing sector is expected to recover from its worst losses by the first quarter of 2021 with the country being on a path of growth by 2025.

The slow erosion of prominent department stores like Neiman Marcus and JC Penney due to COVID-19 is threatening the existence of many prominent malls in America. Already, these malls were facing stiff competition from online retailers for the last few years. The pandemic has confounded matters with many malls likely to shut shop over the next five years, says Mathew W Lazenby, Chief Executive Officer, White Family Development. Their closing will reshape the American suburban landscape as many of abandoned malls will be turned into local markets or office space, even affordable housing.

The slow erosion of prominent department stores like Neiman Marcus and JC Penney due to COVID-19 is threatening the existence of many prominent malls in America. Already, these malls were facing stiff competition from online retailers for the last few years. The pandemic has confounded matters with many malls likely to shut shop over the next five years, says Mathew W Lazenby, Chief Executive Officer, White Family Development. Their closing will reshape the American suburban landscape as many of abandoned malls will be turned into local markets or office space, even affordable housing.

Smaller stores follow as major retailers shut shop

Around 1,200 malls in the country are likely to be closed as most of their retailers have filed for bankruptcy, notes Dehobrah Weinswig, Founder, Coresight Research. Department stores account for about 30 per cent of mall square footage with 10 per cent occupied by Sears and JC Penney. These two retailers are expected to close over half of their mall-based department stores by 2021-end which could lead to other retailers also abandoning these malls, says Vince Tibone, Retail Analyst, Green Street Advisors.

Founder, Coresight Research. Department stores account for about 30 per cent of mall square footage with 10 per cent occupied by Sears and JC Penney. These two retailers are expected to close over half of their mall-based department stores by 2021-end which could lead to other retailers also abandoning these malls, says Vince Tibone, Retail Analyst, Green Street Advisors.

The fortunes of American malls were dwindling even before the pandemic. While those in affluent areas managed to thrive, malls in lower-tier cities suffered as retailers closed stores and filed for bankruptcy. CoStar Group, a data provider for the real estate industry in America informs by June this year, 84 per cent of malls in America were considered healthy which is actually less than 94 per cent deemed healthy in 2006. This percentage is expected to drop further as more retailers plan to close stores this year.

Operators abandon deals over future concerns

Major mall operators in the country have started raising concerns over declining footfalls. One of the biggest mall operations, The Simon Property Group has abandoned its $3.6 billion deal to acquire Taubman Centers, as most of its malls, enclosed within closed spaces, are unlikely to be visited by consumers in the aftermath of COVID-19.

CBL & Associates Properties, which owns and operates roughly 60 malls, outlet stores and open-air shopping centers in the US, has also skipped about $30 million in interest payments due in June over substantial doubt about its continuance of operations.

Jim Hull, Owner and Managing Principal, Hull Property Group in Augusta, Ga., which oversees 30 enclosed malls, anticipates more malls in future to be community-based and located in smaller markets, with local and regional businesses. For instance, the Valco Shopping Mall in Cupertino Calif, is likely to be soon replaced with affordable housing, new entertainment and retail options or office space. Some of the investors have also started repurposing their malls by flipping store entrances to face the street.

Whether malls in America survive the crisis or not, mall culture in the country is definitely set for a change.

Levi Strauss & Co, which expects its business to be hit in the second half of the year, plans to cut about 700 jobs in non-retail, non-manufacturing segments that would help it save $100 million annually.

Met with temporary closure of its own stores as well as partner outlets, Levi introduced curbside pickup and started fulfilling online orders at its stores as customers turned to online shopping to avoid contact with people. The company reported a 25 per cent increase in its online business in the second quarter ended May 24, with a month-over-month rise of nearly 80 per cent in May.

The company also expects its margins for the rest of the year to be under pressure as it tries to offload excess inventory that remained unsold during the lockdowns.

Despite a 12 per cent decrease from the previous season attributed to trade tensions with the US and a slowdown in manufacturing during the COVID-19 containment, China is expected to remain the world’s largest importer of cotton lint and import 1.8 million tonne of cotton in 2019-20, according to the International Cotton Advisory Committee (ICAC).

As tariffs on cotton lint increased in 2018-19, making US cotton 25 per cent more costly to Chinese importers compared to other growths, China had also increased the total volume of imports of cotton lint. As China increased its total imports of cotton lint from 1.3 million tonne in 2017-18 to 2.1 million tonne in 2018-19, US cotton exports to China decreased from 528,000 tonne in 2018 to 360,000 tonne in 2019.

Comparing the August through April period for the 2018-19 and 2019-20 seasons, global imports for the nine-month period are estimated at 1.245 million tonne, a 22 per cent decrease from the previous period, the ICAC period said.

