FW

APLF Ltd, a joint venture between SIC Group and UBM Asia, recently held the Design-A-Bag Online Competition 2018 in Hong Kong. The annual event brought together the global design community to fashion access trade fair in Hong Kong to showcase their creations to the world and exchange design concepts among talents from various cultures and backgrounds.

Lemniscate Handbag designed by Ho Kuan Teck of Singapore was selected Best Overall Design out of the three finalists who received a 4-week bag design course in Milan valued at USD 4,200 with USD 1,000 accommodation allowance at the prestigious Arsutoria School on top of the final prizes. In the online favourite design category, voted by the Facebook audience, "Circular Bag" from Spain emerged as the winner with 345 likes.

The judging panel consisted of representatives from Giordano, All Saints, Jayne Fashion Consultancy, The Arsutoria School, Korea Colour & Fashion Trend Centre, Edizioni AF and OO Agency Paris.

Bangladesh has relaxed the restriction on the import of raw materials, which have already been shipped, under the free of cost scheme for the readymade garment industry.

Export-oriented readymade garment manufacturers have been allowed to release the excess raw materials, mainly fabrics, imported beyond the permissible limit. A hundred per cent export-oriented garment manufacturer can import raw materials worth one-third of its total export earnings in the previous year under the scheme without paying any duty and other taxes.

Foreign buyers sometimes directly provide raw materials free of cost for manufacturers to speed up the export process. But many importers from the readymade garment sector import raw materials, mainly fabrics, up to several times the limit beyond the permissible level.

The provisions were relaxed as many apparel exporters had already bought excess raw materials under the facility.

Some importers brought raw materials several times higher than the limit and sold them in the local market instead of producing finished goods for export. According to the order, raw materials only recently imported, unreleased and those which have already been shipped will get the benefit.

The facility will not be applicable for goods imported in future after releasing the current consignments.

Bangladesh’s exports to Turkey in the first ten months of the current fiscal fell by 19.35 per cent.

Turkey was a very promising market for Bangladesh. A good quantity of apparels used to be re-exported to Russia from Turkey. But Bangladesh lost its competitiveness in Turkey’s market as the country imposed a safeguard duty on apparel imports in 2011.

Turkey imposed the safeguard duty at a rate of 17 per cent in September 2011 on apparel imports from least developed countries, including Bangladesh.

Following the imposition of the safeguard duty, Bangladesh’s exports to Turkey declined by 24.23 per cent in fiscal year ’12 from fiscal year ’11, while the exports in fiscal year ’13 rose by 15.57 per cent. The country’s exports to Turkey in fiscal year ’14 grew by 34.23 per cent.

Export earnings from Turkey in fiscal year ’15 fell by 15.80 per cent. Export earnings from Turkey declined by 8.18 per cent in fiscal year ’16 while earnings fell by 4.57 per cent in fiscal year ’17.

Turkey is also a major readymade garment producing country and a competitor of Bangladesh on the global market with annual clothing exports of around 17 billion dollars and textile exports of nearly ten billion dollars.

Bangladesh’s apparel exports grew 9.37 per cent year-on-year in the first ten months of the fiscal year.

Exports increased 6.41 per cent year-on-year in the July-April period. The earnings slightly missed the periodic target.

Exports rose 7.11 per cent year-on-year in April riding on the higher shipment of garment items. Although the receipt is 0.51 per cent higher than the monthly target, it was the lowest in six months.

Knitwear exports rose 11.43 per cent and woven garments exports were up 7.42 per cent. Cotton, cotton products, and yarn exports went up by 19.01 per cent, jute and jute goods increased 7.66 per cent, home textile exports rose 13.07 per cent, leather and leather goods were down 10.02 per cent.

The industry is confident of achieving more than ten per cent garment export growth at the end of the fiscal year as the trend in the international market shows very bright prospects.

Significant investment in automation in the US textile and apparel industry, particularly in yarn, thread, and fabric production, has depressed US employment despite increases in domestic shipments.

In coming years, increased capital investment in automation should contribute to a further expected decline of 3.7 per cent in employment in the textile and apparel industry during 2015–20.

The most significant decline is projected in textile products (5.9 per cent) and textile mill sectors (5.7 per cent). At the same time, US textile and apparel exports are expected to increase 2.8 per cent, with US apparel exports increasing by ten per cent as a result of growing demand for higher-quality, specialized, or Made in USA apparel.

US textile mill producers are increasingly focused on the production of technical fabrics and smart fabrics used in the automotive, construction, healthcare, sportswear, and agriculture industries, as well as in protective applications.

The value of US technical fabric production is expected to increase by four per cent annually on an average during 2015–17 due to strong global demand. The technical and smart fabric sectors are less price sensitive than imports of lower-cost commodity fabrics.

One of the largest consumers of US-produced technical textiles is the US military, which by law must purchase its textiles from US producers.

India’s apparel exports have not benefited from the rupee depreciation. There was a 22.76 per cent fall for the month of April.

Readymade garment exports have fallen for the seventh consecutive month since October 2017. Exporters have seen the cost of working capital rising and are experiencing a fund crunch due to delays in the refund of taxes paid.

While consumption in the international market is growing at around one to two per cent, competition is increasing too as the business sees new entrants like Myanmar and Ethiopia. Competitors’ currencies are also depreciating, but they don’t have problems that Indian exporters do.

The fall in apparel exports has led to a decline in production. India's apparel production fell 18.6 per cent in March and saw a decline of eleven per cent for the period 2017-18. March saw the eleventh straight monthly decline in apparel production.

Availability of manpower is also a big concern in all the existing textile centers and productivity is low due to huge labor turnover.

If the rupee remains at these levels for the next few months, it can offset the loss of duty drawback to some extent and exports may see a growth of three or five per cent.

Rising cotton prices have hit Bangladesh apparel makers. If the price spiral continues, Bangladesh’s importers might face troubles as almost all the demand for the raw material is met through imports in the absence of domestic production.

The country has to import most of its cotton demand. Imports are from India, the US, the Middle Eastern countries and some African countries.

Cotton textiles is the largest imported category by Bangladesh, representing 55 per cent of total textile and apparel imports. This is followed by manmade textiles, others and apparel with a share of 35 per cent, 6.8 per cent and 3.2 per cent respectively.

China is the largest supplier accounting for a 58 per cent share. India is the second largest supplier of textile and apparel products to Bangladesh. Cotton textiles is the largest category with a share of 77 per cent in India’s textile and apparel exports to Bangladesh. This is followed by manmade textiles and apparel having a share of 17 per cent and four per cent respectively.

Currently Bangladesh imports yarn and fabric from China, India and other nations to fill the demand-supply gap. However, many new investments are planned in the spinning and weaving sectors of Bangladesh in the coming years.

"POINTERS • Lowest growth this fiscal year in four years • The annual index value dipped to 2.56 FY 2017-18 from 3.43 points in FY 2016-17 • The entire fiscal year was marked by low business sentiment • Even the festive period did not bring much cheer • Q4 was the best quarter, reflecting a recovery."

POINTERS • Lowest growth this fiscal year in four years • The annual index value dipped to 2.56 FY 2017-18 from 3.43 points in FY 2016-17 • The entire fiscal year was marked by low business sentiment • Even the festive period did not bring much cheer • Q4 was the best quarter, reflecting a recovery

POINTERS • Lowest growth this fiscal year in four years • The annual index value dipped to 2.56 FY 2017-18 from 3.43 points in FY 2016-17 • The entire fiscal year was marked by low business sentiment • Even the festive period did not bring much cheer • Q4 was the best quarter, reflecting a recovery