For the 2019-20 season, Brazil is expected to export over 1.8 million tonne globally and through April 2020 (where the latest data is available), has exported an estimated 527,000 tonne to China, a 30 per cent increase from the previous period. The United States is expected to export 3 million tonne globally and through April has exported an estimated 277,000 tonne to China, a 29 per cent increase from the previous period. Other countries and regions exporting to China that had seen increases during the 2018-19 season are showing declines in exports to China in the August through April period.

The Work from Home trend has boosted the sales of PJ’s in India with knitwear exporters receiving advance payments from European buyers to replenish their stocks for the basic clothing

Demand for daily essential clothing is more from Europe, which has opened up for a long time. There is very good export demand for kids wear, night wear and inner wear. The retail stores are running low on stock demand for fast fashion clothing is still sluggish, said Ashok Arul, CMO, SCM garments, an exporter to leading retail stores of Europe and US.

Tirupur in Tamil Nadu, which exported knitted garments worth about Rs 30,000 core the previous fiscal, has started getting good export business. Raja Shanmugam, president, Tirupur Exporters Association (TEA) noted a growing demand for night wear, children wear and inner wear.

Burberry, which is reorganising its creative team, has reappointed Adrian Ward-Rees to lead its ready-to-wear business.

Ward-Rees held the role of senior VP and MD of Dior Homme with Christian Dior for the last four years and previously worked at Hong Kong-headquartered Lane Crawford, along with a merchandising role with Burberry. He takes up the new role as senior VP ready-to-wear on July 20, based in London and reporting to Gobbetti.

Burberry will also set up three new business units – ready-to-wear, accessories and shoes and says it plans to pool expertise within them” to improve its focus on products and improve quality.

The local nylon spinning industry is facing a severe threat from China. Along with the sharp fall in demand and with powerloom units still to restart, the existence of Surat’s nylon yarn spinning industry is being threatened by yarn imported from China.

The annual imports of nylon yarn in India stand at 25,000 metric tonne, of which 60 per cent of that comes from China alone. If this year too, Chinese nylon yarn of the same quantity comes to India, then the local industry will be severely affected. These imports are severely damaging the existence of nylon yarn spinners in India, said senior vice-president of Century Enka, Sanjay Mehrotra, who is also the secretary of Surat Nylon Yarn Spinners Association (SNYSA).

In the domestic man-made fibre (MMF) basket, nylon yarn has less than 4 per cent manufacturing share, with 90 per cent consisting of the polyester consumed by domestic powerloom weavers. Around 10 per cent of the powerloom weaving units use nylon yarn for manufacturing dupatta, high-value jacquard saris and square net fabric.

According to the industry payers, Chinese exporters are dumping nylon yarn with heavy under-invoicing. The imported nylon yarn is about 10 per cent cheaper compared to the yarn from Surat.

Yarn Expo Autumn, to be held from September 23-25 at National Exhibition and Convention Centre (Shanghai), will offer visitors a chance to view diverse range of raw and recycled products to satisfy consumer demand for a more sustainable industry. International exhibitors to the event will showcase a wide variety of yarns and fibers made from raw, sustainable materials along with recycled and regenerated products.

Cotton Council International (CCI) will offer buyers quality and traceable fibers from the very beginning of the supply chain. The council has just established the US Cotton Trust Protocol, which will be its signature sustainability program from now on. In terms of environmental impact, this system makes sure that every bale of US cotton is traceable, transparent and measurable

International suppliers such as Hengbang Textile (Vietnam) will showcase their regenerated yarn and cotton yarn; Everest Textile (Taiwan), which - specializes in yarn spinning, twisting, weaving, dyeing, finishing, printing, and coating / laminating processes, will display its recycled polyester, bamboo carbon and cooling yarns, among others.

According to EU data, retail compound growth rate of China's women's underwear market is expected to be worth 197 billion 300 million yuan by 2022. Meanwhile, data by China Apparel Association estimates the size of China's men's underwear market in 2019 to be around 171 billion 300 million yuan, thanks to the steady growth of downstream consumer demand. The main categories of men's underwear include men's underwear, thermal clothing and household clothing.

There are many participants in China’s apparel industry, whose modes are mainly divided into brand enterprise competition and non brand enterprise competition. Women's underwear market, men's underwear market and children's underwear market, the concentration of brand enterprises is low, and market competition pattern is dispersed. For sports bra market, as the market share of Chinese sportswear brand is highly concentrated, market position of the top five sports brands are relatively stable, which poses a great challenge to the expansion of personal clothing brand to sports bra.

According to EU data, in 2018, concentration of top five brands in China's underwear market was only 6.6 per cent, while market concentration of top five markets in Japan, the US and the UK was 56 per cent, 47 per cent and 22 per cent respectively. By contrast, the market concentration of the top five brands in China's underwear market is much lower than that in Japan, the United States and the United Kingdom, so the Chinese underwear market still has the potential to concentrate its market share on leading brands.