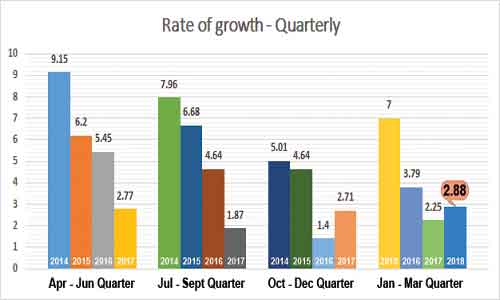

In all four quarters this fiscal year (2017-18), the index values were much lower than comparable quarters in previous fiscal. The annual index value dipped to 2.56 in FY-2017-18 from 3.43 points in FY-2016-17, 5.32 points in FY-2015-16 and 7.28 points in FY-2014-15 -- reflecting 'dismal' growth. The entire fiscal year was marked by low business sentiment including the festive period, perceived as best the time to make up for turnover losses, when buying is high.

The index value was the lowest for July-Sept 2017 (Q2) at 1.87; followed by 2.71 points in Oct-Dec 2017 (Q3); 2.77 points in Apr-Jun 2017 (Q1); and 2.87 points Jan-Mar 2018 (Q4). In fact, Q4 was the best quarter this fiscal, indicating a recovery. The positive aspect is: the Index has been growing in the last two quarters.

2.77 points in Apr-Jun 2017 (Q1); and 2.87 points Jan-Mar 2018 (Q4). In fact, Q4 was the best quarter this fiscal, indicating a recovery. The positive aspect is: the Index has been growing in the last two quarters.

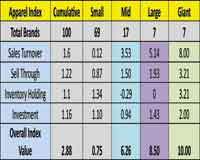

All quarters are reviewed and compared to previous year’s quarters and the comparison is done at the assumed base value of 100.The average off our indices belonging to four quarters of the financial year is the final annual apparel index value.

Slack indices add to slowdown

The Sales Turnover graph over first two quarters followed a downward trend; the fall in July-Sept 2017 was the highest, it then moved up in the remaining two quarters Oct-Dec 17 at 1.52 and Jan-Marc ’18 growing to 1.60. Overall, Sales Turnover was never high throughout the fiscal.

Sell Through, Investments and Inventory Holding though not very dynamic, were never strong enough to influence the index greatly, as the graphs indicates.

The graph below shows varying growth rates for all performance factors over four quarters.

A dip in Sales Turnover, Sell Through and Investment graph and index should not be mistaken as a dip in sales, instead it indicates the rate of growth slowed down but in value and absolute terms there was growth in sales turnover.

Trendspotting: Four year low, it’s a dipping Annual Apparel Index

Annual Year Index Value

A closer look at the last four financial years indicates Apparel Index was much higher in FY 2014-15 and FY 2015-16 at 7.28 and 5.33 respectively compared to FY 2016-17 at 3.44 and 2.56 in FY 2017-18 , which is almost 35 per cent growth rate of what it was in FY 2014-15.

The onus for the dismal performance in the last two years could be attributed to demonetization and implementation of GST which have disrupted market sentiment and overall growth.

"CMAI’s Apparel Index for Q4 Jan-Mar FY 2017-18 indicates a growth recovery at 2.88 points. All the three sized brands termed as Big brands (Mid, Large and Giant) together recorded a growth of 7.61 points. Amongst these, Giant brands, with an impressive growth at 10.00 points led the way. While mid and large brands too were not far behind with growth of 6.26 and 8.50 points. Small brands, however, at 0.75 points, seem to be struggling for growth, indicating the gravity of recession pushing down these smaller players, who are not in a good position to outsmart their business practices, just yet."

CMAI’s Apparel Index for Q4 Jan-Mar FY 2017-18 indicates a growth recovery at 2.88 points. All the three sized brands termed as Big brands (Mid, Large and Giant) together recorded a growth of 7.61 points. Amongst these, Giant brands, with an impressive growth at 10.00 points led the way. While mid and large brands too were not far behind with growth of 6.26 and 8.50 points. Small brands, however, at 0.75 points, seem to be struggling for growth, indicating the gravity of recession pushing down these smaller players, who are not in a good position to outsmart their business practices, just yet.

CMAI’s Apparel Index for Q4 Jan-Mar FY 2017-18 indicates a growth recovery at 2.88 points. All the three sized brands termed as Big brands (Mid, Large and Giant) together recorded a growth of 7.61 points. Amongst these, Giant brands, with an impressive growth at 10.00 points led the way. While mid and large brands too were not far behind with growth of 6.26 and 8.50 points. Small brands, however, at 0.75 points, seem to be struggling for growth, indicating the gravity of recession pushing down these smaller players, who are not in a good position to outsmart their business practices, just yet.

Commenting on scenario, Satyen Momaya, CEO, Celio, that is one of the Large brands avers, “Stronger GDP growth rates in the last quarter and the current fiscal year have translated into handsome growth for discretionary categories such as apparel”. Talking on the similar optimism underling their product line, Neha Shah, Marketing Head, Pepe Jeans India says, “The denim industry has witnessed a slow and gradual growth over the last few years. However Pepe Jeans has witnessed a steady growth in the last couple of years by expanding into online channels and omnichannel retailing.

A comparison between Small and Big Brands index value 0.75 and 7.61 respectively, indicates a very big gap in the growth performance. The biggest gap is in Sales Turnover. Big Brands increased their Sales Turnover to 4.90 points, against insignificant growth of 0.12 points for Small Brands.

the growth performance. The biggest gap is in Sales Turnover. Big Brands increased their Sales Turnover to 4.90 points, against insignificant growth of 0.12 points for Small Brands.

Increase in Sales Turnover

Sales turnover in Q4 reflected an index growth of 1.6 points. Nearly, 54 per cent brands reported an increase in sales this quarter. Giant and Large Brands, which grew at 14.3 per cent each. “The reason for an increase in our sales turnover was , we focused on increasing and streamlining our product line by categorizing production to increase productivity, explains Blazo’s owner Niyam.

Improvement in Sell Through

Nearly 54 per cent of the brands reported an improvement in their Sell Through in this quarter, while for 40 per cent brands the Sell Through remained the same, and around 6 per cent brands recorded a dip. In order to manage better growth and performance brands have been maneuvering their business, as Radhesh Kagzi, President, Creative Lifestyles Pvt. Ltd says, “We have reduced our quantities per style and done ISTs for goods. This has resulted in better Sell Through and reduced Inventory Holding/investment.

Inventory Holding: Inventory Holdings for almost 45 per cent

"As per latest Apparel Export Promotion Council (AEPC) figures, India’s apparel exports have dropped 17.78 per cent to reach $1.49 billion, with an overall dip of 3.83 per cent to $16.71 billion in 2017-18. At the same time, India’s overall goods exports increased 9.78 per cent to $302.4 billion in April-March 2017-18, but declined 0.6 per cent to $29.11 billion in March 2018. Commenting on the startling figures, HKL Magu, Chairman, AEPC, says the fall has been much more in the case of apparel exports. These figures clearly indicate apparel exports are not only stagnating but also heading towards a recession. Apparel manufacturing registered a decline for the tenth straight month in February."

As per latest Apparel Export Promotion Council (AEPC) figures, India’s apparel exports have dropped 17.78 per cent to reach $1.49 billion, with an overall dip of 3.83 per cent to $16.71 billion in 2017-18. At the same time, India’s overall goods exports increased 9.78 per cent to $302.4 billion in April-March 2017-18, but declined 0.6 per cent to $29.11 billion in March 2018. Commenting on the startling figures, HKL Magu, Chairman, AEPC, says the fall has been much more in the case of apparel exports. These figures clearly indicate apparel exports are not only stagnating but also heading towards a recession. Apparel manufacturing registered a decline for the tenth straight month in February. He revealed AEPC was working with policymakers for an early resolution of the sector’s problems, including working capital being stuck due to slow GST refund and reduction in drawback rates. The sector currently employs 12.9 million workers but due to the ongoing slide, several clusters have been impacted, Magu points out.

As per latest Apparel Export Promotion Council (AEPC) figures, India’s apparel exports have dropped 17.78 per cent to reach $1.49 billion, with an overall dip of 3.83 per cent to $16.71 billion in 2017-18. At the same time, India’s overall goods exports increased 9.78 per cent to $302.4 billion in April-March 2017-18, but declined 0.6 per cent to $29.11 billion in March 2018. Commenting on the startling figures, HKL Magu, Chairman, AEPC, says the fall has been much more in the case of apparel exports. These figures clearly indicate apparel exports are not only stagnating but also heading towards a recession. Apparel manufacturing registered a decline for the tenth straight month in February. He revealed AEPC was working with policymakers for an early resolution of the sector’s problems, including working capital being stuck due to slow GST refund and reduction in drawback rates. The sector currently employs 12.9 million workers but due to the ongoing slide, several clusters have been impacted, Magu points out.

For the US, subsidies is an issue

The other negative news for Indian apparel industry is, as per latest reports, the US, which is one of the biggest importers of Indian apparel and textiles, is all set to preempt apparel export subsidies after the US had challenged Indian export subsidy programs at the WTO. The US government is contemplating taking India to the World Trade Organisation forum for continued export subsidies in apparel and other sectors. As a counter measure, the Indian government plans to challenge the US contention at WTO, bearing in mind that if the decision of the world body goes against India, it would adversely impact India’s apparel and other key exports to the world. India’s apparel export to the world between April 2017 and January 2018 was $13,783.14 million. In 2010, India crossed the threshold in apparel and textiles sector by attaining a 3.25 per cent export slot in the global export market, reflecting India’s export competitiveness in the sector.

importers of Indian apparel and textiles, is all set to preempt apparel export subsidies after the US had challenged Indian export subsidy programs at the WTO. The US government is contemplating taking India to the World Trade Organisation forum for continued export subsidies in apparel and other sectors. As a counter measure, the Indian government plans to challenge the US contention at WTO, bearing in mind that if the decision of the world body goes against India, it would adversely impact India’s apparel and other key exports to the world. India’s apparel export to the world between April 2017 and January 2018 was $13,783.14 million. In 2010, India crossed the threshold in apparel and textiles sector by attaining a 3.25 per cent export slot in the global export market, reflecting India’s export competitiveness in the sector.

As per the provisions, once the threshold is crossed, the country gets an eight year reprieve to phase out subsidies. The extension is about to get over by the end of this year. According to WTO norms, subsidies can be non-actionable or prohibited as stipulated by the Subsidies and Countervailing Measures (SCM) agreement. Specifically, subsidies that are prohibited include the ones given to a firm or industry as in the case of apparel and textiles. The SEZ policy and the MEIS scheme which are applicable to the textiles and apparel industry come under this prohibited category. As per SCM norms, WTO member countries can take remedial action against India for such schemes and policies. In short, if India fails to curb the subsidies mentioned under the prohibited list to the apparel and textiles industry within the stipulated eight year period, member countries can refer the issue to the Dispute Settlement Board of the WTO. In this case, the US being the complainant, has the options of imposing countervailing duty on imports from India, which will result in Indian exporters losing competitiveness in the US textiles and apparel market. If that happens, the ultimate beneficiaries will be Bangladesh, Taiwan and Vietnam.

Trump Administration’s new Generalised System of Preferences (GSP) country eligibility assessment process outlined in October 2017, and GSP country eligibility petition imply for India, the GSP country eligibility review is based on concerns related to its compliance with the GSP market access criterion. India has implemented a wide array of trade barriers that create serious negative effects on the US commerce. The acceptance of these petitions and GSP self initiated review will result in one overall review of India’s compliance with the GSP market access criterion, the USTR statement said.